Other taxes

09.27.2016 Print

Disposal of fixed assets may occur upon liquidation of property. If we are talking about buildings and structures, disposal is accompanied by dismantling of objects. Let's figure out what documents to draw up and how to reflect such an operation in accounting.

Typically, fixed assets are dismantled and written off if the property is obsolete and physically worn out, or if an accident, natural disaster or other emergency occurs. Also, the reason for liquidation is often theft or shortage of components and assemblies, without which the use of property is impossible, and their replacement is impractical. Damage to an asset is another reason to dismantle the OS.

Carrying out liquidation of fixed assets

Liquidation of a fixed asset is a standard procedure at an enterprise, which is carried out due to physical wear and tear, when the technical characteristics of the property no longer meet the necessary requirements. The Ministry of Finance provides guidelines on the rules for conducting liquidation. They were approved by order No. 91n of October 13, 2003. Let's consider the liquidation procedure step by step:

- Determine what state the OS object is in;

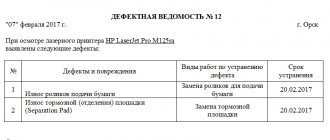

- Record detected deviations and the degree of wear in the reports;

- Request and receive permission to write off a fixed asset;

- Write off fixed assets in accounting;

- Dismantle the fixed asset and disassemble it into parts and spare parts;

- Recycle the OS object.

The manager makes and formalizes the decision to create a special liquidation commission. The commission members decide what to do next with the worn-out fixed asset. Liquidation commission:

- evaluates the technical condition of the OS;

- makes a decision on the advisability of its further use at the enterprise.

If the commission decides that it is time to liquidate the facility, then a conclusion is drawn up on the inappropriateness of using the facility in production in the future.

Then the head of the organization issues an order that the operation of the fixed asset must be stopped, and the object itself must be liquidated. Based on this order, it is necessary to write off the object at its original cost, and also remove accumulated depreciation from accounting.

What documents should I submit?

To dismantle the OS, you must first create a liquidation commission and obtain its conclusion. The commission should include the chief accountant, financially responsible persons and other employees who are appointed by order of the head of the company.

In order to make an informed decision on writing off a fixed asset, the commission must inspect the object (if it is not stolen and is available). The commission also evaluates the possibilities and feasibility of restoring property and establishes the reasons for liquidation. The commission is also charged with identifying the perpetrators if the facility is liquidated before the end of its standard service life due to someone else’s fault. In addition, the commission determines whether it is possible to use individual components, parts or materials of the liquidated fixed asset.

Note!

For firms and entrepreneurs on the simplified tax system with the object “income,” the dismantling of fixed assets does not in any way affect the amount of the single tax (clause 3.1 of article 346.21 of the Tax Code of the Russian Federation).

This is provided for in paragraph 77 of the Methodological Instructions, approved by Order of the Ministry of Finance of Russia dated October 13, 2003 No. 91n (hereinafter referred to as Methodological Instructions No. 91n).

The commission formalizes the result with a conclusion. There is no standard form for it. Therefore, you can develop a document template yourself. The main thing is that the form contains all the necessary details of the primary document. The form is approved by the manager by order to the accounting policy (Article 9 of the Federal Law of December 6, 2011 No. 402-FZ, clause 4 of PBU 1/2008).

The next step: the head of the organization issues an order to liquidate the fixed asset.

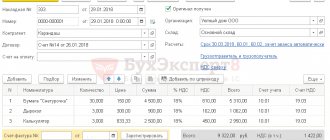

After the conclusion of the commission and the order of the manager, it is necessary to draw up an act on the write-off of the property. You can use an act in standard form No. OS-4 or a self-developed form. In the second case, it is necessary that the document contains all the necessary details. Like any other primary documents used in the organization, the selected form is approved by order of the manager.

Based on write-off acts, make notes on the disposal of fixed assets in inventory cards and books that you use to record the storage and movement of fixed assets. This is provided for in paragraph 80 of Methodological Instructions No. 91n. As a rule, standard forms are used: an inventory card in form No. OS-6 (when accounting for property separately) or a card in form No. OS-6a (when fixed assets are accounted for as part of groups of objects). Small enterprises use an inventory book according to form No. OS-6b.

Note!

Simplified people with the object “income minus expenses” can write off for tax purposes the costs of dismantling the OS either on their own or with the participation of a contractor (Clause 1 of Article 346.16 of the Tax Code of the Russian Federation).

When dismantling a fixed asset, you can obtain individual materials, components and assemblies suitable for use. Such property must be capitalized in accordance with paragraph 57 of Methodological Instructions No. 91n. To register the receipt of objects received during the dismantling of fixed assets, you can use standard form No. M-35.

How to receive spare parts and materials

Liquidation can be carried out by different methods, one of which is dismantling. You can dismantle the object yourself using the organization’s specialists, or you can involve contractors.

Accounting for write-off of fixed assets After dismantling has been carried out, it is important to correctly reflect all income and expenses in accounting. We will have no other income, so we set it to zero. In other expenses, it is necessary to reflect the residual value of the fixed asset and the expenses incurred for the liquidation. After dismantling, it is necessary to correctly reflect both income and expenses incurred in accounting.

General Audit Department on the issue of dismantling written-off fixed assets

Answer Thus, in our opinion, the cost of removing reinforced concrete waste should be considered as the cost of liquidating a fixed asset item

.

Accounting

In accordance with paragraph 31 of PBU 6/01[1], income and expenses from the write-off of fixed assets from accounting are reflected in accounting in the reporting period to which they relate. Income and expenses from writing off fixed assets from accounting are subject to credit to the profit and loss account as other income and expenses.

According to paragraph 11 of PBU 10/99[2], other expenses are those associated with the sale, disposal and other write-off of fixed assets and other assets other than cash (except foreign currency), goods, and products.

Consequently, the costs of removing construction waste generated as a result of dismantling the foundation of a decommissioned production line are subject to inclusion in other costs in the period of occurrence. In addition, in our opinion, liquidation costs include not only the costs of garbage removal, but also the work of actually dismantling the foundation[3]

.

