Postings

Filing reports is one of the main responsibilities of a taxpayer. Of course, they don’t start a business for the sake of

Settings for accounting parameters for wages, taxes and contributions The sequence of salary calculation in 1C Accounting

Proper documentation is one of the important aspects to ensure compliance with established reporting rules,

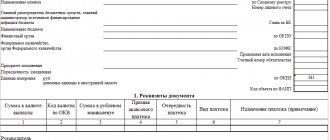

What to follow The current procedure for filling out orders for transferring money to the treasury has been in effect since 01

Description of “accounts receivable” in simple words Accounts receivable, also known as accounts receivable, are all amounts

Companies on OSNO use an invoice (SCF) for VAT accounting. Universal transfer document (UDD)

It often happens at an enterprise that during the next inventory check, things that are included in the inventory are missing.

5.00 5 Reviews: 0 Views: 13060 Votes: 1 Updated: n/a File type Text document

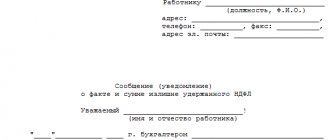

Overpayment of personal income tax: what to do? According to paragraph 1 of Art. 231 of the Tax Code of the Russian Federation personal income tax amounts,

for managers business development 01/28/2021 Author: Academy-of-capital.ru Add a comment Rating: (Votes: 2, Rating: 4.5)