Definition of a gift

There is no separate law on the issuance of New Year's gifts to children of employees and there is no specific definition of a gift. But in accordance with the Labor and Civil Codes, the following signs of a gift are established:

- monetary or other material value;

- transferred into ownership free of charge;

- as a remuneration not related or related to work activity (in connection with a memorable date or at the end of the year, for example).

In this case, the donor is the employer, and the recipient is the employee (Article 191 of the Labor Code of the Russian Federation). And although accounting and taxation of New Year's gifts for children of employees in 2022 are not specifically regulated by regulations, the general rules are clear from the interpretation of current legislation. In addition, regulatory authorities periodically publish explanations on the application of certain legal norms.

ConsultantPlus experts looked at how to arrange specific gifts:

- theater tickets;

- Gift certificates;

- for children;

- souvenirs for contractors.

Use these instructions and samples for free.

Taxation of gifts received from organizations

In accordance with paragraph 2 of Art. 572 of the Civil Code of the Russian Federation, a gift is recognized as a thing or property right transferred free of charge into the ownership of an individual. The donor side may include organizations and individual entrepreneurs who can give gifts, for example, to their employees, clients and potential buyers.

Moreover, in a number of cases, giving gifts entails the obligations of a tax agent for personal income tax and the need to pay tax on the value of the gift given.

According to the law, when determining the tax base for personal income tax, all income of an individual received by him both in cash and in kind, as well as income in the form of material benefits, are taken into account.

Income is recognized as an economic benefit in monetary or in-kind form, taken into account if it is possible to evaluate it and to the extent that such benefit can be assessed (Article 41 of the Tax Code of the Russian Federation). Gifts in this sense are no exception.

However, not all gifts are subject to personal income tax. Thus, gifts received to individuals from organizations and individual entrepreneurs whose value does not exceed 4,000 rubles are not taxed (clause 28 of article 217 of the Tax Code of the Russian Federation). Personal income tax is not paid on such gifts.

In this case, the value of a gift in an amount exceeding the established limit of 4,000 rubles is subject to taxation in accordance with the generally established procedure. That is, if an organization gives an individual more than 4,000 rubles, then the excess amount must be calculated and paid to the personal income tax budget.

Moreover, the threshold value of 4,000 rubles is considered for the tax period, that is, for the whole year. This means that souvenirs worth up to 4,000 rubles, one-time gifts to clients or potential buyers, are not taxed. When giving such gifts, the organization does not have the obligation to calculate, withhold and pay personal income tax.

If an organization gives an employee 2,000 rubles, say, by March 8, and on New Year’s Day (the same year) gives her another 4,000 rubles, then personal income tax on the gifts received will have to be paid in this case.

But the tax of 13% will not be calculated on the total amount of gifts (2,000 + 4,000), but on the amount that exceeds 4,000 rubles. In other words, in this case, the donor organization will have to pay personal income tax to the budget in the amount of 260 rubles (2,000 x 13%).

Gift decoration

Any decision of the employer in the organization is formalized by an administrative act. The Civil Code of the Russian Federation specifies how to register the purchase of sweet New Year's gifts in a budgetary institution, in commerce, in NGOs - by a separate order. In some cases, gifts are formalized by a gift agreement. In accordance with Art. 574 of the Civil Code of the Russian Federation, written form is required only if the donation is made by a legal entity and the value of the gift exceeds 4,000 rubles. An essential condition of such an agreement is its subject matter (Article 572 of the Civil Code of the Russian Federation). If there are many employees being gifted, the agreement is made multilateral (Article 154 of the Civil Code of the Russian Federation). Additionally, you will need to draw up a statement indicating that the issuance actually took place.

General instructions on how to purchase New Year's gifts for employees:

- Issue an order and familiarize employees with it under signature.

- Prepare a statement and present souvenirs.

- Conclude a gift agreement (if necessary).

For a simplified gift agreement, the following details are required:

- Title of the document;

- place and date of its compilation;

- information about the parties: employer and employee;

- subject of the agreement: description of the gift, its value, characteristics;

- signatures.

Free transfer

If valuables are transferred to the counterparty, for example, alcohol, sweets, souvenirs, toys, household appliances, then such expenses cannot be written off as advertising or entertainment expenses. There is a gratuitous transfer or, in other words, a donation.

