What is depreciation?

The concept of depreciation is very similar to the concept of wear and tear. When purchasing any fixed asset at an enterprise, the amount of the cost of the asset is written off to the cost of the products produced or services provided. But this write-off does not happen at once, but in parts. What period of time the write-off of the value of a fixed asset will occur determines its useful life, which is different for different categories of fixed assets. This addition of part of the cost of a fixed asset to the cost of products or services is called depreciation.

Registration

In tax accounting, depreciation is calculated on fixed assets. Depreciation begins to be calculated on the 1st day of the month following the commissioning of the asset subject to depreciation. Terminate - from the 1st day of the month following the month when the cost of the depreciable property was completely written off or when this object was removed from the depreciable property for any reason, regardless of the end of its useful life (clause 5 of Article 259.1 of the Tax Code of the Russian Federation).

However, some fixed assets do not need to be depreciated. In tax accounting, these are objects that are not depreciable.

Here are the reasons why depreciation is not calculated in tax accounting:

| Type of property | Depreciation according to tax accounting rules |

| Fixed assets that are not used to generate income, including external improvement objects | Not accrued (Clause 1, Article 256 of the Tax Code of the Russian Federation) |

| Fixed assets transferred to conservation for a period exceeding three months | Not accrued until December 31, 2022 (clause 3 of Article 256 of the Tax Code of the Russian Federation). From January 1, 2022 - accrued (Federal Law of September 29, 2020 No. 325-FZ) |

| Fixed assets of non-profit organizations | It is not accrued if the property was purchased using targeted proceeds and is used for non-commercial activities (Clause 2 of Article 256 of the Tax Code of the Russian Federation) |

| Housing facilities (residential buildings, dormitories, apartments, etc.) | Accrued if objects are used to generate income |

| Objects of fixed assets whose consumer properties do not change over time. Including: – land plots; – environmental management facilities; – museum objects and museum collections, etc. | Not accrued (clause 2 of article 256 of the Tax Code of the Russian Federation) |

| Fixed assets that have been under reconstruction or modernization for more than a year | Not accrued, except in cases where the objects continue to be used in activities aimed at generating income (clause 3 of Article 256 of the Tax Code of the Russian Federation) |

| Fixed assets worth more than 40,000 rubles, but less than 100,000 rubles. | Not accrued (clause 1 of Article 256 of the Tax Code of the Russian Federation). |

| Objects of unfinished capital construction | Not accrued (clause 2 of article 256 of the Tax Code of the Russian Federation) |

| Capital investments in leased fixed assets | Accrued only on the condition that capital investments are made in the form of inseparable improvements made by the tenant with the consent of the lessor (Clause 1 of Article 256 of the Tax Code of the Russian Federation) |

| Vessels registered in the Russian International Register of Ships | Not accrued (clause 3 of article 256 of the Tax Code of the Russian Federation) |

If you acquired a fixed asset through contributions to the authorized capital, depreciation can be calculated on it (letter of the Ministry of Finance of Russia dated October 18, 2022 No. 03-03-07/74983).

Whether or not to charge depreciation on property depends on the purposes for which the company acquired it and how it is used (letter of the Ministry of Finance of Russia dated July 11, 2022 No. 03-03-06/2/48148).

If the property is not used in the main activity, but is intended for sale, it is a commodity and is not subject to depreciation.

But property that, although not used in the main activity, but generates income, is recognized as depreciable. This applies to rental properties. Thus, if a company purchased property, set a useful life for it and formed an initial cost, and then rented it out to generate income, it must be depreciated.

From January 1, 2022, Federal Law No. 325-FZ of September 29, 2022 allowed the depreciation of fixed assets transferred for free use. But at the same time, depreciation amounts on them cannot be taken into account for taxation (with the exception of fixed assets transferred (provided) for free use in cases where such an obligation is established by the legislation of the Russian Federation).

Medical equipment purchased since January 1, 2022 for the diagnosis and treatment of coronavirus infection, plus the costs of their construction, manufacturing, delivery and bringing them to a condition in which they are suitable for use, are not depreciated. These are those medical products, the purchase costs of which are taken into account in accordance with the new subclause 48.12 of clause 1 of Article 264 of the Tax Code (clause 3 of Article 2 of the Federal Law of April 22, 2020 No. 121-FZ) according to the list approved by the Government of the Russian Federation.

What is depreciable property?

All fixed assets of the enterprise are depreciable. That is, depreciation is charged monthly on the cost of the fixed asset until it is completely written off. Depreciable property is all of the organization's property acquired for profit. Conditions for recognition as an object of fixed assets and depreciable property:

- The property must have a value of over one hundred thousand rubles;

- The period during which the property can be used in economic activity must be more than one year.

If these two conditions are met, the property can be recognized as an object of fixed assets and depreciation can be charged on its value.

Important! Property of mobilization capacities, intellectual property, capital investments and inseparable improvements in the production cycle are also subject to depreciation.

What is unused property

Unused property is considered to be property that is temporarily not involved in the main activities of the organization. The reasons why this may be the case are various:

- change in production volumes;

- transition of the organization to another type of activity;

- property being repaired;

- seasonal activities of the organization;

- obsolescence of fixed assets (obsolescence), etc.

REFERENCE! Such fixed assets can be equipment or (more often) real estate.

If it is planned to use this asset again after a certain time, this means that from an accounting point of view it is “mothballed”. You can rent out an unused OS or sell it - that is, one way or another, bring it back into economic circulation.

What property is not subject to depreciation?

There is a fairly large list of fixed assets that are not subject to depreciation. These are assets such as:

- Property that was created or purchased using budget money;

- Property owned by non-profit organizations that was received as targeted income;

- Objects on the balance sheet of budgetary enterprises;

- External improvement property;

- If the building is officially recognized as a work of art;

- Objects transferred for temporary (more than three months) conservation;

- If an investment tax deduction and some other types of objects were used in relation to the property.

Important! Land plots, natural resources, water, subsoil, and securities are not subject to depreciation.

Accounting for depreciation costs for an unused car

Question: The organization’s car was not used for a long time and depreciation on it was debited to account 90 “Income and expenses for current activities” subaccount 90-10 “Other expenses for current activities.”

In February 2022, the car was “transported” from one location to another. There was no other use of the car in the reporting year. Depreciation charges for the car for February - June 2022 are attributed to account 20 “Main production” and taken into account when taxing profits (February as the month of operation of the car, and March - May as depreciation during idle time).

Did the organization act correctly?

Answer: According to the author, it is illegal.

Rationale: Depreciation charges for fixed assets used in business activities (except for those located in budgetary organizations) are made throughout the entire useful life of the objects and are reflected taking into account the features specified in parts 2 and 3 of clause 45 of Instruction No. 37/18 /6, by monthly inclusion of depreciation charges:

- in production costs or sales costs - when fixed assets are in operation; downtime for up to three months, including due to repairs;

- as part of other expenses for current activities - when fixed assets are idle for more than three months, including in connection with repairs, idle time caused by a complete stop in the production of products (works, services) in a structural unit of the organization or organization in in general, as well as when in reserve (part 1, clause 45 of Instruction No. 37/18/6).

Downtime is a temporary suspension of operation of a facility due to a production (technical or technological) or economic nature (Appendix 5 to Instruction No. 37/18/6).

For profit tax purposes, the costs of production and sale of goods (work, services), property rights, taken into account for taxation, represent the valuation of goods (work, services), property rights of natural resources, raw materials, materials, fuel used in the production and sale process , energy, fixed assets, intangible assets, labor resources and other expenses for their production and sale, reflected in accounting (clause 1 of article 170 of the Tax Code).

Costs for the acquisition of fixed assets used in business activities and in operation are reflected through depreciation. Fixed assets that are idle (including in connection with repairs) for up to three months are equated to fixed assets in operation (subclause 2.1 of Article 170 of the Tax Code).

The amounts of depreciation charges for fixed assets that are not used in business activities and are not in operation are not taken into account when taxing profits (subclause 1.9 of Article 173 of the Tax Code).

According to the author, in this case there is no fact of using a car when carrying out activities related to the production and sale of goods (works, services). Also, in our situation, there is no downtime of up to three months, in which fixed assets are equated to fixed assets in operation.

Therefore, depreciation charges should be reflected in the accounting accounts as follows:

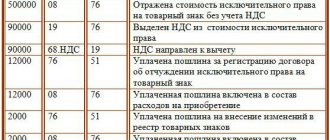

| Contents of operation | Debit | Credit |

| Depreciation has been calculated for a vehicle not used for business purposes. | 90-10 | 02 |

The organization improperly took into account depreciation charges for February - June 2022 when taxing profits.

Identified errors are subject to correction.

Correction of errors is formalized by an accounting statement containing information established by the legislation of the Republic of Belarus for primary accounting documents (clause 9 of National Standard No. 80).

An error made in the reporting year and identified before its end is corrected in the month of the reporting year in which the error was identified by an additional or reversal entry(s) in the relevant accounting accounts. Income or expenses arising as a result of correcting this error are reflected as part of the income or expenses of the reporting year (clause 10 of National Standard No. 80).

In the month the error was identified based on the organization’s accounting statement, the following should be reflected in the organization’s accounting:

| Contents of operation | Debit | Credit |

| Reversal entry for the amount of depreciation accrued to account 20 “Main production” for February - June 2022 | 20 | 02 |

| Depreciation has been calculated for a vehicle not used in business activities for February - June 2022 | 90-10 | 02 |

If incomplete information or errors are detected in the tax return (calculation) filed for the previous reporting period of the current tax period, the payer is obliged to make changes and (or) additions to the tax return (calculation).

With regard to income tax, if incomplete information or errors are detected for the previous reporting period of the current tax period, changes and (or) additions are reflected in the tax return (calculation) submitted for the next reporting period of the current tax period (clause 6 of Article 40 of the Tax Code) .

