In order to collect receivables in court, you need to carefully prepare. It is necessary to collect evidence, correctly formulate the statement of claim and determine which arbitration court it should be submitted to. An appeal to the court can be made only after 30 days have passed after the claim was sent to the debtor. Next, we will consider the steps that should be taken before filing an appeal to the court.

It is worth recalling that accounts receivable is the amount of debt that an organization owes from customers or other debtors. The company expects to receive this amount within a certain time frame.

There are hardly any organizations that have not faced the need to collect receivables from dishonest counterparties. Some of them manage to achieve results by filing a claim, but this method is quite rarely effective. Most often, creditors are forced to go to court to protect their own rights and interests.

Send claims to the debtor

Before the creditor decides to go to court with a statement of claim containing information about the collection of overdue receivables, he needs to perform certain preparatory steps. First, you need to send a claim to the debtor, which must indicate the amount of the debt, as well as the grounds on which it arose. The claim must be accompanied by details that should be used to repay the amount, and copies of documents indicating the occurrence of the debt. If no response to the claim is received within a reasonable period of time, then you can begin preparing documentation for going to court.

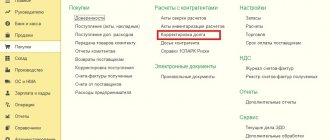

Based on the practice of communicating with our clients, in order to simplify the preparation and sending of a letter of claim to the debtor, it is better to automate this process.

By automating the process of submitting a claim, we mean:

- Creation of claim letters in bulk based on a predefined template;

- Be able to add details and contact information of the debtor en masse to a template from the database;

- The ability to create a business process that will automatically send claim letters to a group of debtors who have reached a certain level of delinquency;

- Integration with the Russian Post service for automated sending of letters to debtors in bulk.

Get more detailed advice

Crisis “receivables”: how to collect money from a problem debtor

Preparation for trial and the process itself require significant time and financial resources. In particularly complex cases, the proceedings can last several years and go through more than one round of authorities. Therefore, you should not rush to go to court until it becomes clear that it is impossible to reach an agreement with the debtor and he does not want to use the methods listed above.

The contract usually specifies a period for reviewing claims (one to two weeks). If by the time this period expires the debtor has not received a response or it has not satisfied the creditor, you can begin preparing a statement of claim.

The application must indicate:

- specific circumstances of the conclusion, execution and termination of the contract (if it is terminated);

- facts of violation by the debtor of his duties with reference to the clauses of the contract and legal norms;

- requirements (otherwise the creditor may never receive anything);

- calculation of the state fee (otherwise the court will leave the application without progress), etc.

In addition, it is worth taking care of the selection of evidence confirming the fulfillment of obligations by the creditor and indicating the debtor’s evasion of counter-fulfillment. Such evidence may be invoices, invoices, transfer deeds, bank account extracts, reconciliation reports, etc.

The creditor may have concerns that the debtor will get rid of his assets. Then you can file a petition to secure the claim and seize the property or money of the unscrupulous counterparty.

If the court makes a positive decision, bailiffs will take over the work. But this does not mean that now we can wait for the receipt of money with folded hands. In order to repay the debt, the work of the bailiffs must be monitored, provided with all available information about the defendant’s availability of money and property that can be foreclosed on, or even work for them (prepare requests, demands, decisions, ensure delivery of documents, etc.) .

The bailiffs themselves have broad powers to obtain information about the availability and movement of the debtor’s property, which can be useful to collection agencies.

The first incentive for the debtor to pay is an enforcement fee in the amount of 7% of the amount of the debt, which is not repaid by the debtor voluntarily within the period specified by the bailiff (usually five days). Therefore, many debtors, realizing the inevitability of retribution, prefer not to spend extra money.

The second incentive is the seizure of accounts and real estate, an inventory of property. Such measures are very effective if they are carried out in a timely manner.

The third incentive is the real threat of a ban on the debtor – an individual entrepreneur – traveling abroad (Article 67 of the Federal Law of October 2, 2007 No. 229-FZ “On Enforcement Proceedings”). In case of malicious evasion of execution of a court decision, the debtor's official will bear criminal liability. Travel outside the country may be limited to him as part of a criminal case.

Taken together, the above measures make it possible to achieve a positive result in enforcement proceedings. Of course, provided that the debtor is a real operating company.

If the debtor turns out to be a shell company or a company that was deliberately bankrupted or reorganized as a merger, then the best way to recover the debt is to contact the police as soon as possible. You can find out such information with the help of a bailiff. And the creditor can write a statement to initiate a criminal case under Art. 159 “Fraud”, art. 173.1 “Illegal formation (creation, reorganization) of a legal entity,” Art. 173.2 “Illegal use of documents for the formation (creation, reorganization) of a legal entity”, Art. 196 “Intentional bankruptcy”, Art. 197 “Fictitious bankruptcy”, Art. 201 “Abuse of power” of the Criminal Code of the Russian Federation.

Check primary documents

A significant point in preparing for judicial debt collection is that the creditor has the originals of primary documentation, which confirms the fact that legal relations have been established. Of primary importance is the contract, which must contain essential terms and be signed by all authorized persons.

In some cases, there may be no agreement. In such a situation, the creditor, when going to court, has the right to provide another document. This possibility is specified in paragraph 2 of Art. 434 of the Civil Code of the Russian Federation, according to which it is permissible to conclude an agreement not only through the preparation of a single document signed by the parties, but also through the exchange of telegrams, letters, faxes and other documentation transmitted through various communication channels, including electronic. The only condition in the latter case is the possibility of reliably establishing that the document was sent by a party to the contract.

In addition, the creditor can confirm the existence of an obligation by providing certificates of completion of work, invoices and other primary documentation. Situations are quite common when the debtor repays the debt partially. This fact can be confirmed by payment documentation certifying partial payment (payment and other cash documents). When going to court, such circumstances must be taken into account.

An important point for debt collection is the existence of a reconciliation act carried out for mutual settlements. This document certifies the debtor's acceptance of the recognition and fulfillment of the debt. The specified act must be properly executed, having personally signed signatures of persons who are authorized representatives of the parties, and a transcript of these signatures. The document must necessarily contain an indication of the legal relations existing between the parties and their amount. The reconciliation act will assist the court in making an informed decision.

Why should you use the services of an agent?

Accounts receivable factoring can solve many business problems. When contacting a financial institution, the supplier company has the opportunity to:

- offer customers a large selection of goods and services, as well as a convenient form of payment depending on the volume of purchase;

- simplify cooperation with foreign partners;

- significantly reduce financial and time costs due to timely receipt of payment from the factor;

- put the received money into circulation and speed up production, thereby increasing income faster.

Thus, for just a small percentage of the commission, the company can significantly advance in the market and get more satisfied customers, maintaining relationships with those who are not able to pay for goods and services on time, but are the main customers. In addition, with this approach you can attract new customers, increasing the profitability of the enterprise.

Determine the possibility of debt collection in court

After checking the information specified above, the creditor needs to determine whether it is possible to go to court to collect the receivables. To do this, you need to clarify a number of questions:

- Has the debtor been liquidated?

If an entry was made in the Unified State Register of Legal Entities according to which the debtor’s activities were terminated due to liquidation, then it is impossible to bring a claim against him. However, if the debtor is in the process of bankruptcy, at one of its stages, then collection of receivables is carried out in the manner established by the Federal Law “On Insolvency”, that is, by including the claim in the existing register of creditors’ claims. Debt collection will be carried out in the order established by law.

If the debtor is an individual entrepreneur, then it should be taken into account that the termination of the functioning of an individual entrepreneur is not an obstacle to filing a claim for collection of receivables in court, since an individual undertakes to answer for all his existing obligations, including those formed in the course of business activities .

- Has the statute of limitations expired?

In general, this period is three years. Its calculation is carried out from the moment when the payment deadline was established. At the same time, if the parties did not indicate a payment deadline, then the rule of the second paragraph of Part 2 of Art. 200 Civil Code of the Russian Federation. According to it, if a deadline for fulfillment was not specified for obligations, then the limitation period should be calculated from the moment when the creditor acquired the right to make a claim regarding the fulfillment of obligations. If the debtor is given a certain period to fulfill such a requirement, then the beginning of the limitation period should be counted after the end of this period. In this case, the limitation period cannot be more than ten years, counted from the date of establishment of the obligations.

If more than three years have passed since the payment due date, you should check whether the debtor has retained any documentation that certifies the recognition of the debt (for example, a document confirming partial repayment). In accordance with Article 203 of the Civil Code of the Russian Federation, the commission by the obligated person of actions that indicate his recognition of the debt interrupts the calculation of the limitation period. After this break, a new countdown begins.

It should be noted that even if the statute of limitations has expired, the creditor is not deprived of the opportunity to go to court due to a violated obligation. In such a situation, if there is no petition on the part of the debtor to skip the statute of limitations and there is evidence confirming the occurrence of the debt, the court will be able to make a decision to collect the receivables.

Working with accounts receivable

In the context of the COVID-19 pandemic and the associated difficult economic situation, many companies are increasingly faced with the fact that their partners do not fulfill their obligations. In 2021, after restrictions were lifted, issues related to accounts receivable became relevant for many of our clients.

Main phases

Accounts receivable is a right of claim against a counterparty who has not fulfilled its obligations to pay for goods, or has not performed work or provided services. If the debtor counterparty has not fulfilled its obligation within the period established in the contract, then such debt becomes overdue, and the creditor company will have the right to take actions to collect it.

As preventive measures you can:

- Assess the integrity and solvency of counterparties;

- Work with advances;

- Insure debt.

If problems arise with counterparties, it is best to first try to negotiate repayment or debt restructuring on terms acceptable to both parties. If it is impossible to reach an amicable agreement for some reason, then the only options left are to try to collect the debt in court, or to sell it to collectors (usually at a discount).

To begin the collection procedure, at a minimum, it is necessary to constantly monitor the terms of payment under contracts and promptly identify which of them require action to be reviewed or collected. An overdue receivable for which the creditor does not take collection action may become uncollectible in two cases:

- After the expiration of the limitation period;

- Based on an act of a state body on the impossibility of collection, or liquidation or bankruptcy of the debtor company.

In this case, the lender will be forced to write off such bad debt at a loss, which will negatively affect its balance sheet. The definition of doubtful and bad debt and the procedure for creating reserves for them are regulated by Article 266 of the Tax Code of the Russian Federation.

Tax risks

It is necessary to carefully approach the choice of counterparty. For example, detailed explanations on the procedure for applying Article 54.1 of the Tax Code of the Russian Federation, including how the Federal Tax Service will check the validity of the choice of counterparties and assess diligence, are given in a recent letter from the Federal Tax Service dated March 10, 2021 BV-4-7/ [email protected]

If the counterparty turns out to be unreliable, then the creditor company, in addition to bad receivables, may have difficulties with VAT reimbursement. Letter of the Ministry of Finance of the Russian Federation dated October 26, 2022 No. 03-07-11/70423:

“In connection with the letter on the issue of reimbursement from the budget of the amounts of value added tax paid to the budget during the provision of services, the obligation to pay for which was not fulfilled by the buyer and was recognized as hopeless, the Department of Tax and Customs Policy reports that the reimbursement of value added tax in this case is not provided for by the norms of the Tax Code of the Russian Federation.”

From the letter of the Ministry of Finance of the Russian Federation dated March 13, 2015 N 03-07-05/13622:

“in the event that a bank writes off receivables for payment for services rendered, subject to value added tax, the tax for payment to the budget should be calculated in the tax period in which this debt was written off. Such amounts of value added tax are paid from one’s own funds in the manner established by Article 174 of the Code.”

Due diligence principle

The tax authorities of the Russian Federation take the position that when concluding any transaction, any company must proceed from the principle of due diligence, i.e., exercise maximum vigilance and conduct an analysis of the counterparty with whom the contract is concluded. Otherwise, the creditor company may be brought to tax liability, a criminal case may be initiated against the head of the creditor company and he may be held criminally liable (for example, under Article 159 of the Criminal Code of the Russian Federation Fraud or Article 199 of the Criminal Code of the Russian Federation - Tax Evasion , fees payable by the organization, and (or) insurance premiums payable by the organization paying the insurance premiums). In addition, according to the mentioned letter of the Federal Tax Service dated March 10, 2021 BV-4-7/ [email protected] , if the tax authorities prove that the company knew about the counterparty’s dishonesty ( including when the counterparty chose suppliers, co-executors and subcontractors ), then the company may be denied a VAT deduction. From the letter:

“the negative consequences of failure by a counterparty conducting economic activity to fulfill the obligation to pay value added tax in the proper amount may be imposed on the taxpayer in the form of denying him the right to apply deductions for amounts of this tax, provided that the tax authority proves that the taxpayer knew about tax offenses committed by the counterparty (including as a result of the counterparty’s failure to comply with the requirements of subparagraph 2 of paragraph 2 of Article 54.1 of the Code in relation to the suppliers (subcontractors, co-executors) it attracted, and benefited from the illegal behavior of the counterparty by causing damage to the budget of the Russian Federation. This approach is based on the legal position expressed in the ruling of the Judicial Collegium for Economic Disputes of the Supreme Court of the Russian Federation dated January 25, 2021 No. 309-ES20-17277.”

Select the court to which you need to file an application for collection

Another significant issue is the choice of the court in which to file a claim for collection of receivables. According to current legislation, such an application must be submitted to the court located at the location of the defendant:

- when filing a claim against an individual entrepreneur or legal entity, its location is the state registration address, and the claim must be sent to the appropriately located arbitration court;

- in the event of a claim being brought against an individual, the place of his location is considered to be the address at which he is registered, and the claim must be sent to the appropriate court of general jurisdiction.

In addition, the parties have the right to indicate in the contract another court that will deal with their dispute.

Prepare a statement of claim

This stage is conventionally divided into two parts: drafting the text of the statement of claim and fulfilling the legal requirements that are associated with filing the application. The application must be prepared in accordance with the legally established requirements for its content and form. The statement of claim must include the following provisions:

- The name of the arbitration court to which it is presented. Before filing a claim for collection of receivables from a legal entity, it is necessary to establish the jurisdiction of the dispute to a certain arbitration court. According to the rule of territorial jurisdiction, the case must be heard by an arbitration court that operates in the same territory where the defendant is located. In other words, in order to determine the jurisdiction of a case by any arbitration court, it is necessary to establish the location of the company that acts as a defendant in the case. The determination of territorial jurisdiction in most cases has no connection with the nature of the case.

- The names of the parties, their addresses and other identifying information, as well as the channels that can be used to contact the plaintiff.

- The plaintiff's claims are on the merits. The arbitration court can satisfy only the stated requirements. If the requirements are formulated incorrectly, the submitted application may be rejected. For this reason, it is important to pay special attention to the formulation of requirements and take a responsible approach to the inclusion of references to the rules of law that are subject to application in the dispute resolution process.

- Circumstances that form the basis of the requirements. It is required to describe in detail the essence of the dispute, referring to specific existing evidence.

- Extracts from the unified register of legal entities or individual entrepreneurs. They are necessary to establish the current status and location of the defendant. It is important to take into account that these extracts must be received no earlier than thirty days before the date when the appeal will be sent to the court.

- The cost of the claim, including the calculation of the disputed or recovered amount of money.

- Amount of debt. It is necessary to provide calculations of the amount that is formed not only from the principal debt, but also from penalties that are imposed in the form of penalties and forfeits.

- Signature of an authorized person. It is necessary to ensure that the person signing the application has the appropriate authority. In general, if we talk about a legal entity, such powers are vested in the sole executive body, which has the right to act on behalf of the legal entity without a power of attorney. Evidence demonstrating the existence of authority to sign the application must also be provided to the court.

Accounts receivable: types, consequences and measures to reduce the risk of its occurrence

There are two main types of accounts receivable: normal (current) and overdue. Current means a debt that has not yet been repaid under the contract. But an overdue debt is a debt that should already be repaid. And based on the length of the time period that has passed since the payment deadline, the overdue debt can be:

- short-term (up to 12 months);

- long-term (from 12 to 36 months).

IMPORTANT: According to the law, the maximum period within which it is possible to collect receivables is 3 years. For this reason, it is important to take action as early as possible, even at the stage when the debt is short-term.

From the point of view of the reality of collecting receivables from legal entities, all debts (both short-term and long-term) are divided into 3 categories:

- Real - debts, payments for which are guaranteed by the presence of collateral, a guarantor or a bank servicing the account of the debtor company;

- Doubtful - outstanding debts not secured by collateral/bank guarantee/surety;

- Bad debts are debts that cannot be collected due to the bankruptcy/liquidation of the debtor company or the expiration of the statute of limitations.

The easiest way to collect receivables is secured by collateral or a bank guarantee. Debts for which there are guarantors are somewhat more difficult to collect, since in some cases the guarantor may refuse to fulfill their obligations. But an experienced lawyer, in pre-trial proceedings or in court, with a probability of more than 80%, will be able to collect the real debt in full.

It is somewhat more difficult to work with doubtful debts, and collecting them through the court takes longer. But even if he has liquid assets, in court, with a probability of more than 60%, it will be possible to return, if not the entire debt, then most of it.

Bad debts are, alas, hopeless. Of course, theoretically, you can work with them, sue the former owners of the liquidated debtor company, look for arguments why the debt was not collected on time, etc. But the probability of returning the money in this case is very low and does not exceed 5%.

Determine the likelihood of collecting receivables from your debtor

By answering 11 questions, you will receive an expert assessment of the right of the claim and the likelihood of its recovery, as well as recommendations for further actions from recovery experts. After this, you will be able to determine how quickly the problem needs to be solved, because delay is a loss of your money.

No. 1 Have there been any cases when you, as a manager or founder, on behalf of the company, sold its property to yourself or your relatives?

No. 2 Has your company sold its property over the past three years: real estate, vehicles, equipment? How did you determine the selling price? Why did you decide to sell the property?

No. 3 Does your organization practice checking counterparties for good faith: do you request their constituent documents, check the information on the website of the Federal Tax Service of Russia, the Bailiff Service, and in the files of arbitration courts? Do you (or your employees) meet in person with the managers (employees) of counterparties when concluding contracts, or do documents exchange by mail?

No. 4 Is it known that bankruptcy proceedings or surveillance have been introduced against your company?

No. 5 Does your company currently have overdue debt? What is the period of delay?

No. 6 Have your counterparties filed debt collection claims against your company over the past three years?

No. 7 Are there any errors in your accounting and tax reporting? Have you received error messages from tax authorities?

No. 8 Were there any cases of loss of accounting documents?

No. 9 Does the organization or you, as a director, have any fines or debts that were assessed by the tax service and other government agencies, as well as by the court for violation of tax, administrative or criminal legislation?

No. 10 Have you entered into the Unified Federal Register of Information on the Facts of Activities of Legal Entities (EFRSFYUL) information that: - a monitoring procedure has been introduced in relation to your company? - there was a change of address - property was pledged - change of founder director, etc.

Pay the state fee

Details for paying the state fee can be easily found on the website of the court that has jurisdiction over the current dispute. On the same resource of the arbitration court there is a state duty calculator, with which you can get the exact amount, avoiding errors in calculations.

The creation of claims and the calculation of state fees can also be automated.

At the moment when the decision to file a lawsuit is made, claims can be created based on the current schedule. Claims can be created either for the entire debt or for part of it. In this case, an unlimited number of claims can be filed for the loan. Accordingly, the amount of claims when resubmitted to court may differ.

When filing claims, the type of proceedings is selected: claim or writ and the state duty is calculated.

Get more detailed advice

Send the defendant a copy of the statement of claim

The law obliges the plaintiff to send to the defendant a copy of the filed statement of claim, supplemented by the documentation attached to it, which the defendant does not have, by registered mail with notification. Evidence of this direction must be provided in the case file. If there are no documents in the case file confirming the payment of the state fee or the filing of the claim, the statement of claim will be guaranteed to be left without progress, which will significantly delay the consideration of the dispute. If the claim procedure has not been followed, the submitted application will be returned by the court without consideration. When sending a statement of claim, you should take into account the possibilities of summary and writ proceedings, but it is best to be prepared for a lengthy trial. It is worth remembering that when collecting receivables through the court, you may encounter certain problems.

Collection of receivables from a legal entity within the framework of writ proceedings

Writ proceedings are the procedure for considering an application regarding the issuance of a court order, which is a judicial act issued by a single judge, acting as an executive document. In writ proceedings, only the documentation submitted by the claimant is examined. After studying these documents, a decision is made regarding the issuance of a court order, which can be applied for in the following cases:

- The basis for demands for collection of receivables from a legal entity is non-fulfillment or improper fulfillment of the terms of the contract. These requirements must be supported by documentation that establishes the monetary obligations recognized by the debtor. The size of these obligations should not exceed 400 thousand.

- The requirements are based on the notary’s undating of acceptance, non-acceptance and protest of the bill of exchange for payment. In this case, their size cannot be more than 400 thousand.

- Requirements have been made regarding the collection of sanctions and mandatory payments. Their size cannot be more than 100 thousand.

The documents provided must clearly demonstrate that the defendant undertakes to satisfy the demands placed on him. At the same time, there should be no legal dispute between the collector and the debtor regarding the collection of receivables.

How does the assignment of rights take place?

The financial agent is a credit company or commercial organization that has permission to conduct factoring-related activities. The fulfillment of the clauses of the agreement is carried out in accordance with the following stages:

| A representative of a company wishing to receive money for goods or services on time provides the agent with invoices, invoices or other documents confirming the fulfillment of obligations by the supplier, subject to deferred payment by the customer. |

| Having studied them, the factor provides the client with about 85% of the total amount specified in the contract. |

| The company notifies the customer about the assignment of the right to claim the debt to a financial organization. Receives his signature on the corresponding annex to the supply agreement. |

| After this, the customer works with the intermediary, transferring the required amounts to the account of the factoring organization on time. |

| If the money is not paid on time, the financial company has the right to collect the debt from the irresponsible debtor. |

| After the customer has fully repaid the debt, the factor transfers the remaining percentage of the total amount to the customer's account. In this case, a commission is charged for the services provided by the factoring agent. They can range from 0.5 to 3% of the remaining amount. |

The factoring agreement can be extended for an indefinite period until the receivables are fully repaid. It is also possible to terminate it by agreement of the parties.

Simplified production

Summary proceedings, unlike writs, have an actionable nature, implying an adversarial process, the provision of arguments and evidence from both parties, even though it is carried out without their direct summons. The following categories of cases can be considered under simplified proceedings:

- for claims for collection of funds, including claims for collection of receivables from a legal entity, if the cost of the claim is no more than 800 thousand rubles for legal entities (from 10/01/2019) and 400 thousand rubles for individual entrepreneurs;

- on the collection of sanctions and mandatory payments, if the generalized amount of the amount collected is from 100 to 200 thousand rubles (from 10/01/2019).

Determining the price threshold is the basis for distinguishing between cases that are considered in simplified and writ proceedings.

The features of making and issuing a court decision include the following:

- According to the general rule, the decision is made by the court immediately after the end of the trial by signing the operative part in the judicial act. The adopted decision becomes valid 15 days after the day of its adoption.

- To draw up a reasoned court decision, that is, in full, it is necessary to submit a corresponding application by the initiative person taking part in the process within five days from the date of formation of the operative part. In this case, the decision becomes valid only after a month, since this is the period allotted for filing an appeal.

Thus, in the absence of a statement from one of the parties, the judge is freed from the need to prepare a reasoning part of the decision, which allows speeding up the legal process.

How to value accounts receivable

The concept of “Accounts receivable”

Accounts receivable is the debt of buyers, customers, borrowers, accountable persons, etc., which the creditor company plans to receive during a certain period.

Accounts receivable arise as a result of contractual relations when the moment of transfer of ownership of goods (work, services) and their payment do not coincide in time.

Accounts receivable are accounted for in the balance sheet at actual sales value, based on the amount of cash that should be received upon repayment, and includes calculations:

with buyers and customers / on bills receivable / with subsidiaries and affiliates / with participants (founders) on contributions to the authorized capital / on advances issued / with other debtors.

In this case, the nominal value of accounts receivable, taken into account in the balance sheet, is the upper limit of value.

The real market value is often lower than the nominal value, which is due to the following factors:

- the longer the repayment period for receivables, the less income from funds attributable to debtors, since money invested in assets must generate profit;

- funds to be returned to the enterprise depreciate under the influence of inflation.

When considering the concept of “accounts receivable”, it is necessary to take into account its specificity, namely that this asset does not have the function of a commodity, since only the assignment of rights to claim repayment of debt can be realized.

When assessing receivables, the above specificity entails the need to determine both the amount of the debt itself, taking into account the timing of its formation, planned repayment periods, the presence of fines and penalties, and to analyze the legal rights to receivables. The fact of the existence of rights to the debt can be confirmed: by an agreement, payment documents under agreements, acts of reconciliation of receivables.

The financial situation of the debtor is also associated with the legal features that form the basis of the assessment study. So, for example, if a case of insolvency is initiated, a special procedure arises for claiming and presenting creditors’ claims. In accordance with the Bankruptcy Law, repayment of accounts payable by debtors is carried out in order of priority: first, the claims of first-priority creditors are satisfied, who can receive debt compensation in full, then the claims of second- and third-priority creditors are satisfied, and so on. At the same time, after the claims of creditors of a higher priority have been fully satisfied, there may not be enough funds to repay the claims of creditors of the next priority, or only partially.

Thus, if the appraiser has information that the debtor is in a state of bankruptcy, he should determine the size of the bankruptcy estate, determine the possibility of repaying this bankruptcy estate, as well as the queue number to which the creditor enterprise belongs.

In practice, the appraiser does not always have the debtor’s financial statements at his disposal. In his report, the appraiser must correctly describe the conditions for conducting the assessment, since they, along with the goals and intended use of its implementation, determine the approaches and methods of the assessment.

Classification of accounts receivable

Valuation and management of receivables involves their ranking, because Depending on which category the receivables belong to, one or another approach to its assessment is applied.

Accounts receivable can be classified according to various criteria:

1. due to education, it is divided into justified and unjustified.

An example of unjustified accounts receivable is accounts receivable, the cause of which is, for example, errors in the preparation of settlement documents.

2. according to the period of formation, accounts receivable in accounting are divided into short-term (payments for which are expected within 12 months after the reporting date) and long-term (payments for which are expected more than 12 months after the reporting date).

3. receivables not repaid on time are overdue.

The general limitation period for the collection of receivables in accordance with Art. 196 of the Civil Code of the Russian Federation is three years. During this time, the receivables must either be collected in the prescribed manner or sold. After three years, accounts receivable are written off as losses.

4. If possible, overdue receivables can be characterized as doubtful or hopeless.

In accordance with paragraph 1 of Article 266 of the Tax Code of the Russian Federation (hereinafter referred to as the Tax Code of the Russian Federation): “doubtful debt is any debt to the taxpayer arising in connection with the sale of goods, performance of work, provision of services, if this debt is not repaid on time, established by the agreement, and is not secured by a pledge, surety, or bank guarantee.”

After the expiration of the statute of limitations, doubtful receivables move into the category of bad debt (not real for collection).

According to paragraph 2 of Article 266 of the Tax Code of the Russian Federation: “bad debts (debts that are unrealistic for collection) are those debts to the taxpayer for which the established limitation period has expired, as well as those debts for which, in accordance with civil law, the obligation has been terminated due to the impossibility of its fulfillment , on the basis of an act of a state body or liquidation of an organization.”

Examples of receivables valuation

When valuing accounts receivable, the most applicable of the three existing approaches is the income approach, which is implemented using the method of discounting the value of the debt collection flow.

The cost approach is not applicable because its use will result in receivables valuation results equal to book value.

Despite the fact that at present some transactions for the sale of receivables are carried out through auctions, there is very little information in open sources to take into account all the pricing factors necessary to determine the value. Thus, the comparative approach is practically not used to evaluate accounts receivable.

The sequence of actions when determining the market value of receivables within the framework of the income approach is as follows:

- The full amount of debt under the contract as of the valuation date is determined, including the amount of the principal debt, accrued interest, fines, and penalties.

- The planned sources of debt repayment are determined.

- Planned debt repayment periods are determined.

- The costs required to collect the debt are determined.

- Net income (less expenses) is discounted to the measurement date.

In practice, appraisers most often evaluate receivables in two cases:

1. Business assessment of the creditor company. In this case, accounts receivable are considered as part of the assets as part of the business of the company being valued. Accounts receivable are considered as an array (without isolating the obligation for each agreement separately from the business as a whole), because assessment of receivables in isolation from a single business does not take into account the general trends in the functioning of the enterprise. All receivables are ranked according to criteria that allow the receivables to be classified. Next, each group of receivables is assessed based on its turnover and the financial condition of the debtor company (if the appraiser has this information at his disposal).

2. Valuation of claims on receivables as an independent asset for sale. Solving this problem requires a thorough study of the legal aspects of the emergence and specific features of the rights being assessed.

The procedure for assessing accounts receivable in the first and second cases is given below.

It is necessary to evaluate accounts receivable as a component of assets within the framework of the net asset method when assessing the value of the business of the creditor company.

The line “Accounts receivable” of the company in question reflects assets in the amount of 445,000 thousand rubles.

Sources of information on the composition of the “Accounts receivable” item:

- Explanation of the line “Accounts receivable” of the balance sheet as of December 31, 2016.

- Balance sheet for account 63.

- Certificate of recognition of receivables as non-cash

Explanation of the line “Accounts receivable” as of December 31, 2016

| Debtor's name | Amount of debt, rub. | Date the debt arose | Reason for debt (operational, investment, financial) | Characteristics of debt (bad, overdue, current) |

| Enterprise A | 400 000 000,00 | 30.09.2016 | operating room | expired |

| Enterprise B | 21 000 000,00 | 05.04.2016 | operating room | current |

| Enterprise B | 24 000 000,00 | 31.10.2013 | operating room | hopeless |

| Total: | 445 000 000,00 |

The market value of the Company's receivables is assessed based on an analysis of its structure and duration of repayment.

The essence of the methodology for valuing receivables comes down to identifying bad debtors and reducing the book value by this amount, as well as bringing future payments on receivables to the present value.

According to the data provided by the owner of the asset (certificate of recognition of non-cash receivables), as of the valuation date, bad debts in the amount of RUB 24,000,000 were identified.

According to paragraph 2 of Art. 266 of the Tax Code of the Russian Federation Bad debts (debts that are not realistic for collection) are debts to an organization:

- for which the established limitation period has expired;

- for which, in accordance with civil law, the obligation is terminated due to the impossibility of its fulfillment;

- on the basis of an act of a state body;

- on the basis of the act of liquidation of the organization.

According to Art. 195 of the Civil Code of the Russian Federation, the limitation period is the period during which a claim can be brought against the debtor due to the fact that he did not fulfill his obligations under the contract (for example, did not pay for purchased products). The general limitation period is three years (Article 196 of the Civil Code of the Russian Federation).

Thus, the book value of bad debts is RUB 24,000,000. The market value of bad receivables is assumed to be 0.

Overdue operating debt with an increased risk of investing in this type of asset amounts to RUB 400,000 at the valuation date.

To obtain the real value of receivables, it is necessary to make an adjustment taking into account the date of repayment of the debt and the liquidity of the debt, according to the formula:

PV = C /(1 + R)n, where

PV – current value;

R - discount rate;

n – turnover period (time to maturity).

The discount rate for current operating receivables is the weighted average interest rates on loans to non-financial organizations in rubles prevailing on the valuation date.

According to the analysis of business activity indicators, the average receivables turnover is 391 days. This turnover period corresponds to the weighted average interest rate on loans to non-financial organizations in rubles as of December 2016 in the amount of 12.86%. (Source: Statistics of the Central Bank of the Russian Federation. Interest rates and structure of loans and deposits by maturity, www.cbr.ru).

The discount rate for overdue debt was calculated using the cumulative method. This method is based on a certain classification of risk factors and assessments of each of them. The calculation base is the risk-free rate. It is assumed that each factor increases this rate by a certain amount, and the total premium is obtained by adding the “contributions” of individual factors. Classification of factors and the size of their contributions” is indicated in the table below.

Indicators (factors) for assessing risk premiums using the cumulative method

| Risks | Premium, % |

| Key figure in leadership, quality of leadership | 0% — 5% |

| Company size | 0% — 5% |

| Financial structure (sources of financing) | 0% — 5% |

| Product and territorial diversification | 0% — 5% |

| Diversification of clientele | 0% — 5% |

| Income: profitability and predictability | 0% — 5% |

| Other special risks | 0% — 5% |

Source: Shcherbakov V. A., Shcherbakova N. A. Estimation of the value of an enterprise (business). 2nd ed., rev. M.: Omega-L, 2007.

The risk-free rate is taken to be the weighted average interest rate on loans to non-financial organizations in rubles, prevailing on the valuation date, i.e. discount rate for current accounts receivable.

The calculation of the premium for the risk of investing in overdue receivables is given in the following table:

Calculation of the risk premium for overdue debt

| Risks | Premium, % | Justification for the value of the award |

| Key figure in leadership, quality of leadership | 0,25% | Managing an organization Does not depend on one key figure. However, there is no management reserve. |

| Company size | 1,00% | A small enterprise that is not a monopolist |

| Financial structure (sources of financing) | 2,00% | Inflated share of borrowed sources in the total capital of the enterprise |

| Product and territorial diversification | 0,00% | Wide range of products; territorial boundaries of the sales market: external, regional, local market |

| Diversification of clientele | 0,50% | The form of the market in which the company operates from the position of demand: many consumers; insignificant share of sales volume per customer |

| Income: profitability and predictability | 2,00% | Instability of income level, profitability; At the same time, the availability of information necessary for forecasting for the last five years on the activities of the enterprise |

| Other special risks | 0,50% | Risks associated with changing suppliers for manufactured products |

| Total: | 6,25% |

Therefore, the discount rate for overdue receivables is:

12,86% + 6,25% = 19,11%.

The calculation of the market value of receivables is given in the following table:

Adjustment of the item “Accounts receivable” as of December 31, 2016.

| Index | Current accounts receivable | Overdue accounts receivable | Uncollectible accounts receivable |

| Accounts receivable, thousand rubles. | 21 000 | 400 000 | 24 000 |

| Discount rate for short-term debt, % | 12,86% | 19,11% | |

| Accounts receivable turnover period, years | 1,087 | 1,087 | |

| Discount multiplier | 0,8768 | 0,8269 | |

| Current value of accounts receivable, thousand rubles. | 18 413 | 330 760 | 0 |

| Market value, thousand rubles. | 349 173 |

Thus, the market value of the item “Accounts receivable” as of the valuation date was taken equal to 349,173 thousand rubles.

The following is an example of assessing the rights of claim on receivables, carried out for the purpose of assigning the rights of claim to another creditor under an assignment agreement.

The creditor under the provision agreement in question, the debtor is Enterprise LLC.

Main parameters of the agreement concluded between JSC Stroitel and LLC Predpriyatie

| Service agreement | No. DOU No. 1 10/20/2016 |

| Latest additional agreement | DS dated November 1, 2016 |

| Receivables maturity date | 01.12.2016 |

| Current debt, rub. | 54 618 875,00 |

Source: loan agreement with additional agreement indicated above

The accounts receivable in question are current operating accounts.

Due to the lack of collateral, repayment of the debt is possible only at the expense of the assets of the debtor - Enterprise LLC.

The calculation of the market value of the assets and liabilities of Enterprise LLC showed that the debtor does not have sufficient assets to repay the debt in full, which is due to the presence of claims against Enterprise LLC from first-priority creditors. After satisfying the claims of first-priority creditors, Enterprise LLC has assets that can be sold to repay the claims of second-priority creditors in the amount of RUB 561,043,724.

A description of the calculation of the market value of the rights to claim repayment of receivables from Stroitel OJSC to Enterprise LLC under the service agreement dated October 20, 2014 No. DOU No. 1 is given in the table below.

Calculation of the market value of the right of claim of OJSC "Stroitel" to LLC "Predpriyatie"

| Creditor | Share of liabilities | Received assets, rub. |

| Creditor A | 1,51% | 8 495 913 |

| Lender B | 0,23% | 1 305 445 |

| JSC "Stroitel" | 0,71% | 4 001 393 |

| Creditor C | 97,54% | 547 240 973 |

| Total liabilities | 100,00% | 561 043 724 |

Thus, the market value of the receivables of Stroitel OJSC to Predpriyatie LLC under the service agreement dated October 20, 2014 No. DOU No. 1 is 4,001,393 rubles.

Source: Press, Financial Director Magazine

Collection of receivables from a legal entity through claims proceedings

Claim proceedings are the most common type of legal proceedings in arbitration courts. In the procedure of claim proceedings, the courts consider economic and other disputes that are related to the conduct of business activities. To initiate legal proceedings, the initiative of the plaintiff is required, carried out by presenting to the court a statement of claim against the defendant containing a request to resolve the legal dispute.

The parties to such a process are the plaintiff and the defendant. The plaintiff is a person whose substantive right has been violated and who requires restoration or protection of this right, and the defendant is the entity against whom the plaintiff’s claim was directed.

According to the fundamental principles of arbitration procedural law, these parties have equal rights during the consideration of the dispute. This principle of equality allows us to guarantee maximum participation of the defendant and plaintiff in the study of the presented evidence and case materials, thanks to which the court can make a reasoned and legal decision.

In addition to the basic powers that are inherent to all persons participating in the case, the parties are characterized by special rights that are unique to them. During the consideration of the case, the plaintiff has the opportunity to make changes to the nature and amount of these requirements, and the defendant can voluntarily fulfill these requirements by recognizing them.

During the consideration of the case and the execution of the court decision, the parties have the opportunity to complete the case by concluding a settlement agreement. In it, the parties determine the procedure for resolving existing disagreements. If the drawn up settlement agreement does not violate the rights of individuals and complies with the current rules of law, then it is approved by the court.

In addition to rights, the parties also have certain responsibilities. The defendant and plaintiff undertake to present evidence of all circumstances and facts underlying the arguments and demands provided. That is, if a party orally or in writing refers to circumstances significant to the case, then he must supplement them with the appropriate evidence base.

Legal collection is a process that requires diligence and care. The human factor can lead to errors and delays in collection. Automating the process of collection through the court will help eliminate errors associated with ridiculous mistakes.

The specialized CRM system for collection “BIT.Debt Management” automates the judicial and enforcement stage of collection as follows:

- Automatic generation of a package of documents individually and en masse for a group of agreements (Statement of Claim, Settlement Agreement, Agreement on Debt Forgiveness, Payment Order, Certificate of Debt Repayment, etc.);

- Access to contact information of bailiffs: phone number, work hours, postal address, position, in which OSP works, manager, which is automatically updated;

- Automatic sending of documents to the court en masse for a group of contracts;

- Automatic tracking of the delivery of documents to the court and setting tasks for employees for further work;

- The program will automatically assign a task to the responsible employee, for example, “Call the court”;

- Automatic receipt of information on the status of enforcement proceedings en masse for a group of contracts;

- Calculation of state duty.

Read more Get demo access

Did you like the article?

Want to receive articles like this every Thursday? Keep abreast of changes in legislation? Subscribe to our newsletter

Agreement on the assignment of rights and transfer of receivables: the procedure for reflecting the transaction in accounting

The organization is on the general taxation system. Under an equipment supply agreement with a foreign supplier concluded in 2013, the organization made an advance payment in dollars. The prepayment amount is specified in the contract. The contract is valid until 2025. According to the agreement, the organization submits requests for the supply of certain equipment according to specifications as necessary. To date, the equipment has been fully supplied according to existing requests; no further deliveries are planned. The balance of the prepayment is included in accounts receivable.

The organization entered into an agreement on the assignment of rights and transfer of responsibilities (transfer of agreement) with a third legal entity. Under this agreement, she transfers receivables under account 60.22 (unfulfilled advance). The debt was assigned at a price lower than that recorded. In accounting, this debt was included in the reserve for doubtful debts.

What entries need to be made in accounting and tax accounting?

11/13/2015 Author: Expert of the Legal Consulting Service GARANT Olga Ivankova

Having considered the issue, we came to the following conclusion:

The assignment of the right of claim by the buyer who has paid an advance towards the future supply of equipment is not subject to VAT.

The Tax Code of the Russian Federation does not contain special provisions for accounting for losses from the assignment of the right of claim on an advance paid by the buyer for the purpose of calculating corporate income tax.

In our opinion, the taxpayer-buyer of goods, assigning receivables arising as a result of the transfer of an advance payment for goods in the event of failure to deliver the goods, has the right to use the procedure established in paragraphs. 1 and 2 tbsp. 279 of the Tax Code of the Russian Federation for taxpayers-sellers, because the provisions of these paragraphs also apply to the taxpayer-creditor of the debt obligation.

In the accounting records of the original creditor, entries in relation to the assignment of the right of claim are made using account 91 “Other income and expenses”.

Rationale for the conclusion:

The right to claim a debt, from the point of view of civil law, is a property right. The assignment of the right to claim a debt is regulated by Art. 382-390 Civil Code of the Russian Federation.

So, according to paragraph 1 of Art. 382 of the Civil Code of the Russian Federation, a right (claim) belonging to the creditor on the basis of an obligation may be transferred by him to another person under a transaction (assignment of the claim).

In accordance with paragraph 1 of Art. 384 of the Civil Code of the Russian Federation, unless otherwise provided by law or agreement, the right of the original creditor passes to the new creditor to the extent and on the conditions that existed at the time of transfer of the right.

A creditor who has assigned a claim to another person is obliged to transfer to him documents certifying the right (claim) and provide information relevant for the exercise of this right (claim) (clause 3 of Article 385 of the Civil Code of the Russian Federation).

According to Art. 506 of the Civil Code of the Russian Federation, under a supply contract, a supplier-seller engaged in business activities undertakes to transfer, within a specified period or terms, the goods produced or purchased by him to the buyer for use in business activities or for other purposes not related to personal, family, home and other similar use.

The parties to the supply agreement may provide for the delivery of goods during the term of the agreement (Clause 1, Article 508 of the Civil Code of the Russian Federation).

VAT

According to paragraphs. 1 clause 1 art. 146 of the Tax Code of the Russian Federation, the object of VAT taxation is, in particular, the transfer of property rights.

The procedure for determining the tax base when transferring property rights is established by Art. 155 Tax Code of the Russian Federation.

So, paragraph 1 of Art. 155 of the Tax Code of the Russian Federation provides that the tax base for the assignment by the original creditor of a monetary claim arising from an agreement for the sale of goods (works, services) is determined as the amount of excess of the amount of income received by the original creditor upon assignment of the right of claim over the amount of the monetary claim for which the rights were assigned . However, this paragraph refers to the assignment of claims under contracts for the sale of goods (work, services), that is, when the creditor is the supplier of goods (work, services). In the situation under consideration, the right of claim for the advance payment was assigned, therefore this rule, in our opinion, is not applicable in this situation.

Clause 3 of Art. 155 of the Tax Code of the Russian Federation contains an open list of property rights, the tax base for the transfer of which is determined as the difference between the cost at which property rights are transferred, taking into account tax, and the costs of acquiring these rights. In this regard, we believe that this procedure for determining the tax base applies only to those types of property rights that are first acquired and then transferred (sold) as the object of property rights (for example, as stated in this norm, this applies to property rights acquired , for example, participants in shared construction).

However, in the analyzed situation, the organization did not acquire property rights, therefore the norm of paragraph 3 of Art. 155 of the Tax Code of the Russian Federation is also not applicable.

Thus, the procedure for determining the tax base in cases where the right to claim debt on an advance payment is transferred, the provisions of Art. 155 of the Tax Code of the Russian Federation is not defined.

Based on clause 2 of Art. 153 of the Tax Code of the Russian Federation, the tax base for the transfer of property rights is determined based on all the taxpayer’s income associated with payments for these property rights. In this case, the indicated income is taken into account if it is possible to estimate it and to the extent that it can be estimated.

As follows from the question, the amount under the agreement for the assignment of the buyer’s right of claim for the advance paid is less than the amount of the supplier’s accounts payable, that is, the buyer does not receive any economic benefit or income (Article 41 of the Tax Code of the Russian Federation), but only partially returns his money. In our opinion, in such a situation the tax base is not determined and VAT is not paid.

From the analysis of arbitration practice, it follows that, in the opinion of the judges, the object of VAT taxation upon assignment of the right to a monetary claim arises only if the transferred obligation is related specifically to the implementation, and the assignment of the right of claim on advances issued is not subject to VAT (see, for example, the decisions of the Federal Antimonopoly Service of the Moscow District dated 05.12.2011 No. A40-139012/10-4-830, Ninth Arbitration Court of Appeal dated 11.08.2011 No. 09AP-17314/11, Ninth Arbitration Court of Appeal dated 11.02.2009 No. 09AP-17462/2008, FAS East Siberian District dated 02.08.2007 No. A78-4501/06-S2-21/228-F02-4764/07).

The Plenum of the Supreme Arbitration Court of the Russian Federation issued Resolution No. 33 dated May 30, 2014 “On some issues that arise in arbitration courts when considering cases related to the collection of value added tax” (hereinafter referred to as Resolution No. 33).

Clause 13 of Resolution No. 33 clarifies that the assignment by the buyer of a claim for the return of funds paid to the seller for the upcoming transfer of goods (work, services), for example due to termination of the contract or its invalidation, cannot be taxed, since the transaction itself Upon return by the seller of funds received as an advance payment, they were not subject to taxation.

It should be noted that the letter of the Ministry of Finance of Russia dated 06/04/2015 No. 03-04-05/32513 states: “When preparing clarifications of the provisions of the legislation of the Russian Federation on taxes and fees in accordance with Article 34.2 of the Code, the Ministry of Finance of Russia cannot fail to take into account the emerging judicial practice.

In cases where written explanations of the Ministry of Finance of Russia on the application of the legislation of the Russian Federation on taxes and fees are not consistent with decisions, resolutions, information letters of the Supreme Arbitration Court of the Russian Federation, as well as decisions, resolutions, letters of the Supreme Court of the Russian Federation, the Ministry of Finance of Russia and tax authorities when exercising their powers, they are guided by the specified acts and letters of the courts.

In addition, in such cases, the Russian Ministry of Finance takes measures to amend the legislation on taxes and fees in order to eliminate gaps and inaccuracies that have given rise to different interpretations of the provisions of this legislation.”

It follows from this that during tax audits in situations similar to the one under consideration, tax authorities should be guided by the position set out in Resolution No. 33.

Corporate income tax

In accordance with paragraphs. 7 paragraph 2 art. 265 of the Tax Code of the Russian Federation, for the purposes of Chapter 25 of the Tax Code of the Russian Federation, losses received by the taxpayer in the reporting (tax) period are equated to non-operating expenses, in particular losses on the transaction of assignment of the right of claim in the manner established by Art. 279 Tax Code of the Russian Federation.

According to paragraphs. 2.1 clause 1 art. 268 of the Tax Code of the Russian Federation, when selling property rights (shares, shares), the taxpayer has the right to reduce income from such transactions by the purchase price of these property rights (shares, shares) and by the amount of expenses associated with their acquisition and sale, unless otherwise provided in clause 9 of Art. . 309.1 Tax Code of the Russian Federation.

When exercising a property right, which represents the right to claim a debt, the tax base is determined taking into account the provisions established by Art. 279 Tax Code of the Russian Federation.

At the same time, in Art. 279 of the Tax Code of the Russian Federation establishes a procedure for determining the tax base upon the initial assignment (assignment) of the right of claim for a taxpayer who is a seller of goods (works, services) calculating income (expenses) on an accrual basis, as well as for a taxpayer who is a creditor under a debt obligation, while the Tax Code The Russian Federation does not contain special provisions for the exercise of the right of claim by a buyer who has paid an advance but has not received delivery.

In our opinion, accounting options in this case may be different.

The first option is the safest during a tax audit, but also the most unprofitable for the buyer who paid the advance; it cannot be taken into account, since the Tax Code of the Russian Federation does not provide for the specifics of accounting for losses from the assignment of the right of claim for the advance paid by the buyer.

The second option is to take into account the loss from the assignment of the right of claim by analogy with the rules established for the taxpayer - seller of goods (works, services) Art. 279 Tax Code of the Russian Federation.

In our opinion, the procedure established in paragraphs. 1 and 2 tbsp. 279 of the Tax Code of the Russian Federation, the taxpayer - the buyer of the goods, assigning the receivables arising as a result of the transfer of an advance payment for the goods in the event of non-delivery of the goods, has the right to use. the essence of the operation is the same.

The procedure for accounting for losses under transactions of assignment of claims depends on whether the payment period stipulated by the contract (in our case, the delivery date of the goods) has arrived on the date of such assignment or not.

In accordance with the first paragraph of paragraph 1 of Art. 279 of the Tax Code of the Russian Federation, when a taxpayer, calculating income (expenses) using the accrual method, assigns the right to claim a debt to a third party before the payment deadline stipulated by the contract, the negative difference between the income from the sale of the right to claim a debt and the cost of goods (work, services) sold is recognized as a loss to the taxpayer.

At the same time, according to the second paragraph of clause 1 of Art. 279 of the Tax Code of the Russian Federation, the amount of loss for tax purposes cannot exceed the amount of interest that the taxpayer would pay based on the maximum interest rate established for the corresponding type of currency, clause 1.2 of Art. 269 of the Tax Code of the Russian Federation, or at the choice of the taxpayer based on the interest rate confirmed in accordance with the methods established by Section V.1 of the Tax Code of the Russian Federation for a debt obligation equal to the income from the assignment of the right of claim, for the period from the date of assignment to the date of payment provided for in the sales agreement goods (works, services), and the provisions of this paragraph also apply to the taxpayer-creditor under a debt obligation. The procedure for accounting for losses in accordance with paragraph 1 of Art. 279 of the Tax Code of the Russian Federation must be enshrined in the taxpayer’s accounting policy. For the calculation of the amount of loss taken into account for taxation, see example 2 of the material “Accounting policy for 2015 for tax purposes: what should be changed” (L. Maslennikova, “New Accounting”, issue 1, January 2015).

According to the Department of Tax and Customs Tariff Policy of the Ministry of Finance of Russia, expressed in letter No. 03-03-06/2/30413 dated May 27, 2015, from January 1, 2015, when determining income (loss) from the assignment of the right to claim a debt, the maximum interest rate is determined based on from the currency in which the assigned debt obligation is denominated.

According to paragraph 2 of Art. 279 of the Tax Code of the Russian Federation, when a taxpayer, calculating income (expenses) on the accrual basis, cedes the right to claim a debt to a third party after the payment deadline stipulated by the contract, the negative difference between the income from the sale of the right to claim a debt and the cost of the goods (work, services) sold is recognized as a loss on the transaction assignment of the right of claim on the date of assignment of the right of claim. In accordance with paragraph four of paragraph 2 of Art. 279 of the Tax Code of the Russian Federation, the provisions of this paragraph also apply to the taxpayer-creditor under a debt obligation.

Since, according to the applications sent by your organization, the equipment was fully supplied by the supplier, new applications were not sent to the supplier, in our opinion, we should assume that the delivery date of the goods on account of the existing prepayment has not yet arrived.

In this case, to account for the loss, paragraph 1 of Art. 279 Tax Code of the Russian Federation.

Since the Tax Code of the Russian Federation does not contain special provisions for accounting for losses from the assignment of the right of claim for an advance paid by the buyer, we recommend that you, on the basis of paragraphs. 1, 2 p. 1 art. 21 of the Tax Code of the Russian Federation, seek information from the tax authority at the place of registration of the organization or for written clarification from the Ministry of Finance of Russia on this issue.

Accounting

In accordance with clause 70 of the Regulations on accounting and financial reporting in the Russian Federation, approved by order of the Ministry of Finance of Russia dated July 29, 1998 No. 34n, the organization creates reserves for doubtful debts in the event that receivables are recognized as doubtful with the amounts of reserves attributed to the financial results of the organization.

An organization's receivables are considered doubtful if they are not repaid or with a high degree of probability will not be repaid within the time limits established by the agreement and are not secured by appropriate guarantees.

At the same time, the reserve is created not only for doubtful debts in relation to settlements with other organizations and citizens for products, goods, works and services. Accounts receivable for advances issued to suppliers may also be considered doubtful.

According to clause 7 of PBU 9/99 “Income of the organization” and clause 11 of PBU 10/99 “Expenses of the organization”, proceeds from the sale of fixed assets and other assets other than cash, products, goods are recognized as other income, and expenses associated with their sale, disposal and other write-offs - other expenses.

In accordance with the Instructions for the application of the Chart of Accounts for accounting the financial and economic activities of organizations, approved by Order of the Ministry of Finance of Russia dated October 31, 2000 No. 94n, account 91 “Other income and expenses” is intended to summarize information on other income and expenses of the reporting period.

The following accounting entries are made in the accounting records of the original creditor (assignor) of the assignment of the right of claim:

Debit of account 76, subaccount “Settlements with a third party under an agreement on assignment of the right of claim” Credit of account 91, subaccount “Other income”

— recognition of income from the assignment of the right to claim debt;

Debit account 63 Credit account 60.22

— writing off the receivables of the equipment supplier using the previously created reserve for doubtful debts;

Debit of account 51 Credit of account 76, subaccount “Settlements with a third party under an agreement on assignment of claims”

— posting of funds received from a third party under an agreement for the assignment of claims;

Debit 99 Credit 91

— reflects the financial result (loss) from the assignment of the right of claim.

It should be noted that according to clause 10 of PBU 3/2006 “Accounting for assets and liabilities, the value of which is expressed in foreign currency,” the recalculation of funds received and issued in advances, prepayments, deposits after they are accepted for accounting due to changes in the exchange rate is not carried out.

GUARANTEE

Post: