Hello, Vasily Zhdanov is here, in this article we will look at the non-current assets of an enterprise. The balance sheet, designed in the form of a two-sided “Asset-Liability” table, is developed by the Russian Ministry of Finance. Assets mean everything that the company owns and uses. Property, in turn, is divided into 2 groups depending on its functions and composition: fixed capital (non-current assets) and working capital (current assets). Let's figure out what place a company's non-current assets occupy in the company's balance sheet, what they are, and how to increase them.

What are non-current assets of an enterprise

In any enterprise, the balance sheet includes current and non-current assets (property) that are involved in the production process, and without which commercial activity is impossible.

Take our proprietary course on choosing stocks on the stock market → training course

Non-current assets are understood as such property for which the following statements are true:

- they are applied in the course of the company’s business activities for more than 12 months;

- their cost is transferred to the price of the finished product (service, work);

- they are useful to a commercial organization and generate income.

The groups of non- and current assets of the Balance Sheet include items of the balance sheet (its individual lines). The items of non-current assets are as follows:

- intangible assets (in our article the abbreviation will be used - intangible assets);

- deferred tax assets (DTA);

- research and development results;

- financial investments;

- non- and material exploration assets (LPA, MPA - 2 separate items of the Balance Sheet);

- profitable investments in material assets (abbr. MT);

- fixed assets (fixed assets).

Let's consider each of the items of non-current assets separately.

Commercial bank assets

Definition 1

The assets of a credit organization are expressed by accounting items that reflect the placement and use of the bank's resources.

The formation of assets occurs due to the bank's implementation of its active operations. Active operations are expressed in the placement of own as well as borrowed funds to generate income, maintain the required level of liquidity and ensure the efficient operation of the bank.

Note 1

Commercial banks receive their main profits only through active operations.

Bank assets have a broad structure and are classified according to many criteria.

Are you an expert in this subject area? We invite you to become the author of the Directory Working Conditions

Classification of bank assets:

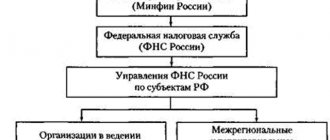

Figure 1. Classification of bank assets. Author24 - online exchange of student work

Let's consider the classification of bank assets by purpose:

- Cash assets. Such assets that provide a sufficient level of liquidity for a commercial bank.

- Current assets or in other words – working assets. Such assets bring current income to the bank.

- Investment assets. Such assets are necessary for the bank to make a profit, as well as to achieve established strategic goals.

- Non-current assets or in other words – capitalized assets. Such assets are necessary for a commercial bank to ensure its business activities.

- Other assets of the bank.

Fixed assets (non-current assets of the enterprise)

We list the types of long-term operating company property that can be classified as fixed assets:

- buildings, structures, structures;

- subsoil, water complexes and other environmental management facilities;

- equipment, power and working machines;

- plots of land;

- regulating and measuring devices and instruments;

- capital investments in objects that were leased;

- Computer Engineering;

- capital investments in fundamental improvements of land plots (reclamation works such as drainage and irrigation);

- transport;

- on-farm roads;

- household and production equipment, tools, accessories;

- perennial plantings;

- breeding, productive, working livestock.

Enterprise assets: concept, management principle

A company's assets are property resources that it owns and uses in production activities to make a profit and develop its business. They may not have a material form, they may be presented in the form of funds in a current account or in the form of some object.

Important! Starting from January 2022, companies have a PPA - the right to use an asset. These are assets that a company has leased and uses to make a profit. They do not belong to the company by right of ownership, but they generate income for it.

Asset management is relevant for any company. Therefore, it is carried out on an ongoing basis.

In this case, assets must meet the following requirements:

- Participate directly or indirectly in the main activities of the company and generate profit (income).

- Have a valuation.

- Belong to the company on the right of ownership (in the case of leased assets - on the right of use).

- The company can exercise control and management of assets.

Who controls?

Large companies with a network of branches and representative offices, as a rule, manage assets through a specially created structural unit.

Medium and small businesses do not have the production capacity to organize a separate asset management body. It is acceptable for them to assign management functions to the accounting department, which, in turn, can distribute control over certain types of assets to other departments.

