Postings

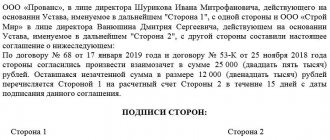

Conditions under which offset can be carried out Offset allows you to pay for goods or services received in

How to arrange the gratuitous transfer of goods Each operation in the course of business activities, including

The property rights of the enterprise are extremely extensive. A company's capital may include both material and

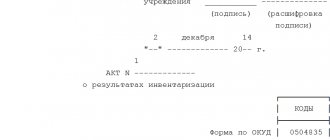

The mechanism of passage It all begins with the order of the head (form INV-22) to begin this procedure.

Why is this necessary? According to Russian legislation, all taxpayers are required to pay their taxes in a timely manner and in full.

What we pay for Membership fees are calculated and paid in accordance with Federal Law No.

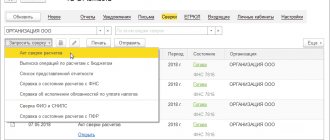

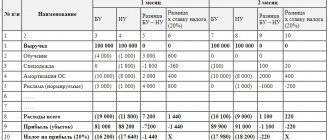

Which accounting accounts are involved in the postings? All tax calculation transactions are displayed by credit

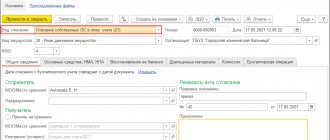

How to form authorized capital in 1C 8.3 Cash, various property (buildings, equipment

2020-11-20 5064 For the first time, people began to think about how much it costs them to create those

What property is classified as fixed assets when reflected in the balance sheet? Accounting rules for this category