Each taxation system has its own list of taxes, which taxpayers are required to remit within the established time frame. They are accrued based on the results of tax periods: for some it is a month, for others it is a quarter, and for others it is a year. Some fees require advance payments. Let's consider the main transactions for calculating taxes and their subsequent transfer to the budget.

Salary in accounting

The accrual and payment of wages, as well as deductions from it, are reflected in account 70 “Settlements with personnel for wages”.

This follows from the chart of accounts approved by order of the Ministry of Finance of Russia dated October 30, 2000 No. 94n. When calculating salaries, the accountant uses the credit of account 70. When paying wages, when withholding personal income tax, alimony and other things, the accountant uses the debit of account 70. Analytics on account 70 must be maintained for each employee of the company.

Insurance premiums should be reflected in account 69 “Calculations for social insurance and security”, and personal income tax - in account 68 “Calculations for taxes and fees” subaccount “Personal Income Tax”.

Fill out and print your balance sheet using the current form for free

Accounting policy settings for income tax

Each enterprise must develop an accounting policy regarding profit taxation that fully takes into account the specifics of its activities.

Read more Income tax accounting policy designer

Setting up accounting policy parameters for income tax in 1C 8.3 is carried out in the Main section - Settings - Taxes and reports - Income Tax tab.

Learn more about each setting

Payroll posting dates

The payroll entry for a particular month is dated to the last day of that month.

The date of postings for accrual of advance payment depends on what method of calculation is accepted in the organization. There are two options:

- The advance is equal to wages for the time actually worked in the first half of the month. In this case, as a rule, reserve deductions are made equal to the amount of personal income tax, alimony, etc. The advance accrual posting is created at the end of the first half of the month for which it was accrued (for example, February 14 or September 15). Then they make postings on reserve deductions.

- The advance is equal to a fixed amount, which is calculated as a percentage of the employee’s monthly salary (for example, 40%). With this option, there is no need to create a separate entry for accruing the advance payment. Only the salary accrual entry is made for the entire month, dated the last day of this month (for more details, see: “Salaries for the first half of the month: how to calculate the advance and what amounts to withhold from it”).

Calculate advance and salary taking into account all current indicators

Postings for accrual and withholding of personal income tax, for writing off reserve withholdings, for calculating insurance premiums and withholding alimony are usually made on the last day of the month for which wages are accrued. And postings for the payment of advance payments and wages, for the transfer of personal income tax and contributions - on the day when the money is debited from the account or issued from the cash register.

How to calculate income tax in 1C

During the tax period, business transactions are reflected in 1C 8.3. When performing the Month Closing procedure, transactions will be automatically generated to determine the financial result and calculate income tax in 1C.

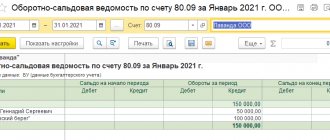

Financial result and accrual of income tax - postings in 1C 8.3

If a profit is made based on the results of the tax period, the following transactions are generated in 1C 8.3:

- Dt 99.01.1 Kt 68.04.1 - income tax charged.

If a loss is received based on the results of the tax period, then the following transactions are generated in 1C 8.3:

- Dt 99.01.1 Kt 68.04.1 (reversal) - income tax adjusted.

Do not forget to check tax accounting in 1C 8.3 using the report Analysis of accounting for income tax : section Reports - Analysis of the report - Analysis of accounting for income tax.

Types of postings for salaries and taxes

Payroll

In accounting, personnel wages are expenses for ordinary activities (PBU 10/99 “Organizational Expenses”).

Manufacturing companies reflect wages in the debit of accounts: 20 “Main production”, 23 “Auxiliary production”, 26 “General business expenses”, 29 “Service production and facilities”. Trading companies - in the debit of account 44 “Sales expenses”.

When calculating salaries, the following entries are made:

DEBIT 20 (23, 26, 29, 44) CREDIT 70 - the salary of such and such employee has been accrued

REFERENCE. When calculating an advance calculated as salary for the first half of the month, you need to make the same entries as when calculating salaries at the end of the month.

