What will change in 2022

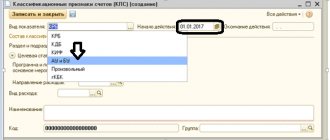

In 2022, the budget classification of types of expenses for 2022 according to 209n essentially does not change. Order of the Ministry of Finance No. 133n dated September 24, 2021 makes adjustments to the procedure for applying KOSGU.

As soon as Order No. 133n is registered with the Ministry of Justice, accountants will have to carry out a number of operations in a new way. For example, subarticle KOSGU 273 “Extraordinary expenses on operations with assets” should reflect the outflow of funds in the event of a shortage, theft, or revocation of a bank’s license. The operation must be carried out on the day the claim for damages is recognized or on the day the money is received to repay the debt.

From 01/01/2022 according to KOSGU 250, state employees separate operations of a current and capital nature. Operations of a current nature are accounted for under subarticles 251, 252, 253. Operations of a capital nature are accounted for according to new codes:

- 254 - transfer of funds to other budgets;

- 255 - transfer of funds to supranational organizations, foreign governments;

- 256 - transfer of funds to international states.

Read more: the rules for applying KOSGU will change from 2022

Regulatory acts governing KOSGU

The table describes legal acts:

| Name of the legislative act | Number | Description |

| Budget Code | Articles 18 – 23.1 | These articles regulate the use of classifiers in government organizations |

| Order of the Ministry of Finance dated 07/01/2013 | 65 | This legislative act clarifies the use of classifiers by government agencies |

What's changed in 2022

Back in 2022, the Ministry of Finance of the Russian Federation introduced new expenditure items of the budget classification for 2022 - 246 “Purchase of goods, works, services for the purpose of creation, development, operation and decommissioning of state information systems” and 247 “Purchase of energy resources” (clause 48.2 .4.6 Order No. 85n).

The 2022 Regulations have been supplemented with links:

- KVR 122 and subarticle 296 regarding compensation to officials for damage caused to their property in connection with their official activities;

- CVR 730 and subarticle 730 regarding budget loans attracted from the Russian Federation in foreign currency as part of the use of targeted foreign loans.

IMPORTANT!

KVR 247 is used exclusively in conjunction with KOSGU 223 “Utilities”. And in 2022, combined contracts for the supply of heat and hot water are also being carried out using code 247 (letter of the Ministry of Finance No. 02-05-11/77361 dated 09.22.2021). Previously, they were carried out using expense code 244.

Some connections between KVR and KOSGU have been completely eliminated as of 01/01/2021. For example, KVR 123 and subarticle 212 of KOSGU, KVR 313 and subarticles 265-266, expense type code 323 and subarticles of KOSGU 220, 261 and 300 are no longer used in budget accounting.

In addition, in 2022, new sub-articles of KOSGU were introduced and updated groupings were formed by categories of persons and sub-articles to increase or decrease borrowing debt, the value of financial assets, receivables and payables (Order of the Ministry of Finance No. 222n dated September 29, 2020):

- 136 - to account for income from the return of accounts receivable from previous years, it is used to receive funds when budgetary and autonomous institutions return subsidies for unfulfilled municipal assignments;

- 139 - to account for income from reimbursement by the Social Insurance Fund of insurers’ expenses for preventive measures to reduce occupational diseases and injuries; it also takes into account the costs of sanatorium and resort treatment;

- subarticles of Article 190 are no longer used to account for cash receipts and disposals.

Changes in group 100 “Income”

In group 100 “Revenue”, the names of KOSGU articles 130 and 140, the description of KOSGU articles 120-140, 170 and 180 have been changed, detailing of previously undetailed KOSGU articles 120-140 has been introduced, sub-articles have been added to the previously detailed KOSGU article 170.

From January 1, 2022, the details of the previously listed articles are as follows:

Article 120 “Income from property” is detailed in the article subart. 121 “Income from operating leases”, 122 “Income from financial leases”, 123 “Payments for the use of natural resources”, 124 “Interest on deposits, cash balances”, 125 “Interest on borrowings provided”, 126 “Interest on other financial instruments”, 127 “Dividends from investment objects”, 128 “Income from the grant of non-exclusive rights to the results of intellectual activity and means of individualization”, 129 “Other income from property”.

Article 130 “Income from the provision of paid services (works), compensation of costs” details subsection 131 “Income from the provision of paid services, 133 “Payment for the provision of information from government sources (registers)”, 134 “Income from compensation of costs”, 135 “ Income from conditional rental payments”, 136 “Budget income from the return of receivables from previous years”.

Article 140 “Fines, penalties, penalties, damages” is detailed in Articles 141 “Income from penalties for violation of procurement legislation and violation of the terms of contracts (agreements)”, 142 “Income from penalties on debt obligations”,

143 “Insurance compensation”, 144 “Compensation for damage to property (except for insurance compensation)”, 145 “Other income from forced seizure amounts”.

Article 170 “Income from transactions with assets” has been supplemented with subart. 175 “Exchange differences based on the results of recalculation of accounting (financial) statements of foreign institutions” and 176 “Income from the valuation of assets and liabilities.”

Article 180 “Other income” is detailed in subart. 181 “Unidentified income”, 182 “Income from gratuitous right of use”, 183 “Income from subsidies for other purposes”, 184 “Income from subsidies for capital investments”, 189 “Other income”.

What changed in 2022

In 2022, the following links were added to the codifiers:

| Expense type code | Classifier of SGU operations | A comment |

| 122 | 221 | Linking is allowed, for example, to pay compensation for the cost of cellular communications to subordinates |

| 243 | 229 and 299 | Conditions regarding the recognition of costs for major repairs and capital investments |

| 454 and 455 | 530 | Apply CVR 454 in conjunction with Article 530 “Increase in the value of shares and other financial instruments” (clause 13.3 of Procedure No. 209n, clause 48.4.4.4 of Procedure No. 85n) |

| 613, 623, 634, 814 | 297 | The new condition applies to the payment of cash bonuses based on the results of competitions. |

In addition, officials clarified that when reflecting the payroll expenses of convicts employed in institutions of the Federal Penitentiary Service of the Russian Federation, it is permissible to use the linkage of KVR 111 with subarticle 211. When paying benefits for the first three days of sick leave in favor of the specified group of workers, the linkage of KVR 111 and subarticle 266 is used.

Typical errors in using KOSGU

Mistake No. 1. Distortion of statistical data

An incorrect code from the classifier will ultimately lead to errors in recording transactions in the organization’s accounting records, as well as to distortion of statistical data when preparing reports. The existing classification system is quite simple and transparent, so if the payer has any questions regarding the definition of the code, it can always be clarified directly in the structural department of the institution to which the funds should be transferred.

Mistake No. 2. Formation of a procurement plan

Drawing up a procurement plan is probably the most difficult and painstaking work for any government agency. This is due to strict control by the inspection authorities of this particular aspect of the activities of institutions. Any error in the generated plan (incorrect transaction code) can lead to it not being agreed upon, and this can lead to many problems, the main one of which is the failure to receive budget funds on time to pay off existing obligations.

Mistake No. 3. Payment using online systems

Nowadays, the need to leave the office or home to pay off your obligations is actively decreasing; to do this, you just need to use the online portal of the public service and make payments through the bank’s online application. But we must never forget that even in this case, it is always necessary to check the correctness of all details and codes from the classifier to prevent possible errors, as well as delays in the transfer of funds and payment identification.

Unified work regulations

Recipients of budgetary funds, such as chief managers of budgetary funds (GRBS), government, budgetary and autonomous institutions, are required to keep records, draw up plans and reports according to uniform standards and in accordance with legal requirements. A list of requirements and rules for the use of special codes that determine the corresponding values of the budget (accounting) account are established by the Ministry of Finance for all participants in the process.

The work algorithm regarding the formation of budget classification codes is established in Order of the Ministry of Finance No. 85n dated 06/06/2019: the types of expenses of KOSGU were updated after the entry into force of Order of the Ministry of Finance No. 75n dated 06/08/2021. The regulation has updated the procedure for applying CWR for budgetary institutions - public sector accountants are required to work in a new way.

In addition, legislators adjusted the rules for the formation of KOSGU. A new Order of the Ministry of Finance No. 209n dated November 29, 2017 (as amended on September 29, 2020) was approved. It is unacceptable to work using old algorithms.

A public sector accountant should pay special attention to the updated regulations - types of expenses, KOSGU according to Order No. 65n are irrelevant. It is necessary to work according to Orders No. 85n and No. 209n. The use of outdated codes in accounting is not allowed, otherwise the manager will be held accountable.

KOSGU in the payment order

When transferring amounts for tax obligations and insurance contributions, the tax payer is required to indicate in the payment order the correct KOSGU code, which is tied to each individual type of tax and the specific budget organization that is the recipient of this amount as income. This is as important as other data that must be included in the payment order. These codes are used for record keeping, which means that the code itself will not affect the time and process of transfer, but will take time in the budget organization itself to correctly identify the payment.

The concept of KOSGU

According to budget standards, the decoding of KOSGU is a classification of operations of the general government sector. The three-digit code is part of the account classification, which allows you to group public sector costs depending on the economic content of the business transaction. The codifier includes a group, article and subarticle.

Since 2016, KOSGU codes are not used by recipients of funds when creating income and expense plans, but are used in accounting and reporting. In 2022, it is necessary to apply them to public sector institutions and organizations when drawing up a working chart of accounts, maintaining records and reporting. Order No. 209n states what KOSGU is in accounting - codes for operational accounting in a budgetary institution. The procedure for approving the chart of accounts for budget accounting is enshrined in Order of the Ministry of Finance No. 162n (as amended on December 28, 2018).

The public administration sector operations codifier represents the following groupings:

| Code group | KOSGU directory for 2022 |

| 100 | Income |

| 110 - tax revenues | |

| 111 - taxes | |

| 112 — state duties | |

| 130 — income from the provision of paid services | |

| 180 - other | |

| 200 | Expenses |

| 211 - salary | |

| 213 - payroll accruals | |

| 221 - communication services | |

| 222 - transport services | |

| 223 - utilities | |

| 224 – rent for the use of property | |

| 225 - works and services for property maintenance | |

| 226 - other works and services | |

| 228: decoding of KOSGU 228 in 2022 for budgetary institutions - services for capital investment purposes | |

| 290 — other expenses | |

| 300 | Receipt of non-financial assets (NA) |

| 310: decoding of KOSGU 310 in 2022 for budgetary institutions - increase in the cost of fixed assets | |

| 320 — increase in the value of intangible assets | |

| 330 - increase in the value of non-produced assets | |

| 340 - increase in the cost of inventories | |

| 341: decoding of KOSGU 341 in 2022 for budgetary institutions - increase in the cost of medicines | |

| 400 | Retirement |

| 410 - decrease in the value of fixed assets | |

| 411 - depreciation of fixed assets | |

| 420 - decrease in the value of intangible assets | |

| 430 - decrease in the value of non-produced assets | |

| 440 - decrease in the cost of inventories | |

| 500 | Receipt of financial assets (FA) |

| 510 - receipt of cash and cash equivalents | |

| 520 — increase in the value of securities | |

| 530 - increase in share price | |

| 600 | Retirement of FA |

| 610 - cash outflow | |

| 620 — decrease in the value of securities | |

| 630 - decrease in share price | |

| 700 | Increase in liabilities |

| 710 — increase in debt on domestic borrowings | |

| 720 — increase in debt on external borrowings | |

| 730 — increase in other accounts payable | |

| 800 | Reducing liabilities |

| 810 — reduction of debt on domestic borrowings | |

| 820 — reduction of debt on external borrowings | |

| 830 - reduction of other accounts payable |

Previously, KOSGU was used in the structure of the budget classification code (BCC), but since 2015, in terms of costs, the code has been replaced by a code for types of expenses. It is important to clearly understand the difference between CVR and KOSGU - these are different codes: types of expenses and operations of the public administration sector. But both encodings are necessary to form the BCC.

