Description of “receivables” in simple words

Accounts receivable, also known as accounts receivable, are all amounts that counterparties, individuals, companies or other debtors are obliged to pay to an enterprise or individual entrepreneur. To describe accounts receivable in simple terms, these are all unpaid debts that are in the balance sheet of a debit account. This could be a contractor's debt, an unpaid invoice for a product or service from a buyer, or a settlement with other accountable parties.

Accounts receivable are classified as property assets and are therefore subject to mandatory inventory, which is carried out regardless of the maturity date. Accounts receivable include not only monetary debts, but also other unfulfilled obligations. To understand when it comes to accounts receivable, here are a few examples:

- the company supplied goods or provided services, but there was no payment;

- an advance payment for the service was transferred, but it was not provided;

- an entrepreneur or enterprise issued a loan to an employee;

- More funds were transferred to the tax service, pension or other fund due to an accounting error:

- non-received goods with partial or full prepayment, which will later be transferred from the counterparty.

In addition, the following can lead to the appearance of receivables:

- dishonesty of the counterparty;

- financial instability or bankruptcy of the supplier;

- an error made by a company or bank when making a payment.

Each of these operations leads to the formation of receivables on the accounts of the enterprise or individual entrepreneur.

An increase in accounts receivable - what does this mean, consequences

The dynamic growth of accounts receivable leads the company to certain financial difficulties. The desire to increase profits by any means possible without taking into account the possible consequences can lead to disastrous results.

For the banking system, an increase in accounts receivable means “pulling out” working capital from circulation and providing it to the borrower in order to receive additional income by returning the loan taken by the client with interest for using the loan. Non-repayment of a loan is a loss of the bank’s own money, and if the number of hopeless defaulters grows and the corresponding work to repay debts is not carried out, then the bank faces losses leading to inevitable bankruptcy.

Also for a trading company, a long-term debt to defer payments for services provided or products supplied can lead to unpleasant consequences in terms of the financial state of affairs and lead to a court settlement.

The solvency of an organization directly depends on the successful management of current assets, and preventing the growth of accounts receivable will prevent a shortage of working capital. If there is inadequate control over payment and settlement discipline and loans are provided without sufficient consideration of the borrower’s solvency, analysis of his reliability in repaying the loan, or market monitoring, then in this case the organization obviously dooms itself to a decrease in the liquidity of its own assets and a decrease in funds in its accounts.

The main goal of the company's management is to keep debt within an acceptable level, which depends on the size of the enterprise, on production volumes, on its territorial affiliation and on many other factors.

What's good and bad about accounts receivable?

Without accounts receivable, no business is possible in principle, unless all counterparties will pay only by prepayment. But most partners prefer a post-payment scheme, when first the goods are received or the service is provided, and then payment occurs. Therefore, when conquering new markets and expanding the customer base, receivables are inevitable.

On the other hand, deferment of payment is beneficial for both parties: the buyer receives “someone else’s” working capital, and the seller receives a new sales market. The main thing in this case is not to accumulate a lot of debt.

Large accounts receivable negatively affects the financial condition of the company. Working capital does not reach accounts, and stagnation sets in. The larger the debt, the higher the risk of non-repayment. This can have a detrimental effect on the sustainability of the business.

An enterprise or entrepreneur is gradually drying up the source of funds to conduct business. To stay afloat, you have to wait for the return of receivables or open your own accounts payable. In this case, your debt already requires costs for repayment and commissions, which are set by creditors.

How debt is formed

There are many possible occurrences; here are the most common ones.

From counterparties:

- when a company pays an advance to a supplier or contractor;

- when the buyer (his role may be a branch or subsidiary) first receives a product or service and pays later;

- when a counterparty causes damage to the company and does not compensate for it immediately (for example, if a logistics company damages goods during transportation).

From government agencies:

- when overpaying tax;

- when deducting “input” VAT (when purchasing goods for the purpose of carrying out transactions subject to VAT, the taxpayer has the right to a deduction (Articles 171 and 172 of the Tax Code of the Russian Federation));

- for social payments that are reimbursed by the Social Insurance Fund (for example, when the amount of benefits paid to an employee exceeded insurance contributions or when the costs of preventive measures are covered (up to 20% of the contributions for the previous year can be spent on them)).

From employees and participants of the enterprise:

- when the financially responsible person is given funds for work needs;

- when an employer issues a loan to an employee;

- when a company member delays payment to the authorized capital.

Differences between accounts payable and receivable

Beginning entrepreneurs can sometimes think that it is good to have accounts receivable and bad to have accounts payable. In the common understanding, a debtor is everything that is owed to you, a creditor is everything that you owe.