Intangible and tangible search assets (non-current assets of the enterprise)

Although the tangible and intangible search assets of an enterprise are interconnected, they are displayed in two different items of the balance sheet:

| Intangible search assets | Material prospecting assets |

| These include: ● results of assessing the feasibility of mineral extraction from a commercial point of view; ● the right (with a license) to search, evaluate deposits, and explore mineral resources; ● results of sampling and exploration drilling; ● information obtained during geophysical, geological, topographical research; ● other information about the subsoil. | These include assets used in the search, evaluation and exploration of mineral resources: ● transport; ● equipment (tanks, pumps, drills); ● structures such as piping systems. |

Management and optimization of the enterprise asset structure

It is necessary to optimize the structure of assets - when determining the optimal ratio of their various types, an assessment of the enterprise's liquidity is given, and ways to increase it and improve economic activity are determined.

The process itself takes three stages:

- The composition of non-current assets is analyzed. The part of active assets, most used in operating activities, and passive (auxiliary) assets is determined.

- The optimal ratio of active and passive non-current assets is calculated. At this stage, it is incorrect to believe that passive non-current assets need to be minimized. They include buildings, structures, and expensive equipment - without them, an effective and uninterrupted production cycle is not possible.

- Optimization of current assets. We also maintain a balance between highly liquid cash, accounts receivable and the availability of raw materials in warehouses. It is necessary to take into account the characteristics of the main type of economic activity, factors of the production cycle, as well as the liquidity of various types of current assets.

Principles of asset management and optimization

To properly organize the process of asset management and optimization, you need to consider the following factors:

- The totality of a company's assets is formed taking into account its development strategy, possible prospects, economic characteristics of the market, as well as the regional segment. Important!

Absence of contradictions with the goals of creating the organization itself. For example, it may seem strange to tax authorities that a large share of the assets of a company in the metallurgical sector consists of short-term financial investments in the absence of fixed assets. - The totality of assets is formed in such a way as to ensure the production of finished products, taking into account compliance with the structure of the enterprise. In the course of activity, the composition of assets must undergo some changes, adapting to the range of products produced. For example, if a confectionery company started baking cheesecakes, it would be necessary to purchase an oven and a freezer to store the products.

- Wise choice of assets. It is necessary to acquire assets taking into account the maximum possible benefit from their use. The low cost of equipment from a supplier may indicate poor quality, short service life, and rapid obsolescence. Too expensive equipment in most cases implies thoughtless spending on their acquisition without the opportunity to significantly increase profits from the use of such an asset. The balance of price and expected benefits is the main principle of choosing an asset to purchase.

- Balance in assets based on liquidity. It is worth noting that it can be difficult to comply with this principle - you need to analyze the existing property, draw up a list of assets that should in the future ensure the achievement of key performance indicators. And strive to bring the actual availability of assets to the planned one. The assets of any company must include both highly liquid assets (money in accounts) in order to timely pay off its obligations, and low-liquid assets (for example, fixed assets in the form of buildings, equipment) that ensure the production cycle. But in what proportions is a task for the manager.

- Interchangeability. It is necessary to form a set of assets taking into account their possible interchangeability. For example, one machine broke down. Spare parts for repairs or equipment capable of taking over the functions of the machine for repair should always be available. This is the only way to ensure continuity of production. Are assets not fungible? Then there is the risk of downtime, especially if the company only has assets that are used for a long time or are not updated.

Results of research and development (non-current assets of the enterprise)

The article “Results of Research and Development” is intended to reflect the company’s costs for technological work, development and research work that have not yet been completed. This article will include, but is not limited to:

- work completed, but by law not subject to legal protection;

- completed work, the result of which is subject to legal protection by the state, but which is not properly documented.

Intangible assets (non-current assets of the enterprise)

Any company property can be called an intangible asset and is listed on the balance sheet if the following conditions are simultaneously met:

- the object in question does not have a material form;

- this is an object that will be used by the enterprise for more than 1 year (including if it is used within one operating cycle lasting 1 year or more);

- the actual cost of the object has been determined;

- the company has rights to this object, which is documented;

- the use of this facility has a positive effect on the company’s income.

