How to make a posting in the 1C Accounting 8.3 program - transfer of raw materials for processing?

Often an organization is engaged in the trade of any product, while at the same time the same product is a raw material for other products, the sale of which the company is also engaged in. But for some reason the company cannot produce the necessary products themselves.

There are many such examples. This is, for example, a fabric store that also sells ready-made clothes. The store sends the fabrics for processing and receives back the finished products (clothing).

Let's look at how to formalize the transfer of raw materials and materials for processing in 1C 8.3 Accounting and receipt of finished products.

Accounting for customer-supplied raw materials - regulatory regulation

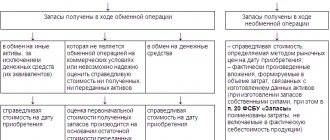

Toll processing is the performance of work on the production of products from the customer’s material under a contract (Article 702, Article 713 of the Civil Code of the Russian Federation).

BOO. When transferred for processing, a transfer of ownership does not occur: the materials continue to be accounted for on the customer’s balance sheet and are reflected in account 10.07 “Materials transferred for processing to third parties” (clause 157 of the Methodological guidelines for accounting for inventories, approved by Order of the Ministry of Finance of the Russian Federation dated December 28 .2001 N 119n, chart of accounts 1C).

Processing services are taken into account as part of expenses for ordinary activities (clause 8 of PBU 10/99).

The cost of materials and services of the processor is included in the cost of manufactured products (clause 6 of PBU 5/01).

WELL. Processor services are taken into account as part of material costs (clause 6 of Article 254 of the Tax Code of the Russian Federation).

VAT. The transfer of raw materials to a processor is not a sale and is not subject to VAT (Article 38, Article 146 of the Tax Code of the Russian Federation).

VAT on processor services is deductible if the requirements are met (Article 171, Article 172 and Article 169 of the Tax Code of the Russian Federation):

- organization - VAT payer;

- goods (work, services) are intended for activities subject to VAT, including for resale;

- goods (work, services) are accepted for accounting;

- A properly executed invoice is available.

Let's look at the accounting of customer-supplied raw materials from the customer in 1C 8.3 in the form of step-by-step instructions.

How to formalize sub-processing operations in 1C:UNF?

Step 1 - get the material for recycling

Let's imagine a situation: a client came to us and ordered us to produce a floor lamp according to an individual sketch from metal rods. In the 1C:UNF program we need to place a buyer’s order for processing the buyer’s raw materials. We move along the path of Sales - Buyer Orders

and click

Create

.

Processing Order

as the operation .

Then in the tabular section Products

We indicate the product item that ultimately needs to be transferred to the buyer.

In the Materials

we enter those product items that were transferred to us by the buyer for processing and process the order without closing it.

After this, we will reflect the fact that materials have been received from the customer by issuing an invoice based on the customer’s order. The operation will be automatically filled with the value Reception for processing

. All that remains is to indicate the batch of incoming material, the price and post the invoice.

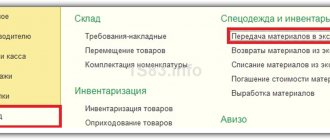

Step 2 - enable the ability to transfer materials for recycling

If we carried out the entire production ourselves, then there would be no need to do any further atypical manipulations. But our organization does not have the necessary equipment and experience in twisting and twisting metal rods. In this regard, we need to contact another organization, but first we need to enable the functionality for transferring materials for processing. Let's move along the path of Procurement - Even more opportunities

and check the box

Transfer of raw materials and materials for processing

.

Now we need to create an order to the supplier for processing, indicating what material we are transferring for processing and the product that we want to receive.

Step 3 - transfer the materials to the sub-processor

Now let's move on to creating an invoice with the type of operation Transfer for processing

. We are trying to do it, and bad luck, a strange error has appeared. For some reason, we do not have enough material that we previously received with our own hands and it lies in our warehouse.

This problem is connected with the fact that the program, using batch accounting, controls what material came from where we received it and prohibits us from transferring previously received materials from our buyer to other organizations for processing. And what to do in this situation? We can forcefully indicate to the program that this material that we are going to transfer for processing is not raw material we received as a customer service, but our own. To do this, open the previously created receipt invoice and go to the Batch

in the line with the incoming material and click on the button in the form of a double square.

