It is not uncommon today for situations where the seller and buyer are in different cities or even countries. In this case, transportation may take several days and sometimes weeks. In this case, the seller’s responsibility is to draw up documents for the goods on the day they are sent. In this case, it turns out that the buyer will accept them on a completely different day, and maybe in another month. The transfer of ownership of the goods occurs at the time of shipment, but in this case the buyer has not actually received them yet, so accounting difficulties may arise. In this article we will look at how accounting of goods in transit occurs.

When carrying out transactions in accounting, it is recommended to use account 15 “Procurement/purchase of material assets”. If materials or raw materials are being transported, then sub-accounts are created for the specified account: “materials in transit”, “goods in transit” and “raw materials in transit”. Using account 15 is only possible for accounting for materials (goods) at accounting prices. However, you can retreat from this and take into account inventory items on 10 or 41 accounts at actual cost. Account 15 will only be used for goods in transit. The seller includes transportation costs in the price of the goods (41 invoices), or takes them into account separately in sales expenses (44 invoices).

In accounting, the supplier recognizes expenses from the sale of goods after ownership transfers to the buyer. Goods, the ownership of which is transferred at the moment of transfer of the goods from the seller to the recipient, are taken into account in account 45 until the ownership is transferred. When transferring the goods to the carrier, its value is written off from the credit of account 41 to the debit of account 45.

When transferring ownership of the goods to the buyer, the supplier must reflect the proceeds on the loan of account 90 (K90 subaccount “Revenue” D62) in the amount of the cost specified in the contract. At the same time, the cost of goods is reflected in expenses for ordinary activities (D90 subaccount 90.2 “Cost of sales” K45). Costs associated with the delivery of goods to the supplier are recognized in the seller's accounting as expenses for ordinary activities.

Supplier services at their cost are reflected in entry D44 “Sales expenses”

K60 “Settlements with suppliers and contractors.” Payments related to the delivery of goods to the buyer are written off by posting D90 K44 when recognizing revenue from the sale of goods. In the balance sheet, the cost of goods in transit is reflected in line 1210 “Inventories”.

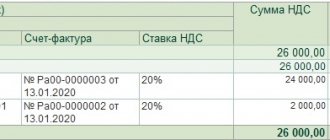

VAT upon shipment of goods

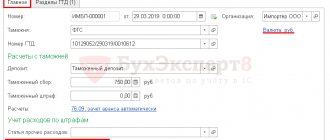

If goods are shipped in one tax period, and the ownership of the goods is transferred to the buyer in another period, then regardless of this, the supplier will have to charge VAT on shipment. The moment at which the tax base for calculating VAT is determined is the very first date: the date of shipment or the date of payment (partial payment). The date of shipment is the first date of drawing up the document, which is issued to the buyer or carrier. In case of sale of goods, an invoice is issued no later than 5 days from the date of shipment of the goods.

Accounting for transport costs (examples)

In practice, payment of transport costs for delivering goods and materials to the warehouse most often falls on the shoulders of the buyer. In this case, transportation can be carried out either by the seller using his own vehicles or with the involvement of third-party organizations, or by the buyer. Let's consider how the listed delivery methods are reflected in accounting.

Example 1

Kubanskoe LLC is engaged in the production of meat products and semi-finished products. The buyer Artek LLC purchased a batch of goods and materials in the amount of RUB 1,158,344. (including VAT RUB 193,057.33).

Situation 1. The buyer picks up the products himself, transportation costs are borne by the buyer.

Postings from the seller

| Dt | CT | Sum | Content |

| 62 | 90.1 | 1 158 344 | Implementation |

| 90.3 | 68 | 193 057,33 | VAT allocated |

| 90.2 | 43 | 883 147,46 | Product cost written off |

Postings from the buyer

To deliver goods and materials to the warehouse, she hired an intermediary company, the cost of which was 163,554 rubles. (including VAT RUB 27,259).

| Dt | CT | Sum | Calculation | Content |

| 41 | 60 | 965 286,67 | 1 158 344 – 193 057,33 | Capitalized |

| 19 | 60 | 193 057,33 | Input VAT allocated | |

| 41 | 60 | 136 295 | 163 554 – 27 259 | Capitalized |

| 19 | 60 | 27 259 | Input VAT allocated |

Let us recall that, according to clause 21 of FSBU 5/2019, when trading, organizations are allowed to include transport costs for the delivery of goods and materials to warehouse premises in business expenses. This situation is reflected in accounting by the entry Dt 44 Kt 60.

