Familiarization with the job description and order for the transfer of cases

The new chief accountant needs to clearly understand his job responsibilities in order to organize his work and understand what to pay attention to when accepting cases from a departing specialist.

To do this, the new chief accountant should read the job description. Unfortunately, many companies simply do not have such documents. And although this is a gross violation of personnel records, such cases are not uncommon. And it is during the transfer of affairs that management draws attention to the fact that job descriptions are an integral part of a properly organized business. Without them, personnel changes can be very painful for the enterprise. So we recommend that you pay special attention to the order in personnel documents and check whether all positions have job descriptions and whether all employees are familiar with them.

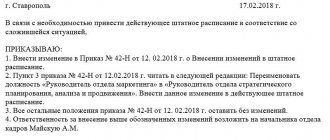

The transfer of cases is carried out on the basis of an order from the head of the organization. The document must indicate the last name, first name and patronymic of the person accepting the affairs (new chief accountant), the person transferring the affairs (former chief accountant), as well as the names of other employees involved in the transfer of affairs (manager, auditor, secretary).

The order should indicate: the reason for the acceptance and transfer of cases - for example, the dismissal of the chief accountant; the timing of the acceptance and transfer of cases and the period during which this procedure will be completed. If the chief accountant resigns of his own free will (clause 3 of Article 77 of the Labor Code of the Russian Federation), then the employer has two weeks to terminate the employment contract in accordance with Article 80 of the Labor Code. In this case, it is advisable to set a period of two weeks. In addition, the order must indicate the name of the employee responsible for the transfer of cases (last name, first name and patronymic of the outgoing chief accountant), and the name of the employee responsible for the reception (last name, first name and patronymic of the new specialist). Be sure to name each member included in the commission, as well as the chairperson of the referral committee. A commission is created if a large volume of documents is subject to transfer. It may include accounting employees, internal control services, security services and other employees. When creating a commission, responsibility for organizing and conducting the transfer of cases rests with the chairman of the commission. Among other things, do not forget that the order must indicate the deadline for drawing up the act of acceptance and transfer of cases.

Transfer of cases: in detail and tastefully

So, the manager approved the act and the dismissal of the chief accountant is imminent. Most likely, the day on which the delivery of cases is completed and the transfer certificate is approved will be the last working day of the resigning chief accountant. Finally, we will give step-by-step instructions for transferring the affairs of the chief accountant.

- A personal resignation letter was submitted and accepted by the manager. Or the employer’s initiative is brought to the attention of the chief accountant and agreed upon. The parties can inform about their decision one month before the date of dismissal of the chief accountant.

- An order for the transfer of affairs was created and signed, and a candidate for the position of a new chief accountant was selected.

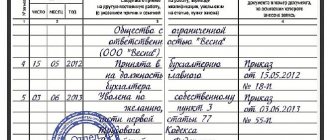

- The cases were transferred within the time period established by the order. The act was approved.

- The dismissal of the chief accountant was formalized in compliance with the requirements of the law.

- The new chief accountant begins to perform his duties.

If in the future you need the help of the dismissed chief accountant and there is mutual agreement, then obtain personal permission from the boss for this. Better in writing.

Checking the status of accounting and reporting

The new chief accountant must conduct an audit of the state of accounting and reporting. To do this, you need to check the availability of documents. These include: constituent and registration papers; accounting policy; primary accounting documents (agreements with suppliers, buyers and other counterparties, acts, invoices, etc.); accounting and tax registers; accounting certificates; financial and tax reporting; reporting to extra-budgetary funds; acts of reconciliation with the Federal Tax Service, acts of inspections; inventory records; cash documents, bank statements and payment orders; personnel papers, documents confirming wage arrears and personal income tax deductions; job responsibilities of accounting employees; a list of persons who have the right to sign on primary documents, and other papers related to the organization and maintenance of accounting and tax records.

The submitted documents must be filed. If there is no signature, a corresponding entry is made in the transfer and acceptance certificate and a list of documents is drawn up.

After this, you should familiarize yourself with the accounting policies for accounting and tax accounting for the two previous years and the current period, i.e., the time interval that can be covered by an on-site audit (clause 4 of Article 89 of the Tax Code of the Russian Federation).

note

The transfer of work is formalized by an act of acceptance and transfer of cases, which must indicate all the main points characterizing the state of the company on the date of dismissal of the previous specialist, and include as much information as possible collected and processed during the transfer of cases.

Then it is important to assess the compliance of accounting and tax reporting with the provisions of accounting policies and current legislation. For example, the creation of reserves, the sequence of application of accounting policies, the correctness of the formation of financial results, etc. The reporting is also checked for compliance of indicators with accounting data and the correctness of calculation of taxes and contributions, submission of declarations and calculations.

Next, you should conduct a random check of the primary documents for the correctness and timeliness of data reflected in the accounting accounts and in tax accounting.

