Postings

Application for withdrawal To leave the LLC, the founder (participant) must submit to the organization a written

When you need the OS-16 form Unified OS-16 form, approved by Decree of the State Statistics Committee of the Russian Federation dated January 21, 2003 No.

Receiving an award is always a pleasant event. And if this bonus is based on the results of work for the year,

Basic concepts and procedure for submitting a declaration Tax period is a calendar year. Tax return

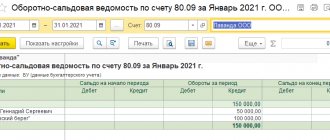

Authorized capital is the assets of the organization, which the founders of the LLC contribute after state registration. Minimum

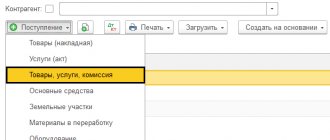

The essence and advantages of a commission agreement A commission agreement is a fairly popular phenomenon in Russian business,

When joining an SRO, a construction company undertakes to pay an entrance fee and transfer funds

Basic rules for filling out form M-4 Since 2013, this form is not strictly

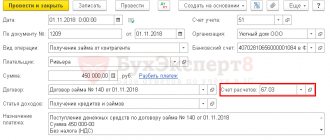

Step-by-step instructions November 01 The organization received a loan from a counterparty in the amount of 450,000 rubles.

A business transaction in accounting is... A business transaction in accounting is