The following objects owned by enterprises can be classified as intangible assets:

- business reputation transferred to the new owner along with the purchased company (as a whole property complex or only part of it);

- works of art, scientific research, literary works;

- production secrets (“know-how”);

- programs for computers and electronic machines;

- trademarks, service marks;

- advances in breeding;

- inventions;

- useful models.

Concept, composition, structure and classification of non-current assets

Content

Introduction. 3

Chapter 1. Theoretical aspects of managing non-current assets of an enterprise 5

1.1. Concept, composition, structure and classification of non-current assets. 5

1.2. Sources of formation of non-current assets of an enterprise. 8

1.3. Indicators of the efficiency of using non-current assets of an enterprise. eleven

Chapter 2. Features of liquidity and profitability management of JSC Uralredmet. 17

2.1. Technical and organizational characteristics of JSC Uralredmet. 17

2.2. Assessment of the dynamics and structure of non-current assets. 23

2.3. Analysis of the efficiency of use of fixed assets. 32

2.4. Recommendations for improving the efficiency of using non-current assets of JSC Uralredmet. 36

Conclusion. 38

List of sources used. 40

Appendix 1. Balance sheet of JSC Uralredmet as of December 31, 2019.

Appendix 2. Report on the financial results of JSC Uralredmet for 2019.

Introduction

The financial condition of the enterprise and its stability largely depend on what property the enterprise has, what assets the capital is invested in, and what income they bring to it.

The placement of enterprise funds is very important in financial activities and increasing its efficiency. The results of the production and financial activities of an enterprise largely depend on what investments are made in fixed and working capital, how many of them are in the sphere of production and circulation, in monetary and material form, and how optimal their ratio is.

Most business entities are faced with the need for an objective assessment of their assets. The efficiency of asset use is one of the most important criteria for assessing the activities of any enterprise whose goal is to generate profit from assets. The development of market relations determines new conditions for their organization. High levels of inflation, non-payments and other crisis phenomena are forcing enterprises to change their policies towards assets, look for new sources of replenishment, and study the problem of the efficiency of their use.

The relevance of the topic of the work lies in the fact that to improve the financial condition of an enterprise and its sustainability, the effective use of assets is important.

The purpose of the work is to consider the role of non-current assets in corporate governance and to develop measures to further improve the effectiveness of the policy using the example of Uralredmet JSC.

To achieve this goal, the following tasks will be solved:

— consider the concept, composition, structure and classification of non-current assets;

— reveal the sources of formation of non-current assets of the enterprise;

— list the efficiency indicators for the use of non-current assets of the enterprise;

— give technical and organizational characteristics of JSC Uralredmet;

— assess the dynamics and structure of non-current assets;

— analyze the efficiency of using fixed assets;

— recommend areas for improving the efficiency of non-current assets management.

The object of the study is JSC Uralredmet.

The subject of the study is the analysis of non-current assets and their role in corporate governance.

Chapter 1. Theoretical aspects of managing non-current assets of an enterprise

Concept, composition, structure and classification of non-current assets

Non-current assets are a set of property assets of an enterprise that are repeatedly involved in the process of individual cycles of economic activity and transfer the used value to products in parts[22].

Non-current assets are one of the most important components of an organization's property. Given the significant volumes of non-current assets, each organization needs to build an effective system for their control, analysis and evaluation. Ultimately, the volume of profit received by the enterprise depends on the effectiveness of the constructed non-current asset management system.

The variety of types and elements of non-current assets of an enterprise determines the need for their preliminary classification in order to ensure targeted management of them.

