Provision for doubtful debts - what is it?

The definition of debt recognized as doubtful for accounting purposes contains clause 70 of the Regulations on Accounting and Financial Reporting in the Russian Federation, introduced by Order of the Ministry of Finance of the Russian Federation dated July 29, 1998 No. 34n (hereinafter referred to as the Regulations on Accounting and Accounting).

Doubtful is the debt of its counterparty to a legal entity that is not secured by guarantees and has not been paid or has a high degree of probability of non-payment within the period specified in the agreement. That is, we are talking about the debts of debtors or part of these debts, in relation to which there are serious doubts about their collection. Creating a reserve for such debt makes it possible to show in accounting and accounting the real amounts of debt expected to be received. What is it for? Firstly, the requirement of paragraph 1 of Art. 13 of the Law of the Russian Federation “On Accounting” dated December 6, 2011 No. 402-FZ on the reliability of accounting data included in the reporting and, accordingly, making these reporting reliable. Secondly, economic analysis, performed using balance sheet figures, in which data on the amount of receivables plays an important role, begins to be carried out taking into account real information on debts expected to be received. And an economic analysis carried out for a specific reporting date and for a number of these dates is a process, the final result of which is of interest not only to inspection authorities or counterparties who want to verify the financial solvency of the analyzed person, but also to the organization itself that has a doubtful debt.

The definition of doubtful debt in accounting and a number of rules for creating a reserve for it differ from the characteristics of a similar debt and the procedure for creating a reserve created in tax accounting (Article 266 of the Tax Code of the Russian Federation). The reserve for tax accounting purposes is not mandatory, while in accounting it is necessary to create it regardless of the desire of the legal entity. At the same time, the rules for working with reserves in tax accounting are regulated in all aspects, and accounting allows the development of some of these rules at the discretion of the organization. Therefore, between the reserves formed in tax and accounting, there is almost always a difference both in the moments of recognition of doubtful debt and in determining the amount of the reserve for it, even if the type of debt is the same. This circumstance determines the existence of temporary differences related to the reserve. Moreover, they arise both in the case of creating a reserve in tax accounting, and in its absence in this accounting.

Find out how to correctly determine the amount of the reserve for doubtful debts in accounting and tax accounting by studying the opinion of ConsultantPlus experts. If you don't have access to the system, get a free trial online.

Read about what actions will lead to a reduction in temporary differences in the article “Provisions for doubtful debts in accounting”.

Purposes of creating accounting and tax reserves

The created reserve in both accounts is intended to write off doubtful debts that have become hopeless. The formation of a reserve in both accounting and financial accounting directly affects the financial result, and this happens much earlier than bad debts get there. In this regard, the formation of reserves for doubtful debts allows you to early take into account in expenses (including those accepted for income tax purposes) losses from writing off debt, which may later turn out to be hopeless.

Let us recall that a bad debt is recognized in the following situations (clause 2 of Article 266 of the Tax Code of the Russian Federation):

- upon expiration of the limitation period (3 years);

- if there is a decision issued by the FSSP on the impossibility of collection;

- in case of liquidation of the counterparty;

- under the influence of circumstances beyond the control of the parties (including those created as a result of the issuance of an act of a public authority), leading to the impossibility of fulfilling obligations to pay the debt.

For information on what actions need to be taken to recognize the write-off procedure as complying with the law, read the article “Procedure for writing off accounts receivable”.

In addition, the reserve created in accounting allows one to comply with one of the main requirements for this accounting: the requirement for the reliability of accounting data and, accordingly, reporting compiled on this data (Clause 1 of Article 13 of the Law of the Russian Federation “On Accounting” dated 06.12.2011 No. 402-FZ). The reliability of accounting and reporting data, in turn, turns out to be important when conducting economic analysis and making economic decisions based on it.

When and by whom should the reserve be created?

Clause 70 of the regulations on accounting and accounting, which, in addition to the definition of doubtful debt, also reflects the basic rules for working with it, does not make any exceptions from the circle of legal entities obligated to create a reserve for debts recognized as doubtful. Thus, the principle of mandatory creation of a reserve is assigned to all organizations without exception.

Note! Small enterprises are required to form reserves for doubtful debts in accordance with the generally established procedure. Even if simplified accounting methods are used (PBU 21/2008 “Changing estimated values”).

In what situations is it necessary to create a reserve? When a debt that meets the criteria for doubtful debt is identified. At the same time, the provision on accounting and accounting does not limit the type of such debt in any way, i.e. it can be any receivable debt, from the debt of an accountable person to the debts of buyers.