A window will open with data on the batch of the item, where we need to change the status of the batch from the value Customer-supplied raw materials

to

Own Inventory

and record the changes.

This operation must be performed with all rows in the Goods

of the invoice being issued and the document must be reposted.

Now we can return to creating an invoice for the transfer of material for processing.

IMPORTANT!

Don't forget to indicate the required batch of items. We issue an invoice.

Step 4 - return of products from processing

Processor Report based on the invoice

.

IMPORTANT!

so that the cost price is correctly formed and all costs are taken into account, fill out the

Services

with the service that was provided by the supplier, indicating its cost. We carry out and close.

To process subsequent processing by other suppliers, we repeat the previous steps.

Step 5 - we will transfer the finished product to the customer

We will reflect the fact of transfer of the finished part to the buyer. Based on the buyer’s order, we create a Processing Report

.

On the Products I

indicate the part that we are transferring to the buyer; on the

Materials

, we indicate the raw materials that the buyer previously transferred to us. We carry out and close.

This completes the processing of all transactions. In the event that the entire production of the lamp was carried out by third parties, the following document tree should be obtained (based on the results of two processing by suppliers, excluding payments), opened by clicking the Related documents button

from buyer's order:

Transfer of customer-supplied raw materials for processing

On August 13, the Organization transferred the following raw materials to AGROCOM LLC for processing:

- wheat grain 1,000 kg.

On August 20, the Organization received from the processor AGROKOM LLC:

- products:

- wheat flour 900 kg;

- act and invoice for processing services in the amount of 2,400 rubles. (including VAT 20%).

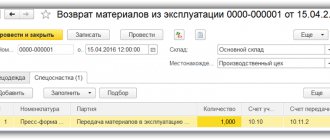

How to transfer customer-supplied materials to the contractor in 1C 8.3? Complete the transfer of customer-supplied raw materials to the processor using the document Transfer of raw materials for processing in the section Production - Transfer for processing - Transfer of raw materials for processing - Create button.

Submission for processing in 1C 8.3:

Indicate in the header of the document:

- Counterparty - the name of the raw material processor, selected from the Counterparties directory;

- Agreement - agreement with the processor, Type of agreement - With the supplier .

Specify customer-supplied materials on the Products :

- Nomenclature - transferred raw materials (materials), selected from the Nomenclature directory;

- Quantity - transferred amount of raw materials (materials);

- Accounting account - the account from which raw materials (materials) are transferred, in our example - 10.01 “Materials”;

- Transfer account - 10.07 “Materials transferred for processing to third parties.”

Transfer of materials to third parties in 1C 8.3 postings:

The document generates the posting:

- Dt 10.07 Dt 10.01 - transfer of raw materials to the processor.

Processor actions

Receipt for processing

Let’s create a document “Receipt for processing”.

Filling procedure:

- We indicate the date, warehouse, customer and his contract.

- We select the material for processing, indicate its quantity, price and cost.

- We set the accounting account to 003.01 “Materials in warehouse” - it is off-balance sheet.

Save the document.

Invoice requirement: transfer materials to production

Next, we transfer the materials to production using the “Requirement-invoice” document.

We indicate the materials to be transferred on the “Customer Materials” tab.

Accounting account 003.01, transfer account 003.02.

Postings:

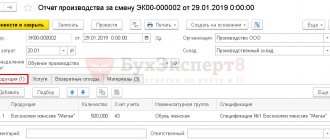

Shift production report

After manufacturing the products, we will create the document “Production Report for the Shift”. We indicate what products we have produced and their quantity. We take into account account 20.02 “Production of products from customer-supplied raw materials.”

We also indicate the cost account and department. Save the document.

Transfer of products to the customer

Let’s create a document “Transfer of products to the customer.” The document does not make postings; it is used only for printing an invoice.

We indicate the products and remaining materials that we transfer to the customer.

Sales of processing services

Let’s create the document “Sales of processing services.”

Filling procedure:

- We indicate the date and customer.

- We indicate the products being transferred.

- We indicate the amount of materials spent.

Save the document.

Registration of SF supplier

Register the invoice using the Register at the bottom of the document.

