Any business activity involves expenses. You have to spend money on diverse processes and purchases: those needed for the production of products, equipment maintenance, the purchase of raw materials, packaging, and transportation. And also on management processes, not to mention wages. This multifactorial nature of costs indicates the need for their classification and separate accounting.

Let’s understand the concept of “overhead costs”, clarify which costs can be attributed to them and how to recognize them in financial accounting.

How are overhead expenses different from core expenses?

What is overhead

Not all costs in production go directly into the product and can be directly planned and taken into account in its cost. Nevertheless, the funds spent turn out to be absolutely necessary for the manufacture of products, their sale, promotion on the market, as well as the management of the organization itself.

The most accurate definition of overhead would be “everything else.” This type of costs is not highlighted in a separate article in the Tax Code of the Russian Federation; naturally, their structure is not spelled out there either. In accounting, it is also impossible to clearly differentiate them.

NOTE! The law establishes a list of overhead costs only in the construction and medical industries. All other enterprises must determine overhead costs themselves, fixing this in their accounting policies.

overhead costs, accepted in business, implies expenses that cannot be attributed directly to technological production processes, accompanying the production process, but not included in the cost of work and raw materials. Another name for overhead costs is indirect costs . They are indicated when planning and drawing up estimates for both the company as a whole and individual structural divisions.

How to calculate the cost of production taking into account overhead costs ?

Why consider overhead costs?

The most obvious goal is planning future profits, which are affected by all the costs incurred by the entrepreneur. But in terms of overhead costs, this poses certain difficulties. If potential direct costs can be fairly accurately calculated for specific types of products, then it is quite difficult to determine how many indirect costs will result and how they will be distributed when, for example, expanding production or signing a certain contract.

IMPORTANT! To adequately determine the cost of a product, it is necessary to take into account and distribute overhead costs in proportion to direct expenses - calculate production costs .

What is included in overhead costs

Indirect costs can be roughly divided into 4 main groups:

- Management costs:

- his salary;

- money spent on training, certification and advanced training of management.

- Contents: purchase of computers, office supplies, expenses for office needs, including communication services.

- Expenses associated with the process of organizing production:

- maintenance repairs of structures, buildings, premises, equipment belonging to the organization;

- costs of transport owned by the company;

- payment of rent for warehouse premises and/or office;

- waste of money due to downtime, defects, etc.;

- money that needs to be spent on maintaining fixed assets.

- Personnel costs:

- social tax contributions;

- payments to social security and other funds;

- equipment of household premises, canteens, showers, etc.

- Non-production costs:

- advertising expenses;

- payment for consultations and examinations;

- payment of utility bills, etc.

Overhead distribution options

IMPORTANT! Recommendations for the distribution of overhead costs from ConsultantPlus are available here

Despite the difficulties of planning indirect costs, this is a necessary procedure that can be carried out in several ways:

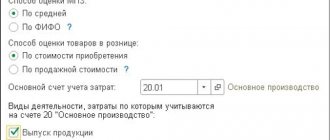

- The "working wage" method. If the main production employs a large number of workers, especially if manual labor predominates, overhead costs can be calculated in proportion to the wage fund for their labor.

- The “sales volume” method is advisable to use if automated processes predominate in the company. You can distribute income in proportion to machine hours.

- The unit of production method is applicable when direct costs significantly exceed indirect costs. Then we can take as a basis the ratio of direct costs per unit of goods to the total amount of direct costs.

- Direct counting method. Indirect expenses are summed up separately for each expense item.

- Combined methods are applicable in large companies with a complex structure, where several types of products are produced. For example, you can account for manufacturing overhead on the payroll basis, and general business overhead on the basis of unit cost.

EXAMPLE OF CALCULATION. Avtokoleso LLC is engaged in the transportation of goods. The staff wage fund is 8 million rubles per year. The overhead cost ratio in 2016 was 80%, that is, 6 million 400 thousand rubles. The company decided to reduce overhead costs, for which it fired several people. At the same time, the wage fund decreased by 20%, which means that the overhead costs of Avtokoleso LLC for 2022 can be planned in the amount of 5 million 120 thousand rubles.

Is there any provision for rationing of overhead costs ?

Norms NR and SP to TSN-2001 for 2022

Overhead costs and estimated profit standards for 2022 have been approved and put into effect, for information follow the link...

Overhead and estimated profit standards for 2022 were approved and put into effect.

Overhead costs and estimated profits, calculated from the wages of workers employed in the main production, should be taken according to the standards put into effect and approved by the Moscow City Committee on pricing policy in construction and state examination of projects, Order No. MKE-OD/19-92 dated 12/30/2019 On approval of overhead costs and estimated profits for 2020.

- Overhead costs from the wages of drivers are 93%;

- The estimated profit on machinists' wages is 64%.

Read the order of Moskomekspertiza dated December 30, 2019 No. MKE-OD/19-92.

