5,00

5

| Reviews: | 0 | Views: | 19483 |

| Votes: | 1 | Updated: | n/a |

File type Text document

Document type: Statement

?

Ask a question Remember: Contract-Yurist.Ru - there are a bunch of sample documents here

STATEMENT No. 1 on the debit of account No. 50 “Cash” from accounts credit +———————————————————————+ ¦ Balance at the beginning of the month rub.¦ +————————— ——————————————¦ ¦Line¦Cash register date¦ 46 ¦ 51 ¦ 52 ¦ 71 ¦ 73 ¦ 29 ¦ and ¦Total¦ ¦ No. ¦report (or for¦ ¦ ¦ ¦ ¦ ¦ ¦ etc.¦ ¦ ¦ ¦ what numbers) ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ +——+—————+——+——+—— +——+——+—-+——+——¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ +——+—————+——+——+——+——+— —+—-+——+——¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ +——+—————+——+——+——+——+——+—-+ ——+——¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ +———————+——+——+——+——+——+—-+——+——¦ ¦ Total ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ +————————————————————————¦ ¦ Balance at the end of the month rub.¦ +————— ——————————————————+

Download the document “Sample. Statement No. 1"

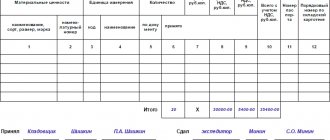

Statement for issuing a salary

Any organization must take into account salary accruals for its employees. The document records payments to each employee. If the staff is large, a statement is compiled for each department.

The paper has a simple shape. First, the serial number is indicated, the name is followed by a table that includes this information:

- FULL NAME.

- The position and rank of the employee to whom the salary is awarded.

- Amount of payment (salary, bonuses, fines).

- The final amount of payments, including salary, bonuses and other benefits.

- Signature of the employee who receives the money.

Compiled according to a unified form:

- For payroll and payroll – form T-49 and T-51.

- For cash payments – T-49.

- For non-cash payments – T-51.

- For payroll – T-53.

The statement, in this case, confirms the correctness of payments. Based on it, accounting is carried out and postings are made.

Account 50 in accounting: typical entries, examples

Accounting account 50 is an active account “Cash”, it is used to record the movement of cash in the cash desk of the enterprise, control over their receipt, expenditure and intended use. Let's look at which accounts account 50 corresponds to, as well as typical transactions for account 50 using the example of an operation for issuing cash from the cash register to a sub-account for payment for the services of a counterparty.

Account 50 “Cash” in accounting

Cash settlements with legal entities, individuals, and counterparties are carried out through cash transactions, the main ones of which are:

- Issuance of wages;

- Administrative expenses;

- Receipts from cash sales;

- Expenses for the purchase of inventories by accountable persons, etc.

All cash transactions related to the disposal, receipt and movement of cash are taken into account in accounting under account 50 “Cash” and are reflected in the cash book. The basis for making entries are primary documents - cash outgoing and incoming cash orders (form KO-2 and KO-1).

Using account 50 “Cash” you can get all the information about cash in the organization, the sources of its receipt and further circulation.

Account balance 50 shows the total amount of cash and monetary documents. The account is active, therefore the debit of the account records the receipt and receipt of cash at the cash desk.

The credit of the account reflects the amount of cash issued from the cash register.

Sub-accounts shown in the figure can be opened for account 50 “Cashier”:

Typical transactions and examples of transactions on account 50

Let's look at typical transactions for this account in Tables 1 and 2.

Table 1. The most common and widespread entries in the debit of account 50:

Get 267 video lessons on 1C for free:

| Account Dt | Kt account | Description of transaction posting | A document base |

| 50 | 50-2 | Cash transferred from operating cash desk to cash desk | KO-1, KM-6, KM-4 |

| 50 | 51 | Transferring funds from the current account to the cash desk | KO-1, bank statement, check counterfoil (checkbook) |

| 50 | 52 | Transferring funds from a foreign currency account to the cash desk | KO-1, bank statement |

| 50 | 62 | Advance received from buyer/payment received for goods | KO-1, cash receipt. |

| 50 | 70 | Return of excess wages to the cash desk. | KO-1 |

| 50/50-3 | 71 | Return to the cash desk the balance of accountable amounts/cash | KO-1 |

| 50 | 73-1 | Payment of loans from employees | KO-1 |

| 50 | 75-1 | Contribution of the founder to the authorized capital | KO-1, constituent documents |

| 50-1 | 90.01.1 | Sales revenue/income from other operations | Cash register |

Table 2. Main entries for the credit of account 50:

| Account Dt | Kt account | Description of transaction posting | A document base |

