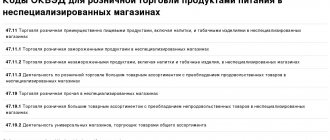

Wholesale and retail trade

Trade is directly related to the purchase and sale of goods (Article 2 of the Federal Law of December 28, 2009 No. 381-FZ). Products are assets that a company originally purchased for resale rather than producing itself.

Accounting for goods is regulated by PBU 5/01. From this PBU we can conclude that the cost of goods includes the purchase price, transportation costs, customs duties, and more. Even interest on loans issued for the purchase of goods can reasonably be included in the cost price.

Companies can trade wholesale and retail. The difference between retail and wholesale trade lies in the volume of goods sold.

At retail, goods are sold in small quantities or individually to satisfy the personal needs of the buyer, while wholesale involves trading in large quantities of goods.

In addition, in retail trade, a transaction is made between a company and an individual, and in wholesale trade, goods are most often sold to a legal entity or individual entrepreneur.

Create receipt orders automatically, not manually! Connect Kontur.Market and Kontur.Accounting. The services are integrated and it will be easier for you to calculate taxes, maintain an income book and maintain cash discipline.

More details

Retail store automation: basic kit

The setup package includes:

- Installation of the 1C: Retail program;

- Introduction of nomenclature (5 positions);

- Setting up users (cashier, administrator);

- Setting up organization parameters (details, address, SNO);

- Cashier and merchandiser training (1 hour);

- Registration of an online cash register with the Federal Tax Service and the Federal Tax Service;

- Setting up a standard check template (54-FZ);

- Connecting an online cash register to 1C;

- Connecting a barcode scanner to 1C;

- 24/7 technical support for the store for 6 months;

More details Order

Features of accounting in trade

Accounting in trade is about correctly executed documents and transactions drawn up on their basis.

Goods for resale are accounted for in account 41. The account has several subaccounts. The most commonly used account is 41.4 “Purchased Items”.

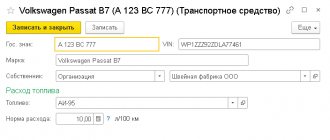

Goods are accounted for by name, quantity, storage location and financially responsible persons.

The cost of a product is its acquisition price, delivery costs, duties, agency fees, etc. (clause 6 of PBU 5/01).

for finished products. This account cannot be used in trading. Here you will need account 41 “Goods”. Sub-accounts are opened for this account. The purchase of goods is reflected by posting Debit 41 Credit 60. If necessary, VAT is allocated as a separate posting.

The sale of goods includes three transactions:

- Debit 62 Credit 90 - revenue.

- Debit 90 Credit 68 - VAT.

- Debit 90 Credit 41 - cost.

Let's analyze the differences between accounting in trade for wholesale and retail sales.

Results

Accounting in trade organizations depends on the type of trade: wholesale or retail. At the same time, in retail outlets equipped with a special software product, accounting is carried out automatically at the cost of each unit of goods, that is, quantitatively.

If the point is not automated, then in retail it is allowed to keep records only in total terms at retail prices with a designated markup. In this case, the financial result of the company’s work is determined by calculation.

The chosen accounting option is necessarily recorded in the accounting policy.

Sources:

- Tax Code of the Russian Federation

- Methodological recommendations for accounting and registration of operations of receipt, storage and release of goods in trade organizations

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Accounting in wholesale trade

All transactions with goods are reflected by postings.

Receipt (purchase) of goods

Debit 41 Credit 60 - goods were purchased from the supplier.

Debit 19 Credit 60 - VAT allocated.

Debit 41 Credit 60 - reflected other costs that increase the cost of purchased goods.

Selling goods

Debit 62 Credit 90 - showed the proceeds from the sale of goods to the buyer.

Debit 90 Credit 68 - VAT was charged on the sale.

Debit 90 Credit 41 - the cost of goods was written off.

Internal movement

Debit 41 Credit 41 - goods were transported from one warehouse of the organization to another. The analytics reflects the corresponding warehouses or materially responsible person (MRP).

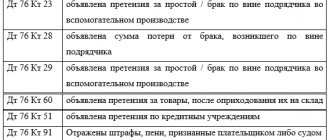

Marriage

Debit 94 Credit 41 - defective goods were found in the warehouse.

Debit 44 Credit 94 - the loss of goods was written off within the limits of natural loss.

Debit 91 Credit 94 - losses in excess of natural loss were written off.

Debit 73 Credit 94 - losses due to marriage were attributed to the guilty party.

Accounting in retail trade

Accounting in retail can be carried out in two ways: the first method is similar to accounting for goods in wholesale trade, and with the second method of accounting, you need to use account 42 “Trade margin”. Let's consider transactions using account 42.

