Payment of state duty

Payment of state duty by a legal entity and individual entrepreneur must be taken into account in their expenses.

VAT

The state duty is a set fee, not a service. Therefore, VAT is not charged on it.

Income tax

Under the general taxation system, for the purposes of calculating income tax, the state duty paid to the budget in connection with the implementation of activities by a legal entity is recognized as an expense (clauses 1 and 40, clause 1, article 264, clause 22, clause 1, article 346.16 of the Tax Code of the Russian Federation ).

However, if payment is made in connection with the organization’s acquisition of any object (vehicle, real estate), it is included in expenses only if paid after the object is put into operation.

If the state duty was paid before this moment, it is included in the initial cost of the object (fixed asset) when it is registered on the balance sheet (Letter of the Ministry of Finance of Russia dated July 24, 2018 No. 03-03-06/3/51800).

Expert opinion

Lawyer Alexander Vasiliev comments

The state fee paid when going to court is taken into account as an expense at the time the court accepts the statement of claim as a non-operating expense (Letter of the Ministry of Finance of Russia dated December 22, 2008 No. 03-03-06/2/176).

Direct and indirect costs: the eternal problem of an accountant

Once again I read Yaroslavna’s latest lament on the forum: “How can I not show losses in my income tax return?” And involuntarily I came to the conclusion that the main principle of the Bolsheviks: first create difficulties for yourself, and then heroically overcome them, has not yet been forgotten by the Soviet Russian accountant and is successfully applied by him.

After all, even if not half, but a third of organizations receive losses for profit tax purposes due to the fact that indirect expenses are written off monthly, and sales of products (works, services) often do not occur every month, or even not every quarter.

Although for almost a decade and a half (since 2005), the list of direct expenses that are included in the cost of manufactured products (work performed, services provided) has been open, and the organization determines it independently (clause 1 of Article 318 of the Tax Code of the Russian Federation).

And other expenses that the organization itself has not recognized as direct will be considered indirect.

I suspect (although I could be wrong) that many colleagues are still captivated by the belief that the terms “direct and indirect costs” have the same interpretation, both in accounting registers and for profit tax purposes.

Let us recall that in accounting (Instructions for the use of the chart of accounts for accounting financial and economic activities of organizations, approved by Order of the Ministry of Finance of Russia dated October 31, 2000 No. 94), direct costs are understood as costs directly related to the production of products (performance of work, provision of services), and included in the cost of accounting units of manufactured products (work performed, services provided) on the basis of primary accounting documents.

Thus, direct expenses, in particular, are recognized as:

- wages of production personnel, included in the cost of a unit of production (work, services) on the basis of work orders, time sheets and other primary documents for labor accounting and payroll;

- materials included in the cost according to write-off acts;

- services (work) of co-executors (subcontractors), included in the cost price on the basis of acceptance certificates for the provision of services (results of work).

The accountant’s task when reflecting direct expenses is to receive such a primary document and include the cost of resources indicated in it in the cost of a unit of production (work, services).

If this primary document contains only natural indicators (pieces, kilograms, meters, etc.), the accountant additionally needs to evaluate the indicators given to him in monetary terms - put the pieces in rubles.

Indirect costs (expenses) that an organization incurs in connection with the simultaneous production of several types of products (works, services) are included in the cost of each of them by some calculation method, according to the economically feasible methods chosen by the organization.

This point of view is supported, in particular, by the Modern Economic Dictionary (Raizberg B.A., Lozovsky L.Sh., Starodubtseva E.B.M. INFRA-M., 2011), according to which indirect costs are costs associated with production several types of products, included in their cost not directly, but indirectly, using special calculations, in accordance with economically sound coefficients.

The Methodological Recommendations for the application of the Chart of Accounts for accounting financial and economic activities of enterprises and organizations of the agro-industrial complex, approved by Order of the Ministry of Agriculture of Russia dated June 13, 2001 No. 654, also states that indirect production costs are a set of costs associated with production that cannot (or economically inexpedient) taken into account and directly attributed to specific types of products. Therefore, they are accounted for in separate accounts and distributed by type of product by calculation.

Thus, it is quite difficult to give an unambiguous definition of direct and indirect costs (expenses) for all organizations, regardless of the type of their activities. Some costs for one organization can be considered direct, while for another they should be considered clearly indirect.

With regard to the costs of maintaining management personnel, as well as costs associated with sales (commercial expenses), the organization has the right to choose (clause 9 of the Accounting Regulations “Costs of the Organization” PBU 10/99, approved by order of the Ministry of Finance of Russia dated 05/06/99 No. 33n).

They can be included in the cost of each type of product (work, service), distributed according to a selected economically justified indicator, for example, the amount of direct costs incurred. The organization also has the right on a monthly basis, regardless of the fact of sales of products (works, services), to write off all administrative and commercial expenses as a reduction in the financial result, without distributing them to the cost price. The option chosen by the organization to write off administrative and commercial expenses must be enshrined in its accounting policies.

And once again I would like to draw your attention to the fact that an organization can write off monthly not all indirect expenses, but only administrative and commercial ones.

