How to reflect water tax in accounting and tax accounting

Accounting

In accounting, take into account the water tax on account 68 “Calculations for taxes and fees.” To do this, open a subaccount for it “Calculations for water tax” (Instructions for the chart of accounts).

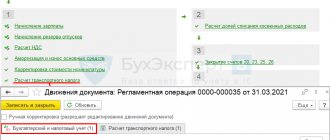

The costs of paying the water tax are classified as expenses for ordinary activities (clause 5 of PBU 10/99). Therefore, reflect the water tax on the last day of the quarter (clauses 16 and 18 of PBU 10/99). In this case, make the following entries:

Debit 20 (21, 23, 25) Credit 68 subaccount “Calculations for water tax”

– water tax is charged;

Debit 68 subaccount “Calculation of water tax” Credit 51

– water tax has been paid.

This order follows from the Instructions for the chart of accounts (accounts 20, 21, 23, 25 and 68).

The procedure for reflecting water tax when calculating taxes depends on what taxation system the organization uses.

The tax has been calculated according to the simplified tax system - we make the posting

Upon completion of each business transaction, the accountant reflects this fact with an accounting entry. The accounts used depend on the chart of accounts adopted by the company.

To keep records of various taxes, subaccounts are allocated in account 68. Their list must be specified in the accounting policy, guided by clause 4 of PBU 1/2008.

Account 68 can be divided into several sub-accounts, for example:

68.1 - calculations for the simplified tax system;

68.2 - calculations for personal income tax, etc.

A situation is possible when, at the end of the year, the total income tax turns out to be either more than the actual tax amount or less. In the first case, the tax amount must be added, in the second, it must be reduced. The wiring is as follows:

- simplified tax system accrued (posting for advance tax payment) - Dt 99–Kt 68.1;

- tax advance is transferred - Dt 68.1 - Kt 51;

- for the year, additional tax was accrued to the simplified tax system - posting Dt 99 - Kt 68.1;

- the tax according to the simplified tax system for the year was reduced (the excessively accrued advance was reversed) - reversal Dt 99 Kt 68.1.

The total amount of tax accrued for the year according to the declaration must be equal to the amount reflected in the accruals for the same period in accounts 99 and 68.1. If more advances are transferred than the tax accrued for the year, then the overpayment amount can be returned.

For information on how to write an application for a refund of overpaid tax, read the article “Sample application for a refund of overpaid tax .

How an LLC uses the simplified tax system to keep records of income and expenses, as well as what kind of reporting to submit, read in the Typical situation from ConsultantPlus. And if you are close to losing the right to use the simplified tax system, find out how the limits will change from 2022 by studying the explanations of ConsultantPlus experts. If you do not have access to the K+ system, get a trial online access for free.

BASIC

When calculating income tax, include the amount of water tax among other expenses associated with production and sales (subclause 1, clause 1, article 264 of the Tax Code of the Russian Federation). These expenses are taken into account for profit tax purposes in full.

When expenses for paying water tax are taken into account when calculating income tax depends on how the organization recognizes expenses.

When using the accrual method, include the amount of water tax in expenses on the last day of the quarter for which the tax was accrued (subclause 1, clause 7, article 272 of the Tax Code of the Russian Federation).

If an organization uses the cash method, then the tax paid must be recognized as expenses on the day it is transferred to the budget (subclause 3, clause 3, article 273 of the Tax Code of the Russian Federation).

An example of how expenses for paying water tax are reflected in accounting and taxation. The organization applies a general taxation system

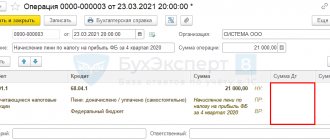

Alpha LLC collects water from surface water bodies under a license. The organization determines income and expenses for calculating profit tax using the accrual method. In the water tax declaration for the third quarter, water tax was accrued in the amount of 23,700 rubles. The organization transferred this amount to the budget on October 23.

In accounting, the Alpha accountant reflected the accrual and payment of water tax as follows.

Debit 20 Credit 68 subaccount “Calculations for water tax” – 23,700 rubles. – water tax has been charged.

Debit 68 subaccount “Calculation of water tax” Credit 51 – 23,700 rub. – water tax was paid to the budget for the third quarter.

In tax accounting, the Alpha accountant included the amount of accrued water tax among other expenses in September and reflected it in the income tax return for nine months.

What exactly is water tax paid for?

Art. 333.8 of the Tax Code of the Russian Federation gives the exact wording of the water tax payer. First of all, these are organizations and individuals (including individual entrepreneurs) using water bodies in activities that require special permission (the so-called special water use).

Special water use is considered to be the use of various types of technical equipment, tools, and buildings for conducting primary activities on the mentioned water bodies. In order for this activity to be considered legal, a special license is issued based on the provisions of the RF CC.

Although the Tax Code of the last decade no longer contains such a term as special water use, its use well conveys the essence of the definition of the payer of this type of tax, which was first announced in 2005 and became a replacement for the Federal Law “On Payment for the Use of Water Bodies.”

REFERENCE. Taxpayers can be enterprises and entrepreneurs who have received permission to use groundwater in their activities, which are also natural resources, but are regulated by the Russian Federation Law “On Subsoil”.

According to paragraph 2 of Art. 333.8 of the Tax Code of the Russian Federation does not include such enterprises and individuals who received water bodies for use by virtue of a relevant agreement/decision as taxpayers.

The right to make decisions is vested in the Government of the Russian Federation, municipal authorities and other executive bodies authorized to independently fix fees for water use, as well as methods for calculating and paying them. All this applies only to contracts and decisions concluded from 01/01/2007.

The water tax is a good help in a rational, careful attitude towards natural resources. This is a kind of flexible tool with the help of which an effective mechanism is created to increase the responsibility of water resource users to the ecology of the country and the whole world. The water tax helps offset the inevitable costs associated with protecting and restoring the country's ecosystems and abundant water resources.

simplified tax system

The use of a simplified system does not exempt an organization from paying water tax (clause 2 of Article 346.11 of the Tax Code of the Russian Federation).

If an organization applies a simplified tax system and pays a single tax on income, then when calculating the tax base, do not take into account the amount of water tax (clause 1 of Article 346.18 of the Tax Code of the Russian Federation).

If you pay a single tax on the difference between income and expenses, include water tax in expenses (subclause 22, clause 1, article 346.16 of the Tax Code of the Russian Federation). These payments will reduce the tax base on the day they are transferred to the budget (clause 2 of Article 346.17 of the Tax Code of the Russian Federation).

Specifics of using account 68 in accounting

Account 68 interacts mainly with accounts 99 “Profits and losses” and 70 “Settlements with personnel for wages”. In the first case, tax deductions are carried out on the basis of tax returns accepted by the organization. In the second, based on the approved amount of income tax for each employee.

In addition, account 68 can take into account such types of taxes and fees as:

Records are kept for each tax return. The result of this work is the reflection of current and overdue payments, fines, deferred and installment payments.

Account 68 can have both a debit and a credit balance. This depends on the nature of the tax debt. The tax amount is taken into account on the credit balance in case of non-payment. If there is an overpayment, on the contrary, the balance becomes a debit.

When reflecting tax transactions in the credit of account 68, the amount of taxes and fees required for payment is taken into account. In debit - repayment or change of tax liabilities.

Subaccounts and analytics

Subaccounts to account 67 are divided according to the method of calculation into the following types:

In addition, subaccounts are differentiated based on the definition of a specific tax or fee:

An enterprise has the right to use only those subaccounts that correspond to the nature of its activities. Most Russian companies conduct their tax activities using account 68, using only the first and second subaccounts.

Analytical accounting for account 68 is carried out for each subaccount separately. This is due to the inevitable difference in balance for each of them. Debit balances are included in its assets, and credit balances are included in liabilities, which is important to correctly reflect in the tax return and other reporting.

Situation:

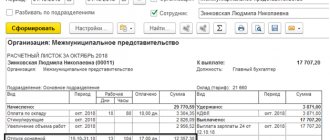

How to reflect the accrual and payment of water tax for the first quarter of 2016 in the organization’s accounting?

Water is taken by the organization on the basis of a subsoil use license obtained for the purposes of drinking and domestic water supply. Water use is carried out from the underground water body of the Volga River basin of the Central Black Earth economic region. The organization has installed a metering device to measure the amount of water resources taken from a water body. According to the meter data, water consumption for the current quarter amounted to 4.4 thousand cubic meters. m, which is within the established water consumption limit. For profit tax purposes, the organization uses the accrual method.

Procedure for calculating and paying water tax

The tax base for taxable objects is determined in relation to each such object separately. There is a procedure for determining the tax base:

- The tax base is calculated as the volume of water when water is withdrawn from a water body.

- The tax base is calculated as the area of the provided water space when using the water area of water bodies. The exception is wood alloy in rafts and purses.

- The tax base is calculated as the amount of electricity produced when using water bodies without water abstraction for hydropower purposes.

- The tax base is calculated as the product of the volume of wood rafted in rafts and wallets during the tax period, expressed in thousands of cubic meters, and the rafting distance, expressed in kilometers, divided by 100, when using water bodies for the purpose of rafting wood in rafts and wallets.

Account correspondence:

According to Part 3 of Art. 9 of the Water Code of the Russian Federation, legal entities acquire the right to use underground water bodies on the grounds and in the manner established by the legislation on subsoil. The provision of subsoil for use is formalized by a special state permit in the form of a license. A license is a document certifying the right of its owner to use a subsoil plot within certain boundaries in accordance with the purpose specified therein for a specified period, subject to the owner’s compliance with pre-agreed requirements and conditions (Part 1 of Article 11 of the Law of the Russian Federation of February 21, 1992 N 2395- 1 “On subsoil”, clause 2.1 clause 2 of the Regulations on the procedure for licensing the use of subsoil, approved by Resolution of the Armed Forces of the Russian Federation of July 15, 1992 N 3314-1).

Characteristics of water tax

Definition 1

Water tax is a federal direct tax paid by legal entities (organizations of all forms of ownership) and individual entrepreneurs who carry out special or special use of water resources recognized as objects of taxation.

Individual entrepreneurs and individuals who use water on the basis of water use agreements or decisions on the provision of water bodies for use, respectively concluded and adopted after the entry into force of the Water Code of the Russian Federation, are not taxpayers of the enterprise water tax.

Note 1

The water tax is regulated by Ch. 25.2 of the Tax Code of the Russian Federation and the Water Code of the Russian Federation.

Are you an expert in this subject area? We invite you to become the author of the Directory Working Conditions

The objects of water taxation are (Fig. 1):

Figure 1. Objects of water taxation

All water tax payers are required to register with the tax authorities at the location of the taxable objects. If taxpayers have several such objects on their balance sheet in different districts, then they must register such objects in each such district.

Municipal and private ownership of water bodies is permitted only for small water bodies that do not have a hydraulic connection with large water bodies.

Such taxpayers can use water bodies on the basis of:

- Limited use rights - water easement.

- Long-term use rights.

- Short-term use rights.

Finished works on a similar topic

Course work Accounting for water tax 460 ₽ Abstract Accounting for water tax 250 ₽ Test work Accounting for water tax 200 ₽

Receive completed work or specialist advice on your educational project Find out the cost

What is water tax in accounting?

Publication date 01/15/2021

How to calculate the water tax, as well as penalties and fines for it?

In accordance with clause 10.9.1 of Procedure No. 209n, the payment of taxes included in expenses is reflected in subsection 291 of KOSGU. Fines and penalties for late payment of taxes fall under subsection 292 of KOSGU (clause 10.9.2 of Procedure No. 209n). Linkage is applied to the element of expense type 852 (clause 48.8.5.2 of the procedure, approved by order of the Ministry of Finance of Russia dated 06.06.2019 No. 85n).

The accrual and transfer of water tax, as well as calculations of penalties and fines for water tax are reflected in the following entries:

Liabilities (including monetary ones) are accounted for on the basis of documents confirming their acceptance in accordance with the list established in the accounting policy. In this case, it is necessary to take into account the requirements for documents provided for by the procedure for accounting for budgetary and monetary obligations of the OFC, the procedure for authorizing the payment of monetary obligations established by the financial authority (clause 318 of Instruction No. 157n).

Accounting is carried out using the accrual method (clause 3 of Instruction No. 157n). This means that the results of transactions are recognized when they occur, regardless of when cash (or cash equivalents) are received or paid in settlement. The basis for reflecting in accounting information about assets and liabilities, as well as transactions with them, are primary accounting documents (Article 9 of the Federal Law of December 6, 2011 No. 402-FZ “On Accounting”, clause 20 of the Federal Standard “Conceptual Fundamentals” , approved by order of the Ministry of Finance of Russia dated December 31, 2016 No. 256n).

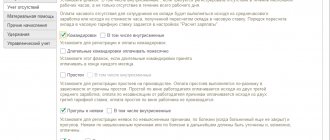

In accordance with paragraph 4 of the letter of the Ministry of Finance of Russia dated August 31, 2018 No. 02-06-07/62480, the procedure for recognizing the obligation to pay taxes (organizational property tax, land tax, other taxes) is determined in the accounting policy of the institution. The accounting policy should:

Tax accrual in accounting can be reflected:

The selected option must be fixed in the accounting policy.

Thus, depending on the option adopted, the institution can accept obligations and monetary obligations either on the last day of the reporting period as an event after the reporting date, or on the date of the actual generation of the tax return (in the period following the reporting period).

To account for monetary obligations, account 502 02 “Accepted monetary obligations” is provided, grouped by financial periods (clause 319 of Instruction No. 157n).

Registration of a monetary liability for tax in the accounting of an institution is reflected in the following accounting entry:

Accounting

The amount of accrued water tax is an expense for the organization for ordinary activities (clause 5 of the Accounting Regulations “Expenses of the Organization” PBU 10/99, approved by Order of the Ministry of Finance of Russia dated May 6, 1999 N 33n).

The amount of calculated water tax due for payment under the tax return for the 2nd quarter should be reflected as part of expenses for ordinary activities related to the 2nd quarter (clauses 16, 18 of PBU 10/99).

Accounting records for the transactions under consideration are made in accordance with the Instructions for the application of the Chart of Accounts for accounting of financial and economic activities of organizations, approved by Order of the Ministry of Finance of Russia dated October 31, 2000 N 94n. They are shown below in the posting table.