But the regulations on accounting and accounting do not establish the rules that must be followed in identifying doubtful debts. And the organization itself will have to determine, reflecting the established procedure in its accounting policies, the following points:

- frequency of debt inventory;

- signs by which a debt should be considered doubtful;

- debtor insolvency criteria;

- principles for assessing the likelihood of repaying the debt in full or in part;

- factors influencing the size of the created reserve.

For information on how the results of debt inventory are compiled, read the article “Inventory of receivables and payables.”

What should be said about reserves in the accounting policy?

The presence of issues that a legal entity must resolve independently for each of the reserves leads to the obligation to reflect these decisions in the accounting policy.

For accounting purposes, it is not necessary to indicate a decision on the formation (non-formation) of a reserve, since it will have to be created if conditions arise that oblige this. But it is necessary to include in the accounting policy a decision on establishing the frequency of debt inventory, and also to develop and reflect in the text of the policy the following criteria:

- assessment of debt as doubtful;

- recognition of the counterparty as insolvent;

- determining the probability of debt repayment;

- establishing the size of the reserve formed.

For tax accounting policy, on the contrary, the decision on the creation (non-creation) of a reserve will be a mandatory moment to be reflected in it. And if such a decision is positive, then it is enough to include in the text of the order an indication of the frequency of the debt inventory. There is no need to describe in this document all other principles of reserve formation: the process will take place in strict accordance with the rules set out in Art. 266 Tax Code of the Russian Federation.

For more information about the requirements for accounting policies, read the article “Drafting a regulation on accounting policies in an organization.”

Calculation of the reserve amount

Another point that should be fixed in the accounting policy is the algorithm for determining the amount of the reserve. The size of the reserve in accounting, unlike the reserve created in tax accounting, is not regulated. Therefore, the organization must independently develop not only a list of those factors on which its size will depend (the financial condition of the debtor, the likelihood of him repaying all or part of the debt), but also a formula for calculating the specific amount of the created reserve.

The amount of the reserve, depending on the assessment of the probability of payment of the debt, may not coincide with the total amount of the debt.

Basic rules for reserve accounting

To account for the reserve for doubtful debts, the Chart of Accounts (order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n) provides for account 63. Analytics on it should be carried out separately for each debt (clause 70 of the regulations on accounting and accounting). Accounting for the reserve in a separate account is due to the requirement of clause 6.7 of PBU 9/99 (Order of the Ministry of Finance of Russia dated May 6, 1999 No. 32n) to reflect sales revenue in its entirety in accounting, regardless of the fact of creating a reserve for it.

Since the reserve for doubtful debts refers to the values of the estimated value (clause 3 of PBU 21/2008, approved by order of the Ministry of Finance of Russia dated October 6, 2008 No. 106n), if the factors influencing its size change, the amount of the reserve changes (clause 2 of PBU 21/ 2008). Moreover, this change can affect both the data of the current period and the data of future periods (clause 4 of PBU 21/2008).

The unused part of the reserve may exist no longer than until the end of the year following the year of its creation (clause 70 of the regulations on accounting and accounting), which does not prevent the creation of a new reserve for the same debt.

Operations of creating, changing, writing off (restoring) the reserve are accounted for through other income (expenses), i.e. in the correspondence of account 63 with account 91. This is indicated in the following documents:

- in the regulations on accounting and accounting (clause 70);

- PBU 10/99, approved by order of the Ministry of Finance of Russia dated May 6, 1999 No. 33n (clause 11);

- PBU 21/2008 (clause 4).

But using the reserve for the purpose for which it was created (writing off a bad debt) will create a posting in the correspondence of account 63 with the account for writing off bad debts (clause 77 of the regulations on accounting and accounting).

For the procedure for writing off bad receivables, as well as sample documents, see the Typical Situation from ConsultantPlus. Get a free trial and proceed to the calculation example.

How to write off bad debts in accounting, see the material “Writing off accounts receivable and accounting entries.”

For a reserve formed for a debt denominated in a foreign currency, on the dates of transactions with this debt and on the dates of reporting, it will be necessary to recalculate not only the debt, but also the reserve on it at the exchange rate established for the corresponding day (clause 7 of PBU 3 /2006, approved by order of the Ministry of Finance of Russia dated November 27, 2006 No. 154n).

