Why is account 02 needed?

Fixed assets (PE) are assets that a company uses to produce products or provide services for more than a year.

Depreciation is regularly charged on fixed assets - their cost, as they wear out, is transferred in parts to the cost of goods, work, and services. Most fixed assets are very expensive, so a one-time write-off of the cost as an expense will result in the cost of production being greatly inflated. Account 02 according to the chart of accounts is called “Depreciation of fixed assets”. On it, accountants keep records of accrued depreciation, its increase and decrease, write-off, and through it they register the disposal of fixed assets.

Depreciation and wear should not be confused. Depreciation is accounted for in off-balance sheet account 010, and is accrued at the end of the year for housing stock, housing and communal services, or fixed assets of non-profit organizations.

Explanations for account 02 are given in the chart of accounts approved by Order of the Ministry of Finance dated October 31, 2000 No. 94n.

Useful life

The second element that we will analyze is SPI. FSBU 6/2020 offers 2 methods for determining it.

The first is familiar - the period during which the OS object (hereinafter we will simply say “object”) will bring economic benefits.

But FSBU 6/2020, like IFRS, requires that this indicator provide as much information as possible to the user.

So, if there are:

- special operating conditions (aggressive environment, operating mode different from the average);

- seasonality of use;

- planned downtime for any reason;

- other similar factors,

then they must be taken into account when determining the term of the SPI. To the point of completely abandoning the definition of SPI by time and applying the second method - by the benefits that the object can bring. For example, the total number of products that can be produced on it.

Note that this approach is not an innovation. The definition of SPI as the volume of products (works) that can be obtained using an object for “separate groups of fixed assets” is prescribed in PBU 6/01. However, without decoding and indicating that such a choice is mandatory.

But FSBU 6/2020 requires a number of assessments to be carried out when determining SPI (clause 9).

- The expected period of actual operation must be assessed taking into account the influence of special factors predicted for the period of operation. And also taking into account regulatory restrictions, contractual restrictions on use, management's plans for the future;

- Expected physical wear and tear also needs to be assessed taking into account similar factors. In addition to the aggressive external environment, you should pay attention to plans and technical support. requirements for repairs, mandatory inspections, maintenance with a stop, etc.;

- The SPI should take into account the possibility of asset obsolescence. For example, the products produced at the facility may become obsolete or the production technology may change to a more efficient and cheaper one;

- Another circumstance follows from the previous paragraph that must be taken into account - these are plans for technical re-equipment, as a result of which a specific object must be modernized or replaced within a certain period of time.

That is, when establishing the SPI, the accountant needs to collect, analyze and make a value judgment on a set of facts in order to decide which depreciation option with this SPI will be more indicative for the user of the statements.

In addition, it is then necessary to periodically monitor the factors on the basis of which the SPI was established. And if something has noticeably changed, the SPI needs to be revised. According to the meaning of FAS 6/2020, such a review must be carried out at least once a year - on the date for which you are preparing reports.

How does depreciation work?

You need to start accruing depreciation from the first day of the month following the day when the fixed asset was accepted for accounting. We accepted the OS in August - we calculate depreciation from September.

Until the useful life expires, accruals cannot be stopped. Suspension of work or cessation of use of equipment is not a reason to stop accrual. Suspension is permitted only for conservation for a period of more than 3 months or for a restoration period of more than 12 months.

Accrual must be stopped from the first day of the month following the one in which the object was written off or its cost was fully paid off. That is, depreciation does not need to be charged on any fully depreciated fixed assets with zero residual value, even if your company continues to use them.

Depreciation for recording is calculated monthly in accordance with the method approved in the accounting policy for individual groups or fixed assets:

- linear;

- reducing balance;

- by the sum of the numbers of years of useful life;

- proportional to production volume.

For any method, the useful life is important - this is the period during which the depreciable object generates income. The organization determines the period when it accepts the asset for accounting. When repairing or improving equipment, the useful life is increased.

Linear method of accrual of fixed assets

The most popular and widespread method for calculating depreciation amounts, according to statistics, it is practiced by about three quarters of all Russian enterprises. It is the easiest to use in practice.

Even if for some types of fixed assets an entrepreneur has chosen non-linear accrual methods, he must use the linear method to write off depreciation balances from the following groups of fixed assets:

- buildings;

- structures;

- transfer devices;

- intangible assets (8-10 depreciation group).

The essence of the linear method is the removal of depreciation funds in equal parts over the entire period established for the useful operation of the object. The countdown begins with the initial cost of a specific fixed asset, reflected in the reporting documents: this is the amount that was spent on the acquisition of this asset. If it was revalued, then the restored value should be taken into account as the original value.

The feasibility of using the linear method is determined by the predominant factor of time, and not the actual or obsolescence of fixed assets.

The amount that is written off each accounting year for depreciation is calculated using the straight-line method as follows:

Lamort. = (Σprimary x Namort.) / 100%

Where:

- Lamort. – annual amount of depreciation charges;

- Σfirst – initial cost of the fixed asset;

- Namort. – standard value of depreciation charges.

The deduction rate is a percentage of the original (or restored) cost of the underlying fixed asset. It is defined this way:

Namort. = 1 / Tuseful x 100%

Where:

- Tuseful – the useful life of the object established by the depreciation group.

Example calculation

In 2012, the LLC purchased computer equipment that cost 15 thousand rubles. The service life established by the manufacturer (and belonging to the depreciation group) is 5 years. Every year the following amount must be written off as depreciation: 15,000 / 5 = 3,000 rubles.

Thus, computer equipment will have a residual value:

- in 2013: 15,000 – 3000 = 12,000 rubles;

- in 2014: 12,000 – 3,000 = 9,000 rubles;

- in 2015: 9000 – 3000 = 6000 rubles;

- in 2016: 6000 – 3000 = 3000 rubles;

- in 2022: 3000 – 3000 = 0, the fixed asset compensated for all the costs of its acquisition by the enterprise.

NOTE! Up to 0 rub. the residual value has decreased, not the price of computer equipment. It is quite possible that it continues to work and will remain operational for a long time, and it may well be sold at a realistic price.

Account 02 - active or passive

Account 02 is classified as passive. This means that the accrual and accumulation of depreciation is reflected on the loan. The reduction or write-off of accrued amounts is carried out by debiting account 02. The account is closed by posting Debit 02 - Credit 01.

Although the account is passive, it is not reflected in sections III-V of the balance sheet, but it participates in the formation of an asset - a line of fixed assets. Let us recall that fixed assets in the balance sheet are reflected at their residual value, that is, they are reduced by the credit balance of account 02.

Keep records of exports and imports in the Kontur.Accounting web service. Simple accounting, payroll and reporting in one service

Analytical accounting for account 02

Depreciation is tightly tied to fixed assets, so all analytics for account 02 are built around individual fixed assets inventory objects. They include both the asset itself and all the necessary fixtures and accessories for its functioning.

They keep analytical records in one of three standard documents, which are also used for OS analytics:

- OS object inventory card;

- inventory card for group accounting of OS objects;

- inventory book for accounting of OS objects.

They reflect information about the receipt, movement, disposal, modifications, improvements of fixed assets, and also make entries about depreciation accrued from the beginning of operation.

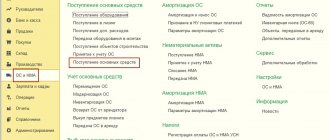

The procedure for calculating depreciation of fixed assets in accounting

Depreciation involves the gradual inclusion in expenses of the cost of fixed assets, which is a significant amount for any organization.

Fixed assets can participate in generating income for a long time and have a long service life. Depreciation of fixed assets must be calculated for all groups. But some of the property does not need to be depreciated:

- if the initial cost is within the limits of the maximum value not exceeding 40,000 rubles. (clause 5 of PBU 6/01) (if these objects are accepted for accounting as inventories);

- if the object is on the list of property for which depreciation is not accrued (clause 17 of PBU 6/01).

Read about non-depreciable fixed assets in the material “Rules for calculating depreciation of non-current assets”.

PBU 6/01 is the main document that establishes the rules for calculating depreciation of fixed assets in accounting. When accepting for accounting for each individual object, the organization determines the depreciation procedure based on PBU 6/01 and fixes the parameters: the method of calculating depreciation of fixed assets , and their useful life.

Read about the basic rules for calculating depreciation of fixed assets in the already familiar material “Rules for calculating depreciation of non-current assets.”

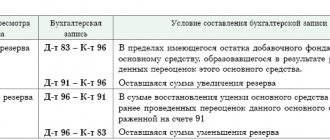

Correspondence of account 02 with other accounting accounts

| Account 02 by debit | Account 02 on loan |

| 01 Fixed assets 02 Depreciation 03 Profitable investments in material assets 79 On-farm calculations 83 Additional capital | 02 Depreciation 08 Investments in non-current assets 20 Main production 23 Auxiliary production 25 General production expenses 26 General business expenses 29 Servicing production and facilities 44 Selling expenses 79 On-farm settlements 83 Additional capital 91 Other income and expenses 97 Deferred expenses |

Depreciation calculation

Depreciation is the gradual transfer of the cost of a fixed asset to the cost of products (works, services).

When to start depreciation

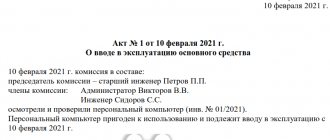

You must charge depreciation for each fixed asset item monthly, starting from the month following the month in which you included the item in fixed assets (after that, post):

DEBIT 01 CREDIT 08

– the fixed asset item is accepted for accounting.

EXAMPLE An organization purchased technological equipment and on March 15 accounted for it as part of fixed assets.