Reserve deductions from wages for the first half of the month

Organizations in which the advance is equal to the salary for the time actually worked in the first half of the month often make reserve deductions in an amount equal to the amount of personal income tax, alimony, etc. They are shown in the debit of account 70 and the credit of account 76 “Settlements with various debtors and creditors” for the corresponding subaccount.

When making backup deductions, the following postings are made:

DEBIT 70 CREDIT 76 subaccount “Reserve deductions for personal income tax” - reserve deduction of personal income tax from the salary of such and such employee

DEBIT 70 CREDIT 76 subaccount “Reserve deductions for alimony” - reserve deduction of alimony from the salary of such and such an employee

Deductions from wages: personal income tax, alimony, etc.

When withholding personal income tax, the following entries are made:

DEBIT 70 CREDIT 68 subaccount “NDFL” - personal income tax is withheld from the salary of such and such employee

When alimony is withheld, the following entries are made:

DEBIT 70 CREDIT 76 subaccount “Alimony payments” - alimony is withheld from the salary of such and such an employee

For other deductions, use the credit of the account appropriate for the specific situation.

If the advance is equal to the salary for the time actually worked in the first half of the month, and reserve deductions were made, then at the end of the month they must be written off.

When writing off reserve deductions, the following entries are made:

DEBIT 76 subaccount “Reserve deductions for personal income tax” CREDIT 70 - reserve deductions for personal income tax of such and such employee are written off

DEBIT 76 subaccount “Reserve deductions for alimony” CREDIT 70 - reserve deductions for alimony of such and such employee are written off

Calculation of insurance premiums

Like wages, insurance premiums in accounting are classified as expenses for ordinary activities. The accrual of contributions is reflected in the debit of accounts 20 (23, 26, 29, 44) and the credit of account 69 in the corresponding subaccount (subaccounts are opened by type of insurance).

IMPORTANT. In the posting for calculating insurance premiums, account 70 is not involved. This is because contributions are not included in wages and are not deducted from it.

When calculating contributions, the following entries are made:

DEBIT 20 (23, 26, 29, 44) CREDIT 69 (sub-account by type of insurance) - insurance premiums have been accrued.

Payment of advance and salary

The advance payment, as well as the accrued salary minus personal income tax, alimony and other deductions, is given to the employee. If an employee receives money at the cash desk, a credit entry is made to account 50 “Cashier”. If money is transferred from an organization’s current account to an employee’s card, a credit entry is made to account 51 “Current accounts”.

When paying an advance and salary, the following entries are made:

DEBIT 70 CREDIT 50 - an advance (salary) was issued from the cash register;

DEBIT 70 CREDIT 51 - advance payment (salary) is transferred from the current account.

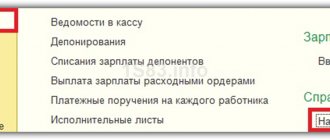

Transfer of personal income tax and contributions

The organization must transfer personal income tax to the budget no later than the day following the day the salary is paid (clause 6 of Article 226 of the Tax Code of the Russian Federation). Insurance premiums for a particular month should be transferred no later than the 15th day of the next month (clause 3 of article 431 of the Tax Code of the Russian Federation; part 4 of article 22 of the Federal Law of July 24, 1998 No. 125-FZ).

When transferring personal income tax and contributions, the following entries are made:

DEBIT 68 (69 corresponding subaccount) CREDIT 51 - personal income tax (insurance contributions) is transferred

Calculate salary, contributions and personal income tax in the web service

Payment of tax for a counterparty: transactions

Starting from 2022, not only the taxpayer himself can transfer taxes and fees personally, but also someone else on his behalf (Clause 1 of Article 45 of the Tax Code of the Russian Federation).

In the letter of the Federal Tax Service of Russia dated January 25, 2018 No. ZN-3-22 / [email protected] it is noted, in particular, that Art. 45 of the Tax Code of the Russian Federation does not provide for restrictions regarding the transfer of payments to the budget system of the Russian Federation.