Characteristics of the reserve for doubtful debts created in accounting

The main volume of information on the SD reserve contains PBU on accounting and accounting (Order of the Ministry of Finance of the Russian Federation dated July 29, 1998 No. 34n). This reserve is discussed in two paragraphs of this document:

- in paragraph 70, which defines doubtful debts, and also provides the basic rules for creating a reserve, accounting for it and writing it off if not used;

- in paragraph 77, which contains the rules for formalizing the procedure for writing off debt that is unrealistic for collection, and the procedure for using reserve amounts for this.

PBU on accounting and accounting defines doubtful debt as the debt of its counterparty (receivable) to an organization - outstanding or having a high probability of non-payment within the terms established by the contract and not secured by guarantees.

The rules for creating a reserve for SD in accordance with this PBU are as follows:

- its formation is mandatory if the debt is identified and recognized as doubtful;

- there are no exceptions from the number of organizations required to create a reserve for SD;

- there is no relationship with the fact of creation or non-creation of the same reserve in tax accounting;

- there are no restrictions on the types of debts recognized as doubtful, but there is an obligation to conduct separate analytics for each of the doubtful debts;

- The organization determines the frequency of identifying doubtful debts at its discretion;

- the amount of the reserve is also determined by the organization independently based on data on the financial condition of the debtor and an assessment of the likelihood of it repaying all or part of the debt;

- the formation of the reserve and the write-off of its unused part are reflected through the financial result, and the unused amounts must be included in this result at the end of the year following the year the reserve was created.

PBU 21/2008 includes the SD reserve in the list of estimated values (clause 3) and allows for ongoing adjustments to its amount depending on changes in factors affecting it (clause 2). Adjusting the amount of the reserve can apply both to the period of change in the factors on which the amount of the reserve depends, and to future periods, but ultimately affects the financial result (clause 4).

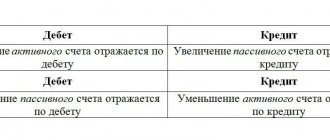

The reserve is accrued and changed: postings

The entry for creating a reserve for doubtful debts will be the same, regardless of which account the debt recognized as doubtful is recorded in. In it, the amount of the reserve accrued for the corresponding debt on account 63 will correspond with account 91:

Dt 91 Kt 63.

A change in the amount of the reserve when factors affecting its size change can lead to either an increase or a decrease in the reserve. Postings in both cases can be of 2 types:

- In correspondence with score 91:

- Dt 91 Kt 63 - with an increase in reserve;

- Dt 63 Kt 91 - when the reserve decreases.

- In correspondence with score 97:

- Dt 97 Kt 63 - if the increase in the reserve affects data for future periods;

- Dt 63 Kt 97 - if the decrease in the reserve was also reflected in the data previously taken into account for this reserve in expenses of future periods.

The write-off of the reserve data reflected in account 97 will occur in the period to which the change in the amount of the reserve relates, taken into account with this change as deferred expenses (clause 4 of PBU 21/2008):

Dt 91 Kt 97.

Example:

Based on the results of the first quarter of 2022, Sigma LLC carried out an inventory of settlements with debtors and identified the following doubtful debts:

Contractor: Smiley LLC

The amount of debt is 100,000 rubles.

The repayment period under the agreement is 01/20/2021.

The basis for recognizing a debt as doubtful is that bankruptcy proceedings have been opened against the debtor, and there is no security for payment.

The accountant of Smiley LLC prepared an accounting statement and, on its basis, increased the reserve for doubtful debts by posting Dt 91.2 Kt 63.

In tax accounting, the accountant showed contributions to the reserve on line 200 of Appendix No. 2 to sheet 02 of the income tax return. There is no need to show the write-off of bad debt through the reserve in the declaration.

Further, having signed the order with the manager, he wrote off the receivables of Smiley LLC, which were unrealistic for collection from the reserve for doubtful debts, by recording Dt 63 Kt 62.

See also “Limitation Period for Accounts Receivable.”

The concept of doubtful accounts receivable

An organization's receivables are considered doubtful if they have not been repaid or with a high degree of probability will not be repaid within the time limits established by the agreement and are not provided with appropriate guarantees (clause 70 of the Accounting Regulations No. 34n, Letter of the Ministry of Finance dated January 14, 2015 No. 07-01-06 /188, dated January 27, 2012 N 07-02-18/01). This is evidenced, in particular:

- or violation by the debtor of the payment deadline;

- or information about the debtor’s financial problems.

Any receivable can be recognized as a doubtful debt, including those reflected in the debit of accounts 60, 62, 76.

After a doubtful debt is recognized as unrealistic for collection, including due to the expiration of the statute of limitations, it must be written off.

