The release of materials from warehouse storage is carried out in different directions: for production, for household needs, for sale. Inventory and materials can also be transferred to third party contractors free of charge.

Accounting for supply of inventory items is carried out according to the rules of PBU 5/1. The movement of inventory items, both internal and external, occurs constantly. The task of the accounting service is to accurately and fully take into account movements in order to avoid warehouse shortages.

How to write off materials when used ?

Accounting methods for inventory items

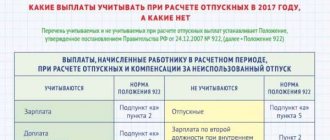

When releasing materials from the warehouse, in addition to quantitative valuation, valuation is used. In accounting, there are several methods for calculating estimated indicators:

- At average cost. When applying this method, first the cost of a certain group of material (or type) at the beginning of the month is added to the cost of received inventory items. The quantity by group or type is also summed up. By dividing the first amount by the second, the average cost of a unit of inventory is determined. Next, the number of units written off per month is multiplied by this average cost and the amount to be written off is obtained. This is how materials that are similar in properties and usage characteristics are written off.

- FIFO. This method assumes that inventory items are used sequentially, in the order in which they are received at the warehouse. Next, the materials that were the first to be transferred, for example, to production, are valued at the cost of the first goods and materials received at the warehouse, taking into account their balance in the warehouse: first, the quantity is written off at the cost of the balance, then the remaining unwritten quantity is written off at the cost of the first batch, then, if necessary, the second and etc. The remaining materials are assessed at the cost of the last received batch. FIFO is used when there are relatively stable prices for inventory items.

- Based on unit cost of inventory items. The method is used to account for particularly valuable items or hazardous substances and consists of recording each receipt of such materials. Upon release, the same price applies as upon arrival at the warehouse. The method is also used for small volumes of warehouse operations.

What documents are used to document the internal movement and release of materials into production ?

the write-off of construction materials in accounting ?

On a note! The LIFO method is the opposite in meaning to the method, i.e. according to the cost of the last received batch, then the penultimate one, etc. FIFO has lost its importance today, since its use is justified in conditions of high inflation.

The essence of the concept of “goods”

Definition 1

Goods are inventory items intended for their further sale, i.e. not limited in circulation.

It is worth noting that, according to regulatory documents and acts, goods are included in inventories, as a result of which operations with them are regulated by relevant documents.

Issues of documenting and reflecting in the accounting records of a business unit issuing goods from a warehouse at the level of legislative and legal acts are regulated in accordance with Federal Law-402 “On Accounting”. We have already completed an essay

The purpose, objectives and content of the Federal Law “On Accounting” No. 402-FZ in more detail, PBU 5/01 “Accounting for inventories”, Guidelines for accounting of inventories On this topic we have already completed an

abstract

The concept and types of accounting accounting entries in more detail, which were developed and approved by the Ministry of Finance of the Russian Federation by order No. 119n.

Are you an expert in this subject area? We invite you to become the author of the Directory Working Conditions

Documentation

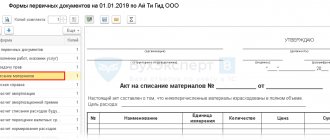

An organization can use standardized forms of documentation to record the disposal of materials from a warehouse, or it can use independently developed forms. Their presence is reflected in the accounting policies.

Unified forms of primary documents for the release of goods and materials for production needs are:

- limit-fence card (according to f. M-8);

- demand-invoice (according to Form M-11);

- invoice (form M-15);

- invoice for internal movement (form TORG-13 or a form developed by the organization).

All forms are standard and can be used regardless of the industry.

Documents confirming other disposals from the warehouse (for example, gratuitous transfer, write-off of shortages, damage, theft) can serve as various acts for the write-off of MC, signed by members of a commission created in the organization, TTN, applications for leave to the outside.

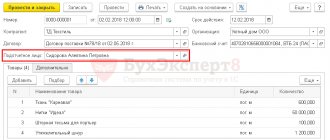

The sale of goods and materials is formalized taking into account the applicable taxation system, the specifics of current legislative acts, etc. The release to buyers, legal entities or individuals, is carried out on the basis of contracts with them. An invoice is issued for the release of goods and materials to the third party, and, if necessary, an invoice and other documents for sale. Transportation of goods and materials from the warehouse is issued by TTN.

Account correspondence

Postings are generated depending on the purpose of the release of materials from the warehouse.

For production and management purposes:

- Dt 20, 23, 29 Kt 10 - materials were transferred to the main, auxiliary, and service production.

- Dt 25, 26 Kt 10 – materials were transferred for general production and general economic needs.

- Dt 10 Kt 10 – internal movement of goods and materials from the warehouse to the storerooms of departments, workshops, and production facilities.

Other write-offs:

- Dt 94 Kt 10 - materials were written off based on the commission’s report.

- Dt 20, 23, 29, 25, 26 Kt 94 - amounts are attributed to the expenses of production - main, auxiliary, servicing, maintenance and experimental work (these entries reflect disposal due to shortages, losses, spoilage within the limits of natural loss norms).

- Dt 73/2 Kt 94 - the shortage is attributed to the guilty persons (above the natural loss norms).

- Dt 50, 70 Kt 73/2 - the guilty person repaid the debt by depositing the amount into the cash register or deducting it from wages.

- Dt 91/2 Kt 68 – VAT, previously presented for deduction on goods and materials, was restored for shortages in excess of the norms of natural loss.

- Dt 91/2 Kt 94 - if inventory items are lost in excess of the norms of natural loss, but there is no possibility of recovering the cost from the culprits (the culprit has not been identified or has been acquitted in court).

The gratuitous transfer of goods and materials is attributed to Dt 91/2 , and loss due to force majeure, natural disasters - to Dt 99, with Kt 10. In this case, it is necessary to restore VAT with a posting similar to the one above.

Implementation:

- Dt 91/2 Kt 10 – disposal from the warehouse.

- Dt 62 Kt 90/1 (with VAT), Dt 91/2 Kt 68 – the sale of inventory items and VAT on them is recorded.

- Dt 50.51 Kt 62 - the buyer paid for the materials.

If there is an advance payment, then:

- Dt 50, 51 Kt 62/2 – the prepayment amount is reflected.

- Dt 76 Kt 68 – VAT is charged on prepayment.

- Dt 91/2 Kt 10 – disposal from the warehouse.

- Dt 62/1 Kt 91/1, (with VAT), Dt 91/2 Kt 68 – the sale of inventory items and VAT on them is recorded.

- Dt 62/1 Kt 62/2 – offset of prepayment for inventory items.

- Dt 68 Kt 76 – crediting VAT on the repaid prepayment amount.

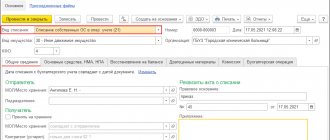

Tax accounting

The write-off of materials for production is involved in the formation of costs for NU purposes (Article 318-1 of the Tax Code of the Russian Federation).

If materials from the warehouse are not immediately written off for production, but are transferred to responsible persons in workshops or departments (their internal movement occurs), then there is no need to rush to write them off to production accounts. This may lead to an overestimation of the costs of the current period and raise questions from officials of the fiscal authority during the next audit, if the basis of the NU is accounting indicators.

In this case, it is also advisable to draw up a statement of expenditure of goods and materials, which directly reflects the expenditure in production - as a justification for costs for the Federal Tax Service.

An act may not be drawn up if the limit card or other vacation documents indicate that inventory items will be used immediately (for example, writing instruments in the accounting department).

However, many organizations use an approach in which they always draw up the specified document, regardless of whether the purpose of the vacation is indicated in the primary vacation documents or not. It is recognized as the safest from the point of view of tax audits and claims from Federal Tax Service officials.

The gratuitous transfer of goods and materials is subject to value added tax under Art. 146-1 Tax Code of the Russian Federation.

Results

Inventory and materials are written off from the warehouse at a cost calculated depending on the method used: FIFO, at unit cost or at average cost.

Postings are formed depending on the nature of the movement of materials - internal or external.

For the purposes of NU, it is advisable to document the consumption of materials with a certificate of consumption of goods and materials. The use of this document excludes overestimation of costs for materials in calculations based on the results of the month, and, consequently, claims from the Federal Tax Service.

For accounting purposes, write-offs are recorded using both unified forms of primary documents and those developed by the organization independently.

Storage in a warehouse

One type of storage is storage in a commodity warehouse, and in the Civil Code of the Russian Federation this type of storage is regulated by Articles 907 - 918.

In accordance with Article 907 of the Civil Code of the Russian Federation, a commodity warehouse is an organization that carries out the storage of goods as a business activity and provides services related to storage. A warehousing agreement is a paid agreement. According to it, a professional custodian, who has the necessary equipment and staff, which in this case will be a warehouse, undertakes to accept goods from the bailor for a fee, store them and return these goods safely.

A wide variety of goods are intended for storage in commodity warehouses and, as a rule, each warehouse is equipped with equipment designed for storing a certain type of goods.

One type of warehouse is a public warehouse. A storage agreement concluded by a public goods warehouse is recognized as a public contract. This means that a public warehouse must accept goods for storage from each bailor who applies to it, and does not have the right to give preference to one bailor over another, except in cases established by law and other legal acts. Refusal to conclude a storage agreement is not allowed, except in cases where the custodian does not have the necessary equipment to store any type of goods; for example, an oil storage facility will not be able to conclude an agreement for the storage of grain, since it will not be able to ensure its safety. The remuneration for storage should be the same for all depositors.

A feature of storage in a commodity warehouse is the inspection of goods by the warehouse upon receipt and during storage.

Inspection of goods, determination of their quantity and external condition in accordance with Article 909 of the Civil Code of the Russian Federation are the responsibility of the warehouse, unless otherwise provided by the contract, and such inspection is carried out at the expense of the custodian. Inspection by the custodian of goods when they are transferred for storage is important to determine the degree of culpability of the custodian in the event of loss or damage to goods during storage.

The responsibility of the warehouse is also to provide the goods owner with the opportunity to inspect goods during storage or samples of goods if storage is de-identified, take samples and take the necessary measures for the safety of goods.

In accordance with the general provisions on storage, if it is necessary to change the conditions of storage of goods, the bailee is obliged to immediately notify the bailor. When stored in a warehouse in accordance with Article 909 of the Civil Code of the Russian Federation, to ensure the safety of goods, the custodian has the right to independently decide to change the storage conditions. The obligation to notify the goods owner occurs if a significant change in storage conditions is required.

When storing goods, damage to the goods may occur not only within the normal limits of damage, but also beyond these limits and the limits agreed upon in the contract. In this case, the warehouse is obliged to immediately draw up a damage report and notify the goods owner on the same day.

If, upon receipt of goods at the warehouse, inspection of the goods and checking their quantity are the responsibility of the warehouse, then when returning the goods to the owner, both the warehouse and the goods owner have the right to demand inspection of the goods and verification of their quantity, and the costs are borne by the party that requested the inspection or verification of the quality of the goods.

If neither party has expressed its desire to inspect the goods and check its quality, and these actions have not been taken, a statement of shortage or damage to the goods due to improper storage is made to the warehouse in writing upon receipt of the goods or within three days, if the shortage or damage could not be detected by the usual method of receiving the goods. If the owner of the goods does not make a statement to the custodian within the specified period, it is considered that the goods are returned in accordance with the terms of the contract.

Let's stop at the conclusion of the contract. The warehouse and the depositor, who transfers the goods for storage, enter into an agreement, the written form of which is considered complied with if the conclusion of the agreement and the acceptance of the goods for storage are certified by a warehouse document. The types of warehouse documents are given in Article 912 of the Civil Code of the Russian Federation:

- double warehouse receipt;

- simple warehouse receipt;

- warehouse receipt.

A double warehouse receipt consists of two parts - a warehouse receipt and a pledge certificate (warrant), which are separated from each other. In accordance with Article 913, in each part of the double warehouse receipt, the following is indicated:

- name and location of the warehouse that accepted the goods for storage;

- current warehouse receipt number;

- the name of the legal entity or citizen who is the bailor, as well as the location of the owner of the goods;

- name of the accepted product, its quantity indicating the number of units and (or) measure of the product;

- the shelf life of the goods or an indication that the goods are stored until required;

- the amount of remuneration or the tariffs on the basis of which it is determined, the payment procedure;

- date of issue of the warehouse receipt.

Both parts of the document must have identical signatures of the authorized person and the seal of the warehouse. A document that does not contain the necessary details, signatures and seals is considered invalid.

A simple warehouse receipt based on Article 917 of the Civil Code of the Russian Federation consists of one document issued to bearer and must contain the same details as a double warehouse receipt, except for the name of the legal entity or citizen who is the depositor, as well as the location of the owner of the goods. The document must indicate that it is issued to bearer. A document that does not contain the necessary details, signatures and seals is not a simple warehouse receipt.

A warehouse receipt or warehouse receipt is a document handed over by the warehouse to the depositor and confirming the acceptance of goods for storage for a certain period and for a specified fee for the goods specified in it. A warehouse certificate is issued either to the owner of the goods himself or to a person acting under a duly executed power of attorney.

According to paragraph 3 of Article 912 of the Civil Code of the Russian Federation, a double warehouse receipt, each of its two parts, as well as a simple warehouse receipt are securities. The definition of a security is contained in Article 142 of the Civil Code of the Russian Federation. In accordance with it, a security is a document certifying, in compliance with the established form and mandatory details, property rights, the exercise and transfer of which is possible only upon presentation. With the transfer of a security, all rights certified by it are transferred in the aggregate (Article 142 of the Civil Code).

Goods accepted for storage under a double or simple warehouse certificate may be subject to collateral during its storage by pledging the corresponding certificate.

Article 914 of the Civil Code of the Russian Federation defines the rights of holders of warehouse and pledge certificates, and these documents can be held by one person or by different persons. The rights of the holders of these documents are different.

The holder of the warehouse receipt has the right to dispose of the goods, but the goods themselves continue to remain in the warehouse and cannot be taken from there until the loan issued under the pledge certificate is repaid. The transfer of the warehouse receipt to the new holder is carried out by an endorsement called an endorsement.

The holder of the pledge certificate, if he is not the same person as the holder of the warehouse receipt, has the right to pledge the goods in the amount of the loan issued under the pledge certificate and interest on it. When pledging goods, an endorsement is also made on the warehouse receipt.

The holder of the pledge and warehouse certificate has the right to dispose of the goods stored in the warehouse in full.

A double warehouse receipt and each of its parts, in accordance with subparagraph 3 of paragraph 1 of Article 145 of the Civil Code of the Russian Federation, are order securities, since the rights certified by them may belong to the person named in the security, as well as to another authorized person appointed by this person.

We have already mentioned that rights under an order security are transferred by making an endorsement on it. The person who transferred the order security is called the endorser, and is responsible not only for the existence of the right, but also for its implementation. The person to whom the security is transferred is called the endorser.

According to paragraph 3 of Article 146 of the Civil Code of the Russian Federation, endorsement can be:

- blank, i.e. without specifying the person to whom the execution should be made;

- order, i.e. indicating the person to whom or whose order the execution should be carried out.

An endorsement may be limited only to an instruction to exercise the rights certified by a security, without transferring these rights to the endorsee (authentic endorsement). In this case, the endorsee acts as a representative.

Goods can be released from the warehouse:

- to the holder of the warehouse and pledge certificates, and issuance is made only in exchange for both of these certificates together. The holder has the right to demand the release of the goods in parts, in this case the warehouse issues him new certificates for the goods that remain in the warehouse.

- to the holder of a warehouse receipt who does not have a pledge certificate, but who has paid the amount of the debt under it. The goods are issued in exchange for a warehouse certificate, while its holder must simultaneously submit a receipt for payment of the entire amount of the debt under the warehouse certificate. If a goods warehouse has released the goods to the holder of a warehouse certificate who does not have a certificate of pledge and has not paid the amount of debt under it, he is liable to the holder of the certificate of pledge for payment of the entire amount under it.

In accordance with Article 918 of the Civil Code of the Russian Federation, a warehouse may dispose of goods deposited with it for storage, unless this is provided for by law, other legal acts or storage agreement. In this case, the relations of the parties are regulated by Chapter 42 of the Civil Code of the Russian Federation on loans, however, the time and place of return of goods are determined in accordance with the rules applied to storage agreements.

Having examined the legal basis for storage in commodity warehouses, we know that in accordance with Article 912 of the Civil Code of the Russian Federation, the acceptance of commodity valuables for storage is confirmed by the issuance by the custodian to the depositor of a double warehouse receipt, a simple warehouse receipt or a warehouse receipt.

In accounting, the movement of these documents is documented by acts of acceptance and transfer from both the depositor, the buyer of the valuables transferred for storage, and the creditor. It should be noted that under a storage agreement with the issuance of a double warehouse certificate, if the warehouse certificate and the pledge certificate are separated from each other, the acceptance and transfer acts are drawn up separately. Acceptance and transfer certificates must contain all the necessary details established by Article 9 of the Federal Law of November 21, 1996. No. 129-FZ “On Accounting”.

Unified forms of primary accounting documents used to reflect transactions on the transfer of property to the custodian, as well as transactions on the return of this property to the depositor, were approved by the Resolution of the State Statistics Committee of the Russian Federation dated August 9, 1999. No. 66.

When transferring property for storage, the unified form No. MX-1 is used.

When returning property to the depositor, the unified form No. MX-3 is used.

Reflection of transactions with the custodian

The custodian must keep records of material assets accepted for storage in off-balance sheet account 002 “Inventory assets accepted for safekeeping.” Analytical accounting for this account must be organized by depositors, types of property transferred for storage, and storage locations.

Alliance LLC, a professional custodian, provided refrigerator storage services to a legal entity in January 2004. The cost of storage services amounted to 9,440 rubles, incl. VAT 1,440 rub. The custodian's expenses amounted to 6,000 rubles.

In the accounting of Alliance LLC, this operation will be reflected in the following account correspondence:

Debit 002 “Material assets accepted for safekeeping”

80,000 rub. – reflects the contractual value of the property accepted for storage

Debit 62 “Settlements with buyers and customers”

Credit 90 “Sales” subaccount “Revenue”

RUB 9,440 – revenue for storage of the bailor’s property is reflected

Debit 90 “Sales” subaccount “Value added tax”

Credit 68 Calculations for taxes and fees" subaccount "Calculations for VAT"

RUB 1,440 – VAT charged

Debit 90 “Sales” subaccount “Cost of sales”

Credit 20 “Main production”, 25 “General production expenses”, 26 “General operating expenses”

6,000 rub. – actual costs of the custodian are reflected

Debit 90 “Sales” subaccount “Profit (loss) from sales”

Credit 99 “Profits and losses”

2,000 rub. – reflects the financial result from property storage services

Debit 51 “Current account”

Credit 62 “Settlements with buyers and customers”

— 9,440 rub. – revenue received for storage services

Credit 002 “Inventory assets accepted for safekeeping”

— 80,000 rub. – the property accepted for storage is returned to the bailor

Reflection of transactions with the bailor

The depositor must keep records of property transferred for storage in accounts intended for accounting for this property, in the appropriate sub-accounts, and analytical accounting must be organized in such a way as to ensure accounting of property at storage locations in its own warehouses, as well as in warehouses of third-party organizations.

In accordance with paragraph 7 of Article 167 of the Tax Code of the Russian Federation, when selling goods transferred by a warehouse under a warehouse storage agreement with the issuance of a warehouse certificate, the date of sale is defined as the day the warehouse certificate is sold.

Storage of property certified by a double warehouse certificate

Azimuth LLC, which produces household appliances, transferred a batch of refrigerators for storage to Alliance LLC, a professional custodian. The custodian issued a double warehouse receipt to Azimut LLC. The actual cost of the batch of refrigerators transferred for storage amounted to 800,000 rubles.

The selling price of refrigerators under the purchase and sale agreement is RUB 1,038,400. (including VAT RUB 158,400). The manufacturer of refrigerators, who is also the depositor, handed over the warehouse certificate to the buyer, having drawn up a transfer and acceptance certificate.

Azimuth LLC received a short-term loan in the amount of RUB 1,038,400 by providing the lender with a certificate of collateral.

These transactions will be reflected in the accounting of Azimut LLC as follows:

Debit 43 “Finished products” subaccount “Products in the warehouse of Alliance LLC”

Credit 43 “Finished products” subaccount “Products in our own warehouse”

800,000 rub. – reflects the cost of products transferred for storage

Debit 51 “Current account”

Credit 66 “Settlements for short-term loans and borrowings”

RUB 1,038,400 – the loan amount has been credited to the current account

Debit 009 “Collateral for obligations and payments issued”

— 1,038,400 rub. – the amount of the transferred pledge certificate is reflected

Debit 62 “Settlements with buyers and customers”

Credit 90 “Sales” subaccount “Revenue”

— 1,038,400 rub. – revenue from the sale of refrigerators is reflected

Debit 90 “Sales” subaccount “Value added tax”

Credit 68 “Calculations for taxes and fees” subaccount “Calculations for VAT”

— 158,400 rub. – VAT amount has been calculated

Debit 90 “Sales” subaccount “Cost of sales”

Credit 43 “Finished products” subaccount “Products in the warehouse of Alliance LLC”

— 800,000 rub. – written off cost of goods sold

Debit 66 “Settlements for short-term loans and borrowings”

Credit 62 “Settlements with buyers and customers”

— 1,038,400 rub. – reflects the loan debt transferred to the buyer

Loan 009 “Securities for obligations and payments issued”

— 1,038,400 rub. – the transfer of the pledge certificate to the buyer is reflected

The materials were prepared by a group of consultants and methodologists of JSC "BKR-Intercom-Audit"

Stay up to date with the latest changes in accounting and taxation! Subscribe to Our news in Yandex Zen!

Subscribe