Account 68 in accounting

68 accounting account is intended to carry out the procedure for summarizing information on complete calculations of fees and taxes. This takes into account not only payments sent to the budget, but also taxes paid by the company’s employees.

Drawing up reports

To make a correct account analysis, you need to take into account all types of interest rates by type of taxation. Its peculiarity is that it is both passive and active at the same time. This is influenced by the data that should be displayed on it.

Important! Filling out account documentation has its own characteristics. In addition, there are special formulas for calculating personal income tax.

Calculation of taxes and fees

How to close a 68.12 account?

We paid a single tax on 1C.

How can I close my 68.12 account now?

According to the code, it cannot be written off as expenses or should it be left as is?

Thanks everyone for the answers.

Sincerely, Vladimir Meleshenko.

Calculate the tax on UTII using accounting entries Dt 99 - Kt 68.12, and the account will be closed.

Calculate tax according to the simplified tax system using accounting entries Dt 99 - Kt 68.12, and the account will be closed.

Reading the topic:

Events

1C free 1C-Reporting 1C:ERP Enterprise management 1C:Free 1C:Accounting 8 1C:Accounting 8 CORP 1C:Accounting of an autonomous institution 1C:Accounting of a state institution 1C:Municipal budget 1C:Settlement budget 1C:Clothing allowance 1C:Money 1 C: Document flow 1C: Salaries and personnel of a budgetary institution 1C: Salaries and personnel of a government institution 1C: Salaries and personnel management 1C: Salaries and personnel management CORP 1C: Integrated automation 8 1C: Lecture hall 1C: Enterprise 1C: Enterprise 7.7 1C: Enterprise 8 1C: Retail 1C: Management of our company 1C: Management of a manufacturing enterprise 1C: Trade management 1 Enterprise 8

When using materials, an active direct hyperlink of the form SOURCE: BUKH.1S is required.

The editors of BUKH.1S are not responsible for the opinions and information published in the comments to the materials.

The editors respect the opinions of the authors, but do not always share them.

Characteristics

Accounting account 68 is an active-passive instrument in accounting. It represents generalized information on calculations, including taxes that the organization pays to the budget and for employees.

All individual entrepreneurs and organizations are required to make transfers to the budget upon conducting economic activities. For legal entities in accounting, account 68 should be used for this. All transactions for paying obligations to the budget will be taken into account and formed on it. The information contains complete information about all accrued and paid tax liabilities, reflects the amounts withheld from employees, as well as those that were declared for deduction.

The question often arises: is the 68 account active or passive? It belongs to the active-passive group. This is because it has a debit and a credit balance. It depends on the nature of the debt. If there is an overpayment of taxes, the balance is considered a debit. In the case of debt, everything is calculated the other way around. The amount that must be transferred to the budget will be placed on credit balances.

Analytical accounting for the calculation of taxes and fees 68 is carried out by type of tax. The amount received is added.

Important! In one case, the balance may be a debit, in the second - a credit.

Procedure for deductions to the budget

How to reflect VAT in accounting?

In accounting, VAT transactions are reflected using two main accounts:

- account 19 “VAT on acquired values”;

- account 68 “Calculations for taxes and fees” - in this case, the corresponding sub-account “Calculations for VAT” is opened for the 68th account.

When purchasing raw materials, goods, works or services, the accountant makes the following entries:

Dt 19 Kt 60 - VAT presented by the supplier is taken into account.

Then the incoming tax must be deducted - this is done by posting to debit 68 credit 19 of account.

The sale of goods is accompanied by the accrual of VAT on the credit of account 68 in correspondence with the account for accounting for proceeds from sales or other income:

Dt 90.3 Kt 68 - VAT is charged on the sale of goods or provision of services in the main type of activity;

Dt 91.2 Kt 68 - VAT is charged on sales not related to the normal activities of the company (for example, when selling fixed assets).

In some cases, taxpayers are required to keep separate VAT records. ConsultantPlus experts explained in detail how to properly organize such accounting. Get free demo access to K+ and go to the Ready Solution to find out all the details of this procedure.

At the end of each quarter, the VAT payer must pay the budget by the 25th day of the month following the reporting period. If the amount of accrued VAT is greater than the amount of VAT accepted for deduction, then the company must pay the resulting difference to the budget and make an entry to debit 68 credit 51 accounts.

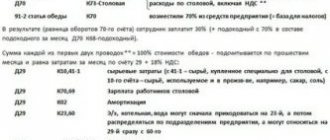

Example

bought raw materials for the production of sweet buns in the amount of 125,000 rubles, including VAT of 13,000 rubles. (since in the production of buns the company purchased raw materials subject to VAT at both 10% and 20%). 4,000 buns were baked from this raw material and sold for 59 rubles per piece. Sales of sweet buns are subject to VAT at a rate of 20%. Thus, when calculating and reflecting VAT in accounting, the accountant of “Sdoba” will make the following entries:

Dt 19 Kt 60 - in the amount of 13,000 rubles: accounting for VAT from the supplier of raw materials;

Dt 68 Kt 19 - in the amount of 13,000 rubles: accepted for deduction of VAT (thus, reflecting the amount of VAT in debit 68 credit 19 means accepting it for deduction when calculating tax);

Dt 90.3 Kt 68 - in the amount of 39,333.33 rubles. (4,000 buns × 59 rubles / 120 × 20 = 39,333.33 rubles): VAT is charged on the sale of buns;

Dt 68 Kt 51 - in the amount of 26,333.33 rubles. (the difference between the accrued VAT is 39,333.33 rubles and the VAT accepted for deduction is 13,000 rubles): “Sdoba” paid VAT to the budget at the end of the quarter (the meaning of posting debit 68 credit 51 is payment of tax to the budget from the current account).

Subaccounts

For each type of tax that an organization is required to transfer, there is its own subaccount. According to the methods of calculation, taxes are usually divided into the following types:

- property - they are paid for the use of objects. These include land, transport, and equipment. Everything that is on the balance sheet of the organization. The tax amount is calculated based on the value of the taxable base. It is not affected by the firm's performance;

- indirect - they are included in the amount for a product or service. This includes VAT, customs duties and excise taxes.

68 subaccount account is used for fees and taxes that the company must transfer. They depend on the field of activity and the chosen tax regime. For each type of tax, your own sub-account must be opened:

- 68.13 - trade tax;

- 68.12 - simplified tax system;

- 68.11 - UTII.

Classification of subaccounts is made based on the instructions for using the plan. In general cases, the composition includes:

- income tax;

- water, transport, gambling;

- local contributions to the budget;

- single imputed;

- agricultural tax.

Also included in the subaccount of account 68 is property tax.

To the question, which personal income tax account is in the chart of accounts, the answer will be as follows. For the calculation and payment of personal income tax, a subaccount 68.1 is opened. All information about charges, deductions, payments and any value-added transactions is reflected in account 68 02.

If a company pays excise taxes, then a subaccount 68.3 is opened for them. For organizations operating under the general taxation system, 68.4 is required.

Organizations on the general taxation system that pay income tax open a subaccount 68.4 to record it.

Classification

Account 68 “Calculations for taxes and fees” - subaccounts, postings

A deferred tax asset upon disposal of the asset for which it was accrued is written off from the credit of account 09 “Deferred tax assets” to the debit of account 99 “Profits and losses”.