If the document has the Reflect VAT deduction in the purchase book by date of receipt checkbox , then when it is posted, entries will be made to accept VAT for deduction.

Postings according to the document

The document generates the posting:

- Dt 68.02 Kt 19.04 - acceptance of VAT for deduction.

Purchase Book report can be generated from the Reports - VAT - Purchase Book section. PDF

Features of reception and transfer for processing in the ERP 2.4 system

- home

- Career

- Blog about the life of a franchisee

- About 1C from our employees

March 17, 2021

This article will discuss the features of acceptance and transfer for processing in the ERP 2.4 system in terms of technical implementation and how to correctly reflect a number of operations in a standard solution.

Introduction:

In the technical implementation part, answers to the following questions will be given: what hidden details are used for schemes (stock type and stock type); how the system understands its own and customer-supplied materials in documents; what are assignments for and how are they used in the tolling scheme; what restrictions are present in the standard solution in the tolling scheme and transfer for processing.

In terms of correct reflection in the standard solution, the following operations will be considered: regrading of customer-supplied materials; shortage of customer-supplied materials; transfer of materials from the supplier to the processor; transfer of finished products from the processor to the seller; reflection of customer-supplied and own materials in one stage of production.

General concept in documents:

This section describes the general technical implementation for each document; the reflection of business processes is disclosed in more detail in the relevant sections. First, let's describe some of the terms that will be present in this section:

Purpose

– this is the separation of finished products to order or the separation of customer-supplied materials. Items purchased/manufactured for assignment can only be shipped against the order that is the source of the separate requirement.

Inventory type

– this is a listing that contains inventory options (own goods, supplier’s materials, supplier’s products, etc.).

Type of inventory

– this is an entity that stores the type of stock, organization, for customer-supplied materials and products: customer, contract, etc. The type of inventory is a separate section of the registers (the main register that will be considered is: the “Goods of Organizations” register; register balances are checked taking into account the type of inventory).

Item accounting analytics

is an entity in which a set of objects is stored: nomenclature, characteristics, series, storage location, purpose, etc. Analytics for inventory accounting is a separate section of registers (the main register that will be considered: the “Goods of Organizations” register; register balances are checked taking into account the analytics for inventory accounting).

This article is considered with the following “Master data and sections” settings: separation of materials for production, when ordering for production = “according to the purpose of the product”; separation of raw materials and supplies during outsourced processing = “according to the intended purpose of the product.”

The general technical implementation between all documents in the form of a block diagram for acceptance for processing and transfer for processing in the ERP 2.4 system is presented in Figures 1 and 2, followed by a detailed description for each individual document.

Figure 1 – General technical implementation of acceptance for processing.

Figure 2 – General technical implementation of transfer to processing.

Document "Order of the seller"

The first document that will be reviewed is the “Order of the Provider”; this document contains two purposes:

1. Hidden details of the document – “Purpose”, which separates the manufactured products under the document “Order of the supplier”. The assignment contains: vendor, contract, vendor’s order (see Figure 3). That is, we will be able to ship manufactured products only according to this order.

Figure 3 – An example of the purpose of finished products in the document “Order from the supplier”.

2. The attribute of the tabular section “Raw materials and supplies for production” contains the attribute “Purpose” (required to be filled out). This assignment separates the supplier’s materials from the supplier’s own materials, and also allows you to separate the supplier’s materials for a specific production stage (the “Master data and sections” setting must be set, segregation of materials for production, when ordering for production = “by production stage”), if you select the assignment with the necessary document (see Figure 4).

Figure 4 – Selecting the purpose of materials in the “Order from the supplier” document.

Document “Receipt of raw materials from the supplier”

The next document in the chain is “Receipt of raw materials from the supplier.” The document is entered on the basis of the document “Order of the seller”.

In the tabular part of the document “Receipt of raw materials from the supplier”, the assignment from the foundation document is automatically filled in (editing is prohibited); for items in excess of the order, you can set the assignment (segregate for a specific stage of production).

When posting the document “Receipt of raw materials from supplier”, a new type of inventory with details will be generated: stock type = “Supplier’s material”; product owner = "Dealer"; agreement = "Dalter's agreement"; counterparty = "Giver"; organization (see Figure 5). Data will be recorded in the “Goods of Organizations” register taking into account the new type of inventory, and the item accounting analytics will contain the purpose. It is the storage of materials for this type of inventory that will not allow us to perform a number of operations, as could be done with ordinary materials.