Micro-enterprises, except those that do not have the right to maintain simplified accounting, can recognize delivery costs as part of the costs of ordinary activities for the period in which they were incurred (clause 2 of FSBU 5/2019).

Situation 2. The seller delivers using its own vehicles.

Accounting with the seller

Delivery costs are highlighted in the sales contract.

We have our own fleet of vehicles, the cost of servicing which during the month is collected on the 23rd account “Auxiliary production”. At the end of the month, the 23rd account is closed at the 44th “Business expenses”.

| Dt | CT | Sum | Calculation | Operation | Document |

| 23 | 10 | 8 350 | fuels and lubricants | Request-invoice | |

| 23 | 70 | 42 500 | Salary of loaders, driver and forwarder | Payslip | |

| 23 | 69 | 14 152 | Contributions from payroll | ||

| 23 | 02 | 6 479 | Depreciation | ||

| 44 | 23 | 71 481 | TR included in sales expenses | ||

| 62 | 90.1 | 1 158 344 | Sale of goods and materials to the buyer | Torg-12 | |

| 90.3 | 68 | 193 057,33 | VAT allocated | Invoice | |

| 90.2 | 43 | 883 147,46 | Write-off of product costs | ||

| 62 | 90.1 | 85 777,20 | 71 481 + 20% | Transport services are assigned to the buyer | Certificate of completed work, TTN or TN |

| 90.3 | 68 | 14 296,20 | VAT charged | Invoice | |

| 90.2 | 44 | 71 481 | The cost of TR is written off |

Accounting for Artek LLC

| Dt | CT | Sum | Calculation | Content |

| 41 | 60 | 965 286,67 | 1 158 344 – 193 057,33 | Received MPZ from Kubanskoye LLC |

| 19 | 60 | 193 057,33 | Input VAT reflected | |

| 41 | 60 | 71 481 | 85 777,20 – 14 296,20 | Delivery services of Kubanskoe LLC have been capitalized |

| 19 | 60 | 14 296,20 | Input VAT allocated |

2.2. The cost of delivery is included in the price of the product and is not highlighted as a separate line in the sales contract.

| Dt | CT | Calculation | Sum | Operation |

| 23 | 10 | 8 350 | Write-off of fuels and lubricants | |

| 23 | 02 | 6 479 | Depreciation written off | |

| 23 | 70 | 42 500 | Remuneration for drivers, forwarders and loaders | |

| 23 | 69 | 14 152 | Salary contributions | |

| 44 | 23 | 71 481 | TR included in sales expenses | |

| 62 | 90.1 | (71 481 + 20%) + 1 158 344 | 1 244 121,20 | Sale of goods by Artek LLC, taking into account TR, which are included in the price for the buyer |

| 90.3 | 68 | 1 244 121,20 × 20 / 120 | 207 353,53 | VAT allocated |

| 90.2 | 43 | 883 147,46 | Closed cost of production | |

| 90.2 | 44 | 71 481 | Transport costs written off |

Accounting with the buyer

| Dt | CT | Sum | Calculation | Content |

| 41 | 60 | 1 053 128,46 | 1 244 121,20 – 207 353,53 | Capitalized |

| 19 | 60 | 207 353,53 | Input VAT allocated |

Situation 3. The seller hires an intermediary, Dostavka LLC, to transport goods and materials to the buyer. The amount of services amounted to 176,500.68 rubles. (including VAT RUB 29,416.78).