At the same time, the write-off of a fixed asset in accounting does not depend on its actual dismantling.

The Ministry of Finance of the Russian Federation came to this conclusion in Letter No. 03-05-05-01/21929 dated 06/13/13:

"Question:

On the absence of grounds for taxation by property tax of organizations of movable property registered on January 1, 2013 as fixed assets, as well as on the write-off from accounting of fixed assets not used for the production of products

until the moment of their actual dismantling

(liquidation) on the basis of an approved the head of the JSC act on the write-off of fixed assets.

Answer:

The Department of Tax and Customs Tariff Policy, together with the Department of Regulation of Accounting, Financial Reporting and Auditing, reviewed the letter from the OJSC on the issue of writing off fixed assets not used for the production of products from accounting until the moment of their actual dismantling (liquidation) on the basis of the Act on write-off of a fixed asset item, from which section was excluded. 3 of the unified form N OS-4, and reports that the Regulations on the Ministry of Finance of the Russian Federation, approved by Decree of the Government of the Russian Federation of June 30, 2004 N 329, do not provide for the consideration of requests from organizations regarding the practice of applying regulatory legal acts of the Ministry of Finance of the Russian Federation, to conduct an examination contracts and other documents of organizations, as well as on the assessment of specific business situations.

At the same time, please note that in accordance with paragraph 1 of Art. 374 of the Tax Code of the Russian Federation (hereinafter referred to as the Code), the objects of taxation for Russian organizations are movable and immovable property (including property transferred for temporary possession, use, disposal, trust management, contributed to joint activities or received under a concession agreement), accounted for on the balance sheet as fixed assets in the manner established for accounting, unless otherwise provided by Art. Art. 378, 378.1 of the Code.

Based on paragraphs. 8 clause 4 art. 374 of the Code, movable property registered on January 1, 2013 as fixed assets is not recognized as an object of taxation for corporate property tax.

The rules for the formation of information about the organization's fixed assets in accounting are determined by the Accounting Regulations “Accounting for Fixed Assets” (PBU 6/01), approved by Order of the Ministry of Finance of Russia dated March 30, 2001 N 26n, according to which the cost of a fixed asset item that is being retired or is not capable of bring economic benefits (income) to the organization in the future, is subject to write-off from accounting.

In accordance with the Federal Law “On Accounting”, the forms of primary accounting documents are approved by the head of an economic entity upon the recommendation of the official responsible for maintaining accounting records. Mandatory details of the primary accounting document are established by the specified Federal Law.”

Income tax

In accordance with subparagraph 8 of paragraph 1 of Article 265 of the Tax Code of the Russian Federation, non-operating expenses not related to production and sales include reasonable costs for carrying out activities not directly related to production and (or) sales. Such expenses include, in particular, expenses for the liquidation of fixed assets being decommissioned, for the write-off of intangible assets, including amounts of depreciation underaccrued in accordance with the established useful life, as well as expenses for the liquidation of unfinished construction projects and other property, the installation of which has not been completed ( expenses for dismantling, disassembly, removal of disassembled property), protection of subsoil and other similar work, unless otherwise established by Article 267.4 of this Code.

In accordance with subparagraph 8 of paragraph 7 of Article 272 of the Tax Code of the Russian Federation, the date of non-operating expenses in the form of expenses for payment to third-party organizations for work performed (services provided) is recognized as the date of settlements in accordance with the terms of concluded agreements or the date of presentation to the taxpayer of documents serving as the basis for making settlements , or the last date of the reporting (tax) period.

Consequently, in our opinion, the costs of dismantling a fixed asset in the form of the cost of removing construction waste should be included in non-operating expenses on the date of signing the certificate of completion of work.

At the same time, the norms of the Tax Code of the Russian Federation do not connect the moment of write-off of a fixed asset with the moment of its actual dismantling.

The Ministry of Finance of the Russian Federation in Letter dated December 8, 2009 No. 03-03-06/1/793 gave the following explanations:

"Question:

The organization put into operation a fixed asset object - a local network. When the organization moved, the network was not dismantled due to the impossibility of using it in the new office. The organization decided to write off the local network from the balance sheet as a result of liquidation. For the purpose of calculating income tax, does an organization have the right to take into account in non-operating expenses the residual value of a liquidated fixed asset on the basis of paragraphs. 8 clause 1 art. 265 of the Tax Code of the Russian Federation? Is dismantling a prerequisite for liquidation of a fixed asset?

Answer:

For tax accounting purposes, write-off of incompletely depreciated property is possible upon its sale or liquidation.

Liquidation of fixed assets decommissioned is carried out as a result of:

— write-offs in case of moral and (or) physical wear and tear;

— liquidation in case of accidents, natural disasters and other emergency situations caused by force majeure;

- for other similar reasons.

In accordance with paragraphs. 8 clause 1 art. 265 of the Tax Code of the Russian Federation (hereinafter referred to as the Code), for the purpose of taxing the profits of organizations, expenses for the liquidation of fixed assets decommissioned, including amounts of depreciation underaccrued in accordance with the established useful life, are included in non-operating expenses not related to production and sales.

Thus, the residual value of an incompletely depreciated liquidated fixed asset is taken into account as part of non-operating expenses on the basis of paragraphs. 8 clause 1 art. 265 of the Code. Moreover, in accordance with the provisions of paragraphs. 8 clause 1 art. 265 of the Code, dismantling is not a mandatory condition for the liquidation of a fixed asset.”

Thus, the Organization has the right to recognize expenses in the form of the residual value of a fixed asset, regardless of whether it was actually dismantled or not.

Currently, there are no official clarifications on whether the Organization has the right to recognize the costs of dismantling a fixed asset in later tax (reporting) periods, after its write-off (signing of the OS-4 act [4], or another similar document) as part of non-operating expenses .

The Letter of the Federal Tax Service of the Russian Federation for Moscow dated September 30, 2010 No. 16-15 / [email protected] contains the following conclusion:

“The write-off of a fixed asset is formalized by an order from the head of the organization and an act on the write-off (liquidation) of fixed assets, signed by members of the liquidation commission (Form N OS-4).

