Very often, accountants in their work are faced with accounts payable and receivable. They can be both from the organization and from the counterparty. There can be many reasons for their occurrence. This includes incorrect data entry into the program, repayment of debt with another equivalent, etc. Debt, as a rule, is revealed in reconciliation reports.

There are two ways to make mutual settlements and adjustments to debt in 1C 8.3: partial repayment of the debt and full repayment (the debt will be fully repaid). Let's look at the step-by-step instructions.

Debt adjustment

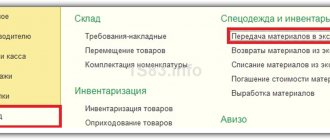

Select the “Debt Adjustment” item in the 1C 8.3 “Purchases” or “Sales” menu.

Our team provides consulting, configuration and implementation services for 1C. You can contact us by phone +7 499 350 29 00 . Services and prices can be seen at the link. We will be happy to help you!

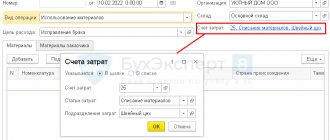

Create a new document from the list form that opens and fill out the header. The most important field is “Type of operation”. Depending on it, the composition of the fields changes. Let's look at these types in more detail:

- Settlement of advances. This type is selected if it is necessary to take into account advances in mutual settlements.

- Debt offset. Selected if it is necessary to change mutual settlements against the debt of the counterparty to us, or a third party.

- Transfer of debt. This type is necessary for transferring debts, advances between counterparties or contracts.

- Debt write-off. This implies complete write-off of the debt.

- Other adjustments.

Criteria and procedure for writing off unrealistic (uncollectible) and doubtful debts

Accounts receivable can be written off from the balance sheet on two grounds (letters of the Ministry of Finance of Russia dated April 17, 2019 No. 02-07-10/27662, dated October 25, 2019 No. 02-07-10/82363, dated March 6, 2020 No. 02-06-10 /17162, dated June 25, 2020 No. 02-07-05/54811):

- If the debt is recognized as doubtful;

- If the debt is deemed uncollectible.

Doubtful debt is the amount of recognized income for which a receivable has been identified that was not fulfilled by the debtor (payer) on time and does not meet the criteria for recognition of an asset (clause 11 of the “Revenue” Standard, approved by order of the Ministry of Finance of Russia dated February 27, 2018 No. 32n).

Debt is considered doubtful if there are documents confirming the uncertainty regarding the receipt of economic benefits or useful potential.

The grounds for recognizing a debt as doubtful (not corresponding to an “asset”) include the lack of confidence that funds will be received in the foreseeable future (at least three years from the year in which the statements are prepared) to repay the receivables.

Doubtful debts are written off from the balance sheet and taken into account as off-balance sheet. On the off-balance sheet, doubtful debts are taken into account until they are recognized as unrecoverable (uncollectible).

Uncollectible (uncollectible) debt is the amount of recognized income for which the obligation to pay the debt, the right to collect the debt has been terminated, and there is uncertainty regarding the receipt of economic benefits or useful potential.

The grounds for recognizing a debt as unrealistic (unreliable) for collection are listed in Art. 47.2 of the Budget Code of the Russian Federation, clause 7 of the Standard “Event after the reporting date”, approved. by order of the Ministry of Finance of Russia dated December 30, 2017 No. 275n.

More on the topic: Group accounting of fixed assets in budgetary institutions from January 1, 2022

These include:

- death of an individual - debtor or declaration of death;

- declaring the debtor bankrupt;

- liquidation of the debtor organization in terms of debt on payments not repaid due to the insufficiency of the organization’s property and (or) the impossibility of repayment by the founders (participants) of the said organization;

- adoption by the court of an act according to which the institution loses the ability to collect debt from the debtor due to the expiration of the collection period (statute of limitations), including the court’s issuance of a ruling refusing to restore the missed deadline for filing an application to the court for debt collection;

- the issuing of a resolution by the bailiff to terminate the enforcement proceedings and to return the writ of execution to the recoverer.

The list of documents required to make a decision to recognize a debt as uncollectible is contained in paragraphs. “c” clause 3 of the order, approved. Decree of the Government of the Russian Federation dated May 6, 2016 No. 393.

A debt that is unrealistic (uncollectible) when written off from the balance sheet is not accepted for off-balance sheet accounting (clause 339 of the Instructions, approved by Order of the Ministry of Finance of Russia dated December 1, 2010 No. 157n, hereinafter referred to as Instruction No. 157n). Recognizing the debt as unrealistic (bad) is also the basis for writing off amounts from the off-balance sheet account.

The decision to write off unrealistic (uncollectible) or doubtful debts is made by the commission for the receipt and disposal of assets (clause 339 of Instruction No. 157n). The procedure and documentation of this procedure is established in the accounting policy (letter of the Ministry of Finance of Russia dated February 18, 2014 No. 02-06-10/6776).