For profit tax purposes (clause 1 of Article 318 of the Tax Code of the Russian Federation), production costs for the sale of goods (products, works, services) are also divided into direct and indirect.

But the same terms have a completely different meaning.

Direct expenses (clause 2 of Article 318 of the Tax Code of the Russian Federation) are included in the cost of goods (products, works, services) and reduce taxable profit as they are sold.

Indirect - monthly, regardless of the fact of sale, they are written off to reduce taxable profit (the same clause 2 of Article 318 of the Tax Code of the Russian Federation).

The organization makes the distribution of expenses for direct and indirect ones independently, enshrining it in the accounting policy (clause 1 of Article 318 of the Tax Code of the Russian Federation).

Thus, for profit tax purposes, the terms direct and indirect expenses mean the moment at which they are attributed to the reduction of profit - upon sale (direct) or monthly (indirect). Whereas in accounting registers - the method of inclusion in the cost price , directly or indirectly (calculated).

When drawing up accounting policies for accounting purposes, the division of expenses into direct and indirect does not make any sense.

This does not depend on the will of the leadership. In addition, as mentioned above, during the year some types of costs may be recognized first as direct and then indirect, or vice versa. But when choosing a method for writing off part of indirect expenses, that is, administrative and commercial, you need to approach it with great care.

At first glance, the monthly write-off of management expenses to reduce the financial result is more convenient and profitable for the organization.

- Firstly, the work of calculating the cost of products (works, services) is simplified. There is no need to distribute the costs of maintaining management personnel between types of products (works, services).

- Secondly, the monthly write-off of these expenses allows you to optimize financial flows when calculating income taxes.

However, such a point of view has the right to exist in the case when the organization has a stable market for its products (works, services).

In this case, with regular revenue, monthly write-off of management expenses (without including them in the cost price) will give almost the same result as the opposite option, that is, including management costs in the cost price. However, for the majority, in the current very difficult economic situation, a stable sales market is a dream that does not always come true.

Manufactured products, especially if their production period is not two or three days, but more, it is still unknown when they will be sold, but all management costs are written off monthly. Losses that are likely to arise in this case may lead, in particular, to a decrease in net assets. This can be avoided by choosing an option in which management costs are included in the cost of production. And in this case, the amount of losses will be less.

The same applies to both the performance of work and the provision of services.

For profit tax purposes, the organization determines the list of direct expenses independently. It should be noted that some of the expenses that may be recognized as indirect in the accounting registers (deductions to extra-budgetary funds for the salaries of key production personnel, in particular) must be recognized as direct for profit tax purposes (clause 1 of Article 318 Tax Code of the Russian Federation).

The list of direct costs, as well as indirect ones, is open. At the same time, some organizations strive to “push” maximum costs into indirect expenses in order to save on paying income tax.

Both the Ministry of Finance of Russia and tax authorities constantly indicate (letters of the Ministry of Finance of Russia dated December 6, 2018 No. 03-03-06/1/88527, dated August 29, 2019 No. 03-03-06/1/66440, letters of the Federal Tax Service of Russia dated February 24, 2011 No. KE-4-3/ [email protected] , dated July 12, 2019 No. KCH-4-7/13613), which, indeed, the organization determines the list of direct and indirect costs independently. However, the list of indirect costs must be justified. This justification should lie in the fact that costs that are associated with the production of products (performance of work, provision of services) cannot be indirect. That is, the algorithm for distributing costs into direct and indirect costs must contain economically sound indicators determined by the technological process. It is possible to recognize costs associated with the production of products (works, services) as indirect costs only if there is no real possibility of classifying them as direct costs using economically sound indicators.

Officials protest against recognizing maximum costs as indirect costs. The opposite situation, in which costs are recognized as direct expenses, does not cause such a protest from them.

This is the first thing.

Secondly , in order not to create even greater differences between accounting and tax accounting (there are already more than enough of them), it is optimal, in our opinion, to recognize as direct expenses for profit tax purposes those costs that are included in the cost in the accounting registers products (goods, works, services) . And although they will be indirect in the accounting registers (distributed according to some calculations), for profit tax purposes they should be recognized as direct, and included in the cost price using exactly the same algorithm.

Thirdly , in modern unstable economic conditions, it is optimal, in the author’s opinion, to reduce the list of indirect expenses for profit tax purposes to a minimum . After all, as mentioned above, most companies do not have firm confidence in the regular receipt of income (sales). And with “inflated” indirect costs, most often the organization will incur losses that could have been avoided by recognizing the maximum of them (or even all) as direct. And so it turns out that the organization is initially concerned with proving to the tax authorities that the maximum costs cannot be attributed to direct expenses using economically sound indicators. Then the accounting department and management begin to rack their brains about how and where to hide the losses, since the inspectorate (albeit unofficially) refuses to accept such a declaration.

These problems can be avoided quite easily by recognizing most (and even all) management expenses in tax accounting as direct.

And then Yaroslavna’s cry: “Where to hide the costs of maintaining the organization’s apparatus in the absence of sales?” They will sound much less often.

Hello Guest! Offer from "Clerk"

Online professional retraining “Chief accountant on the simplified tax system” with a diploma for 250 academic hours . Learn everything new to avoid mistakes. Online training for 2 months, the stream starts on March 1.

Sign up

Reimbursement by the defendant

If the court makes a decision in the case in favor of the plaintiff, the defendant will be obliged to reimburse, according to the court decision, the costs incurred by the plaintiff in conducting the case, including the payment of state fees. Such compensation will be considered an expense for the defendant, and income for the plaintiff.

The date of accounting for the corresponding income and expenses for the purposes of calculating income tax will be the date of entry into force of the court decision, on the basis of which the refund of the paid state duty is made. The justification and documentary evidence of the relevant costs will be a court decision.

Accounting as part of income is carried out in accordance with paragraph 3 of Art. 250 of the Tax Code of the Russian Federation, according to which non-operating income of a taxpayer is, in particular, income in the form of fines, penalties and (or) other sanctions for violation of contractual obligations payable by the debtor on the basis of a court decision that has entered into legal force, as well as amounts of compensation for losses or damage.

Non-operating expenses, the procedure for their recognition and reflection in accounting and reporting

The list of non-operating expenses of the organization is established by paragraph 12 of PBU 10/99. This list is open, and in accordance with it, non-operating expenses may include, in particular, the following expenses of the organization:

- fines, penalties, penalties for violation of contract terms;

- compensation for losses caused by the organization;

- losses of previous years recognized in the reporting year;

- amounts of receivables for which the statute of limitations has expired, and other debts that are unrealistic for collection;

- exchange differences;

- the amount of asset depreciation;

- transfer of funds (contributions, payments, etc.) related to charitable activities, expenses for sporting events, recreation, entertainment, cultural and educational events and other similar events;

- other non-operating expenses.

Fines, penalties, penalties for violation of contract terms, compensation for losses caused by the organization .

Let us turn to the Civil Code of the Russian Federation. In accordance with Article 330 of the Civil Code of the Russian Federation, a penalty (fine, penalty) is a sum of money determined by law or contract, which the debtor is obliged to pay to the creditor in the event of non-fulfillment or improper fulfillment of an obligation, in particular in the case of delay in fulfillment. Upon a claim for payment of a penalty, the creditor is not required to prove that he suffered losses.

In accounting, fines, penalties, and penalties for violation of contractual obligations are included in non-operating expenses. This is determined by paragraph 12 of the Order of the Ministry of Finance of the Russian Federation dated May 6, 1999 No. 33n “On approval of the accounting regulations for “organizational expenses” PBU 10/99.”

Clause 14.2 of PBU 10/99 establishes that fines, penalties, penalties for violation of the terms of contracts, as well as compensation for losses caused by the organization, are accepted for accounting in amounts awarded by the court or recognized by the organization.

If the debtor admits the amount of the fine, he must pay the amount of the fine or confirm in writing his agreement to pay the fine. The Letter of the Ministry of Finance of the Russian Federation dated December 23, 2004 No. 03-03-01-04/1/189 states facts indicating that the organization agrees to pay the fines, penalties, penalties imposed by the creditor based on the terms of the agreement in full or in a smaller amount may be, for example, a bilateral act signed by the parties, a letter from the debtor or another document confirming the fact of violations of contractual obligations, allowing one to determine the amount of the amount recognized by the debtor.

If the debtor refuses to voluntarily recognize the amount of penalties for violation of the terms of the contract, the creditor has the right to file a claim with the arbitration court. When submitting an application to the court, the creditor - the plaintiff - pays the amount of the state duty, which, if the court makes a decision in his favor, is compensated by the party - the defendant.

The amount of fines, penalties, penalties paid by the organization, according to the Chart of Accounts, can be reflected in the credit of settlement accounts, for example, 76 “Settlements with various debtors and creditors” and the debit of account 91 “Other income and expenses” subaccount “Other expenses”.

Example 1.

The Vega organization shipped a consignment of goods to the Delta organization in the amount of 236,000 rubles (excluding VAT). According to the terms of the agreement, for late payment for goods, a fine of 50,000 rubles and a penalty of 0.1% for each day of delay are provided. The Delta organization did not make the payment on time, thereby violating the terms of the contract. The Vega organization filed a claim for a fine in the amount of 50,000 rubles and penalties in the amount of 3,200 rubles. The Delta organization agreed with the claim made against them.

| Account correspondence | Sum | Contents of operation | |

| Debit | Credit | ||

| 41 | 60 | 236 000 | Goods accepted for accounting |

| 91-2 | 76 | 53 200 | Received a complaint from the supplier |

| 60 | 51 | 236 000 | Payment for goods reflected |

| 76 | 51 | 53 200 | Fines and penalties listed |

End of the example.

The following should be noted regarding damages. According to Article 15 of the Civil Code of the Russian Federation, a person whose right has been violated may demand full compensation for the losses caused to him, unless the law or contract provides for compensation for losses in a smaller amount.