The act must contain the year of creation of the object, the date of receipt by the enterprise, the date of commissioning, the initial cost of the object (for revalued - replacement), the amount of accrued depreciation, the number of major repairs carried out, the reasons for write-off and the possibility of using both the object itself and its individual components and details.

In accordance with paragraphs. 3 paragraph 7 art. 272 of the Tax Code of the Russian Federation, the date of non-operating expenses is the date of presentation to the taxpayer of documents serving as the basis for making calculations, or the last date of the reporting (tax) period.

Thus, when writing off (liquidating) property that is not fully depreciated, the residual value is taken into account as part of non-operating expenses, which are taken into account when determining the tax base for corporate income tax at a time on the date the liquidation commission signs the act on the completion of work to liquidate the fixed asset.

At the same time, in Letter dated December 8, 2009 N 03-03-06/1/793, the Ministry of Finance of the Russian Federation adds that the residual value of an incompletely depreciated liquidated fixed asset is taken into account as part of non-operating expenses on the basis of paragraphs. 8 clause 1 art. 265 Tax Code of the Russian Federation. Moreover, in accordance with the provisions of this subclause, dismantling is not a mandatory condition for the liquidation of a fixed asset.”

From the analysis of this letter, we can conclude that expenses are subject to recognition at a time on the date of signing the OS-4 act by the liquidation commission. However, dismantling is not a prerequisite for write-off.

At the same time, we draw your attention to the Resolution of the Federal Antimonopoly Service of the East Siberian District dated May 21, 2012 in case No. A19-16172/2011:

«According to the tax inspectorate, work on dismantling the pipeline cannot be classified as non-operating expenses, since design estimates and technical documentation and witness testimony confirm that these works are a separate stage of a single technological process of construction and installation work for the construction of a fixed asset facility in their place , intended to expand production at the Chelnok-A3 site.

The courts of the first and appellate instances recognized it as legitimate to include in non-operating expenses in accordance with subparagraph 8 of paragraph 1 of Article 265 of the Tax Code of the Russian Federation the costs of dismantling pipelines due to the fact that the dismantling of technological pipelines cannot be attributed to the modernization or reconstruction of a fixed asset, as well as taking into account their liquidation due to wear and tear.

The courts, when considering the case, also established that another basis for the additional accrual of profit tax to the company was the unlawful, in the opinion of the tax inspectorate, inclusion in non-operating expenses of the amounts paid to the limited liability company (LLC) "V&T" under contract No. 207662004, for the dismantling of equipment located in building 803 (pipelines and metal structures in the central row of the building, in axes 112 - 133). During the audit, the tax inspectorate came to the conclusion that the dismantling of the pipeline and metal structures was carried out in connection with the reconstruction of the Chelnok-A section.

By virtue of paragraph 1 of Article 265 of the Tax Code of the Russian Federation, non-operating expenses not related to production and sales include reasonable costs for carrying out activities not directly related to production and (or) sales.

Such expenses, in accordance with subparagraph 8 of paragraph 1 of the said article, include expenses for the liquidation of fixed assets being decommissioned, including amounts of depreciation underaccrued in accordance with the established useful life, as well as expenses for the liquidation of unfinished construction projects and other property, the installation of which was not completed. completed (expenses for dismantling, dismantling, removal of disassembled property), subsoil protection and other similar work.

Paragraph 2 of Article 257 of the Tax Code of the Russian Federation establishes that in the event of disposal of part of an object of fixed assets due to liquidation, there is a change in the initial cost of this object, which is repaid through depreciation.

Modernization work includes work caused by a change in the technological or service purpose of equipment, a building, structure or other object of depreciable fixed assets, increased loads and (or) other new qualities; Reconstruction includes the reconstruction of existing fixed assets, associated with the improvement of production and increasing its technical and economic indicators and carried out under the project for the reconstruction of fixed assets in order to increase production capacity, improve quality and change the range of products.

Thus, the courts came to the correct conclusion that the liquidation of a fixed asset cannot be considered as a reconstruction or modernization of an object.

The tax inspectorate’s argument about the illegality of including the disputed costs in non-operating expenses due to the fact that the dismantling of pipelines was a preparatory stage for the reconstruction of the Chelnok-A section, which, in its opinion, is confirmed by design estimates and technical documentation and testimony of company officials and former employees of ViT LLC is unfounded.

The courts have established that the basis for including the costs of dismantling equipment as non-operating expenses was its liquidation in accordance with Act No. 17/534 dated June 15, 1990

due to wear and tear of this equipment. The inventory act of separation production equipment written off in 1990 dated 07/09/2007 N 17/1093 carried out an inventory of property, as a result of which it was established that in buildings 802, 803, 804, scrap metal from written off, but not dismantled and undisassembled equipment in the amount of 39,505 tons , including in warehouse 35 and in buildings 802, 803, 804. The appendices to the act indicate the write-off of equipment (for building 803) - hot water pipelines, deaerated water. In this part, the equipment was written off and later dismantled by ViT LLC under a contract.”

From this Resolution we can indirectly conclude that the Organization has the right to include in non-sales expenses the cost of dismantling fixed assets written off in previous tax periods, and not include them in the initial cost of the facility under construction.

College of Tax Consultants, October 3, 2016

[1] Order of the Ministry of Finance of the Russian Federation dated March 30, 2001 No. 26n “On approval of the Accounting Regulations “Accounting for Fixed Assets” PBU 6/01”

[2] Order of the Ministry of Finance of the Russian Federation dated 05/06/99 No. 33n “On approval of the Accounting Regulations “Organization Expenses” PBU 10/99”

[3] For example, the work of an excavator dismantling it.

[4] If the use of this unified form is provided for by the accounting policy.

Answers to the most interesting questions on our telegram channel knk_audit

Back to section

Estimation of the cost of remaining materials and spare parts for accounting

If the materials and spare parts remaining after dismantling are suitable for further use, then they must be taken into account at the market price. In this case, the price must be confirmed by a certificate.