Figure 5 – Type of materials supplied by the supplier.

For example, when using the document “Re-grading of goods” (or “Domestic consumption” (writing off as expenses), we cannot use materials from the supplier, since the documents themselves strictly define the selection of inventory types in inventory types. You can only use them in these documents materials with types of inventory, which have the type of inventory: own goods, goods in storage with the right to sell, consignment goods.

In the relevant sections, recommendations will be given on how to reflect these operations using standard means: Shortage of customer-supplied materials and Regrading of customer-supplied materials.

Document “Return of raw materials to the supplier”

The document “Return of raw materials to the supplier” is entered on the basis of the document “Order from the supplier”.

In the document “Return of raw materials to the supplier”, the tabular part is filled in with unsold materials, the hidden detail “destination” is filled in according to the foundation document.

When posting a document, the inventory type is selected: inventory type = “Supplier’s material”; product owner = "Dealer"; agreement = "Dalter's agreement"; counterparty = "Giver"; organization. Taking into account the type of inventory (determined from existing ones) and the purpose in the inventory accounting analytics, the balances in the “Goods of Organizations” register are checked.

Document “Production Order”

Based on the document “Order of the supplier”, the document “Order for production” is created.

The hidden detail “Purpose” is filled in the document, with the purpose from the tabular section “Raw materials and materials for production”. In the tabular part of the “Production Order” document, the “Assignment” column is filled in with the assignment from the hidden “Assignment” attribute of the “Supplier’s Order” document (this assignment can be edited).

Document “Production stage”, “Transfer of materials to production”, “Transfer of products from production”

Document "Production Stage"

Through a separate workplace “Order Queue Management”, “Production Stage” documents are created for the “Production Order” document.

In the “Production Stage” documents for the release of semi-finished or finished products, the hidden details of the document are filled in: “Assignment” - a new assignment is formed, which takes into account the supplier, the supplier’s agreement and the current production stage (see Figure 6); “Purpose of Semi-finished Product” - the purpose is similar to the hidden attribute “Purpose”; “Purpose of Materials” - filled in according to the hidden detail “Purpose” of the “Production Order” document. The “Assignment of Materials” attribute may contain a specific production stage (the “Master data and sections” setting must be set, segregation of materials for production when ordering for production = “by production stage”).

Figure 6 – Formed assignment in the “Production Stage” document.

In the tabular part “Provision”, the purpose of materials is filled in according to the hidden detail “Purpose of Materials” and is filled in according to the hidden detail “Purpose of Semi-finished Product”, if a semi-finished product is included in the tabular section.

The assignment in the tabular section “Provision” cannot be edited and, at first glance, it is impossible to reflect both the customer’s own materials and the supplier’s materials, but this operation can be reflected and this is described in the section: Reflection of the customer’s and own materials in one stage of production.

The assignment in the “Output” tabular section when releasing from customer-supplied materials is mandatory for semi-finished and finished products. Output from customer-supplied materials is determined by the hidden details: “Business Operation” = “Production From Tolling Raw Materials”. When producing a semi-finished product, the assignment is formed taking into account the “Production Stage” document where this semi-finished product is needed, as well as the supplier and the supplier’s agreement. The release of finished products is carried out according to the purpose from the “Order for Production” document (the purpose is from the “Purpose” attribute of the “Products” tabular section).

Document “Transfer of materials to production”

Based on the document “Production Stage”, the document “Transfer of Materials to Production” is created (in the configuration, the document “Movement of Products and Materials”) is created.

In the tabular part “Materials” there are two hidden details: “Purpose” - filled in with the hidden detail “Purpose” of the “Production Stage” document; “Sender’s Destination” - filled in with the “Destination” attribute from the “Provision” tabular section of the “Production Stage” document.