The absence of debts in favor of individual entrepreneurs on the part of counterparties indicates a cautious strategy. Because of fear of taking risks, the entrepreneur works only on prepayment or settlements on the day of delivery. But such an approach is impossible in the long term. Moreover, it deprives the business of part of the profit that conscientious payers can bring.

Accounts payable is a more indicative parameter. Many companies can manage almost completely without it. But with the expansion of client relationships, contractual relationships with partial prepayments still arise, or the client borrows from other lenders.

Even the formed wage fund, the amount for paying dividends to shareholders or the amount of accrued taxes are classified as accounts payable. Therefore, it is more correct to evaluate not the presence of receivables and creditors as such in the balance sheet of the enterprise, but to pay attention to their ratio.

If you do not use accounting formulas, then you can briefly formulate the following theses:

- When the creditor is higher than the debtor, the company does not have enough of its own finances. There are some apparent stability issues. But at the same time, other company resources are also taken into account.

- If the debtor is several times higher than the creditor, then the company is economically healthy, reliable and solvent.

It is important to remember that a significant bias in either direction is unfavorable for a stable business.

How to Create an Accounts Receivable Management System

A system for managing different types of accounts receivable can be considered effective if it allows you to cope with the following tasks:

- formalize and update effective trade and procurement policies that will increase the company’s profitability while maintaining an acceptable level of risks;

- maintain a balance between receivables and liabilities funding them;

- highlight priorities in terms of production volumes and assortment;

- generate and timely update forecasts for the receipt of funds;

- reduce various types of costs for supporting purchases and sales.

Stage 1. Determining the rules of the game.

This stage consists of the following sequence of actions:

Preparation of regulations regarding:

- commercial sales lending (providing deferments to various types of buyers by type of goods);

- commercial advance of purchases (making advance payments to various groups of suppliers by type of purchase).

Almost always, early payment is associated with a discount; for this reason, it is more profitable for buyers to buy in advance, and sellers prefer to ship on credit. Even the incomparability of the cost of such financing of counterparties and the price of attracted loans does not become a serious argument. The fact is that bank interest is not taken into account in EBITDA, and managers motivated by such an indicator are ready to resist to the end.

Step 2.

Personalization of responsibility for compliance with regulations, which allows you to assign a separate manager to each counterparty, as well as assign a responsible department representative for each process. When we talk about a manager, we mean the manager of the sales/purchasing department (OP/PD), and the divisions discussed include the financial department (FD), commercial department (CD), legal service (US) and security service (SB). In this case, accounting is included in the FD.

In real business, a division of responsibility is often used, in which responsibility for sales and collection of receivables is borne by different departments whose goals are opposed to each other.

Step 3.

Definition of liability for violation of regulations at two levels:

- internal measures require personnel to be held accountable for non-compliance with procedures;

- external measures, that is, penalties for counterparties for violating the terms of the agreement.

Step 4.

Motivation to comply with regulations. Reducing various types of receivables is not always possible only through penalties. This approach can not only maintain existing delays, but also reduce the motivation of the company’s staff and partners. This means that, in addition to measures of responsibility, it is worth forming principles of motivation. In practice, the following solutions have proven their effectiveness:

- the amount of remuneration depends on the performance of employees in working with different types of receivables;

- counterparties understand how much more profitable cooperation awaits them if agreements are strictly observed.

Step 5.

Propaganda and explanation of the “rules of the game”. Employees and contractors will comply with regulations only if they understand them and feel like active participants. Otherwise, they will act as formal executors, working under the threat of sanctions or in anticipation of benefits. If you manage to create the most understandable and transparent system, managers themselves will remind counterparties about the timing of debt repayment. Another advantage of this situation: you will see how professionally your specialists cope with the preparation of primary documentation.

Sometimes ideas coming from staff (“from below”) or from interested partners (“from the side”) are the best tools for proactively preventing problems or “expanding” complex types of receivables.

Stage 2. Planning indicators.

Tactical planning is the definition of general principles for working with products and contractors for a specific period of time. Tactical principles of debt formation should be aimed at achieving direct and indirect types of goals of the enterprise for a specific period. The first type includes growth in profit, turnover, market share, and the second type includes political, image goals, etc.

Operational planning refers to the establishment of limits (standards) and working conditions for specific partners and assortment positions. Operational plans are the distribution of tactical plans across the “map” of partners. Let us explain that partners are distributed with the definition of a matrix of working conditions for each of the segments.

