Step-by-step instruction

The authorized capital of the Organization is 1,000,000 rubles, where the shares of participants are:

- Ivanov Ivan Ivanovich – 500,000 rubles. (50%);

- Druzhnikov Georgy Petrovich – 300,000 rubles. (thirty%);

- LLC "Zarya" - 200,000 rubles. (20%).

As of December 31 last year, the value of the company's net assets was RUB 4,000,000.

January 17 Ivanov I.I. submitted an application to resign from the Company.

On March 23, the Company transferred to Ivanov the actual value of his share minus personal income tax to his bank card.

On the same day, the Organization paid the personal income tax withheld for this operation to the budget.

Let's look at step-by-step instructions for creating an example. PDF

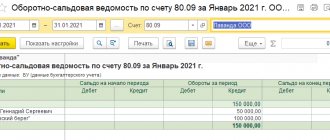

| date | Debit | Credit | Accounting amount | Amount NU | the name of the operation | Documents (reports) in 1C | |

| Dt | CT | ||||||

| Withdrawal of a participant from the Company | |||||||

| January 17 | 80.09 | 80.09 | 500 000 | Transfer of a share from a participant to the Company at nominal value | Manual entry - Operation | ||

| 81.09 | 75.02 | 2 000 000 | Reflection of the company's debt to the withdrawing participant in the amount of the actual value of the share | ||||

| Transfer of the actual value of the share to the withdrawing participant | |||||||

| March 23 | 75.02 | 51 | 1 740 000 | Transfer of the actual value of the share to the withdrawing participant | Write-off from current account - Other write-off | ||

| Withholding personal income tax from the actual value of the individual participant's share | |||||||

| March 23 | 75.02 | 68.01 | 260 000 | Withholding of personal income tax from the amount of the actual value of the share of the withdrawing participant | Manual entry - Operation | ||

| — | — | 2 000 000 | Reflection of an individual's income for personal income tax | Personal income tax accounting operation - Income tab | |||

| — | — | 260 000 | Reflection of calculated personal income tax on the actual value of the share | ||||

| — | — | 260 000 | Reflection of withheld personal income tax from the actual value of the share | Personal income tax accounting operation - Tab Withheld for all rates | |||

| — | — | 260 000 | Reflection of personal income tax paid on the actual value of the share | Personal income tax accounting operation - Tab Listed for all rates | |||

| Payment of personal income tax to the budget | |||||||

| March 23 | 68.01 | 51 | 260 000 | Payment of personal income tax to the budget | Debiting from a current account – Tax payment | ||

How to calculate the real fraction?

In the process of deciding on the fate of the founder’s share, it is important to carry out one more action - calculate its real price. Federal Law No. 14, Article 23 states that this parameter represents the share of the net assets of the structure proportional to the price of the share. Formula:

DSD = NA/100%*VDU.

It uses the following terms:

- DSD is the actual value of the share.

- VDU - the value of the founder's share.

- NA - net assets of the enterprise.

The most important indicator is the NAV, because they reflect the success of the financial and economic activities of the enterprise. The calculation procedure was approved by order No. 84n issued by the Ministry of Finance of the Russian Federation. It states that net asset value is the difference between the LLC's assets and debt obligations. The calculation takes into account the book value of liabilities and assets.

Withdrawal of a participant from the Company

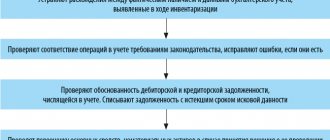

Regulatory regulation

When a participant leaves the Company (LLC), his share passes to the Company itself (clause 6.1, Article 23 of the Federal Law of 02/08/1998 N 14-FZ).

No later than three months from the date of acceptance of the application for withdrawal from the LLC or within other periods established by the company, the actual value of his share in the authorized capital (AC) is paid to the withdrawn founder.

If the withdrawing participant refused to receive payment for the share in the management company, then the actual value of the share is the non-operating income of the company in terms of calculating income tax (Letter of the Ministry of Finance of the Russian Federation dated January 16, 2020 N 03-03-06/1/1609).

The actual cost is calculated only from the paid part of the participant’s share in the management company.

The actual value of the share is determined according to the financial statements for the last reporting period (clause 6.1 of Article 23 of the Federal Law of 02/08/1998 N 14-FZ).

Learn more about how to determine the size of net assets - Valuation of net assets.

The actual value of the share is paid out of the difference between the size of the net assets and the Company's capital.

At the time of withdrawal of a participant from the LLC, the amount of net assets must be greater than the amount of the Company's capital. Otherwise, the Company must reduce the amount of the authorized capital to the amount of net assets, but it cannot be less than the minimum amount of the authorized capital - 10,000 rubles. (Clause 8 of Article 23 of the Federal Law of 02/08/1998 N 14-FZ).

More details:

- Net assets, reduction of authorized capital

- Prohibited areas for spending net profit

Calculation of the actual value of a share

Check that the net assets are greater than the authorized capital:

- 4,000,000 rub. > 1,000,000 rub.

The difference between the size of the net assets and the capital stock of the LLC is sufficient to pay the actual value, therefore, the size of the capital stock does not need to be reduced!

Let's calculate the actual value of the share:

- 4,000,000 rub. *50% = 2,000,000 rub., where: 4,000,000 rub. – is the value of net assets;

- 50% is the paid share of the management company.

Accounting in 1C

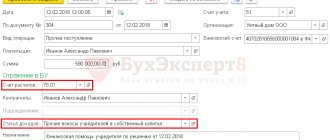

Complete the document Operation entered manually in the Operations – Operations section.

Please indicate:

- Date – the date of the application for withdrawal of the LLC participant.

In the postings:

- change in the structure of the management company - transfer by the withdrawing participant of the share to the company: Debit - 80.09;

- Subconto – exited participant;

- Credit – 80.09;

- Subconto is the name of the LLC, i.e. our organization, to do this, enter its data in the Contractors directory;

- Amount – the nominal value of the share.

- Debit– 81.09;

Amendments to the constituent documents related to changes in the structure of the company are subject to mandatory state registration (Article 18 of the Federal Law of 08.08.2001 N 129-FZ, paragraph 6 of Article 24 of the Federal Law of 08.02.1998 N 14-FZ).

Documents for registration are submitted within a month from the date of transfer of the share or part of the share to the company. (clause 7.1 of article 23 of the Federal Law of 02/08/1998 N 14-FZ).

When submitting documents not in electronic form, a fee is paid (clause 3, clause 1, article 333.33 of the Tax Code of the Russian Federation, clause 32, clause 3, article 333.35 of the Tax Code of the Russian Federation).

Changes to the Unified State Register of Legal Entities are made within 5 working days after receipt of the documents (Clause 1, Article 8 of the Federal Law of 08.08.2001 N 129-FZ).

Then, during the year, the company decides what to do with the share of the withdrawing participant. She may be:

- distributed free of charge among other participants (clause 2 of article 24 of the Federal Law of 02/08/1998 N 14-FZ);

- purchased by one or more participants or third parties, if this does not contradict the charter (clause 2 of article 24 of the Federal Law of 02/08/1998 N 14-FZ);

- repaid by reducing the capital (clause 5 of article 24 of the Federal Law of 02/08/1998 N 14-FZ).

Calculation of the value of a participant’s share in the authorized capital of an LLC in 2022

When leaving a limited liability company, a participant receives not the amount that he contributed to the authorized capital (the nominal value of the share), but the amount into which the participant’s contribution turned into as a result of the activities of the LLC (the actual value of the share). It can be either more or less than the nominal share, depending on the success of the company. The actual value of the share is calculated using the following formula:

Actual value = nominal value / authorized capital * net asset value,

wherein:

- The nominal value is equal to the contribution to the authorized capital when creating an LLC. The amount of the deposit can be clarified in the Unified State Register of Legal Entities extract. Regardless of the actual form of the contribution (money, property, etc.), in the Unified State Register of Legal Entities the value of the share will be indicated in rubles.

- The authorized capital may have changed since the creation of the limited liability company. Its size can also be viewed in the Unified State Register of Legal Entities.

- Net assets are calculated based on the balance sheet data. To arrive at your net assets, you need to subtract your liabilities from your assets. If the net assets of the company are negative, it is impossible to pay the share to the withdrawing participant.

Example:

The founder sent a statement to the LLC about his resignation from the company.