The budget classification code is 20 characters long and determines the content of the transaction. For specialists, this means that state (municipal) expenses and income are classified according to various criteria: planned and unplanned, current and capital, according to the level of ownership of the corresponding budget, etc. The Codifier of Operations of the Public Administration Sector (KOSGU) is used for additional detailing of budget accounting operations .

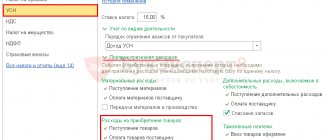

Separate rules for the application of the new provisions

From 2022, transactions of taxpayers - state (municipal) autonomous and budgetary institutions for value added tax and corporate income tax are reflected in the corresponding subsection. KOSGU 131 “Income from the provision of paid services (work)” or 189 “Other income” in accordance with the decision of the institution adopted within the framework of its accounting policy. Previously, they were taken into account in KOSGU articles 130 “Income from the provision of paid services (work)” or 180 “Other income”, respectively.

In subst. 271 “expenses for depreciation of fixed assets and intangible assets” description “transfer into operation of fixed assets worth up to 3,000 rubles. inclusive, with the exception of real estate and library collections” was replaced by “transfer for operation of fixed assets worth up to 10,000 rubles. inclusive, with the exception of real estate and library funds”, the rest is unchanged

The condition previously stated in paragraph is also excluded. 2 clause 2 of Section V of the Instructions that expenses when concluding an agreement, the subject of which is the modernization of a unified functioning system that is not an inventory facility (for example, a security and fire alarm system, etc.) are reflected under subart. 226 “Other works, services”, taking into account the cost of equipment and consumables purchased by the contractor to modernize the system. This eliminates the contradiction between subart. 226 and para. 8 substations 225 “Works, services for property maintenance.”

Reimbursement of expenses for the use of bedding in transport, various types of fees when issuing travel documents (commission fees, etc.) when sending athletes, coaches, students to various types of events, which were previously reflected under article 290 “Other expenses” from January 1 2022 are reflected according to subart. 296 “Other expenses” of KOSGU.

The list of items that an institution has the right to independently further detail when developing its accounting policies has been reduced. In 2022, the institution does not have the right to detail KOSGU articles 120, 130, 140, 180 and 290.

Note that in 24-26 digits of account numbers:

- settlements 210.02.000 and 210.04.000, liabilities 304.04.000, financial results 401.10.000 and 401.40.000, authorization transactions 504.00.000 and 507.00.000, 508.00.000 includes “income” items KOSGU 120-140 at 1-17 in the categories of these accounts, an analytical code based on the classification of receipts (KDB);

- group expenses 109.00.000, settlements 206.91.290 and 208.91.290, liabilities 302.91.290, 304.04.290 and 304.05.290, financial results 401.20.290, authorizations 502.01.290 and 502.02.290 “expenses” are included article KOSGU 290.

In order to bring accounting data into compliance with the new provisions, in cases where the institution during the current year kept records according to its own additional classification or the accounting contains transactions according to the above-mentioned KOSGU, the accounting data should be updated in accordance with the requirements of the Instructions that have entered into force.

When drawing up and executing budgets, it is not necessary to use detailed codes in Budget Estimates and FHD Plans for 2022, unless such a requirement is expressly provided for by a higher organization (Letter of the Ministry of Finance of the Russian Federation dated 02/27/2018 N 02-05-11/12228).

Currently, the provisions of Instructions 157n, 162n, 174n and 183n do not comply with the Standards and Guidelines. Until the discrepancies are resolved, we will not be able to fully comply with the changes that came into force on January 1, 2022.

For example, letter of the Ministry of Finance of the Russian Federation dated December 13, 2017 No. 02-07-07/83463 “Guidelines for the transitional provisions of the GHS “Rent” for the first application” provides for keeping records on balance sheet accounts 111.40.000 “Right to use property” and 104.40.450 “ Depreciation of the right to use property,” which are not provided for in the previously listed Instructions.

