The most active flow of the company's financial resources passes through accounts that are associated with the movement of funds with suppliers and other counterparties. The speed of money turnover, existing debt indicators, and the presence of penalties are criteria for assessing the solvency of an enterprise. All these positions are assessed by potential partners before contracts are concluded. Accounting for transactions with suppliers and contractors is one of the central ones for the company’s entire accounting system. In this case, a count of 60 is used.

Scope of application of account 60 in accounting

Suppliers are firms that deliver raw materials, semi-finished products, components, goods, fixed assets and other inventories to other organizations for production and commercial activities.

Settlements with suppliers and contractors require strict accounting

Contractors are individuals and legal entities who perform work under a contract concluded in accordance with the current legislation.

Accounting account 60 aims to summarize information on transactions with specified persons in the following aspects:

- acquisition of inventory items;

- performing certain work;

- provision of service;

- delivery of valuables;

- unpaid deliveries;

- excess inventories and inventories;

- transport services;

- communication services.

Organizations involved in the execution of construction contracts, contracts for the performance of research, development and technological work and other contracts for the functions of a general contractor are also reflected in account 60.

All transactions are reflected in accounting account 60, regardless of the time of payment.

The tasks facing the accounting system for account 60 relate to issues of tracking financial flows operating between the company and suppliers. The account allows you to receive information that performs the following tasks:

- control over the status of amounts due to contractors and suppliers of goods and materials (information is relevant for owners, as well as for the formation of reliable reporting);

- formation of an information base. On its basis, the speed of funds turnover is controlled. The database is used to generate management reports;

- control over compliance with contractual obligations, terms, volumes of supplies and payment for them;

- drawing up a payment plan for suppliers when distributing financial resources;

- eliminating opportunities to violate the law regarding payment issues;

- monitoring of overdue payments.

60 account in accounting is a variant of an active-passive account, regardless of the chosen accounting system and the organizational and legal form of activity. It is designed to generate and collect data about each supplier and counterparty.

The basis for starting accounting are:

- concluding an agreement for the supply of inventory, fixed non-current assets, and intangible assets;

- provision of services of various nature (utilities, repair and maintenance of buildings, structures, machinery and equipment);

- transportation of goods;

- performance of work under the contract, etc.

Important! Accounting under account 60 is called “Settlements with suppliers and contractors.” A synthetic version of accounting is maintained for all organizations. For analytics, sub-accounts are generated for individual counterparties.

To account for transactions between counterparties when delivering goods, account 60 is used

Writing off fuel in 1C 8.3 - step-by-step instructions

The table shows that fuel is written off in 1C in the same way: regardless of whether fuel and lubricants are recorded using fuel cards in 1C 8.3, or using coupons, or something else. But the purchase and accounting of gasoline in warehouses (centralized warehouse or in car tanks) differ.

Receipt of fuels and lubricants

Receipt of fuel and lubricants can be:

- through accountable persons (for cash, using corporate payment cards, fuel cards, statements or coupons);

- centralized (using coupons, when transferring ownership of fuel at the time of advance payment or purchase into the organization’s tanks).

When purchasing fuel and lubricants through accountable persons, use the Advance report document, section Bank and cash desk - Advance reports.

If fuel is purchased using statements, coupons and fuel cards, the organization receives a delivery note and an invoice. Therefore, VAT charged by the supplier can be deducted. The format of the Advance Report document looks like this:

If fuel is purchased in cash or using payment cards, the supplier does not present any other documents other than a receipt, so VAT cannot be deducted. The format of the Advance report document looks like this:

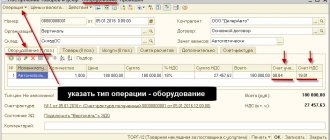

For the centralized purchase of fuel and lubricants, the document Receipt (act, invoice) is used, the transaction type is Goods (invoice), section Purchases - Receipt (acts, invoice). The invoice is registered and VAT is deducted in the general manner.

Fuel accounting

Further accounting of gasoline in car tanks and its write-off in 1C 8.3 is carried out:

- by moving from a general warehouse () to a warehouse with the name auto () by the document Movement of goods, section Warehouse - Movement of goods - if such movement is necessary;

- taking into account the amount of fuel consumed outside the program on the waybill;

- write-off of fuel and lubricants.

