Why do you need the KS-2 form?

The information from Rosstat indicates what the KS-2 and KS-3 forms are - this is the final documentation that is signed by the parties who entered into a state contract for construction, installation and repair work (Rosstat letter No. 01-02-9/381 dated 05/31/2005 ). The documents signed by both organizations mean that the parties have no claims to the volume and quality of the work performed and are the basis for further mutual settlements.

After the contractor fulfills its obligations under the government contract, the customer carries out inspection and acceptance. Confirmation of fulfillment of contract conditions is a signed act of acceptance of work performed - form KS-2. It is formed at the stage of closing the government order, after the supplier has fulfilled all obligations assigned to him, and the customer has checked the completeness and quality and accepted the work performed.

Which form to use

To sign the final documentation upon completion of construction, repair or installation activities, the unified form KS-2 is used - OKUD 0322005. The forms of the act and certificate were developed and enshrined in the Decree of the State Statistics Committee No. 100 of November 11, 1999. The procedure for filling out and the content of the act depend on the type of work performed.

Although the form of the act is unified, the executor has the opportunity to modify it depending on his needs without violating current regulations.

ConsultantPlus experts sorted out what to use: a universal transfer act (UTD) or KS-2, KS-3. Use these instructions for free.

How to fill out

The act is formed after the completion of repairs, construction, or reconstruction of the facility. Here are step-by-step instructions on how to fill out KS-2 for a supplier:

Step 1. Fill out the introductory part - the header of the form. Information about the investor is filled in if there is such an economic entity in the contractual relations of the parties.

The basis for entering information about the customer and contractor is their registration information. Here the names of both organizations, their addresses, contact numbers and OKPO of each party are indicated.

Step 2. Fill in the “Construction” column - the address of the construction site under a government contract. In the “Object” field, indicate the full name of the subject of the contract.

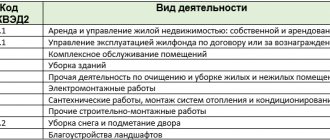

In the fields we indicate the type of activity of the organization according to OKDP, the details of the contract - the number of the government contract and its date.

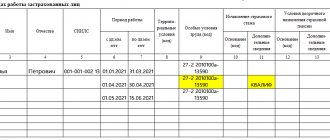

Step 3. We generate information about the period of work and indicate the details of the act. It is assigned a number in order and its date is indicated. The “Reporting period” sign shows the start and end dates.

Step 4. We enter the cost of construction, repair or installation work in accordance with the estimate. The amount must match the price specified in the contract and be written in rubles.

Step 5. Fill out the table. The table of this act is a reflection of the estimate for performing work under a government contract. The form accumulates data from several estimates.

All numbers in order (column 1), positions in the estimate (item 2) and names of work performed (item 3) are written down similarly to the lines of the estimate calculation. Numbers from the collections of federal unit rates (FER) are indicated in column 4 for each type of work, if available for this category. Column 5 reflects the unit of measurement - exactly as it is written in the estimate. It is not allowed to record the volume of work performed in percentage and proportional terms. Column 7 - “Price per unit in rubles.” — is formed using data from FER collections. If the terms of the contract require a fixed cost for contractual activities, then dashes are indicated in column 7.

Column 8 reflects the actual cost of construction or repairs based on the estimate, which is an integral annex to the government contract. This column is also filled in based on the calculated values for each item from the collections of federal unit prices.

Step 6. When the customer verifies the data from the act with the estimate and actual volumes, the act is signed by the manager or other responsible person.

The document is drawn up in two copies. The seal is affixed only if it is used by institutions. The report form also reflects all the comments that the customer makes to the contractor regarding inadequate quality, volume or deadlines.

How to fill out an acceptance certificate for completed work

The structure of the act consists of a title and tabular parts. It is recommended to start drafting a document from the title section. So, in accordance with the current rules:

- The fields “Investor”, “Customer”, “Contractor” should be filled out in strict accordance with the constituent and registration documents (charter, certificates or extracts from the Unified State Register of Legal Entities from the Federal Tax Service). Please note that if there is no information about the investor in the agreement, then the corresponding field does not need to be filled in.

- The “Construction” and “Object” fields contain information about the location (performance) of construction and installation work. So, in the “Construction” field, indicate the name of the construction and address. In the “Object” field, enter the full name of the construction project in accordance with the design and estimate documentation and the subject of the contract.