Receipt (purchase) of goods

Debit 41 Credit 60 - purchased goods from a supplier.

Debit 19 Credit 60 - VAT allocated.

Debit 41 Credit 60 - reflected other costs that increase the cost of purchased goods.

Debit 41 Credit 42 - showed the trade margin.

Selling goods

Debit 50 (62) Credit 90 - showed the proceeds from the sale of goods to the buyer.

Debit 90 Credit 68 - VAT was charged on the sale.

Debit 90 Credit 41 - the book value of goods was written off.

Debit 90 Credit 42 - the trade margin was minus (reversed).

Debit 90 Credit 44 - took into account the costs of selling goods.

Debit 90 Credit 99 - identified the financial result from the sale of goods.

Accounting for financial results and subaccounts for retail trade

Absolutely every commercial structure is created for the purpose of making a profit. At the end of each month, the accounting department displays financial results and conducts “Month Closing”. For these purposes, account 90 with subaccounts is used. It is not reflected in the balance sheet and should not have a balance at the end of the month, but subaccounts are closed at the end of the year. Let's look at what subaccounts the 90th account has:

| Subaccount | Decoding |

| 1 | Revenue |

| 2 | Cost price |

| 3 | VAT |

| 4 | Excise taxes |

| 9 | Profit/loss |

90.1 – proceeds from the sale of inventory items are collected in this account during the month. This subaccount is credit only and is formed by the following transactions:

Dt 51 (50) Kt 90.1 – revenue received;

Dt 62 Kt 90.1 – goods and materials sold to a specific buyer.

90.2 – this account reflects the fact of writing off the cost of inventory items. All expenses incurred for the month are also covered. The account is debit and is formed by the following entries:

Dt 90.2 Kt 41 – the cost of inventory and materials is written off (based on sales);

Dt 90.2 Kt 44 – costs written off (at the end of the month).

90.3 – collects sold VAT, which must be transferred to the budget. In this case, the fact of payment does not affect the need to transfer VAT. That is, if the sale has taken place, but the buyer has not yet paid the money for the goods and materials, VAT must still be transferred by the 20th of the next month. This accounting method is called the “realization method.” Upon the fact of sale, you should issue an invoice, register it in the sales book and record it with the following entry:

Dt 90.3 Kt 68.2 VAT

However, in retail trade, the “Cash method” is most often used, since payment occurs at the time of transfer of inventory items. We have it in more detail below.

90.4 -Excise duties. This sub-account is dealt with by accountants whose companies sell highly profitable products: tobacco, oil, alcohol, etc. Wiring:

Dt 90.4 Kt 68 - excise duty

90.9 - Profit Loss. This subaccount is used to display financial results. It determines the difference between income and expenses incurred, that is, the profit or loss of the organization. Account balance 90.9 is closed monthly to account 99 by posting

Dt 90.9 Kt 99 – profit is reflected;

Dt 99 Kt 90.9 – loss received.

If we remember the initial example, then the Turnover Balance Sheet (SAS) for account 90 looked like this:

| check | rpm | Balance | ||

| Debit | Credit | Debit | Credit | |

| 90.1 | 4 348,50 | 4 348,50 | ||

| 90.2 | 2 834,75 | 2 834,75 | ||

| 90.3 | 663,33 | 663,33 | ||

| 90.9 | 3 498,08 | 4 348,50 | 850,42 | |

As a result of this operation, a profit was received in the amount of 850.42 rubles. That is, at the end of the month, the entire amount accumulated on account 90.3 must be written off to account 99. In this example the wiring is:

Dt 90.9 Kt 99 – 850.42 rub.

Examples of accounting entries

LLC "Zapchast"

We bought seven fuel pumps at a price of 8,340 rubles per unit. Paid 58,380 rubles, including VAT 8,905.42 rubles. Accounting is carried out at sales prices. The trade margin for each pump is 10%.

The accountant reflected the transactions with the following entries:

| Wiring | Payment in rubles | Operation |

| Debit 41 Credit 60 | 49 474,58 (58 380 — 8 905,42) | Capitalized the pumps |

| Debit 19 Credit 60 | 8 905,42 | I allocated VAT on the purchase |

| Debit 41 Credit 42 | 4,947.46 (49,474.58 x 10%) | Added trade markup on pumps |

| Debit 41 Credit 42 | 890,54 | Included VAT as part of the markup |

| Debit 50 Credit 90 | 64 218 (58 380 + 890,54 + 4 947,46) | All pumps are sold at retail |

| Debit 90 Credit 41 | 64 218 | Wrote off the book value of the pumps |

| Debit 90 Credit 42 | 5 838 | Reversed the trade margin |

| Debit 90 Credit 68 | 9 795,97 | Charged VAT on the sale of pumps |

LLC "Raduga"

We bought nine KAMAZ-5320 brake pads at a price of 632 rubles per piece. Paid 5,688 rubles, including VAT 867.66 rubles. Accounting is carried out at sales prices. The trade margin on each block is 13%.

