Reserve capital is a part of the enterprise’s property, made up of retained earnings and performing an insurance role, ensuring the uninterrupted operation of the company and the fulfillment of obligations to counterparties even in crisis situations. This is a reserve source of finance, which the organization resorts to in cases where it suffers losses or is in dire need of investment.

The reserve capital of an enterprise acts as a financial source:

- when eliminating the shortage of working capital in the course of the company’s current activities;

- short-term cash investments.

A prerequisite for spending reserves is a shortage of funds in other financial sources of the company (working capital, profit, etc.).

Purpose of reserve capital

The purposes for which it is permissible to spend reserve capital are strictly regulated by law. The company can allocate reserve funds to:

- for compensation for damages and losses;

- repayment of debts on bonds;

- repurchase of shares of a joint stock company (JSC) or limited liability company (LLC);

- payment of income to investors;

- payment of dividend income to holders of preferred shares;

- repayment of urgent accounts payable.

Reserve capital cannot be used for any other purposes.

What is it used for?

Possible directions for using reserve capital funds are determined by the organizational and legal form of the company:

- Joint-Stock Company. The purposes of using the funds are to repay issued bonds, repurchase shares of own issue, and cover incurred losses. This is prescribed in para. 3 p. 1 art. 35 of Law No. 208-FZ of December 26, 1995.

- Unitary enterprise. The purpose of using the funds is to cover the losses incurred. This is regulated by paragraph 1 of Art. 16 of Law No. 161-FZ of November 14, 2002.

- Certain types of cooperatives. The purposes of using the funds are to reimburse unforeseen expenses and cover incurred losses. This requirement is established by Part 1 of Art. 53 of Law No. 215-FZ of December 30, 2004, clause 16, part 3, art. 1 and part 3 of Art. 26 of Law No. 190-FZ of July 18, 2009, as well as clauses 6-7 of Art. 36 of Law No. 193-FZ of December 8, 1995.

Limited liability companies (abbreviated as LLC) use this fund for any needs specified in the constituent documentation, in particular the charter. This rule is stipulated by the content of paragraph 1 of Art. 30 of Law No. 14-FZ of 02/08/1998.

A similar principle applies to homeowners’ associations (abbreviated as HOAs), which is provided for in paragraphs. 5 hours 2 tbsp. 145 and part 3 of Art. 151 of the Housing Code of the Russian Federation.

Features of formation

All legal entities have the right to create reserve funds: LLC, JSC, unitary enterprises, etc. Joint-stock companies, unlike other legal entities, are required to form reserve capital! The lower limit of the size of the reserve capital of a joint stock company established by law is 5% of the authorized capital.

Each form of ownership has its own characteristics of replenishing and using financial reserves.

The process of formation of reserve capital is regulated by general legislative norms and the constituent documentation of a particular company.

Control over the formation of reserve capital

For a joint stock company, at the end of each year it is mandatory to provide financial statements on the company’s activities, so you can easily determine the amount of transfers to the reserve fund and the use of funds from it.

Since reserve capital is formed from the profits of the organization to which shareholders and investors are related, the distribution of profits (including the use of reserve capital) must be agreed upon at a meeting of shareholders.

An accounting report on the organization's activities is provided after the reporting period, which may raise the question of how the budget plan for the next year is laid out. To resolve this issue, an organizational meeting of shareholders is held, where reporting documentation is provided. At the same time, reserve planning for the next reporting period occurs.

JSC Reserve Fund

The Law on Joint Stock Companies (No. 208-FZ) obliges them to form a reserve fund. Shareholders determine its size independently, without violating the lower limit established by law. The decision on the volume of the fund must be recorded in the organization's charter.

Mandatory contributions are allocated annually to replenish the fund, continuing until the required reserve size is reached. The amount of annual contributions is determined by the shareholders and reflected in the charter; it should not be less than 5% of the net profit.

We form and use a reserve fund

Formation procedure Since it is an obligation for joint-stock companies to form a reserve fund, this condition must certainly be reflected in the charter. That is, this fund cannot be less than 5 percent of the authorized capital. But shareholders can determine it on a larger scale. This should also be stated in the charter. The fund is formed through annual deductions from net profit until its size becomes equal to the established value. As a general rule, the distribution of profits falls within the exclusive competence of the general meeting of shareholders (subclause 11, clause 1, article 48 of Federal Law No. 208-FZ of December 26, 1995, hereinafter referred to as Law No. 208-FZ). Therefore, in our opinion, the transfer of the net profit of the reporting year to the reserve fund, among other areas for its use, should be determined in a decision of the general meeting. This will be the document on the basis of which the accountant will make the appropriate accounting entries. LEGISLATION ON THE FORMATION OF RESERVES

The obligation of joint stock companies to form a reserve fund is established by paragraph 1 of Article 35 of the Federal Law of December 26, 1995 No. 208-FZ “On Joint Stock Companies”.

Its size cannot be less than 5 percent of the authorized capital. But the maximum fund size is not limited. This is determined by the owners of the company and reflected in the charter. The source of the reserve fund is net profit, and deductions are made annually without fail until the fund reaches the size specified in the charter. Limited liability companies can also form a reserve fund. But for them this is not an obligation, but a right. In this case, the owners indicate the procedure for forming the fund and its size in the charter (Article 30 of the Federal Law of February 8, 1998 No. 14-FZ). Reflection in accounting We noted that the document on the basis of which the accountant will reflect the distribution of profits will be the decision of the general meeting of shareholders. But such a meeting will take place after the end of the financial year. DECISION OF THE MEETING OF SHAREHOLDERSSubclause 11 of clause 1 of Article 48 of Law No. 208-FZ establishes that the annual report, annual financial statements, including the profit and loss statement of the joint-stock company, must be approved by the general meeting of shareholders. It must take place within the time frame specified by the charter, but no earlier than two months and no later than six months after the end of the financial year (Clause 1, Article 47 of Law No. 208-FZ). In addition, the general meeting approves the distribution of profits, including the payment (declaration) of dividends and the procedure for paying off losses. It is also necessary to remember about the procedure for drawing up and presenting financial statements, which was approved by order of the Ministry of Finance of Russia dated July 22, 2003 No. 67n. The fact is that according to this procedure, the balance sheet at the end of the year shows the total amount of net profit received by the enterprise (line 470). But the directions for using profits, including the amount of declared dividends, are shown in the explanatory note without being reflected in the accounting accounts. It follows from this that contributions to the reserve fund are reflected in the accounting records of the next year - on the date of the decision of the general meeting of shareholders. This is made by making an entry to the credit of account 82 “Reserve capital” in correspondence with the debit of account 84 “Retained earnings (uncovered loss).” This rule is fully applicable to enterprises created in the form of limited liability companies. INCREASING THE SIZE OF THE RESERVE FUND Owners have the right to increase the size of the reserve fund originally recorded in the charter. Moreover, they can do this even if it has not yet reached 5 percent of the authorized capital. To do this, at the meeting of shareholders, a decision should be made to increase the reserve fund, the amount of annual contributions and, based on these decisions, appropriate changes should be made to the charter. Let us pay attention to the interdependence of the size of the authorized capital and the reserve fund. The fact is that the legislation determines that the amount of increase in the authorized capital cannot be greater than the difference between the value of net assets and the amount of the authorized and reserve capital of the company. Accordingly, when the authorized capital increases or decreases, the reserve capital must increase or decrease. The formation and use of all funds that are formed in a joint-stock company at the expense of net profit are reflected in a special Report on Changes in Capital (Form No. 3). Use of the reserve fund The reserve fund of joint-stock companies is intended only to cover losses, repay the company's bonds and repurchase its own shares in the absence of other funds. The reserve fund cannot be used for any other purposes (Clause 1, Article 35 of Law No. 208-FZ). REPAYMENT OF LOSSES Making a decision on the use of funds from the reserve and other funds of the company is the exclusive competence of the board of directors or supervisory board (subclause 12, clause 1, article 65 of Law No. 208-FZ). If a loss is incurred at the end of the year, the entire reserve fund or part of it can be used to repay it. This use is reflected in the following entry: DEBIT 82 subaccount “Reserve capital” CREDIT 84 subaccount “Retained earnings (uncovered loss)”

- funds from the reserve fund are used to repay the loss.

This operation is carried out on the basis of a decision of the board of directors or an extract from the minutes of the board meeting. And the accounting entry itself, as with contributions to the reserve fund, is made in the year when the board of directors made the decision. This is explained as follows. In the current version of the procedure for drawing up and presenting financial statements (approved by Order of the Ministry of Finance of Russia dated July 22, 2003 No. 67n), there is no longer any special instruction on the rules for reflecting data in the annual report for the groups of items “Reserve capital”, “Retained earnings (uncovered loss)” . Only in the canceled paragraph 14* of this document it was indicated that such data should have been reflected taking into account the consideration of the results of the organization’s activities for the reporting year and the decisions made on covering losses. Consequently, the prepared financial statements, for example, for 2009 with an identified loss, must be submitted to the board of directors for consideration. The council meeting will take place in 2010. After a decision is made to repay the loss from the reserve fund, a corresponding accounting entry is made, which will also be dated 2010. But in the explanatory note to the report for 2009 they indicate the fact of repayment of the loss. * Clause 14 of the procedure for preparing financial statements has been canceled starting with the reporting for 2004. REPURCHASE OF SHARES A joint stock company may decide to repurchase its own shares. As a rule, this is done for the purpose of their further repayment and reduction of the authorized capital. You can spend funds from the reserve fund for such purposes only if other funds are insufficient (for example, this operation will lead to a loss). Consider the following example. EXAMPLE 1

The General Meeting of Shareholders decided to reduce the authorized capital by 20,000 rubles.