At the same time, on the title page of such a tax return (calculation) in the line “Making changes and (or) additions” the sign “X” is not affixed (part 2, sub-clause 8.2 of Instruction No. 2).

In the context of previous reporting periods, you should fill out Section III “Information on understatement (overstatement) of the amount of tax subject to payment (refund) on a tax return (calculation) in which incomplete information or errors were found” of Part I of the tax return (calculation) for income tax (Subclause 8.2 of Instructions No. 2). In the tax return (calculation) for income tax submitted for subsequent reporting periods, the information reflected in this section is not filled in (subclause 46.18 of Instruction No. 2).

Read this material in ilex >>* *follow the link you will be taken to the paid content of the ilex service

How to calculate the amount of depreciation - methods and features of calculation

The calculation procedure and methods for calculating depreciation charges are regulated by Article 259 of the Tax Code of the Russian Federation. There are two main calculation methods:

- Linear method;

- Nonlinear method.

Each business entity must decide for itself which method of calculating depreciation to choose; this decision must be spelled out in the accounting policy of the organization, which is drawn up every year and approved by the sole executive body of the legal entity.

Important! You can change the accrual method only from the beginning of the new year and only once every five years.

The applied method must be used for all property - fixed assets. That is, there cannot be a situation where the linear accrual method is applied to one object, and the non-linear method is applied to another object at the same enterprise.

As soon as the object is put into operation, starting from the next month, the organization’s accountant (or director, if the responsibility for maintaining accounting records has not been transferred to the accountant) must calculate depreciation.

The right not to charge depreciation in 2022: practical aspects

Resolution No. 229 was adopted as a temporary measure in order to overcome the negative consequences of the current epidemiological situation in the world.

Resolution No. 229 established that organizations and individual entrepreneurs have the right to decide not to accrue depreciation from January 1 to December 31, 2022 for all or individual fixed assets and intangible assets used by them in business activities. At the same time, the standard service life and useful life of the specified fixed assets and intangible assets are extended for the period during which depreciation was not calculated.

For reference Before the adoption of Resolution No. 229, it was allowed not to charge depreciation only on fixed assets and intangible assets provided for by business plans of investment projects for the creation or modernization of production facilities. This norm is provided for by Resolution No. 802.

Question 1. The organization is implementing an investment project, within the framework of which fixed assets were introduced in 2022 - 2022. In 2022, the organization decided not to charge depreciation on such objects in accordance with Resolution N 802 (for three years from the date of commissioning).

Does the organization have the right to continue not to charge depreciation in 2022, guided by Resolution No. 802? Is it necessary to make an additional decision not to charge depreciation in 2022? If three years expire in 2022 from the date of commissioning of the facilities, will it be necessary to return to depreciation until December 31, 2022?

Resolution No. 802 gives organizations the right to decide not to charge depreciation on fixed assets and intangible assets used by them in business activities, provided for by business plans of investment projects for the creation or modernization of production facilities. In this case, additional restrictive conditions are provided <*>:

— until December 31 inclusive of the year in which these production facilities reach their designed capacity or achieve a positive financial result (availability of net profit);

- no more than three years from the date of commissioning of fixed assets and the date of acceptance of intangible assets for accounting.

The norms of Resolution No. 229 are rules of a broader nature in relation to the norms of Resolution No. 802, because they contain no restrictions on the use of the right not to charge depreciation depending on the availability of a business plan for the investment project, the period for reaching design capacity, and the emerging financial result.

Thus:

the norms of paragraph 1 of Resolution No. 802 continue to apply in 2020;

To continue to apply the norms of Resolution No. 802, a mandatory additional decision on not accruing depreciation in 2022 is not required.

At the same time, if the organization does not decide not to accrue depreciation from January 1 to December 31, 2022 on the basis of Resolution No. 229, for fixed assets introduced as part of the implementation of investment projects, it will be necessary to return to accrual of depreciation after three years from date of commissioning, if the specified period expires before December 31, 2022.

If an organization decides not to charge depreciation, it needs to decide on the list of objects in respect of which it will apply this right. This can be one, several, a group or all objects listed in accounting <*>.

The decision should be documented. For example, by issuing a separate order indicating the objects of non-accrual of depreciation.

Please note that if the decision is made by organizations whose property is in state ownership, shares (shares) in the authorized funds of which belong to the Republic of Belarus and administrative-territorial units:

Resolution No. 229 does not provide for mandatory coordination of decisions made with a higher body (organization);

it is necessary to notify higher state bodies (organizations) of the decision taken within three days <*>.

Let's consider some practical issues of applying Resolution No. 229 in 2022.

Nonlinear method

The nonlinear method is more complex in nature. To calculate depreciation charges for a month, you need to multiply the total balance of the depreciation group by the norm.

The total balance of a depreciation group is the sum of the values of all fixed assets that are in one depreciation group. It is reduced by the amount of accrued depreciation and calculated on the first day of each month. The depreciation rate for the purposes of the nonlinear method can be seen in the picture.