See also: How to view warehouse balances in 1C?

How to write off fuel in 1C 8.3

Write-off of fuels and lubricants, including fuel cards in 1C 8.3, is carried out using the document Requirement-invoice, section Warehouse - Requirements-invoices.

Please indicate:

Warehouse - name of the fuel and lubricants storage warehouse.

Materials tab:

- Nomenclature - fuel grade from the Nomenclature directory: Materials;

- Quantity - the amount of fuel of the specified brand recorded in account 10.03 “Fuel”.

Cost Account tab:

- Cost account - a cost account to which fuel and lubricants are written off;

- Cost division - a division of the organization where the car is registered and for whose needs it is used;

- Cost items - Write-off of materials (with an established type of expense).

Characteristics

Active - passive 60 account in accounting is used to combine data on transactions with counterparties.

The main characteristics that answer the question of whether the 60 account is active or passive:

- summarizes information about transactions with counterparties;

- summarizes information on transactions with subcontractors under construction contracts;

- the cost of acquired property is reflected according to Dt: 08.10, 20, 41 and Kt60;

- repayment of obligations is reflected according to Dt 60 and Kt 51,52,55;

- analytical accounting is formed in the context of each supplier, contractor and performer.

Count 60 belongs to the active-passive type:

- a debit balance indicates that the partner has not yet fulfilled his obligations to the company. The supplier company has a debt for the supply of goods, works or services;

- the presence of a credit balance indicates that the company has not yet paid the debt to the supplier or contractor.

Advances provided to suppliers for the upcoming supply of materials, raw materials, advances to contractors for upcoming work and services are taken into account.

Analytical accounting for account 60 is maintained for each accrued amount, for each supplier and contractor. The construction of analytical accounting provides the necessary data on:

- suppliers and accepted documents, the payment deadline for which has not yet arrived;

- suppliers who did not pay documents on time;

- to suppliers in case of unpaid deliveries;

- advances to suppliers;

- when issuing bills whose due date has not yet arrived;

- to suppliers for overdue payments;

- when receiving a commercial loan, etc.

Count 60 is active-passive, which characterizes its main feature

Accounting for settlements with suppliers

Article 60 is the accounting of a synthetic species. The balance sheet displays all debt for all obligations to suppliers and contractors.

All transactions on this account can be classified into two types:

- Acquisition of property rights, goods, etc. These could be supply contracts, utilities or sales contracts.

- Payment for contractors' services. These are, first of all, transactions for the provision of contract services, paid services and R&D.

All incoming data is recorded and analytically processed - for each issued payment document, and when displaying planned payments - for each counterparty.

The data is obtained:

- for unpaid accepted payments and other payment documents;

- if bills have not been paid;

- for uninvoiced deliveries;

- advances that have been issued;

- on promissory notes with undue payment terms;

- on overdue bills;

- due to commercial loans.

Movement on account 60 occurs in the presence of the following regulations:

- In order for an enterprise to record a debt for materials or services provided, the supplier or contractor must present an invoice or delivery note to the company. They are the basis for the creation of a purchase ledger (received VAT).

- To repay a debt obligation to organizations, it is necessary to present a payment order or demand to the debtor organization.

- An expense order, which confirms the repayment of a debt in part or in full, using cash payment at the cash desk of the paying company.

- The basis for payment for work or services can be an act of completion of work. 5. When repaying the claim amount in cash or in the case of returning the prepaid contribution, a receipt order is issued.

If there is no documentation for the received goods, then the fact of its arrival is confirmed using the register. When invoices are presented, account 60 undergoes data adjustment - the difference in amounts between the price of the goods according to the submitted acts and the accounting value is calculated.

Credit transactions:

- The debt incurred by the organization to its counterparties is displayed here.

- The balance at the beginning of the reporting period (month) is recorded as a credit, but if, according to the terms of the agreement, a prepayment payment was transferred to the supplier, then it can be displayed as a debit.