Thus, legal entities can transfer taxes from their account to other organizations, and managers (owners) have the right to pay off the company’s tax obligations from their own funds.

And this rule applies not only to taxes, but also to fees, penalties, fines, and insurance premiums. And it also applies to payers of fees, tax agents and a responsible participant in a consolidated group of taxpayers.

At the same time, for the purposes of accounting by tax authorities of receipts of payments paid by other persons, it does not matter on what civil law grounds the corresponding payment was transferred for the taxpayer.

It is quite enough that payment documents for tax transfers make it possible to identify that the corresponding amount was paid for a specific taxpayer.

By virtue of the Rules for indicating information in the details of orders for the transfer of funds for payment of payments to the budget system of the Russian Federation (approved by order of the Ministry of Finance of Russia dated November 12, 2013 No. 107n), when paying taxes by another person, it is necessary to indicate in fields 60 “TIN”, 102 “KPP” the value of the TIN and KPP of the payer for whom the tax is paid (if the tax is paid for an individual, then “0” is indicated in the “Taxpayer KPP” field).

When filling out field 24 “Purpose of payment”, you must indicate the TIN and KPP of the organization that transferred the tax (fee), and through a double fraction (“//”), the details of the organization for which it was paid.

When filling out the “Payer” field, you must provide information about the person who issued the payment order.

But the Russian Ministry of Finance drew attention to the fact that relations arising between a taxpayer and another person who paid taxes for him are regulated by civil law (letter dated June 28, 2017 No. 03-03-06/1/40668). The rights of the creditor under the obligation are transferred to the third party who has fulfilled the debtor’s obligation (Article 313 of the Civil Code of the Russian Federation).

In other words, debt obligations may arise between them in this case. Another person who made the payment for a taxpayer-organization will therefore not incur an expense. A debt obligation arises. The organization that paid has accounts receivable, the one for which they paid has accounts payable. You should also take into account that not only a new debt may arise, but also an old one that arose earlier may be repaid.

Let's consider a real situation, just the other day, discussed on the site's forum.

We received the goods on the terms of subsequent payment. A few days later, the seller received a letter with a request to pay off part of the debt not by transferring to the current account specified in the contract, but by paying off the debt for, for example, transport tax (or, say, personal income tax). And specific amounts and details of the tax office are indicated.

This may be due to the fact that, for example, the seller has some problems with the bank where he has this account opened, and late payment of the debt threatens the accrual of penalties.

Acceptance of goods for accounting was reflected by the buyer with the entry:

Debit account 10 Credit account 60.

The fact that partial repayment of accounts payable will be made by transferring money to the budget does not impose any additional obligations on the buyer.

It will reflect the repayment of debt to the supplier, and nothing more:

Debit account 60 Credit account 51.

The seller, having shipped the goods, made the following posting:

Debit account 62 Credit account 90-1.

When he receives information from the buyer that the debt to the budget has been repaid, the entries will be:

Debit account 76 Credit account 62;

Debit account 68 Credit account 76.

That is, money was received into the budget, but not from their current account, but from the debtor. And now no one owes anyone anything. Well, or I still owe, but less.

Here we looked at a fairly simple situation in which there are no pitfalls.

The creative director (if he is also the owner) may try to concoct some cunning scheme: - let the buyer pay the tax for my wife, an individual entrepreneur, who is having financial problems, and the deadline for paying the tax for six months has come (or there for 9 months).

But this option most likely will not work. The LLC’s money is not yet the founder’s own money. He can pay off his wife’s debts to the budget, but only from his personal funds (from his current account). And since she is not bound by any obligations with the company’s debtor, he will in no way be able to pay off her payments.

Although, if you really want to, you can come up with something here too. But that will be a different story.

Hello Guest! Offer from "Clerk"

Online professional retraining “Accountant on the simplified tax system” with a diploma for 250 academic hours . Learn everything new to avoid mistakes. Online training for 2 months, the stream starts on March 1.

Sign up