Of course, it can be simply unrealistic for a new chief accountant to check all the primary papers due to their large number. In this case, you should confirm the availability of primary documents, the correctness of filling in the details and their reflection on the accounts. This needs to be done at least selectively. The criterion for such verification may be large amounts for which business transactions were carried out.

It is also advisable for the new chief accountant to familiarize himself with the audit reports, acts and decisions based on the results of the audits. This will allow you to get an idea of the typical mistakes of the former chief accountant, shortcomings in his work that were identified by the inspection bodies.

Read also “Errors in primary documents”

How does the chief accountant transfer matters upon dismissal?

If a new employee is hired while the employee is leaving, then the transfer of affairs to the chief accountant upon dismissal is relevant. To do this, you should carefully study the scope of work, since it may not always be described correctly and in detail in the vacancy.

Upon dismissal, the chief accountant can explain to the newcomer the specifics of the job. To delegate the main responsibilities, documents and tools for work, a transfer act is drawn up.

In addition to documents, the following items may be included in the act:

- transfer of keys and passwords for online banking;

- flash cards for logging into bank accounts;

- keys to the safe, etc.

This document must confirm that the new employee accepted confidential information and tools for its use, and the departing employee handed it over in full.

When transferring cases, the chief accountant must explain the main points of the work and identify problems:

- availability of loans and their repayment schedules;

- features of placing funds on deposits;

- functionality and number of accounting staff;

- availability of tax reporting of various types;

- dates of salary payment and relevant documents confirming the payment procedure, etc.

The volume of transfer of cases and quality depend on how much time the departing employee has left to work and how loyal he is to the newcomer. If the chief accountant does not leave of his own free will, then difficulties may arise with the transfer of affairs.

Reception and transmission of documents

The chief accountant must receive the following documents.

Constituent and registration papers:

- charter, constituent agreement;

- extract from the Unified State Register of Legal Entities;

- registration certificate;

- certificate of registration with the tax authorities;

- Certificate of registration with the Pension Fund, Social Insurance Fund.

Documents related to the organization of accounting:

- accounting policy;

- tax accounting policy;

- chart of accounts;

- job descriptions of accounting employees.

Accounting and tax registers:

- balance sheets for all accounting accounts;

- accounting and tax registers for all accounts.

Accounting, financial and tax reporting:

- financial statements;

- declarations and calculations for all taxes;

- books of purchases and sales;

- log of received and issued invoices.

Inventory documents:

- order to conduct an inventory;

- inventory and comparison lists.

Documents relating to relationships with tax authorities:

- tax audit reports;

- acts of reconciliation with inspectors.

Documents for accounting of fixed assets:

- order to create a commission for acceptance of fixed assets;

- acts of acceptance and transfer of fixed assets according to form No. OS-1;

- inventory cards for fixed assets in form No. OS-6;

- acts for write-off of fixed assets.

Documents for accounting of inventory items:

- materials accounting cards;

- receipt orders in form No. M-4;

- requirements – invoices in form No. M-11.

Cash accounting documents:

- cash book, incoming and outgoing cash orders;

- money orders;

- bank statements on current accounts;

- cashier-operator's journal and Z-reports.

Documents on labor and wages accounting:

- employment contracts;

- orders on hiring, dismissal, bonuses;

- staffing schedule;

- time sheets;

- payroll statements.

Documents for settlements with accountable persons:

- expense reports.

Documents for accounting of settlements by counterparties:

- agreements with suppliers and customers;

- acts of reconciliation with debtors and creditors;

- invoices, certificates of work performed, services rendered.

Other papers:

- primary documents for accounting for loans, financial investments, intangible assets;

- accounting certificates;

- waybills;

- strict reporting forms;

- powers of attorney and other papers.

Step by step procedure

The procedure for transferring cases by the chief accountant involves going through the following stages.

Stage 1. An order is issued to carry out the procedure for transferring cases, which contains an indication of the need to check the chief accountant by a commission of employees. The company may have a local document regulating the procedure when changing the chief accountant.

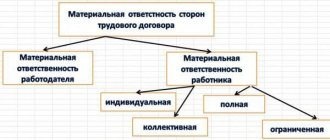

Stage 2. The activities of the chief accountant are checked. If deficiencies are identified, an order is issued to eliminate them within an acceptable time frame.

Stage 3. An inventory of property, cash (in the company's cash register and in a bank account), and other balance sheet items is carried out, and reconciliation of settlements with regulatory authorities is requested.

Stage 4. Cases are transferred in favor of a successor or another person.

Stage 5. An act of acceptance and transfer of affairs by the chief accountant is drawn up.

The procedure for transferring cases by an accountant is very labor-intensive and in order to facilitate it, the employer should include in the job description the mandatory transfer of cases; make regular audits of reporting (by independent auditors, consultants, experts, etc.); avoid maximum concentration of areas of responsibility in one person and distribute individual accounting areas among several specialists.