The accountant reflected the transactions with the following entries:

| Wiring | Payment in rubles | Operation |

| Debit 41 Credit 60 | 4 820,34 (5 688 — 867,66) | Capitalized the pads |

| Debit 19 Credit 60 | 867,66 | I allocated VAT on the purchase |

| Debit 41 Credit 42 | 626.64 (4,820.34 x 13%) | Added trade markup on pads |

| Debit 41 Credit 42 | 12.80 (626.64 x 18%) | Included VAT as part of the markup |

| Debit 50 Credit 90 | 6 427,24 (5 688 + 626,64 + 112,80) | All pads sold to retail buyer for cash |

| Debit 90 Credit 41 | 5 559,78 (4 820,34 + 626,64 + 112,80) | Wrote off the book value of the pads |

| Debit 90 Credit 42 | 739,44 (626,64 + 112,80) | Reversed the trade margin |

| Debit 90 Credit 68 | 848,10 | Charged VAT on the sale of pads |

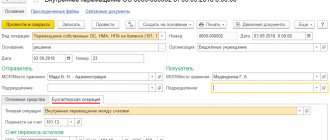

Retail sales in 1C 8.3 via NTT

Let's look at how to fill out a report on retail sales in NTT in 1C 8.3.

The organization retails goods through NTT. Accounting is carried out without using account 42 “Trade margin”.

On May 1, the balances at the NTT warehouse were:

- Fabric “Blackout Scarlett” - 100 linear meters.

- Fabric "Jacquard Sylvia" - 100 linear meters.

There were no other receipts to the warehouse during May.

In May, retail revenue in the amount of:

- May 06 — 12,980 rub.

- May 18 — 11,210 rub.

- May 23 — 14,750 rub.

- May 31 — 8,850 rub.

On May 31, an inventory was carried out, the balances in the warehouse were:

- Fabric “Blackout Scarlett” - 65 linear meters.

- Fabric "Jacquard Sylvia" - 20 linear meters.

On the same day, based on the inventory, a retail sales report was generated for a total amount of 47,790 rubles:

- Fabric “Blackout Scarlett” - 35 linear meters. at a price of 826 rubles.

- Fabric "Jacquard Sylvia" - 80 linear meters. at a price of 236 rubles.

Unlike ATT, in this case, in 1C 8.3, the capitalization of retail revenue is first recorded, and then a detailed report on goods sold is entered.

Posting retail revenue to the cash register

The posting of retail proceeds to the main cash desk of an organization in 1C is formalized by the document Receipt of cash transaction type Retail proceeds in the section Bank and cash desk - Cash desk - Cash documents.

In the document please indicate:

- Warehouse - retail outlet, selected from the Warehouses , Warehouse type - Manual retail outlet ;

- Payment amount - the amount of retail revenue deposited at the cash desk.

Postings

Revenue received at the cash register from a retail store (NTT) is considered undistributed until the Retail Sales Report document is entered into the 1C document, and is reflected according to:

- Dt RV.1 - revenue,

- Dt RV.2 - VAT.

The delivery of proceeds for other days (May 18, 23 and 31) is processed in the same way.

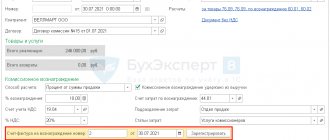

Retail sales report in 1C 8.3

For a detailed sales report in 1C 8.3 Accounting for NTT, fill out the document Retail Sales Report type of operation Manual retail outlet in the section Sales - Retail sales - Retail sales reports - Report - Manual retail outlet.

Please indicate:

- Warehouse - retail outlet, selected from the Warehouses directory, Warehouse type Manual retail outlet .

On the Products , fill in the sold products from the Nomenclature directory.

- The accounting account is filled in automatically in the document, depending on the settings in the Item Accounting . If necessary, it can be changed manually. Learn more about setting up item accounting accounts.

- Subconto is a product group related to retail trade, selected from the Product Groups directory.

It is very important to indicate the Nomenclature Group correctly, since filling out the income tax return depends on this. Read more about Setting up accounting policies in NU

Postings

When conducting a sales report in 1C 8.3, previously unallocated revenue will be distributed to the goods sold.

To access the section, log in to the site.