Sometimes an employee may receive more than what is owed, and the employer will want to return this money. Labor legislation, although quite humane, is not always on the side of workers in this situation. On the other hand, the employer may make a mistake in the other direction - pay less. We figure out how to correct errors in payroll calculations in accounting and reporting.

Article 137 of the Labor Code of the Russian Federation. Read to the end

Traditionally, it looks like this: when asked to return overpayment, an employee refers to the Labor Code, because it says that:

“Wages paid in excess to an employee (including in the event of incorrect application of labor legislation or other regulatory legal acts containing labor law norms) cannot be recovered from him...”

But any document is worth reading to the end. The same paragraph 4 of Article 137 of the Labor Code of the Russian Federation provides for at least three cases when overpaid wages can still be recovered:

- if the overpayment occurred due to a calculation error;

- if the employee is guilty of failure to comply with established labor standards or idle time (Articles 155, 157 of the Labor Code of the Russian Federation), and this fact is recognized by the commission for the consideration of individual labor disputes (LCD);

- the overpayment arose in connection with the unlawful actions of the employee (provided that this was established by a judicial act).

If there are grounds for the return of overpaid wages, then you can invite the employee to return the excess voluntarily. If the employee refuses, then the only 100% legal methods that remain are an appeal to the CCC and the court.

Arithmetic inaccuracies

In Russian regulations there is no specific definition of the concept of what a counting error is, but in accounting practice it is customary to use the following designation: this is an oversight made when performing all kinds of arithmetic operations with wage amounts .

In this case we are talking about elementary mathematical operations: multiplication and division, summation and subtraction. An error in calculation can be made either in favor of the employee or vice versa. If it turns out that the employee was underpaid in the amount of cash support, then the enterprise is obliged to reimburse the withheld amount with the subsequent payment of wages. Even if this error is discovered much later when filing documents for dismissal, the company must pay for the losses. The situation is much more complicated if a mistake made caused an excessive payment.

Important! A counting error is a legal basis for deducting excess payment from an employee’s income if it was made as a result of incorrect arithmetic calculations.

The law determines that an employer can retain the required amount of funds in two legal ways:

- with the written consent of the employee himself;

- on the basis of an appropriate court decision (this method can be applied to both employed persons and already dismissed employees).

How to return overpayment

A counting error is always an arithmetic error, that is, one that was made during calculations. For example, it was necessary to add, but multiplication occurred. The following are not considered counting errors:

- typos in payments;

- double payment of wages;

- incorrect application of the law (see explanation of Rostrud dated October 1, 2012 No. 1286-6-1).

A conscientious employee has the right to return the overpayment in cash to the cashier, or agree to deduction. The employer has a month to withhold the overpayment from the employee (provided that the employee does not dispute it).

You can act as follows: issue an order to deduct from wages, in which the employee indicates his agreement with both the basis and the amounts of deduction. The wording could be as follows:

“In connection with a counting error made when calculating wages for August 2022 and on the basis of parts 2 and 3 of Article 137 of the Labor Code of the Russian Federation,

I ORDER:

Withhold from M. A. Ivanova’s salary for September 2022 the overpaid amount of 5,500 (five thousand five hundred) rubles.”

Employee visa:

“I have read the order and agree with the basis and amount of the withholding, M. A. Ivanova.”

A handwritten signature is required.

A similar procedure is applicable when the overpayment occurred in other cases established by law (proven guilt of the employee in failure to comply with labor standards, downtime, etc.). And under these circumstances, the employee’s agreement with the grounds and amounts of deduction is required. It should be remembered that the total amount of all deductions for each salary payment cannot be more than 20% (Article 138 of the Labor Code of the Russian Federation).

If the worker is in no hurry to agree or has already quit, then it makes sense to immediately go to court to get the overpayment back.

Error. Incorrect amount to be paid for salary in the statement

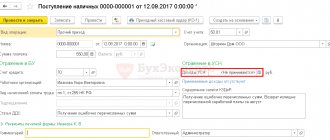

When creating a statement for the payment of wages for September, the accountant discovered that the amount in the To be paid includes the debt for August and does not correspond to the organization’s wage debt to one of the employees of A.V. Kuznetsova.

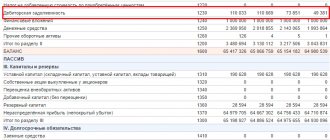

From the balance sheet for the account it is clear that in front of the employee Kuznetsova A.V. The following salary arrears have arisen:

- for September - 26,100 rubles.

