Postings online. We use 1C

No company engaged in business activities can do without accounting entries. The accuracy of calculations made in accounting is achieved by displaying all transactions on 2 corresponding accounts. The amount of each transaction when entered into both accounts is equal, but in one of them it is classified as a debit, and in the other as a credit.

Postings play an important role in recording activities, as they record all transactions performed. Double entry performs the function of monitoring the correctness of document maintenance. At the end of the period, the amounts are compared; if the actions are performed correctly, they should match.

No one is immune from mistakes; sometimes accountants with extensive experience can get confused when performing all these actions. To understand all the classifications, specialists are forced to turn to a large number of forums and special services.

What is an account

Every commercial company is created for the purpose of making a profit.

At the same time, she makes various transactions every day, the accounting of which is very easy to get confused without a clearly organized accounting structure. Moreover, according to Art. 2 of the Law “On Accounting” dated December 6, 2011 No. 402-FZ, all legal entities are required to maintain accounting records. It is organized through continuous documentation of each business transaction and carries several functions:

- informational;

- control;

- feedback;

- analytical.

Find out who is responsible for organizing accounting here.

Accounting provides information about the financial and economic state of affairs to both internal (managers, management, founders, etc.) and external users (controlling, fiscal and other government agencies).

One of the accounting methods is double entry using accounts approved by Order of the Ministry of Finance of Russia dated October 31, 2000 No. 94n (for commercial structures).

You can familiarize yourself with the chart of accounts in this article.

Double entry is an accounting entry that reflects a business transaction using 2 offsetting accounts. Each account has a specific number, structure and characteristics. In this case, the same amount is recorded in both accounts.

Example 1

Consider the operation “Cash in the amount of 20,000 rubles. handed over from the cash desk to the bank.”

Based on its economic meaning, we select the appropriate corresponding accounts: 50 “Cash”, 51 “Settlement accounts”.

Funds are sent from the credit of account 50 to the debit of account 51. This operation is recorded by a cash receipt order, a bank statement, the counterfoil of an advertisement for cash deposits and the entry: Dt 51 Kt 50 - in the amount of 20,000 rubles.

This means that the balance at the bank servicing the enterprise increased, but at the cash desk decreased by the same amount (RUB 20,000).

To use accounts correctly, you must not only choose them correctly, but also know what type they are.

Accounts can be active, passive and active-passive.

Active accounts reflect the assets (property, debts, etc.) of the enterprise and have only a debit (positive) balance. An increase in assets is recorded as a debit to the corresponding account, a write-off is recorded as a credit.

The main active accounts are presented in the table:

| Check | Definition |

| 01 | Fixed assets |

| 04 | Intangible assets |

| 10 | Materials |

| 11 | Animals in production |

| 20 | Production |

| 21 | Semi-finished products |

| 41 | Goods |

| 43 | Finished products |

| 50 | Cash register |

| 51 | Current accounts |

| 52 | Currency accounts |

| 81 | Own shares |

Liability accounts indicate the sources of the company's assets and have only a credit balance. These include, in particular:

| Check | Definition |

| 02 | Depreciation of fixed assets |

| 05 | Depreciation of intangible assets |

| 42 | Extra charge |

| 66/67 | Loans |

| 70 | Settlements with personnel |

| 80 | Authorized capital |

| 82 | Reserve capital |

| 83 | Extra capital |

Active-passive accounts include accounts that have both a debit and a credit balance. For example, if account 60 “Settlements with suppliers” has a credit balance, it means that the company owes the counterparty for supplies or services supplied. If we paid an advance to the supplier, it means that the counterparty already owes our company. This transaction has a debit balance.

| Check | Definition |

| 60 | Settlements with suppliers |

| 62 | Settlements with customers |

| 68/69 | Taxes and fees |

| 71 | Accountable persons |

| 84 | Retained earnings (loss) |

| 99 | Profit/loss |

On account 62, an unpaid receivable may arise, which in some cases is considered doubtful, because may not be paid by the buyer. In order to correctly reflect such debt on the balance sheet, each organization is required to create a reserve for doubtful debts.

Find out how to correctly record entries for doubtful debts in the ConsultantPlus ready-made solution by getting trial access to the system for free.

Accounts also have analytics for subaccounts. For example, for account 10 these will be accounts 10.1 “Raw materials”, 10.2 “Purchased semi-finished products”, 10.3 “Fuel”, etc.

Typical wiring and rules for their implementation

There are dozens of transactions; only a few basic types relate to accounting; fixed and cash assets, materials, costs and others are of particular importance.

There are several important points. Posting can only be carried out if a source document is available. When receiving a document via the Internet, confirmation with an electronic signature or sending the original in the future is required.

The correct definition of the account type and the correct coding are required. There is a certain difference between the cash register and the current account, which leads to an incorrect result at the end of the period.

There are no descriptions in accounting, and the entry is a completely incomprehensible set of symbols for an outsider. Often, many reference books are used to check the accuracy of the entries made, but the best programs to help ease the work of an accountant are programs such as 1C, the remote versions of which are very easy to use.