| 04 | 50-1 | Purchase of intangible assets | KO-2 |

| 51 | 50 | Transferring cash from the cash desk to the bank | KO-2 |

| 60 | 50-1 | Payment to the supplier (contractor) for goods received (work performed) | KO-2 |

| 52 | 50-1 | Refund of advance payment to the buyer from a special bank account | KO-2 |

| 70 | 50 | Issuance of wages to employees | KO-2, T-53 |

| 70 | 50 | Payment of income from participation in the organization to employees | KO-2 |

| 71 | 50/50-3 | Issuance of accountable amounts/cash documents | KO-2 |

| 73-1 | 50 | Obtaining a loan by an employee | KO-2 |

| 75-2 | 50 | Payment of income from participation in the organization to persons who are not employees | KO-2 |

| 76 | 50-1 | Payment of obligations in the form of debt to other counterparties | KO-2 |

| 94 | 50 | Reflection of cash shortages | INV-15, INV-26 |

Practical example with wiring

VolgaDon LLC and Garant LLC concluded an agreement for the provision of legal services in the amount of RUB 8,800.00. To pay for consulting legal services under the contract, employee of VolgaDon LLC Yuzik K.M. received funds for reporting in the amount of RUB 9,000.00. To perform settlements with Garant LLC, Yuzik K.M. provided the accountant with an advance report and returned the balance to the cashier.

The accountant of VolgaDon LLC generated the following entries for the issuance of cash from the cash register to the sub-account for payment of legal services to a third-party organization:

| Account Dt | Kt account | Transaction amount, rub. | Description of transaction posting | A document base |

| 26 | 60 | 7 458,00 | reflected in costs (8,800.00-1,342.00) | Certificate of completed work (hereinafter referred to as the Certificate) |

| 19 | 60 | 1 342,00 | VAT is allocated from the cost of services | Act |

| 68 VAT | 19 | 1 342,00 | VAT is accepted for deduction | Act, invoice |

| 71 | 50-1 | 9 000,00 | From the cash desk of VolgaDon LLC, funds were issued under the report of Yuzik K.M. | KO-2, statement of the reporting person |

| 60 | 71 | 8 800,00 | Payment for | Act, advance report |

| 50-1 | 71 | 200,00 | Balance of unused funds Yuzik K.M. returned to the organization's cash desk | Act, advance report, KO-1 |

Source: //BuhSpravka46.ru/buhgalterskiy-plan-schetov/schet-50-v-buhgalterskom-uchyote-tipovyie-provodki-primeryi.html

Advance payment statement

An advance statement is prepared when an advance is provided to employees. It is prepared in the accounting department. After compilation, it is sent to the cashier. The document is generated in a single copy. It must contain the required details:

- Cashier's name.

- Debit and credit data.

- Advance amount.

- A signature indicating that the employee received the money.

The statement must be certified by the signature of the cashier and the accounting and operational employee.

Statement for the provision of special clothing

Sometimes company employees are given special clothing. The organization must take care of its condition. Clothes are issued on the basis of a statement compiled according to the MB-7 form. The given form is universal. It can be used for any warehouse accounting. The document must contain this mandatory information:

- Full name of the recipient of the workwear.

- Employee personnel number.

- Name and nomenclature of clothing.

- Number of issued protective clothing.

- Start date of use.

- Life time.

The employee signs both when receiving the workwear and when handing it over. Based on the document, you can control the amount of clothing and shoes issued to employees.

Related documents

- Sample. Statement No. 2.1

- Sample. Statement No. 5

- Sample. Statement No. 7 on analytical accounting

- Sample. Sheet for monitoring the inclusion of the cost of shipped products in financial statements (Form No. 2) and in tax calculations

- Sample. Statement for replenishment (withdrawal) of a permanent stock of tools (devices). Form No. MB-1

- Sample. Statement of accrual and payment of wages

- Sample. Statement of receipt of funds at the cash desk of a branch of a foreign legal entity. Form No. 2-vpp (instruction of the State Tax Service of the Russian Federation dated June 16, 1995 No. 34 (as amended on December 29, 1995 No. vz-6-06-672))

- Sample. List of requirements for materials and calculation of the cost of materials for the object and sections of the estimate (form No. 4-mat)

- Sample. List of requirements for construction machines and calculation of the costs of operating these machines for the facility as a whole and sections of the estimate. Form No. 4-fur

- Sample. Statement of expenditure of funds from the cash desk of a branch of a foreign legal entity. Form No. 4-vpp (instruction of the State Tax Service of the Russian Federation dated June 16, 1995 No. 34 (as amended on December 29, 1995 No. vz-6-06-672))

- Sample. Statement of results identified by inventory (order of the Ministry of Finance of the Russian Federation dated June 13, 1995 No. 49)

- Sample. Record sheet for the issuance (return) of workwear, safety footwear and safety equipment. Form No. MB-7

- Sample. Payroll records for branch employees in the Russian Federation. Form No. 3-pp (instruction of the State Tax Service of the Russian Federation dated June 16, 1995 No. 34 (as amended on December 29, 1995 No. vz-6-06-672))

- Sample. Statement of accounting for intangible assets and depreciation (No. 17)

- Sample. A list of remaining materials in the warehouse. Form No. m-14

- Sample. Statement of accounting of expenses of a branch of a foreign legal entity. Form No. 2-vop (simplified) (instruction of the State Tax Service of the Russian Federation dated June 16, 1995 No. 34 (as amended on December 29, 1995 No. vz-6-06-672))

- Sample. Product sales accounting sheet for shipment (No. 16/1)

- Sample. Statement of financing of a branch of a foreign legal entity. Form No. 1-vop (simplified) (instruction of the State Tax Service of the Russian Federation dated June 16, 1995 No. 34 (as amended on December 29, 1995 No. vz-6-06-672))

- Sample. Statement-inventory of obligations and orders (obligations) issued by buyers for goods sold on credit. Specialized form No. 9-tkr

- Sample. Loose sheet 2 to statement No. 7

Defective statements

The defective statement is the primary document. Needed to reflect defects and breakdowns of equipment/assets used by the company. If a breakdown occurs, the equipment is usually sent for repair. However, you cannot simply send the equipment for repair. Documentation required.

Drawing up a defective statement is part of this documentation. There is no unified form for this document. When drawing it up, you need to take into account the provisions of Article 9 of Federal Law No. 129 of November 21, 1996.

FOR YOUR INFORMATION! The most common forms of documents are a statement for the repair of a premises, a car.

Sample of drawing up order journal No. 1 and statement No. 1

The balance at the beginning (Sn) at the cash register is 61,000 rubles.

Table Journal of business transactions using account 50 “Cash”

| № | Contents of a business transaction | Primary document | Wiring | Amount, rub. |

| 1 | Cash proceeds received for products sold and services provided | PKO | D 50 – K 62 | 5000 |

| 2 | Received cash proceeds for sold fixed assets and other property | PKO | D 50 – K 62 | 30000 |

| 3 | Long-term securities paid | RKO | D 58 – K 50 | 4000 |

| 4 | Paid services from third parties | RKO | D 60 – K 50 | 1000 |

| 5 | Cash deposited into bank account | RKO, announcement for cash payment | D 51– K 50 | 45000 |

Let's fill out journal order No. 1 based on data from the business transactions journal.

| Journal-order No. 1 | ||||

| for March 2015 under the Kassa loan | ||||

| № | From the credit of the "Cash" account to the debit of the accounts | TOTAL | ||

| 58 | 60 | 51 | ||

| 3 | 4000 | 4000 | ||

| 4 | 1000 | 1000 | ||

| 5 | 45000 | 45000 | ||

| TOTAL | 4000 | 1000 | 45000 | 50000 |

Let's fill out statement No. 1 based on the initial data

| Statement No. 1 | ||||

| for March 2015 by debit “Cash” | ||||

| Balance at the beginning of the month | 61000 | |||

| № | To the debit of the "Cash" account from the credit of accounts | TOTAL | ||

| 62 | ||||

| 1 | 5000 | |||

| 2 | 30000 | |||

| TOTAL | 35000 | |||

| Balance at the end of the month = 61000+35000-50000=46000 | ||||

Turnover balance sheet

The balance sheet is a reporting document. Based on it, reporting on the financial condition of the company is created. It records balances on individual accounts and subaccounts. From the balance sheet you can obtain data on the movement of finances and the turnover of funds for the reporting period. It is divided into these types:

- Monthly.

- Quarterly.

- Annual.

The need for a balance sheet arises in the following cases:

- Analysis of the company's financial position.

- Analytics of results for a certain period.

- Analysis of general indicators.

The document records all actions with the organization’s money. Accounting will be conducted based on the statement.

Magazine order No. 2

- Form of a simple registered share Securities and shares, issue → Form of a simple registered share ... walkie-talkie January 22, 1992 annex to the regulations on the commission for the privatization of land and reorganization of a collective farm (state farm) form of a simple registered share share joint-stock company "" Moscow May 5 1991 (date of issue of shares) ten thousand rubles...

- Statement of accrual and issuance of wages Enterprise records management documents → Statement of accrual and issuance of wages Sheet of accrual and issuance of wages No. organization (division): No. ...

- Sample.

Statement No. 11 Accounting statements, accounting → Sample. Statement No. 11 statement no. 11 movement of material assets (at accounting prices) for 20 to workshops, farms (in production) (unnecessary... - Sample. Statement No. 1 Accounting statements, accounting → Sample. Statement No. 1 statement no.