Subaccount 68.12 is used in accounting by organizations and individual entrepreneurs that are on a simplified taxation system to reflect transactions based on single tax amounts.

Count 68 is active-passive. The loan displays the amounts accrued for payment to regulatory authorities in accordance with the declarations provided in correspondence with the corresponding accounting accounts (for example, employee compensation, profits and losses, etc.). On debit, data on actual transfers of the organization is collected.

Organizations operating in accordance with PBU 18/02 must open an additional sub-account to reflect information on the calculation of advance payments.

If an organization owns vehicles on which transport tax is paid, then subaccount 68.7 is used. Account 68 Calculations for taxes and fees is intended to summarize information about settlements with budgets for taxes and fees paid by the organization, and taxes with employees. Let us recall the procedure for using accounts in accounting.

At the same time, debt for settlements with buyers, customers and other debtors, secured by overdue bills of exchange, continues to be recorded in accounts receivable accounts.

Accounting for calculations of taxes and fees is carried out on account 68, which reflects the accrual of taxes and their payment to the budget.

Correspondence with other accounts

68 account is credited for the amounts indicated in tax returns. Calculations in correspondence are also taken into account here:

- 70 - amounts for personal income tax;

- 99 - accrued income tax;

- 51- receipt of overpaid fees from the budget;

- 20, 26,25,44 - local taxes.

Account 68, in turn, corresponds with the following accounts:

- 50 - cash register;

- 51 - current account;

- 52 - foreign currency account;

- 19 — value added tax;

- 10 - materials;

- 20 - main production, 21 - auxiliary;

- 41 - goods;

- 26 - general expenses on the economic line;

- 90 - sales.

Drawing up declarations

Explanation of the concept of transport tax

Transport tax is regional.

Its rates are regulated by regional authorities, but they should not differ more than 10 times from the rate specified in the Tax Code (Article 28 of the Tax Code of the Russian Federation). This tax must be paid by all owners of transport (Article 357 of the Tax Code of the Russian Federation) - legal entities and individuals who have at their disposal (by right of ownership or ownership) transport registered in accordance with the laws of the Russian Federation.

Read about the nuances of vehicle registration and the tax consequences of its absence in the article “Lack of vehicle registration will not exempt you from transport tax .

Reflection of debit and credit on account 68

The debit of account 68 shows the amount of taxes that were actually transferred to the budget. This also includes VAT amounts that are debited from account 19.

The credit displays accrued amounts that must be transferred to the budget. All data must strictly coincide with the results of the reports submitted to the tax office.

Account credit means all amounts contributed to the budget on the basis of reports, declarations and other calculations. These include:

- profit and loss D99;

- settlements with the founders - D75;

- sales - D90;

- settlements with personnel regarding wages - D70.

Debit to account 68 includes:

- all amounts from the value added tax account for VAT;

- funds actually contributed to the budget from the current account.

To account for all amounts, entries are made: D68 K51 and D68 K19.

Display of credit and debit

Count 68 – active or passive?

For the amounts spent by accountable persons, account 71 “Settlements with accountable persons” is credited in correspondence with the accounts that record expenses and acquired values, or other accounts depending on the nature of the expenses incurred.

The use of account 68 to display information on mutual settlements with budgets of various levels in terms of taxes and fees paid is carried out in accordance with the current Chart of Accounts, approved by Order of the Ministry of Finance dated October 31, 2000 No. 94, and other legislative acts.

How to take taxes into account in accounting? For this, account 68 “Calculations for taxes and fees” is used. This is a passive account designed to summarize information about the company’s settlements with government budgets of all levels.

Postings

The balance sheet for account 68 is used for calculations based on the results of the periods. To generate income tax amounts for the budget, subaccount 68.04.01 is used. It is important to take into account that income tax is calculated on an accrual basis. When forming it, all advance payments for the reporting periods are taken into account. This includes:

- quarter;

- half year;

- 9 months;

- calendar year.

In accordance with the chosen tax regime, an organization can independently open the necessary sub-accounts according to the types of required fees.

Account 68 postings are classified into two groups:

- by debit;

- on loan.

The following types of debit are distinguished:

- D68 K50 - the amount of fees that were taken in cash at the organization's cash desk;

- D68 K51 - the amount of funds transferred to the budget from the company’s current accounts;

- D68 K19 - value added tax, which is allocated on purchased goods, valuables, materials, aimed at reimbursement from budget funds.

Typical transactions

for a loan include:

- D70 K68.1 - a reflection of the amount of personal income tax that is withheld from the wages of the company’s employees. This amount must be paid to the budget;

- D90.3 K68.2 - the amount of funds, which reflects the amount of VAT on products sold or services performed;

- D99 K68.12 - reflects information on payment of the simplified tax system;

- D99 K68.11 - generates all accruals for UTII;

- D26 K68.8 - an accounting tool for generating amounts for payment to the budget for property;

- D90 K68.3 - display of excise taxes received by the company from the sale of excisable products;

- D99 K68.4 - the amount of income tax that is transferred to the Federal Tax Service;

Note! To reflect the amount of transport fees to be transferred to the budget, K68.7 D20.26 is used.

Accounting entries when calculating income tax

If the organization applies PBU 18/02

The procedure for applying PBU 18/02 is configured in the Accounting Policy information register (Main section). If an organization applies the provisions of PBU 18/02, then the switch Accounting for deferred tax assets and liabilities (PBU 18 “Accounting for calculations of corporate income tax”) should be set to one of the positions:

- Maintained using the balance sheet method;

- It is carried out using the costly method (delay method). In the program, this method can be used after 2022, since PBU 18/02 does not contain restrictions on the use by an organization of any of these methods of its choice (Information message of the Ministry of Finance of Russia dated December 28, 2018 No. IS-accounting-13).

If the cost method is installed in the program, then the routine operation Calculation of income tax performs two functions at once: the calculation of tax for payment to the budget (according to tax accounting data), and calculations according to PBU 18/02 (according to accounting data).

If the organization uses the balance sheet method, then the Month Closing processing includes two separate routine operations:

- Calculation of income tax - only calculates tax according to tax accounting data for payment to the budget;

- Calculation of deferred tax according to PBU 18/02 - performs only calculations according to PBU 18/02 according to accounting data (according to the new algorithm, that is, the balance sheet method) for financial statements.

In any case, the calculated amounts of income tax are accrued by posting:

Debit 68.04.2 Credit 68.04.1.

At the same time, tax amounts are distributed among budgets of various levels.

A decrease in amounts due for payment to the budget is reflected by a reversal entry with simultaneous distribution among budgets:

REVERSE Debit 68.04.2 Credit 68.04.1.

Account 68.04.2 “Calculation of income tax” is specifically used in the program to summarize information on the procedure for calculating income tax for organizations in accordance with the provisions of PBU 18/02. Analytical accounting for account 68.04.2 is not provided.

Calculations according to PBU 18/02 include the following operations:

- recognition (settlement) of deferred tax assets (DTA) and deferred tax liabilities (DTL). Accounts 09 “Deferred Tax Assets” and 77 “Deferred Tax Liabilities” are intended to summarize information about the presence and movement of IT and IT. Analytical accounting of IT and IT is carried out by type of assets or liabilities in the assessment of which a temporary difference has arisen;

- determination of conditional income tax expense (income). Conditional income tax expense (income) is calculated as the product of accounting profit for the reporting period and the income tax rate. To summarize information about the amounts of conditional income tax expense (income) in the program, accounts 99.02.1 “Conditional income tax expense” and 99.02.2 “Conditional income tax income” are intended;

- recognition of a constant tax expense (income) for income tax. The permanent tax expense (income) for income tax is calculated as the product of the permanent difference that arose in the reporting period and the income tax rate. To summarize information about the amount of recognized permanent tax expense (income), the program uses account 99.02.3 “Permanent tax liability”.

Note

About the advantages of the balance sheet method and how in “1C: Accounting 8” edition 3.0 this method is used when determining temporary differences, see the articles “PBU 18/02: how the balance sheet method is used in “1C: Accounting 8” and “Application PBU 18/02 and the balance sheet method in “1C: Accounting 8”.

Postings related to calculations according to PBU 18/02 using the balance sheet method are presented in the table.

Table

Postings generated in the program when performing the routine operation “Calculation of deferred tax according to PBU 18/02”

Please note that income tax is calculated in whole rubles, and the amounts of conditional income tax expense (income), SHE and IT, constant tax expense (income) are in rubles and kopecks. As a result, a difference may arise on account 68.04.2 (even if permanent and temporary differences are reflected correctly in accounting). The resulting balance is automatically written off to account 99.09 “Other profits and losses” by posting:

Debit 99.09 Credit 68.04.2 or Debit 68.04.2 Credit 99.09.

Thus, after performing the regulatory operations Calculation of income tax and Calculation of deferred tax according to PBU 18/02, account 68.04.2 is always closed.

Let's look at a specific example of how income tax calculations are performed when applying PBU 18/02 in “1C: Accounting 8” edition 3.0 and what transactions are generated in this case.

Example 1

| LLC "Trading House "Complex"" applies OSNO and the provisions of PBU 18/02 in accordance with the new edition, approved. Order No. 236n. The income tax rate is 20% (including 3% to the Federal budget, 17% to the regional budget). In January 2022, the organization’s accounting records reflected the following financial indicators:

The tax accounting registers reflect the following indicators:

The deductible temporary difference for the type of asset “Deferred income” is:

The taxable temporary difference for the type of asset “Fixed assets” is:

|

Let's calculate income tax for January 2022 according to tax accounting data:

- 700,000 rub. — tax base (RUB 1,000,000 - (RUB 72,000 + RUB 228,000)).

- 140,000 rub. — income tax (RUB 700,000 x 20%), including RUB 21,000. — to the Federal Budget (RUB 700,000 x 3%); 119,000 rub. — to the regional budget (RUB 700,000 x 17%).

When performing the routine operation Calculation of income tax, postings will be automatically generated (see Fig. 1).

Rice. 1. Calculation of income tax in correspondence with account 68.04.2

Let us perform calculations according to PBU 18/02 for January 2022 according to accounting data:

- 1,600 rub. — repayment of ONA ((112,000 rub. - 104,000 rub.) x 20%).

- 400 rub. — repayment of IT ((118,000 rub. - 116,000 rub.) x 20%).

- 706,000 rub. - profit according to accounting data ((RUB 1,000,000 + RUB 8,000) - (RUB 230,000 + RUB 72,000)).

- RUB 141,200 — conditional income tax expense (706,000 x 20%).

When performing the routine operation Calculation of deferred tax according to PBU 18/02, the following transactions will be automatically generated (see Fig. 2).

Rice. 2. Calculations using PBU 18/02

Figures 3 and 4 show Analyzes of accounts 68.04.1 and 68.04.2.

Rice. 3. Analysis of account 68.04.1

Rice. 4. Analysis of account 68.04.2

The presented entries and standard reports on income tax settlement accounts demonstrate that account 68.04.2 in the program plays a purely technical (auxiliary) role. For example, in recommendation R-102/2019-KpR “Procedure for accounting for income tax”, adopted by the Committee on the recommendations of the NRBU “BMC” fund on April 26, 2019, account 68.04.2 is not used at all.

If the organization does not apply PBU 18/02

If the organization does not apply the provisions of PBU 18/02, then the switch Accounting for deferred tax assets and liabilities (PBU 18 “Accounting for calculations of corporate income tax”) should be set to the Not maintained position.

In this case, when performing the regulatory operation Calculation of income tax, account 68.04.1 corresponds with account 99.01.1 “Profits and losses on activities with the main tax system” (with the value of the subconto type Income tax and similar payments). The accrual of current income tax amounts payable is reflected by posting with simultaneous distribution among budgets:

Debit 99.01.1 Credit 68.04.1.

Accordingly, the decrease in amounts due for payment is reflected by an entry with distribution by budget:

REVERSE Debit 99.01.1 Credit 68.04.1.

Let’s change the conditions of Example 1 and consider how “1C: Accounting 8” edition 3.0 reflects income tax calculations if the provisions of PBU 18/02 are not applied.

Example 2

| LLC "Trading House "Complex"" applies OSNO, but does not apply the provisions of PBU 18/02. Numerical indicators correspond to the conditions of Example 1. |

In this situation, when performing the routine operation Calculation of income tax, postings will be automatically generated (see Fig. 5).

Rice. 5. Calculation of income tax in correspondence with account 99.01.1

Regardless of the procedure for applying the provisions of PBU 18/02, the credit turnover of account 68.04.1 by type of payment Tax (contributions): accrued / paid for the reporting (tax) period coincides with:

- with the amount of calculated income tax indicated in line 180 of sheet 02 of the income tax return;

- with the amount of current income tax indicated in the statement of financial results (form approved by order of the Ministry of Finance of Russia dated July 2, 2010 No. 66n).

On the calculation of income tax in “1C: Accounting 8” (rev. 3.0), see also the answer from 1C experts (+ video).

If the organization acts as a tax agent

An organization that pays dividends to a company participant (shareholder) - a legal entity, must fulfill the duties of a tax agent and withhold income tax when paying dividends.

To summarize information on settlements with the budget for income tax when paying dividends, a separate account 68.34 “Income tax when performing the duties of a tax agent” is intended. Tax on dividends is always paid to the Federal Budget, therefore analytical accounting in account 68.34 is carried out only by type of payments to the budget.

For limited liability companies, the accrual of dividends and withholding tax on the payment of participation income can be registered in the program automatically using the Accrual of Dividends document (Operations section).

For joint stock companies, the accrual of dividends on shares and tax withholding should be reflected in the Transaction document (section Transactions - Transactions entered manually).

In any case, the withholding of income tax when performing the duties of a tax agent when paying dividends should be reflected by posting:

Debit 75.02 Credit 68.34.

Account 75.02 “Calculations for the payment of income” is intended to summarize information on the payment of income to the founders (participants) of the organization (shareholders of a joint-stock company, participants of a general partnership, members of a cooperative, etc.).

Thus, the “agency” tax is taken into account separately and does not affect the turnover of account 68.04.1.

| 1C:ITS For more information about the procedure for taxation and accounting of corporate income tax, see the practical manual “Practical Annual Report 2018” edited by D.E. Sc., prof. S.A. Kharitonov in the section “Instructions for accounting in 1C programs”. |

Accounting for disposal of intangible assets.

The disposal of intangible assets can occur in the form of a contribution to the authorized capital of other organizations, gratuitous transfer, contribution to joint activities, liquidation and sale.

All transactions on the disposal of intangible assets are reflected in account 91 “Other income and expenses” , the debit of which reflects the costs of disposal of each retiring intangible asset, and the credit reflects receipts associated with the sale and other write-off of assets. The account is balanceless; the difference in turnover determines the financial result from the disposal of intangible assets. Records for subaccounts 91/1 “Other income” and 91/2 “Other expenses” are kept cumulatively during the reporting year.

On a monthly basis, by comparing debit turnover on 91/2 and credit turnover on 91/1, the balance of other income and expenses for the reporting month is determined, which is written off from 91/9 to account 99.

Income and losses from the write-off of intangible assets are recorded in the reporting period in which they are identified. These income and losses are taken into account when determining the financial result from write-off.

1. When selling intangible assets, the organization determines its sales value; it must be determined in the contract by agreement of the parties. Moreover, the sale of intangible assets can occur not only under sales and purchase agreements.

The patent holder has the right to assign the patent to any individual or legal entity under an agreement on the transfer of exclusive rights to use industrial property objects (Clause 6, Article 10 of the Patent Law of the Russian Federation). Such agreements must be registered with the State Patent Office of the Russian Federation.

The owner of a registered trademark or service mark can transfer it to another person under an agreement on the assignment of a trademark or service mark (Article 25 of the Law of the Russian Federation “On Trademarks, Service Marks and Appellations of Origin of Goods”). Such an agreement must be registered with the State Patent Office of the Russian Federation.

The cost of an object retiring from intangible assets is subject to write-off from accounting (clause 22 of PBU 14/2000). In this case, the cost of intangible assets recorded on account 04 “Intangible assets” is reduced by the amount of depreciation accrued during its use, reflected on account 05 “Amortization of intangible assets”

D 05 K 04

.

The residual value of intangible assets is recognized as another expense of the organization and is written off from account 04 to the debit of account 91 “Other income and expenses”, subaccount 91-2 “Other expenses”. The amount of the contractual value of intangible assets is reflected in D 62 “Settlements with buyers and customers” and the credit of account 91/1 subaccount “Other income”. From the sale of intangible assets, VAT is charged, which is reflected in the debit of account 91/3 and the credit of account 68 “Calculations for taxes and fees.” Other costs associated with the sale of intangible assets are reflected in the debit of 91/2 and the credit of accounts 44,60,76. For the amount of the financial result obtained from the sale of intangible assets, entries are made in accounting: if the profit is D 91/9 K 99, for the amount of loss - D 99 K 91/9. For the selling party, the basis for the entry in accounting will be documents: an agreement, an act of acceptance and transfer of intangible assets.

The following entries are made:

1) Accrued depreciation of sold intangible assets D 05 K 04

2) The residual value of intangible asset D 91/2 K 04

3) Revenue is reflected in the amount of the sale price of the asset + VAT D 62 K 91/1

4) VAT is charged on the sales amount D 91/3 K 68

5) Sales costs written off D 91/2 K 44.60

6) The financial result from the implementation of intangible assets is reflected:

- profit from sales D 91/9 K 99

- loss on sale D 99 K 91/9

Loss from the sale of intangible assets reduces taxable profit. When the residual value of an intangible asset, taking into account the costs of its sale, exceeds the proceeds from the sale ,

the resulting loss for tax purposes is taken into account in a special manner (clause 3 of Article 268 of the Tax Code of the Russian Federation). This loss is included in other expenses of the organization evenly over the period that the property “has not served enough” = (useful life minus the period of actual use): 12 months.

2. Disposal of intangible assets due to unsuitability.

Before writing off an intangible asset as unusable, an enterprise must determine that the intangible asset can no longer be used. For this purpose, by order of the manager, a special commission is created at the enterprise, which includes an accountant. The commission must establish the reasons for the write-off of the object (obsolescence, long-term non-use for production purposes, etc.), drawing up an appropriate act about this. The act is transferred to the accounting department of the enterprise. And on its basis, in the inventory card f. No. NMA -1, a note is made about the disposal of the object.

The cost of intangible assets recorded on account 04 “Intangible assets” is reduced by the amount of depreciation accrued during its use, reflected on account 05 “Amortization of intangible assets”

D 05 K 04

.

The residual value of intangible assets is recognized as another expense of the organization and is written off from account 04 to the debit of account 91 “Other income and expenses”, subaccount 91-2 “Other expenses”. For the amount of the financial result obtained when writing off intangible assets, entries are made in accounting: for the amount of loss - D 99 “Profits and losses” K 91/9 “Balance of other income and expenses”. The following entries are made:

1) Accrued depreciation of intangible assets D 05 K 04

2) The residual value of intangible asset D 91/2 K 04

3) Loss from write-off of intangible assets D 99 K 91/9

3. When transferring intangible assets free of charge, one should be guided by clause 1 of Article 572 of the Civil Code of the Russian Federation.

Article 575 of the Civil Code of the Russian Federation prohibits the donation (free transfer) of property in relations between commercial organizations, the value of which exceeds 5 minimum wages established by law.

The cost of an object retiring from intangible assets is subject to write-off from accounting (clause 22 of PBU 14/2000). In this case, the cost of intangible assets recorded on account 04 “Intangible assets” is reduced by the amount of depreciation accrued during its use, reflected on account 05 “Amortization of intangible assets”

D 05 K 04

.

The residual value of intangible assets is recognized as another expense of the organization and is written off from account 04 to the debit of account 91 “Other income and expenses”, subaccount 91-2 “Other expenses”. From the sale of intangible assets, VAT is charged, which is reflected in the debit of account 91/3 and the credit of account 68 “Calculations for taxes and fees.” For the amount of the financial result obtained from the sale of intangible assets, entries are made in accounting: for the amount of loss - D 99 K 91/9. The transferring party will have the following documents as the basis for the accounting entry: an agreement, an act of acceptance and transfer of intangible assets.

The following entries are made:

1) Accrued depreciation of sold intangible assets D 05 K 04

2) The residual value of D 91/2 K 04

3) VAT is charged on the market value (Clause 1.Article 146 of the Tax Code)

D 91/2 K 68

4) The loss from the gratuitous transfer is written off at the expense of one’s own funds

D 99 K 91/9

5) Reflected permanent tax liability D 99 K 68

Losses from gratuitous transfers are not taken into account when taxing profits (clause 16, article 270 of the Tax Code of the Russian Federation).

4. Disposal of intangible assets upon expiration of their useful life .

Typically, intangible assets have a limited life. Patents for an invention are valid for 20 years, a patent for an industrial design is valid for 10 years, and a certificate for a utility model is valid for 5 years. The validity period for registration of trademarks, service marks and appellations of origin is 10 years from the date of receipt of the application by the patent office.

Based on the useful life, the enterprise sets the depreciation rate for intangible assets. After which this intangible asset is written off from the balance sheet of the enterprise.

The following entries are made:

1) Written off from the balance sheet of intangible assets upon expiration of its useful life D 05 K 04

If an intangible asset that is not subject to depreciation is written off (trademark upon expiration):

1) Written off from the balance sheet of NMA D 91/2 K 04

2) The loss from writing off intangible assets D 99 K 91/9

5. When transferring intangible assets as a contribution to the authorized capital or for joint activities.

Such a transfer is not recognized as a sale of goods and is not subject to VAT. VAT paid on the acquisition of intangible assets, which an enterprise transfers as a contribution to the authorized capital of another organization or in a joint activity, must be restored at its own expense (if by this time it has already been offset from the budget).

For the transferring party, the basis for making entries in accounting are: the constituent agreement, the acceptance certificate, confirming the transfer of intangible assets.

The following entries are made:

1) Accrued depreciation of intangible assets D 05 K 04

2) The residual value of intangible asset D 91/2 K 04

3) The transfer of intangible assets on account of the deposit is reflected in the amount established in the agreement D 58 K 91/1

4) The amount of VAT refunded from the budget on intangible assets transferred as a contribution to the capital of another organization has been reversed D 68 K 19

5) The amount of VAT was written off when transferring intangible assets to account for a contribution to the capital of another organization D 91 K 19

6) A loss from the write-off of intangible assets was identified, provided that the residual value exceeds the size of the contribution share in Criminal Code D 99 K 91/9

7) Profit from writing off intangible assets was identified, provided that the residual value is less than the size of the share contributed to Criminal Code D 91/9 K 99

The loss received in this case does not reduce taxable profit. The profit received is not taken into account for tax purposes (clause 1 of Article 277 of the Tax Code of the Russian Federation)

Revaluation of intangible assets

Section III “Subsequent valuation of intangible assets” regulates the procedure for revaluation. As is known, the value of intangible assets at which they were accepted for accounting is not subject to change (clause 17 of PBU 14/2007). An exception is the revaluation and depreciation of objects.

The company has the right to revaluate homogeneous intangible assets no more than once a year (at the beginning of the reporting year) at the current market value determined according to the active market for these intangible assets. The market value of the object is determined based on documents received:

— from the manufacturer based on written data on prices for similar products;

- in state statistics bodies, trade inspections, the media, specialized literature, catalogues, advertisements, press releases of information about the price level;

- based on the data of the appraiser’s conclusion.

It is important. If a firm once decides to revaluate assets, it will subsequently have to revaluate regularly. This is necessary to ensure that the value at which objects are reflected in accounting and reporting does not differ significantly from the current market value.

Revaluation should be carried out by recalculating the actual (initial) value (current market value, if the objects were revalued earlier) and the amount of depreciation accrued during the use of assets (clause 20 of PBU 14/2007). Let's look at the revaluation procedure using an example.

Example. Cobra LLC decided to revaluate intangible assets. As of December 31, 2022, their book value is RUB 1,000,000, accrued depreciation (A) is RUB 380,000. According to an independent appraiser, as of January 1, 2022, the market value of assets will be RUB 1,200,000.

The amount of additional valuation is 200,000 rubles. (1,200,000 - 1,000,000).

Next, you need to adjust the amount of depreciation accumulated at the time of revaluation. To do this, calculate the coefficient (K):

K = BC: PS,

where ВС is the replacement cost of the intangible asset;

PS is the initial cost of an intangible asset before revaluation.

In our example, the coefficient will be 1.2 (1,200,000: 1,000,000).

Then the amount of adjusted depreciation (Acor.) will be equal to the product of the amount of depreciation before revaluation and the coefficient:

Akor. = (A x K) - A.

Akor. = (380,000 x 1.2) - 380,000 = 76,000 rub.

Thus, accrued depreciation should be increased by RUB 76,000.

D 04 K 83,200,000

D 83 K 05 76000

Revaluation can be carried out either by a specialist appraiser or by our own employees. If an organization engages appraisers, it is necessary to conclude a written agreement with them. At the end of the examination, you need to draw up a certificate of completion of work based on the report, which will be compiled by a specialist appraiser.

If the company decides to do everything on its own, then it will be necessary to create an evaluation commission. The results of the revaluation in this case are formalized by the Statement on the results of the revaluation of intangible assets, drawn up in any form.

It must indicate all the objects that will be revalued, as well as the date of their acquisition and acceptance for accounting, the initial and residual value as of the date of revaluation, the basis for the revaluation (for example, a document confirming the market value of the revalued object).

The act is signed by all members of the commission and approved by the head of the organization.

In addition to the act, the following statements must be drawn up: revaluation of intangible assets, revaluation of depreciation for intangible assets, a consolidated statement of revaluation of intangible assets and accrued depreciation. They indicate:

—

name of objects;

— inventory number of objects;

— date of revaluation;

— revaluation factor (if any);

- book value before revaluation; - cost of the (new) object after revaluation;

— procedure for calculating the new cost;

— the amount of revaluation (depreciation).

As stated in paragraph 21 of PBU 14/2007, the results of revaluation are accepted when generating balance sheet data at the beginning of the reporting year. The results of the revaluation are not included in the balance sheet data of the previous reporting year, but are disclosed in the explanatory note to the financial statements of the previous reporting year.

The amount of revaluation of intangible assets as a result of revaluation is credited to the company’s additional capital. At the same time they make notes:

D 04 “Intangible assets” K 83 “Additional capital”

— the initial cost of intangible assets has been increased;

De 83 K 05 “Amortization of intangible assets”

— accrued amortization of intangible assets has been increased.

If the object has previously been revalued, then the amount of revaluation of intangible assets, equal to the amount of its depreciation, which was carried out in previous reporting periods and attributed to other expenses, is credited to other income. In this case, the accountant should make the following entry:

D 04 K 91 - the initial cost of intangible assets was increased by an amount not exceeding the size of the previous markdown;

D 91 K 05 - accrued depreciation has been increased.

Please note that when an intangible asset is disposed of, the amount of its revaluation is transferred from the organization’s additional capital to retained earnings:

D 83 K 84 - reflects the decrease in additional capital by the amount of the additional valuation of the disposed object.

The amount of write-down of intangible assets as a result of revaluation is included in other expenses

The depreciation of an object is reflected by the following transactions:

D 91 K 04 - the initial cost of intangible assets was reduced;

D 05 K 91 - accrued depreciation of intangible assets has been reduced.

If the object was previously revalued, then:

1) the amount of write-down of intangible assets is included in the reduction of the company’s additional capital, which was formed due to the amounts of the additional valuation of this asset carried out in previous reporting periods:

D 83 K 04 - the initial cost of intangible assets was reduced;

D 05 K 83 - accrued depreciation has been reduced;

2) the excess of the amount of depreciation of intangible assets over the amount of its revaluation credited to the organization’s additional capital as a result of the revaluation that was carried out in previous reporting periods is charged to other expenses:

D 91 K 04 - reflects the difference between the amount of the markdown and the amount of the previous revaluation;

D 05 K 91 - depreciation adjustment is reflected.

Note that the amount attributed to the account of retained earnings (uncovered loss) must be disclosed in the organization’s financial statements.

The disposal of intangible assets can occur in the form of a contribution to the authorized capital of other organizations, gratuitous transfer, contribution to joint activities, liquidation and sale.

All transactions on the disposal of intangible assets are reflected in account 91 “Other income and expenses” , the debit of which reflects the costs of disposal of each retiring intangible asset, and the credit reflects receipts associated with the sale and other write-off of assets. The account is balanceless; the difference in turnover determines the financial result from the disposal of intangible assets. Records for subaccounts 91/1 “Other income” and 91/2 “Other expenses” are kept cumulatively during the reporting year.

On a monthly basis, by comparing debit turnover on 91/2 and credit turnover on 91/1, the balance of other income and expenses for the reporting month is determined, which is written off from 91/9 to account 99.

Income and losses from the write-off of intangible assets are recorded in the reporting period in which they are identified. These income and losses are taken into account when determining the financial result from write-off.

1. When selling intangible assets, the organization determines its sales value; it must be determined in the contract by agreement of the parties. Moreover, the sale of intangible assets can occur not only under sales and purchase agreements.

The patent holder has the right to assign the patent to any individual or legal entity under an agreement on the transfer of exclusive rights to use industrial property objects (Clause 6, Article 10 of the Patent Law of the Russian Federation). Such agreements must be registered with the State Patent Office of the Russian Federation.

The owner of a registered trademark or service mark can transfer it to another person under an agreement on the assignment of a trademark or service mark (Article 25 of the Law of the Russian Federation “On Trademarks, Service Marks and Appellations of Origin of Goods”). Such an agreement must be registered with the State Patent Office of the Russian Federation.

The cost of an object retiring from intangible assets is subject to write-off from accounting (clause 22 of PBU 14/2000). In this case, the cost of intangible assets recorded on account 04 “Intangible assets” is reduced by the amount of depreciation accrued during its use, reflected on account 05 “Amortization of intangible assets”

D 05 K 04

.

The residual value of intangible assets is recognized as another expense of the organization and is written off from account 04 to the debit of account 91 “Other income and expenses”, subaccount 91-2 “Other expenses”. The amount of the contractual value of intangible assets is reflected in D 62 “Settlements with buyers and customers” and the credit of account 91/1 subaccount “Other income”. From the sale of intangible assets, VAT is charged, which is reflected in the debit of account 91/3 and the credit of account 68 “Calculations for taxes and fees.” Other costs associated with the sale of intangible assets are reflected in the debit of 91/2 and the credit of accounts 44,60,76. For the amount of the financial result obtained from the sale of intangible assets, entries are made in accounting: if the profit is D 91/9 K 99, for the amount of loss - D 99 K 91/9. For the selling party, the basis for the entry in accounting will be documents: an agreement, an act of acceptance and transfer of intangible assets.

The following entries are made:

1) Accrued depreciation of sold intangible assets D 05 K 04

2) The residual value of intangible asset D 91/2 K 04

3) Revenue is reflected in the amount of the sale price of the asset + VAT D 62 K 91/1

4) VAT is charged on the sales amount D 91/3 K 68

5) Sales costs written off D 91/2 K 44.60

6) The financial result from the implementation of intangible assets is reflected:

- profit from sales D 91/9 K 99

- loss on sale D 99 K 91/9

Loss from the sale of intangible assets reduces taxable profit. When the residual value of an intangible asset, taking into account the costs of its sale, exceeds the proceeds from the sale ,

the resulting loss for tax purposes is taken into account in a special manner (clause 3 of Article 268 of the Tax Code of the Russian Federation). This loss is included in other expenses of the organization evenly over the period that the property “has not served enough” = (useful life minus the period of actual use): 12 months.

2. Disposal of intangible assets due to unsuitability.

Before writing off an intangible asset as unusable, an enterprise must determine that the intangible asset can no longer be used. For this purpose, by order of the manager, a special commission is created at the enterprise, which includes an accountant. The commission must establish the reasons for the write-off of the object (obsolescence, long-term non-use for production purposes, etc.), drawing up an appropriate act about this. The act is transferred to the accounting department of the enterprise. And on its basis, in the inventory card f. No. NMA -1, a note is made about the disposal of the object.

The cost of intangible assets recorded on account 04 “Intangible assets” is reduced by the amount of depreciation accrued during its use, reflected on account 05 “Amortization of intangible assets”

D 05 K 04

.

The residual value of intangible assets is recognized as another expense of the organization and is written off from account 04 to the debit of account 91 “Other income and expenses”, subaccount 91-2 “Other expenses”. For the amount of the financial result obtained when writing off intangible assets, entries are made in accounting: for the amount of loss - D 99 “Profits and losses” K 91/9 “Balance of other income and expenses”. The following entries are made:

1) Accrued depreciation of intangible assets D 05 K 04

2) The residual value of intangible asset D 91/2 K 04

3) Loss from write-off of intangible assets D 99 K 91/9

3. When transferring intangible assets free of charge, one should be guided by clause 1 of Article 572 of the Civil Code of the Russian Federation.

Article 575 of the Civil Code of the Russian Federation prohibits the donation (free transfer) of property in relations between commercial organizations, the value of which exceeds 5 minimum wages established by law.

The cost of an object retiring from intangible assets is subject to write-off from accounting (clause 22 of PBU 14/2000). In this case, the cost of intangible assets recorded on account 04 “Intangible assets” is reduced by the amount of depreciation accrued during its use, reflected on account 05 “Amortization of intangible assets”

D 05 K 04

.

The residual value of intangible assets is recognized as another expense of the organization and is written off from account 04 to the debit of account 91 “Other income and expenses”, subaccount 91-2 “Other expenses”. From the sale of intangible assets, VAT is charged, which is reflected in the debit of account 91/3 and the credit of account 68 “Calculations for taxes and fees.” For the amount of the financial result obtained from the sale of intangible assets, entries are made in accounting: for the amount of loss - D 99 K 91/9. The transferring party will have the following documents as the basis for the accounting entry: an agreement, an act of acceptance and transfer of intangible assets.

The following entries are made:

1) Accrued depreciation of sold intangible assets D 05 K 04

2) The residual value of D 91/2 K 04

3) VAT is charged on the market value (Clause 1.Article 146 of the Tax Code)

D 91/2 K 68

4) The loss from the gratuitous transfer is written off at the expense of one’s own funds

D 99 K 91/9

5) Reflected permanent tax liability D 99 K 68

Losses from gratuitous transfers are not taken into account when taxing profits (clause 16, article 270 of the Tax Code of the Russian Federation).

4. Disposal of intangible assets upon expiration of their useful life .

Typically, intangible assets have a limited life. Patents for an invention are valid for 20 years, a patent for an industrial design is valid for 10 years, and a certificate for a utility model is valid for 5 years. The validity period for registration of trademarks, service marks and appellations of origin is 10 years from the date of receipt of the application by the patent office.

Based on the useful life, the enterprise sets the depreciation rate for intangible assets. After which this intangible asset is written off from the balance sheet of the enterprise.

The following entries are made:

1) Written off from the balance sheet of intangible assets upon expiration of its useful life D 05 K 04

If an intangible asset that is not subject to depreciation is written off (trademark upon expiration):

1) Written off from the balance sheet of NMA D 91/2 K 04

2) The loss from writing off intangible assets D 99 K 91/9

5. When transferring intangible assets as a contribution to the authorized capital or for joint activities.

Such a transfer is not recognized as a sale of goods and is not subject to VAT. VAT paid on the acquisition of intangible assets, which an enterprise transfers as a contribution to the authorized capital of another organization or in a joint activity, must be restored at its own expense (if by this time it has already been offset from the budget).

For the transferring party, the basis for making entries in accounting are: the constituent agreement, the acceptance certificate, confirming the transfer of intangible assets.

The following entries are made:

1) Accrued depreciation of intangible assets D 05 K 04

2) The residual value of intangible asset D 91/2 K 04

3) The transfer of intangible assets on account of the deposit is reflected in the amount established in the agreement D 58 K 91/1

4) The amount of VAT refunded from the budget on intangible assets transferred as a contribution to the capital of another organization has been reversed D 68 K 19

5) The amount of VAT was written off when transferring intangible assets to account for a contribution to the capital of another organization D 91 K 19

6) A loss from the write-off of intangible assets was identified, provided that the residual value exceeds the size of the contribution share in Criminal Code D 99 K 91/9

7) Profit from writing off intangible assets was identified, provided that the residual value is less than the size of the share contributed to Criminal Code D 91/9 K 99

The loss received in this case does not reduce taxable profit. The profit received is not taken into account for tax purposes (clause 1 of Article 277 of the Tax Code of the Russian Federation)

Revaluation of intangible assets

Section III “Subsequent valuation of intangible assets” regulates the procedure for revaluation. As is known, the value of intangible assets at which they were accepted for accounting is not subject to change (clause 17 of PBU 14/2007). An exception is the revaluation and depreciation of objects.

The company has the right to revaluate homogeneous intangible assets no more than once a year (at the beginning of the reporting year) at the current market value determined according to the active market for these intangible assets. The market value of the object is determined based on documents received:

— from the manufacturer based on written data on prices for similar products;

- in state statistics bodies, trade inspections, the media, specialized literature, catalogues, advertisements, press releases of information about the price level;

- based on the data of the appraiser’s conclusion.

It is important. If a firm once decides to revaluate assets, it will subsequently have to revaluate regularly. This is necessary to ensure that the value at which objects are reflected in accounting and reporting does not differ significantly from the current market value.

Revaluation should be carried out by recalculating the actual (initial) value (current market value, if the objects were revalued earlier) and the amount of depreciation accrued during the use of assets (clause 20 of PBU 14/2007). Let's look at the revaluation procedure using an example.

Example. Cobra LLC decided to revaluate intangible assets. As of December 31, 2022, their book value is RUB 1,000,000, accrued depreciation (A) is RUB 380,000. According to an independent appraiser, as of January 1, 2022, the market value of assets will be RUB 1,200,000.

The amount of additional valuation is 200,000 rubles. (1,200,000 - 1,000,000).

Next, you need to adjust the amount of depreciation accumulated at the time of revaluation. To do this, calculate the coefficient (K):

K = BC: PS,

where ВС is the replacement cost of the intangible asset;

PS is the initial cost of an intangible asset before revaluation.

In our example, the coefficient will be 1.2 (1,200,000: 1,000,000).

Then the amount of adjusted depreciation (Acor.) will be equal to the product of the amount of depreciation before revaluation and the coefficient:

Akor. = (A x K) - A.

Akor. = (380,000 x 1.2) - 380,000 = 76,000 rub.

Thus, accrued depreciation should be increased by RUB 76,000.

D 04 K 83,200,000

D 83 K 05 76000

Revaluation can be carried out either by a specialist appraiser or by our own employees. If an organization engages appraisers, it is necessary to conclude a written agreement with them. At the end of the examination, you need to draw up a certificate of completion of work based on the report, which will be compiled by a specialist appraiser.

If the company decides to do everything on its own, then it will be necessary to create an evaluation commission. The results of the revaluation in this case are formalized by the Statement on the results of the revaluation of intangible assets, drawn up in any form.

It must indicate all the objects that will be revalued, as well as the date of their acquisition and acceptance for accounting, the initial and residual value as of the date of revaluation, the basis for the revaluation (for example, a document confirming the market value of the revalued object).

The act is signed by all members of the commission and approved by the head of the organization.

In addition to the act, the following statements must be drawn up: revaluation of intangible assets, revaluation of depreciation for intangible assets, a consolidated statement of revaluation of intangible assets and accrued depreciation. They indicate:

—

name of objects;

— inventory number of objects;

— date of revaluation;

— revaluation factor (if any);

- book value before revaluation; - cost of the (new) object after revaluation;

— procedure for calculating the new cost;

— the amount of revaluation (depreciation).

As stated in paragraph 21 of PBU 14/2007, the results of revaluation are accepted when generating balance sheet data at the beginning of the reporting year. The results of the revaluation are not included in the balance sheet data of the previous reporting year, but are disclosed in the explanatory note to the financial statements of the previous reporting year.

The amount of revaluation of intangible assets as a result of revaluation is credited to the company’s additional capital. At the same time they make notes:

D 04 “Intangible assets” K 83 “Additional capital”

— the initial cost of intangible assets has been increased;

De 83 K 05 “Amortization of intangible assets”

— accrued amortization of intangible assets has been increased.

If the object has previously been revalued, then the amount of revaluation of intangible assets, equal to the amount of its depreciation, which was carried out in previous reporting periods and attributed to other expenses, is credited to other income. In this case, the accountant should make the following entry:

D 04 K 91 - the initial cost of intangible assets was increased by an amount not exceeding the size of the previous markdown;

D 91 K 05 - accrued depreciation has been increased.

Please note that when an intangible asset is disposed of, the amount of its revaluation is transferred from the organization’s additional capital to retained earnings:

D 83 K 84 - reflects the decrease in additional capital by the amount of the additional valuation of the disposed object.

The amount of write-down of intangible assets as a result of revaluation is included in other expenses

The depreciation of an object is reflected by the following transactions:

D 91 K 04 - the initial cost of intangible assets was reduced;

D 05 K 91 - accrued depreciation of intangible assets has been reduced.

If the object was previously revalued, then:

1) the amount of write-down of intangible assets is included in the reduction of the company’s additional capital, which was formed due to the amounts of the additional valuation of this asset carried out in previous reporting periods:

D 83 K 04 - the initial cost of intangible assets was reduced;

D 05 K 83 - accrued depreciation has been reduced;

2) the excess of the amount of depreciation of intangible assets over the amount of its revaluation credited to the organization’s additional capital as a result of the revaluation that was carried out in previous reporting periods is charged to other expenses:

D 91 K 04 - reflects the difference between the amount of the markdown and the amount of the previous revaluation;

D 05 K 91 - depreciation adjustment is reflected.

Note that the amount attributed to the account of retained earnings (uncovered loss) must be disclosed in the organization’s financial statements.

Account 91 Other income and expenses - postings in the 1C 8.3 program

Account 91 “Other income and expenses” of the chart of accounts collects “ information” about other income and expenses of the reporting period.

You must understand that every income most often has an accompanying expense. For example, when selling a product, we not only receive income, but also incur expenses in the form of the cost of the product sold. Accounts such as account 90 and account 91 are necessary to “output” the final “financial result” (profit or loss) from each sales transaction. Managers need to clearly understand which sales operations were unprofitable, and which operations brought profit and in what amount.

“Other” income includes: - income from the “rental” of property; — income from participation in other organizations; — income from the “sale of fixed assets” and non-core assets; — “interest” on loans provided; — “interest” on deposits placed in the bank;

— fines from suppliers and other contractors in our favor; - exchange differences;

The account has three sub-accounts:

91.1 “Other income” - we collect other income for each sales transaction 91.2 “Other expenses” - we collect other expenses for each sales operation 91.9 “Balance of other income and expenses” - the difference (91.1 minus 91.2) at the end of the month is written off by posting to account 99 " Profit and loss".

Summary of account 91: (see all bookmarks)

— on the account we collect “information” about “other income and expenses”, which do not form a significant part in the organization’s activities.

— postings in 1C 8.2 for account 91 are mainly formed by four documents: document “Sales of goods and services” (accrual of revenue, accrual of cost) document “Receipt to current account” (accrual of revenue) document “Transfer of fixed assets” (accrual of revenue , accrual of cost)

document “Write-off of OS” (accrual of cost)

- if you build SALT according to the account, you will see all the OS that have been received into ownership, put into operation and are currently in operation.

RENTAL INCOME

Posting: D. 62 “Settlements with customers” - K.91 “Other income and expenses”

Description: by posting we record “information” about the occurrence of an “obligation” from the buyer to our organization and by posting we record “information” about the occurrence of “other non-operating” income in the sales amount.

Amount: sales amount

Document 1C 8.3: Sales of goods and services.

INCOME from interest on a bank deposit

Posting: D. 51 “Current accounts” - K.91 “Other income and expenses”

Description: by posting we recorded “information” about the receipt of funds to the current account (account 51) and by posting we recorded “information” about the occurrence of “other non-operating income” (account 91) as a result of interest received on a deposit in the bank.

Amount: amount received.

Document 1C 8.3: Receipt to the current account. .

DISPOSAL of fixed assets - sale to counterparty

Posting: D. 62 “Settlements with customers” - K. 91 “Other income and expenses”

Description: by posting we recorded “information” about the buyer’s “obligation” that arose (account 62) and by posting we recorded “information” about the arising other income (account 91) as a result of the sale of a fixed asset.

Amount: the amount of proceeds from the sale of a fixed asset. Posting date: date of sale or disposal from the document “Act of write-off of an asset”, document “Act of disposal of an asset”, document Torg-12

Document 1C 8.2 creating wiring D.62 - K.91:

doc. "OS Transfer"

— set the field.Counterparty, the counterparty whose obligation we reflect on account 62.

- tab. Settlements accounts, issue “account for accounting of settlements with the buyer” = account 62.01/62.02.

- tab. Fixed assets, issue “expense account” = account 91.02

Posting: D. 91 “Other income and expenses” - K. 01 “Fixed assets”

Description: by posting we recorded “information” about expenses in the amount of “residual value of a fixed asset”, which will have to be attributed to the financial result (account 91) and by posting we recorded “information” about the disposal of an asset from the fixed assets of the organization (account 01 ) as a result of the sale.

Amount: “residual” value of the object

Posting date: date of sale or disposal (indicated in the invoice or act of write-off of fixed assets) Document: document “Act of write-off of fixed asset” or document “Act of disposal of fixed asset”.

Document 1C 8.2 creating wiring D.91 - K.01:

doc. "OS Transfer"

- tab. Fixed assets, set “expense accounting account” = account 91.02 - the program knows that the fixed assets are listed on account 01.01 (in the document “Acceptance for accounting of fixed assets” we indicate “accounting for the fixed assets object”). Accordingly, in the document it is necessary to issue only an “expense account”, and we indicated to the program where to write off the OS earlier, in the document “Acceptance for accounting of OS”.

Posting: D. 91 “Other income and expenses” - K. 68.02 “VAT”

Description: by posting we recorded “information” about the costs associated with the sale of fixed assets, for the payment of VAT (account 91) and by posting we recorded “information” on the accrual of “liabilities” to the budget of the Russian Federation (account 68.02). When using different taxation systems, some organizations have an obligation to charge tax on the “sale” transaction, which is what we did. The accrued tax is part of the expense of the operation, which we reflected on account 91 (debit 91 just recorded the expense that is associated with our sales operation).

Amount: estimated value

Document 1C 8.2 creating wiring D.91 - K.68.02:

doc. "OS Transfer"

- tab. Fixed assets, set “account for VAT expenses” = account 91.02 - the program knows that account 68.02 should always correspond with this cell.

DISPOSAL of fixed assets - as a result of loss of performance

Posting: D. 91 “Other income and expenses” - K.01 “Fixed assets”

Description: by posting we recorded “information” about the premature “expense for the period” that arose (account 91) and by posting we recorded “information” about the write-off of a fixed asset (account 01) as a result of loss of performance.

Amount: the amount of the “residual” value of the asset. Posting date: date of disposal (indicated in the act of write-off of fixed assets) Document: document “Act of write-off of fixed assets”.

Document 1C 8.2 creating wiring D.91 - K.01:

doc. "Decommissioning of OS"

— we issue “account for settlements” = invoice 91.02.

— indicate the “fixed asset item” that is subject to write-off.

- the program knows that the fixed assets are listed on account 01.01 (in the document “Acceptance for accounting of fixed assets” we indicate “account for accounting of the fixed assets object”). Accordingly, in the document it is necessary to issue only an “expense account”, and we indicated to the program where to write off the OS earlier, in the document “Acceptance for accounting of OS”.

www.finbuh1c.ru

Account 68 - common accounting entries

Accounting for tax amounts is necessary to monitor the fulfillment of the enterprise’s obligations to pay taxes to the budget. Account 68 is used to reflect tax transactions.

Subsequently, these amounts are written off from account 94 “Shortages and losses from damage to valuables” to the debit of account 70 “Settlements with personnel for wages” (if they can be deducted from the employee’s wages) or 73 “Settlements with personnel for other operations” ( when they cannot be deducted from the employee’s wages).

In particular, for the calculation and payment of personal income tax (abbreviated as personal income tax or income tax, as people like to call it), a subaccount 68.1 is opened. The procedure for calculating VAT depends on the type of operations that were carried out by the enterprise (sale/free transfer of goods, construction and installation works on its own, advances received, unconfirmed exports, etc.) Let's consider typical entries for reflecting the amount of VAT depending on the type of operations performed.

Account 68 in accounting is intended to collect information about mutual settlements on accrued tax payments required for payment to budgets, the organization's debts to regulatory authorities and identified amounts of overpayments. The legislation provides for differentiated tax rates for different regions and constituent entities of the Russian Federation. The rate range (from 5% to 15%) is determined depending on the category of payer (range from 5% to 15%).

Is count 68 active or passive? this account can have both a debit and a credit balance. It all depends on the nature of the debt. If there is an overpayment of taxes, then the balance is a debit. In case of debt to budgets - credit.

The accounts of this section are intended to summarize information on the availability and movement of objects of labor intended for processing, processing or use in production or for economic needs, means of labor, which, in accordance with the established procedure, are included in the composition of funds in circulation, as well as operations related to their procurement (purchase).