Debit transactions in correspondence:

- 07 and 08 – acquisition, improvement and use of non-current assets;

- 10, 15 – purchased funds (materials, goods);

- 20 (20, 23, 25, 26) – work provided by third-party companies in order to increase the cost of production of main and additional production or for general economic and general expenses for the production process;

- 41 – purchase of goods;

- 43, 44 – increase in trading costs due to the provision of services by contractors;

- 50 (51, 52, 55) – operations to reimburse financial resources from counterparties. For various reasons (inflated payment, settlements on claims, in case of detection of poor quality goods or when less goods were shipped due to its shortage);

- 60 – crediting of previously paid advance funds;

- – using an assignment agreement, payment for a short-term loan or loan;

- 76 – the amount of claims that were presented to the buyer;

- 79 – the main company made a payment for the goods and materials supplied to the subordinate company or branch office;

- 91.2 – if the difference in the exchange rate (negative) was written off as other costs.

Debit transactions on the account:

- , 15 – return of inventory items;

- 50 – repayment of debt on the presented invoice at the company’s cash desk in cash;

- 51 – payments by non-cash method from a current or other type account;

- 52 – payment to the supplier in the currency specified in the text of the contract;

- 55 – payment with funds blocked until the goods arrive (finances are debited from the company’s account and transferred to a special letter of credit issued at the recipient’s cash desk or bank - the amount is determined by the rules of the contract);

- 60 – the previously made advance payment is taken into account;

- 66 – with the help of a short-term credit loan, the debt to counterparty enterprises was repaid;

- 72 – when the debt is assigned under an assignment agreement to another third-party company.

Write-off of accounts payable for reasons:

- The deadline for filing claims has passed.

- Liquidation of the creditor organization.

- The difference is in the course.

- Recalculation of the debt amount.

- Penalties arising from violation of the terms of the contract.

Subaccounts

Analytics on account card 60 is carried out separately for each account.

It is necessary to organize the analysis of invoice 60 in such a way that you can track information on suppliers:

- according to separate documents;

- according to documentation that is not due;

- under unpaid contracts;

- on bills issued;

- by suppliers with issued credit amounts, etc.

To record transactions, sub-accounts are opened:

- 60.01: reflect mutual transactions with partners in purchase transactions and payment for goods;

- 60.02: reflect prepayment transactions;

- 60.03: reflects the company's securities.

Important! It is possible to open additional sub-accounts taking into account the specifics of the company.

Separate accounts are organized for mutual transactions with counterparties in foreign currency:

- 60.21: analogue to 60.01 for currency accounting;

- 60.22: analogue to 60.02 for currency accounting;

- 60.31 - analogue to 60.01 for transactions in monetary units;

- 60.32: analogue to 60.02 for transactions in monetary units.

During accounting, separate sub-accounts are created for counterparties

Let's start with the name

Account 10 “Materials”, in accordance with Instruction 94n, is used to reflect on it everything that happens in the company with materials, raw materials, fuel, spare parts, inventory and other similar acquisitions.

Briefly, we can say that account 10 reflects what relates to inventories (inventories): their receipt and disposal. Subaccounts to account 10 can be opened by types of inventories enlarged: raw materials and supplies (10-1), fuel (10-3), spare parts (10-5), account 10-10 (which applies) - special equipment and special clothing, etc. etc., in accordance with those recommended in Instruction 94n or independently created and included in the accounting policy.

Balance sheet for account 60

This document is a summary of data on account 60 for all business transactions that were carried out using this account in the company for the period.

Important! The main feature of this document is that count 60 is active-passive.

Basic rules for forming a statement:

- Credit turnover. The loan reflects transactions that are associated with the purchase of materials, work, services, and equipment. Basic documents: invoices, acts, invoices.

- Debit 60 of account shows debit turnover. Transactions for payment of funds to suppliers are reflected. Among them: debt repayment, prepayment. Documents: payment slips, cash documents.

An example of a balance sheet for a conditional company for dummies is presented in the table below.

| Index | Balance at the beginning | Period transactions | balance at the end of period | ||

| Debit | Credit | Debit | Credit | Debit | Credit |

| 60 | 13691,00 | 155317,00 | 141626,00 | ||

| Supplier LLC "Phoenix" | 13681,00 | 154727,00 | 141046,00 | ||

| 321 from 11/01/2019 | 13681,00 | 154727,00 | 141046,00 | ||

| Document of transactions with the counterparty UK00-000001 dated 04/30/2019 | 10000,00 | 10000,00 | |||

| Receipt (act, invoice) from UK 00-000001 dated 05/20/2019 | 3481,00 | 3481,00 | |||

| Receipts (act, invoice) UK 00-000002 dated 06/02/2019 | 200,00 | 3304,00 | 3104,00 | ||

| Receipts (act, invoice) UK 00-000003 dated 06/19/2019 | 118000,00 | 118000,00 | |||

| Receipt of additional expenses UK 00-000002 dated June 19, 2019 | 11800,00 | 11800,00 | |||

| Receipts (act, invoice) UK 00-000004 dated July 17, 2019 | 1888,00 | 1888,00 | |||

| Receipts (act, invoice) UK 00-000005 dated 10/16/2019 | 5900,00 | 5900,00 | |||

| Receipts (act, invoice) UK 00-000006 dated 10/18/2019 | 354,00 | 354,00 | |||

| Afra LLC | 10,00 | 10,00 | |||

| 1 from 12.102.2019 | 10,00 | 10,00 | |||

| Write-off from account UK00-000004 dated 10/19/2019 | 10,00 | 10,00 | |||

| Transport company Altair LLC | 590,00 | 590,00 | |||

| 123 from 05/12/2019 | 590,00 | 590,00 | |||

| Receipts of additional expenses UK00-000001 dated May 29, 2019 | 590,00 | 590,00 | |||

| TOTAL | 13691,00 | 155317,00 | 141626,00 |

According to this statement, it is clear that in 2022 the conditional company paid the supplier Phoenix LLC 13,681.00 rubles, and goods were received at a cost of 154,727.00 rubles.

The total debt amounted to 141,046.00 rubles. Important! The debit balance of account 60 is reflected in the asset balance sheet (in the form of accounts receivable). The credit balance is reflected in the liabilities side of the balance sheet (in the form of accounts payable).

A comment

The double entry method was invented by the medieval Italian mathematician Luca Pacioli (1445 - 1517). He described the principle of double entry in his Treatise on Accounts and Records.

Double entry accounting is expressly required by law. Thus, Article 10 of the Federal Law of December 6, 2011 N 402-FZ “On Accounting” indicates:

“Accounting is carried out by means of double entry in the accounting accounts, unless otherwise established by federal standards.”

The essence of double entry is that a business transaction is reflected by an accounting entry (entry) consisting of:

— transaction amount;

- account debit entries

— entry on the credit of the corresponding account

Example

An organization purchases goods from a seller for the amount of 100 rubles.

Receipt of goods is reflected by posting Debit (D) 41 Credit (C) 60,100 rubles

The first part of the entry (D 41) means that goods worth 100 rubles appeared on the buyer’s balance sheet (account 41 means goods, and its reflection in debit means the receipt of goods).

The second part of the entry (K 60) means that the buyer has a debt for the goods delivered (account 60 means Debt, and its reflection on the loan means an increase in the amount of debt).

Payment for goods received from the current account is reflected by the entry:

D 60 K 51 100

The first part of the entry (D 60) means a reduction in debt for goods in the amount of 100 rubles. As a result of this operation, the balance on account 60 will be 0 (when purchasing goods, a balance was formed on the credit of account 60 in the amount of 100 rubles, and after payment, entry D 60 led to a zero balance on account 60, which means there is no debt).

How debits and credits are displayed

The account is credited for the cost of goods, inventory items, works and services accepted for accounting and corresponds with their accounts. Synthetic loan accounting is based on the supplier's documents, which does not depend on the assessment of values.

Account 60 is debited for the amounts of performance obligations. This also includes advances and prepayments. Corresponds with the accounts in which these funds are recorded.

The debit and credit of account 60 reflects different transactions

Account correspondence 60

The accounting characteristics of account 60 show that such an account can have both a payable balance and a receivable balance, depending on the current state of mutual settlements. Based on the above, the credit of account 60 increases when the organization registers materials, raw materials, fuel, fixed assets, goods, equipment, as well as various services and works. Correspondence is carried out (according to documentation from counterparties) with object accounting accounts.

What is reflected in the debit of account 60? These are the amounts of fulfillment of obligations stipulated by contractual terms. That is, payment of invoices received from suppliers/contractors, including the listed prepayment. Analytical account card 60 allows you to obtain accurate information about the status of mutual settlements, including overdue debts.

Postings

The main transactions for account 60 are reflected in the table below.

By debit.

| Debit | Credit | Explanation of the operation |

| 60 | 50.01 | The debt to the supplier is repaid from the cash register |

| 60 | 51 | The debt to the supplier has been repaid from the current account |

| 60 | 52 | The debt to the supplier was repaid in foreign currency |

| 60 | 55.01 | The amount of the used letter of credit is written off for settlements with the supplier |

| 60 | 76.02 | The amount of claims against the supplier is reflected |

| 60 | 91.01 | Accounts payable are included in other income after the statute of limitations expires |

| 60 | 91.01 | Positive exchange rate difference reflected |

Analytical monitoring

According to current legislation, legal entities have the right to open any number of accounts necessary to carry out their activities, both in Russian and foreign currency. Data on the opening are automatically transmitted to the Federal Tax Service inspection where the company is registered.

Analysis of incoming and outgoing non-cash funds is carried out in the context of each individual current account opened by the organization.

In order to verify the correctness of mutual settlements and filling in information in the company’s accounting records, an extract is requested from the credit institution (through the Bank-client system or in person through the branch operator).

Account document flow

Account 60 is used to form transactions with suppliers. Basic documents for the movement of funds:

- An invoice and invoice are the basis for creating a purchase book (VAT received).

- A payment order or bank statement serves to close accounts payable to contractors.

- The certificate of completion of work is the basis for payment of the amount specified in the contract.

When goods are delivered without a document, the actual receipts are also reflected in the registers. At the time of presentation of invoices 60, the invoice is adjusted taking into account the difference between the accounting prices and the cost of the goods according to the submitted documents.

Documentation for settlements with counterparties is strictly maintained

Accounting for waybills

Input of remaining fuel and lubricants

Before the functionality for accounting for waybills appeared, fuel was accounted for in account 10.03.1 in the warehouse. It turns out that there may be balances on this account. To account for waybills, you need to transfer balances using the “Operation” document. Let's create a new document and enter the postings Dt 10.03.02 and Kt 10.03.01:

Purchase and write-off of fuel and lubricants

Let's look at what transactions will be generated when purchasing and writing off fuel and lubricants when accounting for waybills.

You can pay for fuel in cash, by bank card or by fuel card. The payment method determines what documents and postings will be created.

Payment in cash or by bank card

When paying in cash or by bank card, a “Waybill” document is created. Let’s create a new document in the “Purchases” section.

We indicate the organization, document date, vehicle, employee (accountable person), and check the expense account. When choosing a car, the consumption rate is automatically entered:

On the “Fuel” tab enter:

- The document and its number - this could be a cash receipt or a fuel card. In this case, “Cashier's Receipt”.

- Date.

- Quantity and cost of fuels and lubricants.

On the “Route” tab enter:

- Point and time of departure and destination.

- Odometer readings at the beginning and end of the journey.

- Distance and consumption will be automatically calculated.

At the bottom of the document, the initial fuel balance is displayed, how much was filled, how much was spent on the trip, and the final balance in the tank is also calculated.

After saving the document, you can print it:

- Waybill.

- Waybill according to form No. 3.

- Advance report.

Let's go through the document and look at the postings:

According to Dt 10.03.2, the operation of filling fuel and lubricants into the tank (quantity and amount) is reflected. According to Kt 10.03.2, the operation of writing off fuel and lubricants is reflected

Please note that only quantity is written off. The write-off is carried out to the cost account specified in the document. The posting according to Kt 10.03.2 to write off the amount of fuel consumed will be made when closing the month using the “Adjustment of item cost” operation:

The amount is calculated based on the average cost per month.

Payment by fuel card

When paying with a fuel card, two documents are created:

- Waybill.

- Receipt (act, invoice) with the type of operation “Fuel”.

When filling out the “Way List” document, select the “Fuel Card” document and indicate the amount of fuel and lubricants; you do not need to indicate the price and amount:

The rest of the information is filled out in the same way.

Let's go through the document and look at the postings:

According to Dt 10.03.2, the operation of filling fuel and lubricants into the tank is reflected (only quantity, without amount).

To reflect the amount, create the document “Receipt (act, invoice)”, operation “Fuel”:

According to Dt 10.03.2 the amount of fuel is reflected. There is no amount of fuel and lubricants here, since it was already reflected in the waybill.

At the end of the month, the “Adjustment of item cost” operation is also performed.