When writing off debt from accounting, the following can be issued:

- inventory list of settlements with buyers, suppliers and other debtors and creditors (f. 0504089) with the attachment of documents confirming the existence of debt;

- documents confirming the uncertainty regarding the receipt of economic benefits or useful potential;

- decision of the institution’s commission on the receipt and disposal of assets;

- written justification for the decision to write off debt;

- order (instruction) of the head of the institution to write off the debt;

- accounting certificate (f. 0504833).

An example of writing off accounts payable in 1C 8.3

In our example, it is necessary to write off a debt of 3,000 rubles, which is owed to the supplier. There may be many reasons, but in this situation they are not particularly interesting to us.

Let's move on to filling out the main part of the document. This can be done automatically using the button of the same name, but keep in mind that there are two of them on the form. In this case, there is no difference, just as with the selected type of operation “Debt transfer”. In other cases, the “Fill” button, which is located at the top of the form, will fill in both accounts payable and accounts receivable.

Manual input is also available here. It is convenient in cases where adjustments are made based on one or two documents.

Everything was filled in correctly automatically. Our receipt of 11 chairs in the amount of 33,000 rubles appeared in the tabular section.

Now we will correct 33,000 rubles to the amount of our debt.

Next, fill out the “Write-off account” tab. In our example, we specified the account as 91.01. In the case where the debt is not with us, but with the counterparty to us, it is necessary to indicate account 91.02.

Support and assistance

Receive articles by email

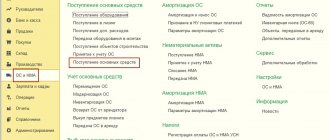

There are documents in the 1C program that will help us carry out this operation.

As we said in the article, first you need to take an inventory. To do this, let’s go to the “Sales” or “Purchases” section and find the item “Calculation Inventory Acts” (see Fig. 1).

Rice. 1. Inventory acts of settlements

Let’s fill out the document by clicking the “Fill” button and reflect the debt in the line provided for this “Incl. the statute of limitations has expired” (see Fig. 2).

Rice. 2. Filling out the settlement inventory report

Write-off is carried out using “Debt Adjustment”, which is located in the “Sales” or “Purchases” section (see Fig. 3).

Rice. 3. Debt adjustment

We write off accounts receivable using the previously created reserve. We fill out the lines of the document as indicated below (see Fig. 4).

We select our debtor from the Directory. Click "Fill".

Rice. 4. Filling out the debt adjustment document

On the “Write-off account” tab, select account 63, since the write-off occurs at the expense of the reserve. Next, we indicate our buyer, select a contract and a settlement document - this is our sale to this counterparty (see Fig. 5).

Rice. 5. Tab “Write-off account”

We post the document and look at the transactions generated by the program (see Fig. 6). Accounts receivable are written off.

Rice. 6. Written off receivables

We create a balance sheet (TBS) for account 63 and see a zero balance at the end of the period (see Fig. 7).

Rice. 7. Balance sheet for account 63

According to the SALT account 62.01, we can also verify that the accounts receivable were written off (see Fig. 8).

Rice. 8. Checking written off debt

Next, we will reflect the written-off debt on the balance sheet. This can be done using the “Operation” document (see Fig. 9).

Rice. 9. Reflection of written-off debt on the balance sheet

For five years, the written off debt will be reflected in the debit of account 007, and after that, if the debt is not repaid, the organization has the right to write off this debt from the off-balance sheet account. Then we will reflect the business transaction on the credit of account 007, also using the document “Operation” (see Fig. 10).

Rice. 10. Document “Operation”

In the example discussed above, the company created a reserve, but how to write off the debt if there was no reserve?

In this case, on the “Write-off account” tab, in the already familiar “Debt adjustment” item, select account 91.02 (see Fig. 11).

Rice. 11. Selecting a write-off account

In order to fill out the line “Other income and expenses,” you will need to enter a new article in the directory with the form “Write-off of accounts receivable (payable)” and check the “Accepted for tax accounting” checkbox (see Fig. 12).

Rice. 12. Introduction to the reference book of a new article

If, at the time of writing off the debt, the reserve was not fully created, then two “Debt Adjustment” documents should be created in the program. The first will be for part of the debt in the amount of the formed reserve. The second document will be using account 91, indicated on the “Write-off account” tab for the remaining amount of the debt. We discussed filling out such documents above.

In conclusion, it should be added that in 1C 8.3 there are restrictions on creating reserves automatically. Namely, the program does not create reserves for overdue debt in foreign currency and in conventional units. This is also true for advances issued to suppliers. To create a reserve for such debts, you should use the “Manual Transactions” document.

