Accounting for the consumption (issue) of materials into production. Accounting entries

The release of materials into production means their release from the organization's warehouse (shops) directly for the manufacture of products (performance of work, provision of services), as well as the consumption of materials for the management needs of the organization.

The release of materials to the warehouses of departments (shops) of the organization and to construction sites is considered as internal movement.

As materials are released from the warehouses of departments (shops) to workplaces, they are written off from the material asset accounts and credited to the corresponding production cost accounts. The cost of materials released for management needs is charged to the appropriate accounts for accounting for these expenses.

The primary accounting documents for the release (consumption) of materials from the organization's warehouses to the organization's divisions (shops) are a limit-fetch card (standard interindustry form N M-8), a demand invoice (standard interindustry form N M-11), an invoice (standard interindustry form form N M-15).

Accounting methods for inventory items

When releasing materials from the warehouse, in addition to quantitative valuation, valuation is used. In accounting, there are several methods for calculating estimated indicators:

- At average cost. When applying this method, first the cost of a certain group of material (or type) at the beginning of the month is added to the cost of received inventory items. The quantity by group or type is also summed up. By dividing the first amount by the second, the average cost of a unit of inventory is determined. Next, the number of units written off per month is multiplied by this average cost and the amount to be written off is obtained. This is how materials that are similar in properties and usage characteristics are written off.

- FIFO. This method assumes that inventory items are used sequentially, in the order in which they are received at the warehouse. Next, the materials that were the first to be transferred, for example, to production, are valued at the cost of the first goods and materials received at the warehouse, taking into account their balance in the warehouse: first, the quantity is written off at the cost of the balance, then the remaining unwritten quantity is written off at the cost of the first batch, then, if necessary, the second and etc. The remaining materials are assessed at the cost of the last received batch. FIFO is used when there are relatively stable prices for inventory items.

- Based on unit cost of inventory items. The method is used to account for particularly valuable items or hazardous substances and consists of recording each receipt of such materials. Upon release, the same price applies as upon arrival at the warehouse. The method is also used for small volumes of warehouse operations.

What documents are used to document the internal movement and release of materials into production ?

the write-off of construction materials in accounting ?

On a note! The LIFO method is the opposite in meaning to the method, i.e. according to the cost of the last received batch, then the penultimate one, etc. FIFO has lost its importance today, since its use is justified in conditions of high inflation.

List of accounts involved in accounting entries:

|

|

Below are accounting entries reflecting the consumption of materials for production and administrative needs.

| Account Dt | Kt account | Wiring Description | Transaction amount | A document base |

| 20 | 10 | Materials were released into main production. The consumption of materials in the main production is taken into account | Cost of materials | Limit-fence card (TMF No. M-8) Demand-invoice (TMF No. M-11) Invoice (TMF No. M-15) |

| 23 | 10 | Materials were released to auxiliary production. Material consumption taken into account | Cost of materials | Limit-fence card (TMF No. M-8) Demand-invoice (TMF No. M-11) Invoice (TMF No. M-15) |

| 25 | 10 | Materials were released for general production needs. Material consumption taken into account | Cost of materials | Limit-fence card (TMF No. M-8) Demand-invoice (TMF No. M-11) Invoice (TMF No. M-15) |

| 26 | 10 | Materials were released for general business needs. Material consumption taken into account | Cost of materials | Limit-fence card (TMF No. M-8) Demand-invoice (TMF No. M-11) Invoice (TMF No. M-15) |

| 10 | 10 | Materials were released to warehouses (storerooms) of departments (shops) | Cost of materials | Internal movement invoice |

Accounting for other disposals (write-offs, gratuitous transfers) of materials. Accounting entries

Write-off of materials can be carried out in the following cases:

- that have become unusable after expiration of the storage period;

- obsolete;

- when identifying shortages, thefts or damage, including due to accidents, fires, and natural disasters.

The preparation of the necessary information for making a decision on the write-off of materials is carried out by the Commission with the participation of financially responsible persons. Based on the results of the inspection, the Commission draws up an Act on the write-off of materials for each division of the organization, for financially responsible persons.

The write-off of materials transferred under a gift agreement or free of charge is carried out on the basis of primary documents for the release of materials (waybills, applications for the release of materials to third parties, etc.). Article 146 “Object of taxation” of the Tax Code of the Russian Federation states that the transfer of ownership of assets free of charge is recognized as a sale, that is, subject to VAT.

