What is the ratio of income and expenses taken into account when planning business processes?

How to evaluate the impact of this ratio on profits, profitability and costs?

How to calculate the break-even point when planning sales?

How to assess the financial condition of a company by tracking the dynamics of the ratio of cost to revenue, profit to revenue and profit to expenses?

The goal of any commercial organization is to generate income. The performance of work, services, production of products, sale of goods are associated with costs: the purchase of materials, their delivery, payment of wages to employees, rent, payment of taxes, expenses for advertising and pre-sale preparation, etc. The lower the costs, the higher the profit, so as sales profit is exactly the difference between sales income and the organization's expenses.

When income and expenses grow proportionally, we can say that the financial condition of the company is stable. Revenues are growing and costs are falling - this is an ideal situation that rarely occurs in practice. And if expenses grow faster than income, this is an unfavorable situation. It can even lead to bankruptcy.

The financial condition of the company, including profitability, is determined based on accounting data. Therefore, first we will consider what is included in income and expenses for accounting purposes.

Income and expenses of an organization in accounting are divided into:

- income and expenses from ordinary activities (core activities);

- other income and expenses.

Income and expenses of the organization from core activities

Income of the organization in accordance with the Accounting Regulations “Income of the Organization” PBU 9/99, approved by Order of the Ministry of Finance of Russia dated 05/06/1999 No. 32n (as amended on 04/06/2015; hereinafter referred to as PBU 9/99) is recognized as an increase in economic benefits as a result receipt of assets (cash, other property) and (or) repayment of liabilities, leading to an increase in the capital of this organization, with the exception of contributions from participants (owners of property).

The following types of income do not count as income:

- commissions received under contracts, subject to transfer to the principal;

- advances received for upcoming deliveries of products, goods, performance of work, provision of services;

- amounts of deposits and pledges received;

- amounts received to repay a credit (loan) previously provided to the borrower.

The expenses of an organization in accordance with PBU 10/99 are a decrease in economic benefits as a result of the disposal of assets (cash, other property) and (or) the occurrence of liabilities, leading to a decrease in the capital of this organization, with the exception of a decrease in contributions by decision of participants (owners of property ).

The following are not recognized as expenses:

- contributions to the authorized (share) capitals of other organizations, acquisition of shares and other securities not for the purpose of resale;

- transfers under commission agreements, agency and other similar agreements in favor of the principal, principal, etc.;

- advance payments to suppliers and contractors for inventories, fixed assets, intangible assets, works, services;

- transfers against deposits and guarantees under supply contracts;

- repayment of loans and borrowings received by the organization.

Expenses for ordinary activities for the analysis of financial results can be grouped into variable and fixed.

Variables include material costs, labor costs for production workers, social contributions, depreciation of production assets, and other costs directly related to production. Variable costs are directly proportional to the volume of output.

Fixed expenses are divided into administrative and commercial. Administrative expenses are indirectly related to the production process and include the cost of maintaining the administrative staff of a production enterprise, travel and entertainment expenses, communication costs, Internet, office rental, etc.

Commercial expenses are associated with pre-sale preparation, advertising, and product promotion.

Fixed costs do not depend on production volume.

Variable costs form an incomplete cost of production. Revenue minus variable expenses forms gross (marginal) profit.

The gross profit indicator does not depend on changes in the volume of output (in other words, the share of gross profit per unit and for the entire volume of product sold will be the same).

Variable and fixed costs form the total cost of production. goods, works, services.

Revenue less total cost is operating profit.

The relationship between income, expenses and profit is shown in Fig. 1.

Accounting for expenses for normal posting activities

PBU 10/99 dictates the rules for recording company expenses in the accounts. The document was introduced by order No. 33n dated 05/06/99. According to its norms, expenses from ordinary activities include reductions in the company's benefits due to the disposal of assets such as money and property. The following payments and withdrawals from accounts are not considered expenses:

- directly related to the creation or purchase of a non-current asset;

- directly being an authorized contribution or share capital;

- payments in the form of commissions and agents to principals and principals;

- various options for advances, deposits and prepayments for inventories;

- transfers against debts on loans and credits of the company.

All these movements are not expenses, but are reflected as payments.

Classification of expenses by ordinary activities

The regulation “Organizational Expenses” clearly prescribes the division of disposals into basic expenses and other expenses. This approach is intended to bring the data of financial statements under RAS closer to the requirements of international standards. Expenses for ordinary activities are the enterprise's expenses for production, sales of products, purchase and sale of goods, and provision of optimal conditions for the sale of services.

Specifics of classifying expenses as basic for various types of activities

When leasing or financial lease, if this type of activity is the main one for the company, expenses for ordinary activities include profitable investments in material assets. If leasing is only an addition to the main business, then such costs will be classified as other.

A similar procedure applies to companies that:

- grant rights secured by patents for a fee;

- participate in the authorized capital of other enterprises;

- provide their intellectual property for a fee.

The regulation on company expenses also established the following mandatory rule: expenses for ordinary activities are considered to be reimbursement of the original cost of non-current assets that are used by the enterprise as fixed assets and intangible assets. The costs of their acquisition are repaid by calculating depreciation according to a special rule.

Expenses for ordinary activities formula for depreciation

It is more convenient to consider the inclusion of the cost of fixed assets in the composition of fixed expenses using an example.

Let’s assume that you bought a machine for producing packaging that costs RUB 2,500,000 excluding VAT. According to the classifier, it refers to assets with a useful life of 61 months. This means every month for 61 months. The company's accountant will include 1/61 of the cost of the machine in basic expenses, which is 40,983.61 rubles.

Procedure for estimating expenses for accounting purposes

An organization's expenses for ordinary activities are the amount that reduces the total profit of the period. That is why it is necessary to approach its assessment, armed with the requirements of the law. PBU “Organization’s expenses” prescribes assessing them as follows:

- by the amount of payment in cash;

- according to the amount of existing accounts payable.

The amount of payment and the amount of accounts payable are fixed taking into account the price agreed upon by the parties at the conclusion of the contract.

If the contract does not specify a price, it should be based on its estimated value for comparable transactions. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Other income and expenses

Other income and expenses are not related to the main activities of the company.

Other income includes:

- income received not from the main activity, for example, from leasing property, for payment of rights arising from patents for inventions, industrial designs and other types of intellectual property;

- proceeds related to participation in the authorized capitals of other organizations (including interest and other income on securities);

- profit received by the organization as a result of joint activities (under a simple partnership agreement);

- income from the sale of fixed assets and intangible assets, other tangible assets;

- interest received by the organization for loans and borrowings provided, as well as bank interest accrued by it for the use of funds in the organization’s account with this bank;

- fines, penalties, penalties for violation of contract terms (awarded or recognized);

- assets received free of charge, including under a gift agreement (accepted for accounting at market value on the date the asset is accepted for accounting).

Other expenses are:

- expenses not related to the main activities of the organization, for example, from leasing property;

- expenses associated with participation in the authorized capitals of other organizations;

- expenses associated with the sale, disposal and other write-off of fixed assets, intangible assets, inventory items;

- interest paid by an organization for providing it with funds (credits, borrowings) for use;

- expenses related to payment for services provided by credit institutions;

- fines, penalties, penalties for violation of contract terms, compensation for damages for claims made or by court decision.

Income from ordinary activities

The rules for recording income in the accounting of Russian organizations are enshrined in PBU 9/99. The accounting regulations were approved by Order No. 32n dated 05/06/99. It instructs companies to recognize receipts as income from ordinary activities or classify them as other transfers. In this case, income from ordinary activities of the organization is recognized as receipts for products or payment for services rendered.

Features of revenue recognition for organizations of different types of activities

If a company is engaged in renting out objects, including leasing, its revenue will be rent or leasing payment. For organizations whose business is based on participation in authorized capital or the provision of rights for a fee, income from ordinary activities includes revenue from these activities.

Rules for assessing revenue for accrual purposes

Revenue is reflected in the accounting accounts as follows:

- in the amount of total receipts for goods shipped, work performed

- in the amount of receipts and receivables in case of partial payment

- in the amount of receivables when a deferred payment is given to the customer

- according to the value of values transferred in exchange for goods and works

If agreements have changed and amendments have been made to the price of products or work under a previously concluded contract, the original amount of revenue must also be adjusted. Income from other types of activities is accounted for in the same way, but on other accounting accounts, in accordance with the instructions to the chart of accounts and PBU “Income of the organization.”

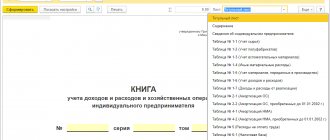

Example

The settlement account of an organization engaged in the sale of plumbing fixtures received proceeds from a contract for the sale of a batch of toilets in the amount of 250,000 rubles, and the cash desk received a fee for renting out a utility room next to the warehouse in the amount of 18,000 rubles.

Since wholesale and retail trade is the main activity of the company, the amount of 250 thousand rubles. will be reflected by the wiring:

Debit 51 “Current account” Credit 90 “Revenue”.

Renting is classified as other operations and is not classified as the main activity of the company, so the income is 18 thousand rubles. The accountant will write it like this:

Debit 50 “Cash” Credit 91.1 “Other income”.

Company performance indicators

The efficiency of business activities can be monitored by indicators of profitability of sales and costs, as well as the share of costs in revenue.

Profitability is defined as the ratio of profit to a certain indicator (revenue, costs, assets, etc.). For example, return on sales is calculated as the ratio of profit to revenue, return on costs is calculated as the ratio of profit to the costs of producing finished products, purchasing goods, performing work, and services.

The calculation of profitability can use marginal, operating or net profit.

Formulas for calculating performance indicators of a company's financial activities:

- marginal profit (Pmarzh):

Pmarzh = BP – Zper;

- operating profit (Poper):

Poper = VR – Zper – Zpost,

where VR is revenue from sales of products, goods, works, services:

VR = Sales volume (quantity in pieces, kg, m, etc.) × Selling price per unit of product (goods, works, services);

Zper - variable costs:

Zper = Sales volume × Variable costs per unit/;

Zpost - all fixed costs of an enterprise for a certain period of time;

- return on sales by operating profit (RPoper):

RPoper = PROper / BP × 100%,

where PROper is operating profit;

- cost profitability for core activities (RZosn):

RZosn = PROper / (Zper + Zpost) × 100%.

The share of costs in revenue is determined as follows:

Kz = Zper + Zpost / VR × 100,

where Кз is a coefficient showing the share of costs in revenue.

Cost profitability from core activities

Cost profitability from core activities is an important indicator for analyzing the financial results of a company. It shows how much profit is generated per 1 ruble of expenses and reflects the efficiency of the company’s financial activities.

Example 1

The company carries out construction and installation work under a contract.

The cost of work includes variable and fixed costs. The company's financial performance indicators for 3 years are presented in table. 1.

Let us trace the dynamics of the ratios of cost, income, profit and profitability of costs over three years of activity of a construction company.

The highest return on costs from core activities was in 2017: by 1 rub. expenses accounted for 0.32 rubles. arrived.

In 2016, profitability fell by 9.9% compared to 2015, and increased again in 2022: compared to 2016 - by 22.61%, and compared to 2015 - by 12.62 %.

High cost return in 2022 is ensured by a profit in the amount of RUB 650,000. (the largest compared to 2015 and 2016).

The profit was obtained as a result of reducing the cost of work performed, reducing management costs and saving on materials, as well as increasing the estimated cost of work performed.

In 2016, profit decreased by RUB 180,000 compared to 2015. due to declining sales volumes and rising prices for basic building materials. In 2022, profit increased by RUB 500,000 compared to 2016.

The dynamics of financial indicators for 3 years are presented in Fig. 2.

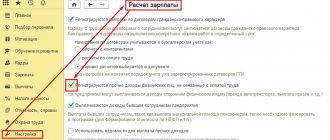

Accounting for organization expenses

Accounting for expenses is carried out in accordance with PBU 10/99 “Expenses of the organization”.

An organization's expenses are recognized as a decrease in economic benefits as a result of the disposal of assets (cash, other property) and (or) the occurrence of liabilities, leading to a decrease in the capital of this organization, with the exception of a decrease in contributions by decision of participants (owners of property).

The following assets are not recognized as expenses of the organization:

- in connection with the acquisition (creation) of non-current assets (fixed assets, construction in progress, intangible assets, etc.);

- contributions to the authorized (share) capitals of other organizations, acquisition of shares of joint-stock companies and other securities not for the purpose of resale (sale);

- under commission agreements, agency and other similar agreements in favor of the principal, principal, etc.;

- in the order of advance payment of inventories and other valuables, works, services;

- in the form of advances, deposits to pay for inventories and other valuables, works, services;

- to repay a loan received by the organization. The expenses of the organization, depending on their nature, conditions of implementation and areas of activity of the organization, are divided into:

- for expenses for ordinary activities;

- other expenses.

Expenses for ordinary activities are expenses associated with the manufacture and sale of products, acquisition and sale of goods. Such expenses also include expenses the implementation of which is associated with the performance of work or provision of services.

Expenses for ordinary activities are also considered to be reimbursement of the cost of fixed assets, intangible assets and other depreciable assets, carried out in the form of depreciation charges.

Expenses for ordinary activities are accepted for accounting in an amount calculated in monetary terms equal to the amount of payment in cash and other forms or the amount of accounts payable. If payment covers only part of the recognized expenses, then the expenses accepted for accounting are determined as the sum of payment and accounts payable - in the part not covered by payment.

The amount of payment and (or) accounts payable is determined based on the price and conditions established by the agreement between the organization and the supplier (contractor) or other counterparty. If the price is not provided for in the contract and cannot be established based on the terms of the contract, then to determine the amount of payment or accounts payable, the price at which, in comparable circumstances, the organization usually determines expenses in relation to similar inventories and other valuables, works, services is accepted. or providing for temporary use (temporary possession and use) of similar assets.

Expenses for ordinary activities form:

- expenses associated with the acquisition of raw materials, materials, goods and other inventories;

- expenses arising directly in the process of processing (refinement) of inventories for the purposes of production, performance of work and provision of services, their sale, as well as the sale (resale) of goods (expenses for the maintenance and operation of fixed assets and other non-current assets, as well as to maintain them in good condition, commercial expenses, administrative expenses, etc.).

When forming expenses for ordinary activities, their grouping should be ensured by the following elements:

- material costs;

- labor costs;

- contributions for social needs;

- depreciation;

- other expenses.

For management purposes, accounting organizes the accounting of expenses by cost items. The list of cost items is established by the organization independently.

For the purpose of formation by an organization of the financial result of its activities from ordinary activities, the cost of goods sold, products, works, services recognized both in the reporting year and in previous reporting periods, and carryover expenses related to the receipt of income in subsequent reporting periods, is determined. taking into account adjustments depending on the specifics of production, performance of work and provision of services and their sale, as well as the sale (resale) of goods.

At the same time, commercial and administrative expenses may be recognized in the cost of sold products, goods, works, services in full in the reporting year of their recognition as expenses for ordinary activities.

Other expenses are:

- expenses associated with the provision for a fee for temporary use (temporary possession and use) of the organization’s assets;

- costs associated with the provision for a fee of rights arising from patents for inventions, industrial designs and other types of intellectual property;

- expenses associated with participation in the authorized capitals of other organizations;

- expenses associated with the sale, disposal and other write-off of fixed assets and other assets other than cash (except foreign currency), goods, products;

- interest paid by an organization for providing it with funds (credits, borrowings) for use;

- expenses related to payment for services provided by credit institutions;

- contributions to valuation reserves created in accordance with accounting rules (reserves for doubtful debts, for depreciation of investments in securities, etc.), as well as reserves created in connection with the recognition of contingent facts of economic activity;

- fines, penalties, penalties for violation of contract terms;

- compensation for losses caused by the organization;

- losses of previous years recognized in the reporting year;

- amounts of receivables for which the statute of limitations has expired, and other debts that are unrealistic for collection;

- exchange differences;

- the amount of asset depreciation;

- transfer of funds (contributions, payments, etc.) related to charitable activities, expenses for sporting events, recreation, entertainment, cultural and educational events and other similar events;

- other expenses.

Other expenses are also expenses arising as a consequence of extraordinary circumstances of economic activity.

For accounting purposes, the amount of other expenses is determined in a manner similar to the procedure for determining income.

Expenses are recognized in accounting if the following conditions are met:

- the expense is made in accordance with a specific agreement, the requirements of legislative and regulatory acts, and business customs;

- the amount of expenditure can be determined;

- there is certainty that a particular transaction will result in a reduction in the economic benefits of the entity.

There is certainty that a particular transaction will result in a reduction in the entity's economic benefits when the entity has transferred an asset or there is no uncertainty about the transfer of the asset.

If at least one of the above conditions is not met in relation to any expenses incurred by the organization, then receivables are recognized in the organization’s accounting records.

Depreciation is recognized as an expense based on the amount of depreciation charges, determined on the basis of the cost of depreciable assets, useful life and the methods of depreciation adopted by the organization.

Expenses are subject to recognition in accounting, regardless of the intention to receive revenue, other or other income and the form of the expense (monetary, in-kind and other).

Expenses are recognized in the reporting period in which they occurred, regardless of the time of actual payment of funds and other form of implementation (assuming the temporary certainty of the facts of economic activity).

Expenses are recognized in the income statement:

- taking into account the relationship between expenses incurred and revenues (correspondence between income and expenses);

- by their reasonable distribution between reporting periods, when expenses determine the receipt of income over several reporting periods and when the relationship between income and expenses cannot be clearly defined or is determined indirectly;

- for expenses recognized in the reporting period when the non-receipt of economic benefits (income) or receipt of assets becomes determined;

- regardless of how they are accepted for the purposes of calculating the taxable base;

- when obligations arise that are not caused by the recognition of the corresponding assets.

Return on sales

Profitability of sales depends on sales prices, sales volume and the share of costs in the total volume of products sold. Shows what portion of an organization's revenue is profit.

Profit, in turn, depends on how much sales revenue covers the costs incurred. In other words, the higher the revenue and the lower the costs, the higher the profit, and therefore the more efficient the business activity.

Revenue can increase due to an increase in sales volume or an increase in prices for products, goods, works, services. Costs can be reduced through the effective use of inventory and materials (compliance with cost standards, reduction of waste and defects), optimization of costs for maintaining administrative personnel, etc.

Example 2

The manufacturing company produces three types of products.

The values of financial performance indicators are in table. 2.

Let's analyze the profitability of sales.

They are presented in table. 2 data shows that the most profitable in terms of sales are goods A and C - the marginal return on sales was 41% (provided by low variable costs).

Next comes product B, whose marginal return on sales is 39.10%.

The overall return on sales in terms of marginal profit is 40.27%, in terms of operating profit - 6.04%. This difference between marginal and operating profitability is explained by the high share of fixed costs for personnel and advertising.

The total share of costs in revenue is 94%. This is a lot, so the company did not make much profit from sales. Operating profit amounted to RUB 410,000. With sales income of 8 million rubles. Such a profit can be called modest, but it covered all the company's costs.

The profitability of sales by type of product is presented in Fig. 3.

Break even

The company may not make a profit, but also not incur losses. This “golden mean” is reflected by the break-even point (critical point).

The critical point shows how far revenue can fall before there is a loss. The equality of income and expenses in this case can be written by the following equation:

VRKT = Zper + Zpost

or:

Sales volume × Sales price per unit of product (work, services) = Sales volume × Sales/unit. + Zpost.

The minimum (critical) sales volume can be calculated using marginal profit - as the sales volume at which marginal profit is equal to fixed costs:

Pmarzh = BP – Zper = Zpost.

We find the critical point of sales volume, i.e. we determine how many units of product need to be sold in order not to make a loss:

Critical point (in units of sales) = Zpost / Pmargin = Zpost / (Price per unit – Zper./unit).

This calculation can be made for the entire range and for individual types of products.

Example 3

A manufacturing company produces plastic products. Quantitative accounting of sales volume is carried out in pieces.

According to the plan, the production of products is 15,000 pieces, the selling price is for 1 piece. — 400 rub.

Let's determine how many plastic products need to be sold so that the income from the sale covers all expenses, i.e., we determine the break-even point.

The production and sales plan is presented in table. 3.

Critical point = 876,000 rub. / (400 rub. – 208 rub.) = 5104 pcs.

Conclusion

The company needs to produce 5,104 plastic products to cover all costs. If sales volume is lower, the company will make a loss.

Using the relationship between fixed costs and marginal profit per unit of production, you can find out whether fixed costs are recoverable and obtain information about the amount of marginal profit for each type of product.

By changing the amount of fixed costs or sales price, you can plan the minimum volume of production.

Example 4

Let's use the initial data of example 3.

The company's management decided to reduce general expenses by 10% and increase the sales price by 5%.

Then fixed costs will be equal to:

980,000 rub. – 10% = 882,000 rub.,

and sales price for 1 piece:

400 rub. + 5% = 420 rub.

Let us determine the minimum sales volume (critical) point in this case.

The adjusted production and sales plan is presented in table. 4.

Sales critical point:

882,000 rub. / (420 rub. – 208 rub.) = 4160 pcs.

Before optimization, the critical sales volume was 5104 units. And now the company needs to produce only 4160 units. products so as not to be at a loss.

Conclusion

With such optimization of costs and sales price growth:

- the planned profit will increase by 398,000 rubles. (RUB 2,298,000 – RUB 1,900,000), the growth rate will be 17.32% (RUB 2,298,000 – RUB 1,900,000) / RUB 2,298,000 × 100%));

- sales volume at the break-even point decreased by 944 units. (5104 pcs. – 4160 pcs.), or by 18.5% ((5104 pcs. – 4160 pcs.) / 5104 pcs. × 100%).

Analysis of the ratio of income and expenses in production plans allows you to calculate the required amount of profit. In this case, the following relationship is used:

BP = Zper + Zpost + Profit (target value).

The volume of sales in quantitative terms (in natural units - kg, m, pcs., etc.), which will ensure the target profit, can be calculated using the formula:

Vsales, units = Zpost + Profit (target) / (Price of 1 unit – Zper./unit).

If we put the value of marginal profit into the formula, the formula will look like:

Vsales, units = (Zpost + Profit (target)) / Pmargin/unit.

Example 5

The company has set the planned profit from sales at RUB 100,000.

The selling price of 1 product is 400 rubles.

Fixed costs for the period are 980,000 rubles, and variable costs per unit of product are 208 rubles.

Let's calculate how many products need to be sold to get the planned profit:

1. Find the marginal profit for 1 product:

400 rub. – 208 rub. = 192 rub.

2. Determine the required sales volume in units

(980,000 rub. + 100,000 rub.) / 192 rub. = 5625 pcs.

Conclusion

To make a profit of 100,000 rubles, the company must sell 5,625 products.

Example 6

Data for calculation:

income from sales - 6,000,000 rubles;

price of 1 product - 400 rubles;

variable costs per 1 piece. — 208 rub.;

fixed costs for the period - 980,000 rubles;

marginal profit per unit - 192 rubles. (400 rub. – 208 rub.).

Let's calculate the ratio of gross profit to revenue and determine the profit from sales:

1. Find the percentage ratio of the marginal profit per unit of product and its selling price:

192 rub. / 400 rub. × 100% = 48%.

2. Determine the total gross profit:

6,000,000 rub. × 48% = 2,880,000 rub.

3. Determine the profit from sales - subtract the amount of fixed expenses from the total gross profit and get the company's operating profit:

RUB 2,880,000 – 980,000 rub. = 1,900,000 rub.