If a company sends incorrectly executed payment documentation (for example, there are errors, inaccuracies), the treasury registers an unclear payment.

Question: The winner of the electronic auction confirmed the payment of funds as security for the execution of the contract, providing a payment order along with the signed contract. However, the account indicated in this payment order is the customer's current account, taken from the contract details, and not the account that was specifically indicated in the auction documentation for depositing contract security. As a result, the money came from “unexplained payments.” What should the customer do in this case? View answer

What is an unclear payment?

An uncleared payment is an incorrectly executed payment. For example, the accompanying documentation may contain the following errors, which are the basis for registering an unclear payment:

- The order contains an incorrect INN/BIC of the taxpayer.

- The tax structure identification number was recorded incorrectly.

- The purpose of the funds sent, indicated in writing, does not correspond to the funds purpose code.

- The payment is sent to a tax structure in which the taxpayer is not registered.

- The taxpayer does not have to pay the type of tax that he paid.

- The personal account number is not registered (or it is registered incorrectly).

How to clarify a tax payment if there is an error in a payment order ?

As a rule, errors are contained in codes. They are most likely to occur when using payment terminals. If payment documents are completed incorrectly, the payment will not be counted. Thus, the company accumulates debts.

IMPORTANT! If an unclear payment is registered, the company needs to submit a refund application. An alternative option is to credit the amount paid in error to the entity to which the payment should be sent.

ATTENTION! Unclarified payments must be reflected in accounting.

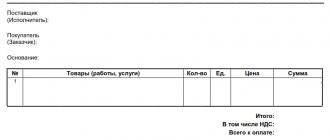

Creating “Account Receipts” based on an invoice for payment

The 1C system provides the ability to create receipt documents based on a previously issued invoice to the buyer. To do this, go to the “Sales-Invoices” menu.

Fig. 12 Creation of “Account Receipts”

In the list of accounts, find, select and open an account for which you need to create a payment document and click “Enter based on - Receipt to account”.

Fig. 13 Enter based on - Receipt to account

In this case, all the details filled in in the invoice will be automatically added to the receipt. If necessary, they can be adjusted manually. After filling out all the fields, the document can be recorded or posted.

Accounting for outstanding payments

The uncleared payment is reflected by the income form code. The detail of the code is determined by the form of the budget. The uncleared payment must be recorded on account 1 205 82. The corresponding rule is stated in clause 77 of Instruction No. 162n. The entries used are determined by whether the payment is adjusted or sent back to the taxpayer. Let's look at the wiring used:

- DT1 210 02 180 KT1 205 82 660. Acceptance of an unclear payment for accounting. The primary document in this case is an extract from the personal account.

- DT1 205 82 560 KT1 210 02 180. Write-off of an unclear payment after the ownership of the funds has been established. Primary documentation: account statement, application.

- DT1 210 02 100 KT1 205 00 660. Settlement of money according to the updated KDB.

- DT1 205 00 560 KT1 401 10 100. Accrual of income (relevant only if this procedure has not been carried out before).

How do tax authorities deal with uncleared payments ?

These postings are relevant when clarifying payments. If the money is returned to the taxpayer, these accounting entries are used:

- DT1 210 02 180 KT1 205 82 660. Acceptance of an unclear payment. The primary paper on the basis of which the posting is created is an account statement.

- DT1 205 82 560 KT1 210 02 180. Transfer of an unclear payment to the taxpayer. The primary document is the taxpayer’s application.

Accounting entries can only be created based on information from primary documents.

Unclear payments

In accordance with the budget legislation of the Russian Federation, the Federal Treasury records outstanding revenues credited to the federal budget using the budget classification of income code 10011701010016000180 “Unknown revenues credited to the federal budget” without division by type of payer. Information about unexplained revenues is publicly available and posted on the official website of the Federal Treasury www.roskazna.ru in the “Budget Execution” section, subsection “Federal Budget”, report type - annual/quarterly, financial period - 2022/2018.

Thus, as of July 1, 2018, outstanding payments amounted to more than 11 billion rubles.

Documenting

If the authority has registered an unclear payment, a request is created and sent to establish the ownership of the funds. The request is made in form 0531808. To clarify the payment, a corresponding notification is provided. The purpose of the notification is to correct incorrect details to correct ones. The need to send this document is stipulated in paragraph 2 of Article 160.1 of the Budget Code. The provision concerning the situation under consideration is also contained in paragraph 56 of Order of the Ministry of Finance No. 125n.

If the payment was sent incorrectly, the money must be returned to the taxpayer. To do this, create a return application in form 0531803. It must be sent to the treasury.

Features of creating a letter of clarification

The note is drawn up by a representative of the accounting department or an employee with appropriate authority. The document must be signed by the head of the company. If the person who sent the letter learns about the error, the following procedure is relevant:

- Contacting the bank to obtain evidence of the actual transfer of funds. The bank must provide proof in writing.

- Sending a letter to the tax office confirming payment.

There is no special form for the letter, so when drawing it up, you can use local acts. The document must include this information:

- The name of the entity that received the payment.

- Company address.

- Payment recipient information.

- The number of the order drawn up with errors, the date of its creation.

- Indication of an error (for example, incorrect codes).

- Method for removing the error.

If the order contains several errors, each of them must be indicated separately. There are recommended paper requirements:

- Business style.

- No ambiguity.

- A brief summary solely on the essence of the issue.

