Business entities operating on the territory of the Russian Federation have the right to terminate the obligations of the parties using the methods specified in federal legislation. In practice, cash offsets are most often used. This procedure involves drawing up an appropriate agreement. Special conditions for mutual offset are given in Art. 410 of the Civil Code of the Russian Federation. The legislation also approved a list of situations when the use of this method is unacceptable (Article 411 of the Civil Code of the Russian Federation).

Reasons for overpayment

Overpayment between counterparties can occur for a number of reasons:

- The simplest of situations. Due to an error by an accountant or other person responsible for transferring funds, more money was transferred to the supplier’s account than it should have been.

- If the supplier has delayed a delivery for which funds have already been transferred. If the agreement between organizations does not stipulate otherwise, then the recipient in this case may refuse to accept the goods altogether. This is clearly stated in Article 511 of the Civil Code of the Russian Federation, paragraph 3.

- Refusal by the buyer of a product due to its low quality (defects, etc.). If the supplier in this case has already been paid an advance, then an overpayment arises (Article 523 of the Civil Code of the Russian Federation).

- The agreement under which the funds were transferred was terminated by one of the parties. In this case, there is, of course, no talk of offset by future supplies or services.

Before drawing up a letter about the offset of the overpayment, you need to make sure that the calculations by the organization’s accounting department were made correctly. To do this, the supplier is asked to draw up a bilateral reconciliation report. This will allow you to reach a common opinion regarding the amount of the overpayment.

The essence of the letter

The payment made is credited by the recipient to the agreement that is specified in the purpose of payment in the payment order, or the payment is made on the basis of an invoice presented under a particular agreement (field number 24). A situation is possible when the counterparty immediately sends a notification after payment (if the purpose of payment does not indicate the account or contract number, but says, for example, “for goods”, “services for...”) (Clause 1 of Article 319.1 of the Civil Code of the Russian Federation) .

Various circumstances always arise when the counterparty needs to transfer the payment made to another agreement, either the entire amount or partly.

Composition of the letter form

Typically, this kind of paper is printed on the organization’s letterhead. On their upper part are the company details. If a business letter is printed on a regular A4 sheet without notes, then at the very top you must indicate the name and basic information of the organization that is sending the message.

The letter must contain:

- Information about the addressee. Full name of the head of the supplier’s organization, his position, the name of the company itself.

- Document Number. It is needed for subsequent accounting and recording of outgoing documentation.

- Date of signing.

- Title of the paper.

- The amount of overpayment. It must be clearly known to both parties.

- To which account the payment was made (link with document number and date).

- What to do with the overpayment: return it or offset it against payment for subsequent deliveries (or provision of services). If there is information about the number and date of the account to which the overpayment should be credited, then it is indicated.

- Please offset the overpayment against future payments if a specific account number is not available.

- If necessary, the amount of VAT.

- Signature, position of the head, seal of the organization.

We are drawing up a letter regarding payment for another contract.

The transfer of payment to another contract is formalized in the form of a bilateral agreement. However, you can limit yourself to only a letter from the payer. In confirmation of the transfer of payment, a response letter of consent is requested or a reconciliation report for mutual settlements under the contract of interest is drawn up.

A letter about the transfer of payment is drawn up in any form, indicating the amount of payment under the contract, which the payer requests to transfer from one contract to another (indicating the details of the payment order by which it was transferred), as well as the details of such contracts.

Attention! If an agreement has been reached to transfer the payment to another agreement, then advance VAT does not need to be deducted (Letters of the Ministry of Finance dated 04/01/2014 No. 03-07-RZ/14444, dated 08/29/2012 No. 03-07-11/337).

Options for replying to a letter

The supplier may agree to the terms proposed in the letter, or may refuse them. Also, if you refuse, he will probably offer his own way out of the situation. For example, it will be much more convenient for the supplier’s accounting department (and more profitable for their manager) to transfer excess funds back than to transfer them towards future deliveries. The likelihood of such circumstances is especially increased by the lack of information on this point in the contract between organizations. Thus, the supplier may have to provide another letter requesting a refund of the overpaid funds.

General requirements

The document is an application (request) for the return of the transferred money. There is no unified form, so we draw up a free application. Be sure to include the following information:

- details of your organization: the application can be made on company letterhead;

- bank details for refund;

- name of the counterparty's manager, his position and full name;

- subject of the appeal (subject of the claim): indicate on the basis of which document (agreement, invoice agreement, universal transfer document) the letter is drawn up;

- subject of appeal: describe exactly how and as a result of which the money was transferred to the supplier’s bank account. Indicate the basis on which you need to return the money, your requirements for terms, include fines and penalties, if any, in the document that forms the basis of the obligation. Justify your position with the law or terms of the contract, on the basis of which the supplier is obliged to return the funds.

Attach copies of supporting documents: payment slips, bank statements about debits from the account. In the inventory, indicate not only the quantity, but also the number of pages in each of them. In the attachment to the letter, be sure to add a reconciliation act for mutual settlements. Confirm the application with the signatures of: the responsible executive, the financial director (chief accountant) and the head of the organization.

What to do with VAT

If an incorrect payment (for goods not delivered, services not performed, etc.) was provided along with VAT, then the amount of this payment should be recalculated. The algorithm is as follows:

- If the advance invoice was issued by the supplier for an incorrect amount (one that was received in error or was exceeded), then it must be corrected. To do this, you need to send a letter to the supplier asking him to issue another advance invoice with the correct numbers.

- The supplier forwards a copy of the correct invoice.

- Then the entry in the organization’s purchase book is canceled. But this correction must be the exact number for which the correct invoice is issued.

- If the reporting quarter has expired, you will have to draw up an additional sheet for the purchase book, through which the marks on registered invoices are still corrected.

- The correct VAT is charged on the new invoice.

However, there is a fundamentally important nuance regarding the last point. The amount that was overpaid is, in fact, an advance payment for future delivery. However, VAT should not be taken from it until the shipment or provision of services. After all, the contract (referenced by the correct invoice) indicates a different contract number with the supplier. And before the transaction is actually completed, the deduction will be illegal.

In the letter about offset of the overpayment to the supplier, be sure to specify under which specific agreement the overpayment arose and in what amount.

At the same time, indicate what you expect from the seller. For example, so that he can offset other agreements. Provide the number and date of the contract to which you are asking to transfer the overpayment. It is better to put live signatures and stamps on the document, send it by mail or deliver it with a courier. There are no trifles in business correspondence.

Registration of transfer. When is payment transferred?

It is possible to transfer payment to another agreement when the payer transferred an amount under the agreement that was higher than it should have been. Or the prepayment under one contract must be “split” into two others.

Also, a signed agreement between counterparties may provide for the procedure for offsetting the amount of an overpayment under a specific agreement or payment for which the purpose of the payment is not specified.

In other cases, a letter is drawn up to transfer the payment amount to a specific agreement. Without such a letter, the recipient has all the rights to credit the payment to the obligation whose due date occurs earlier (clause 3 of Article 319.1, clause 3 of Article 522 of the Civil Code of the Russian Federation).

A letter is required when payment is transferred from one contract to another and it was not unnecessary. If this point is not provided for in the contract, then the payee may refuse to transfer payment, according to the letter, especially if the creditor’s property interests are violated (for example, transfer of payment for goods under an expired contract to a new one, thereby, after such a transfer, the payer, in fact, borrows another batch of goods).

How long is the letter stored and where is it registered?

All business correspondence must go through the outgoing documentation journal. It notes the main content of the letter, its number and date. This way you can confirm the existence of the paper if legal proceedings are subsequently held on this issue.

As for the storage period, for letters of this kind it is 5 years.

This is due to the fact that it is directly related to the business relationship with the supplier of goods or services. When these documents, the letter of request and the letter are systematized, the response to it is classified as a single matter. This is the only way to reconstruct the entire course of the correspondence and study the arguments and demands of both sides subsequently.

Contents of the application for state duty offset

The offset of any payment assumes the similarity of the actions for which the specified fee was paid. The grounds for offset are the same as for the return of state duty. But the procedure is different. This procedure and grounds are established by the Tax Code of the Russian Federation.

The similarity of actions during offset means that offset is possible only for the state duty that was previously paid for the same action. If the interested party paid a state fee, for example, for the provision of government services (issuing a passport, registering property rights), it is impossible to offset this amount as for filing a claim. Only the state duty paid for the consideration of applications or claims by the courts is offset. In this case, the interested party has the right to make such offset within 3 years.

In the text of the document, the applicant sets out in detail the circumstances of the case: the essence of the claim, the price and calculation of the state duty, referral to the court and return or refusal to accept the statement of claim by the court. Based on the meaning of the offset of the state duty, the relevant procedural acts of the court are attached to the application: a ruling on the return of the claim or refusal to consider it, etc., a payment receipt for payment of the state duty. The application is submitted together with a new statement of claim in compliance with the rules for filing a claim in court.

Offset and refund of tax overpayments: new rules

Most often, the reason for overpayment is errors in the payment order or declaration, double write-off of tax at the request of the Federal Tax Service, previously paid advance payments exceeding the total tax amount for the year. In 2022, an additional reason may be exemption from paying taxes and fees for the second quarter on the basis of Federal Law No. 172-FZ dated 06/08/2020.

Previously, it was possible to find out about an overpayment only after reconciliation with the tax office or from a certificate in the KND form 1160081. Starting from October 1, 2022, the Federal Tax Service is obliged to always notify the taxpayer that there is an overpaid amount of tax on his personal account within 10 days period from the moment of its detection (clause 3 of article 78 of the Tax Code of the Russian Federation).

How can you manage your money?

You can dispose of the overpayment in three ways (clause 5, clause 1, article 21 of the Tax Code of the Russian Federation):

- return to your current account;

- offset against future payments;

- pay off debts on other taxes, pay penalties or fines.

Until October 1, 2022, overpayments of taxes can only be offset against taxes of the same level. Thus, by overpaying federal income tax, you can cover arrears and upcoming payments from federal taxes: VAT, income tax, mineral extraction tax.

Another rule that will soon be changed: money is returned to the account for those taxpayers who do not have debts to the budget for taxes of the same type.

From October 1, 2022, the provisions of Federal Law dated September 29, 2019 No. 325-FZ will come into force, and the rules will change:

- You can offset the overpayment against future payments or pay off the debt for various taxes. Regardless of which budget of the Russian Federation they are credited to. For example, due to overpaid income tax (federal budget), you can pay off arrears or a fine on property or transport taxes (regional budget).

- If you have tax debts of any type (federal, regional or local), you cannot return the overpayment of taxes in cash. Debtors, due to overpayment, are obliged to first pay off their obligations for taxes, fines and penalties (Clause 6 of Article 78 of the Tax Code of the Russian Federation).

Deadlines for filing an application for a refund or credit

An application for a refund or offset of money must be submitted no later than 3 years from the date of the overpayment, which is determined by the date of transfer of funds to the budget (clause 7 of Article 78 of the Tax Code of the Russian Federation). There are exceptions to this rule.

If the overpayment was due to an excess of advance payments, for example for income tax, to the amount of tax calculated at the end of the year, then the period begins to count from the date of filing the annual tax return (Resolution of the Presidium of the Supreme Arbitration Court dated June 28, 2011 No. 17750/10).

If you miss the three-year period specified in the Tax Code of the Russian Federation, money from the budget can only be returned through the court.

The statute of limitations for such cases is 3 years from the moment the taxpayer learned or should have learned about his right to a refund (letter of the Ministry of Finance of the Russian Federation dated March 15, 2022 No. 03-02-08/16920).

In the article “How to Refund Overpaid Tax,” we figured out how to correctly calculate deadlines and avoid conflicts with the tax office.

Now that the Federal Tax Service will be required to notify of the discovery of an overpayment, the deadline for filing a claim for a refund must be counted from the moment of receipt of the tax notice or reconciliation with the budget.

Mechanism for refund or offset of overpayment

The tax office does not automatically refund overpaid amounts. This happens only at the request of the taxpayer. For your convenience, we have prepared a detailed scheme for carrying out a tax offset or refund of an overpayment.

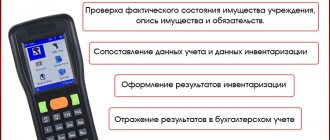

Stage 1. Conduct a reconciliation with the tax office

Submit an application to the Federal Tax Service at the place of registration regarding the need to carry out a reconciliation. Such an application can be brought in person or sent by mail or through Kontur.Extern. Within 5 working days, the tax office will send you a reconciliation report, check it.

If everything is correct, sign the document and submit it to the tax office. If errors or discrepancies are found, indicate at the end of Section 1 of the act that “the act was signed with discrepancies.”

Stage 2. Prepare an application for offset or refund of overpayment

Submit an application for offset or refund to the tax office at the place of registration or location of the taxpayer.

The application can be submitted in any form or on the form recommended in Appendix 9 to the order of the Federal Tax Service dated February 14, 2017 No. ММВ-7-8 / [email protected] Attach payment orders and documents confirming the overpayment to the application.

If the overpayment arose due to errors in the tax return, submit an updated calculation.

Stage 3. Wait for the tax inspector’s decision

Within 10 working days, but not earlier than the day the desk audit on the updated declaration is completed, the inspector will make a decision on whether to carry out a tax offset or refund the money.

The period for returning the overpayment is 1 month from the date of filing the application or from the date of completion of the desk audit of the updated declaration (clause 6 of Article 78 of the Tax Code of the Russian Federation).

If a refund is refused, you can appeal the refusal to a higher tax authority within one year (Articles 137, 138 of the Tax Code of the Russian Federation). When the appeal does not help, return the overpayment through the court. The statute of limitations for filing an application is 3 years.

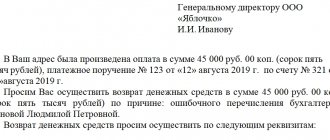

Letter to offset overpayment to supplier. sample, form 2022

SAMPLE LETTER FOR CREDITING AN OVERPAYMENT ON AN ACCOUNT

ON THE ORGANIZATION'S LETTERHEAD

_______20____ To Accounting

Public Press Capital LLC

Please offset the overpayment on account No. _____ dated ___.__.06. in the amount of _________ rubles, including VAT 18% - _______ rubles (payment order No._____ dated __.__.06 in the amount of __________ rubles, including VAT 18% _______ rubles) in partial payment of invoice No. _____ dated ___.___.06 ., remaining funds in the amount of __________ rub. towards subsequent work.

General Director (signature) signature transcript

Chief accountant (signature) signature transcript

More details

Application for crediting the amount of overpaid tax

→ Accounting consultations → General tax issues

Current as of: January 23, 2022

If you have overpaid any tax to the budget, then you can return the amount of the overpayment or offset it against future payments (clause 5, clause 1, article 21 of the Tax Code of the Russian Federation). In the second case, you need to submit an application to your Federal Tax Service to offset the amount of overpaid tax. It can be submitted to the tax office within 3 years from the day the overpayment was made (clause 2, 7, article 78 of the Tax Code of the Russian Federation).

To what payments can overpaid tax be offset?

Overpayment of taxes can be offset against future tax payments, as well as towards repayment of arrears, penalties or fines. But subject to the rules of tax offset (Clause 1, Article 78 of the Tax Code of the Russian Federation).

“Type” of overpayment Which payments can be offset against

| overpayment of federal tax (VAT, income tax, UTII, etc.) | any federal tax or penalty thereunder |

| overpayment of regional tax (organizational property tax, transport tax) | the same or another regional tax or penalties on them |

| overpayment of local tax (land tax) | this local tax or penalties on it |

Let us note that a separate offset procedure has been established for offset of excessively withheld or paid personal income tax from the income of employees.

By the way, if the tax authorities themselves discover an overpayment, they will count it against the arrears of another tax (of the same “level”), or penalties or fines for such a tax themselves (clause 5 of Article 78 of the Tax Code of the Russian Federation).

How to apply for a credit for overpayment of taxes

An application for tax offset (KND 1150057) is submitted in the form approved by the Federal Tax Service (Appendix No. 9 to the Order of the Federal Tax Service of Russia dated February 14, 2017 No. ММВ-7-8/ [email protected] ).

Application for offset of overpayment of tax (form)

In the organization and individual entrepreneur form, only page 1 is filled out. The second is intended for individuals who are not entrepreneurs. There is no order for filling out the form, but in general the rules for displaying data in it are intuitive. In addition, there are some explanations at the end of the form.

Application for offset of overpaid tax: sample

The sample we provided is also relevant for 2022.

Application methods

You can submit an application to offset the overpayment to the tax office in one of 3 ways:

- the head of the organization (IP) can present it to the tax authorities personally, or this can be done by a representative on the basis of a power of attorney;

- send by mail in a valuable letter with a list of the contents;

- send electronically, provided that the application is signed with an enhanced qualified electronic signature (clause 4 of article 78 of the Tax Code of the Russian Federation).

Also read:

Subscribe to our channel in Yandex. Zen

Letter of Settlement

According to the Civil Code, it is possible for companies to terminate the obligations of the parties. One of the most common methods is to offset debt amounts. Under what conditions is it possible to carry out netting, in what form to draw up a letter for netting between organizations, in which case is it impossible to carry out the procedure - let's take a closer look.

Conditions for mutual settlement

In order for debt obligations to be repaid by offsetting mutual claims, certain conditions must be met:

- The claims must be counter-claims, that is, the participants in the offset must simultaneously have debts to each other;

- As a general rule, claims must be valid (depending on the timing of their repayment) and undisputed;

- The requirements must be uniform. In this case, homogeneity means the same method of repaying obligations. However, it is worth keeping in mind that by agreement of the parties, the contract may stipulate the termination of obligations with heterogeneous requirements (for example, obligations may be expressed in different currencies);

- The claims that are planned to be offset should not be among those claims that cannot be offset. Claims that cannot be offset: for compensation for harm caused to life or health, for the collection of alimony, for maintenance for life, and in other cases provided for by law or contract.

Settlement of debt claims is recognized as valid depending on their maturity dates, which:

- or have already occurred according to the terms of the contract;

- or are not specified in any way in the terms of the contract;

- or determined by the moment of demand.

Letter of settlement (sample)

According to civil law, the possibility of terminating an obligation by offsetting a counterclaim of a similar nature arises when the relevant document is sent to one of the parties. This document can be drawn up in the form of a letter to the counterparty, an agreement on netting, an application for netting, or in another form.

The form of this document does not have an approved unified form and is not defined by the Civil Code of the Russian Federation. The offset letter (we will provide a sample below, you can use it when drafting the letter yourself) is developed by the company in-house.

Typically the letter takes the following form. In the upper right corner you must indicate the details of the organization to which the offset letter is sent.

The letter is sent to the general director, so it is advisable to indicate the details as follows: “To the General Director of LLC “Name of Organization” (full name of the director) from...”.

You can indicate the name of the organization, location and other details in full or indicate the details in abbreviated form.

Then you need to indicate the title of the document and move on to the main part of the letter.

In the body of the letter, it is necessary to indicate that, on the basis of Article 410 of the Civil Code of the Russian Federation, the company is asking for an offset of mutual claims and list in detail what debts to each other are in question.

When transferring, it is necessary to indicate in detail the numbers of contracts, the dates of their conclusion, the parties, the amount of the transaction, the deadline for fulfilling obligations, and what amount is subject to offset.

Application for tax credit sample 2018

If you have overpaid any tax, it can be refunded. Or offset against future payments (subclause 5, clause 1, article 21 of the Tax Code of the Russian Federation). To make such a castling, you will need an application for a tax offset from one BCC to another. A sample of such a document for 2018 with offset rules can be found in our article.

Calculate your salary online

Urgently! Courts against paying vacation pay 3 days before vacation

Legal basis for paying for another organization

For another organization, payment is possible on the basis of Art. 313 Civil Code, Art. 45 of the Tax Code of the Russian Federation, unless other conditions are specified in the agreement between the creditor and the debtor.

When choosing this method of debt repayment, you should remember the possible risks. For example, a creditor may consider that the receipt of funds into the account is an error. To avoid being sued for illegal enrichment, the creditor will return the funds to the sender. In this case, the borrower's debt, of course, will not be repaid.

To prevent such a misunderstanding from occurring, the creditor should be notified that another legal entity will pay the debt for the debtor. The debtor will be required to:

- Provide a letter about the transfer of funds, a sample of which can be found on the website below.

- Ask your counterparty to hand over to the creditor a document indicating for whom the debt is being paid (name of the organization) and on what basis (details of the agreement between the counterparties). The purpose of the payment must also be specified in the purpose of the payment (for non-cash payments).

Letters, a sample of which can be seen below, are evidence of payment of debt by the debtor through another company. Having received them, the creditor will know which debt the funds received should be credited to.

Thanks to the documents accompanying the payment, the lender will be able to explain the origin of the funds to the tax service. In addition, this is a guarantee against a claim for illegal enrichment, since legal entities are required to return all unknown payments to the senders.

Attention! Payment by one legal entity for another company or individual entrepreneur cannot exceed one hundred thousand rubles (Instruction of the Bank of Russia No. 30 73). Payment for an individual is not limited by a limit.