Thus, the discrepancy is obvious - the program shows different amounts of arrears in payment of wages to employee A.V. Kuznetsova. :

- in the payroll statement - 27,904.04 rubles;

- account credit balance – RUB 26,100.00;

- difference (error) – RUB 1,804.04.

But the program will not be able to detect an error based on accounting entries, which is reflected in the salary payment slip. Since 1C has created a special subsystem for accounting for salaries and personnel, which is based on savings registers.

The accumulation register Salary to be paid is responsible for an error in filling out the salary payment slip.

See also How to find out which register moves what?

Recalculation of personal income tax and insurance contributions in case of overpayment of wages

Excessively accrued and paid wages are included in the base for personal income tax and insurance contributions. It is permissible to reduce the amounts payable on account of taxes and contributions only if the overpayment is withheld or returned (voluntary or by court decision) (Articles 210, 421 of the Tax Code of the Russian Federation, Article 20.1 of the Federal Law of July 24, 1998 No. 125-FZ “On Mandatory social insurance against accidents...").

If the withholding or return took place from the first quarter of 2021, then an updated calculation of 6-NDFL is submitted to the Federal Tax Service in the form valid from January 1, 2022, which is submitted:

- for the period of accrual of surplus;

- for subsequent periods of the same year for which calculations have already been submitted.

When correcting information for the tax period (year), you should also include in 6-NDFL a certificate of income and personal income tax amounts.

If an adjustment is made for 2022, then the calculation form on which the information was originally submitted should be used. The recalculation of wages is subject to reflection in the calculation of insurance premiums for the reporting period to which the error relates. Updated calculations for insurance premiums are submitted to the tax authority, for contributions for injuries - to the Federal Social Insurance Fund of the Russian Federation.

Income tax. How to fix the error

If an error is discovered and corrected before the excessively accrued amounts were taken into account when calculating income tax, then, when determining the tax base of the reporting (tax) period, it is sufficient to include already corrected, updated amounts in labor costs.

The corrected amounts for insurance and injury premiums are included in other expenses.

Otherwise, if the surplus has already been taken into account when calculating income tax, you will have to recalculate the tax base for the period in which this surplus was taken into account, pay the arrears and penalties and submit an updated declaration.

If an employee is underpaid

We discussed the situation when an employee was overpaid, because it is precisely this situation that causes a lot of disputes and disagreements, both regarding the very fact of the overpayment (whether the employer really made a mistake in the calculation and payment) and regarding the amounts of deduction.

But when it comes to underpayment, everything is clear here: the employee must be paid the underpaid salary, and even with compensation for each day of delay (Article 236 of the Labor Code of the Russian Federation).

Compensation calculation

Compensation is calculated as follows. First, we count how many days are overdue (counting starts from the day following the day on which the salary should have been paid according to the schedule, and includes the day the debt is repaid). Then we multiply the three indicators together:

1/150 of the key rate * days of delay * amount of underpaid wages

Example: salaries in an organization are paid on the 10th. But in August 2022, the accountant accidentally did not transfer the salary to one of the employees (did not send the payment to the bank) and transferred it only on August 13. The salary amount is 18,000 rubles, the number of days of delay is 3 days (from August 11 to August 13 inclusive).

The key refinancing rate is 5.5%.

We calculate compensation:

5.50/150% * 3 * 18,000 = 19.80 rub.

The amount of compensation is not subject to personal income tax both within the established norms (i.e., within 1/150 of the refinancing rate), and in cases where the employer has established an increased amount of compensation and recorded this fact in an employment or collective agreement.

Compensation is subject to insurance contributions, since it is not indicated in the list of non-taxable payments (Article 422 of the Tax Code of the Russian Federation).

Correction of reports due to underpayment

Due to underpayment, adjustments will have to be made to the reports of previous periods. This must be done if wages, for example, were not paid in the second quarter, and all reports for it have already been submitted.

Changes must be made to the 6-NDFL . In the form valid from 2022, you need to update the following data:

- line 110 - the amount of accrued income;

- line 112 - the amount of income accrued under employment contracts;

- line 140 - the amount of calculated tax.

The tax will be withheld during the period of actual payment, therefore, in the line with the amount of personal income tax withheld, the tax on the amount of underpayment is not shown.

It is also necessary to adjust the calculation of insurance premiums . There, the changes will affect many sections, since it will be necessary to recalculate not only the amount of accruals, but also all types of contributions - for pension, social, health insurance and the total values.

It is also necessary to make changes to the calculation of 4-FSS (for contributions to accident insurance).

Before submitting updated reports, we recommend paying additional fees and penalties on them.

How to correct accounting errors

It can hardly be assumed (unless we are talking about criminal intent) that the amounts of overpaid wages are significant. Therefore, such an accounting error can most likely be considered insignificant.

The amount of compensation is not subject to personal income tax both within the established norms (i.e., within 1/150 of the refinancing rate), and in cases where the employer has established an increased amount of compensation and recorded this fact in an employment or collective agreement.

Compensation is subject to insurance contributions, since it is not indicated in the list of non-taxable payments (Article 422 of the Tax Code of the Russian Federation).

Correction of reports due to underpayment

Due to underpayment, adjustments will have to be made to the reports of previous periods. This must be done if wages, for example, were not paid in the second quarter, and all reports for it have already been submitted.

Changes must be made to the 6-NDFL . In the form valid from 2022, you need to update the following data:

- line 110 - the amount of accrued income;

- line 112 - the amount of income accrued under employment contracts;

- line 140 - the amount of calculated tax.

The tax will be withheld during the period of actual payment, therefore, in the line with the amount of personal income tax withheld, the tax on the amount of underpayment is not shown.

It is also necessary to adjust the calculation of insurance premiums . There, the changes will affect many sections, since it will be necessary to recalculate not only the amount of accruals, but also all types of contributions - for pension, social, health insurance and the total values.

It is also necessary to make changes to the calculation of 4-FSS (for contributions to accident insurance).

Before submitting updated reports, we recommend paying additional fees and penalties on them.

What rules of law govern it?

The Labor Code of the Russian Federation in Article 137 provides for the possibility of deducting from an employee’s salary excess amounts previously paid to him due to the presence of an error in the calculations.

However, the Russian Labor Code does not provide a clear definition of the concept of a counting error.

This term is considered:

- In the Letter of Rostrud dated October 1, 2012 No. 1286-6-1

- In the Supreme Court Decision No. 59-B11-17 dated January 20, 2012

How to correct accounting errors

It can hardly be assumed (unless we are talking about criminal intent) that the amounts of overpaid wages are significant. Therefore, such an accounting error can most likely be considered insignificant.

Let us recall that the organization must indicate and justify the materiality criteria in its accounting policies.

Minor errors of the current year are easily corrected - you need to make the necessary entries - for example, reverse the salary of a worker in the main production by posting:

D 20 K 70 - reversal

The correction is made in the month the error was discovered (clause 5 of PBU 22/2010).

An error discovered after the year has ended, but before the director signs the balance sheet , is corrected by the date - December 31 of the reporting year (clause 6 of PBU 22/2010).

If an error is discovered after the financial statements have been signed , then it is corrected by the current period (clause 14 of PBU 22/2010).

In this case, it is also important whether the error affected the financial result of the reporting year or not.

- If it has an impact, a record is made according to the principle of posting the reverse of the incorrect entry corresponding to the 91st account “Other income and expenses.” Those. if the salary was accrued excessively (using the previous example, the salary accrual posting is D 20 K 70), then the reverse posting looks like this:

D 70 K 91

The point is that previously the salary amount was included in expenses. And since it was accrued excessively, it was impossible to include it in expenses - we restore justice by reflecting it in other income.

Note that it is more logical to transfer the amount from account 70 to 73 - other settlements with employees, because it is not remuneration:

D 73 K 70

When an employee returns money, we make the following entry:

D 50 (51) K 73

- If the error did not affect the financial result, it’s even easier. It is enough to reverse the incorrect wiring and make the correct one.

In the case of over-accrued wages, simply reverse the required amount:

D 20 K 70 - reversal

Let us remind you that small enterprises that are not subject to mandatory audit have the right to correct all errors as insignificant - provided that this rule is enshrined in the accounting policy (clauses 9, 14 of PBU 22/2010).

Identifying the error

To identify the error, we will use the Universal Report setting - Checking salary payments in NU.

Let's generate a report with the specified settings.

The report shows that in August 2022 Kuznetsova A.V. less was paid out than accrued. Therefore, the outstanding balance for August is RUB 1,804.04. falls into the statement for September, when it is formed we will get the following result.

After this, it is necessary to generate SALT for the employee’s account and figure out whether the organization really has a debt to the employee or is it a mistake?

Discrepancies may be due to:

- errors in the database;

- Carrying out incorrectly completed documents, including documents Operation entered manually ;

- database transfer errors;

- database trimming errors;

- program failure.

After discovering an error, you need to decide what to do about it:

- if the error occurred in an “unclosed” month, then you need to correct the documents and re-post them;

- if the error occurred in an already “closed” month or it is not clear why it appeared, then we advise you to correct it by creating a corrective entry in the Salaries payable .