The vending business in Russia is gaining momentum every year. At the beginning of 2022, the number of vending machines in Moscow alone amounted to more than 12 thousand units, and according to market estimates, the capital’s need for automated trading is at least 10 times higher. In the article we will analyze the features of taxation of vending machines: what tax regimes can be applied by vending business entities, what are the conditions for choosing one or another regime, what taxes are paid by the owner and tenants of vending machines in 2022.

What is vending

Taxation of vending machines

Vending is understood as a type of retail trade through the use of automated systems (so-called vending machines).

The main areas of the vending business include:

- sale of food products (snacks, bars, bottled drinks, coffee);

- sale of finished goods (toys, tobacco products, etc.);

- provision of services (payment of bills, replenishment of a mobile phone, calling a taxi, etc.);

- gaming vending (prize vending machines).

The subject of a vending business is an organization in the form of a legal entity or an individual entrepreneur who is the owner of a vending machine or rents a vending machine under a fixed-term contract.

Participants in the vending business also include vending machine operators, whose functions include:

- loading goods into a vending machine;

- collection of proceeds;

- control over the availability and assortment of goods in the device;

- vending machine maintenance.

The mechanism of interaction between vending business entities is as follows:

- A legal entity or individual entrepreneur registered as a business entity purchases a vending machine or receives it for paid use under a lease agreement.

- A business entity places the device in a designated location (for example, in the foyer of a shopping center), renting retail space.

- The vending operator is responsible for servicing the device, performing actions stipulated in the agreement with the business owner. The operator loads the goods into the machine, collects the proceeds, after which he transfers them to the owner, monitors the serviceability and performance of the retail equipment.

- The owner of a vending business receives income, the amount of which is taxed in accordance with the chosen tax system.

When should you think about switching to new machines?

Vending machines are special devices that provide for the sale of goods using special automated vending machines. This method of trading has become widespread throughout the world, because you do not need to have large retail premises, a lot of staff, cashiers, and you can simultaneously reduce the costs of a trading company. Today you can find both office vending machines and gaming machines for children. But for the most part, such devices are used by micro-enterprises and individual entrepreneurs who are not equipped with online data transmission. There is no need to worry and curtail trade until 2022.

You can wait to switch to new equipment if the device is owned by individual entrepreneurs who use PSN, as well as UTII payers. Such taxpayers, until July 1, 2022, can make cash payments and (or) payments using payment cards without using cash registers, provided that, at the request of the buyer (client), a document is issued confirming the receipt of funds for the relevant goods (work, service) in the manner specified established by Federal Law No. 54-FZ dated May 22, 2003 (as amended July 3, 2016 No. 290-FZ).

But from July 1, 2022 it is necessary:

—

modernize vending machines;

—

replace vending machines with those that provide online data transfer.

—

conclude an agreement with the fiscal data operator (OFD) Taxcom, since without a mandatory agreement with the OFD, work according to the new rules for the use of CCP is impossible.

Among the positive aspects are the following:

—

availability of online control over vending equipment online;

—

transition to modern accounting and reporting methods;

—

Possibility of registering a vending machine online.

A phased transition to the use of cash register equipment that transmits information about settlements made using cash and electronic means of payment through the fiscal data operator to the tax authorities in electronic form will reduce the volume of “shadow” cash turnover and increase tax revenues to the budget through the transition to the widespread use of cash register equipment and the provision of additional operational mechanisms for monitoring the correctness of the reflection of revenue received in the form of cash (Letter of the Ministry of Finance of Russia dated 06/06/2016 No. 03-01-15/32703).

Among the negative points, we highlight the following:

—

the need to re-equip the devices. To install online cash registers, you will have to significantly change the design of the machines, because they do not have space for such equipment. You will have to replace one of the payment devices with cash register equipment, and this may entail the loss of the manufacturer’s warranty;

—

mandatory re-registration of machines with the Federal Tax Service in case it is necessary to transport the device to another location.

In addition, some vending machines do not provide the ability to integrate cash register equipment. By virtue of paragraph 2 of Art. 2 of the Federal Law of May 22, 2003 No. 54-FZ “On the use of cash register equipment when making cash payments and (or) payments using electronic means of payment,” organizations and individual entrepreneurs, due to the specifics of their activities or the characteristics of their location, can make cash cash payments and (or) settlements using payment cards without the use of cash register equipment when carrying out the following types of activities, including retail trade in food and non-food products (with the exception of technically complex goods and food products requiring certain conditions of storage and sale) with hand carts, baskets, trays (including frames protected from precipitation, covered with plastic film, canvas, tarpaulin).

Thus, if the machine does not provide the ability to provide a check, then such a machine can currently be used. But from 2022, such an opportunity will not exist, even if you present an expert opinion on the impossibility of integrating a cash register with data transfer into a vending machine model.

Often, a vending operator combines as much as possible all the related elements of vending: repairs equipment (through its own service center), arranges vending machines through its employees (or independently). Therefore, it will be necessary to train personnel and make changes to the equipment repair process.

Thus, in 2022 it is necessary:

—

check the possibility of modifying vending machines with cash registers with online data transfer;

—

train staff to work with new devices;

—

register the devices with the tax authority;

—

conclude a contract for technical maintenance of devices or independently carry out maintenance not only of the device itself, but also of the cash register device in its composition.

Taxation of vending machines

Trading activities using automated systems are subject to taxation in accordance with the general procedure. This means that before placing the device at a retail outlet, a businessman must:

- register a business entity as a legal entity or individual entrepreneur;

- choose a taxation system in accordance with which the vending business entity will calculate and transfer payments to the budget.

