Account 05 Amortization of intangible assets is used in an organization if it has intangible assets (intangible assets). Amortization of an intangible asset is a gradual transfer of its value to the cost of products (works, services) over the established period of its useful use.

According to the Instructions for using the Chart of Accounts, the amounts of accumulated depreciation can be reflected not only on account 05 “Depreciation of intangible assets”, but also on the credit of account 04 “Intangible assets”. The most popular and convenient way to reflect depreciation is using 05 accounts.

Account 05 Amortization of intangible assets

Depreciation for each intangible asset must be accrued monthly, starting from the month following the month when the intangible asset was accepted for accounting and its value was reflected in account 04 “Intangible assets”.

Depreciation of intangible assets is accrued over their specified useful life. Not accrued for intangible assets with an indefinite useful life.

The amortization period for the acquired business reputation of an organization is always set equal to 20 years, but not more than the life of the organization.

Depreciation can be carried out in three ways: linear, reducing balance method, and write-off method in proportion to the volume of production (work).

Depreciation on positive goodwill is calculated using the straight-line method. Negative business reputation in full is attributed to the financial results of the organization in the form of other income.

The depreciation of intangible assets is reflected by posting:

Debit 20,23,25,26,…. Credit 05 - amortization has been accrued on an intangible asset.

Debit 08 Credit 05 - depreciation has been accrued on intangible assets used in the process of creating non-current assets: other intangible assets or fixed assets.

Debit 97 Credit 05 - depreciation has been accrued on intangible assets used in the performance of work, the costs of which are taken into account as deferred expenses.

When selling intangible assets, writing off, gratuitously transferring or transferring as a contribution to the authorized capital, the following entry is made:

Debit 05 Credit 04 - depreciation of intangible assets is written off to reduce its residual value.

Account 05 in accounting

There are not many accounts with which account 05 corresponds. They are presented in the diagram:

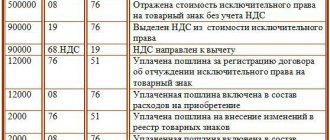

Analytical accounting for accrued depreciation must be maintained for each intangible asset.

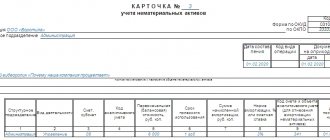

The account balance shows the amount of depreciation of intangible assets accumulated over their entire useful life.

Not all intangible assets are subject to depreciation. It is important to know one nuance, which is shown in the diagram:

Which intangible assets are considered “with an indefinite useful life”? The Ministry of Finance decided that these are intangible assets for which it is impossible to reliably determine the useful life. But, if an organization encounters factors by which it can determine the useful life of intangible assets, then from this moment depreciation on the object should be accrued. The presence of these factors is checked once a year.

Instructions for account 05 Amortization of intangible assets

According to the instructions for using the chart of accounts for accounting the financial and economic activities of organizations in accordance with Order No. 94n dated October 31, 2000:

Account 05 “Amortization of intangible assets” is intended to summarize information on depreciation accumulated during the use of the organization’s intangible assets (with the exception of objects for which depreciation charges are written off directly to the credit of account 04 “Intangible assets”).

The accrued amount of depreciation of intangible assets is reflected in accounting under the credit of account 05 “Amortization of intangible assets” in correspondence with the accounts of production costs (selling expenses).

Upon disposal (sale, write-off, transfer free of charge, etc.) of intangible assets, the amount of depreciation accrued on them is written off from account 05 “Amortization of intangible assets” to the credit of account 04 “Intangible assets”.

Analytical accounting for account 05 “Amortization of intangible assets” is carried out for individual objects of intangible assets. At the same time, the construction of analytical accounting should provide the ability to obtain data on the depreciation of intangible assets necessary for managing the organization and drawing up financial statements.

In which accounts should intangible assets be recorded?

