What are auxiliary productions?

At manufacturing enterprises with a complex technological process structure, there are almost always workshops and divisions that perform functions that are assistive in relation to the main production cycle.

Examples include:

- own transport fleet;

- repair and commissioning department;

- energy management;

- workshop for the production of special equipment and tools.

All such divisions also produce products or provide services, but the main consumer of their products (services) is the enterprise itself. More precisely, they are needed to carry out the main production process of the enterprise.

A separate account 23 is intended for accounting for auxiliary production. Analytics on it is carried out by divisions of auxiliary production and types of costs. The specificity is that the account is also intended to account for the production process and cost calculation, so most of the item analytics that may be present on account 20 “Main production” will find their place on account 23 “Auxiliary production”.

Unlike accounting for main production (on account 20), the cost of production of auxiliary production formed on account 23 is not transferred to separate accounts intended for further accounting of finished main products (accounts 40, 43). The cost of auxiliary production is written off immediately to the credit of account 23.

For example, if one auxiliary division produces something for another auxiliary division, a posting is made Debit 23 Credit 23 for the subaccounts of the corresponding divisions.

Important! Some of the products of auxiliary production can be sold externally. In this case, the cost of sales is also reflected by posting Dt 90 (91) Kt 23, bypassing the accounts for accounting for finished products of the main production.

1.3) Closing 23 accounts for 44

In the current example, the support production OS provides some services to the business unit. From the point of view of Integrated Automation 2.4, the provision of such a service will be an expense. Its amount will be formed only based on the results of work at the end of the month. This means that in order to attribute a service to account 44, the document “Production without an order” and proper registration of the cost item are also required.

An expense item for a commercial division should have the following settings:

Expense type - “Business expenses”, specify the distribution settings “Write off to financial result”, in our example the expense will be distributed to areas of activity in accordance with the revenue received.

On the “Regulated Accounting” tab, data for tax reporting, as well as accounting accounts, are entered; in the current example, account 44 is closed using direct costing to account 90.07.1.

After filling out the cost item, a basis is formed for determining consumption through the document “Production without an order.” One document is generated for one area of activity. If the 44th invoice at the end of the month must be distributed to all areas of activity in accordance with the necessary rule, then it is not recommended to fill out the corresponding field on the “Additional” tab in the “Production without an order” document.

On the “Main” tab, the auxiliary department is indicated in the corresponding field (otherwise account 23 will not be included in the loan posting).

On the “Products” tab, in the “Direction of output” column, indicate “Write off as expenses”, fill in the “Recipient/item and analytics/accounting account” column with the recipient department, as well as the expense item with accounting account 44, created earlier.

Document postings will be generated in the previously created document “Production without an order” only after the routine operation “Distribution of costs and calculation of cost” is completed as part of the closing of the month, that is, at the moment when the cost of an hour of fixed assets is generated. The subconto “Direction of activity” will not be filled in, because in the settings, the expense on account 44 should be distributed on 90.07 to areas of activity, according to the revenue received.

As part of the month closure, the document “Distribution of expenses between areas of activity” will be automatically generated:

The document will distribute the expense on account 90.07 by area of activity. In the current example, implementation was completed within a month for only one area of activity.

Now everything is ready to begin closing account 23.

Posting Debit 23 Credit 23

Posting Debit 23 Credit 23 is most often used in situations where one auxiliary unit transfers its products or provides services to another auxiliary unit. Thus, the entry Debit 23 Credit 23 is made in the context of analytics for various auxiliary productions.

Example

The flour mill has:

- own fleet of special vehicles;

- own sorting and loading shop for finished products;

- workshop for the production of equipment and tools;

- repair shop.

According to the accounting regulations of the enterprise, the inventory used in the main production and repair work are accounted for on account 20, and the costs of loading and delivering finished products to customers using their own transport are accounted for on account 44 “Sales expenses”.

1. The repair shop performed work on repairing the equipment of the loading shop in the amount of 100,000 rubles. In this case, equipment and tools from our own workshop were used in the amount of 20,000 rubles.

2. The repair shop also repaired the elevator equipment in the amount of RUB 500,000. In this case, the products of our own inventory and tool shop were used for 130,000 rubles.

In order to correctly distribute the amounts that form the actual value of the main production on account 20, sales expenses on account 44, as well as the balance of accounts of auxiliary production, it is necessary to make transactions of the type Debit 23 Credit 23:

- Dt 23 (repair shop) Kt 23 (equipment and tools workshop) - 150,000 rubles. (20,000 + 130,000). The workshop's products were transferred to the repair shop.

- Dt 23 (loading shop) Kt 23 (repair shop) - 100,000 rubles. Repairs were carried out in the loading shop using our own repair shop.

- Dt 20 Kt 23 (repair shop) - 500,000 rubles. Current repairs of main production equipment were carried out using our own repair shop.

- Dt 44 Kt 23 (loading shop) - 100,000 rubles. The cost of routine repairs of equipment in the loading department is included in sales expenses.

In addition, the entry Debit 23 Credit 23 can be used to adjust data on the nomenclature and reflect the identified misgrading.

Example (continued)

Let's introduce additional conditions.

On the last day of the month, an inventory was taken in the equipment and tools workshop. The results revealed:

- excess items related to inventory - 4,000 rubles;

- shortage of nomenclature related to tools - 4,000 rubles.

The study of documents for internal movement showed that when releasing the production of the workshop to the repair shop, errors were made: the item items of inventory and tools worth 4,000 rubles were reflected with re-grading.

To eliminate inaccuracies, the accounting department will make a posting in the format Debit 23 Credit 23 by item: Dt 23 (tools) Kt 23 (inventory) - 4,000 rubles.

Account 23 can also be used when performing work in your own production workshop. For example, when performing repairs in a rented premises.

Find out how a tenant can account for expenses for current and major repairs of rented premises using account 23 in ConsultantPlus. Get trial demo access to the K+ system and access the material for free.

HIGHLIGHTS OF THE WEEK

02/28/20209:30 Personnel

Established benefits for military personnel and investigators

01.03.202214:42

Accounting and reporting

Economic measures introduced from March 1, 2022

yesterday at 13:4313:43

Accounting and reporting

Central Bank of the Russian Federation on restrictions on foreign exchange transactions: clarifications, March 2022

28.02.202216:00

Accounting and reporting

Salary paid early: consequences

28.02.202209:15

Responsibility

Increased responsibility of the management of non-state pension funds and insurance companies

PODCAST

What legislative changes do accountants need to know and apply in their work from 2022

All episodes

Comments on documents for an accountant

About personal income tax on income received outside the Russian Federation

02/28/2022 Remuneration for the performance of labor or other duties, work performed, service provided, with...

Is it possible to apply tax deductions when paying personal income tax on interest on a deposit?

02/28/2022 Personal income tax is accrued on the total interest income on deposits (account balances) in...

Compensation for the use of personal transport for business purposes: what about personal income tax and contributions?

02/27/2022 When an employee uses personal property with the consent or knowledge of the employer and in his interests...

‹Previous›Next All comments

Wiring Dt 20 Kt 23

As can be seen from the example, by adding the posting Dt 23 Kt 23 to the postings Dt 20 Kt 23, we reflected the transfer of the results of the auxiliary production to the main production process. This transfer is the main purpose of any auxiliary production. Accordingly, Dt 20 Kt 23 is the main entry, including the cost generated in auxiliary production in the cost of the main product of the enterprise.

ATTENTION! Since 2022, all organizations are required to apply FAS 5/2019 “Inventories”. The new standard also regulates the rules for accounting for work in progress.

ConsultantPlus experts explained in detail how to take into account work in progress and finished products according to the rules of FSBU 5/2019. If you do not have access to the K+ system, get a trial demo access and upgrade to the Ready Solution for free.

Learn more about the formation of turnover and balance on account 20 from the article “Main production in the balance sheet (nuances)”.

Corresponding accounts

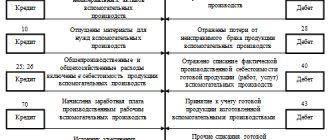

As for correspondence with other accounts, in the debit part these could be:

- depreciation charges (02);

- NMA (04);

- depreciation calculation for intangible assets (05);

- materials (10);

- settlements with suppliers and contractors (60);

- other expenses and income (91).

Speaking about the combination with accounts on the credit side, here it is worth highlighting:

- installation equipment (07);

- contribution to non-current assets (08);

- key production (20);

- manufacturing defects (28);

- finished products (43).

Wiring Dt 20 Kt 10 and Dt 23 Kt 10

Accounting entries Dt 20 Kt 10 and Debit 23 Credit 10 reflect the transfer of materials from warehouse to production. If account 20 is debited, it means that the materials are transferred to the main production process; if account 23 is debited, the materials are sent to auxiliary production.

Example (continued)

Based on the results of the inventory of the equipment workshop, a shortage of fuel and lubricants stored in the same workshop was also identified by 1,000 rubles.

It was found that, along with equipment for repairing the loading workshop, a container with lubricant for the transport department worth 1,000 rubles was taken away, without properly reflecting this in the documents for internal movement. The container was found in the transport department.

To reflect the movement of a container with fuels and lubricants, after correct execution of documents for the movement, you can make a posting: Dt 23 (transport department) Kt 10 (inventory and tools / fuels and lubricants workshop) - materials were transferred from one auxiliary production to another.

Pay attention to the structure of analytics for account 10 given in the example - in the context of both storage location and nomenclature (names).

You can read in detail about the special requirements for accounting on account 10 in the article “Features of the balance sheet on account 10.”

Results

Postings in the format Debit 23 Credit 23 can be used to:

- reflect the transfer of products (services) of one auxiliary production to another auxiliary production;

- make adjustments in terms of the nomenclature of auxiliary production, for example, when identifying mis-grading.

The main posting for disposal from account 23 is Dt 20 Kt 23 - when the product of auxiliary production is sent to the main one.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.