The certificate indicates the average market cost of similar materials and spare parts. Such a document can be prepared by an expert from a specialized organization or a specialized employee of the enterprise. If the analysis is carried out by an employee, then he must analyze market prices for similar materials and make a conclusion in which it is necessary to justify the proposed price.

Problem 1: salvage value

The fundamental innovation of FSBU 6/2020 is the calculation of the liquidation value of fixed assets.

Let's say you bought a lathe that requires installation and has a useful life of 6 years. If it is liquidated at the end of the joint investigation, dismantling will be required. As a result, before putting the machine into operation, you will have to assemble a group of specialists who can make an assessment of future income and costs:

- calculate how much the cost of dismantling will cost in 6 years;

- predict the state of the machine at the end of the test;

- determine the possibility of selling it in 6 years or predict the cost of scrap metal that can be recovered during disposal;

- determine which spare parts can be capitalized during dismantling and which ones can be disposed of.

And only after this is it possible to calculate the liquidation value as the difference between projected income (the cost of scrap metal and suitable spare parts) and liquidation costs (dismantling, disassembly, etc.).

Such a procedure for each fixed asset (not only for liquidation value, but also for private investment and depreciation method) is required to be carried out when registering the object and reviewed every year !

But the standard forgot to mention who exactly should do this and where to get such professional predictors? And which of them will agree to load themselves with additional technical and analytical and forecasting functions? It seems, as always, that the solution to this issue will fall as a dead weight on the shoulders of the long-suffering accountant...

Fortunately, there are loopholes in the standard that help avoid these “draconian” calculations. But read the article to the end.

Reflection in accounting of materials and spare parts after dismantling

Everything that remains after dismantling can be used in the organization’s activities, or can be sold.

Reflecting the receipt of materials and spare parts To reflect the receipt of materials as a result of dismantling a fixed asset, you need to make the following posting: Debit 10 credit 91-1

If you left the materials for yourself If you still decide to use the spare parts and materials further in your own production, then we make the following posting: Debit 20/25/25 credit 10

If materials are sold If materials are sold, then revenue and other expenses will arise in the amount for which they were sold. How we reflect it in accounting: Debit 62 credit 91-1 Debit 91-2 credit 10.

What documents are used to receive materials received from the write-off of fixed assets?

As a result of writing off fixed assets (fixed assets), the organization can receive materials. But what documents should be used to register them? Here you need to take into account which fixed assets - real estate or something else - are written off and what materials - scrap of precious metals, scrap metal or usable parts - are received.

In the process of disassembling and dismantling write-off fixed assets (FPE), the organization can receive, for example, suitable spare parts, assemblies, assemblies, materials, components, scrap and waste of ferrous and non-ferrous metals (scrap metal), as well as parts and assemblies containing precious metals. They are registered with the entry: D-t 10 - K-t 91-1 (clause 45 of Instruction No. 133; part 3, clause 30 of Instruction No. 26).

The fact of write-off of fixed assets is documented by an act of write-off of property. The organization develops its form independently (clause 28 of Instruction No. 26).

Sample

Sample act on write-off of property

The basis for the capitalization of suitable materials received from the write-off of fixed assets, as well as scrap metal, can be a wide variety of documents used in the organization. Their choice depends on the type of asset being written off (real estate, non-title structures or something else), as well as on the documents used in the organization. Usually this:

- acts of receipt of materials received from dismantling (its approximate recommended form C-14 has been established) - if materials are received from demolition, dismantling, dismantling of real estate;

- acts on the dismantling of non-title temporary buildings and structures (its approximate recommended form C-6 has been established) - if the materials come from the dismantling of non-title temporary buildings and structures;

— acts of receipt of materials, acts of write-off of property (if they contain the necessary information about materials received), invoices, delivery notes, etc. - if the materials are received from the write-off of other fixed assets (clause 58 of Instruction No. 133).

Samples

Sample act of receipt of materials received from dismantling the structure

A sample act on the write-off of a fixed asset, which includes materials suitable for use.

Sample act of acceptance of scrap metal for accounting, received from the write-off of tools and equipment

, parts, assemblies and components containing precious metals are removed from them , the basis for capitalization are:

— act of dismantling (seizure), attached to the act of write-off of property, if the organization dismantles the OS on its own and at the same time indicates the content of precious metals in the seized parts;

- an act drawn up by a specialized organization - a processor - in other cases, namely when dismantling OS by a third-party specialized organization or by an organization if it uses a simplified version of accounting for precious metals and does not reflect their quantity in the act of dismantling (withdrawal) (Part 1, 3 clause 70, clause 71 of Instruction No. 34).

The accounting policy may establish that the posting of materials is formalized by receipt orders. In this case, an additional order should be drawn up (clauses 26, 27 of Instruction No. 133).

Read this material in ilex >>*

* following the link you will be taken to the paid content of the ilex service

Taxes on capitalized materials

All income and expenses arising from the dismantling of a fixed asset must be taken into account when calculating corporate income tax.

How we keep tax records in case of write-off of fixed assets:

- Non-operating income: spare parts, materials, other property received during dismantling of the fixed assets;

- Non-operating expenses: all expenses for the liquidation of an asset, underaccrued depreciation;

- Accrual method: as of the date of drawing up the liquidation act;

- Cash method: on the date of acceptance of the property for accounting.

Thus, all costs incurred by an enterprise to liquidate a fixed asset must be accounted for as non-operating income (Article 265 of the Tax Code). Similarly, we write off the remaining cost of a fixed asset that is being taken out of service.

Dismantling a fixed asset - how to calculate depreciation in the future?

Dismantling costs should be included in the costs associated with the liquidation of the OS, and not in the initial cost of the future premises

09.22.2017 Author: Expert of the Legal Consulting Service GARANT, auditor, member of the RSA Tatyana Karataeva

The enterprise is planning a reconstruction. The production building will be reconstructed into a storage room for raw materials. For this purpose, the installed equipment, heating and gas supply systems of the workshop will be partially dismantled (they are not taken into account separately as part of fixed assets). The industrial building, which houses equipment, heating and sewerage systems (all listed separately as part of fixed assets is not taken into account), is not fully depreciated. What are the costs of dismantling? Will these costs increase the initial cost of the building?