The accounting account for an intangible asset depends on the right under which it was obtained.

| Right | Account | Example |

| Exclusive right | 0 102 XN 000 “Scientific research (research development)” 0 102 XR 000 “Experimental design and technological development” 0 102 XI 000 “Software and databases” 0 102 XD 000 “Other intellectual property” | Exclusive right to software - account 0 102 ХI 000; Exclusive right to a selection achievement - account 0 102 ХN 000; Exclusive right to a trademark - account 0 102 ХD 000; Exclusive right to an invention - account 0 102 ХN 000 |

| Non-exclusive right | 0 111 6N 000 “Rights to use scientific research (research developments)” 0 111 6R 000 “Rights to use experimental design and technological developments” 0 111 6I 000 “Rights to use software and databases” 0 111 6D 000 “Rights to use other objects of intellectual property" | Non-exclusive right to antivirus - account 0 111 6I 000; Non-exclusive right to a utility model - account 0 111 6N 000; Non-exclusive right to an electronic archive - account 0 111 6I 000; Non-exclusive right to a literary work - account 0 111 6D 000. |

Objects of intangible assets are grouped according to clause 37 of Instruction No. 157n. That is, objects received under exclusive right are accounted for in the corresponding account 102 00, where X can take the value 2 “Especially valuable movable property of the institution”, 3 “Other movable property of the institution” or 9 “Property in concession”.

More on the topic: Report on the implementation of the FHD plan (f. 0503737): features of filling out (video)

For example, on account 102 91 “Software and databases in concession” information about programs for electronic computers, databases, information systems and (or) sites on the Internet or other information and telecommunication networks that are the objects of concession agreements is subject to reflection. which includes such computer programs and (or) databases, or about the totality of these objects, as well as about operations that change them.

The grouping by type of property, designated by the letters N, R, I or D, corresponds to the subsections of the classification established by OKOF *(3) (clause 67 of Instruction No. 157n, letter of the Ministry of Finance of Russia dated September 17, 2020 No. 02-07-10/81813). Namely, OKOF provides for the following groups of intellectual property objects (OKOF code 700):

- scientific research and development (OKOF code 710);

- software and databases (OKOF code 730);

- other objects of intellectual property (OKOF code 790).

For example, multimedia applications are named in the “Software and Databases” group - OKOF code 732.00.10.08. Consequently, the exclusive right to this object, related to other movable property, is taken into account in account 102 3I. And if an institution has a non-exclusive right to multimedia applications, then it will be reflected in account 111 6I.

Typical postings for account 05

By debit of the account

| Contents of a business transaction | Debit | Credit |

| Depreciation on intangible assets disposed of as a result of sale, gratuitous transfer or liquidation is written off to reduce its original cost | 05 | 04 |

| Depreciation on intangible assets transferred to a branch allocated to a separate balance sheet was written off (posting in the accounting of the head office of the organization) | 05 | 79-1 |

| Depreciation on intangible assets transferred to the head office of the organization was written off (in the accounting of the branch) | 05 | 79-1 |

| Depreciation on intangible assets transferred to trust management was written off (posting in the accounting of the management founder) | 05 | 79-3 |

| Depreciation on intangible assets previously received for trust management and returned to the management founder was written off (on a separate balance sheet of trust management) | 05 | 79-3 |

By account credit

| Contents of a business transaction | Debit | Credit |

| Depreciation has been accrued for intangible assets used in the reconstruction or modernization of fixed assets | 08 | 05 |

| Depreciation is accrued on intangible assets used to create other intangible assets | 08 | 05 |

| Depreciation was accrued for intangible assets used during the construction of the facility for the organization’s own needs | 08-3 | 05 |

| Depreciation is calculated on intangible assets used in the main production | 20 | 05 |

| Depreciation is calculated on intangible assets used in auxiliary production | 23 | 05 |

| Depreciation is calculated on intangible assets for general production purposes | 25 | 05 |

| Depreciation is calculated on intangible assets for general business purposes | 26 | 05 |

| Depreciation is calculated on intangible assets used in service production | 29 | 05 |

| Depreciation is calculated on intangible assets intended to support the sales process (by trademark) | 44 | 05 |

| Depreciation is calculated on intangible assets of a trading organization | 44 | 05 |

| Depreciation on intangible assets received from the head office of the organization is taken into account (posting in the branch accounting) | 79-1 | 05 |

| Depreciation on intangible assets received from the branch is taken into account (posting in the accounting of the head office of the organization) | 79-1 | 05 |

| Depreciation has been accrued for intangible assets used in the performance of work, the costs of which are taken into account as deferred expenses. | 97 | 05 |

Postings to account “05”

By debit

| Debit | Credit | Content | Document |

| 05 | 04.01 | Write-off of the amount of accrued amortization of an intangible asset upon transfer (sale) | Transfer of intangible assets |

| 05 | 04.01 | Write-off of the amount of accrued amortization of an intangible asset upon write-off (liquidation) | Write-off of intangible assets |

| 05 | 83.01.2 | Write-down of previously discounted intangible assets: Change in the amount of accrued depreciation | Operation |

| 05 | 91.01 | Depreciation of intangible assets during the first revaluation: Change in the amount of accrued depreciation | Operation |

| 05 | 91.01 | Write-down of previously discounted intangible assets: Change in the amount of accrued depreciation | Operation |

By loan

| Debit | Credit | Content | Document |

| 000 | 05 | Entering opening balances: accumulated depreciation on an intangible asset | Entering balances |

| 20.01 | 05 | Depreciation on an intangible asset that is used in the main production | Regular operation |

| 23 | 05 | Calculation of depreciation on an intangible asset that is used in auxiliary production. Depreciation is calculated by paying off the original cost of an intangible asset | Regular operation |

| 25 | 05 | Accrual of depreciation on an intangible asset for general production purposes | Regular operation |

| 26 | 05 | Accrual of depreciation on an intangible asset for general economic purposes | Regular operation |

| 29 | 05 | Calculation of depreciation on an intangible asset that is used in service industries and farms | Regular operation |

| 44.01 | 05 | Depreciation on an intangible asset that is used in organizations engaged in trading activities | Regular operation |

| 44.02 | 05 | Calculation of depreciation on an intangible asset that is used in organizations engaged in industrial and other production activities | Regular operation |

| 83.01.2 | 05 | Revaluation of previously discounted intangible assets: Change in the amount of accrued depreciation | Operation |

| 83.01.2 | 05 | Revaluation of intangible assets during the first revaluation: Changes in the amount of accrued depreciation | Operation |

| 91.02 | 05 | Revaluation of previously discounted intangible assets: Change in the amount of accrued depreciation by the amount of the previous discount | Operation |

| 91.02 | 05 | Additional accrual of depreciation for previous periods on an intangible asset | Operation |

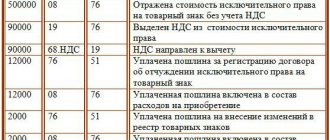

Basic operations with intangible assets

Creation of an intangible asset

Intangible assets are recognized as created if two rules are met:

- If they are received as a result of the performance of official duties or on the individual instructions of an entrepreneur.

- If they were received from other persons as a result of concluding an agreement for the creation of intangible assets.

- If the name of the organization has been issued certificates for the trademark used or for the right to use the name of the place where the required product is produced.

Amortization of intangible assets

Reflection in accounting of monthly depreciation of intangible assets with accumulation of depreciation amounts in a separate account.

| № | Debit | Credit | Contents of operation |

| Accounting entries for intangible assets under capital construction | |||

| 1 | 08 | 05 | The amount of depreciation of an intangible asset used in the creation of new non-current assets and in operations to bring acquired assets to a state suitable for further operation is reflected. |

| Accounting entries for production intangible assets located in the main production | |||

| 1 | 20 | 05 | The amount of depreciation of an intangible asset used in the production of one specific type of product (work, service) is reflected. |

| Accounting entries for production intangible assets located in auxiliary production | |||

| 1 | 23 | 05 | Reflects the amount of depreciation of an intangible asset used in the production of products (works, services) that are auxiliary (auxiliary) for the main production of the organization |

| Accounting entries for production intangible assets in general production use | |||

| 1 | 25 | 05 | The amount of depreciation of an intangible asset used in the production of several types of products (works, services) or classified as workshop objects is reflected. These expenses can be taken into account directly on account 23 “Auxiliary production”, without first accumulating them on account 25 “General production expenses” |

| Accounting entries for production intangible assets in general business use | |||

| 1 | 26 | 05 | The amount of depreciation of an intangible asset object classified as intangible assets for managerial and general business purposes is reflected. |

| Accounting entries for production intangible assets located in service industries and farms | |||

| 1 | 29 | 05 | The amount of depreciation of an intangible asset object used in the production of products (works, services) of service industries and farms of the organization is reflected |

| Accounting entries for production intangible assets located in divisions of the organization engaged in sales of products | |||

| 1 | 44 subaccount “Business expenses” | 05 | Reflects the amount of depreciation of an intangible asset used in the sale of products |

| Accounting entries for intangible assets located in trading organizations | |||

| 1 | 44 subaccount “Distribution costs” | 05 | Reflects the amount of depreciation of an intangible asset used in organizations engaged in trading activities |