Transcript of KVR

According to Order No. 85n, KVR is a code for the type of expenses, but in essence it is part of the KBK classification, and therefore part of the accounting account. It includes group, subgroup and expense element element.

The structure of the CWR is three numbers from 18 to 20 categories in the structure of the BCC of budget expenditures. KVR is represented by the following groups:

- costs of payments to personnel in order to ensure the performance of functions by state (municipal) bodies, government institutions, management bodies of state extra-budgetary funds;

- procurement of goods, works and services to meet state (municipal) needs;

- social security and other payments to the population;

- capital investments in state (municipal) property;

- interbudgetary transfers;

- provision of subsidies to budgetary, autonomous institutions and other non-profit organizations;

- servicing state (municipal) debt;

- other appropriations.

Expense type codes are used to determine the structure of the BCC of expense transactions. If you are creating a code for income receipts, then use AGPD in the budget - this is the code for the analytical group of the income subtype. The ciphers are a large grouping of OSGU codes. For example, when reflecting a subsidy for the implementation of a municipal task, AGPD is 130, and KOSGU is 131.

The procedure for determining KVR and KOSGU

Detailing each expenditure transaction of an economic entity in the budgetary sphere is the basis for budget planning and execution. Effective and transparent planning, ensuring the intended use of allocated funds and the reliability of financial statements depend on the correctness of the chosen code for the type of expense and the classification of operations of the public administration sector.

To accurately link CVR and KOSGU, the Ministry of Finance recommends using a table of correspondence between codes of types of expenses and classification of the public administration sector.

Example. Expense operation - car repair. KOSGU - st. 225 “Works, services for property maintenance.” But the CVR depends on the type of repair. For routine repairs, select KVR 244 “Other procurement of goods, works and services to meet state (municipal) needs.” And for major repairs - decoding KVR 243 in 2022 for budgetary institutions “Purchase of goods, works, services for the purpose of major repairs of state (municipal) property.” If an institution spends funds on services or work for capital investment purposes, then use KOSGU 228 in accounting, in accordance with the provisions of Order No. 209n.

Special cases when using KOSGU and KVR

Legislators introduced the code OSGU 266, which should include social benefits and compensation provided to the personnel of a state (municipal) institution in cash. What is included in social benefits? At KOSGU 266, include temporary disability benefits for the first three days of illness, that is, benefits paid at the expense of the employer. The code includes a monthly allowance for child care up to three years old (in the amount of 50 rubles). All categories of payments and compensation are enshrined in Art. 10.6.6 Ch. 2 Order No. 209n.

Officials from the Ministry of Finance communicated to users a separate letter No. 02-05-10/45153 dated June 29, 2018, which reflects methodological recommendations on the use of such KOSGU.

In the practice of procurement for several CWR, issues arise with the correct reflection of codes, which is determined by the use of classification. For this case, the budget classification of CWR provides for a special procedure. In 34-36 digits, 0 is set if these expenses are subject to reflection across several CVRs.

Order No. 209n: changes in the application of KOSGU.

From January 1, 2022, a new document is in force, establishing the procedure for applying the classification of operations of the general government sector (KOSGU), Procedure No. 209n. Even before entering into force, this document was adjusted by Order of the Ministry of Finance of the Russian Federation dated November 30, 2018 No. 246n. What innovations in the application of KOSGU need to be taken into account from 2022 according to the updated Order No. 209n, we will consider in the article.

The classification of operations of the public administration sector is used (including by state (municipal) institutions) for maintaining budgetary (accounting) records, drawing up budgetary (accounting) and other financial statements that ensure comparability of budget indicators of the budgetary system of the Russian Federation. In addition, KOSGU codes are used when detailing (additional detailing) budget indicators, budget estimates of government institutions, justifications for budget allocations (clause 2 of Order No. 209n).

Let us recall that in 2022, the procedure for applying KOSGU was established by Instructions No. 65n (Section V). Even then, the first significant innovations were made to further detail the income and expense items of KOSGU. From 2022, the detailing is expanded to other items, in particular items on the increase (decrease) of inventories (340, 440), accounts receivable (560, 660) and accounts payable (730, 830). In addition, according to Order No. 209n, transactions on payments and receipts should now be differentiated:

– for current and capital; – social and non-social; – cash and in kind.