You must charge depreciation on this equipment starting in April. Depreciation accrual stops from the first day of the month following the month when the fixed asset item is completely depreciated or written off from the balance sheet of your company (sold, liquidated, etc.).

EXAMPLE An organization sold technological equipment on September 15. Despite this, depreciation on this equipment must be fully charged for September.

You must charge depreciation for each fixed asset item only within the limits of its value recorded in account 01 “Fixed Assets”.

If the equipment is fully depreciated, but your company continues to use it, the residual value of such equipment is zero. There is no need to charge depreciation on such equipment. However, if it is completed (additional equipment, reconstruction, modernization, technical re-equipment, partial liquidation), then in tax accounting the initial cost of the equipment should increase. This cost must be depreciated according to the same standards that were previously determined for this equipment when it was put into operation (letter of the Ministry of Finance of Russia dated November 18, 2013 No. 03-03-06/4/49459).

You must record depreciation in accounting as a credit to account 02 and a debit to the corresponding expense account:

DEBIT 08 (20, 23, 25, 26, 29, 44, 91-2) CREDIT 02

– depreciation of fixed assets has been calculated.

Depreciation is suspended:

- during the restoration period of the facility, the duration of which is more than 12 months;

- if the object, by decision of the manager, is transferred to conservation for a period of more than three months.

When depreciation is not charged

Depreciation is not charged for the following fixed assets:

- for housing facilities (if they are not used to generate income);

- on fixed assets that are used to implement Russian legislation on mobilization and mobilization preparation;

- about fixed assets of non-profit organizations;

- for other fixed assets, the consumer properties of which do not change over time (for example, land plots, environmental management facilities, museum objects and collections).

note

Even if the property is temporarily not used in the activities of your company and does not generate income, it still needs to be depreciated. This was indicated by the Russian Ministry of Finance in its letter dated February 28, 2013 No. 03-03-10/5834. The Federal Tax Service of Russia, in turn, sent this clarification to all its departments for implementation. The controllers reported this in their letter dated May 22, 2013 No. ED-4-3/ [email protected]

Depreciation not taken into account for tax purposes

Depreciation accrued on fixed assets is not taken into account when taxing profits:

- purchased using budget funds for targeted financing (with the exception of property received during privatization);

- budgetary organizations (except for property acquired and used for business activities);

- non-profit organizations (if these fixed assets were acquired from earmarked funds and are used to carry out non-profit activities).

Fixed assets with a cost of no more than 40,000 rubles per unit are written off as expenses in accounting as they are put into operation (without depreciation). Please note that since 2016, in tax accounting, the limit on the value of depreciable property has been increased from 40,000 to 100,000 rubles. The innovation applies to fixed assets put into operation from January 1, 2016 (Federal Law of June 8, 2015 No. 150-FZ).

In tax accounting, books, brochures and other publications (regardless of their cost) can be written off as expenses in full at the time of purchase. In accounting, books, brochures, etc. are included in expenses if their cost does not exceed 40,000 rubles or their service life does not exceed a year.

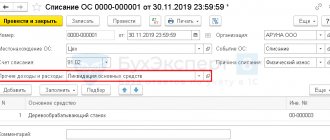

Standard operations on account 02

Any company has fixed assets - its own or leased. Therefore, almost everyone uses 02 account. There are typical accounting entries that occur most often.

| Wiring | The essence of the operation |

| Dt 02-1 Kt 02-2 | The amounts of depreciation of leased fixed assets that became property are reflected |

| Dt 02 Kt 01 | Depreciation accrued during use is written off |

| Dt 02 Kt 83 | Reduced depreciation as a result of markdown |

| Dt 02 Kt 79 | Reduced depreciation on fixed assets transferred to OP on a separate balance sheet |

| Dt 20 (25, 23, 26, 44, 91) Kt 02 | Accrued depreciation on fixed assets |

| Dt 79 Kt 02 | Depreciation was accrued for fixed assets of a separate division |

| Dt 83 Kt 02 | Increased depreciation as a result of revaluation of fixed assets |

| Dt 91 Kt 02 | Depreciation accrued by the lessor organization on leased fixed assets |

Use the cloud service Kontur.Accounting to automate the calculation and calculation of depreciation. Keep records, submit reports, pay salaries and calculate sick leave - 14 days free for all new users.

Average depreciation rate

Calculating the average annual rate is an important point in planning the amount of depreciation, since this indicator affects the final financial result. The initial parameters required for calculating the average rate of depreciation are:

- Cost of fixed assets at the beginning of the period;

- Annual and future payments for the commissioning of the PF;

- Information about the planned disposal of property.

The average annual depreciation rate for the reporting period is determined by the formula:

- Na=∑Ao /OFsr, where Na is the depreciation rate in%;

- ∑Ао – the amount of fixed assets depreciation calculated in the reporting period, in rubles;

- OFSR – average annual cost of fixed assets in rubles.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.