Authorized capital - 200,000 rubles.

The nominal value of the retiring participant's share is RUB 70,000.

The amount of net assets at the time of exit is RUB 1,100,000.

The actual value of the share will be equal to:

70,000 rub. / 200,000 rub. * RUB 1,100,000 = 385,000 rub.

Important!

The actual value of the share is paid in full only to the participant who has fully paid the nominal value of the share. If the nominal value is partially paid, upon leaving the LLC such participant will receive compensation in proportion to the paid part.

Transfer of the actual value of the share to the withdrawing participant

Income received when a participant (individual) leaves the LLC in the form of paid actual value of the share is subject to personal income tax (Article 209 of the Tax Code of the Russian Federation, clause 1 of Article 210 of the Tax Code of the Russian Federation, clause 3 of Article 214 of the Tax Code of the Russian Federation).

If the share belonged to an individual continuously for more than 5 years, then the income is not subject to personal income tax (clause 17.2 of Article 217 of the Tax Code of the Russian Federation).

For payment of the actual value of the share in cash, document the document Debiting from the current account in the Bank and cash department - Bank statements section.

Please indicate:

- Transaction type – Other write-off ;

- Recipient – do not fill in, despite the fact that the field is underlined in red, it is not required to be filled in and does not affect the data;

- Amount – actual value minus personal income tax: (RUB 2,000,000 – RUB 2,000,000 *13% = RUB 1,740,000);

- Founders – retired participant;

- An expense item is a cash flow item with the type of movement Payments to owners in connection with the repurchase of shares (shares) from them or their withdrawal from the membership .

Postings according to the document

The document generates the posting:

- Dt 75.02 Kt - transfer of the actual value of the share to the withdrawing participant.

Withholding personal income tax from the actual value of the individual participant's share

Withholding personal income tax

The procedure for determining the tax base for calculating personal income tax is not specifically prescribed in the legislation. Accounting expert8 is guided by a more cautious position and believes that:

- income in the form of an excess of the paid actual value of the share over the cost of its acquisition is equated to dividends and is subject to personal income tax (clause 1, clause 1, article 208 of the Tax Code of the Russian Federation).

- income within the nominal value is also subject to personal income tax in the general manner (Article 209 of the Tax Code of the Russian Federation, clause 1 of Article 210 of the Tax Code of the Russian Federation).

Personal income tax is calculated on the date of receipt of income, i.e. on the date of their payment (clause 4 of article 226 of the Tax Code of the Russian Federation).

The deadline for transferring personal income tax is the next day after payment of income (clauses 4, 6, article 226 of the Tax Code of the Russian Federation).

To reduce his expenses, a participant can (clause 1, clause 1, clause 2, clause 2, clause 7 of Article 220 of the Tax Code of the Russian Federation, clause 1 of Article 226 of the Tax Code of the Russian Federation):

- submit a 3-NDFL declaration and receive a property deduction in the amount of expenses for acquiring a share in the management company;

- receive a property deduction in the amount of RUB 250,000 if there is no evidence of acquisition of a share

There is no standard document for this operation in 1C, so reflect the withholding of personal income tax through the document Operation, entered manually in the Operations - Operations section.

Please indicate:

- Date – date of transfer of the actual value of the share.

In the postings:

- Debit – 75.02;

- Subconto – exited participant;

- Credit – 68.01;

- Subconto – exited participant;

- Amount – personal income tax amount.

Reflection of personal income tax withholding in registers

Because Personal income tax is withheld by a manual operation, then to reflect it in the personal income tax registers and further generate reports on it, additionally enter the document Personal Tax Accounting Operation in the section Salaries and Personnel - All documents on personal income tax - Create button.

Please indicate:

- Transaction date – the date the data is reflected in the personal income tax registers.

- Income tab : Date of receipt of income - date of payment of the actual value of the share;

- Revenue code – 1542;

- Type of income – Other income ;

- Amount of income – paid actual value of the share, taking into account personal income tax;

- The date of receipt of income is the date of payment of the actual value of the share;

- The date of receipt of income is the date of payment of the actual value of the share;

tab for all rates ; movements in the personal income tax registers for its payment will be registered when personal income tax is paid to the budget.