- Now we enter the type of activity according to OKPD, which is assigned to the customer in accordance with Order of Rosstandart dated January 31, 2014 No. 14-st.

- We register information about the concluded contract, agreement, agreement for construction and installation work. We enter in the appropriate field the date of conclusion of the agreement in the format DD.MM.YYYY and the agreement number.

- Then we indicate the date of drawing up the act, its number, taking into account the chronological order. We also specify the time period for which the document was compiled.

- We enter information about the estimated cost of the work. The amount is indicated in rubles. Please note that the data must comply with the terms of the concluded contract and be confirmed by design and estimate documentation.

The title section is complete. Now let's look at an example of how to fill out KS-2 in the tabular part of the act. The current order is:

- Number in order - assign a serial number, new for each position.

- “Item number according to the estimate” - indicate the number of the construction and installation work item, in accordance with the approved design and estimate documentation. If several estimates are executed within the framework of one contract, then the numbering is duplicated.

- The name of the work is prescribed in strict accordance with the approved estimate. Abbreviations, changes or additions to names are not permitted.

- The unit price number is entered from the estimate documentation data, in accordance with the current classifier and the FER collection.

- The unit of measurement denotes a qualitative expression assigned to a specific type of construction and installation work.

- The number of completed works is a quantitative indicator characterizing the volume completed. Specifying percentages is not allowed.

- In the “Price per unit” column, you should indicate the accounting price that is established for a specific type of construction and installation work. For fixed contract prices, put dashes in the column.

- The “Cost” column is filled in in any case. It reflects the cost expression of completed emergency services taking into account the volume.

If there are disagreements or comments regarding the procedure and timing of fulfillment of the terms of the agreement, appropriate entries are made in the document.

After filling out the act form, a certificate of the cost of the work performed is drawn up. Then both documents are sent to the customer for reconciliation, approval and further payment.

Why do you need the KS-3 form?

Legislative regulations explain in what cases KS-2 and KS-3 are filled out - when purchasing construction and repair work. The result of the completion of the contract is acceptance by the customer organization and signature of the act. For final acceptance, the contractor draws up a certificate of the cost of the work.

A certificate of the cost of work performed and expenses is a financial document on the basis of which the cost of contracting activities is approved. In accordance with this documentation, the results of the execution of the government contract are reflected in the accounting records.

The form reflects information about the total cost and expenses for the object of repair, construction or installation activities. The certificate also indicates costs not taken into account in the estimate (price increases, rental costs, etc.).

Filling out the tabular part of the KS-3 form

After filling out the upper part of the certificate on the cost of work performed KS-3, you can proceed to entering information in the tabular part of the form. It should be noted that this part is the most significant in the entire document, since it reflects the cost of work performed on the site.

First of all, the example of filling out a certificate of the cost of work performed and expenses involves assigning a document number. There is no specific algorithm for document numbering. In this case, everything depends on the requirements of the inspection organizations for the preparation of documentation.

Sometimes numbering helps to understand how KS-3 is deciphered and for which object this form was compiled. However, sequential numbering is most often typical for documents of this type.

After assigning the number, it is recommended to indicate the date of preparation of the certificate of cost of work KS-3. As a rule, the date of drawing up the document coincides with the date of drawing up the KS-2 acts.

However, sometimes the sample for filling out KS-3 requires indicating a specific date in the specified field. This is usually due to individual requirements for the preparation of reporting documentation for the facility.

Also individual may be the indication of information on the withholding of the advance payment in KS-3 or other financial transactions that occurred during the execution of construction and installation work at the site. Requirements for entering such information must be separately stipulated in the contract.

This is followed by an indication of the reporting period in KS-3. Most often, the reporting period in the document is the month in which the work under the contract was performed. However, sometimes other dates of the reporting period may be indicated in the corresponding cells.

This is followed by a decoding of KS-3, namely, that it is a certificate of the cost of work performed and expenses. It is this name that makes it immediately clear what KS-3 is in construction and what data is contained in the form.

The easiest way to understand what KS-3 is is in practice, that is, at the time of filling out the form. It is in the process of forming this document that you can obtain comprehensive information about the documentation for the work performed.

After filling out all the necessary information about the dates in the document, information directly about the cost of work performed at the site should be entered into the sample form KS-3 from the KS-2 act. Please note that a special table is provided in the help to display information of this kind.