It is recommended to supplement the letter with documents that confirm the actual payment. For example, you can send a payment order with the mark of a banking institution. If this is not enough for tax representatives, you can attach an extract from your current account. It will serve as proof of the funds being written off.

ATTENTION! If, due to errors, the payment is not taken into account in the payment card, the letter should formulate a request for recalculation of the penalty.

IMPORTANT! The deadline for sending the letter is not established by regulations. It can be sent at any convenient time.

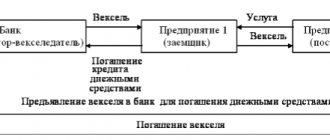

Return code for electronic payments with registry

From 07/01/2013, the Central Bank of the Russian Federation introduced a new payment document - ED108, which is an electronic order for the total amount with the register (information letter dated 04/08/2013 MCI-12-2-16/1401). This initiative of the Central Bank was related to the need to implement clause 3.9 and clause 3.15 of the Regulations of the Central Bank of the Russian Federation dated June 29, 2012 No. 384-P.

From the moment document ED108 is put into circulation, the RCC, when processing relevant payment receipts, must check:

- the correctness of the “Type of payment” details (when using the BESP system, it should not be filled in);

- status of the sender and recipient of the payment (if they are part of the structure of the same payment system of the territorial institution of the Central Bank, then both must be participants in the corresponding system);

- compliance of the sender and recipient - if they work on different TS of the Central Bank, with the status of an electronic exchange participant;

- the recipient has a license - if it is revoked by the Central Bank, then code 2313 is entered;

- compliance of the indicator in the “Transfer Amount” detail, which is indicated in the register, with the values in the “Amount” detail of the electronic payment order.

Thus, if control shows that the payee does not have a license from the Central Bank, the RCC rejects the transfer and records a return code with the value 2313 in the payment order.

How to clarify the details for paying insurance premiums

You can make a mistake not only when sending tax payments, but also when sending contributions. In this case, you need to clarify the amount in the standard manner. However, there are some nuances:

- There is no need to specify the amount of contributions if information about the amount is recorded on the company’s personal account. The basis for this is paragraph 9 of Article 45 of the Tax Code of the Russian Federation.

- The clarification procedure is determined by the date on which the payment was made. If it was made for the reporting period before January 1, an application for clarification must be sent to the Pension Fund. Review of the application takes 5 days. If the transfer was made after January 1, the application is sent to the tax office.

After the structure reviews the document, a decision is made on the possibility of clarifying the details.

Clarification at the request of the tax office

When the taxpayer himself discovers an error that does not entail non-payment of tax, he independently sends an application to the tax office to clarify the payment.

When the tax authority finds such an error, it informs the taxpayer of the need to clarify the payment. Such a message contains information that the tax transfer payment was issued in violation of the Rules and indicates a specific violation. Variants of indicated violations:

- KBK or OKTMO are indicated incorrectly or not indicated at all;

- The TIN of the payer or recipient is incorrectly specified or not specified;

- The checkpoint of the payer or recipient is not specified or is specified incorrectly;

- The taxpayer is not registered with the tax authority;

- Tax paid for a third party (

Features of the return of uncleared payments

The procedure for returning an outstanding payment to the budget is established by Order No. 125 of December 18, 2013. Refunds are subject to the following conditions:

- The specified payment purpose indicates that the payment was not sent to the budget.

- An unknown payment was credited due to an error by the banking institution.

Returns can be processed within 3 days. The basis for it is a refund application submitted by the taxpayer. It is drawn up on the basis of a letter from the company received by the Treasury.

What to do if there are no conditions for return stipulated by law? For such cases, there is another regulatory act - Article 1102 of the Civil Code of the Russian Federation. According to this article, a person who has unjustifiably received someone else's property must return it. To make a refund, the company needs to contact the person who received the transfer. If a person refuses to return the funds, the company should go to court.

IMPORTANT! If a company receives an erroneous payment, it should contact its bank within 10 days. Write-off of returned funds involves the use of posting DT76 KT51.

Main transactions for account 76

Because of its versatility, account 76 corresponds with almost all accounting accounts in debit and credit. In the table we have collected the main transactions that most organizations face.

| Debit | Credit | Description |

| 20 / 23 / 25 | 76 | Insurance costs are allocated to production. |

| 50 / 51 / 52 | 76 | Insurance compensation received. The supplier has paid the penalty or fine due to the claim. The due dividends have been received. |

| 68.02 | 76.VA | Accepted for deduction of VAT on advance payments to the supplier. |

| 70 | 76 | Salary deposited. |

| 76 | 10 / 41 | Materials were written off due to an insured event. There was a shortage of materials from the supplier, identified after acceptance. |

| 76 | 28 | The supplier admitted a fine for a manufacturing defect that was his fault. |

| 76 | 50 | Deposited wages were issued from the cash register. |

| 76 | 50 / 51 / 52 | The amount presented for payment has been repaid. |

| 76 | 60 | The supplier has been assessed a penalty or fine for a claim for violation of the terms of the contract. |

| 76.AB | 68.02 | VAT is charged on the advance payment from the buyer. |

| 76 | 73 | The amount of insurance compensation payable to the employee has been accrued. |

| 76 | 91 | The amount of the penalty for the claim against the supplier is included in other income. Insurance compensation has been calculated. Income received in the form of dividends from another organization. |

To record settlements with other debtors and creditors, we recommend the cloud service Kontur.Accounting. Calculate penalties, take into account insurance and leasing payments, deposit wages. We give all newcomers a trial period of 14 days.