Restoration and use of reserve: postings

Restoration (write-off) of reserve amounts occurs in 2 cases:

- when paying off a debt or part of it, the reserve is reduced by the corresponding amount;

- when writing off an unused reserve (or its balance) upon expiration of the deadline established for its existence.

The wiring will be the same in both cases:

Dt 63 Kt 91.1.

The amount recorded on account 97 can be added to it if part of the reserve was formed from deferred expenses that were not written off by the time the reserve was restored (written off):

Dt 63 Kt 97.

The presence of a reserve obliges to write off at its expense those doubtful debts that are recognized as bad (clause 77 of the regulations on accounting and accounting). When using the reserve for doubtful debts, the entries will have the same appearance, differing only in the account number from which the bad debt accounted for is written off:

Dt 63 Kt 62 (76, 73, 71).

Bad debts written off within 5 years are taken into account in the balance sheet in case of possible payment:

Dt 007.

Read about the actions that will need to be taken to justify writing off bad debts in the article “Procedure for writing off accounts receivable”.

Application of PBU 18/02

If a taxpayer does not create a tax reserve for doubtful debts, the costs of creating the reserve are reflected in accounting, but are not taken into account when calculating income tax.

The resulting permanent difference leads to the formation of PNO. Its value is 20% of the amount of the constant difference.

PNO in accounting is reflected by the following entry:

Debit 68, subaccount “Calculations for income tax”, Credit99, subaccount “PNO/PNA”,

— the amount of PNO is reflected.

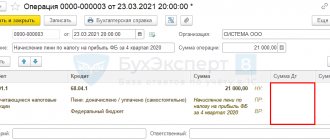

Then these transactions should be reflected in accounting as follows:

| Contents of operations | Debit | Credit | Amount, rub. | Primary document |

| A reserve for doubtful debts has been formed | 91-2 | 63 | 354 000 | Order of the head of the organization, Accounting certificate |

| PNO reflected (RUB 354,000 x 20%) | 99 | 68/PNO | 70 800 | Accounting certificate - calculation |

Let's continue with the example.

Let us assume that during the fourth quarter of 2016 the tenant’s debt is fully repaid.

Accounting reserve

The reserve is not shown as a separate line in the accounting statements. By its amount, the amount of receivables is reduced, reflected in the corresponding line in the balance sheet (clause 35 of PBU 4/99, approved by order of the Ministry of Finance of Russia dated July 6, 1999 No. 43n).

If the amount of the reserve changed during the reporting period, then in the explanations to the statements it will be necessary to disclose the reasons for this change and its impact on the reporting data of the current or future periods (clause 6 of PBU 21/2008). In relation to reserves formed for transactions with related parties, organizations that do not have the right to prepare simplified reporting are required to provide information about such reserves in explanations (clause 3 and clause 10 of PBU 11/2008).

Results

The reserve for doubtful debts, which is an object of accounting, is fully subject to the rules of this accounting. Therefore, accounting entries for transactions with this reserve are formed in accordance with the instructions contained in the PBU.

Sources:

- Tax Code of the Russian Federation

- Law “On Accounting” dated December 6, 2011 N 402-FZ

- Order of the Ministry of Finance of the Russian Federation “On approval of the Regulations on accounting and financial reporting in the Russian Federation” dated July 29, 1998 No. 34n

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Criteria for classifying a debt as doubtful

In the conditions of a modern market economy, when many counterparties “burn out” every now and then, enterprises are faced with the question of the impossibility of receiving payment from the debtor.

As a result, a debt appears on the company’s balance sheet, the possibility of repayment of which is in doubt. Doubtful debt is an amount of debt that, with a high degree of probability, will not be paid within the terms stipulated by the contract. At the same time, companies can assume this probability on their own.

A reserve is created to reflect doubtful debts in accounting. Clause 70 of Order No. 34n of the Ministry of Finance of the Russian Federation dated July 20, 1998 states that a company can write off such debt if certain conditions are met:

- The deadlines for payment specified in the contract have expired.

- There is no collateral or guarantee to secure the debt.

That is, if the debtor company sends a letter of guarantee to the creditor indicating the terms of payment, then it will not be possible to include the receivable in the reserve (letter of the Ministry of Finance of the Russian Federation dated 06.08.2007 No. 07-05-06/211).

IMPORTANT! Companies will not be able to include in the reserve for doubtful debts the amount of the deposit or the remaining funds in the current account of a bank with a revoked license (letter of the Ministry of Finance of Russia dated February 18, 2016 No. 03-03-06/2/9007). Advances transferred to suppliers should also not be included in the reserve (letter of the Ministry of Finance dated October 15, 2003 No. 16-00-14/316).