In the balance sheet, the non-current assets of the enterprise are presented in a separate (first) section in the Order of the Ministry of Finance of the Russian Federation “On the forms of financial statements of organizations” dated July 2, 2010 No. 66n[2]. They include:

- fixed assets - material assets used as means of labor in the production of products, performance of work or provision of services, or for the management of an enterprise. These include: buildings, structures, working and power machines and equipment, computer technology, vehicles, measuring and control instruments and devices, tools, production and household equipment, working and productive livestock, perennial plantings and other fixed assets;

- intangible assets - assets that do not have a tangible form (exclusive rights to the results of intellectual activity and means of individualization, etc.): patents, licenses, know-how, software products, trademarks, etc.;

- results of research and development - costs of completed research, development and technological work (R&D);

- intangible exploration assets, tangible exploration assets - costs of searching, assessing mineral deposits and exploring mineral resources in a certain subsoil area, which are incurred before the commercial feasibility of production is established and documented in relation to this subsoil area;

- profitable investments in material assets - fixed assets intended exclusively for provision by an organization for a fee for temporary possession and use or for temporary use in order to generate income (including under leasing, rental, rental agreements). Includes: property for leasing and property provided under a rental agreement;

- financial investments - investments of an organization whose circulation (repayment) period exceeds 12 months after the reporting date (securities, contributions to the authorized (share) capital of other organizations, loans provided to other organizations, deposits in credit institutions, etc.);

- deferred tax assets - part of the deferred income tax, which should lead to a reduction in income tax payable to the budget in the next reporting period or in subsequent reporting periods;

- other non-current assets - assets not listed above, the circulation period of which exceeds 12 months or the duration of the operating cycle, if it is more than 12 months (for example, expenses related to future reporting periods, the amounts of transferred advances and prepayments for work, services related to construction of fixed assets, etc.).

In the balance sheet, the classification of non-current assets is carried out by functional types, however, from the standpoint of financial management, the classification can be based on a number of other characteristics, the totality of which is presented in Table 1 [22, p. 118].

Table 1 – Classification of non-current assets

| No. | Classification feature | Types of intangible assets |

| 1. | By the nature of servicing certain areas of operating activities | 1. Non-current assets serving the production process. 2. Non-current assets serving the process of product sales. 3. Non-current assets serving the operational management process. |

| 2. | By nature of ownership | 1. Own non-current assets. These include long-term assets of an enterprise that belong to it under the rights of ownership and ownership, reflected as part of its balance sheet. 2. Leased non-current assets. They characterize a group of assets used by an enterprise on a right of use in accordance with a rental (leasing) agreement concluded with their owner. |

| 3. | According to the forms of loan collateral and insurance features | 1. Movable non-current assets (long-term property assets that, in the process of collateral (mortgage) can be withdrawn from his possession in order to secure a loan). 2. Real estate non-current assets. These include a group of long-term property assets of an enterprise that cannot be removed from its possession in the process of collateral securing a loan (land plots, buildings, structures, transmission devices, etc.). |

| 4. | By the nature of wear reflection | 1. Depreciable non-current assets. 2. Non-depreciable non-current assets. |

| 5. | According to the form of existence | 1. Material - buildings, structures, machines, equipment, etc. 2. Intangible - computer programs, inventions, utility models, production secrets, trademarks, service marks, etc. 3. Financial (investments in subsidiaries and dependent companies, long-term loans provided, etc.) |

Non-current assets, being the company's own funds, are withdrawn from the turnover of economic assets for a long period (over one year) and are returned to their composition when depreciation is calculated.

Thus, non-current assets formed at the initial stage of the enterprise’s activity require constant management. This management is carried out in various forms and in different functional divisions of the enterprise. Some of the functions of this department are assigned to financial management.

Content

Introduction. 3

Chapter 1. Theoretical aspects of managing non-current assets of an enterprise 5

1.1. Concept, composition, structure and classification of non-current assets. 5

1.2. Sources of formation of non-current assets of an enterprise. 8

1.3. Indicators of the efficiency of using non-current assets of an enterprise. eleven

Chapter 2. Features of liquidity and profitability management of JSC Uralredmet. 17

2.1. Technical and organizational characteristics of JSC Uralredmet. 17

2.2. Assessment of the dynamics and structure of non-current assets. 23

2.3. Analysis of the efficiency of use of fixed assets. 32

2.4. Recommendations for improving the efficiency of using non-current assets of JSC Uralredmet. 36

Conclusion. 38

List of sources used. 40

Appendix 1. Balance sheet of JSC Uralredmet as of December 31, 2019.

Appendix 2. Report on the financial results of JSC Uralredmet for 2019.