On this issue we take the following position:

When dismantling equipment, heating and gas supply systems, partial liquidation of the fixed asset occurs.

These expenses should be taken into account in accounting as part of other expenses, and in tax accounting as part of non-operating expenses.

Demolition costs do not increase the original cost of the building.

Justification for the position:

Accounting

Inclusion of dismantling costs in the initial cost of the warehouse

1. The rules for the formation of information about the organization’s fixed assets in accounting are regulated by PBU 6/01 “Accounting for fixed assets” (hereinafter referred to as PBU 6/01) and the Guidelines for accounting of fixed assets, approved by order of the Ministry of Finance of the Russian Federation dated October 13, 2003 N 91n (hereinafter referred to as the Guidelines).

In accordance with PBU 6/01, an asset is accepted as part of fixed assets (FPE) subject to the simultaneous fulfillment of the conditions established by clause 4 of PBU 6/01, and also provided that the object has been brought to a state in which it is suitable for use in the organization’s activities .

Based on clause 6 of PBU 6/01, the accounting unit of fixed assets is an inventory item. An OS inventory object is recognized as an object with all its fixtures and accessories, or a separate structurally isolated object, intended to perform certain independent functions, or a separate complex of structurally articulated objects, representing a single whole, intended to perform a specific job. A complex of structurally articulated objects is one or more objects of the same or different purposes, having common devices and accessories, common control, mounted on the same foundation, as a result of which each object included in the complex can perform its functions only as part of the complex, and not independently.

If one object has several parts, the useful lives of which differ significantly, each such part is accounted for as an independent inventory item.

In general, according to clause 21, part 2, art. 2 of the Federal Law of December 30, 2009 N 384-FZ “Technical Regulations on the Safety of Buildings and Structures” (hereinafter referred to as Law N 384-FZ), the building’s engineering and technical support system is an integral part of the building (Clause 6, Part 2, Article 2 of the Law N 384-FZ). Thus, according to this standard, an engineering and technical support system is one of the systems of a building or structure designed to perform the functions of water supply, sewerage, heating, ventilation, air conditioning, gas supply, electricity supply, communications, information technology, dispatching, waste disposal, vertical transport (elevators, escalators) or safety features.

In the “Introduction” section of the All-Russian Classifier OK 013-2014 (SNS 2008) “All-Russian Classifier of Fixed Assets” (adopted and put into effect by order of Rosstandart dated 12/12/2014 N 2018-st), valid from 01/01/2017, it is indicated that:

- non-residential buildings and their parts also include fittings, devices and equipment that are their integral parts;

- buildings include communications inside buildings necessary for their operation, such as: a heating system, including a boiler installation for heating (if the latter is located in the building itself); internal water supply, gas and sewerage networks with all devices and equipment; internal network of power and lighting electrical wiring with all lighting fixtures, internal telephone and alarm networks, ventilation devices for general sanitary purposes, lifts and elevators. Similar provisions were contained in the introduction to the All-Russian Classifier of Fixed Assets OK 013-94 (OKOF) (approved by Decree of the State Standard of the Russian Federation of December 26, 1994 N 359), which was valid until 2022.

Therefore, as a rule, the cost of the relevant equipment, heating and gas supply systems is included in the initial cost of buildings, which, as we understand, is the case in this case.

The initial cost of fixed assets acquired for a fee is recognized as the amount of the organization's actual costs for acquisition, construction and production, with the exception of VAT and other refundable taxes (except for cases provided for by the legislation of the Russian Federation) (clause 8 of PBU 6/01).

The initial cost of the operating system includes, in particular, the following costs:

- amounts paid in accordance with the contract to the supplier (seller), as well as amounts paid for delivering the object and bringing it into a condition suitable for use;

— amounts paid to organizations for carrying out work under a construction contract and other contracts;

— other costs directly related to the acquisition, construction and production of OS.

As defined in paragraph 27 of PBU 6/01, the costs of modernization and reconstruction of an OS facility after their completion increase the initial cost of such an object if, as a result of modernization and reconstruction, the initially adopted standard indicators of its functioning improve (increase) (useful life, power, quality applications, etc.). The basis for increasing the cost of an operating system by the amount of costs for its modernization and reconstruction may also be an increase in the remaining useful life of the facility while all other performance indicators remain unchanged (power, quality of use, etc.) (see letter of the Ministry of Finance of Russia dated January 29, 2014 N 07 -04-18/01).

At the same time, the accounting legislation does not provide for the inclusion of the residual value of retired fixed assets (parts of objects) in the initial cost of new fixed assets. This position is shared by specialists from the Ministry of Finance of Russia, who pointed out that if during the reconstruction process old equipment to be replaced is dismantled, then the costs of dismantling do not increase the initial cost of new fixed assets (letter of the Ministry of Finance of Russia dated September 7, 2007 N 03-11-04/ 1/21, see also letters of the Ministry of Finance of Russia dated September 10, 2012 N 03-03-06/1/475, UMNS for Moscow dated August 23, 2004 N 26-12/55121).

In the resolution of the Ninth Arbitration Court of Appeal dated August 30, 2010 N 09AP-17226/2010, 09AP-18203/2010, the judges considered the inspectorate’s statements that the company, in accordance with paragraph 2 of Art. 257 of the Tax Code of the Russian Federation unlawfully included the costs of dismantling liquidated fixed assets as part of non-operating expenses, which were unfounded. Since the work on dismantling liquidated (in whole or in part) OS objects is related to the types of work listed in clause 2 of Art. 257 of the Tax Code of the Russian Federation do not apply; the costs of their production could not be included by the company in the initial cost of the modernized installations. In connection with the above, the costs of dismantling OSes being decommissioned could not be included in the initial cost of modernized installations. The position is confirmed by arbitration practice (for example, resolution of the Federal Antimonopoly Service of the Moscow District dated May 17, 2007 N KA-A40/3766-07), as well as explanatory letters from the Ministry of Finance of Russia (N 03-03-04/1/29 dated August 3, 2005; N 03- 03-06/1/675 dated 09/19/2007; N 03-03-06/1/479 dated 08/27/2008).