Segmentation has to be carried out because not all partners are equally interesting and significant for the company from an economic point of view. Effective division into types requires the identification of criteria that reflect the characteristics of the business, as well as the inherent risks of it and its counterparties according to the following parameters:

- economic – solvency and discipline of the partner, his share in turnover and profit, financial terms of interaction, etc.;

- marketing – the possibility of testing a new range, impact on brand recognition and attractiveness, etc.;

- others, capable of identifying types of partners, in accordance with various principles of interaction; this may be the scale of the business, geography of development, history of relationships, whether the counterparty belongs to a specific field of activity, the presence of specific risks, etc.

We note that the level of detail should not significantly complicate or increase the cost of initial planning and further support of cooperation with partners. Therefore, three types of basic techniques are usually used:

- ABC analysis, which allows you to assess the prospects of customer and assortment policies;

- XYZ analysis, the purpose of which is to classify counterparties based on the stability of turnover and the accuracy of forecasting their dynamics;

- partner analysis to assess direct and indirect benefits from different perspectives.

For each segment, an attractiveness rating and a policy for working with this type of counterparty should be established.

Among the goals of segmentation, it is worth mentioning not only increasing profits and solving marketing problems, they also include diversifying debtors to reduce the level of financial risks. The latter are usually caused by non-payment by a monopoly customer or problems in a particular market sector. If a company periodically makes advance payments to counterparties that are too large, it is necessary to calculate different types of risks and their possible consequences. Sometimes a potential loss can cause a company to go bankrupt, in which case it is recommended to refuse a loan even if the probability of default is low.

Ideally, to optimize profitability, liquidity, risk and target marketing indicators, the company should establish the maximum allowable volume of all types of receivables in the aggregate, as well as by counterparties, their segments, individual assortment and purchasing positions.

When a list of conditions has been prepared and methods for assessing risks have been selected, you need to move on to planning (forecasting and limiting) the volume of uncollected debt on time and the procedure for working in this case. Including its timely assessment, sale and write-off with further compensation for losses by including them in the price of goods sold on a deferred basis, or in a discount on values purchased on an advance payment basis.

Next, a system of penalties is created, which should not scare off reliable counterparties, but at the same time motivate them to fulfill their obligations and compensate for potential financial losses and lost profits.

Stage 3. Operational work.

This stage is associated with constant verification of compliance with regulations and agreements; in addition, monitoring of key indicators and the dependence of the financial stability of the company on the current and forecast amount of debt is mandatory.

Operational work involves simultaneous solution of four tasks:

1. Preventing the unreasonable formation of problem debts is the main goal of working with different types of receivables and the factors that determine their level. To do this, they predict the status of debt by amounts and partners, create and maintain up-to-date registers of actual debt, and prepare the basis for the following actions:

- encouraging timely payment (delivery) by a counterparty with a deteriorating rating through additional incentives;

- restructuring/extension of debt to partners if there are objective reasons;

- blocking shipments (purchases);

- reduction in line size/refusal to provide a deferment (advance);

- a requirement to repay the debt early or return the advance, provided that this is possible under the terms of the contract;

- refinancing using factoring, barter, offset, drafting a bill, etc.

2. Preventing the aging of debts that were not closed within the prescribed period. In addition to the actions already indicated, you can resort to penalties, transfer the case to court proceedings, or assign the debt to specialized organizations.

3. Monitoring the level of effectiveness of the purchasing and sales policies used. To do this, additional income from the presence of “receivables” is compared with the cost of its funding, taking into account the risk premium.

4. Liquidity management. If problems with short-term liquidity become noticeable in the company, you can offer partners discounts for early payment or the opportunity to refinance current debts through factoring or using other instruments. Unplanned excess resources can be used to advance purchases, but this is done only subject to an additional reduction in purchase prices or other benefits for early payment.

Stage 4. Audit of the “rules of the game”.

It is quite logical that without timely updating and addition, existing regulations will not bring the desired result. Amendments to these documents may occur when:

- detection of errors (shortcomings), “blank spots”;

- changes in internal settings and conditions;

- changes in the external environment.

As practice shows, some problems and situations not initially specified in the regulations can be included after some time. Typically, documents forget to write about three categories of problems:

- random double payments;

- technical overpayments (for example, due to refusal of part of the supply after making an advance);

- excessively early transfer of payment at the request of a procurement department manager appropriately motivated by the partner.

Sometimes the buyer complies with the delivery payment schedule, but is in no hurry to repay the debt, for example, for joint participation in a promotion, and as a result this debt turns out to be “orphaned”. Each such case must be carefully considered in order to amend the regulations and prevent the repetition of mistakes.

Types of receivables

Accounts receivable are classified according to several criteria. From an accounting point of view, attention is paid to the period during which debts will be repaid. According to this criterion, the following are distinguished:

- Short-term or current receivables. Its repayment period is less than 12 months. If the debt was initially long-term, but gradually its term became less than a calendar year, it will be transferred to the current category.

- Long-term. Accounts receivable belongs to this category if the counterparty, according to the terms of the agreement, settles with the company no earlier than 12 months in advance.

According to the type of payment, receivables are:

- Urgent, real or normal debts , when the maximum payment period specified in the agreement has not expired.

- Overdue obligations arise when the counterparty fails to fulfill its obligations on the date specified in the contract. Within this type, a distinction is made between doubtful and bad debts.

Doubtful and bad receivables

doubtful until the payment period has expired. If there is no specific date in the agreement with the counterparty, then it is determined subjectively based on the nature and content of similar transactions. In addition, a debt can be recognized as doubtful not only based on the date, but when information about the financial difficulties of the counterparty was published in the media or other sources. As soon as suspicions arise that a receivable may become dubious, accounting begins to form reserves for it.

hopeless when the company has no chance of repaying it. This happens in two cases:

- The statute of limitations has expired . The period is calculated from the date when the delay began from the date of fulfillment of obligations by the debtor. The maximum period is 3 years.

- The obligation cannot be fulfilled . For example, a company was declared bankrupt and excluded from the register of legal entities. But if the debtor is an individual entrepreneur, then even after deregistration he continues to be liable for debts with his property. The individual entrepreneur's debt will be considered uncollectible if he begins personal bankruptcy proceedings and the bailiffs will have nothing to collect debts from.

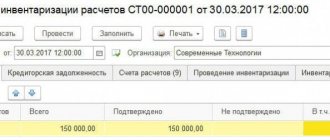

Very rarely does a receivable immediately become uncollectible. Usually the process starts with doubt. The company decides how to form a reserve for doubtful debts after conducting an inventory.

Debt quality assessment

The main parameters on the basis of which a loan can be structured in order to assess its quality are normality/overdue, “age”, risks of non-repayment and repayment period. Based on these characteristics, it is divided into the following types.

In relation to maturity:

- Urgent or normal (the maturity date has not yet arrived).

- Overdue, can also be divided into categories based on the duration of the delay in days. For example: up to 30, from 31 to 60, from 61 to 90, more than 90.

A finer division helps assess the risks of non-repayment: the longer the debtor delays payment, the less likely he is to repay the debt. The statute of limitations for the collection of overdue debt is limited and is three years (Article 196 of the Civil Code of the Russian Federation). The countdown begins from the date when the organization learned of non-payment (for example, the day following the day of payment under the agreement.

If the debt is regulated by an agreement that does not specify a repayment period, then the statute of limitations must begin to count 30 days after the request to repay the debt is presented, and it should not be more than 10 years from the moment the debt arose (Clause 2 of Article 200 of the Civil Code of the Russian Federation ).

By probability of return:

- Reliable: not expired or confirmed by a reliable counterparty or provided with a guarantee.

- Doubtful: one that may not be repaid at all or in full. Usually it is overdue and not secured by a pledge, guarantee or bank guarantee (clause 1 of Article 266 of the Tax Code of the Russian Federation), but even if the company learns from any sources about the financial difficulties of the counterparty, its debt should also be considered doubtful. Once the collection period has expired, it becomes hopeless.

- Hopeless: one that cannot be recovered. It may be overdue with an expired statute of limitations, or recognized as such by a court decision (for example, in the event of bankruptcy of a debtor, when the remaining funds went to creditors of the previous priority), or relate to an organization that has already been liquidated (clause 2 of Article 266 of the Tax Code of the Russian Federation). An exception for the third case is the debt of an individual entrepreneur: even after exclusion from the register, he is liable for his obligations with his property (Article 24 of the Civil Code of the Russian Federation), unless the court declared him bankrupt.

By maturity:

- Short-term or current (on the balance sheet it refers to quickly realizable assets, group A2): repayment is planned within a year (you can also separately highlight debts that will be paid during the quarter and month).

- Long-term (on the balance sheet refers to slowly selling assets, group A3): repayment is expected in more than 12 months. When the repayment period for long-term debt becomes less than 1 year, it becomes classified as short-term.

The degree of liquidity can also be assessed not only using a formula, but also using manual grouping:

- A loan with a maturity of up to 30 days is highly liquid.

- Hopeless - illiquid.

- The rest is medium liquid.

For those components of accounts receivable that, due to the specifics of the enterprise’s activities, are quite large in size, you can create separate lines in the balance sheet so that it shows a more complete picture of the financial condition of the business. Also, reflection of categorization in reporting is required when maintaining accounting under IFRS.

By default, the item in the balance sheet is the same for all accounts receivable (“Trade and other receivables”), but either in the “receivables” disclosure or in the financial risk management disclosure, it is necessary to separate financial and non-financial debt (usually payments to suppliers for goods not yet received )

Ways to reduce doubtful and hopeless receivables

Every entrepreneur faces a dilemma: to hold up funds in receivables or miss out on profits by refusing potential clients. Therefore, it is important to determine in advance the maximum amount of receivables, taking into account the cost of borrowed funds that will need to be taken before the debtors are settled. In addition, do not miss the point that not all counterparties can be financially disciplined. And also include the possibility of force majeure and other unforeseen delays when crediting funds.

To minimize the risks of doubtful and bad debts, you can use the following tools:

| Name | Description |

| Advance payments | If all contracts provide for 100% prepayment, then most of the receivables will not be generated. The downside is that not all clients are ready to work according to this scheme, and this will directly affect profits and lost benefits. This option is only suitable for monopolists or areas where there is very little competition. |

| Securing the deal | The security may be a pledge, surety or bank guarantee. In case of violation of contractual obligations, the guarantor assumes obligations to fulfill settlements. Or the supplier's collateral becomes at the disposal of the enterprise. |

| Letter of Credit | With this settlement option, the bank takes part in the transaction and issues the letter of credit. The money does not go directly to the seller, but to a special bank account. After this, the bank informs the supplier about the crediting of funds, and he ships the goods or provides the service. When the supplier provides documents on the fulfillment of obligations to the bank, he receives a settlement. The letter of credit form of payment protects the interests of both the seller and the buyer, but you will need to pay a third party for the service - the bank. |

To reduce risks, before concluding a contract, you should conduct an examination of the counterparty:

- check the condition of fixed assets and the level of solvency of the partner;

- find out information about the company and its authority in the field;

- check inclusion in the state register;

- on the FSSP website, monitor for the presence of initiated cases and enforcement proceedings against the company;

- find out all available information about the manager and financially responsible persons.

In addition, it is important to pay attention to those representatives of the counterparty who sign the agreement. Check their powers and rights to take such actions so that the transaction is legal.

What to do with problem receivables

When the debt has already been classified as a doubtful receivable, all is not lost for the company that is owed. First of all, you should start the process of systematic work to collect the debt. Legal methods consist of the following steps:

- The first step is for the debtor to declare his company bankrupt. This development of events is not suitable for all businessmen. A complaint filed by a debtor to the tax service stimulates regulatory authorities to increase their attention to the debtor company. In some cases, this leads to faster settlement of doubtful accounts receivables.

- Sell the receivable to a collection agency. The amount that will be paid upon redemption rarely exceeds 30-50% of the total debt. But if the company is desperate to get its money back, then this approach will help reduce the losses incurred.

- File a lawsuit. In this case, the term of the debt should not exceed 3 years from the date of occurrence. The case is considered from 2 to 6 months.

- At the next stage, work takes place with bailiffs who help return the receivable.

- Contacting the debtor's bank. When a court decision is made, the bank is obliged to fulfill it. If there is money left in the debtor’s accounts, it will be used to pay off obligations.

- If nothing helps and the receivable remains, then all that remains is to write it off at the expense of your own created reserve.

Another way to minimize the risk of non-collection of receivables is to insure them. The insurance contract specifies the conditions of the insured event, the rules for assessing the solvency of the supplier and other points that will help regulate the actions of the parties.

5 / 5 ( 1 voice )

about the author

Klavdiya Treskova is an expert in the field of financial literacy and investment. Higher education in economics. More than 15 years of experience in banking. He regularly improves his qualifications and takes courses in finance and investments, which is confirmed by certificates from the Bank of Russia, the Association for the Development of Financial Literacy, Netology and other educational platforms. Collaborates with Sravni.ru, Tinkoff Investments, GPB Investments and other financial publications. [email protected]

Is this article useful? Not really

Help us find out how much this article helped you. If something is missing or the information is not accurate, please report it below in the comments or write to us by email

Comments: 0

Your comment (question) If you have questions about this article, you can tell us. Our team consists of only experienced experts and specialists with specialized education. We will try to help you in this topic:

Author of the article: Klavdiya Treskova

Consultant, author Popovich Anna

Financial author Olga Pikhotskaya