When posting the document “Transfer of materials to production,” there are no restrictions on the use of types of inventory with the type of inventory: own goods, supplier’s products or supplier’s material. At the time of posting, the type of inventory is determined and the balance is checked according to the item accounting analytics, taking into account the destination from the “Sender’s Purpose” column and the warehouse (storage location) from the document in the “Goods of Organizations” register. This is how expense movements are determined in the “Goods of Organizations” register. Receipt movements use the already found inventory type, but a new inventory accounting analytics is generated (the purpose is taken from the hidden “Purpose” attribute of the tabular section; the storage location is a department from the document).

Document "Production Stage"

When posting the “Production Stage” document, there are no restrictions on the use of inventory types with the inventory type: own goods, supplier’s products or supplier’s material for materials from the “Supply” tab. At the time of conducting, the type of inventory is determined and the balance is checked according to the item accounting analytics, taking into account the purpose from the hidden detail “Purpose” and the department (storage location) from the document in the “Goods of Organizations” register, this is how expense movements (writing off materials to cost) are determined in the “Goods of Organizations” register " When forming incoming movements in the “Goods of Organizations” register, a new type of inventory is formed: inventory type = “Products of the Provider”, Inventory owner = “Designer”, counterparty = “Provider”, agreement = “Designer’s Agreement”, organization and new analytics for accounting for items (the purpose is filled in from the hidden detail “Purpose” of the document; storage location = department from the document).

If at the time of posting the “Production Stage” document the “Transfer of materials to production” document has not been posted, then the system will record all expense movements in the default inventory type = “Organization’s own goods.”

"Transfer of products from production"

Based on the document “Production Stage” in which the “Produced” column is filled in the “Produced” tabular section, the document “Transfer of Products from Production” is created (in the configuration the document “Movement of Products and Materials”).

In the tabular part “Products” there are two details: “Purpose” - the attribute “Purpose” of the document “Production Stage” is filled in from the tabular part “Issue”; “Sender’s Destination” (hidden attribute) – the “Destination” attribute of the “Production Stage” document is filled in from the “Release” tabular section.

When carrying out the document “Transfer of products from production” there are no restrictions on the use of types of inventory with the type of inventory: own goods, products of the supplier or material of the supplier. At the time of posting, the type of inventory is determined and the balance is checked according to the item accounting analytics, taking into account the purpose from the “Purpose” column and the department (storage location) from the document in the “Goods of Organizations” register, this is how expense movements are determined in the “Goods of Organizations” register. Incoming movements use the already found type of inventory, but a new inventory accounting analytics is generated (the purpose is taken from the “Destination” attribute of the tabular section; the storage location is the warehouse from the document).

Document “Transfer to the seller”

The document “Transfer to the Provider” is entered on the basis of the document “Order of the Provider”.

In the tabular part “Released products”, the hidden attribute “Purpose” is filled in from the hidden attribute “Purpose” of the document “Order of the seller”.

In the document “Transfer to the Provider”, a strict selection is established by type of stock; when carried out in the document, only the type of inventory can be used for the following selections: Owner of the goods = “Designer”, agreement = “Designer’s Agreement”, counterparty = “Designer”, stock type = “Products” giver", organization. Taking into account this type of inventory (determined from existing ones) and the purpose in the inventory accounting analytics, the balances in the “Organizational Goods” register are checked.

Document "Report of the dealer"

This document does not take into account the purpose and type of inventory. The tabular part of the document is filled out on the basis of the balance in the “Supplier’s services for registration” register (the supplier’s order is taken into account).

Document “Order to processor”

The “Order to Processor” document can be created either independently or on the basis of the “Production Stage” document.

Based on the “Production Stage” document, you can create an “Order to Processor” document if the production is not for the supplier (determined by the requisite: “Business Operation” is not equal to “Production From Provided Raw Materials”).

- The “Purpose” attribute of the “Output Products” tabular section, which identifies manufactured products for a specific processor, contract and production stage. The assignment contains: processor, processor agreement, processor order. That is, we will be able to ship the products produced according to a given processor’s order only for this purpose. The option of separating raw materials and materials when processing on the side is set in the settings of master data and sections (production).

- The details of the tabular section “Raw materials” contain the details “Products and purpose” (required to be filled out). This assignment segregates materials in the processor's order.

Document “Transfer of raw materials to the processor”

The next document in the chain is “Transfer of raw materials to the processor.” The document is entered on the basis of “Order to processor”.

