Let's understand the concepts

The first question is: who are the suppliers and who are the contractors?

A certain category of economic entities that are sellers of goods, products, materials or raw materials or provide any services or perform certain types of work. In other words, suppliers are legal entities, individuals, individual or private entrepreneurs who sell material assets, services, raw materials, and work. Moreover, the organizational and legal form and type of activity of an economic entity do not play any role. Accounting for settlements with suppliers and contractors can be briefly described as follows. This is a reflection in the accounting of business transactions for the acquisition from third parties of materials, fixed assets, works or services necessary for the institution to carry out its activities. Settlements are recognized as the transfer of funds by an organization in cash or by bank transfer in favor of the seller company on the basis of an agreement, agreement or contract. In addition to monetary payment, the terms of the agreement may determine other terms of mutual settlements. For example, offset, bill, currency. The supplier may issue valuables in installments or provide them free of charge.

Count 60: basic information

Count 60 – active-passive. Its balance can be formed by both debit and credit.

- Credit balance - the company has debts for goods supplied or services provided.

- Debit balance – third-party companies have not fulfilled their obligations to the enterprise.

The amount of VAT on goods and services received is recorded on the loan as part of the total amount. Tax payment is made in the total amount, but in debit.

Features of accounting in a budgetary institution

In a budgetary institution, accounting for settlements with suppliers and contractors is kept in a special account 0 302 00 000. The current chart of accounts provides for separate detailing.

Subaccounts to reflect liabilities

| Account code | Account name |

| 302 10 000 | Calculations for wages and accruals for wage payments |

| 302 11 000 | Payroll calculations |

| 302 12 000 | Calculations for other payments |

| 302 13 000 | Calculations for accruals for wage payments |

| 302 14 000 | Calculations for other non-social payments to staff in kind |

| 302 20 000 | Calculations for works and services |

| 302 21 000 | Payments for communication services |

| 302 22 000 | Payments for transport services |

| 302 23 000 | Payments for utilities |

| 302 24 000 | Calculations of rent for the use of property |

| 302 25 000 | Calculations for work and property maintenance services |

| 302 26 000 | Payments for other works and services |

| 302 27 000 | Insurance calculations |

| 302 28 000 | Calculations for services and work for capital investment purposes |

| 302 29 000 | Calculations of rent for the use of land plots and other isolated natural objects |

| 302 30 000 | Calculations for receipt of non-financial assets |

| 302 31 000 | Calculations for the acquisition of fixed assets |

| 302 32 000 | Calculations for the acquisition of intangible assets |

| 302 33 000 | Calculations for the acquisition of non-produced assets |

| 302 34 000 | Calculations for the acquisition of inventories |

| 302 40 000 | Calculations for gratuitous transfers to organizations |

| 302 70 000 | Calculations for the purchase of securities and other financial investments |

| 302 72 000 | Calculations for the purchase of securities, except shares and other financial instruments |

| 302 73 000 | Calculations for the purchase of shares and other financial instruments |

| 302 75 000 | Settlements for the acquisition of other financial assets |

| 302 90 000 | Calculations for other expenses |

| 302 93 000 | Calculations of fines for violation of the terms of contracts (agreements) |

| 302 95 000 | Settlements for other economic sanctions |

| 302 96 000 | Calculations for other current payments to individuals |

| 302 97 000 | Calculations for other current payments to organizations |

For the costs of transferring advance payments provided for by the terms of the agreement, a separate account 0 206 00 000 is provided. Similar details are established for this account.

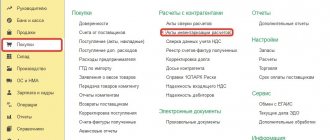

How to prepare an accounting entry when transferring funds to suppliers

Transactions for the transfer of funds to companies for goods, work or services from the current account of the organization - the buyer are recorded in the accounting program with the following accounting entries:

- By debit 60.1 By credit 51 - if the primary time was the receipt and registration of goods, work or materials from the supplier. If the delivery and payment amounts are the same, then the final balance of these transactions will be zero.

- By debit 60.2 By credit 51 - if, under the terms of the contract, the organization pays the supplier an advance (prepayment) and only upon receipt of funds in the account ships goods, performs work and provides services. As a result, the paying organization has a receivable.

Record the repayment of debt to the supplier as the debit of account 60.

The list of subaccounts can be expanded to reflect settlements in conventional units (cu) or currencies of foreign countries.

In specialized programs, postings are generated automatically when performing cash transfer transactions across the bank.

Subaccounts to reflect prepayments by group

| Group account code | Account group name |

| 206 10 000 | Calculations for advances on wages, accruals on wage payments |

| 206 20 000 | Calculations for advances for work and services |

| 206 30 000 | Calculations for advances on receipt of non-financial assets |

| 206 40 000 | Calculations for advance gratuitous transfers of a current nature to organizations |

| 206 50 000 | Calculations for gratuitous transfers to budgets |

| 206 60 000 | Social Security Advance Settlements |

| 206 70 000 | Calculations for advances for the purchase of securities and other financial investments |

| 206 80 000 | Calculations for advance gratuitous transfers of capital nature to organizations |

| 206 90 000 | Calculations for advances on other expenses |

These accounting accounts reflect mutual settlements with suppliers in the context of organizations, individual entrepreneurs or individuals. It is recommended to carry out accounting for each counterparty in the context of agreements and contracts. This approach to organizing accounting will reduce the number of violations of current legislation in the field of procurement and when calculating tax obligations, such as VAT.

Before preparing financial statements and reflecting settlements with suppliers and contractors on the balance sheet, the institution must conduct a special inventory of debts (liabilities). The procedure is mandatory when preparing an annual report. It is mandatory to carry out an inventory before the reorganization or liquidation of a government agency. The organization has the right to independently initiate an inventory of settlements with suppliers and contractors before the due date. For example, when disputes arise or supporting documents are lost.

Typical accounting entries for account 60

There are several standard entries for account 60 that allow you to record transactions in the company’s accounting. The most common ones include:

| Debit accounts | Credit accounts | the name of the operation |

| , , | 60 | Receipt of valuables |

| 60 | 50.01, 51, 52 | Payment of debt for previous deliveries |

| 94, 76 | 60 | Write-off of shortage |

| 19 | 60 | VAT on purchased goods |

| 50, 51, 52 | 60 | Payment by supplier invoice |

| 10, 15, 41 | 60 Non-faculty supplies | Receipt of materials without documents |

| 60 Non-faculty supplies | 60 | Payment for uninvoiced goods |

| 60, 91.02 | 91.01, 60 | Write off exchange rate differences |

| 91.02, 63 | 60 Advances issued | Write-off of previously paid advance |

When drawing up a balance sheet, account balances 60 are indicated in different sections. Accounts receivable are recorded as assets, and credit balances are recorded as liabilities.

Example No. 1. Suppliers and contractors

GBOU DOD SDYUSSHOR "ALLUR" entered into an agreement with the supplier LLC "Seller" in the amount of 100,000 rubles for the purchase of sports equipment using subsidies for the implementation of government assignments. According to the terms of the agreement, an advance payment in the amount of 30,000.00 rubles is provided. The accountant made entries for payments to suppliers:

| Operation | Debit | Credit | Amount, rub. |

| The advance payment was transferred to the settlement account of the supplier LLC “Seller” | 4 206 31 560 | 4 201 11 610 | 30 000,00 |

| The institution received equipment | 4 106 31 310 | 4 302 31 730 | 100 000,00 |

| The advance payment for the supply of sports equipment has been credited | 4 302 31 830 | 4 206 31 660 | 30 000,00 |

| The balance for the sports equipment is transferred to the supplier | 4 302 31 830 | 4 201 11 610 | 70 000,00 |

Payment of tax for a 3rd person - postings in 1C 8.3 Accounting

The Organization has a loan payable to a counterparty in the amount of RUB 50,000.

At the time of repayment of the loan, the Organization received a letter from the counterparty with a request to transfer the entire amount of debt to pay VAT for the 1st quarter.

On April 20, the Organization transferred the amount of debt 50,000 rubles. to the budget.

| date | Debit | Credit | Accounting amount | Amount NU | the name of the operation | Documents (reports) in 1C | |

| Dt | CT | ||||||

| Generating a payment order for tax payment | |||||||

| 20 April | — | — | 50 000 | Formation of a payment order | Payment order - Payment of tax for third parties | ||

| Payment of tax to the budget for a third party | |||||||

| 20 April | 66.03 | 51 | 50 000 | 50 000 | Payment of tax for a third party on account of loan debt | Debiting from a current account – Payment of tax for third parties | |

Generating a payment order for tax payment

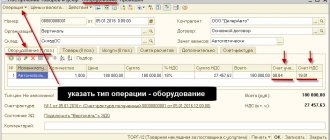

To transfer tax, create a Payment order - for such a case, the program implements a special Operation Type : Payment of tax for third parties (Bank - Payment orders).

Fill out the document:

- The organization is your organization;

- Taxpayer is the counterparty for whom you pay the tax;

- Recipient - tax office of the counterparty;

- using the link Payment details to the budget, indicate the BCC and all payment data corresponding to the tax paid;

- Expense item - Repayment of loans and borrowings , since for our organization the loan is repaid under the contract;

- Purpose of payment - is issued automatically based on the completed data, manually specify the tax payment period.

Check that the printed form is completed. In the figures, the details of the counterparty are marked in blue, and the details of our organization are marked in red.

Payment of tax to the budget for a third party

Based on the Payment Order, issue a Debit from the current account (Bank - Payment Orders).

The document is filled out automatically according to the Payment Order .

Manually enter:

- Settlement account - an account that reflects the debt to the counterparty, against which the tax was paid (in our example - 66.03).

Postings

Control

Check the result of the operation using the Balance Sheet for the account on which the accounts payable were registered: in our example - 66.03 (Reports - Account Balance Sheet).

In the SALT we see that the debt under this loan agreement has been repaid.