The first step is to draw up an order for the purchase of gifts. It should indicate their quantity, types and cost. The transfer of gifts is formalized by an act for their write-off. If we are talking about a gift to an individual whose value is more than 3,000 rubles, then you need to draw up a written gift agreement and draw up a deed of transfer signed by the recipient.

Accounting for gifts in accounting

The delivery to employees is reflected in the account entry. 73. It is incorrect to use account 70: a New Year’s gift is not taken into account in the salary, since the gift is not related to the performance of work duties.

Acquisition

| Dt 10 Kt 60 | Purchase price taken into account |

| Dt 19 Kt 60 | Input VAT included |

| Dt 68 Kt 19 | Input VAT claimed for deduction |

There is another way to account for gifts in accounting - assign their value directly to the debit of account 91 without reflecting the acquisition on the account. 10. Accounting for acquired valuables for employees’ children is carried out on the balance sheet (for example, in account 012 “Gifts and other property”). This is explained by the fact that purchased materials are not recognized as an asset, since the organization does not expect to receive economic benefits from their use.

Issue

Here's how to make transactions for New Year's gifts for children or the employees themselves in the organization:

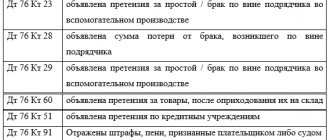

| Non-monetary | |

| Dt 73 Kt 41 (10, 43) | The transfer to the donee is reflected |

| Dt 91 Kt 73 | The cost is recognized as an expense. |

| Dt 91 Kt 68 | VAT charged on gratuitous transfer |

| Dt 70 Kt 68 | Personal income tax is withheld from the employee’s salary for donations over 4,000 rubles. |

| Dt 99 Kt 68 | A constant tax expense of 20% of the value of the gift is reflected, since such amounts are not accepted as expenses for income tax |

| Cash | |

| Dt 73 Kt 50 | Money issued from the cash register |

| Dt 91 Kt 73 | The cost is recognized as an expense. |

| Dt 70 Kt 68 | Personal income tax is withheld from the employee’s salary for donations over 4,000 rubles. |

| Dt 99 Kt 68 | A constant tax expense of 20% of the value of the gift is reflected |

According to accounting rules, if New Year's gifts were written off incorrectly, cancel the incorrect entry and make the correct accounting entry. Be sure to prepare a write-off act: it is documentary evidence of the transaction.

For public sector employees, different rules apply. The Ministry of Finance recommends that they be carried out according to KOSGU 349, accounted for as assets and immediately written off to account 040120272 (Order No. 209n dated November 29, 2017, letter No. 02-07-07/31230 dated April 26, 2019).

Registration of gifts in 1C: Accounting 8 ed. 3.0

The organization LLC "AvtoRemont" purchased gifts for the New Year for the most significant representatives (employees) of its business partners: Xiaomi thermal mugs in the amount of 50 pieces for a total amount of 59,000.00 rubles, including VAT 18% 9,000.00 rubles . Gifts were presented on December 24, 2022. The cost of one gift was 1,180 rubles, including VAT 18% 180.00 rubles.

According to the organization’s accounting policy, gifts for holidays are recorded in account 10.01 “Materials” before they are issued to recipients.

AvtoRemont LLC uses the general taxation system (GTS), the accrual method and PBU 18/02 (as amended).

| № | date | Operation | Dt | CT | Sum | Document 1C Create based on | Package of documents Incoming Outgoing Interior |

| 1 | Receipt of gifts to the warehouse | ||||||

| 1.1 | 03.12.2018 | Purchased gifts for business partners | 10.01 | 60.01 | 50 000,00 | Receipt (act, invoice) | Consignment note TORG-12 |

| 1.2 | 03.12.2018 | Input VAT included | 19.03 | 60.01 | 9 000,00 | ||

| 1.3 | 03.12.2018 | Input VAT is accepted for deduction | 68.02 | 19.03 | 9 000,00 | Invoice received Receipt (act, invoice) | Invoice |

| 2 | Presentation of gifts | ||||||

| 2.1 | 24.12.2018 | The cost of gifts issued is reflected in expenses | 91.02 BU - PR | 10.01 BU NU — | 50 000,00 50 000,00 50 000,00 | Free transfer Receipt (act, invoice) | Order (instruction) on the delivery of a gift Statement of accounting and transfer of gifts Accounting information |

| 2.2 | 24.12.2018 | VAT has been calculated on the gratuitous transfer of gifts | 91.02 BU PR | 68.02 BU - | 9 000,00 9 000,00 | ||

| 2.3 | 24.12.2018 | Invoice issued | — | — | 59 000,00 | Invoice issued | Invoice |

| 3 | Recognition of a permanent tax liability (PNO) | ||||||

| 3.1 | 31.12.2018 | A permanent tax liability (PNO) has been recognized in relation to the cost of gifts given (RUB 50,000.00 + RUB 9,000.00) x 20% | 99.02.3 | 68.04.2 | 11 800,00 | Regular operation “Calculation of income tax” as part of the “Month Closing” processing | Accounting information |

| 4 | Formation of tax reporting | ||||||

| 4.1 | 31.12.2018 | VAT declaration | — | — | — | Tax return for value added tax | VAT return |

| 5 | Formation of accounting (financial) statements | ||||||

| 5.1 | 31.12.2018 | Income statement | — | — | — | Financial statements | Financial statements |

Receipt of gifts to the warehouse

1.1. Gifts were purchased for business partners.

1.2. Input VAT included.

Document Receipt (act, invoice)

(Fig. 1):

- Section: Purchases – Receipts (acts, invoices)

. - Receipt

button .

Document transaction type – Goods (invoice)

. - Fill out the document:

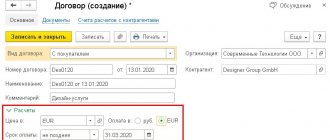

- Specify the counterparty, agreement, warehouse, check the accounting accounts and settlement terms using the link in the “Settlements” field.

- Fill out the tabular part of the document using the Add

: - in the Nomenclature

, select incoming gifts; when creating new elements, select the type of nomenclature “Materials” (if gifts are taken into account in account 10 “Materials”); - in the Accounting Account

and

VAT Account

, check that account 10.01 “Raw materials and materials” and account 19.03 “VAT on purchased inventories” are indicated; - fill in the remaining columns (quantity, price, amount, rate and VAT amount).

button .

Rice. 1

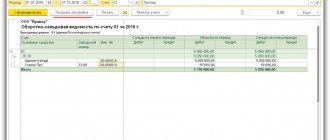

Click the button to see the result of document processing (Fig. 2).

Rice. 2

1.3. Input VAT is accepted for deduction.

Document Invoice received

(Fig. 3):

- In the receipt document, fill in the fields Invoice No.

and

from

, then click the

Register

(Fig. 1).

Invoice received

will be automatically created , the fields of the document will be filled with data from the base document, and a link to the created document will appear in the form of the base document. - Click the link to open the document Invoice received

.

Check that the document fields are filled in and the Reflect VAT deduction in the purchase book by date of receipt

.

If you clear the checkbox, the deduction is reflected in the regulatory document Formation of purchase ledger entries

.

Rice. 3

Click the button to see the result of document processing (Fig. 4).

Rice. 4

Presentation of gifts.

2.1. The cost of gifts issued is reflected in expenses.

2.2. VAT has been calculated on the gratuitous transfer of gifts.

Document Free transfer

(Fig. 5–6):

- The document can be:

- create on the basis of the document Receipt (deed, invoice)

, in this case, information about the transferred gifts, their quantity and accounting accounts will be automatically transferred to the document from the base document; - create as a new document (section Sales - Free transfer

).

.

button .

- the Recipient

field blank. - Specify the Warehouse

from which gifts are issued. - On the Products

, fill out the tabular part using the

Add

(Fig. 5): - in the Nomenclature

, select the gifts to be transferred; - indicate the number and price of gifts, VAT rate, and account.

(Fig. 6):

- in the fields Cost account

,

VAT account,

check the accounting account (account 91.02 “Other expenses” is entered by default); - in the Other income and expenses

field, the item of other income and expenses “Expenses for the transfer of goods (work, services) free of charge and for one’s own needs” is automatically indicated by default with the item type of the same name and the

Accepted for tax accounting

(Fig. 7).

- Carry out

button . - To print a request invoice for the release of gifts from the warehouse (form M-11) and an invoice for gratuitous transfer, use the Print

.

Rice. 5

Rice. 6

Rice. 7

Click the button to see the result of document processing (Fig. 8).

The cost of gifts and VAT calculated on the transfer of gifts are not included in expenses for the purposes of calculating income tax.

Postings to the debit of account HE.01.9 are for informational purposes only. On subaccounts NOT

“Income and expenses not taken into account for tax purposes” when posting some documents, amounts of expenses that are not accepted for tax accounting are reflected.

Rice. 8

2.3. An invoice has been issued.

Document Invoice issued

(Fig. 9):

- Click the Issue an invoice

in the

Gratuitous transfer

(Fig. 5).

Invoice issued

will be automatically created , its fields will be filled with data from the base document, and a link to the created document will appear in the form of the base document. - Using the link, open the document Invoice issued

and check the completion of its fields. - Operation type code

field is filled in automatically with the value “10”, which corresponds to the shipment (transfer) of goods (performance of work, provision of services), property rights free of charge in accordance with the Appendix to the order of the Federal Tax Service of Russia dated March 14, 2016 No. ММВ-7-3/ [email protected] - To print the invoice, use the Print

.

In the consolidated invoice for the gratuitous transfer of gifts, dashes will be placed in lines 6 “Buyer”, 6a “Address”, 6b “TIN/KPP of the buyer”. The invoice will be reflected in the sales book (section Reports – Sales book

). - The document does not generate transactions.

Rice. 9

Recognition of a permanent tax liability (PNO)

Processing Closing the month

(Fig. 10):

- Section Operations – Month Closing

. - Set the closing month (December 2022).

- Button Perform month closing

.

Rice. 10

3.1. A permanent tax liability (PNO) has been recognized in relation to the value of gifts given.

Regular operation “Calculation of income tax” as part of the processing “Closing the month” (Fig. 11): follow the link with the name of the regulatory operation Calculation of income tax

(Fig. 10) select

Show postings

and see the result of its execution (Fig. 11).

A permanent tax liability (PNO) has been recognized on the value of gifts and VAT calculated on gratuitous transfers (not included in expenses for calculating income tax) in the amount of 11,800.00 rubles: (50,000.00 rubles + 9,000.00 rubles. ) * tax rate 20% = RUB 11,800.00.

Rice. eleven

Formation of tax reporting

4.1. VAT declaration.

Report Tax return for value added tax

(Fig. 12):

- Section Reports – Regulated reports

. - The period for which the report is generated is the 4th quarter of 2018.

Line 010 of Section 3 of the VAT return reflects the tax base and the amount of tax calculated from the value of the gifts given.

Rice. 12

Gifts for clients

The transfer of something to third parties in itself is a gratuitous transfer subject to VAT and without reducing income tax on the cost of such transfer. If you want to take into account the costs of gifts to clients, tax accounting implies the inclusion of such costs as other expenses (clause 49, clause 1, article 264 of the Tax Code of the Russian Federation). But such expenses must be justified, including with documentation.

Fix in the local act the general criteria of the clients you want to retain as partners, since this is economically significant for the company. One of the methods of such retention is the periodic delivery of valuable gifts on holidays or dates specified in the local act.

Delivery of postcards to clients, costs for them (including envelopes) are taken into account as part of other expenses (clauses 24 and 25, clause 1, article 264 of the Tax Code of the Russian Federation, FAS in case No. A40-22927/12-107-106).

Obligation to pay VAT

The organization can deduct the input VAT indicated in the invoice of the gift seller on a general basis, regardless of the amount or the recipient.

For VAT payers, the transfer of a gift is recognized as a sale and is subject to VAT at a rate of 18% (Clause 1, Article 39, Paragraph 2, Clause 1, Clause 1, Article 146 of the Tax Code of the Russian Federation). The invoice is drawn up in a single copy and registered in the organization's sales book. The basis for calculating VAT is the cost of purchasing a gift (excluding VAT) or, if the gift is a product of the organization, its cost.

For “simplified” recipients, the transfer of a gift to an individual is taxed in accordance with the applicable taxation system. There is no obligation to subject this transaction to VAT and to issue an invoice.

Taxation

Income tax

Personal income tax on gifts is paid, but only on amounts over 4,000 rubles. This is the opinion of law enforcers, based on the interpretation of the norms of the Tax Code of the Russian Federation (clause 2, clause 2, article 211, clause 28, article 217 of the Tax Code of the Russian Federation, letter of the Ministry of Finance No. 03-04-06/16327 dated 05/08/2013). Not only material income, but also intangible income is subject to taxation.

Tax calculation:

- sum up the cost of all gifts and presents received during the reporting year;

- deduct a non-taxable amount of 4,000 rubles;

- We calculate the tax at a rate of 13% for residents and 30% for non-residents.

Withholding is made from cash payments on the day of issuance of the gift, transfer - no later than the next day, from intangible gifts - at the expense of the nearest cash payments, and the transfer is made no later than the day following the day of withholding.

Insurance premiums

Insurance premiums, regardless of the cost and type of gift, are not charged on gifts. This opinion of representatives of government agencies is based on clauses 1, 4 of Art. 420 Tax Code of the Russian Federation, clause 1, art. 20.1 of Law No. 125-FZ and set out in the letter of the Ministry of Finance dated December 4, 2017 No. 03-15-06/80448.

Value added tax

VAT is charged on gifts; the opinion of representatives of government agencies is based on paragraphs. 1 clause 1 art. 146 of the Tax Code of the Russian Federation and set out in letter of the Ministry of Finance No. 03-07-09/6171 dated 02/08/2016. Tax is calculated on the purchase price of the gift without VAT, and when donating the company’s own products - on its cost. The invoice is drawn up in a single copy for all gifts according to the statement. Input VAT can be deducted only if there is a supplier invoice (letter from the Ministry of Finance No. 03-07-11/61750 dated 08/15/2019 and No. 03-07-09/6171 dated 02/08/2016).

Income tax

Expenses in the form of the value of donated gifts and costs associated with their transfer are not taken into account for income tax purposes (clause 16 of Article 270 of the Tax Code of the Russian Federation). This statement is confirmed by the opinion of law enforcement officials. It is reflected in letter No. 03-03-06/1/653 dated 10/19/2010. Gifts are property transferred free of charge into the ownership of employees; their value should not be taken into account when calculating income tax. But if the souvenir is related to work activity, it is taken into account as expenses for income tax purposes (letter of the Ministry of Finance No. 03-04-06/6-329 dated November 22, 2012).

Key points about paying taxes and fees on gifts

We offer an easy-to-use table reflecting the basic rules for paying taxes and fees when donating valuables to employees.

| Financial responsibility | Gift to an employee within the framework of labor relations |

| Personal income tax | The non-taxable amount of the gift is 4,000 rubles per year. Gifts in excess of 4,000 rubles (increasing amounts at the end of the year) are taxed at a rate of 13% for residents and 30% for non-residents. |

| Insurance contributions, including pensions, health insurance and others | Not credited. |

| VAT | Accrued on the purchase price excluding VAT or on the cost price. |

| Income tax | If the gift is employment-related, it is expensed for profit purposes. And if a souvenir is presented simply for a holiday, then it is not taken into account in income tax expenses. |

What taxes arise

As a general rule, VAT follows income tax. This means that if a company does not take into account the costs of a corporate event for profit tax purposes, then VAT cannot be deducted. The reason is as follows: in this case, the conditions established in paragraph 2 of Art. 171 Tax Code of the Russian Federation.

If the company takes into account entertainment expenses, then value added tax is deducted within the established limit. The courts believe that the right to deduct VAT does not depend on the economic justification of expenses, but only on whether the taxpayer complied with the provisions of Art. 171 and 172 of the Tax Code of the Russian Federation on tax deductions, whether VAT was transferred to the budget.

In practice, it is difficult to prove the connection of economically unjustified expenses with the production activities of a company subject to VAT. Tax authorities may make claims. Therefore, the choice is up to the company - either act conservatively (not deduct VAT) or go to court.

When a company buys goods and transfers them to the event organizer (for example, food to a restaurant for preparing dinner), there is no VAT subject to taxation. There is no fact of sale of products within the meaning of Art. 39 of the Tax Code of the Russian Federation: the company does not transfer ownership of goods on a reimbursable basis. Therefore, there is no need to charge VAT on such an operation. The courts agree with the conclusion.

The courts have also repeatedly emphasized that there is no need to calculate VAT on the cost of a festive dinner organized for employees of an enterprise, since these transactions do not constitute sales.

The object of VAT taxation does not arise (Resolutions of the Federal Antimonopoly Service of the West Siberian District dated 04.03.2009 No. F04-1315/2009, FAS Northwestern District dated 11.12.2008 No. A56-19219/2008, FAS Ural District dated 05.09.2007 No. F09-7170 /07-С2).