However, another approach is also possible. Thus, in relation to the period of validity of the expired PBU “Accounting for fixed assets” (PBU 6/97), approved by order of the Ministry of Finance of Russia dated 09/03/97 N 65n, in the letter of the Department of Tax Administration for Moscow dated 03/14/2001 N it was explained that expenses for dismantling of liquidated equipment, included in the estimate for the manufacture and installation of a new fixed asset, can be taken into account in the initial cost of the acquired fixed asset (see also Question: The organization acquired a fixed asset. In the estimate for the manufacture and installation of a fixed asset, the dismantling of the old structure is highlighted as a separate line. Does the organization have the right to include the costs of dismantling the old structure in the initial cost of the acquired fixed asset? (“Moscow Tax Courier”, N 12, June 2001), letter of the Ministry of Finance of Russia dated December 24, 2010 N 03-03-06/1/806) .

On the issue of including dismantling costs as part of reconstruction costs (for tax accounting purposes), we cite the letter of the Ministry of Finance of Russia dated 01.08.2006 N 03-03-04/2/185. The bank, together with a design organization, developed a project for the reconstruction of an office building. Design and estimate documentation also includes preparatory work (preparation of the construction site, dismantling of equipment, etc.) to begin reconstruction work. The financial department explained that there are two possible options for accounting for the cost of costs associated with preparatory work:

1. If the current legislation provides for the possibility of carrying out the specified preparatory work necessary for reconstruction, without design documentation approved in the established manner, then the bank can, as indicated in the question, carry out preparatory work, which, according to the design and estimate documentation, constitutes an integral part of the reconstruction work. In this case, the cost of preparatory work as a component of the total estimated cost of reconstruction work after the completion of reconstruction will increase the initial cost of the building and will be taken into account for profit tax purposes through the depreciation mechanism;

2. If the cost of preparatory work is not included in the design and estimate cost of reconstruction and their implementation requires the conclusion of additional contracts and permits, then the cost of such preparatory work as work of a capital nature should be taken into account by the bank separately from the costs associated with reconstruction.

As we can see, accounting for the cost of dismantling work depends, among other things, on whether they were carried out within the framework of a general contract for reconstruction (they are a separate stage of reconstruction work) or whether they are carried out separately from the reconstruction itself. We also note that claims from the tax authorities regarding the failure to include the cost of dismantling work in the cost of reconstruction work and the initial cost of fixed assets are possible (see material: Write-off of fixed assets: accounting and taxation (Yu.A. Suslova, “Accounting”, N 9, 10 , September, October 2014), section “Write-off of fixed assets during the reconstruction of facilities”).

In our opinion, in your case, the costs of dismantling systems and equipment are relevant to the proposed reconstruction of the building, however, we believe that dismantling costs should not be included as part of the reconstruction costs. This is due to the fact that despite the fact that the reason for the disposal of such parts of the asset (building) is the proposed reconstruction, the dismantling costs themselves are due precisely to the fact of liquidation of objects that will not be used in the future, and the corresponding costs are associated precisely with their disposal .

Thus, we believe that dismantling costs should be included in the costs associated with the liquidation of the fixed assets (in the case under consideration with the partial liquidation of the fixed assets), and not in the initial cost of the future premises for storing raw materials.

2. PBU 6/01 and the Guidelines do not disclose the exact definition of the concept of “partial liquidation”. However, definitions of this concept can be found in other legal acts. So, for example, in clause 1.2.8 of the order of the Moscow Property Department dated April 27, 2012 N 56-p “On approval of the Procedure for approval by the Moscow Property Department of proposals (applications) of state unitary enterprises (state enterprises, state-owned enterprises) of the city of Moscow for liquidation (partial liquidation) and write-off of real and movable property and amendments to the Department’s order dated September 8, 2011 N 504-p” states that partial liquidation of movable and immovable property means destruction (disassembly, dismantling, disposal, etc. .) parts of a fixed asset object, consisting of several parts (items), but listed in accounting as a single inventory item, or the liquidation of a part of a fixed asset object that represents a single whole (building, structure, linear object, etc.).

Clause 14 of PBU 6/01 provides an exhaustive list of cases when changes in the initial cost of fixed assets at which they are accepted for accounting are allowed (completion, additional equipment, reconstruction, modernization, partial liquidation and revaluation of fixed assets).

From clause 29 of PBU 6/01 and clause 76 of the Methodological Instructions it follows that during partial liquidation, a partial disposal of the fixed asset occurs. Hence, we believe that partial liquidation should be reflected in accounting in the general manner provided for the disposal of fixed assets.

From the provisions of paragraphs. 77-79 of the Methodological Instructions it follows that in order to write off fixed assets in an organization, by order of the head, a commission is created, which includes relevant officials, including the chief accountant (accountant) and persons who are responsible for the safety of fixed assets. The decision taken by the commission to write off a fixed asset object is documented in the act of writing off a fixed asset object, indicating the data characterizing the fixed asset object (date of acceptance of the object for accounting, year of manufacture or construction, time of commissioning, useful life, initial cost and amount of accrued depreciation, revaluations, repairs, reasons for disposal with their justification, condition of main parts, parts, assemblies, structural elements). The act of decommissioning an asset is approved by the head of the organization.

Taking this into account, the commission, in the act of partial liquidation, indicates the reasons for the partial liquidation of the building (dismantling of equipment, heating and gas supply systems), and also determines the share of the liquidated property in the manner prescribed in the accounting policy (Part 4 of Article 8 of Law No. 402-FZ, clause 7 of PBU 1/2008 “Accounting Policy”), for example, as a percentage of the building area. Taking into account the established share, the initial cost and accrued depreciation attributable to the liquidated part of the building are calculated. A similar methodology was reflected in letters of the Ministry of Finance of Russia dated 08/27/2008 N 03-03-06/1/479, dated 08/19/2011 N 03-03-06/1/503, dated 08/03/2012 N 03-03-06/1 /378.

