What is depreciation?

Depreciation is the process of periodically transferring the initial cost of a fixed asset or intangible asset to manufacturing, selling, or general expenses, depending on how the asset is used.

There are several methods of depreciation, but legal entities using the simplified tax system should probably choose the simplest one - the linear method of depreciation.

The straight-line method is that over the entire useful life of a fixed asset or intangible asset, it is written off in equal shares. Depreciation is charged monthly, starting from the next month after the property is put into operation, and until the original cost of the fixed asset or intangible asset is fully amortized.

Where is depreciation shown on the balance sheet?

It is impossible to see the amount of depreciation in the balance sheet, since in this accounting form all assets are reflected at their residual value, that is, minus depreciation. By debit account 01 “OS” the initial cost is fixed, depreciation is accrued on the credit account. 02, in the balance sheet they indicate the difference between the initial cost and accrued depreciation (credit balance of account 02) - the residual value in line 1150. This is the principle of constructing the balance sheet - the user of financial statements should see the real cost reflection of assets as of a certain reporting date.

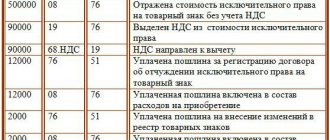

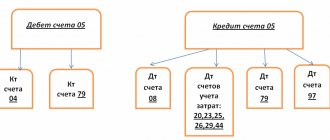

So, depreciation of fixed assets is taken into account on the account. 02, which according to its characteristics is regulatory, i.e., does not have independent significance. It is used only in conjunction with main account 01, which takes into account the initial cost of depreciable property. The same algorithm is applied to intangible assets, the initial cost of which is fixed on the account. 04 and is regulated by the calculation of depreciation according to account. 05. Thus, it is impossible to see depreciation charges in the balance sheet. Accrued depreciation is not recorded in the balance sheet, since it is not an asset, but transfers the value of the property to production costs, participating in the formation of production costs.

Determining the useful life

For an intangible asset, the useful life is determined by the company itself. This is the period during which the intangible asset will be used and thereby generate income.

For fixed assets in accounting, an enterprise can also set the period of use independently, but it would not be amiss to coordinate this period with already developed standards and classifiers.

Therefore, to determine the useful life, we recommend using a fixed asset classifier.

If a fixed asset belongs to several depreciation groups, we recommend choosing a useful life from the range of the groups to which it belongs, based on the expected service life of the fixed asset.

Thus, it will be possible to obtain the monthly depreciation amount.

If it is necessary to determine the amount of depreciation for a period, for example, as of 01/01/2021, then you should first determine the date of commissioning, and then calculate how many monthly depreciation amounts should have been made. Thus, the monthly depreciation amount can be multiplied by the number of months from the date of commissioning.

Depreciation: fixed or variable costs

Since the amount of accrued depreciation of fixed assets practically does not depend on changes in production volume, it is classified as a fixed cost: no matter what method of calculating depreciation is adopted by the company, the amount of monthly deductions will remain unchanged both with the volume of output, for example, 100 units of product, and with production of 1000 units.

If the economist has no problems with the issue of the constant nature of such costs as depreciation, then attributing them to direct or indirect costs often involves enormous analytical work and the subsequent consolidation of the methodology for determining costs in the company’s accounting policy.

Car depreciation

Any equipment wears out over time and requires repair. Thanks to the accurate calculation of depreciation, it is possible to take into account the wear and tear of equipment and transfer the cost of repairs to the final product. In simple terms, the costs that go into maintaining fixed assets in working order are one of the pricing factors.

If we are talking about vehicles used to perform certain tasks, then the owners take into account its wear and tear. For example, if you buy a metro ticket or order cargo delivery by road, the cost of this service includes repairs and maintenance of vehicles.

Entrepreneurs calculate how much it costs them to maintain transport and base their prices on their services on this basis.

Car depreciation calculation

We have already written on our website Vodi.su about how to correctly calculate the depreciation of a car. There is nothing particularly complicated here, especially if we are talking about a privately owned vehicle. You just need to take into account all your expenses for the purchase of consumables, oil changes, replacement of parts and components throughout the year, and then simply divide the resulting amount by the mileage. This way you will get the final result - the cost of one kilometer.

It is much more difficult to calculate depreciation in large transport enterprises. Here, as a rule, each driver keeps a special journal where he writes down all unforeseen expenses: replacing light bulbs, installing new filters, and so on. But there is also an accounting department, whose employees indicate all these expenses as production costs, and accordingly they are not subject to taxes.

There is also an average approach. You can find special reference books that contain information about different car models and their book value. The book value depends on the age of the vehicle and its normal wear and tear. The resulting amount is divided by the number of months during which the machine was used and the average depreciation rate per month is obtained.

It is clear that this approach does not take into account a lot of nuances, the main one of which is the skill of the driver. It has long been noted that in those motor transport enterprises where there is a high turnover of personnel, vehicles are more likely to need repairs, since drivers are not interested in devoting their time to proper care.

If a specific driver is attached to a specific car, then the productivity of his work will largely depend on this; accordingly, he will not be too lazy to once again check the oil level or battery charge.

Methods for calculating depreciation

Today, several main methods of calculating depreciation are used:

- linear;

- reducing balance method;

- write-off of funds in proportion to the volume of work performed;

- accelerated method.

The linear method is considered the simplest. You can calculate the amount of depreciation using a simple formula.

Here's a simple example:

- you bought a car for 400 thousand for the needs of the enterprise;

- its service life is 10 years;

- Divide 400 thousand by 10 years, we get 40 thousand.

That is, every year the cost of your car will decrease by 40 thousand rubles. It is clear that after 10 years, according to this scheme, the cost of the car should be zero, but if you want to sell it, the price can be set depending on the technical condition, just in 10 years your company will fully compensate for its costs of purchasing the car.

All other methods are nonlinear. When calculating depreciation of fixed assets, various factors are taken into account, such as acceleration coefficient or wear rate. All these formulas and coefficients are constantly undergoing changes; they can be found in numerous accounting literature and periodicals.

Accelerated depreciation of cars

Accelerated depreciation of cars, and in general any special-purpose equipment, has greatly influenced the popularization of this method of purchasing vehicles, such as leasing. We have already written briefly on our portal Vodi.su about what leasing is and why it is more profitable than a car loan.

If we talk about purchasing a car by an individual on lease, then the benefit is minimal, but for legal entities and entrepreneurs it is beneficial for a number of reasons:

- accelerated depreciation - usually calculated at a factor of 3, that is, you have to deduct smaller amounts for property and profit taxes;

- You can buy the car at a reduced residual value;

- risks of property depreciation are minimized.

Take any example: a small company enters into a leasing agreement for a crane or van to deliver bread within the city. Book value decreases three times faster than if you took out equipment on credit or bought it with your own money. After a few years, you may end up paying a fraction of the price for the vehicle to finally buy it out.

An important point is that while you are using the vehicle under the terms of the contract, it is not on the balance sheet of your company. Well, when you buy it back at its residual value, which can range from 75 to 25 percent of the initial value, then this is the amount you will indicate in the declaration, and accordingly the property tax will be lower.

When is depreciation not required?

The legislation mentions a number of cases when depreciation does not need to be calculated. First of all, this applies to repairs or modifications - termination of depreciation for up to a year. Also, if you transfer the vehicle for free use under the terms of the contract, depreciation is stopped.

It is also allowed that the vehicle is sent for preservation for a period of up to three months. This is the case, for example, in many agricultural enterprises.

( 2 ratings, average: 5.00 out of 5)

Practical use of wear rate

Based on the data obtained on the CA, it is possible to determine how outdated the fixed assets of the enterprise are, when replacement of worn-out objects is necessary. At the regulatory level, there are no minimum and maximum coefficient values; each organization independently evaluates the threshold data. In this case, you should take into account the specifics of the activity, as well as whether the accelerated depreciation method is used or not. The standards are approved in the company's accounting policies.

Most organizations use an average coefficient of 50%. The lower its value, the more effective the management of the organization’s property. If, as a result of calculations, an excess of the indicator value is determined, this indicates a high degree of wear and tear of the OS. To detail data by type of object, it is recommended to carry out calculations by type of asset or by group of assets.

Note!

If an enterprise operates in an industry for which other KA threshold values are generally accepted, these standards should be adhered to in order to get a real picture of the results of the analysis of OS wear and tear. Otherwise, the data obtained will deviate from reality and will not correspond to reality. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.