Losses on the basis of paragraph 2 of Article 15 of the Civil Code of the Russian Federation mean:

- expenses that a person whose right has been violated has made or will have to make to restore the violated right;

- loss or damage to his property (real damage);

- unearned income that this person would have received under normal conditions of civil transactions if his right had not been violated.

The amounts of losses reimbursed to the organization are also reflected on account 76 in correspondence with account 91-1 “Other income”.

If the organization pays the amount of penalties by court decision, then the amount of the state duty compensated to the plaintiff, which in this case will be compensation for losses caused by the organization, should be reflected in the credit of account 76 “Settlements with various debtors and creditors” and the debit of account 91 “Other income and expenses."

Losses of previous years recognized in the reporting year.

The procedure for correcting errors found in an organization’s accounting records depends on whether the annual financial statements are approved.

Let us turn to paragraph 11 of the Instructions on the procedure for drawing up and presenting financial statements, approved by Order of the Ministry of Finance of the Russian Federation dated July 22, 2003 No. 67n “On the forms of financial statements of organizations.” It states, in particular, that in cases where an organization identifies in the current reporting period an incorrect reflection of business transactions in the accounting accounts last year, corrections to the accounting and financial statements for the last reporting year (after approval of the annual financial statements in the prescribed manner) are not are being entered.

The amounts of losses from previous years identified in the reporting year on the basis of paragraph 12 of PBU 10/99 are included in the non-operating expenses of the organization.

The Letter of the Ministry of Finance of the Russian Federation dated December 10, 2004 No. 07-05-14/328 “On the reflection in the accounting records of an organization of additional income and expenses identified after the approval of the financial statements for the previous reporting year” states that if, after the approval of the financial statements for the previous reporting year, the organization has identified additional expenses related to it, then in the period during which these expenses are identified, the organization must recognize and reflect in the manner prescribed by the Instructions for the Application of the Chart of Accounts, the loss of previous years. These amounts are reflected in the income statement as non-operating expenses.

In accordance with the Chart of Accounts, the profit of previous years identified in the reporting year is reflected in the credit of account 91 “Other income and expenses” subaccount 91-1 “Other income” in correspondence with the settlement accounts.

In accordance with the Accounting Regulations “Accounting for Income Tax Calculations” PBU 18/02, approved by Order of the Ministry of Finance of the Russian Federation dated November 19, 2002 No. 114n (hereinafter referred to as PBU 18/02), the specified amounts of non-operating expenses are considered as permanent differences, which are the source of the formation of a permanent tax liability.

In the Profit and Loss Statement, the amount of additional payment of income tax due to the detection of errors (distortions) in previous tax (reporting) periods, which does not affect the current income tax of the reporting period, is shown after the current income tax indicator and forms net profit (loss ) reporting period.

Amounts of receivables for which the statute of limitations has expired.

Amounts of receivables for which the statute of limitations has expired, as well as other debts that are unrealistic for collection, according to paragraph 12 of PBU 10/99, are non-operating expenses of the organization.

The concept of limitation of actions is contained in Article 195 of the Civil Code of the Russian Federation. The limitation period is the period for protecting the right under a claim of a person whose rights have been violated. The general limitation period is established by Article 196 of the Civil Code of the Russian Federation and is three years. The limitation period begins from the day when the person learned or should have learned about the violation of his right.

Example 2.

Let's assume that a wholesale trade organization shipped goods to the buyer on November 15. According to the terms of the contract, payment for the goods must be made within ten days from the date of delivery, that is, from November 16 to 25, but payment was not received within the specified time. The limitation period in the example above will begin on November 26th.

End of the example.

Accounts receivable for which the statute of limitations has expired, as well as other debts that are unrealistic for collection on the basis of paragraph 77 of Regulation No. 34n, are written off for each obligation and are included in the financial results of the organization.

The basis for writing off amounts of accounts payable and depositors for which the statute of limitations has expired are:

- inventory data;

- written justification;

- order (instruction) of the head of the organization.

According to the Chart of Accounts, amounts of receivables for which the statute of limitations has expired are reflected in the debit of account 91 “Other income and expenses” subaccount “Other income” in correspondence with the accounts receivable.

According to clause 14.3 of PBU 10/99, receivables for which the statute of limitations has expired and other debts that are unrealistic for collection are included in the organization’s expenses in the amount in which the debt was reflected in the organization’s accounting records.

If a reserve for doubtful debts is not created, the written off debt, and in the amount in which it was reflected in the accounting records (including VAT), is included in the financial results. In accordance with paragraphs 12 and 14.3 of PBU 10/99, written off debt is included in non-operating expenses.

Moreover, in accordance with paragraph 77 of the Accounting Regulations, writing off a debt at a loss due to the insolvency of the debtor does not constitute cancellation of the debt. Within five years from the date of write-off, the amount of the written-off debt is taken into account on the balance sheet in account 007 “Debt of insolvent debtors written off at a loss”, intended to summarize information about the state of receivables written off due to the insolvency of debtors.

In accounting, this operation is reflected by the following entries:

| Account correspondence | Contents of operation | |

| Debit | Credit | |

| 91-2 | 62 (60, 76) | The amount of receivables written off as losses (including VAT) |

| 007 | The amount of written off receivables is taken into account on the balance sheet | |

If an organization creates a reserve for doubtful debts, amounts of receivables with an expired statute of limitations are written off from the reserve funds.

At the same time, the amount of debt written off is taken into account on the balance sheet. In accounting, this operation is reflected by the following entries:

| Account correspondence | Contents of operation | |

| Debit | Credit | |

| 63 | 62 (60, 76) | The amount of receivables written off against the reserve |

| 007 | The amount of written off receivables is taken into account on the balance sheet | |

When the buyer receives an amount of previously written-off debt, the amount of debt is written off off-balance sheet accounting and reflected in the non-operating income of the organization on the basis of paragraph 8 of the Accounting Regulations “Income of the organization” PBU 9/99, approved by Order of the Ministry of Finance of the Russian Federation dated May 6, 1999 No. 32n “On approval of the Accounting Regulations “Income of the Organization” PBU 9/99” (hereinafter referred to as PBU 9/99). In this case, the following entries will appear in the accounting records:

| Account correspondence | Contents of operation | |

| Debit | Credit | |

| 51 (50) | 91-1 | The amount of written off debt returned by the debtor is reflected in non-operating income |

| 007 | The amount of the repaid debt is written off off-balance sheet | |

If the organization did not have time to write off the debt, but created a reserve, and the debtor repaid the debt, the amount of the reserve must be restored. In this case, the wiring is drawn up:

| Account correspondence | Contents of operation | |

| Debit | Credit | |

| 63 | 91-1 | When the debtor repays the debt that has not been written off, the amount of the created reserve is restored |

Let's look at an example of the procedure for writing off accounts receivable.

Example 3.

In July, the organization sold goods to a buyer in the amount of 59,000 rubles, including VAT -9,000 rubles. The purchase price of the goods is 33,000 rubles, distribution costs are 11,500 rubles. The organization determines revenue for tax purposes “on payment”. In August, a debt forgiveness agreement was signed between the buyer and the creditor.

Reflection of transactions in July in the organization’s accounting:

| Account correspondence | Amount, rubles | Contents of operation | |

| Debit | Credit | ||

| 62 | 90-1 | 59 000 | An invoice was presented to the buyer for the sale price of the goods, the proceeds from the sale of the goods were reflected |

| 90-3 | 76 | 9 000 | The amount of VAT has been accrued on goods shipped but not paid for by the buyer |

| 90-2 | 41 | 33 000 | The purchase price of goods sold is written off |

| 90-2 | 44 | 11 500 | Distribution costs for goods sold are written off |

| 90-9 | 99 | 5 500 | The financial result from the sale of goods is reflected |

Reflection of transactions in August in the organization’s accounting:

| Account correspondence | Amount, rubles | Contents of operation | |

| Debit | Credit | ||

| 91-2 | 62 | 59 000 | The amount of accounts receivable was written off as a result of debt forgiveness, which is included in non-operating expenses |

| 76 | 68 | 9 000 | The tax obligation to pay VAT to the budget on the amount of receivables has been fulfilled |

End of the example.

Exchange differences .

Exchange differences in accordance with paragraph 12 of PBU 10/99 are included in non-operating expenses in the reporting period in which they arose.

Exchange rate is the difference between ruble valuations (previous and subsequent) of the corresponding asset or liability, the value of which is expressed in foreign currency.

The first ruble valuation of an asset or liability arises when recalculating its value on the date of receipt. Subsequent ruble estimates are formed when recalculating its value as the exchange rate changes, at the reporting date or at the date of fulfillment of obligations.

When a new ruble valuation of an asset or liability denominated in a foreign currency is formed, exchange rate differences arise. They are positive and negative.

If the exchange rate difference increases the organization's profit, then it is positive. If the exchange rate difference reduces the organization's profit, this is a negative exchange rate difference.

The exchange rate difference is recognized as negative and is charged to non-operating expenses:

- when the currency exchange rate in relation to assets (claims) depreciates;

- when the exchange rate of the liabilities increases.

To reflect exchange rate differences in accounting, it is necessary to apply the norms of Order of the Ministry of Finance of the Russian Federation dated January 10, 2000 No. 2n “On approval of the accounting regulations “Accounting for assets and liabilities, the value of which is expressed in foreign currency” PBU 3/2000” (hereinafter referred to as PBU 3 /2000).

Thus, the exchange rate difference is recognized as a result of changes in the official exchange rate of the foreign currency to the ruble used in the calculations:

- on the reporting date of the current period in relation to the date of the currency transaction;

- on the date of fulfillment of payment obligations in the reporting period and the previous reporting date;

- on the previous reporting date and the reporting date of the current period, when transactions in foreign currency were not carried out in this period;

- on the date of occurrence of obligations in accounting and the date of fulfillment of obligations to pay them and, if their recognition and settlement of such obligations is carried out in one reporting period.

Calculation of the exchange rate difference from the value of banknotes at the organization's cash desk and funds in accounts with credit institutions can be carried out in addition to the specified dates and as the exchange rates of foreign currencies quoted by the Central Bank of the Russian Federation change.

The exchange rate difference associated with the formation of the authorized (share) capital is recognized only on the date of receipt of the amount of foreign currency deposits from the founders or participants under simple partnership agreements.

Accounting for the results of changes in the official exchange rate of foreign currency to the ruble is determined by the nature of the foreign exchange transaction, and the exchange rate difference is credited depending on this:

- on financial results for all current operations;

- for additional capital for operations related to the formation of authorized (share) capital.

Let's consider an example of recognizing exchange rate differences with a supplier (exporter).

Example 4.

Until the transfer of ownership, the goods must be accounted for by the exporter in account 45 “Goods shipped”. To record revenue from the sale of goods sold for export, the moment of transfer of ownership of the goods from the seller to the buyer must be determined. According to paragraph 1 of Article 224 of the Civil Code of the Russian Federation, transfer is recognized as the delivery of a thing to the acquirer, as well as delivery to a carrier for shipment to the acquirer or delivery to a communications organization.

Revenue received under an export contract must be recalculated for accounting purposes into rubles on the date of transfer of ownership at the Bank of the Russian Federation exchange rate in effect on that date.

The buyer's debt for the shipped goods must be recalculated into rubles at the official rate at each reporting date, as well as at the date of repayment of the debt.

When selling goods, a VAT tax rate of 0% is applied if there is documentary evidence of the validity of its application in relation to:

- goods exported under the customs export regime;

- goods placed under the customs regime of a free customs zone;

- works (services) directly related to their production and sale;

- works (services) related to the transportation or transportation of goods placed under the customs regime of international customs transit;

- works (services) named in subparagraphs 4-9 of paragraph 1 of Article 164 of the Tax Code of the Russian Federation.

In accordance with paragraph 9 of Article 154 of the Tax Code of the Russian Federation, until the tax base is determined, it does not include amounts of payment, partial payment received on account of upcoming deliveries of goods (performance of work, provision of services), taxed at a tax rate of 0%.

According to paragraph 3 of Article 153 of the Tax Code of the Russian Federation, when determining the tax base, proceeds from the sale of goods (work, services) taxed at a tax rate of 0%, received in foreign currency, are recalculated into rubles at the rate of the Bank of the Russian Federation on the date of payment for shipped goods (work performed , services provided). This amount is reflected in the VAT return at a tax rate of 0% at the time the tax base is determined. In accordance with paragraph 9 of Article 167 of the Tax Code of the Russian Federation, the moment of establishing the tax base for the sale of goods for export is the last day of the month in which the full package of documents provided for in Article 165 of the Tax Code of the Russian Federation is collected.

To confirm the validity of applying a tax rate of 0%, a bank statement (copy of the statement) is submitted to the tax authority, confirming the actual receipt of proceeds from the sale of the above goods to a foreign person to the taxpayer’s account in a Russian bank. Moreover, from January 1, 2006, it does not matter from whom the payment is made: directly from a foreign person or from a third party. If the proceeds from the sale of goods (supplies) to a foreign person were transferred to the taxpayer’s account from a third party, along with a bank statement (a copy thereof), an agreement of authorization for payment for the above goods (supplies), concluded between the foreign person and the organization (person), is submitted to the tax authorities. who made (made) the payment.

If the organization has not collected the required set of documents, then the organization’s revenue received in foreign currency is recalculated into rubles at the rate of the Bank of the Russian Federation on the date corresponding to the moment of determining the tax base for the sale (transfer) of goods (work, services), property rights, established by Article 167 Tax Code of the Russian Federation (clause 3 of Article 153 of the Tax Code of the Russian Federation).

On the date of shipment, the foreign currency exchange rate of the Bank of the Russian Federation may be less than the foreign currency exchange rate on the date of payment for shipped goods (work, services). In this case, the tax base must be increased in accordance with paragraph 2 of Article 162 of the Tax Code of the Russian Federation by the amount of increased income or amounts otherwise associated with payment for goods (work, services) sold.

For export transactions, a special procedure for applying VAT deductions has been established. VAT amounts can be claimed for deduction only in the tax period in which the validity of the application of such a rate is documented (clause 3 of Article 172 of the Tax Code of the Russian Federation). In addition, the right to a tax deduction appears if the taxpayer, within the established 180-day period (clause 9 of Article 165 of the Tax Code of the Russian Federation), has not collected a complete package of supporting documents provided for in Article 165 of the Tax Code of the Russian Federation (clause 10 of Article 171 of the Tax Code of the Russian Federation).

Until the taxpayer has the right to deduct VAT on export transactions, the amounts of this tax are reflected in the debit of account 19.

An updated declaration for VAT amounts at an unconfirmed tax rate of 0%, subject to payment to the budget, is submitted for the period in which the goods (work, services) were shipped, which entails the occurrence of overdue tax debt starting from the 20th day of the month, following the given period, until the day of actual payment of the tax on which the penalty is calculated.

Upon receipt of the documents specified in Article 165 of the Tax Code of the Russian Federation and their submission to the tax authorities, the paid VAT amounts are returned to the taxpayer on the basis of the submitted VAT return at a tax rate of 0% (clause 4 of Article 176 of the Tax Code of the Russian Federation).