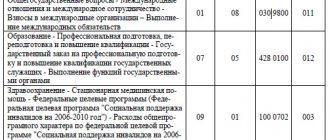

Table of overhead costs and estimated profit for 2022

- Construction and installation work

- Repair Work

- Restoration and restoration work on historical and cultural monuments

- Operation of construction machines

Construction and installation work

| Item no. | Types of construction and installation work | Overheads | Estimated profit |

| 1.01 | Excavation work performed: mechanized | 92 | 50 |

| 1.02 | Excavation work performed: manually | 85 | 41 |

| 2 | Drilling and blasting works | 116 | 55 |

| 3 | Pile work | 119 | 75 |

| 4 | Consolidation of soils, sinkholes | 68 | 54 |

| 5 | Concrete, reinforced concrete monolithic structures | 92 | 65 |

| 6 | Prefabricated concrete and reinforced concrete structures | 124 | 56 |

| 7.01 | A set of works for the installation of structures of large-panel residential buildings erected by DSK: zero cycle, underground part | 124 | 59 |

| 7.02 | A set of works for the installation of structures of large-panel residential buildings erected by DSK: above-ground part | 131 | 89 |

| 8 | Brick and block structures | 92 | 41 |

| 9 | Metal constructions | 70 | 50 |

| 10 | Wooden structures | 87 | 41 |

| 11 | Floors | 87 | 41 |

| 12 | Roofs | 87 | 41 |

| 13 | Protection of building structures and equipment from corrosion | 85 | 41 |

| 14 | Structures in rural construction (construction of greenhouses) | 85 | 41 |

| 15 | Finishing works (painting, plastering, glass, tiling, wallpaper, stucco) | 88 | 42 |

| 16 | Internal sanitary work (pipelines, water supply, sewerage, heating, gas supply, ventilation and air conditioning) | 100 | 45 |

| 17 | External networks of water supply, sewerage, heat supply, gas pipelines | 106 | 53 |

| 18 | Thermal insulation work | 79 | 41 |

| 19 | Car roads | 131 | 54 |

| 19.1 | Sidewalks, paths and playgrounds | 106 | 41 |

| 20 | Railways | 96 | 59 |

| 21 | Bridges, pipes and overpasses | 94 | 64 |

| 22 | City transport tunnels and underground passages | 104 | 41 |

| 23.1 | Metro: closed way of working | 122 | 51 |

| 23.2 | Metropolitan: open way of working | 105 | 44 |

| 24 | Power lines | 92 | 41 |

| 25 | Communications facilities | 90 | 41 |

| 26 | Laying and installation of communication networks | 90 | 41 |

| 27 | Installation of radio and television equipment | 90 | 41 |

| 28 | Bank protection works, hydraulic structures | 90 | 54 |

| 29 | Industrial furnaces, pipes | 88 | 63 |

| 30 | landscaping | 102 | 47 |

| 31 | Installation of equipment | 68 | 43 |

| 31.1 | Installation of electrical installations | 90 | 43 |

| 32 | Commissioning works | 68 | 41 |

| 33 | Other construction work | 85 | 41 |

Repair Work

| Item no. | Types of construction and installation work | Overheads | Estimated profit |

| 34 | Manual excavation work | 73 | 41 |

| 35 | Concrete and reinforced concrete monolithic structures | 68 | 41 |

| 36 | Concrete and reinforced concrete prefabricated structures | 110 | 41 |

| 37 | Metal constructions | 68 | 41 |

| 38 | Wooden structures | 85 | 41 |

| 39 | Floors | 85 | 41 |

| 40 | Roofs | 85 | 41 |

| 41 | Finishing works: painting, plastering, glass, wallpaper, tiling | 81 | 41 |

| 42 | Plumbing work - internal (pipelines, water supply, sewerage, heating, gas supply, ventilation and air conditioning) | 88 | 41 |

| 43 | Electric installation work | 77 | 41 |

| 43.1 | Installation work | 68 | 41 |

| 44 | External networks of water supply, sewerage, heat supply, gas pipelines | 94 | 41 |

| 45 | Men at work | 112 | 41 |

| 46 | Other repair and construction work (strengthening structures, laying walls from piece materials, installing scaffolding, etc.) | 73 | 41 |

| 47 | Dismantling of structures and systems of engineering equipment of buildings and structures | 68 | 41 |

| 48 | landscaping | 90 | 41 |

3. Restoration and restoration work on historical and cultural monuments

| Item no. | Types of construction and installation work | Overheads | Estimated profit |

| 49 | Architectural, artistic and decorative works | 88 | 41 |

| 50 | Roofs | 85 | 41 |

| 51 | Structures made of stone and brick | 73 | 41 |

| 52 | Metal structures and products | 68 | 41 |

| 53 | Wooden structures and products | 85 | 41 |

Operation of construction machines

| Item no. | Types of construction and installation work | Overheads | Estimated profit |

| Operation of construction machines | 93 | 64 |

Procedure for calculating overhead costs

Planning and accounting of all expenses, including overheads, is carried out in a certain order:

- The total amount of costs for general business activities of the company is calculated.

