When was the BCC for insurance premiums last updated?

Since 2022, the bulk of insurance premiums (except for payments for accident insurance) began to be subject to the provisions of the Tax Code of the Russian Federation and became the object of control by the tax authorities.

As a result of these changes, in most aspects, insurance premiums were equated to tax payments and, in particular, received new, budgetary BCCs. The existence of a situation where, after 2016, contributions accrued according to the old rules can be transferred to the budget, required the introduction of special, additional to the main, transitional BCCs for such payments.

As a result, from 2022, there are 2 BCC options for insurance premiums supervised by the Federal Tax Service: for periods before December 31, 2016 and for periods after January 2022. At the same time, the codes for contributions to accident insurance that remain under the control of the Social Insurance Fund have not changed.

Read more about KBK in this material.

From April 23, 2018, the Ministry of Finance introduced new BCCs for penalties and fines on additional tariffs for insurance premiums paid for employees entitled to early retirement. KBK began to be divided not by periods: before 2017 and after - as before, but according to the results of a special labor assessment.

From January 2022, BCC values were determined in accordance with Order of the Ministry of Finance dated June 8, 2018 No. 132n. These changes also affected codes for penalties and fines on insurance premiums at additional tariffs. If in 2022 the BCC for penalties and fines depended on whether a special assessment was carried out or not, then at the beginning of 2022 there was no such gradation. All payments were made to the BCC, which is established for the list as a whole.

We talked about the nuances in the material “From 2022 - changes in the KBK.”

However, as of April 14, 2019, the Ministry of Finance returned penalties and fines for contributions under additional tariffs to the 2022 BCC.

In 2022, the list of BCCs was determined by order of the Ministry of Finance dated November 29, 2019 No. 207n, in 2021 - by order No. 99n dated June 8, 2020, and from 2022 a new list of BCCs is introduced, approved. by order of the Ministry of Finance dated 06/08/2021 No. 75n. But the BCC for contributions did not change any of these regulations. Find out which BCCs have changed here.

Thus, the last update of the BCC on insurance premiums took place on April 14, 2019. Nothing else has changed yet, and these same BCCs will be in effect in 2022 (Order of the Ministry of Finance dated 06/08/2021 No. 75n).

All current BCCs for insurance premiums, including those changed as of April 14, 2019, can be seen in the table by downloading it in the last section of this article.

A complete list of current BCCs on taxes and insurance premiums can be found in ConsultantPlus, having received a free trial access to the legal system.

Decoding KBK 182 10200 160

Any KBK is a set of numbers that encrypt information about the administrator, budget level, type of payment, its purpose, and so on. Having received your payment, the tax authorities look at the specified KBK and send the money to repay this or that payment. There are a lot of BCCs, the full list was approved on June 8, 2020 No. 99N.

The decoding of KBK 182 10200 160 is as follows:

- 182 - administrator of budget revenues of the Federal Tax Service;

- 102 - tax income in the form of social insurance contributions;

- 02010 — insurance contributions for employee pension insurance;

- 06 - the recipient of the payment is the Pension Fund, and not the Compulsory Medical Insurance Fund or the Social Insurance Fund;

- 1000 - insurance premiums for billing periods expired before January 1, 2022;

- 160 - income from insurance premiums for compulsory social insurance.

BCC for insurance premiums in 2022 for the Pension Fund of Russia

Payment of insurance premiums to the Pension Fund is carried out by:

- Individual entrepreneurs working without hired employees (for themselves);

- Individual entrepreneurs and legal entities hiring workers (from the income of these workers).

At the same time, payment of a contribution by an individual entrepreneur for himself does not exempt him from transferring the established amount of payments to the Pension Fund for employees and vice versa.

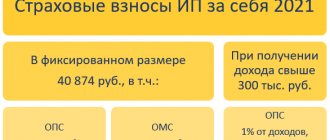

Individual entrepreneurs who do not have staff pay 2 types of contributions to the Pension Fund:

- In a fixed amount - if the individual entrepreneur earns no more than 300,000 rubles. in year. For such payment obligations in 2022, KBK 18210202140061110160 (if the period is paid from 2017) and KBK 18210202140061100160 (if the period is paid until 2017) are established.

- In the amount of 1% of revenue that exceeds RUB 300,000. in year. For the corresponding payment obligations accrued before 2022, KBK 18210202140061200160 has been established. But contributions accrued in 2017–2022 should be transferred to KBK 18210202140061110160. That is, the code is the same as for the fixed part (see letter from the Ministry of Finance of Russia dated 04/07 .2017 No. 02-05-10/21007).

Find out about the current fixed payment amount for individual entrepreneurs by following the link.

Individual entrepreneurs and legal entities that hire employees pay pension contributions for them, accrued from their salaries (and other labor payments), according to KBK 18210202010061010160 (if accruals relate to the period from 2017) and KBK 18210202010061000160 (if accruals are made for the period until 2022) . This is KBK at a general and reduced rate.

KBC for insurance premiums for compulsory health insurance at additional rates:

- for workers engaged in hazardous work (the list of works is specified in clause 1, part 1, article 30 of the law on insurance pensions):

- contributions at an additional tariff that does not depend on the results of the special assessment - 18210202131061010160;

- contributions at an additional tariff depending on the results of the special assessment - 18210202131061020160;

- for workers engaged in heavy or dangerous work (list in paragraphs 2 - 18, part 1, article 30 of the law on insurance pensions):

- contributions at an additional tariff that does not depend on the results of the special assessment - 18210202132061010160;

- contributions at an additional tariff depending on the results of the special assessment - 18210202132061020160.