From clause 20 of PBU 6/01 and clause 59 of the Methodological Instructions it follows that the useful life of an asset is determined by the organization when accepting the object for accounting. And it is possible to change the useful life of an asset after the start of its depreciation only in cases of improvement (increase) in the initially adopted standard indicators of the functioning of the asset as a result of reconstruction or modernization.

If the initial cost of an asset increases as a result of modernization (reconstruction), the annual amount of depreciation is recalculated based on the residual value of the asset, increased by the costs of modernization (reconstruction), and the remaining useful life (letter of the Ministry of Finance of Russia dated June 23, 2004 N 07-02- 14/144).

During modernization (reconstruction), depreciation is accrued at the old rate, and to calculate the new depreciation rate, the residual value is taken on the first day of the month following the commissioning of the modernized (reconstructed) OS.

In this case, we believe that for the remaining part of the fixed asset (building), depreciation continues to be accrued in the generally established manner based on the residual (adjusted for the cost of partial liquidation of equipment, heating and gas supply systems) cost of the building and its previously established useful life.

In accordance with the Chart of Accounts and instructions for its use, approved by Order of the Ministry of Finance of Russia dated October 31, 2000 N 94n (hereinafter referred to as the Instructions), upon partial liquidation of an asset, the following entries must be made in accounting:

Debit 01, subaccount “Retirement of fixed assets” Credit 01, subaccount “Own fixed assets”

- for the part of the original cost attributable to the liquidated part of the building (equipment, heating and gas supply systems);

Debit 02 Credit 01, subaccount “Retirement of fixed assets”

- the amount of accrued depreciation in the part attributable to the liquidated part of the building (equipment, heating and gas supply systems);

Debit 91, subaccount “Other expenses” Credit 01, subaccount “Retirement of fixed assets”

- for the amount of the residual value of the liquidated part of the building (equipment, heating and gas supply systems) (clause 31 PBU 6/01, clause 11 PBU 10/99 “Organization expenses”);

Debit 91, subaccount “Other expenses” Credit 60 (69, 70)

— expenses associated with the dismantling of equipment, heating and gas supply systems are reflected (clauses 4, 5, 11 PBU 10/99 “Organization expenses”).

Income tax

1. In accordance with paragraph 1 of Art. 256 of the Tax Code of the Russian Federation, depreciable property for profit tax purposes is recognized, in particular, as property that is owned by the taxpayer (unless otherwise provided by Chapter 25 of the Tax Code of the Russian Federation), is used by him to generate income and the cost of which is repaid by calculating depreciation. Depreciable property is property with a useful life of more than 12 months and an original cost of more than 100,000 rubles.

The initial cost of a fixed asset is determined as the sum of the costs of its acquisition, construction, production, delivery and bringing it to a state in which it is suitable for use, excluding VAT and excise taxes.

Dismantling work during the liquidation of equipment, heating and gas supply systems, in our opinion, is not associated with bringing the new facility to a state in which it is suitable for use; therefore, as already noted, such work should not be taken into account in the initial cost of the new facility (warehouse ).

For profit tax purposes, the initial cost of fixed assets changes in cases of completion, additional equipment, reconstruction, modernization, technical re-equipment, partial liquidation of relevant facilities and for other similar reasons (clause 2 of Article 257 of the Tax Code of the Russian Federation).

In the situation under consideration, as already noted, when the equipment, heating and gas supply systems are dismantled, the building is partially liquidated. Therefore, its initial cost can be reduced.

In accordance with paragraphs. 8 clause 1 art. 265 of the Tax Code of the Russian Federation, expenses for the liquidation of fixed assets decommissioned, including the amount of depreciation underaccrued in accordance with the established useful life, are taken into account as part of non-operating expenses (letter of the Ministry of Finance of Russia dated October 21, 2008 N 03-03-06/1/592, dated 17.01. 2006 N 03-03-04/1/27, dated 04/08/2005 N 03-03-01-04/2/61).

Thus, in the letter of the Ministry of Finance of Russia dated September 10, 2012 N 03-03-06/1/475 regarding the question of whether the residual value of demolished under-depreciated fixed assets is included in the initial cost of the construction project for the purpose of calculating income tax, it is indicated that expenses for liquidation and dismantling of fixed assets, as well as the amount of underaccrued depreciation for this object are included in expenses for profit tax purposes in accordance with the provisions of Art. 265 of the Tax Code of the Russian Federation, subject to their compliance with Art. 252 of the Tax Code of the Russian Federation.

Let us note that this position is supported by arbitration courts (see, for example, resolutions of the FAS of the East Siberian District dated May 21, 2012 N F02-1730/12).

In the resolution of the Federal Antimonopoly Service of the Ural District dated April 11, 2011 N F09-1678/11-S3, the court came to the conclusion that when dismantling a building in connection with technical re-equipment, the cost of dismantling should not increase the cost of depreciable property and is subject to accounting in the manner established by paragraphs. 8 clause 1 art. 265 Tax Code of the Russian Federation.

Taking into account the above, we believe that for profit tax purposes, the costs of dismantling equipment, heating and gas supply systems can be taken into account as part of non-operating expenses with proper documentation (clause 1 of Article 252 of the Tax Code of the Russian Federation).

2. It is necessary to take into account that expenses in the form of amounts of depreciation underaccrued in accordance with the established useful life are included in non-operating expenses not related to production and sales only for depreciable property items for which depreciation is calculated using the straight-line method. Thus, taxpayers using the straight-line method of calculating depreciation, when liquidating part of an asset, the amount of underaccrued depreciation on the liquidated part of the object can be included in non-operating expenses on the basis of paragraphs. 8 clause 1 art. 265 of the Tax Code of the Russian Federation (letters of the Ministry of Finance of Russia dated December 3, 2015 N 03-03-06/1/70529, dated April 27, 2015 N 03-03-06/1/24095). For example, in the letter of the Ministry of Finance of Russia dated December 15, 2016 N 03-03-06/1/75343 it is reported that in the event of partial liquidation of depreciable property, the taxpayer incurs non-operating expenses, which are taken into account when determining the tax base for corporate income tax at a time on the date of signing the liquidation document. commission of the act on the performance of work on the partial liquidation of the fixed asset. And in letters of the Ministry of Finance of Russia dated 08/03/2012 N 03-03-06/1/378, dated 08/19/2011 N 03-03-06/1/503 regarding the partial liquidation of fixed assets, it was proposed to take into account the amounts of underaccrued depreciation based on paragraphs. 20 clause 1 art. 265 of the Tax Code of the Russian Federation (and not paragraph 8 of clause 1 of Article 265 of the Tax Code of the Russian Federation).

At the same time, the Tax Code of the Russian Federation does not contain a specific algorithm for determining the residual value in the event of partial liquidation of fixed assets. In practice, as a rule, the share of the liquidated part of the depreciable property is determined as a percentage of the depreciable property. Taking into account the established share, the initial (residual) value and accrued depreciation attributable to the liquidated part of the property are calculated. Such recommendations were given by the Ministry of Finance of Russia (see, for example, the above-mentioned letters of the Ministry of Finance of Russia dated 08/03/2012 N 03-03-06/1/378, dated 08/19/2011 N 03-03-06/1/503, dated 08/27/2008 N 03-03-06/1/479).

Thus, when carrying out partial liquidation of an asset, tax accounting must reflect the change in its initial value, as well as calculate the residual value (the amount of underaccrued depreciation) attributable to the liquidated part of the asset.

From the letter of the Ministry of Finance of Russia dated November 7, 2008 N 03-03-06/1/619 it follows that for a partially liquidated fixed asset, the use of which continues, the organization can continue to charge depreciation based on the residual value of such fixed assets, reduced by the market value of inventory assets (if any received in the process of partial liquidation).

These clarifications, in our opinion, contradict the clarifications given in letters of the Ministry of Finance of Russia dated 08/03/2012 N 03-03-06/1/378, dated 08/19/2011 N 03-03-06/1/503, dated 08/27/2008 N 03-03-06/1/479, according to which the residual value of a fixed asset after its partial liquidation is determined as the difference between the residual value of this fixed asset before the partial liquidation process and the residual value attributable to the liquidated part of the fixed asset (determined based on the percentage of the depreciable property that is partially liquidated).

Since the norms of the Tax Code of the Russian Federation do not establish the procedure for determining the residual value of fixed assets upon their partial liquidation, the organization should independently determine in its accounting policy for tax purposes how the residual value of the building will be determined after its partial liquidation. In our opinion, it is necessary to be guided by later clarifications of the authorized bodies.

During partial liquidation, the useful life of the building does not change, and accordingly, the depreciation rate does not change either (clause 1 of Article 258 of the Tax Code of the Russian Federation, see letters of the Ministry of Finance of Russia dated January 23, 2015 N 03-03-06/1/1750, dated February 5, 2013 N 03-03-06/4/2438, dated 06/20/2012 N 03-03-06/1/313, dated 06/09/2012 N 03-03-10/66).

3. The cost of materials or other property received during dismantling or disassembly during the liquidation of fixed assets decommissioned is included in non-operating income (clause 13 of Article 250 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated May 25, 2017 N 03-03-05/32014 ).

According to paragraph 5 of Art. 274 of the Tax Code of the Russian Federation, non-operating income received in kind is taken into account when determining the tax base based on the transaction price, taking into account the provisions of Art. 105.3 of the Tax Code of the Russian Federation (that is, based on the market price) (letter of the Ministry of Finance of Russia dated August 10, 2012 N 03-03-06/1/400, clause 1 of letter of the Ministry of Finance of Russia dated July 30, 2012 N 03-01-18/5-101 ). Moreover, the current market value of elevator equipment must be documented.

Note that neither for accounting nor for tax accounting the list of documents that can be used to confirm the market value is not defined. We believe that such a document could be an act of independent assessment or, for example, an agreement for the sale of this property (clause 8 of Article 250 of the Tax Code of the Russian Federation).

When determining market prices, information on prices published in official publications of authorized bodies, in particular bodies authorized in the field of statistics, pricing, and customs authorities can also be used (see, for example, letters of the Ministry of Finance of Russia dated May 10, 2011 N 03-02-07 /1-160, dated December 31, 2009 N 03-02-08/95, dated August 1, 2008 N 03-02-07/1-329, dated August 1, 2008 N 03-02-07/1-333, dated March 29 .2007 N 03-02-07/1-144). At the same time, in the letter of the Ministry of Finance of Russia dated May 10, 2011 N 03-02-07/1-160, it was stated that information on market prices for goods, works, and services contained in the specified official sources does not include information on the cost of goods provided by organizations carrying out activities to collect and process information without special indication in regulatory legal acts of the status of its publication as an official source.

In accordance with paragraphs. 8 clause 4 art. 271 of the Tax Code of the Russian Federation, non-operating income is recognized on the date of drawing up the act of liquidation of depreciable property (in this case, partial liquidation), drawn up in accordance with accounting requirements.

According to the Ministry of Finance of Russia, when liquidating fixed assets that are being taken out of service, non-operating income includes income in the form of the cost of received materials or other property, regardless of their use or non-use in production (letter of the Ministry of Finance of Russia dated May 19, 2008 N 03-03-06/ 2/58).

Thus, the costs of dismantling equipment, heating and gas supply systems of the organization should be taken into account as part of non-operating expenses, and the cost of materials or other property received during the dismantling of this equipment should be taken into account as part of non-operating income (on the issue of accounting for materials received during liquidation (in including partial) OS, we recommend that you familiarize yourself with the Encyclopedia of Solutions. Accounting for materials received as a result of the liquidation of fixed assets).

GUARANTEE

Post: