When debt is bad

The fact of writing off debts of debtors affects both accounting (this is reflected in the balance sheet and other accounting records) and tax accounting (the tax base changes).

Therefore, the issue of recognizing a debt as bad should be approached very carefully. There are several situations in which the taxpayer has the right to recognize receivables as uncollectible.

1. If the buyer who has not paid for the delivered goods, or the seller who has not repaid the advance payment, is declared bankrupt (clause 2 of Article 266 of the Tax Code of the Russian Federation).

True, according to the explanations of officials, the debtor company must be declared bankrupt in court, and its registration data must be excluded from the Unified State Register of Legal Entities (see, for example, letters of the Ministry of Finance dated March 18, 2019 No. 03-03-06/1/17813, dated 06.06.2016 No. 03-03-06/1/32678). If the proceedings in court have not been completed, and the creditor is listed in the register of those who have filed material claims against the debtor, then the debt cannot be attributed to non-operating expenses. In this case, the statute of limitations does not apply.

2. If the statute of limitations has expired.

In accordance with Art. 196 of the Civil Code of the Russian Federation, this period is 3 years from the date, which is determined according to the rules of Art. 200 Civil Code of the Russian Federation. And the total limitation period, taking into account interruptions, cannot exceed 10 years (clause 2 of article 196 of the Civil Code of the Russian Federation).

Important! It does not matter whether the creditor took any measures to collect the debt or not. This is confirmed by both officials and courts (letters from the Ministry of Finance dated February 21, 2008 No. 03-03-06/1/124, and dated November 25, 2008 No. 03-03-06/2/158, Ruling of the Supreme Court of the Russian Federation dated January 19, 2018 No. 305-KG17-14988, resolution of the Federal Antimonopoly Service of the Moscow District dated September 14, 2012 in case No. A40-85915/11-91-367).

3. If information about the registration of the debtor company is excluded from the Unified State Register of Legal Entities at the request of the tax authority. This situation may arise if a legal entity does not submit reports and does not conduct transactions on a bank account for 12 months. When applying this provision, it should be taken into account that:

- On September 1, 2014, the Federal Law of May 5, 2014 No. 99-FZ “On amendments to Chapter 4 of Part One of the Civil Code of the Russian Federation and on the recognition of certain provisions of legislative acts as invalid” came into force, as a result of which Article 64.2 was added to the Civil Code of the Russian Federation — this norm allows the above-mentioned enterprises to be equated with liquidated ones;

- Until September 1, 2014, this provision was not in effect, since exclusion from the Unified State Register of Legal Entities was not considered the liquidation of the debtor, which means there was no basis for writing off the debt (clause 2 of Article 266 of the Tax Code of the Russian Federation).

4. If the statute of limitations has not passed, but the debtor company has been liquidated. The basis for writing off a debt can be an extract from the Unified State Register of Legal Entities, which will contain information about the liquidation of the debtor.

ConsultantPlus experts spoke about the nuances of accounting for VAT when writing off accounts receivable. To do everything correctly, get trial access to the system and go to the Ready solution. It's free.

Features of writing off bad receivables in accounting

But in accounting, the company has no choice about how to write off bad receivables; according to clause 70 of the Regulations on maintaining accounting records, it is necessary to use the method of forming a reserve for doubtful debts. The procedure for its formation is not established by law, therefore each enterprise develops this procedure independently and reflects it in its accounting policies.

Unlike tax accounting, in accounting, the reserve for doubtful debts includes any overdue debt, and not just those associated with the sale of services, goods and work.

The formation of the reserve is reflected by the following posting:

credit account 63 “Provision for doubtful debts”

debit account 91 “Other expenses and income”

Write-off from the debt reserve is reflected by the following entry:

debit account 63

credit account 62 (or 76, 60)

An example of how to reflect in accounting the write-off of bad receivables at Solnyshko LLC

At Solnyshko LLC, the reserve for doubtful debts as of June 30 amounted to 280,000 rubles.

debit account 91 credit account 63

With this posting, overdue accounts payable to customers are included in the reserve.

The next month (July), 50,000 rubles from the debt became uncollectible (as a result of the liquidation of the debtor's enterprise). The wiring is completed:

debit account 63

loan account 62

Using this entry, the debt in accounting is written off against the reserve.

Important information!!! The company always has a chance that even after the statute of limitations has expired, the buyer (counterparty) will return the money to the company for the goods or services provided. Therefore, written-off debts are recorded in an off-balance sheet account for 5 years from the date of the write-off operation. Only in the case when the debtor organization is liquidated or an individual. the person is declared bankrupt, the accounting of such debt can be suspended.

Did you like the article?

Want to receive articles like this every Thursday? Keep abreast of changes in legislation? Subscribe to our newsletter

How to determine the statute of limitations

Typically, the date for counting the limitation period should be considered the deadline for payment for the buyer who received the goods, or for shipment (refund) for the buyer when transferring an advance payment. If the deadline for fulfilling obligations is not established, then the countdown begins from the moment the demand for payment or repayment of obligations is presented.

It is important to know! The limitation period may be interrupted, and then you should start counting it again from the date of the event.

Let us list the actions of the debtor that lead to the restart of the limitation period (Article 203 of the Civil Code of the Russian Federation):

- signing a reconciliation act or transmitting a letter acknowledging the debt (letter from the Ministry of Finance dated July 10, 2015 No. 03-03-06/39756, Federal Tax Service dated December 6, 2010 No. ShS-37-3/16955);

- payment of interest for a late payment or partial repayment of debt - the latter interrupts the term only in relation to the repaid part (clause 20 of the resolution of the Plenum of the Supreme Court of the Russian Federation dated September 29, 2015 No. 43);

- request for an installment plan, drawing up an application for offsetting counterclaims, adjusting the terms of the concluded agreement with recognition of the existing debt;

- filing a claim in court. Here, an important condition is precisely the court’s acceptance of the statement of claim for consideration, otherwise the period will not be considered interrupted (Article 204 of the Civil Code of the Russian Federation).

See also our material “How to write off a bad debt with an expired statute of limitations”

How to draw up a balance sheet

The form of the balance sheet has not changed significantly in recent years. It was approved by Order of the Ministry of Finance dated July 2, 2010 No. 66n (as amended by Order of the Ministry of Finance dated April 19, 2019 No. 61n). If your organization maintains accounting in a general manner, fill out the balance sheet using the form from Appendix No. 1; if the accounting form is simplified, fill out the balance sheet using the form from Appendix No. 5 or the general form.

The annual balance sheet is drawn up as of December 31 of the reporting year. It also needs to indicate data as of December 31 of the two previous years. For example, when preparing a balance sheet for 2022, enter data as of December 31, 2022, 2022 and 2022.

The basis for filling out the balance sheet is the account balances as of the reporting date. Before you proceed to filling out the balance sheet, check whether all business transactions are reflected and whether the account turnover is formed correctly.

How to write off accounts receivable with an expired statute of limitations

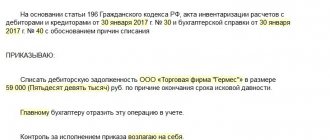

The Ministry of Finance of Russia, in letter dated January 14, 2015 No. 07-01-06/188, provided the necessary list of documents that accompany the procedure for writing off receivables with an expired statute of limitations:

- act on the inventory carried out;

- an order to write off accounts receivable with an expired statute of limitations, signed by the head of the enterprise.

In this case, write-offs must be made separately for each counterparty and each agreement with him.

How to reflect the write-off of accounts receivable

Let's figure out how to write off accounts receivable with an expired statute of limitations in accounting and tax accounting.

In accounting

The receivables written off include:

- to account 63 “Reserve for doubtful debts”, if a reserve was created;

- for financial results, if in the previous reporting period the amounts for these debts were not reserved (clause 70 of the Regulations on accounting and financial reporting in the Russian Federation, approved by order of the Ministry of Finance of the Russian Federation dated July 29, 1998 No. 34n).

Important! At the same time, for tax accounting it is absolutely irrelevant whether the written off receivables participated in the formation of the reserve for doubtful debts or not. This is important for accounting, because then the values of the balance sheet lines will differ (after all, balance sheet line 1230 is reduced by the balance of account 63).

Bad receivables as of the inventory date are included in the total value of other expenses and are reflected in the accounting subaccount 91-2 of the same name in the “Other income and expenses” account.

However, writing off bad receivables at a loss due to the debtor's insolvency does not constitute cancellation of the debt. This debt must be accounted for in off-balance sheet account 007 for 5 years. This requirement is due to the fact that it is necessary to monitor the debtor’s property status in order to identify prospects for repaying the debt.

If the reserve for doubtful debts has not been created, then the following entries need to be made:

- Dt 91-2 Kt 60, 62, 76 and others;

- Dt 007 - reflection on the balance sheet of the amount of written off receivables.

If a reserve was created, then the postings are as follows:

- Dt 63 Kt 60, 62, 76 and others;

- Dt 007 - reflection on the balance sheet of the amount of debt written off.

At the same time, if the written-off debt of debtors exceeds the reserve, the balance is reflected in the “Other expenses” account (clause 11 of PBU No. 10/99 “Organizational expenses”).

In tax accounting

The write-off of bad receivables is reflected in tax accounting differently, depending on the reason for which it arose. The traditional reasons are:

1. The buyer paid an advance, but did not wait for the goods to be shipped or the money paid to be returned.

In this case, the write-off of receivables is carried out to the account equivalent to non-operating expenses, since the buyer does not take into account the prepayment under the supply agreement when creating a reserve for doubtful debts (see letters of the Ministry of Finance dated September 4, 2015 No. 03-03-06/2/51088, dated June 30 .2011 No. 07-02-06/115);

2. The seller shipped the goods, but did not wait for payment for it in full or in part.

There are two options for writing off accounts receivable:

- if a reserve for accounting for doubtful debts was not created in the previous reporting period, then the debt is written off to the account of non-operating expenses (subclause 2, clause 2, article 265 of the Tax Code of the Russian Federation);

- If a reserve has been created, then writing off the debt reduces this reserve. It does not matter whether this amount participated in its formation (letters from the Ministry of Finance dated November 24, 2017 No. 03-03-06/1/77995, dated June 17, 2012 No. 03-03-06/2/78).

Important! Write-off of bad debts after the statute of limitations has expired is carried out in the reporting period when this period expired (letters of the Ministry of Finance dated June 20, 2018 No. 03-03-06/1/42047, dated August 25, 2017 No. 03-03-06/1/54556) . Bad debts from previous years can also be taken into account in the discovery period, provided that by the time the declaration is submitted, the three-year period for return or offset of the overpayment has not expired (letter of the Ministry of Finance dated 01.07.2019 No. 03-03-06/1/48327, attachment to the letter of the Federal Tax Service dated 11.04 .2018 No. SA-4-7/6940).

When are accounts receivable written off?

The supplier did not fulfill his obligations under the contract and did not ship previously paid goods. Services were provided to the customer, but payment was not made on time. The above situations happen sooner or later in the course of an organization’s activities. As a result, the company has an outstanding debt - accounts receivable. In a situation where there are grounds for writing off overdue debt, you can attribute the amount of debt to the financial result or non-operating expenses. We will describe in detail below the reasons for writing off receivables from the balance sheet.

The statute of limitations has expired

This basis is the first and most significant criterion for writing off debt from the balance sheet. According to the requirements of the Civil Code, the debtor has three years to repay the debt, and you have three years to collect it. After the expiration of the specified period, the statute of limitations on the debt is considered to have expired.

Read the article about “Writing off accounts receivable (account 62)”

The question arises: from what point should the statute of limitations be calculated in order to determine its expiration date? Based on the same Civil Code (Article 196), we answer: the period must be counted from the date when the debtor violated the obligations under the contract. For example, if the supplier was supposed to ship the goods on 05/18/16, then the period must be calculated starting from 06/19/16.

When determining the statute of limitations, you should take into account that the period does not have to last continuously (for example, from 08/16/14 to 08/16/17), and in some cases it may be interrupted:

| The deadline is interrupted | The deadline is interrupted | The deadline is NOT interrupted |

| The creditor filed a lawsuit to collect the debt from the debtor | The debtor acknowledges the debt, the amount of which is confirmed by signing a reconciliation report | Change of persons in the obligation: · the right to claim the debt has passed to another person; · payment obligations have passed to another person (for example, due to the bankruptcy of the original debtor) |

As you can see, at the moment when your debtor acknowledged the debt, or when you went to court to collect the debt, the countdown of the statute of limitations stops and begins again. The period until the calculation is interrupted in the new period is not taken into account.

And vice versa: if you have acquired the right to collect a debt, the statute of limitations continues to count even after the debt has been transferred from the previous creditor to you. Likewise, if your debtor has transferred payment obligations to another person due to the fact that he himself cannot pay the debt.

Example No. 1.

According to the agreement between Vityaz LLC and Knyaz JSC, the latter was supposed to ship a batch of plumbing fixtures to Vityaz. Shipment deadline – 04/14/13. “Vityaz” paid the cost of the plumbing in advance, but on 04/14/13 “Knyaz” did not make the shipment.

On 04/15/13, the debt of “Prince” was declared overdue. On 03/18/16, a reconciliation act was signed between “Vityaz” and “Prince”, according to which the latter recognizes the entire amount of the debt.

Three years have passed since the “Prince’s” debt was declared overdue (04/15/16) – 04/15/16. But nevertheless, the statute of limitations did not expire from that moment, since before the expiration of the three-year period (until 04/15/16) a reconciliation act was signed between the counterparties (03/18/16). From this date, Vityaz will calculate a new period, which will expire on 06/18/19, provided that no other actions are taken by the parties.

The debtor cannot fulfill the obligation

The grounds for confirming the fact that the debtor cannot fulfill payment obligations may be:

- act of a government agency. For example, you filed a lawsuit, as a result, the decision was made in your favor, and the court recognized the impossibility of collecting the debt. The basis for writing off the debt from the balance sheet will be an act of the bailiff;

- liquidation of the debtor organization. For example, a legal entity that owes money to you is declared liquidated. The basis for writing off the debt here is an entry in Rosreestr about the exclusion of the organization from the Unified State Register of Legal Entities.

The creditor recognizes the debt as unrealistic for collection

Another situation is that the statute of limitations has not expired, and you do not have any other documents to write off the amount of the debt, but at the same time you consider the debt to be hopeless. In this case, you can recognize the debt as impossible to collect unilaterally.

In order to write off debt from the balance sheet, you will need to draw up an internal document - an order from the manager, a decision of the board, etc.

It is important to know that under these conditions you can write off the debt only in accounting, but not in tax accounting. The write-off is made at the expense of the organization's profit. Practice shows that this scheme is advisable to use if your company has many small debtors. The cost of legal expenses will significantly exceed the size of the debt itself, so it makes sense to take inventory of the amounts owed and write them off according to the decision of the manager.

VAT when writing off accounts receivable

For the seller

VAT will not need to be adjusted when writing off receivables (the situation where the buyer has a debt for the goods he received), since the tax has already been assessed by the seller on the date of shipment of the goods (subclause 1, clause 1, article 167 of the Tax Code of the Russian Federation). It is impossible to refund the paid VAT , but it will be written off (at the expense of the reserve or for profit expenses) along with the amount of bad debt (see letters from the Ministry of Finance of Russia dated October 26, 2017 No. 03-07-11/70423, dated July 24, 2013 No. 03-03 -06/1/29315, Determination of the Constitutional Court of the Russian Federation dated May 12, 2005 No. 167-O).

For the buyer

But for the buyer, the situation with VAT when writing off the seller’s advance payment debt is ambiguous. There is a certain conflict of interest expressed in the existing rule of law and its interpretation by the Ministry of Finance.

Thus, the financial department believes that VAT accepted for deduction on the advance payment transferred to the seller is subject to restoration in the period when the amount of the debt is written off (letters of the Ministry of Finance dated 06/05/2018 No. 03-07-11/38251, dated 06/23/2016 No. 03-07- 11/36478).

At the same time, the norms contained in sub. 3 p. 3 art. 170 of the Tax Code of the Russian Federation do not provide for such a tax recovery when writing off receivables, which has been repeatedly emphasized by the arbitrators (resolutions of the AS of the West Siberian District dated March 12, 2018 No. F04-6237/2017, AS of the Volga District dated November 16, 2016 No. F06-14629/2016, AS of the Moscow District dated October 10, 2016 No. F05-14000/2016, etc.).

Based on this, we conclude that a requirement for VAT restoration when the buyer writes off receivables from controllers may arise, but it can be challenged in court.

We write off accounts receivable: what to do with VAT

When writing off the amount of receivables recognized as bad for one of the reasons listed above, the entire amount of the debt is reflected in non-operating expenses. In other words, you write off the entire debt of the debtor, including VAT. This fact is confirmed by the Tax Code and letters from the Ministry of Finance. Tax legislation does not require that the amount of VAT debt be taken into account separately when writing off a bad debt. The same position has been confirmed by judicial practice, including the decision of the Constitutional Court.

Typical case: You shipped the goods, but the buyer did not transfer payment on time. You decide to write off the debt from your balance sheet (for example, after the statute of limitations has expired). When recording a write-off in your accounting, feel free to include the entire amount in expenses, including VAT. Since the tax was transferred to you upon shipment of the goods, you do not have any additional obligations to pay VAT.

What to do if VAT has not been paid and the debt needs to be written off. If you do not want unnecessary bickering on the part of the fiscal service, you can separate VAT from the debt amount and transfer it to the budget. But on the other hand, you have legal grounds not to pay VAT when writing off, namely:

- in the list of taxable objects listed in Art. 146 Tax Code, write-off of accounts receivable is not indicated;

- there is clause 5 of Art. 167, according to which the date of write-off is equal to the date of sale. But due to the fact that the date of appearance of the taxable object cannot be earlier than the date of appearance of the object itself, Art. 167 and art. 146 contradict each other.

Thus, you can reflect the write-off of debt with the following entries:

| Debit | Credit | Description |

| 91 | 62 | Write-off of bad debt |

| 76 | 91 | Write-off of VAT amount |

In account 91, you reflect the amount that you could receive if you pay the debt, but which, as a result, leads to an increase in your expenses.

Reflection in accounting

As stated earlier, when writing off the amount of bad debts, you can write off the entire amount, including VAT. We will consider an example of recording a write-off in accounting below.

Example No. 2.

Lyubimets LLC produces and sells animal feed. 05/17/13 “Lyubimets” shipped a batch of food worth 547,300 rubles, VAT 83,486 rubles to the pet store “Cat and Dog”. According to the agreement, payment from the pet store should have been received by 05/31/14, but “Cat and Dog” did not pay for the goods on time.

On 01/12/13, a reconciliation act was signed between the pet store and “Lubimets”, in which “Cat and Dog” acknowledges the debt in full. On January 12, 2016, the statute of limitations under the contract with the pet store expired. Lyubimets wrote off the amount of debt (including VAT) as non-operating expenses.

On August 22, 2016, funds from the pet store were received into the Lyubimets bank account to pay off the debt for a previously received shipment of goods.

The operations of shipping goods to the pet store, writing off the debt for non-operating expenses, and paying off the debt of the pet store were reflected by the Lyubimets accountant with the following entries:

| date | Debit | Credit | Operation description | Sum | A document base |

| 17.05.13 | 62 | 90.1 | The cost of a batch of animal food sold to a pet store is taken into account | RUB 547,300 | Packing list |

| 17.05.13 | 90.3 | 68 VAT | VAT is reflected on the sold batch of animal feed | RUR 83,486 | Waybill, invoice |

| 17.05.13 | 68 VAT | 51 | The VAT amount was transferred to the budget | RUR 83,486 | Payment order |

| 12.01.16 | 91.2 | 62 | The amount of debt of the pet store "Cat and Dog" was written off from the balance sheet due to the statute of limitations | RUB 547,300 | Agreement, reconciliation report, accounting certificate |

| 12.01.16 | 007 | The debt of the pet store "Cat and Dog", written off from the balance sheet, is recorded in an off-balance sheet account | RUB 547,300 | Agreement, reconciliation report, accounting certificate | |

| 22.08.16 | 51 | 91.1 | The funds received from the pet store to pay off the debt were credited to the “Lubimets” account | RUB 547,300 | Bank statement |

| 22.08.16 | 007 | Repayment of overdue debt by the pet store is reflected on the off-balance sheet | RUB 547,300 | Accounting information |

As you can see, VAT was paid by Lyubimets upon shipment of the goods, so the organization does not have any additional tax obligations.