Introduction

The financial condition of the enterprise and its stability largely depend on what property the enterprise has, what assets the capital is invested in, and what income they bring to it.

The placement of enterprise funds is very important in financial activities and increasing its efficiency. The results of the production and financial activities of an enterprise largely depend on what investments are made in fixed and working capital, how many of them are in the sphere of production and circulation, in monetary and material form, and how optimal their ratio is.

Most business entities are faced with the need for an objective assessment of their assets. The efficiency of asset use is one of the most important criteria for assessing the activities of any enterprise whose goal is to generate profit from assets. The development of market relations determines new conditions for their organization. High levels of inflation, non-payments and other crisis phenomena are forcing enterprises to change their policies towards assets, look for new sources of replenishment, and study the problem of the efficiency of their use.

The relevance of the topic of the work lies in the fact that to improve the financial condition of an enterprise and its sustainability, the effective use of assets is important.

The purpose of the work is to consider the role of non-current assets in corporate governance and to develop measures to further improve the effectiveness of the policy using the example of Uralredmet JSC.

To achieve this goal, the following tasks will be solved:

— consider the concept, composition, structure and classification of non-current assets;

— reveal the sources of formation of non-current assets of the enterprise;

— list the efficiency indicators for the use of non-current assets of the enterprise;

— give technical and organizational characteristics of JSC Uralredmet;

— assess the dynamics and structure of non-current assets;

— analyze the efficiency of using fixed assets;

— recommend areas for improving the efficiency of non-current assets management.

The object of the study is JSC Uralredmet.

The subject of the study is the analysis of non-current assets and their role in corporate governance.

Chapter 1. Theoretical aspects of managing non-current assets of an enterprise

Concept, composition, structure and classification of non-current assets

Non-current assets are a set of property assets of an enterprise that are repeatedly involved in the process of individual cycles of economic activity and transfer the used value to products in parts[22].

Non-current assets are one of the most important components of an organization's property. Given the significant volumes of non-current assets, each organization needs to build an effective system for their control, analysis and evaluation. Ultimately, the volume of profit received by the enterprise depends on the effectiveness of the constructed non-current asset management system.

The variety of types and elements of non-current assets of an enterprise determines the need for their preliminary classification in order to ensure targeted management of them.

In the balance sheet, the non-current assets of the enterprise are presented in a separate (first) section in the Order of the Ministry of Finance of the Russian Federation “On the forms of financial statements of organizations” dated July 2, 2010 No. 66n[2]. They include:

- fixed assets - material assets used as means of labor in the production of products, performance of work or provision of services, or for the management of an enterprise. These include: buildings, structures, working and power machines and equipment, computer technology, vehicles, measuring and control instruments and devices, tools, production and household equipment, working and productive livestock, perennial plantings and other fixed assets;

- intangible assets - assets that do not have a tangible form (exclusive rights to the results of intellectual activity and means of individualization, etc.): patents, licenses, know-how, software products, trademarks, etc.;

- results of research and development - costs of completed research, development and technological work (R&D);

- intangible exploration assets, tangible exploration assets - costs of searching, assessing mineral deposits and exploring mineral resources in a certain subsoil area, which are incurred before the commercial feasibility of production is established and documented in relation to this subsoil area;

- profitable investments in material assets - fixed assets intended exclusively for provision by an organization for a fee for temporary possession and use or for temporary use in order to generate income (including under leasing, rental, rental agreements). Includes: property for leasing and property provided under a rental agreement;

- financial investments - investments of an organization whose circulation (repayment) period exceeds 12 months after the reporting date (securities, contributions to the authorized (share) capital of other organizations, loans provided to other organizations, deposits in credit institutions, etc.);

- deferred tax assets - part of the deferred income tax, which should lead to a reduction in income tax payable to the budget in the next reporting period or in subsequent reporting periods;

- other non-current assets - assets not listed above, the circulation period of which exceeds 12 months or the duration of the operating cycle, if it is more than 12 months (for example, expenses related to future reporting periods, the amounts of transferred advances and prepayments for work, services related to construction of fixed assets, etc.).

In the balance sheet, the classification of non-current assets is carried out by functional types, however, from the standpoint of financial management, the classification can be based on a number of other characteristics, the totality of which is presented in Table 1 [22, p. 118].

Table 1 – Classification of non-current assets

| No. | Classification feature | Types of intangible assets |

| 1. | By the nature of servicing certain areas of operating activities | 1. Non-current assets serving the production process. 2. Non-current assets serving the process of product sales. 3. Non-current assets serving the operational management process. |

| 2. | By nature of ownership | 1. Own non-current assets. These include long-term assets of an enterprise that belong to it under the rights of ownership and ownership, reflected as part of its balance sheet. 2. Leased non-current assets. They characterize a group of assets used by an enterprise on a right of use in accordance with a rental (leasing) agreement concluded with their owner. |

| 3. | According to the forms of loan collateral and insurance features | 1. Movable non-current assets (long-term property assets that, in the process of collateral (mortgage) can be withdrawn from his possession in order to secure a loan). 2. Real estate non-current assets. These include a group of long-term property assets of an enterprise that cannot be removed from its possession in the process of collateral securing a loan (land plots, buildings, structures, transmission devices, etc.). |

| 4. | By the nature of wear reflection | 1. Depreciable non-current assets. 2. Non-depreciable non-current assets. |

| 5. | According to the form of existence | 1. Material - buildings, structures, machines, equipment, etc. 2. Intangible - computer programs, inventions, utility models, production secrets, trademarks, service marks, etc. 3. Financial (investments in subsidiaries and dependent companies, long-term loans provided, etc.) |

Non-current assets, being the company's own funds, are withdrawn from the turnover of economic assets for a long period (over one year) and are returned to their composition when depreciation is calculated.

Thus, non-current assets formed at the initial stage of the enterprise’s activity require constant management. This management is carried out in various forms and in different functional divisions of the enterprise. Some of the functions of this department are assigned to financial management.

Non-current assets of the enterprise in the balance sheet (lines)

In the balance sheet of a commercial organization, non-current assets are reflected as fixed assets, including:

- Intangible assets (intangible assets),

- Deferred tax assets,

- profitable investments in material assets,

- financial investments,

- vehicles,

- buildings and constructions,

- equipment, machines and tools.

Significant financial resources are spent on the acquisition of non-current assets, which are recognized as investments in production. Such investments in non-current property are reflected in the asset balance sheet, where all information about what is owned by the enterprise is accumulated. Let's consider the contents of the balance sheet lines, which reflect data on non-current assets:

| Fixed assets | Balance line | Property whose value is reflected in the line |

| Intangible assets | 1110 | By page: The difference between the debit balance in account 04 “Intangible assets” (without taking into account R&D costs) and the credit balance in account 05 “Depreciation of intangible assets”. In page: Residual value (= original price - depreciation amount) of assets to which the company has exclusive rights (computer programs, innovations, trademarks...). |

| Research and development results | 1120 | By page: Debit balance account 04 “NMA” s/ac. “R&D expenses.” On page: Information on costs of completed R&D. |

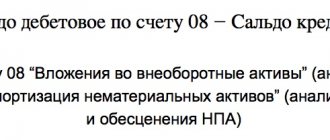

| Intangible search assets (IPA) | 1130 | By page: Debit balance account 08, account. “NPA” minus the credit balance of account 05, s/ac. “Depreciation and impairment of legal assets.” In page: Costs for geological information about the subsoil (results of sampling and exploratory drilling, geophysical and geological studies, topographic studies, etc.). |

| Material prospecting assets (MPAs) | 1140 | By page: Debit balance account 08, account. “MPA” minus the credit balance of account 02, s/ac. “Depreciation and Impairment of Tangible Exploration Assets.” In page: Cost of transport, equipment, structures used in mineral exploration and evaluation of deposits. |

| Fixed assets | 1150 | According to page: Debit balance for account 01 “Fixed assets” minus the credit balance of account 02 “Depreciation of fixed assets” (without taking into account the depreciation of income-generating investments and interbank assets). |

| Profitable investments in material assets | 1160 | According to page: Debit balance of account 03 “Income investments in MC” minus credit balance of account 02, account. “Depreciation of profitable investments in MC.” In page: Residual value of property provided by the enterprise for rent or leased or leased. |