Save time! Keep records and submit reports in the familiar and convenient interface of the 1C program.

MORE ABOUT THE 1C-REPORTING SERVICE

Accounting records for writing off unrealistic (uncollectible) and doubtful debts

Write-off of unrealistic (uncollectible) and doubtful receivables (for income, sources of financing the budget deficit, granted loans, advances) relates to subarticle 173 “Extraordinary income from transactions with assets” of the KOSGU (clause 9.7.3 of the procedure, approved by order of the Ministry of Finance Russia dated November 29, 2017 No. 209n, hereinafter referred to as Procedure No. 209n).

More on the topic: Standard “Long-term contracts”: application in practice and in 1C:BGU 8

Unrealistic (unreliable) for collection, doubtful receivables for expenses (for advance payments made, for state and municipal guarantees for which equivalent claims do not arise on the part of the guarantor to the debtor) are written off to subarticle 273 “Extraordinary expenses for transactions with assets” of KOSGU ( clause 10.7.3 of Order No. 209n).

Transactions are reflected in accordance with paragraphs. 78, 80, 82, 84 instructions, approved. by order of the Ministry of Finance of Russia dated December 6, 2010 No. 162n (for government institutions), paragraphs. 94, 98, 102, 106, 152 instructions, approved. by order of the Ministry of Finance of Russia dated December 16, 2010 No. 174n (for budgetary institutions), paragraphs. 97, 101, 105, 109, 180 instructions, approved. by order of the Ministry of Finance of Russia dated December 23, 2010 No. 183n (for autonomous institutions).

Accounting entries are reflected in correspondence with accounts 040110173 “Extraordinary income from transactions with assets”, 040120273 “Extraordinary expenses on transactions with assets”. In 1 – 17 digits of accounts the same code is indicated as that of the settlement account corresponding to them.

Doubtful debts written off from the balance sheet are accounted for in off-balance sheet account 04 (clause 339 of Instruction No. 157n).

Example 1. A budgetary educational institution provides paid educational services. The accounts include doubtful accounts receivable for the education of children who graduated from school. The institution's commission decided to write off the debt from the balance sheet to the off-balance sheet to monitor the possibility of collection.

Debit KDB 2,401 10,173 Credit KDB 2,205 31,667 – doubtful debts are written off from the balance sheet;

Increase in off-balance sheet account 04 – debt accepted on off-balance sheet.

Example 2. A budgetary educational institution has accounts receivable for advance payment for materials. The counterparty is declared insolvent. The institution's commission decided to write off doubtful debts from the balance sheet to the off-balance sheet to monitor the possibility of collection.

Debit KRB 2,401 20,273 Credit KRB 2,206 34,664 – doubtful debts are written off from the balance sheet;

Increase in off-balance sheet account 04 – debt accepted on off-balance sheet.

Write-off procedure

For this purpose, the software provides for the use of the “Debt Adjustment” document. It is located on the purchases and sales tab of the “Settlements with counterparties” section - if you are using a standard interface, and on the purchases or sales tabs - in the “Taxi” interface.

In this document we find “Debt write-off”. Next, in the “Write off” field, enter the type of debt we need; for example, let’s take “Buyer’s Debt”. Now you need to select the same buyer and click “Fill”. The corresponding data should appear in the table.

Now, on the “Write-off account” tab, select the account to which the debt should be written off. Since since 2011, all companies must create a reserve for doubtful debts when conducting accounting, here we will indicate account 63 “Provisions for doubtful debts.” It is also necessary to indicate in the subconto the counterparty, the agreement signed with him, as well as the payment document.

Important!

If the reserve was not formed, if the buyer is in debt, you need to select account 91.02 and fill out the subaccount. It is mandatory to select the type of other income and expenses – “Write-off of receivables (payables)”.

When the document is posted, one of 2 corresponding transactions will be generated.

Accounting entries for debt recovery

When funds are received to repay doubtful debts, the amounts are written off from off-balance sheet accounting and taken into account in the corresponding balance sheet accounts for accounting for settlements. The balance sheet records entries that are “reverse” to those entries that were used when writing off receivables from the balance sheet (letter of the Ministry of Finance of Russia dated February 11, 2016 No. 02-07-10/7306).

More on the topic: Federal standard “Asset Impairment”: what awaits budgetary institutions at the end of 2022

Example. The institution's commission decided to write off doubtful receivables for prepayment for materials from the balance sheet to the off-balance sheet to monitor the possibility of collection. The debtor's property status has changed and funds to repay receivables have been transferred to the personal account.

Decrease in off-balance sheet account 04 – debt is written off from off-balance sheet accounting;

Debit KRB 2,206 34,564 Credit KRB 2,401 20,273 – the debt was accepted onto the balance sheet.