Below are accounting entries reflecting the write-off and gratuitous transfer of materials

| Account Dt | Kt account | Wiring Description | Transaction amount | A document base |

| Accounting for shortages (damage) of materials in the presence of culprits | ||||

| 94 | 10 | The write-off of the book value of materials is reflected based on the write-off report drawn up by the commission | Actual cost of written-off materials | Material write-off act |

| 20 | 94 | The write-off of shortages (losses from spoilage) of materials is reflected within the approved norms of natural loss due to the expenses of the main production | Natural loss rate | Accounting certificate-calculation Act of write-off of materials |

| 23 | 94 | The write-off of shortages (losses from spoilage) of materials is reflected within the approved norms of natural loss due to the costs of auxiliary production | Natural loss rate | Accounting certificate-calculation Act of write-off of materials |

| 25 | 94 | The write-off of shortages (losses from spoilage) of materials is reflected within the approved norms of natural loss at the expense of overhead costs | Natural loss rate | Accounting certificate-calculation Act of write-off of materials |

| 26 | 94 | The write-off of shortages (losses from spoilage) of materials is reflected within the approved norms of natural loss at the expense of general business expenses | Natural loss rate | Accounting certificate-calculation Act of write-off of materials |

| 29 | 94 | The write-off of shortages (losses from spoilage) of materials is reflected within the approved norms of natural loss due to the costs of service industries | Natural loss rate | Accounting certificate-calculation Act of write-off of materials |

| 73.2 | 94 | The write-off of shortages (losses from spoilage) of materials to the perpetrators in excess of the norms of natural loss is reflected | The amount of excess of the norm of natural loss | Accounting certificate-calculation Act of write-off of materials |

| 91.2 | 68.2 | VAT, previously claimed for deduction, was restored for shortages (losses) of materials in excess of the norms of natural loss | VAT amount | Accounting certificate-calculationInvoice |

| 50.01 | 73.2 | Repayment by the guilty person of the debt for cash shortages is reflected | Shortfall amount | Receipt cash order. Form No. KO-1 |

| 70 | 73.2 | Repayment by the guilty person of the debt for shortfalls at the expense of wages is reflected | Shortfall amount | Accounting certificate-calculation |

| Features of accounting for shortages (damage) of materials in the absence of perpetrators. In this situation, the amount exceeding the natural loss rate is written off not to account 73, but to account 91 | ||||

| 91.2 | 94 | Reflects the write-off of shortages (losses from spoilage) of materials in excess of the norms of natural loss in the absence of guilty persons or shortages, the recovery of which was refused by the court | The amount of excess of the norm of natural loss | Accounting certificate-calculation Act of write-off of materials |

| Accounting for material loss due to natural disasters | ||||

| 99 | 10 | Recorded write-off of materials lost as a result of natural disasters | Cost of lost materials | Material write-off act |

| 99 | 68.2 | VAT, previously claimed for deduction, was restored on lost materials | VAT amount | Accounting certificate-calculationInvoice |

| Accounting for free transfer of materials | ||||

| 91.2 | 10 | Disposal of materials reflected | Actual cost of materials | Invoice (TMF No. M-15) Invoice |

| 91.2 | 68.2 | VAT is charged to the budget on the cost of materials donated free of charge | VAT amount | Invoice (TMF No. M-15) Invoice Sales book |

Documentation

An organization can use standardized forms of documentation to record the disposal of materials from a warehouse, or it can use independently developed forms. Their presence is reflected in the accounting policies.

Unified forms of primary documents for the release of goods and materials for production needs are:

- limit-fence card (according to f. M-8);

- demand-invoice (according to Form M-11);

- invoice (form M-15);

- invoice for internal movement (form TORG-13 or a form developed by the organization).

All forms are standard and can be used regardless of the industry.

Documents confirming other disposals from the warehouse (for example, gratuitous transfer, write-off of shortages, damage, theft) can serve as various acts for the write-off of MC, signed by members of a commission created in the organization, TTN, applications for leave to the outside.

The sale of goods and materials is formalized taking into account the applicable taxation system, the specifics of current legislative acts, etc. The release to buyers, legal entities or individuals, is carried out on the basis of contracts with them. An invoice is issued for the release of goods and materials to the third party, and, if necessary, an invoice and other documents for sale. Transportation of goods and materials from the warehouse is issued by TTN.

Accounting for the sale of materials. Accounting entries

When an organization sells materials to individuals and legal entities, the sales price is determined by agreement of the parties (seller and buyer). The calculation and payment of taxes is carried out by the organization in the manner prescribed by current legislation.

The sale of materials is formalized by issuing an invoice for the release of materials to the third party, on the basis of contracts or other documents and an invoice. When transporting goods by road, a consignment note is issued.

The following are accounting entries reflecting the sale of materials.

| Account Dt | Kt account | Wiring Description | Transaction amount | A document base |

| Sale of materials with payment after shipment (transfer) | ||||

| 91.2 | 10 | The disposal of materials is reflected. The posting amount depends on the methodology for estimating the cost of materials upon disposal (at the cost of each unit, at the average cost, using the FIFO method) | Cost of materials | Invoice (TMF No. M-15) |

| 62.01 | 90.1 | Revenue is reflected in the sales cost of materials including VAT. | Sales cost of materials (amount including VAT) | Invoice (TMF No. M-15) Invoice |

| 91.2 | 68.2 | The amount of VAT on materials sold is reflected | VAT amount | Invoice (TMF No. M-15) Invoice Sales book |

| 51 | 62.01 | The fact of repayment of the buyer’s debt for previously shipped materials is reflected. | Selling cost of materials | Bank statementPayment order |

| Sale of materials on prepayment | ||||

| 51 | 62.02 | The buyer's prepayment for materials is reflected | Advance payment amount | Bank statementPayment order |

| 76.AB | 68.2 | VAT is charged on advance payment | VAT amount | Payment orderInvoiceSales book |

| 91.2 | 10 | The disposal of materials is reflected. The posting amount depends on the methodology for estimating the cost of materials upon disposal (at the cost of each unit, at the average cost, using the FIFO method) | Cost of materials | Invoice (TMF No. M-15) |

| 62.01 | 91.1 | Revenue is reflected in the sales cost of materials including VAT. | Sales cost of materials. Value with VAT | Invoice (TMF No. M-15) Invoice |

| 91.2 | 68.2 | VAT is charged on materials sold | VAT amount | Invoice (TMF No. M-15) Invoice |

| 62.01 | 62.02 | The previously received prepayment is offset against the debt for the transferred materials. | Advance payment amount | Accounting certificate-calculation |

| 68.2 | 76.AB | VAT is credited from the prepaid payment | VAT amount | InvoicePurchase book |

Registration of SF supplier

VAT is accepted for deduction if the conditions are met (clause 2 of Article 171 of the Tax Code of the Russian Federation):

- materials purchased for activities subject to VAT;

- a correctly executed SF (UPD) is available;

- materials were accepted for accounting (clause 1 of article 172 of the Tax Code of the Russian Federation).

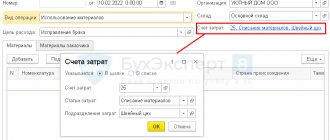

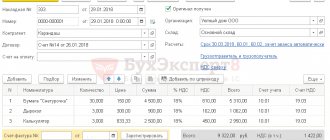

To register an incoming invoice from a supplier, you must indicate its number and date at the bottom of the Receipt document form (act, invoice) and click the Register . PDF

The Invoice document received is automatically filled in with the data from the Receipt document (act, invoice) .

- Operation type code : “Receipt of goods, works, services.”

If the document has the Reflect VAT deduction in the purchase book by date of receipt checkbox , then when it is posted, entries will be made to accept VAT for deduction.

Postings according to the document

The document generates the posting:

- Dt 68.02 Kt 19.03 – VAT accepted for deduction.

Purchase Book report can be generated from the Reports – VAT – Purchase Book section. PDF

If non-raw materials are purchased for the production of finished products for export, then VAT is deducted without any specifics - the same as when purchasing materials for operations on the domestic market (clause 2 of article 171 of the Tax Code of the Russian Federation, clause 3 of article 172 Tax Code of the Russian Federation).

Separate VAT accounting is not maintained. The right to accept VAT as a deduction will arise on purchased inventories, regardless of confirmation or non-confirmation of the 0% VAT rate for the export of non-commodity goods (clause 10 of Article 165 of the Tax Code of the Russian Federation).

The list of raw materials has been approved and is valid from July 1, 2018 (Resolution of the Government of the Russian Federation of April 18, 2018 N 466).

Reporting

The VAT return reflects the amount of VAT deducted:

In Section 3 page 120 “Amount of VAT to be deducted”: PDF

- the amount of VAT accepted for deduction.

In Section 8 “Information from the purchase book”:

- invoice received, transaction type code "".

See also:

- Scheme for purchasing materials

Did the article help?

Get another secret bonus and full access to the BukhExpert8 help system for 14 days free of charge

Related publications

- Sales of products during the month of production at planned cost and in subsequent periods at actual cost Sales of finished products are the final stage of the turnover of funds spent on...

- Determining the specification for writing off materials for product release Entering data on production operations in 1C can be accelerated and...

- Purchasing materials for operations not subject to VAT and transferring them for advertising purposes Let's consider the features of reflecting in 1C received materials intended for operations...

- Test No. 38. Acquisition and use of materials (household equipment) for non-production purposes...