| Financial investments | 1170 | Note: When a company provides a reserve for reducing the cost of financial investments, then in line 1170 it is necessary to reduce the cost of investments by the amount of contributions to the reserve fund (in terms of long-term investments). Per page: Information on interest-bearing loans with a repayment period of more than 12 months, purchased shares, contributions to authorized capital. On page: Debit balance account 58 “FV”, account. 55, s/sch. “Deposit accounts”, account. 73, s/sch. “Calculations for loans provided.” |

| Deferred tax assets | 1180 | Per page: Contingent assets resulting from the difference between tax accounting and accounting. Example - in tax accounting, the value of property is taken into account one-time, in accounting - gradually. — Deferred tax assets are part of deferred income taxes that reduce income taxes for payment in future tax periods. — If the company accounts for deferred assets in a collapsed manner, line 1180 records the positive difference between the balance in the debit of account 09 and the credit of account 77 “Deferred tax liabilities.” In p.1420 “IT” should be “-”. — If the company reflects the amount of tax assets in detail, the debit balance of account 09 “Deferred tax assets” is recorded in line 1180. — When the loan indicator account 77 > debit balance account 09, line 1180 contains “-”, only line 1420 is filled in. |

| Other noncurrent assets | 1190 | Line 1190 reflects other VNA that are not included in other lines of the balance sheet. |

Rating of banks by assets

Typically, the largest assets are found in banks that occupy top indicators in many areas of activity. Not only ratings of assets within the country are maintained, but also international ones, but we will consider only domestic organizations.

Please note that asset tracking is done frequently, every month. As a result, it is possible to track the dynamics by month, the growth and outflow of assets for each specific bank.

As of February 2022, the top ten largest Russian banks by assets look like this (indicator in billions of rubles):

- Sberbank, 28596. Increase compared to the previous month - 0.21%.

- VTB, 14124. Compared to January, the figure is 1.45% less.

- Gazprombank, 6651. Growth - 1.47%.

- Alfa-Bank, 3761. Reduction by 0.01%.

- National Clearing Center, 3714. The reduction is significant - 6.18%.

- Rosselkhozbank, 3409. Reduction by 3.73%.

- Opening, 2714. Reduction by 0.02%.

- Moscow Credit Bank, 2528. Increase by 0.41%.

- National Bank Trust, 1314. Reduction of 4.96%.

- UniCredit Bank, 1306. Increase by 4.98%.

As you can see, the confident leader of the rating is Sberbank, the gap from second place (VTB Bank) is twofold. Which is not surprising, because Sberbank can rightfully be called the main financial organization of the country. It has a huge circle of depositors, borrowers, and serves many business representatives. This is the most reliable bank in the country, with liquidity there will definitely not be any problems; the government will not allow this.

The rating of Russian banks practically repeats the rating in terms of reliability, which is important for depositors.

Other non-current assets (line 1190)

The cost of all non-current assets that are not reflected in other lines of the balance sheet is reflected on line 1190. These include:

- Costs of subsequent periods with write-off periods exceeding 1 year, for example:

- lump-sum payment for means of individualization, for the right to use the results of intellectual work;

- costs for the development of natural resources, etc.

- Prepayment, advance payment for services rendered and work performed, paid for the purpose of constructing environmental facilities.

- Costs for incomplete R&D, costs for objects that in the future will be included in the financial statements as intangible assets and fixed assets (these are investments in non-current assets).

- Equipment requiring installation:

- equipment that will be put into operation only after its parts have been assembled and when it is attached to the supporting structures of the building/structure;

- spare parts for such equipment.

- Perennial plantings that have not reached the age of exploitation.

The following table shows on the basis of which accounting accounts line 1190 of the balance sheet is filled out:

| Non-current asset | Accounting account* *DS - debit balance |

| Deferred expenses whose write-off period is at least 1 year | DS ch.97 “Future expenses” |

| Prepayment and advances for services rendered and work performed on the construction of OS | DS account 60 “Settlements with suppliers and contractors” of the corresponding account. |

| Company expenses on objects that are subsequently accepted for accounting as intangible assets and fixed assets, and expenses in relation to incomplete R&D | DS of the corresponding s/ac. to account 08 “Investments in non-current assets” |

| Equipment requiring installation | DS ch.07 “Equipment for installation”. DS ch.15 “Procurement and acquisition of MC” in terms of equipment requiring installation. Balance of account 16 “Deviation in cost of MC” regarding equipment not yet installed. |

| Perennial plantings that have not reached the age of exploitation | DS account 01 “OS”, s/sch. “Young plantings.” |

Which accounts should I use to record intangible assets?

The main account for accounting for intangible assets is 04. It collects information about what intangible assets the organization has, their receipt and sale, as well as the company’s expenses on R&D. Account 04 is active, therefore the receipt of intangible assets is reflected as a debit, and the disposal as a credit.

The procedure for accounting for intangible assets is similar to that for fixed assets. Before entering the debit of account 04, the asset and all costs of obtaining it are taken into account in account 08 “Investments in non-current assets”.

To calculate depreciation on intangible assets, account 05 is used - depreciation is reflected on the loan. From January 1, 2008, it is no longer possible to charge depreciation on the credit of account 04, thereby reducing the initial cost of intangible assets.

Regulatory and legislative acts on the topic

| Order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n Order of the Ministry of Finance of the Russian Federation dated July 2, 2010 No. 66n clause 20 PBU 4/99 | The procedure for reflecting information about non-current assets in the lines of the balance sheet |

| Order of the Ministry of Finance of the Russian Federation of October 31, 2000 No. 94 | About the formation of line 1190 |

| PBU 19/02 | On reflecting financial investments in the balance sheet |

| PBU 14/2007 | Reflection in the balance sheet of intangible assets |

| PBU 6/01 | On the reflection in the balance sheet of transport and other fixed assets, as well as profitable investments in material assets |

| PBU 14/2007 | Regulation of intangible assets |

| PBU 17/02 | Regulation of research and development results |

| PBU 24/2011 | Regulation of intangible search assets |

| PBU 24/2011 | Regulation of tangible exploration assets |

| PBU 19/02 | Regulation of financial investments |

| PBU 18/02 | Regulation of deferred tax assets |

Answers to frequently asked questions on the topic “Non-current assets of an enterprise”

Question: An intangible asset is not recognized as such on the balance sheet if the company cannot document the existence of rights to use it. What documents confirm the right to own and use intangible assets?

Answer: Depending on what kind of intangible asset we are talking about, the right to it can be proven by providing a registered patent, certificate, some other document of protection, as well as documents that confirm the transfer of the exclusive right to a means of individualization or the result of an intellectual property activities without an agreement, or such an agreement.

Accounting for the transfer of intangible assets

You will be able to sell your intangible asset to another organization, individual entrepreneur or individual. To do this, they transfer the exclusive right to the object by concluding an alienation agreement. Another option is to transfer only the right to use the asset.

Sale of intangible assets. To sell an object, enter into an agreement on the alienation of ownership, draw up an invoice and an acceptance certificate. Also, the transfer of rights sometimes needs to be registered.

Recognize income from the sale of intangible assets as other income and reflect it in accounting on the date of signing the agreement or registering the transfer of rights, if required.

Make the following entries:

- We reflect income from the transfer of exclusive rights - Dt 62 Kt 91-1;

- We charge VAT (if the transfer is taxed) - Dt 91-2 Kt 68-VAT;

- We write off depreciation on the transferred asset - Dt 05 Kt 04.

- We attribute the residual value of intangible assets to expenses - Dt 91-2 Kt 04.

- We take into account the duty and other sales costs - Dt 91-2 Kt 76.

Transfer of the right of use. In this case, the buyer of the right of use will regularly transfer royalties to you. Since the asset remains your property (you have the exclusive right), you cannot write it off the balance sheet and stop accruing depreciation. The wiring is as follows:

- We reflect the received license payments in other income or sales income - Dt 62 Kt 90-1 or 91-1.

- We continue to charge depreciation. If the transfer of use rights is your main activity, write off depreciation as expenses for ordinary activities Dt 20 (23, 25, 44) Kt 05, if not the main one, as other expenses - Dt 91-2 Kt 05.