In the tabular part of the document “Transfer of raw materials to the processor,” the purpose from the foundation document is automatically filled in (editing is prohibited).

When posting a document, types of inventory are selected with a limited range of inventory types: own goods, goods in storage with the right to sell, consignment goods. Taking into account the type of inventory (determined from existing ones) and the purpose in the inventory accounting analytics, the balances in the “Goods of Organizations” register are checked.

In the standard solution, it is impossible to transfer the supplier’s materials to the processor, but the corresponding section provides recommendations for recording this operation.

Document “Return of raw materials from the processor”

The document “Return of raw materials from the processor” is entered on the basis of the document “Order of the processor”.

In the document “Return of raw materials from the processor”, the tabular part is filled in with materials from the processor’s order. In the tabular part, the hidden detail “purpose” is filled in according to the foundation document.

When posting a document, a type of inventory with a limited range of types is selected: own goods, goods in storage with the right to sell, consignment goods. Taking into account the type of inventory (determined from existing ones) and the purpose in the inventory accounting analytics, the balances in the “Goods of Organizations” register are checked. Additionally, it is checked that more is not returned than was transferred.

Document “Receipt from processor”

The “Receipt from Processor” document is entered based on the “Order to Processor” document.

In the “Products” tabular section, fill in the “Purpose” attribute from the “Purpose” attribute in the “Output Products” tabular section of the “Order to Processor” document.

The document “Receipt from Processor” establishes a strict selection by type of stock when carried out. The document can only use the inventory type for the following selections: inventory type = “Own goods”, organization. Taking into account the type of inventory (determined from existing ones) and the purpose in the inventory accounting analytics, the balances in the “Goods of Organizations” register are checked.

Document "Recycler's Report"

The document “Report of the processor” is entered on the basis of the document “Order to the processor”.

In the “Products” tabular section, fill in the “Purpose” attribute from the “Purpose” attribute in the “Output Products” tabular section of the “Order to Processor” document. The “Products and Purpose” detail of the “Raw Materials and Supplies” tabular section is filled in from a similar detail of the “Raw Materials and Supplies” table of the “Order to Processor” document.

The document “Receipt from Processor” establishes a strict selection by type of stock when carried out. Only the inventory type for the following selections can be used in the document: inventory type = “Own goods”, organization. Taking into account this type of inventory (determined from existing ones) and the purpose in the inventory accounting analytics, the balances in the “Goods transferred to processor” register are checked.

“Reflection of customer-supplied and own materials in one stage of production”

In the document “Production Stage”, when producing from customer-supplied materials, it may initially seem that you cannot use your own materials, because The document is filled in by default with the name of the seller. If you add new material to the document, the seller's assignment will be filled in by default. But if you change the supply option for a material from “provide separately” (“ship separately”) to “ship”, then the assignment will be cleared, and the system will allow you to write off your own material for production.

The only point: when changing customer-supplied material to your own material, you need to re-create the document “Transfer of materials to production” (if it was previously created).

But changing the collateral option back from “ship” to “ship separately” will not work, because the assignment has already been cleared. In this case, you need to delete the line with the material and add it again (the assignment will be filled in automatically).

“Shortage of customer-supplied materials”:

To reflect the operation “Shortage of supplied materials” in a standard solution, you cannot use standard documents. This is due to legal requirements; we cannot write off customer-supplied materials, because... they don't belong to us. Therefore, the standard solution imposes strict technical restrictions on standard documents (“Domestic consumption” (write-off as expenses). This is described in detail in the section: General concept in documents.

For example, the following situation may arise: the responsible user did not measure the material and reflected 60 meters in the receipt documents from the supplier. At the time of transfer to production, the material from the supplier was re-measured and it was established that what came from the supplier was not 60 meters, but 50 meters (the supplier measured the material incorrectly).

In the ERP 2.4 system, this operation can be reflected in two ways:

1) If it is possible to correct in the primary documents (document: “Receipt of raw materials from the supplier”) with the preliminary approval of the supplier;

2) Enter the document “Return of materials to the supplier”, having previously agreed with the supplier.

In the ERP 2.5 system, the functionality will be expanded to reflect such operations.

“Re-grading of customer-supplied materials”:

To reflect the operation “Re-grading of customer-supplied materials” in a standard solution, you cannot use standard documents - this is due to legal requirements; we cannot re-sort customer-supplied materials, because they don't belong to us. Therefore, the standard solution imposes strict technical restrictions on standard documents (“Re-grading of goods”). This is described in detail in the section: General concept in documents.

For example, the responsible user reflected the material for series No. 1 from the seller in the receipt document. But at the time of transfer to production, it was found out that the supplier’s material should be from series No. 2.

In the ERP 2.4 system, this operation can be reflected in two ways:

1) Correct in the primary documents (document: “Receipt of raw materials from the supplier”) if possible;

2) Enter the document - “Return of materials to the supplier” (there will be a fictitious document), and then enter “Receipt of raw materials from the supplier” (according to the correct series).

In the ERP 2.5 system, the functionality will be expanded to reflect such operations.

“Transfer of materials from the supplier to the processor”:

To reflect the operation “Transfer of supplied materials to the processor” in a standard solution, you cannot use a standard document according to legal requirements; we cannot transfer supplied materials, because they don't belong to us. Therefore, the standard solution imposes strict technical restrictions on standard documents (“Transfer of raw materials to the processor”). This is described in detail in the section: General concept in documents.

To reflect this operation, you can use the following options:

- Buy the materials from the supplier and use the standard scheme for the processor;

- Rent equipment from a processor. Draw up the “Production Stage” document. Reflect rental costs when drawing up the document “Report of the Provider” (the costs are attributed to the Provider).

- Rent equipment from a processor. Draw up the “Production Stage” document. Reflect rental costs in a separate document (for example, “Purchase of services and other assets” costs were not attributed to the vendor).

“Transfer of finished products from the processor to the supplier”:

To reflect the operation “Transfer of finished products from the processor to the supplier” in a standard solution, you cannot use a standard document; we cannot transfer customer-supplied materials, because they do not belong to us and, accordingly, the processor cannot make finished products for the seller. Therefore, the standard solution imposes strict technical restrictions on standard documents (“Receipt from the processor”). This is described in detail in the section: General concept in documents.

To reflect this operation, you can use a standard diagram of a processor with your own materials (or buy the materials from the supplier). After receiving the finished product from the processor, create a separate document “Production Stage” according to the tolling scheme (the finished product is from the processor at the input, the same is the output), in which the finished product will change the type of inventory to the toller’s product and it will be possible to transfer it to the toller.

Conclusion:

The article will help you understand the relationships between documents when accepted for processing and transferred for processing in the ERP 2.4 system. The article describes in detail the concept of documents in terms of technical implementation for the tolling scheme and transfer for processing. This information will help solve problems associated with such schemes. The article also provides options for reflecting operations that cannot be reflected in the standard version; these options can help in similar situations.

The article was prepared by Alexander Retunsky, an expert analyst on information systems at InfoSoft. The article was published on the portal

Income tax return

In the income tax return, the costs of the processor's services are reflected as part of the cost price as the products are sold:

- Sheet 02 Appendix No. 2: page 010 “Direct costs related to goods sold (work, services).”

The nomenclature group related to the sale of products of own production must be indicated in the Nomenclature groups for the sale of products and services PDF in the Main section - Settings - Taxes and reports - Income Tax tab - link Nomenclature groups for the sale of products and services. The correct completion of the income tax return depends on this setting.

Read more Accounting policy for income tax

Receipt from processing

After the contractor produces the goods and reports information about the consumption of raw materials, we can enter the “Production Report” document. With this document in 1C we reflect the receipt of goods from processing.

To capitalize products from processing, in the “Production” section, create a “Production Report” document.

Since this is not our own production, at the top of the document in the “Type” field we must indicate “Receipt from production”. In this case, the Partner, Counterparty and Contract fields will be available - in them we fill in information about the processor to whom we previously transferred customer-supplied raw materials for processing.

We fill out the tabular part with the finished products and indicate the quantity produced. The program will automatically fill in the raw materials based on the specification. But we can adjust the amount of raw material consumption.

If you need to reflect the cost of the processor’s services and include them in the cost of finished products, then go to the “Additional costs” tab.