For this purpose, 20 shares with a par value of 1000 rubles will be purchased. with their subsequent repayment. The actual repurchase price of one share was 1,200 rubles. It was decided to cover the difference between the redemption price and the nominal value of the canceled shares from the reserve fund. The following entries were made in accounting: DEBIT 81 subaccount “Own shares (shares)” CREDIT 50

– 24,000 rubles.

(RUB 1,200/piece x 20 pieces) – shares were purchased from shareholders; DEBIT 80 subaccount “Authorized capital” CREDIT 81 subaccount “Own shares (shares)”

– 20,000 rubles.

(RUB 1,000/piece x 20 pieces) – the authorized capital is reduced by redeeming purchased shares; DEBIT 82 subaccount “Reserve capital” CREDIT 81 subaccount “Own shares (shares)”

- 4000 rubles.

(24,000 – 20,000) – reflects the difference between the redemption price and the par value of the canceled shares. REPAYMENT OF BONDS The reserve fund funds can be used to pay off interest on bonds issued by the company. This is also permissible if the company has no other means for this, and reflection according to the general rules can lead to a loss. When a company redeems bonds, the amount paid to bondholders consists of their face value and interest. Interest repaid at the expense of the reserve fund is included in the debit of account 82. But it is unreasonable to reflect the debt in the form of the nominal value of bonds in the debit of this account, since when they are repaid, the borrowed funds are returned, the receipt of which was shown in the debit of account 51. EXAMPLE 2

A joint-stock company placed 2000 bonds with a nominal value of 500 rubles.

each. Interest accrued during the circulation period amounted to 100,000 rubles. Upon expiration of the circulation period, the bonds were redeemed. To prevent losses, the board of directors decided to repay the interest accrued to bondholders from the reserve fund. The following was recorded in the accounting records: DEBIT 51 CREDIT 67

– 1,000,000 rubles.

(500 rubles/piece x 2000 pieces) – funds received when placing bonds; DEBIT 67 CREDIT 51

– 1,100,000 rub.

(1,000,000 + 100,000) – bonds are repaid and accrued interest is paid; DEBIT 82 subaccount “Reserve capital” CREDIT 67

– 100,000 rub.

– accrued interest on bonds is charged to the reserve fund. The reserve fund funds are part of the enterprise's equity capital along with retained earnings. Considering the strict restrictions on the use of this reserve, when deciding on its size, you need to remember that the amount can only be spent upon the occurrence of events to prevent the consequences of which the reserve was created. The article was published in the journal “Accounting in Production” No. 1, January 2010.

Hello Guest! Offer from "Clerk"

Online professional retraining “Accountant on the simplified tax system” with a diploma for 250 academic hours . Learn everything new to avoid mistakes. Online training for 2 months, the stream starts on March 1.

Sign up

Reserve Fund LLC

The Law on Limited Liability Companies (No. 14-FZ) provides for the independent decision-making by the founders of the organization on the need to form a reserve fund. There is no minimum threshold for the amount of reserve capital. The only mandatory condition is to record the decision on the size of the fund in the statutory documentation.

The source of financing when replenishing the reserve fund, as in the case of a joint-stock company, is the deduction of part of the profit. The amount of contributions is set by the founders at their discretion.

Increasing the amount of reserve capital

The rules do not prohibit increasing the amount of reserve capital, and this can be done at any stage, even until the amount of reserve capital reaches the threshold of 5%.

The size of the reserve can be increased by holding a meeting of shareholders and making this decision. After this, all changes must be made to the charter.

There is a relationship between the value of reserve and authorized capital, so it must be taken into account that when increasing the amount of reserve capital, it is necessary to increase proportionally the amount of total (authorized) capital.

The value of the reserve fund

The space for using reserve capital is seriously limited. Its main function is to compensate the company for its losses. This is a kind of financial airbag.

The process of spending reserve finances does not affect the company’s assets in any way: it does not reduce or increase them. It only changes the composition of the organization's equity capital.

The formation of reserve capital is an auxiliary means of saving corporate finances. The fund, formed by deductions from the company’s income, protects part of the profit from immediate spending immediately after its appearance, forces it to be put aside in reserve in case of potential losses - and thereby insures the enterprise against the acute negative consequences of the crisis.

Return to list

How is reserve capital formed?

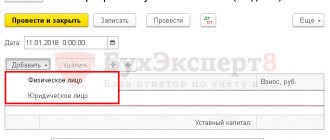

After the calendar year is completed, all final entries are reflected, reporting for the year is drawn up - a meeting of the participants (founders) of the company is held, at which it is decided how the net profit will be distributed: for the payment of dividends, for the formation of a reserve, etc.

As mentioned above, for joint-stock companies the formation of reserve capital is a mandatory procedure, and it is established that the amount of reserve capital must be at least 5% of the authorized capital. The specific amount of the reserve for each individual organization is determined by its constituent documents (charter).

Therefore, contributions to the reserve each year must be at least 5% of the net profit received for the year. The specific amount of annual contributions must be such that the resulting reserve capital is not less than the amount established by the charter of the company.