How to make an accounting entry

In the latest issue of accounting educational program, Alexey Ivanov talks about how to make accounting entries. Not to memorize, but to consciously compose. There is no magic in this - it is enough to understand the economic meaning of the reflected fact of economic life and the principles of operation of accounting accounts.

Hi all! Alexey Ivanov is with you, the knowledge director of the online accounting “My Business” and the author of the telegram channel “Accounting Translator”. Every Friday on our blog at The Clerk I talk about accounting. I started with the basics, then I will move on to more complex matters. For those who are just preparing to become an accountant, this will help them get to know the profession better. Seasoned chief accountants should look at familiar categories from a different angle.

Let's return to the accounts. Today is a post that is very important for further delving into accounting. Postings are something that accounting work is often associated with. At the same time, it is with postings that a lot of problems arise for both students and practicing accountants. Usually, difficulties in studying accounting begin when the teacher begins the training not with the economic principles of accounting and balance sheet, but with postings. Students do not understand how to compile them, because they do not understand the economic essence of the facts of economic life (FHL) that need to be reflected. Then they begin to learn the wiring by heart. Then they get a diploma and start working as accountants, without understanding the essence of their work.

If you have read all the blog episodes dedicated to accounting objects and accounting accounts, then you are now prepared for this topic. If not, better read them first.

When implementing FHJ, changes in assets and liabilities occur. The amount of changes is reflected using double entry. This method is described in the first known textbook on accounting - “Treatise on Accounts and Records” by Luca Pacioli, which was published in 1494. But double entry appeared much earlier and still remains the cornerstone of accounting.

Double entry is a way of reflecting FHZh on accounting accounts. The amount of any FHZ is reflected in the accounts twice: in the debit of one account and the credit of another account in the same assessment. Why twice? Because any FHJ changes one asset and one liability, or two assets, or two liabilities. If this is not obvious, see the post on permutations and modifications. Each individual asset or liability is accounted for in its own account. Therefore, the amount of the FHZ forms the turnover in two accounts at once.

The relationship between the accounts that participate in the FHJ record is called correspondence of accounts . The accounts themselves, between which interaction occurs, are called corresponding . A record reflecting the correspondence of accounts is called an accounting entry . It is written like this: Dt 50 Kt 51 - 100 rubles. This means that 100 rub. went through the debit of account 50 “Cash” and the credit of account 51 “Cash accounts”. Translated: “100 rubles were withdrawn from the current account to the cash register,” but more on that below.

There is no magic in creating accounting entries. It is very simple if you understand the economic meaning of FHZ. Here is a checklist of questions that need to be answered sequentially in order to get an accounting entry at the end.

- What assets and/or liabilities does the FHJ affect?

- How do they change as a result of FH: do they decrease or increase?

- In what accounting accounts are they recorded?

- What are these accounts in relation to the balance: active or passive?

- How did the turnover on accounts change as a result of the FHZ: which account corresponded as a debit and which account as a credit?

Here are some tips for answering these questions.

- We classify assets and liabilities using posts about accounting objects. Active links to them can be found in posts about the balance sheet and income statement.

- We use common sense - no hints are needed here.

- We use the Chart of Accounts for accounting the financial and economic activities of organizations and the Instructions for its use. I will talk about the purpose of each account later.

- We determine the type of account in relation to the balance using the post on active and passive accounts. Mixed accounts in each specific FHZ work as active if the asset changes, and as passive if the liability changes.

- We determine the corresponding sides of the accounts using the structures of active and passive accounts from the same post.

Ready. You are awesome!

And now a master class on preparing accounting entries.

Example 1.

Finished products are released from production.

Solution.

- The operation involves two assets: work in progress and finished goods (active permutation).

- Work in progress decreases, finished goods increase.

- Work in progress is accounted for on account 20 “Main production”, finished products are accounted for on account 43 “Finished products”.

- Both accounts are active, that is, an increase is reflected as a debit, and a decrease as a credit.

- The turnover increased in the debit of account 43 “Finished products” and the credit of account 20 “Main production”.

Answer: Dt 43 Kt 20.

Example 2.

Dividends were accrued to the founders, that is, they were promised a portion of the profits earned during the year.

Solution.

- The operation involves two liabilities: retained earnings and accounts payable to the founders (passive permutation).

- Retained earnings decrease, accounts payable to the founders increase.

- Retained earnings are accounted for on account 84 “Retained earnings (uncovered loss)”, accounts payable to the founders - on account 75 “Settlements with founders”.

- Both accounts are active-passive, but since the operation affects liabilities, both accounts act as passive: an increase is reflected as a credit, and a decrease as a debit.

- The turnover increased in the debit of account 84 “Retained earnings (uncovered loss)” and the credit of account 75 “Settlements with founders”.

Answer: Dt 84 Kt 75.

Example 3.

Materials were purchased from the supplier.

Solution.

- The transaction involves one asset - materials and one liability - accounts payable to the supplier.

- Materials increase, accounts payable to the supplier also increases (positive modification).

- Materials are accounted for on account 10 “Materials”, accounts payable to the supplier are accounted for on account 60 “Settlements with suppliers and contractors”.

- Account 10 “Materials” is active, that is, an increase is reflected as a debit, and a decrease as a credit. Account 60 “Settlements with suppliers and contractors” is active-passive, but since the operation affects a liability, the account acts as a passive account: an increase is reflected as a credit, and a decrease as a debit.

- The turnover in the debit of account 10 “Materials” and the credit of account 60 “Settlements with suppliers and contractors” increased.

Answer: Dt 10 Kt 60.

Example 4.

Accounts payable to the supplier were paid from the current account.

Solution.

- The transaction involves one asset - cash in the current account and one liability - accounts payable to the supplier.

- Cash in the current account decreases, accounts payable to the supplier also decreases (negative modification).

- Cash in the current account is recorded in account 51 “Settlements”, accounts payable to the supplier - in account 60 “Settlements with suppliers and contractors”.

- Account 51 “Current accounts” is active, that is, an increase is reflected in debit, and a decrease is reflected in credit. Account 60 “Settlements with suppliers and contractors” is active-passive, but since the operation affects a liability, the account acts as a passive account: an increase is reflected as a credit, and a decrease as a debit.

- The turnover in the debit of account 60 “Settlements with suppliers and contractors” and the credit of account 51 “Settlement accounts” increased.

Answer: Dt 60 Kt 51.

As you can see, there is nothing complicated about the wiring. The main thing is to understand the economic meaning of the operation, that is, the first two steps of the algorithm. Next is a matter of technology!

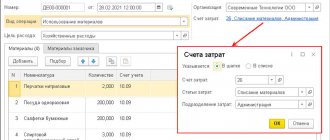

Why is it more convenient to make transactions online in 1C?

The difficulty in maintaining double accounting is best manifested when the actions are performed by hand. If there is not at least a reference book available, then mistakes become inevitable.

With the use of 1C Online in the workflow, activities become much simpler. Postings can be made manually or activated automatically using templates. Specialized software simply will not allow the accountant to make mistakes.

The services of Laboratory IT, which provide access to 1C via cloud technologies, will not only make work easier, but will allow you to work from anywhere where there is Internet. The employee will no longer be limited to the office; he will be able to fully perform his functions at home or on a business trip.

You can start using 1C via remote access right now, to do this you need to call 84997097106 or register on the website.

Goods

Every enterprise that conducts business activities has commodity-material assets. Below is a list of most accounting entries for goods:

- Accounting for goods in accounting: postings, examples, laws

- Revaluation of goods in accounting entries

- Movement of goods through warehouses: postings, rules, examples

- Resale of goods between the commission agent and the principal in accounting

- Reflection of goods in storage in accounting entries

- Accounting entries for the transfer of goods free of charge

- Accounting accounts and entries for payment for goods and services

- Accounting for goods in transit

- Consignment goods: the relationship between the consignor and the commission agent

- Carrying out an inventory: receipt of surpluses and write-off of shortages

- How goods are shipped in accounting entries using an example

- Postings for the purchase of goods and services

- Postings for the sale of goods and services

- Returning goods to the supplier: reasons, posting tables, examples

- Postings for receipt of goods to the warehouse

- How to reflect the return of goods from a buyer in accounting

- Write-off of goods in case of shortage or damage in accounting entries

- Postings according to additional costs for delivery of goods

How to solve accounting problems

In addition to tests, for company specialists whose work is related to the field of accounting, the process of solving accounting problems online is of interest.

There is no single generally accepted algorithm for solving accounting problems contained in the legal documents of the Russian Federation. At the same time, it is possible to identify the general stages and the composition of tasks that a specialist faces at each stage.

In particular, these are the following stages:

- General theoretical. This stage implies the need for a specialist to “refresh” his understanding of the basic principles of accounting, the types of business transactions inherent in the company, as well as the existing forms of the company’s financial statements. You should also review the chart of accounts in order to clarify the necessary aspects of synthetic and analytical accounting and determine the corresponding accounts within the specific task at hand.

- The stage of determining the general solution. During this stage, the specialist studies the conditions of the accounting task facing him, understands the essence of the transactions that took place, and then makes accounting entries using “airplanes” for the necessary accounts.

PAY ATTENTION! The method of compiling “airplanes” for accounting accounts allows a specialist to clearly see what obligation arises, terminates, when property is received or disposed of in the company, etc.

- Reporting stage. Often, as part of an accounting task, it is necessary to generate a report based on the results of its solution. To correctly cope with this requirement, a specialist should review the procedure for drawing up a specific report, which may be contained in the PBU or in orders of the Ministry of Finance of the Russian Federation.

ConsultantPlus experts regularly create tests for accountants. There they give the correct answers and explain the rules of accounting and solutions to each problem. Get trial demo access to the K+ system and take the K+ test for free.