Below we present the main innovations in the use of KOSGU, which must be taken into account from 2022.

table of correspondence

Since the expense type code is a larger grouping than the codifier of government sector operations, to simplify the application of the corresponding codes, the Ministry of Finance has approved a correspondence table.

| Type of expenses | KOSGU | Notes | ||

| Code | Name | Code | Name | |

| 100 Expenses for payments to personnel in order to ensure the performance of functions by state (municipal) bodies, government institutions, management bodies of state extra-budgetary funds | ||||

| 110 Expenses for payments to personnel of government institutions | ||||

| 111 | Institutions' wage fund | 211 | Wage | Including in terms of expenses for remuneration of convicts employed in institutions of the penal system of the Russian Federation |

| 266 | Social benefits and compensation to staff in cash | Including the payment of benefits for the first three days of temporary disability of convicts employed in institutions of the penal system of the Russian Federation | ||

| 112 | Other payments to the personnel of institutions, with the exception of the wage fund | 212 | Other non-social payments to staff in cash | |

| 214 | Other non-social payments to staff in kind | |||

| 220 | Payment for work and services | In terms of compensation to employees (employees) for expenses in connection with the performance of official (official) duties, subarticles of KOSGU are used that correspond to the economic content of the expenses incurred by the employee (employee) | ||

| 266 | Social benefits and compensation to staff in cash | |||

| 267 | Social benefits and compensation to staff in cash | |||

| For purchases, codes from group 240 are used | ||||

| 241 | Research, development and technological work | 226 | Other works, services | |

| 320 | Increase in the value of intangible assets | |||

| 242 | Procurement of goods, works, services in the field of information and communication technologies | 221 | Communication services | |

| 224 | Rent for the use of property (except for land plots and other isolated natural objects) | |||

| 225 | Works and services for property maintenance | |||

| 226 | Other works, services | |||

| 228 | Services, work for capital investment purposes | |||

| 310 | Increase in the value of fixed assets | |||

| 320 | Increase in the value of intangible assets | |||

| 346 | Increase in the cost of other working inventories (materials) | |||

| 347 | Increasing the value of inventories for capital investment purposes | |||

| 349 | Increase in the cost of other disposable inventories | Regarding strict reporting forms | ||

| 243 | Purchase of goods, works, services for the purpose of major repairs of state (municipal) property | 222 | Transport services | |

| 224 | Rent | |||

| 225 | Property maintenance work | |||

| 226 | Other works, services | |||

| 228 | Services for capital investment purposes | |||

| 229 | Rent for the use of land plots and other isolated natural objects | |||

| 296 | Other current payments to individuals | Reimbursement (compensations) provided for by the consolidated estimate of the cost of major repairs | ||

| 297 | Other current payments to organizations | Regarding the fee for compensatory landscaping in case of destruction of green spaces | ||

| 299 | Other capital payments to organizations | |||

| 310 | Increase in the value of fixed assets | |||

| 344 | Increased cost of building materials | |||

| 346 | Increase in the cost of other working inventories (materials) | |||

| 347 | Increasing the value of inventories for capital investment purposes | |||

| 244 | Other procurement of goods, works and services | 214 | Other non-social payments to staff in kind | In terms of recording transactions for the purchase of milk or other equivalent food products for free distribution to employees engaged in work with hazardous working conditions |

| 220 | Payment for work and services | Including costs for the delivery (shipment) of pensions, benefits and other social payments to the population | ||

| 267 | Social compensation to staff in kind | |||

| 310 | Increase in the value of fixed assets | |||

| 320 | Increase in the value of intangible assets | |||

| 340 | Increase in the cost of inventories | |||

| 530 | Increase in the value of shares and other financial instruments | |||

| 245 | Purchase of goods, works and services to meet state (municipal) needs in the field of geodesy and cartography outside the framework of the state defense order | 220 | Payment for work and services | |