At the same time, non-assessment of VAT deprives an organization of the right to deduct tax on goods, works, and services purchased for a corporate event (subclause 1, clause 2, article 171 of the Tax Code of the Russian Federation). It is also impossible to take into account “input” VAT for profit tax (clauses 1, 2 of Article 170 of the Tax Code of the Russian Federation).

A corporate holiday is not a production-oriented event, therefore it is impossible to take into account the expenses associated with it for taxation:

- they do not meet the requirements of paragraph 1 of Art. 252 of the Tax Code of the Russian Federation on the economic justification of costs (Letters of the Ministry of Finance dated September 11, 2006 No. 03-03-04/2/206, dated December 20, 2005 No. 03-03-04/1/430);

- these expenses can be qualified as made for the benefit of employees. And they are directly prohibited from being taken into account by clause 29 of Art. 270 Tax Code of the Russian Federation.

There will be no obligation to withhold personal income tax from employees on gifts received at a corporate party, since in order to calculate the tax, it is necessary to determine the amount of income of each of them. And the Ministry of Finance advises taking all possible measures for this (for example, in Letters dated 04/03/2013 No. 03-04-05/6-333, dated 03/06/2013 No. 03-04-06/6715). However, in the case of a corporate event, there is no opportunity to personalize the economic benefit, so the calculation is very difficult. Officials agree with this (Letter of the Ministry of Finance dated August 3, 2018 No. 03-04-06/55047).

It is necessary to withhold personal income tax if the event is an off-site event: payment for workers’ travel to the location of the corporate event, as well as accommodation there, are the workers’ income in kind (Letter of the Ministry of Finance dated 04/21/2017 No. 03-04-06/24140).

If a company excludes income from the tax base, the tax office may charge additional personal income tax. To prevent this from happening, measures must be taken to prevent claims from arising. In particular, the documents should not indicate the lists of those present at the corporate event, as well as the number of participants.

Taxation of children's gifts

Accounting and tax accounting of New Year's gifts for children of employees is carried out according to special rules:

- Personal income tax is calculated on the entire amount of gifts made to one employee, no matter whether they were intended for children or the employee himself. So, if a citizen received a gift on March 8 at a cost of 3,000 rubles, and then two New Year gifts for children worth 2,000 rubles each, personal income tax will have to be withheld from the amount of 3,000 rubles;

- insurance premiums are not charged on such gifts, especially since such gifts are in no way related to work activity and are neither remuneration nor any other encouraging gesture within the framework of labor relations;

- When calculating income tax, company expenses for purchasing gifts for children are not taken into account;

- Similar to the general rule, value added tax is charged on the purchase price of things that act as gifts to the children of employees, excluding VAT. When donating your own products, the cost of such an item is taken into account for tax purposes.

The registration of such gifts is carried out in a similar way: with the issuance of an order and the preparation of a statement on the transfer of gifts. The statement is signed by parents receiving valuables for their children.

Gifts to contractors

Option A

Here you will need documents: an agreement for the production of promotional products with the logo or name of your company and an order for the distribution of gifts for advertising purposes to suppliers, customers, and business partners.

If the gift is more expensive than 3,000 rubles, then you need to conclude a gift agreement in writing, the Civil Code insists on this. But even if it is cheaper, the contract is still worth drawing up, as there will be fewer questions from the tax office. And gifts to legal entities over RUB 3,000 are completely prohibited.

If the cost of gifts from the beginning of the year per person is more than 4,000 rubles, it is necessary to calculate personal income tax. Since this person is not your employee, it is impossible to withhold personal income tax; you must notify the tax office about this.

If gifts are given during an advertising campaign, then insurance premiums do not arise because there is no employment relationship with the recipients.

To reduce income tax on the general taxation system, expenses for gifts can be taken into account, but only within 1% of revenue.

VAT is charged on the cost of production or purchase of gifts without VAT, and if you give your own products, then on its cost. Make one copy of the invoice for all gifts. VAT can be deducted for the production of such gifts in the general manner, that is, you need not only to receive and account for the goods, but also to receive an invoice from the supplier for raw materials or components, and, of course, to be a VAT payer. Therefore, to reduce tax, purchase gifts from those who are on OSNO.

Using the simplified tax system “Income minus expenses”, you can also take into account expenses to reduce tax, also within 1%.

Option B Documents: an agreement for the production of promotional products with the logo or name of your company and an order for the distribution of gifts for advertising purposes - everything is as in the previous case.

Personal income tax: does not arise, but remember that the limit for each individual is calculated from the beginning of the year.

Insurance premiums: do not arise.

Income tax under OSNO: costs can be taken into account within 1% of revenue.

VAT under OSNO: if the gift is not more than 100 ₽, then it is not charged, but it cannot be deducted from the cost of production.

Tax under the simplified tax system “Income minus expenses”: expenses can be taken into account within 1% of revenue.

Option C

Let's face it - organizing an advertising campaign and handing out gifts without a logo is quite strange. It will not be possible to take such expenses into account; the tax office may have questions. Maybe we should limit the circle of people?

Documents: conclude gift agreements.

Personal income tax: personal income tax must be calculated for amounts greater than 4,000 rubles; the limit is calculated for all gifts from the beginning of the year. It is impossible to withhold personal income tax because this is not your employee. Don't forget to notify the tax office. Let us remind you that gifts to legal entities exceeding RUB 3,000 are prohibited.

Insurance premiums: no.

Income tax under OSNO: such expenses are not taken into account when calculating tax.

VAT under OSNO: is charged on the cost of making or purchasing gifts without VAT, and if you give your own products - on its cost. Make one copy of the invoice for all gifts. VAT on the production of such gifts is accepted for deduction in the general manner.

Tax under the simplified tax system: cannot be taken into account in expenses.

Option D

Such gifts are prohibited by the Civil Code of the Russian Federation.

Option E

Documents: to confirm entertainment expenses, you need to prepare several documents, otherwise the tax office will have questions:

1) Order on holding a representative event - indicating the purpose of the event and the employees of the organization who must participate in it;

2) Estimate of entertainment expenses - indicate the price of souvenirs;

3) Agreement for the production of souvenir products, primary documents for its transfer and write-off - invoice, delivery note, act;

4) Act on the implementation of entertainment expenses - it must indicate the actual expenses;

5) A report on the event, indicating the purpose and results.

Personal income tax: for amounts greater than RUB 4,000, personal income tax must be calculated. The limit is calculated for all gifts from the beginning of the year. It is impossible to withhold personal income tax because this is not your employee - do not forget to notify the tax office about this. When making a gift to a legal entity, personal income tax does not arise, but remember - gifts exceeding 3,000 rubles are prohibited in this case as well.

Insurance premiums: no.

Income tax under OSNO: there is a good chance to take expenses into account as entertainment expenses. The Ministry of Finance does not agree with this position, but the courts usually support taxpayers. The main thing is not to go beyond the limit (no more than 4% of labor costs) and follow the tax authorities’ explanations.

VAT under OSNO on such gifts is charged on their purchase price excluding VAT and is deductible only from the normative part of expenses, which can be taken into account when calculating income tax - this is 4% of labor costs.

Simplified tax system: it will not be possible to take it into account in expenses and reduce tax.

Option F

Documents: issue an order, distribute gifts according to the list. For gifts over 3,000 rubles, draw up a gift agreement.

Personal income tax: personal income tax must be calculated for amounts greater than 4,000 rubles; the limit is calculated for all gifts from the beginning of the year. It is impossible to withhold personal income tax because this is not your employee - do not forget to notify the tax office. If you give it to a legal entity, then personal income tax will not arise, but remember - no more than 3,000 rubles.

Insurance premiums: no.

Income tax under OSNO: such expenses cannot be taken into account.

VAT under OSNO: add on the purchase price of gifts without VAT, and if you are giving your own products, on their cost. Deduct VAT on the purchase or production of such gifts in the general manner.

Tax under the simplified tax system: it will also not be possible to take it into account.

We've sorted out the contractors, let's move on to the employees

Related documents

In addition to the act of writing off gifts, the manager or other person organizing the holiday must draw up and submit for signature:

- Leader's order.

- Event program.

- List of participants at the gala lunch or dinner (if one is planned).

- Cost estimate for carrying out. It is first transmitted to the company's accounting department.

- List of gifts. The main part of it is a table with a list of recipients and their signatures. The statement is the basis for drawing up an act for writing off gifts.

Only after legally competent preparation of this documentation can you begin to draw up an act.