License acquired: KOSGU 2022

The purchase of the right to use any product of intellectual work under a license from January 1, 2022 is recorded in budget accounting by KOSGU analytical codes 226, 352, 353 and is regulated by the Procedure, approved. By Order of the Ministry of Finance No. 209n dated November 29, 2017 (as amended by Order No. 222n dated September 29, 2020).

According to clauses 11.5.2, 11.5.3 of the Procedure, operations for taking into account non-exclusive rights to “intellectual” objects are classified under the following sub-articles:

- 352 KOSGU, if their useful life (SPI) is established;

- 353 KOSGU for undetectable SPI.

However, these codes are not acceptable for recording cash disposals and receipts (this is prohibited by Order No. 209n), i.e., it is impossible to pay for a license using one of these items. Therefore, on the basis of clause 13 of Order No. 222n, the costs incurred when purchasing a license in the enterprise’s accounting are reflected in subarticle 226 “Other work, services” of KOSGU in conjunction with cost code 244 “Other procurement” of KVR.

In the future, the purchased product must be taken into account in subsection 352 or 353, depending on whether the program’s SPI is defined or not. Those. in the operation of purchasing a license for a software product and accepting it for registration, two KOSGU codes are always used - 226 and 352 or 353.

How to record the purchase of a license to use software products?

Operations related to obtaining the right to use the software are reflected in accounting on the basis of license and other agreements concluded in accordance with the legislation of the Russian Federation (clause Instruction No. 157n).

In accordance with Procedure No. 85n, expenses for the acquisition of non-exclusive rights to software are reflected in expense type 244 “Other purchase of goods, works and services.” Government institutions, instead of code 244, use code 242 “Purchase of goods, works, services in the field of information and communication technologies”, if such a decision is enshrined in the regulatory act of the relevant financial authority.

Such expenses are included in subarticle 226 “Other work, services” of KOSGU (see Procedure No. 209n). From 2022, to reflect the costs of acquiring non-exclusive rights to software, subarticles 352 and 353 of the KOSGU are applied (clauses 11.4.2, 11.5.3 of Order No. 209n, clause of Order No. 209n).

The KOSGU Kontur.Normativa directory allows you to find the appropriate code for the operation. Simply enter keywords into the search bar. The most frequently used codes can be found and saved in “Favorites”.

The procedure for recording expenses for the purchase of software depends on the provisions of the concluded agreement and accounting policies.

If the validity period of the license exceeds 12 months (that is, it is valid for several reporting periods), then the costs of its acquisition are reflected as deferred expenses (clause 302 of Instruction No. 157n). Subsequently, they are included in the financial result of the current year (cost of products, works, services) in the manner determined by the accounting policy (clause 302 of Instruction No. 157n, clause 124 of Instruction No. 162n, clause 160 of Instruction No. 174n, clause 188 Instructions No. 183n).

If the validity period of the license does not exceed 12 months, then the costs, as a rule, are attributed directly to the current financial result (cost of products, works, services). However, as part of the development of accounting policies, a decision may be made to attribute such expenses to deferred expenses (clause 302 of Instruction No. 157n, clause 102 of Instruction No. 162n, clause 128 of Instruction No. 174n, clause 138 of Instruction No. 183n).

Also, acquired rights to the software during the validity period of the license are reflected in off-balance sheet account 01 (clause 333 of Instruction No. 157n, letter of the Ministry of Finance of Russia dated October 24, 2019 No. 02-07-10/81930).

Can expenses be recognized when purchasing a software license?

When purchasing a license to use a software product, there will be no “input” VAT, since the transfer of non-exclusive rights is not subject to this tax (subclause 2 of Article 149 of the Tax Code of the Russian Federation).

Institutions can take into account expenses for corporate income tax if the software product is used in income-generating activities (KVD 2) - this rule is enshrined in paragraph Art. 252 of the Tax Code of the Russian Federation. This means that budgetary and autonomous institutions can recognize the costs of purchasing software for income tax:

- completely, if the software product is used only for profit-generating activities;

- partially, if the software product is used both in income-generating activities and in other operations - for example, when performing a state/municipal task (KVD 4) or compulsory medical insurance (KVD 7). In this case, expenses will be recognized only to the extent that relates to income-generating activities.

Thus, in most cases, budgetary and autonomous institutions, in accordance with paragraphs. clause 1 art. 251, paragraph art. 252 and paragraph Art. 270 of the Tax Code of the Russian Federation, expenses for income tax will not be accepted. For government institutions, no expenses are accepted for profit tax purposes (see clause 33.1, clause 1, article 251, clause 252, clause 270 of the Tax Code of the Russian Federation).

Let's look at the accounting records that reflect the acquisition of rights to software1.

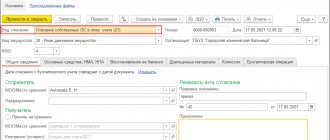

License: KOSGU 352

Code 352 denotes operations to accept for accounting the rights to use software with a certain SPI. For example, the purchase of a program with a 2-year SPI specified in the contract is reflected in code 226 KOSGU, and then when registering it (to account 111 60), subarticle 352 of KOSGU is used.

If the validity of the license does not exceed a year, then there is no need to reflect its cost on account 111 60 (such costs are taken into account in deferred expenses or in current expenses, depending on the terms of the agreement and the provisions of the adopted accounting policy).

Accounting software in accounting

Today it is impossible to find a company that does not use any software in its work - from specialized production and accounting programs to security tools and reporting services. How to reflect software in accounting will be discussed in our publication.

Software accounting system: exclusive rights

Such a right to use software usually arises if the program is developed by order of a company in accordance with the stated requirements. In this case, the software is taken into account in tax and accounting as an intangible asset (intangible asset).

Software should be registered at its original cost, which includes the costs incurred when purchasing the product. If the cost of the software does not exceed 100,000 rubles, then in tax accounting the asset is recognized as non-depreciable (clause 1 of Article 256 of the Tax Code of the Russian Federation), i.e. a program worth up to 100,000 rubles. can be fully written off as costs at the time of commissioning.

The useful life (USL) in tax accounting is determined according to the technical documentation for the software. If it is impossible to establish it, the company has the right to determine the service life itself, which cannot be less than 2 years (clause 2 of Article 258 of the Tax Code of the Russian Federation).

In accounting, a limit on the cost of software to identify it as a depreciable intangible asset has not been established, therefore depreciation should be calculated for all intangible assets with a known SPI. For assets with undetectable SPI, depreciation is not calculated, but annually enterprises are required to review and clarify the service life of intangible assets, confirming the impossibility of determination or establishing it (clause 27 of PBU 14/2007).

The exclusive right to software does not have a time frame, therefore, in accounting, the exclusive right to software is determined based on the period in which it is planned to be used. In practice, in order to avoid discrepancies in tax and accounting, enterprises set the same period of use for software.

Accounting software: postings

The purchase of software under exclusive rights is recorded in accounting with the following entries:

| Operations | D/t | K/t |

| Costs for purchasing software are taken into account | 08/5 | 60 |

| Software put into operation | 04 | 08/5 |

| Calculation of monthly depreciation in accounting for intangible assets with a known SPI | 20,26,44 | 05 |

| Software - tax accounting: | ||

| — if the cost of purchasing the software does not exceed 100,000 rubles. its full cost is written off as expenses | 20,26,44 | 04 |

| - if the cost of the software is above 100,000 rubles. - depreciation is calculated | 20,26,44 | 05 |

Example

In July 2022, a company operating on OSNO acquired exclusive rights to software for organizing personnel records management worth RUB 300,000.

Registration of the transfer of the right to the software, registration was completed in July 2022, and a state fee in the amount of 7,500 rubles was paid. The validity period of the exclusive right is 60 months.

In tax and accounting, depreciation on intangible assets is calculated using the straight-line method.

| Operations | D/t | K/t | Sum |

| Software costs taken into account: | |||

| Cost of the right to use the software invoiced by the supplier | 08/5 | 60 | 300000 |

| Payment of state duty | 08/5 | 76 | 7500 |

| Putting the software into operation | 04 | 08/5 | 307500 |

| Depreciation calculation from August 2022 (307500 / 60 months) | 20,26,44 | 05 | 5125 |

At the end of the SPI (60 months), the cost of the software will be fully included in expenses. If a company wants to extend the exclusive right, then the software does not need to be written off in accounting, but continues to be accounted for at zero residual value. The accountant will have to include the amount of state duty paid in connection with current expenses.

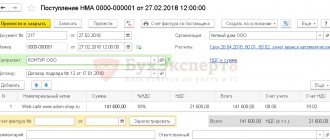

Accounting for non-exclusive rights to software

Purchasing a software product under a license agreement gives the purchaser non-exclusive rights confirmed by the license. In such a situation, the program cannot be classified as part of the intangible asset, since it is not the property of the company. Accounting for the costs of its acquisition will be carried out in deferred expenses (FPR) on account 97.

In tax accounting, such software costs are written off monthly in equal shares throughout the entire period of use, i.e. license validity period. If the SPI is not specified in the contract, clause 4 of Art. 1235 of the Civil Code of the Russian Federation considers it to be concluded for 5 years, i.e.

The company distributes costs based on this period, setting it independently. In accounting, you can write off the costs of acquiring non-exclusive rights to software, just like in tax accounting - in equal shares or simultaneously.

Typically, companies practice accounting and accounting records, evenly distributing expenses over the entire period of validity of the license.

In addition, the user is required to keep records of software licenses on the balance sheet by opening, for example, a new account 012 “Intangible assets received for use under a license agreement,” since the seller’s non-exclusive right to the software is the subject of intangible assets. Payments for updating the program are taken into account as part of operating operating costs.

Accounting for software in accounting 2022 when purchased with non-exclusive rights is carried out with the following entries:

| Operations | D/t | K/t |

| Payment for using the program | 60,76 | 51 |

| The right to use the software has been acquired | 97 | 60,76 |

| The software license (accounting) is included off the balance sheet in the value of the contract estimate | 012 | |

| Write-off (monthly) of a share of deferred expenses (amount of expenses / number of months of using the software) | 20,26,44 | 97 |

| Write-off of the value of an asset upon expiration of the license to use the software | 012 |

License: KOSGU 353

Code 353 KOSGU reflects operations to register rights to software with an undetectable SPI. When purchasing a software license, the institution establishes the fact of determining its validity period. It happens that the SPI is not fixed in the contract. The specialized commission on the movement of assets checks the possibility of establishing such a period, taking into account various factors when determining it.

If the SPI is determined by the commission, then the acceptance for accounting of the rights to use the software will be reflected using code 352 KOSGU. If it is impossible to establish the IPI, the cost of the license will be fixed under subsection 353.

However, SPI for objects with an indeterminable validity period can be established during the annual inventory of intangible assets. In this case, the object is reclassified from code 353 KOSGU to code 352 KOSGU.

In which accounts should intangible assets be recorded?

The accounting account for an intangible asset depends on the right under which it was obtained.

| Right | Account | Example |

| Exclusive right | 0 102 XN 000 “Scientific research (research development)” 0 102 XR 000 “Experimental design and technological development” 0 102 XI 000 “Software and databases” 0 102 XD 000 “Other intellectual property” | Exclusive right to software - account 0 102 ХI 000; Exclusive right to a selection achievement - account 0 102 ХN 000; Exclusive right to a trademark - account 0 102 ХD 000; Exclusive right to an invention - account 0 102 ХN 000 |

| Non-exclusive right | 0 111 6N 000 “Rights to use scientific research (research developments)” 0 111 6R 000 “Rights to use experimental design and technological developments” 0 111 6I 000 “Rights to use software and databases” 0 111 6D 000 “Rights to use other objects of intellectual property" | Non-exclusive right to antivirus - account 0 111 6I 000; Non-exclusive right to a utility model - account 0 111 6N 000; Non-exclusive right to an electronic archive - account 0 111 6I 000; Non-exclusive right to a literary work - account 0 111 6D 000. |

Objects of intangible assets are grouped according to clause 37 of Instruction No. 157n. That is, objects received under exclusive right are accounted for in the corresponding account 102 00, where X can take the value 2 “Especially valuable movable property of the institution”, 3 “Other movable property of the institution” or 9 “Property in concession”.

More on the topic: Reserves for future expenses: accounting and application in practice

For example, on account 102 91 “Software and databases in concession” information about programs for electronic computers, databases, information systems and (or) sites on the Internet or other information and telecommunication networks that are the objects of concession agreements is subject to reflection. which includes such computer programs and (or) databases, or about the totality of these objects, as well as about operations that change them.

The grouping by type of property, designated by the letters N, R, I or D, corresponds to the subsections of the classification established by OKOF *(3) (clause 67 of Instruction No. 157n, letter of the Ministry of Finance of Russia dated September 17, 2020 No. 02-07-10/81813). Namely, OKOF provides for the following groups of intellectual property objects (OKOF code 700):

- scientific research and development (OKOF code 710);

- software and databases (OKOF code 730);

- other objects of intellectual property (OKOF code 790).

For example, multimedia applications are named in the “Software and Databases” group - OKOF code 732.00.10.08. Consequently, the exclusive right to this object, related to other movable property, is taken into account in account 102 3I. And if an institution has a non-exclusive right to multimedia applications, then it will be reflected in account 111 6I.