From January 1, 2006, organizations independently establish the procedure for determining the amount of VAT relating to goods (work, services), property rights acquired for the production and (or) sale of goods (work, services), transactions for the sale of which are taxed at a tax rate of 0%.

End of the example.

Example 5.

CJSC Vega exported goods worth $10,000. The goods were shipped from the exporter's warehouse on February 2. The goods were handed over to the carrier on February 7. The foreign buyer repaid the debt on February 12. According to the contract, ownership passed when the goods were transferred to the carrier. The cost of goods amounted to 250,000 rubles.

The exchange rate of the US dollar against the ruble was (conditionally):

- February 2 - 30.40 rubles/USD;

- February 7 — 30.50 RUB/USD;

- February 12 - 30.60 rubles/USD.

The working chart of accounts provided for the use of the following accounts:

41 “Goods”;

45 “Goods shipped”

52 “Currency accounts”, sub-account “Transit” (52 transit);

62 “Settlements with buyers and customers”

68 “Calculations for taxes and fees”, subaccount “VAT for reimbursement” (68-4);

90 “Sales”, subaccount “Revenue” (90-1);

90 “Sales”, subaccount “Cost of sales” (90-2);

90 “Sales”, subaccount “Value Added Tax” (90-3).

The following entries were made in the accounting records of Vega CJSC:

| Account correspondence | Amount, rub. | Contents of operation | ||

| Debit | Credit | |||

| February 2 | ||||

| 41 | 60 | 250 000 | Goods to be sold for export have been accepted for accounting | |

| 19 | 60 | 45 000 | VAT presented by the supplier of goods is reflected | |

| 45 | 41 | 250 000 | The actual cost of goods shipped is reflected | |

| February 7 | ||||

| 62 | 90-1 | 305 000 | Recognition of revenue from the sale of goods for export is reflected (USD 10,000 x RUB 30.50/USD) | |

| 90-2 | 45 | 250 000 | Cost of goods sold written off | |

| 12th of February | ||||

| 52transit | 62 | 306 000 | The amount of revenue received to the transit currency account is reflected (10,000 USD x 30.60 rubles/USD) | |

| 91-2 | 62 | 1000 | The positive exchange rate difference on the date of debt repayment is reflected [(30.50 rub./USD – 30.40 rub./USD) x 10,000 USD] | |

| A package of documents confirming export has been collected (on the last day of the month in which the full package of documents is collected, that is, on the date the tax base is determined) | ||||

| 68-4 | 19 | 45 000 | VAT subject to deduction on goods shipped under an export contract is reflected | |

| The tax authority made a decision on VAT refund (based on the date of the decision, but not more than 3 months) | ||||

| 51 | 68-4 | 45 000 | VAT subject to deduction on goods shipped under an export contract is reflected | |

| The package of documents confirming export has not been collected | ||||

| 90-3 | 68-4 | 54 720 | VAT is charged on unconfirmed exports on the date of shipment (USD 10,000 x RUB 30.40/USD x 18%) | |

| 68-4 | 19 | 45 000 | Accepted for VAT deduction | |

| 91-2 | 68-4 | 360 | VAT is charged on the amount of increase in the tax base (tax base on the day of payment for goods minus the tax base on the day of shipment) [(30.60 rubles/USD – 30.40 rubles/USD) x 10,000 USD) x 18%] | |

End of the example.

Example 6.

Continuing with example 12, let us assume that, under the terms of the contract, ownership transferred to the foreign buyer only after payment for the goods. In this case, exchange rate differences are not created in accounting.

The following entries were made in the accounting records of Vega CJSC:

| Account correspondence | Amount, rub. | Contents of operation | |

| Debit | Credit | ||

| February 2 | |||

| 45 | 41 | 250 000 | The actual cost of goods shipped is reflected |

| 12th of February | |||

| 52transit | 62 | 304 000 | The amount of revenue received to the transit currency account is reflected (10,000 USD x 30.40 rubles/USD) |

| 62 | 90-1 | 304 000 | Recognition of revenue from the sale of goods for export is reflected (USD 10,000 x RUB 30.40/USD) |

| 90-2 | 45 | 250 000 | Cost of goods sold written off |

End of the example.

Amount of asset depreciation .

The amounts of asset depreciation included in the non-operating expenses of the organization, in accordance with paragraph 14.4 of PBU 10/99, are determined in accordance with the rules established for the revaluation of assets.

These amounts, based on paragraph 16 of PBU 9/99, are recognized in accounting in the reporting period to which the date as of which the revaluation was made applies.

Having analyzed Regulation No. 34n, we note that revaluation is provided only for fixed assets.

At the same time, paragraph 62 of Regulation No. 34n of this provision establishes that valuables, the price of which has decreased during the reporting year, or which have become obsolete or partially lost their original quality, are reflected in the balance sheet at the end of the reporting year at the price of possible sale, if it below the initial procurement (purchase) cost. Such assets include raw materials, basic and auxiliary materials, fuel, purchased semi-finished products and components, spare parts, containers, finished products, goods, and other inventories. The difference in prices for a commercial organization is included in the financial results, that is, it is reflected in the debit of account 91 “Other income and expenses” subaccount “Other expenses” and the credit of accounts in which the values in respect of which the markdown is made are recorded.