Accounting with the seller

| Dt | CT | Sum | Calculation | Content | Documentation |

| 44 | 60 | 147 083,90 | 176 500,68 – 29 416,78 | Services provided | Certificate of completed work from the carrier, waybill |

| 19 | 60 | 29 416,78 | Input VAT allocated | Invoice | |

| 62 | 90.1 | 1 158 344 | Sales of products of Artek LLC | TORG-12 | |

| 90.3 | 68 | 193 057,33 | VAT allocated | Invoice | |

| 90.2 | 43 | 883 147,46 | Product cost written off | ||

| 62 | 90.1 | 176 500,68 | Delivery is charged to the buyer | Certificate of completed work, TTN | |

| 90.3 | 68 | 29 416,78 | VAT allocated | Invoice | |

| 90.2 | 44 | 147 083,90 | Transport costs written off |

Accounting with the buyer

In this situation, the buyer’s accounting is similar to option 2.1 or 2.2, depending on whether the seller presents the amount of delivery costs to the buyer separately (2.1) or includes inventory items in the price (2.2).

Is it necessary to issue an invoice if the supplier re-invoices the costs of transport services for delivery of goods by a third party to the buyer? The answer to this question from 2nd class adviser to the State Civil Service of the Russian Federation A.G. You can look at Dyakonov in ConsultantPlus. Trial access to the system is provided free of charge.

Let us remind you that for tax purposes, TR profits are included in costs if there is an economic need and correctly executed primary documents (clause 1 of Article 252 of the Tax Code of the Russian Federation). Let's look at what documents accompany transportation costs.

Income tax when accounting for goods in transit

If the supplier uses the accrual method, then the date of recognition of income from sales is the date of transfer of ownership. Taxable income arises on the date on which the goods are transferred from the carrier to the buyer. At the same time, the supplier has the right to reduce the base for calculating the tax on the cost of products sold, as well as on the costs of delivering them to the buyer.

If the supplier uses the cash method of revenue recognition, then revenue is recognized on the date cash is received from customers. The very fact of transfer of goods in this case will not affect the procedure for recognizing income (

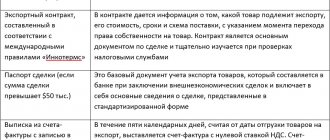

Goods in transit and uninvoiced deliveries - analysis of sales in UT 11.4

Let's consider two procurement schemes that appeared in version 11.4 of the 1C: Trade Management 11 configuration, in which receipt at the warehouse and transfer of ownership are separated in time

.

This need arises, for example, if documents from the supplier arrive earlier or later than the actual receipt of goods.

It is important not to confuse these situations with others:

“Quarantine” of goods

(yes, goods also have quarantine) - when we separate the received goods before they are checked, for example, by series, deadlines.

The classic situation, say, in pharmaceuticals - batches accepted into the warehouse, but not checked, receive the status of “quarantine”, physically this is either a colored label or a separate placement in the receiving area of the warehouse. Until the quarantine status is lifted, they cannot be shipped or moved. Only after checking the compliance of the batches / dates, these batches are transferred to the “good” status, and they themselves are first moved to the regular acceptance area and to standard storage locations.

However, already at the moment the goods are received for quarantine, ownership of it passes to us; in case of discrepancies, a report is drawn up and the erroneous batch is returned to the supplier.

In addition, this should not be confused with schemes with order warehouses . On the one hand, order warehouses separate financial and warehouse flows. But when using the order scheme, it is assumed that ownership of the goods and actual receipt occur simultaneously. In this case, goods are accepted by warehouse employees, where a receipt order for goods is created. And the financial service or accounting department reflects the invoice from the supplier.

And it would be even more ridiculous to confuse this with responsible storage

.

In general, be careful and careful in the wording of certifications and in communicating with clients

However, let’s return to the “Goods in transit” and “Uninvoiced deliveries” schemes.

To see how this works we need:

- Perform system settings

- Set up contracts with suppliers

- Complete a chain of documents.

Go!

Purchasing under the “Goods on the way” scheme

When should you use the “Goods in transit” scheme?

Everything is simple here - when documents have already been received from the supplier, but the goods have not yet arrived to us, that is, the ownership rights to the goods transferred to us before the goods arrived

.

The bottom line: we need to record obligations to the supplier, and also reflect that the goods are on the way.

To implement this scheme, you need to enter the following documents:

- Purchase of goods and services with the transaction type “Purchase from a supplier (goods in transit)” – obligations to the supplier are reflected.

- Receipt of goods to the warehouse – the actual receipt of goods is reflected.

Let's look at the video:

Timing of important stages of the video:

0:31 – setting up the “Goods in transit” scheme 0:58 – purchasing goods according to financial accounting, reflecting debt to the supplier 2:06 – setting up an agreement for the “Goods in transit” scheme 3:18 – analyzing goods in transit using reports 4 :13 – registration of goods receipt according to warehouse accounting data.

Purchasing under the “Uninvoiced Delivery” scheme

This scheme is necessary in the opposite situation - the goods have already arrived at our warehouse, but there are no supplier documents.

As a result, the goods are already with us, but the ownership of it has not yet transferred to us

.

The chain of documents is reversed here:

- Receipt of goods to the warehouse

- Purchase of goods and services with the transaction type Delivery invoice .

The nuance of this scheme is that when registering a receipt at the warehouse, the system requires you to indicate an order. Therefore, for this scheme you will have to create an order to the supplier.

Watch the video:

Timing of important stages of the video:

0:30 – setting up uninvoiced deliveries 0:42 – reflecting delivery invoices (receipt of goods without supplier documents) 2:18 – setting up an agreement for uninvoiced deliveries 3:00 – creating an order for uninvoiced deliveries 4:15 – reflecting supplier’s financial documents.

New course for preparing for 1C certification: Specialist Consultant

These video lessons are from the new course Preparation for certification 1C: Specialist consultant for the implementation of a standard solution 1C: Trade Management 11.4 .

The topics covered in the course will be useful not only in preparing for the exam, but also in real implementations of standard solutions UT 11, KA 2.4 and 1C:ERP 2.4.

Course description and lesson plan

- A complete analysis of all situations

of certification tickets. - Two end-to-end examples, tasks more complex than certification ones

. - Additionally – 30+ tasks for individual accounting areas

. - 24 training hours

of video. - Support for three months

. - For the April group – free second course of your choice

- For the April group – an additional month of support

Accounting for goods in transit by the supplier

When shipping goods from a warehouse, the supplier must issue a TORG-12 consignment note and an invoice; they are drawn up on the date of shipment of the goods. The carrier's representative must accept the goods at his warehouse and sign the invoice to confirm their receipt. On the date of shipment, the buyer must record the goods in accounting (D41 subaccount “Goods in transit” K60). At the same time, the VAT presented by the supplier is taken into account by another posting (D19 K60).

When the goods arrive at the buyer’s warehouse, they are transferred from subaccount 41 of the “Goods in transit” account to subaccount 41 of the “Goods in warehouses” account.

In accounting, goods are accepted at actual cost. The cost price is understood as the sum of the buyer's expenses for the purchase of goods, excluding VAT and other taxes subject to reimbursement. In this case, the buyer takes into account all the costs of transporting goods to the warehouse. At the same time, accounting defines 2 options for accounting for costs associated with the delivery of goods:

- As part of the actual cost (clause 6 of PBU 5/01). The wiring will be as follows:

- D41 K60 – for costs associated with the delivery of goods;

- D19 K60 – for VAT, which is presented for payment by the carrier.

- As part of sales expenses (clause 13 of PBU 5/01). In this case, the wiring will be as follows:

- D44 K60 – for costs associated with the delivery of goods;

- D19 K60 – for VAT, which is presented for payment by the carrier.

Important! The buyer must indicate in the accounting policy his chosen method of accounting for costs associated with the delivery of goods.

What are the shipping costs?

When determining transportation costs (hereinafter referred to as TR), companies should be guided by the following regulations:

- FSBU 5/2019 “Reserves”;

Since 2022, inventory accounting is regulated by the new FSBU 5/2019 “Inventories”, PBU 5/01 has become invalid. Some accounting rules have changed significantly. The changes were explained in detail by ConsultantPlus experts. Get trial access to the system for free and go to the Ready-made solution.

- All-Russian classifier of types of economic activities (approved by order of Rosstandart dated January 31, 2014 No. 14-st) - section “Transportation and storage”.

For example, TR may include:

- costs of loading materials into vehicles and transporting them;

- costs of remuneration and social needs of personnel involved in the procurement, purchase, delivery and maintenance of goods and materials to the company’s warehouses;

- payment of commissions to intermediary companies;

- costs of storing inventory items in third parties;

- losses (damage, damage, shortage) of goods and materials in transit;

- services of third-party transport and forwarding companies;

- loading and unloading services;

- cost of materials for maintaining vehicles;

- costs for labor and social needs of company employees performing loading and unloading operations, transportation of goods and materials, etc.

In trade enterprises, TR is charged to the 44th account “Business expenses”.

Postings for accounting for goods in transit

| Business transaction | Debit | Credit |

| Payment for goods (Cost of goods including VAT) | 62 | 51 |

| Ownership of the purchased goods has been obtained (Cost of goods excluding VAT) | 15 | 60 |

| VAT included | 19 | 60 |

| Transport services paid (Transportation cost) | 60 | 51 |

| Transport costs are included in the price of the goods (Transportation Cost) | 15 | 60 |

| VAT is calculated from the cost of transportation costs | 19 | 60 |

| The goods are capitalized at their actual cost (cost of goods without VAT + cost of transportation with VAT) | 41 | 15 |

Rationale

According to the official position expressed by the Russian Ministry of Finance, as long as the goods are in transit and not entered into the warehouse, amounts of “input” VAT are not deductible. There are judicial acts supporting this position. At the same time, there is another approach, confirmed by judicial practice, according to which an organization has the right to apply a deduction without waiting for the goods to actually arrive at the warehouse. For existing points of view on this issue, including a selection of judicial acts and letters from the Russian Ministry of Finance, see the extract from the Encyclopedia of Disputed Situations on VAT.

Extract from Ready-made solution: Is it possible to deduct VAT on goods in transit (ConsultantPlus, 2021)

VAT on goods on the way to deduction can be accepted if the ownership of them has already transferred to you. But there is a risk of a dispute with the tax authority.

One of the mandatory conditions for deduction is the acceptance of goods for registration (clause 1 of Article 172 of the Tax Code of the Russian Federation). At the same time, the Tax Code of the Russian Federation does not contain such a deduction condition as the receipt of goods at the warehouse.

Acceptance of a product for registration means reflecting its value on the accounting accounts. Moreover, you need to record goods when ownership of them has transferred to you, even if these goods are still on the way (this follows from clause 22 of FSBU 5/2019 “Inventories”).

Title may pass to you before the goods reach the warehouse. For example, if you deliver goods from the seller using your own transport or hire a carrier, then ownership will transfer on the day the seller transferred the goods to you or the carrier (clause 1 of article 223, clause 1 of article 224 of the Civil Code of the Russian Federation).

In this case, you can account for the goods on a self-entered subaccount “Goods in transit” to account 41 “Goods” or on account 15 “Procurement and acquisition of material assets” (Instructions for using the Chart of Accounts).

Thus, you can deduct “input” VAT on goods in transit if you own these goods, you have accepted them for accounting, you have a correctly executed invoice, delivery note and other mandatory conditions for deducting VAT have been met.

The Russian Ministry of Finance does not have a clear position on this issue. The Letter dated 03/04/2011 N 03-07-14/09 only says that goods must be registered on the basis of primary documents. There is no direct prohibition on deducting VAT on goods in transit in the Letter.

However, previously the Russian Ministry of Finance was clearly against deducting VAT on goods that had not yet arrived at the warehouse (Letter dated September 26, 2008 N 03-07-11/318).

Therefore, if you do not want disputes with the tax authority, wait until the goods arrive at the warehouse and then claim a deduction.

Extracted from Tax Guide. Encyclopedia of VAT disputes {ConsultantPlus}

3.3. Is it legal to apply a VAT deduction on goods in transit (not entered into a warehouse) (Clause 1, Article 172 of the Tax Code of the Russian Federation)?

In accordance with Art. 172 of the Tax Code of the Russian Federation, the taxpayer has the right to deduct VAT if there is an invoice after the goods are registered. The Russian Federation does not explain whether it is possible to register goods before they arrive at the warehouse and, accordingly, declare VAT for deduction.

There are two points of view on this issue.

The position of the Russian Ministry of Finance is as follows: while the goods are in transit and have not been posted to the warehouse, the deduction cannot be applied, even if there are corresponding invoices and delivery notes. There are judicial acts that express a similar opinion.

There are judicial acts according to which it is possible to deduct VAT on goods that are not entered into the warehouse.

Position 1. VAT cannot be deducted on goods that are not entered into the warehouse

Letter of the Ministry of Finance of Russia dated March 4, 2011 N 03-07-14/09

The financial department, considering the situation regarding the application of a deduction for goods that are in transit, clarified that VAT is deducted after the goods are accepted for registration on the basis of the relevant primary documents and invoices, provided that the goods are purchased for taxable transactions.

Resolution of the Arbitration Court of the Volga-Vyatka District dated 06/03/2015 N F01-1244/2015 in case N A43-6613/2014

The court found that the counterparty delivered the goods to the company in the first quarter, but the cargo was received by the taxpayer in the second quarter, which is confirmed by the warehouseman’s receipt of the goods.

The court indicated that the company did not have the right to deduct VAT in the first quarter, since one of the conditions for the legality of the tax deduction was not met (the goods were not recorded in accounting).

At the same time, the taxpayer’s argument regarding the terms of the additional agreement concluded with the counterparty, providing for the transfer of ownership of the goods to the buyer at the time of loading at the supplier’s warehouse, was rejected. The conditions established by law for the application of VAT deductions cannot be provided for (changed) by agreement of the parties within the framework of civil law relations.

Resolution of the Federal Antimonopoly Service of the North-Western District dated October 24, 2011 in case No. A05-11812/2010 (Determination of the Supreme Arbitration Court of the Russian Federation dated February 20, 2012 No. VAS-1760/12 refused to transfer this case to the Presidium of the Supreme Arbitration Court of the Russian Federation)

The court came to the conclusion that the deduction for goods not received was unlawful. At the same time, the court, referring to Art. Art. 223, 224, 458 of the Civil Code of the Russian Federation, indicated that since the goods were received in April 2008, the taxpayer could not take them into account and capitalize them in March 2008 and deduct VAT in the first quarter of 2008.

Position 2. For goods not entered into the warehouse, VAT can be deducted

Resolution of the Arbitration Court of the West Siberian District dated April 2, 2015 N F04-17463/2015 in case N A46-9189/2014

The court came to the conclusion that it was legal to deduct VAT on goods accepted for accounting but not received at the warehouse. The court also noted that documents confirming the receipt of goods at the warehouse are not included in the list of documents for granting the right to apply VAT deductions.

Contains similar conclusions:

- Resolution of the Federal Antimonopoly Service of the West Siberian District dated December 16, 2011 in case No. A27-353/2010

- Resolution of the Federal Antimonopoly Service of the North-Western District dated November 1, 2010 in case No. A52-3413/2009

The court found that, under the terms of supply contracts, ownership of the goods and all risks of its accidental loss or accidental damage pass to the taxpayer from the moment of delivery. In this case, the delivery date is considered to be the date of transfer of the goods to the carrier, indicated in the delivery note. Thus, the company accepted for accounting the goods in transit and lawfully applied the deduction in those tax periods in which the ownership of the products was transferred to the taxpayer.

Accounting in retail trade

Retail accounting is a little more complicated than wholesale, because by virtue of Order of the Ministry of Finance dated October 31, 2000 No. 94n, it is necessary to use account 42 “Trade margin” in your work. This is due to the fact that if goods are recorded at sales prices, it is necessary to highlight the markup, as well as possible discounts. The markup is formed by postings that look like this:

Dt 41 Kt 42.

On account 42, it is imperative to organize analytical accounting in order to be able to distinguish between markups on goods in retail organizations and on goods already sold to customers. The shipped margin is usually reversed as follows:

Dt 90, subaccount “Cost of sales” Kt 42.

In addition, in retail it is necessary to take into account selling costs. The corresponding accounting entries are as follows:

- Dt 44 Kt 60, 10, 70, 69, etc. - costs associated with sales;

- Dt 90, subaccount “Sales expenses” Kt 44 - write-off of expenses associated with sales.

At the end of the month, the accountant must display the profit based on the sales results and reflect it in the following way:

Dt 90, subaccount “Profit/loss from sales” Kt 99.

Accounting entries in retail trade with UTII differ from those given above only in the absence of VAT, and therefore the need to allocate it. The use of count 42 is mandatory.

Transport costs when purchasing goods

We will consider an accounting option for an organization that conducts trading activities.

Accounting for TRP (transportation and procurement costs) can be carried out using or without account 15 “Procurement and acquisition of material assets”, and can also be immediately included in the cost of goods or taken into account separately and only then written off to cost.

Trade management service MoySklad: acceptance and shipment of goods, movement, inventory, write-off. Cost calculation. Remains and turnovers. All the necessary basics. Free plan for one employee.

No installation required, accessible from any phone or tablet.

Try MySklad for free

Example 1. Delivery is immediately included in the cost.

SklaDebetorg LLC sells pet supplies. In July, the organization bought hamster cages for resale in the amount of 150,000 rubles (including VAT 25,000 rubles). Delivery of the cells cost 30,000 (including VAT 5,000 rubles).

Postings in the accounting of SklaDebetorg LLC:

- Debit 41 Credit 60 - the cost of the cells is taken into account: 125,000 rubles;

- Debit 19 Credit 60 - VAT - 25,000 rubles;

- Debit 41 Credit 60 - delivery taken into account - 25,000 rubles;

- Debit 19 Credit 60 - VAT on delivery - 5,000 rubles.

Note! If the company delivered several types of goods at once and it was necessary to distribute costs between them, this could be done in accordance with the provisions of the accounting policy. Options: in proportion to the cost of the product, its weight, quantity and in any other way specified in the UP.

If you use account 15 , then the postings will be as follows:

- Debit 15 Credit 60 - the cost of the cells is taken into account: 125,000 rubles;

- Debit 19 Credit 60 - VAT - 25,000 rubles;

- Debit 15 Credit 60 - delivery taken into account - 25,000 rubles;

- Debit 19 Credit 60 - VAT on delivery - 5,000 rubles.

- Debit 41 Credit 15 - goods were capitalized taking into account expenses.

Account 15 is usually used when accounting prices are used and deviations need to be taken into account. Deviations are reflected through account 16 “Deviation in the cost of material assets.” As a rule, these two accounts are not used in trading today.

Example 2. Delivery costs are taken into account separately.

Let’s take the same conditions as in example 1, but at the same time let the organization collect TRP in account 44 “Sales expenses”.

- Debit 41 Credit 60 - the cost of pet supplies is taken into account: 125,000 rubles;

- Debit 19 Credit 60 - VAT - 25,000 rubles;

- Debit 44 Credit 60 - delivery costs are reflected;

- Debit 19 Credit 60 - VAT on delivery - 5,000 rubles.

All goods and materials collected in account 44 must be proportionally distributed among the goods sold and remaining in the warehouse at the end of the month.

For calculations, it is convenient to use the formulas that are in the Tax Code (Article 320), and this way it is easier to bring together accounting and tax data:

Formula No. 1:

TRsp = TRnm TRdm - TRot

TRsp - TZR that need to be written off in the current month;

TRnm - balance of TZR at the beginning of the month;

TRdm - delivery costs for the month;

TRot - TZR attributable to the balance of goods at the end of the month.

To calculate the last indicator, Formula No. 2 :

TRot = Tot × SP

Tot - the cost of the balance of goods at the end of the month;

SP - average percentage, needed to calculate the amount of expenses related to the balance of goods.

And here you will need one (we promise - this is the last) Formula No. 3 :

SP = (TRnm TRdm) / (Tpm Tot) × 100%

TRnm - balance of TZR at the beginning of the month;

TRdm - delivery costs for the month;

TPM - the purchase price of goods sold during the month;

Tot is the cost of the balance of goods at the end of the month.

Costs collected on account 44 can be written off at the end of the month as cost - on account 90.

Debit 90-2 Credit 44

Accounting for absolutely any transactions with goods, starting with their purchase, delivery to the warehouse, and ending with further sale (retail, wholesale - it doesn’t matter) can be kept in the MyWarehouse service.

The program is integrated with marketplaces, CRM and other services, and allows you to manage the operation of retail outlets - stores, stalls, etc. - in real time. It is easy to connect retail equipment to My Warehouse, including an online cash register. You can count and sell labeled goods. Start working right now completely free of charge!

Try MySklad. Free plan with no time limits