| Accounting entries for intangible assets located in the social sphere | |||

| 1 | 91-2 | 05 | The amount of depreciation of an intangible asset used in the social sphere is reflected. The amount of depreciation is accrued to the financial results (other expenses) of the organization |

| Accounting entries for intangible assets located in divisions of the organization engaged in performing work taken into account as deferred expenses | |||

| 1 | 97 | 05 | Reflects the amount of depreciation of an intangible asset used in the development of new production and other types of work taken into account as part of deferred expenses |

| Accounting entries for intangible assets received free of charge | |||

| 1 | 20, 23, 25, 26, 29, 44, etc. | 05 | Reflects the amount of depreciation of an intangible asset received free of charge and simultaneously |

| 2 | 98-2 | 91-1 | Other income is reflected in the amount of accrued depreciation of the intangible asset received free of charge |

Reflection in accounting of the monthly depreciation of intangible assets provided for use under license agreements with the accumulation of depreciation amounts in a separate account.

| № | Debit | Credit | Contents of operation |

| Accounting entries, if the provision of intangible assets for use is the subject of the activities of the licensor organization | |||

| 1 | 20, 26 | 05 subaccount “Amortization of intangible assets provided for use under license agreements” | The amount of depreciation of an intangible asset object is reflected in the organization’s expenses with the accumulation of depreciation amounts in a separate account |

| Accounting entries, if the provision of intangible assets for use is not the subject of the activities of the licensor organization | |||

| 1 | 91-2 | 05 subaccount “Amortization of intangible assets provided for use under license agreements” | The amount of depreciation of an intangible asset object is reflected as part of the organization’s other expenses with the accumulation of depreciation amounts in a separate account |

| Accounting entries if the licensor continues to use the intangible asset in its business activities, and the transfer of the right does not entail additional expenses in the form of depreciation | |||

| 1 | 20, 44 | 05 subaccount “Amortization of intangible assets provided for use under license agreements” | The amount of depreciation of an intangible asset is reflected. The entire monthly amount of depreciation charges is recognized as an expense for ordinary activities |

| Accounting entries if the licensor continues to use the intangible asset in its business activities, and the transfer of the right does not entail additional expenses in the form of depreciation. The licensor organization has developed and enshrined in its accounting policies a procedure for distributing expenses in the form of depreciation charges between expenses for ordinary activities and other expenses | |||

| 1 | 20, 44 | 05 subaccount “Amortization of intangible assets provided for use under license agreements” | The share of monthly depreciation of an intangible asset attributable to expenses for ordinary activities is reflected in accordance with the distribution procedure developed by the organization and enshrined in its accounting policies |

| 2 | 91-2 | 05 subaccount “Amortization of intangible assets provided for use under license agreements” | The share of monthly depreciation of an intangible asset attributable to other expenses is reflected in accordance with the distribution procedure developed by the organization and enshrined in its accounting policies |

Reflection in accounting of the monthly depreciation of intangible assets provided for use under commercial concession agreements with the accumulation of depreciation amounts in a separate account.

| № | Debit | Credit | Contents of operation |

| Accounting entries, if the provision of intangible assets for use is the subject of the activities of the organization-right holder | |||

| 1 | 20, 26 | 05 subaccount “Amortization of intangible assets provided for use under commercial concession agreements” | The amount of depreciation of an intangible asset object is reflected in the organization’s expenses with the accumulation of depreciation amounts in a separate account |

| Accounting entries, if the provision of intangible assets for use is not the subject of the activities of the copyright holder organization | |||

| 1 | 91-2 | 05 subaccount “Amortization of intangible assets provided for use under commercial concession agreements” | The amount of depreciation of an intangible asset object is reflected as part of the organization’s other expenses with the accumulation of depreciation amounts in a separate account |

| Accounting entries if the copyright holder continues to use the intangible asset in his business activities, and the transfer of the right does not entail additional expenses in the form of depreciation | |||

| 1 | 20, 44 | 05 subaccount “Amortization of intangible assets provided for use under commercial concession agreements” | The amount of depreciation of an intangible asset is reflected. The entire monthly amount of depreciation charges is recognized as an expense for ordinary activities |

| Accounting entries if the copyright holder continues to use the intangible asset in his business activities, and the transfer of the right does not entail additional expenses in the form of depreciation. The copyright holder organization has developed and enshrined in the accounting policy a procedure for distributing expenses in the form of depreciation charges between expenses for ordinary activities and other expenses | |||

| 1 | 20, 44 | 05 subaccount “Amortization of intangible assets provided for use under commercial concession agreements” | The share of monthly depreciation of an intangible asset attributable to expenses for ordinary activities is reflected in accordance with the distribution procedure developed by the organization and enshrined in its accounting policies |

| 2 | 91-2 | 05 subaccount “Amortization of intangible assets provided for use under commercial concession agreements” | The share of monthly depreciation of an intangible asset attributable to other expenses is reflected in accordance with the distribution procedure developed by the organization and enshrined in its accounting policies |

Reflection in accounting of the correction of an error in the calculation of an inflated amount of depreciation of intangible assets.

| № | Debit | Credit | Contents of operation |

| Accounting entries when correcting an error in the current reporting year in accruing an inflated amount of depreciation of intangible assets with the accumulation of depreciation amounts in a separate account, identified before the end of this year | |||

| 1 | 20, 26, 44, etc. | 05 | The erroneously accrued amount of depreciation of an intangible asset in the month the error was detected was reversed |

| Accounting entries when correcting an error of the previous reporting year in accruing an inflated amount of depreciation of intangible assets with the accumulation of depreciation amounts in a separate account, identified after the end of this year, but before the date of signing the annual reports for this year | |||

| 1 | 20, 26, 44, etc. | 05 | The erroneously accrued amount of depreciation of an intangible asset object was reversed by the final turnover as of December 31 of the previous year |

| Accounting entries when correcting an error of the previous reporting year in accruing an inflated amount of depreciation for intangible assets with the accumulation of depreciation amounts in a separate account, identified after the approval of the annual reporting for this year, or an error was identified in earlier reporting periods. The identified error according to the organization’s accounting policy is insignificant | |||

| 1 | 05 | 91-1 | The erroneously accrued amount of depreciation of an intangible asset object is reflected in the current reporting period as part of the organization’s other income as profit of previous years identified in the reporting year |

| Accounting entries when correcting an error of the previous reporting year in accruing an inflated amount of depreciation for intangible assets with the accumulation of depreciation amounts in a separate account, identified after the approval of the annual reporting for this year, or an error was identified in earlier reporting periods. The identified error according to the organization’s accounting policy is significant | |||

| 1 | 05 | 84 subaccount “Correction of errors in accounting | The erroneously accrued amount of depreciation of an intangible asset was reflected in the current reporting period in the account of retained earnings (uncovered loss) |

Reflection in accounting of the correction of an error in the calculation of an underestimated amount of depreciation of intangible assets.

| № | Debit | Credit | Contents of operation |

| Accounting entries when correcting an error in the current reporting year in accruing an underestimated amount of depreciation for intangible assets with the accumulation of depreciation amounts in a separate account identified before the end of this year | |||

| 1 | 20, 26, 44, etc. | 05 | Additional depreciation amount was added to the intangible asset in the month the error was discovered |

| Accounting entries when correcting an error of the previous reporting year in accruing an underestimated amount of depreciation of intangible assets with the accumulation of depreciation amounts in a separate account, identified after the end of this year, but before the date of signing the annual reports for this year | |||

| 1 | 20, 26, 44, etc. | 05 | The erroneously accrued amount of depreciation of an intangible asset was added to the final turnover as of December 31 of the previous year. |

| Accounting entries when correcting an error of the previous reporting year in accruing an underestimated amount of depreciation of intangible assets with the accumulation of depreciation amounts in a separate account, identified after the approval of the annual reporting for this year, or an error was identified in earlier reporting periods. The identified error according to the organization’s accounting policy is insignificant | |||

| 1 | 91-2 | 05 | In the current reporting period, the amount of depreciation of an intangible asset was additionally accrued. Correction of an error in depreciation calculation is reflected in the organization’s other expenses as a loss from previous years identified in the reporting year |

| Accounting entries when correcting an error of the previous reporting year in accruing an underestimated amount of depreciation of intangible assets with the accumulation of depreciation amounts in a separate account, identified after the approval of the annual reporting for this year, or an error was identified in earlier reporting periods. The identified error according to the organization’s accounting policy is significant | |||

| 1 | 84 subaccount “Correction of errors in accounting | 05 | In the current reporting period, the amount of depreciation of an intangible asset was additionally accrued. Correction of the depreciation calculation error is reflected in the account of retained earnings (uncovered loss) |