| 310 | Increase in the value of fixed assets | |||

| 320 | Increase in the value of intangible assets | |||

| 346 | Increase in the cost of other working inventories (materials) | |||

| 246 | Purchase of goods, works, services for the purpose of creation, development, operation and decommissioning of state information systems | 221 | Communication services | |

| 224 | Rent for the use of property (except for land plots and other isolated natural objects) | |||

| 225 | Works and services for property maintenance | |||

| 226 | Other works, services | |||

| 228 | Services, work for capital investment purposes | |||

| 310 | Increase in the value of fixed assets | |||

| 320 | Increase in the value of intangible assets | |||

| 340 | Increase in the cost of inventories | |||

| 247 | Procurement of energy resources | 223 | Public utilities | In terms of payment at tariffs for the supply of electricity, gas supply, heat supply and payment for the transportation of gas, electricity through gas distribution and electrical networks (with the exception of similar expenses of foreign apparatus of government bodies (expenditure line 90039 “Expenses for ensuring the functions of foreign apparatus of government bodies”), when ensuring the activities of which expense type 247 does not apply) |

Payroll expenses

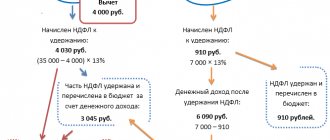

Expenses for the payment of wages, carried out on the basis of agreements (contracts), in accordance with the legislation of the Russian Federation on state (municipal) service, labor legislation are included in subarticle 211 “Wages” of KOSGU. Regarding the application of this sub-article in the Letter of the Ministry of Finance of the Russian Federation No. 02-08-10/102939:

- an interpretation of the concept of “wages” is given in terms of the application of Order No. 209n;

- it is indicated that wages can be paid in cash and (or) in kind;

- provides a list of payments that are included in the category “salaries in cash”;

- a list of payments is provided that does not apply to subarticle 211 “Wages” of KOSGU.

As an example of payments related to wages, the following payments are indicated in the letter:

1) basic salary:

- payments based on official salaries, wage rates, hourly wages, and military and special ranks;

- monthly monetary remuneration of the judge;

- additional payments to wages up to the minimum wage;

- payment of wages carried out on the basis of court decisions;

- payment of wages for work at night, holidays and weekends;

- overtime payments;

- payments for combining positions, expanding service areas, increasing the volume of work or performing the duties of a temporarily absent employee without release from work (Article 151 of the Labor Code of the Russian Federation); and so on.;

2) awards:

- incentive and stimulating payments, including remuneration based on the results of work for the year, bonuses;

- payment of a bonus in the form of a monthly cash incentive;

- one-time payment for the anniversaries of municipal employees;

- payment of financial assistance from the wage fund; and so on.;

3) special allowances (additions for length of service, payment of wages for work under harmful and (or) dangerous and other special working conditions, etc.);

4) vacation pay.

When assigning expenses to subarticle 211 “Wages” of KOSGU, it is important to remember that the following are not subject to reflection under this subarticle:

1) reimbursement by the employer to employees of expenses incurred so that they can take their jobs or perform their work, in particular:

- reimbursement of travel, relocation or related expenses incurred by employees when they take up new jobs, or required by employers to relocate to other parts of the country or to another country;

- reimbursement of expenses incurred by employees for tools, equipment, clothing or other items that are necessary to enable them to perform their work. In these cases, the amounts recovered are reflected as

acquisition of works and services;

2) payment of social benefits by the employer to employees in the form of:

- compensation payments to employees on parental leave;

- temporary disability benefits at the expense of the employer in the event of an employee’s illness or injury;

- severance pay and compensation to employees upon their dismissal, loss of ability to work, etc.

Expenses for non-social payments to personnel

Expenses in the form of non-social payments made to personnel are reflected in the following sub-items:

- 212 (if payments are made in cash);

- 214 (if payments are made in kind).

Regarding non-social payments in Letter of the Ministry of Finance of the Russian Federation No. 02-08-10/102939:

- an interpretation of the concept of “non-social payments to personnel” is given;

- an approximate list of payments that are non-social is provided;

- clarifies which payments are cash payments and which are payments made in kind.