On the “Additional expenses” tab, we reflect in 1C information on the cost of expenses for processing raw materials for manufacturing products, broken down by expense items. The specified cost will be reflected in the cost of finished products of the 1C: Trade Management + Production program.

After posting the “Production Report” document, the 1C program will do the following:

- Receipt of finished products

- Removing from reserves and warehouse balances the amount of raw materials specified in the document

- Reducing the balance of raw materials transferred to the processor

Based on this, the report “Remains and availability of goods” will show the following picture

Those. balances and reserves in 1C have become smaller because we actually used our own raw materials.

For the same reason, we will see that in the report “Designated raw materials transferred”, the availability of raw materials from the processor has become less

Transfer of construction materials to a subcontractor

The materials were prepared by a group of consultants and methodologists of JSC Intercom-Audit

Civil Code of the Russian Federation

Article 713. Performance of work using the customer’s material

1. The contractor is obliged to use the material provided by the customer economically and prudently, after completing the work, provide the customer with a report on the consumption of the material, and also return the remainder or, with the consent of the customer, reduce the price of the work taking into account the cost of the unused material remaining with the contractor.

2. If the result of the work was not achieved or the achieved result turned out to have shortcomings that make it unsuitable for the use specified in the contract, and if there is no corresponding condition in the contract, not suitable for normal use, for reasons caused by shortcomings in the material provided by the customer, the contractor has the right to demand payment for work performed by him.

3. The contractor may exercise the right specified in paragraph 2 of this article if he proves that the defects of the material could not have been discovered when the contractor properly accepted this material.

According to the construction subcontract agreement, the general contractor provides the subcontractor with the materials necessary for construction. The transfer of construction materials must be documented with appropriate delivery notes, invoices and invoices. The subcontractor prepares a report on the materials used.

When paying the subcontractor's bills for work performed, the general contractor withholds from it the cost of the transferred materials. As for the balance of unused materials, the subcontractor either returns the general contractor or reduces the price of its work by their value.

The procedure for paying VAT when transferring materials to a subcontractor depends on how the company determines revenue for VAT purposes.

Tax Code of the Russian Federation

Article 167. The moment of determining the tax base for the sale (transfer) of goods (work, services) (as amended by Federal Law No. 57-FZ of May 29, 2002)

1. For the purposes of this chapter, the moment of determining the tax base depending on the accounting policy adopted by the taxpayer for tax purposes, unless otherwise provided by paragraphs 6 - 11 of this article, is: (as amended by Federal Laws of December 29, 2000 N 166-FZ, dated 05/29/2002 N 57-FZ)

1)

for taxpayers who have approved in their accounting policy for tax purposes the moment of determining the tax base upon shipment and presentation of settlement documents to the buyer - the day of shipment (transfer) of the goods (works, services);

(Clause 1 as amended by Federal Law No. 57-FZ dated 29.05.2002) 2)

for taxpayers who have approved in their accounting policies for tax purposes the moment of determining the tax base as funds are received - the day of payment for shipped goods (work performed, services rendered) services).

(as amended by Federal Laws dated December 29, 2000 N 166-FZ, dated May 29, 2002 N 57-FZ) From the above it follows: if revenue is determined “by shipment,” then payment of VAT occurs at the time of transfer of materials to the subcontractor. If revenue is determined “by payment,” then VAT is paid after the subcontractor’s debt for materials is offset (clauses 1 and 2 of Article 167 of the Tax Code of the Russian Federation).

In the general contractor’s accounting, the transfer of materials is reflected in the following entries:

Debit 62/subaccount “Settlements for inventory items” Credit 91/subaccount “Other income” - an invoice was issued to the subcontractor for the transferred construction materials;

Debit 91/subaccount “Other expenses” Credit 10 - the purchase price of building materials is written off (excluding VAT);

Debit 91/subaccount “Other expenses” Credit 68/subaccount “Calculations for VAT” (76/subaccount “Calculations for unpaid VAT”) - VAT was calculated on the sale of materials;

Debit 91/subaccount “Balance of other income and expenses” Credit 99 - profit from the sale of materials is taken into account;

Debit 60/subaccount “Settlements with the subcontractor” Credit 62/subaccount “Settlements for goods and materials” - the subcontractor’s debt for materials is offset.