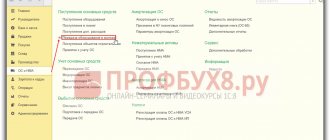

Postings

Who accrues depreciation Depreciation on fixed assets belonging to them is accrued by non-profit organizations (paragraph 3

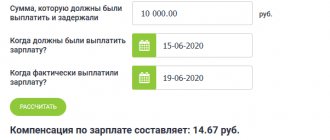

How is the amount calculated? In case of late payment of wages or other amounts established by the payment system

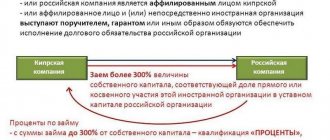

EXAMPLE On 02/01/2013, an organization received a loan in the amount of 600,000 rubles from a foreign organization.

Valuation of intangible assets is a comprehensive assessment of assets that do not have physical expression, but

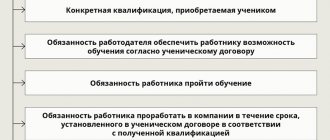

Training an employee at the expense of the employer according to the Labor Code of the Russian Federation. Article 196 of the Labor Code states that

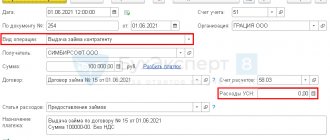

Step-by-step instructions June 01 The organization transferred a loan in the amount of 100,000 rubles to the counterparty. By

In what cases is an agreement signed? If the parties to the agreement have outstanding claims, the creditor has the right

Agree, getting used to something new is always difficult. But it’s even more difficult for department employees

The concept of inventory The calendar year ends. What do organizations do as economic entities based on its results?

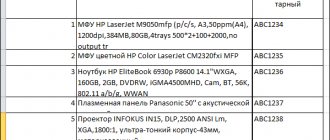

Today we will look at the assembly and commissioning of a fixed asset that requires installation and consists of