Please note that before January 1, 2006, the provisions of paragraph 15 of PBU 6/01 suggested that the amount of write-down of fixed assets should be attributed to the profit and loss account as operating expenses or to the account of retained earnings (uncovered loss).

From January 1, 2006, in connection with changes made to PBU 6/01 by Order of the Ministry of Finance No. 147n, the amounts of depreciation of fixed assets are attributed only to account 84 “Retained earnings (uncovered loss)”.

Leisure and charity expenses.

In accordance with the accounting regulations “Expenses of the organization” PBU 10/99, approved by Order of the Ministry of Finance of the Russian Federation dated May 6, 1999 No. 33n, in the profit and loss statement, the expenses of the organization are recognized regardless of their recognition for the purposes of calculating the taxable base.

In accordance with PBU 10/99, expenses of an organization for sporting events, recreation, entertainment, cultural and educational events and other similar events, as well as transfers by the organization of funds (contributions, payments) related to charitable activities are other expenses. The instructions for applying the Chart of Accounts for accounting financial and economic activities of organizations, approved by Order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n, do not provide for the reflection of these expenses on account 84 “Retained earnings (uncovered loss).”

For example, an organization purchased prizes for a corporate event. For profit tax purposes, these expenses are not taken into account, since they do not satisfy the conditions of paragraph 1 of Article 252 of the Tax Code of the Russian Federation.

For accounting purposes, the cost of purchased prizes is recognized as a non-operating expense and is reflected in the debit of account 91 “Other income and expenses”, subaccount 91-2 “Other expenses”, in correspondence with the credit of account 41 “Goods”.

Hello Guest! Offer from "Clerk"

Online professional retraining “Chief accountant on the simplified tax system” with a diploma for 250 academic hours . Learn everything new to avoid mistakes. Online training for 2 months, the stream starts on March 1.

Sign up

Return

In some cases, the state fee can be returned if the legal action paid for did not take place. The refund is made by decision of the government agency where the applicant applied or should have applied. According to Art. 333.40 of the Tax Code of the Russian Federation, funds are returned to the account within 1 month from the date of a positive decision. The returned amount must be taken into account as the applicant’s income on the day of return (clause 3 of article 250, clause 1 of article 346.17 of the Tax Code).

State duty under the simplified tax system

Under the simplified taxation system (STS), the state duty paid to the budget is also subject to inclusion in the expenses of the enterprise.

When satisfying the claim, the defendant will have to take into account the amount to be reimbursed to the plaintiff in expenses, and the plaintiff - accordingly, in income. The accounting date will be the date of actual payment of funds (clause 1 of Article 346.17, clause 31 of clause 1 of Article 346.16 of the Tax Code of the Russian Federation).

If the state duty is refunded at the request of the applicant upon refusal to go to court or on other grounds established by the Tax Code:

- when applying the simplified tax system with the object of taxation “Income”, the returned amount of state duty is not taken into account when determining the object of taxation;

- when applying the simplified tax system with the tax object “Income - Expense”, the returned amount is not taken into account, provided that the amount paid was not previously taken into account as an expense (Letter of the Ministry of Finance of Russia dated December 21, 2022 No. 03-11-11/85518).

As part of what costs during simplification is the state duty taken into account?

How the state duty is accepted as an expense under the simplified tax system depends on the action for which the duty was paid. If the state fee is paid for filing a lawsuit, registering changes in the Unified State Register of Legal Entities, issuing duplicate documents or other similar actions, then such a fee is included in the costs for determining the simplified tax according to the norms of subsection. 22 clause 1 art. 346.16 Tax Code of the Russian Federation.

For information about the procedure for reducing the tax base, see this publication.

But if the state duty is paid to register a vehicle or register real estate, then such a fee will increase the amount of depreciable property and will reduce the tax base in accordance with the procedure described in paragraph 3 of Art. Code 346.16. But this applies only to those fees that were paid before the depreciable property was put into operation. If the fee is paid after, then the state duty is included in the expenses under the simplified tax system at a time in accordance with clause 2 of Art. 346.17 Tax Code of the Russian Federation.

Recommendations and a sample from ConsultantPlus experts will help you issue a payment order to pay the state duty. Get trial full access to the system for free and go to the Typical situation.

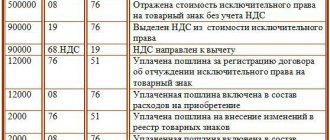

Accounting entries for state duty accounting

Payment of state duty is reflected in accounting by the following entries:

Payment: D 68 - K 51;

The second entry depends on the type of state duty:

- when going to court: D 91.2 - K68;

- if the state duty is included in the initial cost of the fixed asset: D 08 - K 68

- if it was paid as part of normal business activities (registration of changes to constituent documents, obtaining an extract from the Unified State Register of Real Estate, obtaining a license): D20, 26 or 44 - K 68.