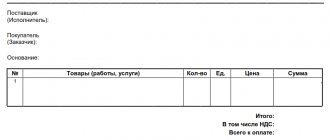

The KS-3 example in Figure 1 contains only an empty, unfilled table. However, for a real construction project, it is the information in this part that plays an important role in deciphering what it is - KS-3.

Registration of KS-3 in the tabular part begins with the serial numbering of all KS-2 forms, on the basis of which the certificate is drawn up. The fact is that even within one month or one reporting period, several reports of work performed can be drawn up for an object.

Therefore, the numbering of all existing KS-2 forms, even if you download the KS-3 form, is an important element that helps organize and systematize all information on the object. Therefore, the easiest way is to use the unified form KS-3 in Excel format.

After this, all acts of KS-2 with the names of launch complexes, as well as types of construction and installation work or equipment must be included in the KS-3 document. When filling out the KS-3 form, this column may also indicate information about objects and costs that affected the cost of the work.

If you fill out KS-3 online, then providing such information is sometimes possible in an automated form. However, most often it is necessary to enter information manually to avoid inaccuracies in the designation and further confusion.

If you have any doubts about how to fill out KS-3 correctly, it is recommended to consult inspection authorities or find a solution based on existing experience in this area.

After specifying information about the types of construction work according to the rules for registration of KS-3, it is necessary to indicate codes for each of the positions in the certificate. These codes can be found in the KS-2 acts themselves or in the reporting documentation for the facility.

If you download the KS-3 form in Excel for free, you can set up automatic links for many cells in the document, including those for designating codes. However, it is recommended to enter all data manually, which will help avoid errors in calculations.

Next, the storage part in sample KS-3 is filled. A sample of filling out KS-3 with a cumulative total should include two types of information. Firstly, in this part it is important to reflect information on the cost of work performed from the beginning of the work.

That is, if the construction of an object is carried out over several months or years, then in each reporting period, a sample certificate of the cost of work should take into account the sum of all previous KS-3. An example of how to fill out KS-3 with a cumulative total should be available for every site and in every construction organization.

It should be noted that the sample filling out KS-3 with an advance payment should also take into account all previous amounts of work performed. It must be borne in mind that the amounts in the certificate of the cost of work performed in the KS-3 form are entered without VAT.

Next, the sample filling out and execution of KS-3 should take into account the cost of work performed from the beginning of the calendar year in which the documentation is drawn up. Sometimes the cost in the column called “since the work began” and the cost in the column “since the beginning of the year” are the same.

This is typical according to the rules for filling out unified forms KS-3 for objects whose construction began and continues within one calendar year. However, if construction began in one year, and a sample KS-3 certificate form for certain work performed is provided in another year, then the amounts in the two columns will differ.

In this regard, it is very important to understand how to correctly compose KS-3 for such objects. The last column of the table contains the total cost of work performed during the reporting period.

Sometimes the question arises of how to do KS-3 in the “Grand Estimate” or in another estimate program. Answers can be found on specialized resources and consulting companies related to a specific estimated product.

If KS-3, then compiling and entering all information is usually done manually. It should be noted that the formation of KS-3 is not completed by entering all amounts into the table.

The procedure for filling out KS-3 involves summing up all costs and summing up the results according to the certificate. The total amount of value added tax must be taken into account in the results of the document.

However, it is possible to compile a sample KS-3 without VAT. This depends on the tax conditions for organizations involved in the construction process of the facility. In this case, it is possible to include the amount of VAT compensation in the sample form KS-3 in construction.

How to fill out

The basic rules for registering KS-2 and KS-3 are given in Goskomstat Resolution No. 100. The register is filled out in two copies: one for each party to the contract. If the contractual terms provide for the presence of an investor, then the form is drawn up in triplicate. The document is prepared both for the entire construction project and for each stage of construction or repair, indicating the full cost of contracting activities according to the estimate.

Algorithm for generating information in a certificate of cost of work:

- We enter information about the contractor and customer, their contacts, OKPO codes. The name of the construction site and details of the government contract are indicated here.

- We assign a number to the document in order and indicate the date of its formation, designating the reporting period.

- Let's fill out the table. Units of measurement, volumes and FER codes are not needed here. The table indicates only the names of contract actions, their numbers in order and prices on an accrual basis for the periods: from the beginning of the work, from the beginning of the year and data for a specific reporting period. If the performer has a need, actions are grouped by type of work code or type of equipment used.

- Let's summarize. We sum up the cost for each type of action, enter the result in the “Total” line and calculate VAT. We add up the estimated amount and the VAT amount and get the final price of the work.