- The amount of overhead costs that will need to be included in the estimate per unit of each type from the product range is determined.

ATTENTION! It is necessary to take into account the legal limits for overhead costs for specific items and the standards defined by the company's internal regulations.

Composition of production costs

Expenses incurred in the production of products (works, services) are divided into 2 types:

- direct ones, which can be unambiguously linked to the process of creating a specific type of product or a specific object;

- invoices, the direct connection of which with production objects is difficult to establish, but these expenses ensure the functioning of both the production itself and the enterprise as a whole.

Look at what expenses the adviser of the state civil service of the Russian Federation, 2nd class, I. O. Gorchilin calls overhead. Get free trial access to ConsultantPlus and go to the official’s point of view.

Overhead costs, in turn, are also divided into 2 types:

- general production - ensuring the work of production units directly involved in the creation of products;

- general economic - related to ensuring the operation of the organization as a whole, including its management.

When starting its activities, the organization draws up a planned calculation (estimate) for each type of product (or object) produced, the purpose of which is:

- determination of the composition and quantitative volumes of direct costs for the production of a unit of production (one object);

- assessment of quantitative volumes of overhead costs in general and broken down by type;

- establishing the cost of direct costs, overhead costs and the total cost of producing a unit of product (object);

- determination of the selling price of a unit of production (object) taking into account planned profit and VAT.

In the process of work, this calculation will be adjusted, approaching the actual performance indicators obtained from the analysis of actual data. Accordingly, the relationship between direct and overhead costs will become closer to reality, which will make it possible in further economic calculations to focus both on the percentage of overhead costs in the total amount of production costs, and to determine the volume of overhead costs by calculating the amount of direct costs.

Read about existing methods of calculating cost in the material “The concept of cost in accounting (nuances).”

Legal limits regarding overhead costs

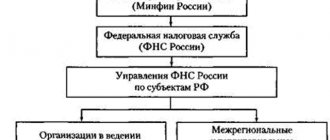

The law determines the composition and limits of overhead costs in the construction and medical industries.

Construction overhead

In this industry, overhead planning is especially important. An estimate is drawn up, which indicates the average costs for the industry, which are included in the cost of construction products or services.

Cost rationing in the construction industry is regulated by the Methodological Guidelines for determining the amount of overhead costs in construction, approved by the Resolution of the State Construction Committee of Russia (separately for regions of the Far North and equivalent regions). These documents define the coefficient that must be applied to determine overhead costs for a particular construction activity, and also clarify the scope of its application. The wage fund for construction workers is taken as the base. The distribution of coefficients is carried out according to the following main types of construction:

- industrial;

- agricultural;

- transport;

- housing;

- energy;

- related to water management;

- in the field of nuclear energy;

- restoration work;

- major repairs;

- other types.

FOR YOUR INFORMATION! Overhead costs according to construction standards must be applied at the stage of drawing up estimates, as well as when paying for work performed.

Medical overhead

The standards and composition of overhead costs in the medical industry are regulated by Order of the Ministry of Health and Medical Industry of Russia No. 60 dated March 14, 1995. According to the provisions of this order, the cost of medical care must include all annual costs of a medical institution:

- salaries of all types of personnel, except medical personnel, with all accruals;

- expenses for the purchase of furniture, stationery, household goods (everything, except medicines and dressings);

- means for repairs.

The basis is the wage fund of medical personnel providing specific medical services, based on a coefficient of 1.5.

IMPORTANT! Typically, overhead costs are significantly higher in medicine than in construction.

Structure of direct and overhead costs by item

Direct costs most often consist of the following costs:

- for materials necessary to create specific products;

- salaries of personnel directly involved in the creation of these products;

- insurance premiums accrued on the salaries of personnel creating products.

The composition of overhead costs, usually divided into 2 main types, is much wider and is characterized by significant similarity in the lists that occur for general production and general business costs. These lists typically include expenses:

- for remuneration of management and other personnel of a production or general business unit;

- insurance premiums accrued to pay for the labor of these personnel;

- material support for the current work of departments (low-value equipment, office and household supplies, consumables for low-value equipment);

- depreciation of used fixed assets;

- maintenance and operation of fixed assets, including their routine maintenance, provision of necessary resources (fuel and lubricants, replacement parts, electricity, water, heat, gas), current and major repairs;

- property rental;

- property and personnel insurance;

- obtaining permits;

- ensuring the quality of products;

- labor protection;

- information, consulting and legal support;

- business trips;

- entertainment events;

- personnel selection.

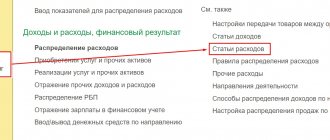

Read more about the composition of general business expenses in the article “Account 26 in accounting (nuances).”

Due to the impossibility of direct correlation with specific types of products created (objects), overhead costs are allocated. The organization chooses the basis for this distribution independently. This may be one type of direct costs (materials or labor) or their total amount.