You will find a sample payment order for contributions to compulsory pension insurance for employees in ConsultantPlus. If you do not already have access to this legal system, a full access trial is available for free.

Filling out a payment order with KBK 182 10200 160

The rules for filling out a payment slip for payment of insurance contributions for compulsory pension insurance that expired before January 1, 2017 are no different from the rules for filling out a regular payment slip.

The recipient of the contribution will not be the Pension Fund, but the tax office where you are registered. You can find out the payment details of “your” Federal Tax Service on the official website of the tax office.

In field 101 you need to indicate the payer status:

- for a legal entity - 01;

- for an individual entrepreneur - 09, but from October 1, 2021 you will need to indicate - 13.

In field 104 for payment of contributions we indicate BCC 182 102 02010 06 1000 160. We remember that for penalties, fines, contributions by individual entrepreneurs “for oneself” or contributions arising after January 1, 2022, the BCC will be different.

In field 106 we indicate the basis for the payment. There may be several of them:

- ZD - voluntary repayment of debt;

- TR - repayment of debt at the request of the Federal Tax Service;

- AP - repayment of debt according to the inspection report.

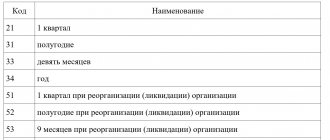

Field 107 is filled in depending on the basis of payment specified in field 106:

- if you indicated a salary, indicate the month for which we are transferring contributions in the format MC.NN.YYY;

- if you indicated TR, enter the date of the tax demand;

- if you specified AP, set it to 0.

Field 108 also depends on field 106:

- if you indicated the PO, set it to 0;

- if you indicated TR or AP, write the number of the requirement or act (we do not put the “No” sign).

Field 109 also depends on the basis of the payment:

- ZD - set 0;

- TR - set the date of the Federal Tax Service requirement;

- AP - we set the date for bringing to tax liability.

We write the purpose of the payment in the format “Insurance contributions for compulsory pension insurance for March 2016, expired before January 1, 2022.” If desired, you can indicate the registration number in the Pension Fund. But this is not necessary, according to the Rules, approved by Order of the Ministry of Finance of the Russian Federation dated November 12, 2013 No. 107n.

What BCCs for FFOMS contributions are established in 2022

Contributions to the FFOMS, as well as contributions to the Pension Fund, are paid by:

- IP - for yourself;

- Individual entrepreneurs and legal entities - for hired employees.

Contributions for individual entrepreneurs to the FFOMS are paid for themselves using KBK 18210202103081013160 (if related to the period from 2022) and KBK 18210202103081011160 (if related to the period until 2022).

For hired employees, individual entrepreneurs and legal entities must pay contributions to the Federal Compulsory Medical Insurance Fund using KBK 18210202101081013160 (for payments accrued from 2022) and KBK 18210202101081011160 (for accruals made before 2022).

You will find a sample payment order for compulsory medical insurance contributions for employees in ConsultantPlus. You can get a trial full access to K+ for free.

Payments by KBK 182 10200 160

Employers pay pension insurance contributions monthly. The deadline is the 15th day of the month following the month in which the employee’s income was accrued. For example, for August 2022, contributions to the Pension Fund must be paid before September 15, 2022. And if the 15th falls on a weekend or holiday, then the payment can be postponed to the next business day. The standard contribution rate is 22%.

KBK 182 10200 160 is used to pay pension contributions, the payment obligation for which expired before January 1, 2022. More recent insurance premiums to the Pension Fund must be paid according to KBK 182 1 0210 160.

In 2022, BCC 182 10200 160 is practically not used, since arrears in contributions to the Pension Fund that expired before 2022 are now very rare.

The KBK will probably be useful to those employers who had a small arrears before 2022, the tax authorities did not notify them about it, and the accounting department discovered the debt by accident.

What BCCs for insurance premiums are established for the Social Insurance Fund in 2022

Payments to the Social Insurance Fund are classified into 2 types:

- paid towards insurance for sick leave and maternity leave;

- paid towards insurance for accidents and occupational diseases.

Individual entrepreneurs working without hired employees do not list anything in the Social Insurance Fund.

Individual entrepreneurs and legal entities working with hired personnel make payments for them:

- for sick leave and maternity insurance - using KBK 18210202090071010160 (if we are talking about accruals made since 2017) and KBK 18210202090071000160 (if accruals were made before 2017) - contributions are administered by the Federal Tax Service;

- for insurance against accidents and occupational diseases - in the amount determined taking into account the class of professional risk by type of economic activity, using BCC 393 1 0200 160 - contributions are transferred directly to the Social Insurance Fund.

Individual entrepreneurs and legal entities concluding civil contract agreements with individuals pay only the second type of contributions, provided that this obligation is specified in the relevant agreements.

A sample payment order for contributions to OSS from VNiM for employees can be found in ConsultantPlus. You can get a trial full access to K+ for free.

Read more about the specifics of calculating insurance premiums when signing civil contracts in this article .

Results

Insurance premiums intended for extra-budgetary funds are required to be paid by both individual entrepreneurs and legal entities. BCC for insurance premiums in 2022 when making payments, you should use only current ones - this is an important factor in the timely recording of payment by its recipient.

Sources: Tax Code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

An example of filling out a payment order for KBK 182 102 02101 08 2011 160

Here is an example of a payment slip for payment of penalties on insurance premiums for periods expired before January 1, 2022.

It is convenient to fill out a payment order in the cloud service Kontur.Accounting. The program remembers your tax details and inserts them into payments automatically. And after creating a payment card, you can immediately upload it to the client bank for payment. We give all newbies a free trial period of 14 days.