- We sign the register and approve it with the customer organization. The certificate is certified by managers or other responsible persons. The seal is affixed if it is available in organizations.

If everything is filled out correctly, you will get a document like this:

How to fill out forms: step-by-step instructions with samples

Let's look at an example of what the KS-2 and KS-3 forms are when repairing gates, and how the forms are filled out when performing such work. Let’s say that an agreement is concluded between LLC “Subcontractor” and LLC “Customer” (it also acts as an investor in the project). The acceptance certificate is drawn up at once upon completion of all stages of the contract. It acts as an invoice for payment, and the certificate allows you to pay for the work.

Note:

if we are talking about the provision of services over a long period of time, then the document on acceptance and transfer is drawn up based on the results of the agreed reporting period, for example, every month. Work performed is paid at the same frequency.

An example of filling out a work completion certificate

First, fill out the document on acceptance of completed work:

- We begin filling out by indicating the names, addresses, telephone numbers and OKPO of the persons involved in the transaction: investor, customer and subcontractor.

- Below we provide the details of the facility under construction - the address for conducting activities at the facility.

- The “Object” line reflects information about the complex of works performed in accordance with the contract. Sometimes the information in the construction and object sections in KS-2 and KS-3 coincides, this is not considered a violation.

- When filling out, it is necessary to make a reference to the contract indicating its number and date.

- We assign a number to the document and indicate the date of its preparation. Next to it, you must indicate the time period during which the subcontractor carried out activities at the site. Please note that the serial number of KS-2 and KS-3 must be common: there cannot be an act with number 3, and an estimate with number 4.

- The tabular part provides line-by-line data on the work performed, its volume, unit price and total cost. At the end of the table you need to display the total amount.

- After completion of the acceptance of work, the act is signed by authorized persons of the delivering and receiving parties. These persons can be both general directors and other employees authorized to perform these actions by a power of attorney from the head of the organization.

Note:

When generating documentation in Excel, there are no problems with how to connect two KS-2 if the work was carried out at the same facility. If the parties additionally agreed on a new front of activity, two different acts and two different estimates are drawn up.

Since not everyone works with unified forms, there is an option to make the KS-2 table a fact of work - to enter it into the template of the work completion certificate proposed by the customer. This document includes the same data - name and volume, cost.

Example of filling out a certificate

We proceed to filling out a certificate of the cost of work performed. The relevant information from the acceptance certificate is transferred to it. In addition, it is necessary to indicate the amount of VAT calculated on the final cost of all stages and include it in the total cost to be transferred by the customer to the subcontractor. But there are nuances that can be found in the methodology, approved. by order of the Ministry of Construction dated 08/04/2020 No. 421/pr.

The question is often asked how many decimal places are in the calculation results and final data in KS-2 and KS-3, but there are no exceptions to the general rules: they use 2 digits, as in other accounting documents.

Once completed, the certificate must be given to the same authorized persons for signature.

Explanations on the topic

| Main points | Document details | Download |

| On filling out the unified form No. KS-2 when concluding a government contract within the framework of Federal Law No. 94-FZ of July 21, 2005 | Letter of the Ministry of Economic Development No. D22-1743 dated September 27, 2010. | |

| In the letter, the Federal State Statistics Service explains the procedure for using unified forms of primary accounting documentation and filling out unified forms of primary accounting documentation in conventional monetary units | Letter of the Federal State Statistics Service dated May 31, 2005 No. 01-02-9/381. |

About the author of this article

Alexandra ZadorozhnevaAccountant, project expert Practicing accountant. I have been working since the beginning of my studies at the university. I have experience in both commerce and budgeting. From 2006 to 2012 she worked as an accountant-cashier and personnel officer. From 2012 to the present - chief accountant in a budgetary institution. In addition to direct accounting, I am involved in purchasing and economic planning activities. I have been writing feature articles for specialized publications for 4 years.

Other publications by the author

- 2022.02.28 Procurement control The Ministry of Finance clarified whether to simultaneously provide benefits to organizations of people with disabilities and penal institutions

- 2022.02.28 Procurement controlInstructions for drawing up a report on purchases from SMP and SONO according to 44-FZ

- 2022.02.25 Procurement control How the Treasury authorizes transactions with funds of treasury support participants from 2022

- 2022.02.25 Customer documents Plan to change the rules for drawing up FCD plans in institutions