As financiers have clarified, non-social payments to personnel represent amounts of money, as well as payments for goods, work, services, paid (provided) by employers in accordance with the legislation of the Russian Federation in favor of personnel and (or) their dependents, family members, not related to wages additional payments (with the exception of compensation for personnel expenses) due to the conditions of labor relations, the status of workers (employees)).

Non-social payments to employees include mandatory payments related to attracting and retaining workers in the workplace, aimed at stimulating employment in the relevant field, in particular, such as:

- compensation (payment) for renting housing, travel to and from work (with the exception of providing officials with travel documents for official purposes, compensation (payment) for expenses of employees who have a traveling nature of work);

- payment (compensation for payment expenses) for housing and utilities;

- compensation (provision) of food on a regular basis;

- payment (compensation for expenses) for the use of sports facilities, leisure facilities, recreation centers for employees and members of their families, kindergartens and nurseries for children of employees;

- payment for parking (except for payment for business purposes).

Regarding the inclusion of non-social payments in the composition of payments in kind , it is said that the designated payments include payment for goods, work, services provided to employees, as well as compensation (reimbursement) for their expenses for the purchase of goods, work and services. Payments in kind have a value equivalent, expressed in the cost of goods, works, services at the time of their provision to employees. According to the norms of clause 10.1.4 of Order No. 209n, compensation for the cost of travel and baggage transportation to the place of use of vacation and back for persons working in the Far North and equivalent areas, and members of their families, is classified as other payments in kind (reflected under subarticle 214 “Other non-social payments to personnel in kind” of KOSGU).

Regarding why this payment, although it is actually paid in cash, in Order No. 209n is classified as payments made in kind, financiers give the following explanation: this payment is classified as payments made in kind, since it is made for the purpose of provision (compensation of the cost) of services guaranteed by law to certain categories of workers in order to stimulate employment in certain areas.

You can see examples of other payments that, according to the Ministry of Finance, relate to other payments in kind in the letter.

As for the monetary form of payments, then, according to the financial department, payments should be included in them if it is impossible to classify the payment as in-kind. Payment in cash can be calculated from certain physical and monetary indicators: for example, payment for the repair of residential premises, calculated from the standard cost of repairing a square meter of housing and the area of living premises, provided to the employee at a certain frequency (say, once every ten years), but not conditioned by the presence of specific expenses of an individual, represents a monetary form of payments to the employee.

In Letter No. 02-08-10/102939 you can see the list of payments that, according to financiers, are monetary.

Responsibility for violation

It is worth separately identifying the level of responsibility that is provided for violation of budget legislation. The level of punishment for incorrectly reflecting CVR and KOSGU in the accounting records of institutions directly depends on their type.

For example, if a government agency makes a mistake and a business transaction is reflected according to an incorrect CVR, controllers have the right to recognize such a mistake as an inappropriate use of budget funds. For such violations, administrative liability is provided under Art. 15.14 Code of Administrative Offences.

Things are different with budgetary institutions. The agreement to provide a subsidy for the implementation of a state or municipal task does not indicate the CWR. Consequently, the public sector employee determines the encodings independently, and it is impossible to prosecute a government agency for misuse if the codifier for types of expenses is incorrectly chosen. But the incorrect code is reflected in the reporting, and this is already a violation of the rules of accounting (Article 15.11 of the Administrative Code) and reporting (Article 15.15.6 of the Administrative Code).

Application of the classification of operations in the work of government agencies

As mentioned above, this classifier is used in government agencies in several cases:

- In accounting and reporting for maintaining and controlling all internal activities of the institution, as well as for public finance statistics;

- When paying, in the process of filling out a payment order, the corresponding transaction code and payment purpose are indicated;

- In the procurement plan, when forming a procurement plan for each expense item, a specific code from the classifier is assigned.

It is necessary to clarify that the last two points have not been relevant for more than a year; the expense classifier is used for them. At the same time, all institutions received the necessary table of correspondence between old codes and new ones to simplify the transition.