Types of taxes, applicable rates, payment calculation procedures and the right to tax benefits for vending business entities are determined based on the chosen taxation system. Below we will tell you which tax system is currently the most profitable and convenient in the field of automated trading.

Changes affecting vending

Currently, a bill is being considered in the State Duma that would establish a number of changes affecting the way vending operates with online cash registers. Let's look at them briefly:

- Devices with a display that displays a QR code will free you from paper receipts

Vending machines equipped with a display that allows the buyer to read a QR code from it will be able to refuse to issue paper cash receipts.

An exception will be for machines selling excisable or technically complex goods, as well as goods that require labeling and special storage conditions. They will be required to issue a paper receipt to the buyer.

- Mechanical vending will be freed from online cash registers altogether

At the moment, there is no clear answer to the question of exempting mechanical devices from the obligation to use CCT. If the bill is passed, machines that accept coin payments will completely eliminate the need to install cash registers.

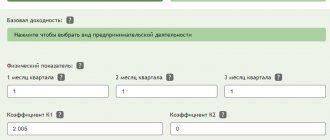

UNDV for vending

Currently, most vending business entities use UTII (single tax on imputed income) as a taxation system.

The advantages of “imputation” for vending are as follows:

- the amount of income received from trading through machines does not affect the amount of tax liabilities;

- vending entities on UTII can conduct accounting and reporting in a simplified form;

- UTII payers are exempt from a number of taxes (VAT, income tax - for legal entities, personal income tax - for individual entrepreneurs for themselves).

Based on the RVF Tax Code, trade using automated systems is included in the closed list of activities within which UTII can be used. In this case, a vending business entity can switch to UTII if other requirements are met:

| No. | Criteria for applying UTII | Description |

| 1 | The number of employees | Vending can use UTII only if the average number of employees of the organization/individual entrepreneur at the end of the reporting period does not exceed 100 people |

| 2 | Share of participation of other organizations in the authorized capital | Legal entities selling goods through vending machines are considered UTII payers, provided that the share of participation of other organizations in the company’s charter does not exceed 25% |

| 3 | Agreement of simple partnership, trust management | UTII is not provided for activities carried out on the basis of a simple partnership or trust management agreement. |

Please note that not all vending machines can operate on “imputed” mode. In its letter No. 03-11-09/64113 dated December 12, 2014, the Ministry of Finance provided clarifications containing a ban on the use of UTII for vending machines for the provision of services (copiers, massage chairs, shoe shine machines, self-service laundries).

What inspections of vending machines can there be from the state?

In our experience, tax authorities have never inspected vending machines. Perhaps the only authority that may be interested in you is the SES, and then only based on a private complaint from a client or when the machine itself is in complete disrepair.

In fact, in 100% of cases, if clients have any complaints, they will not bother contacting any authorities, but will go straight to the landlord. So what you should be more afraid of is not the tax authorities, but the loss of a profitable place if you do not take care of the maintenance of the machine and do not maintain its performance.

What documents do you need to have when checking?

It is advisable to have certificates for the products that you sell through the machine. But the machines themselves do not require certificates. You can do them, but according to the law, certification is voluntary. Rather, this can be used for a PR move (you can actively tell the lessor that your machine is certified, tested, etc.).

Vending on PSN

If a vending business entity is registered as an individual entrepreneur, then it can apply the PSN (patent taxation system) provided that the entrepreneur works independently or with employees of up to 15 people.

The PSN tax is paid in advance upon the issuance of a patent, the validity period of which can be set from 1 month to 1 year, at the request of the taxpayer.

Individual entrepreneurs on a patent are not payers of VAT, personal income tax, or income tax. At the same time, entrepreneurs with a patent are obliged to calculate and pay personal income tax for employees in the prescribed manner.

Pros and cons of individual entrepreneurs and LLCs for vending

Both organizational and legal forms have pros and cons that make adjustments to the development of the vending business.

When a vendor chooses an individual entrepreneur to conduct business, he receives a number of advantages:

- easy registration,

- free use of the money received,

- low fines for administrative offenses,

- optional bookkeeping,

- work without a seal and a current account.

At the same time, the entrepreneur

- is responsible for the business with its own property,

- pays insurance premiums even when activities are suspended,

- cannot attract partners.

If a vendor wants to carry out its activities together with partners, then it is necessary to choose an LLC to conduct business.

This form has the following advantages over individual entrepreneurs:

- the liability of each of the partners is limited to their share contributed to the authorized capital,

- the authorized capital can be increased and new partners can be involved,

- the business or its share can be sold, donated or left as an inheritance,

- the ability to create branches and sell franchises.

Of course, there are also disadvantages to this form:

- complex registration and high state duty, which increases investment in business,

- mandatory accounting,

- significant administrative fines,

- income can be received in the form of dividends no more than once a quarter,

- cost control and documentation.

So, each legal form has its own advantages and disadvantages, which the vendor should take into account based on his own plans and preferences. Having dealt with business registration, let's now return to the form of taxation.

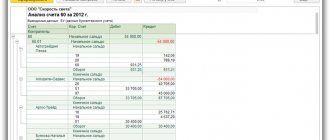

Subjects of the vending business in simplified terms

Subjects of vending in the simplified market are exempt from paying VAT, income tax (legal entity) and personal income tax (individual entrepreneurs for themselves) and calculate the tax in the following order:

- Vending that uses the simplified tax system of 6% calculates the tax based on total revenue, excluding expenses.

- Taxpayers using the simplified tax system of 15% determine the tax base as the difference between income and expenses.

It is advisable to transfer trading through vending machines to the simplified tax system if the sale of goods is carried out using a large number of vending machines, while the income from trading remains at a low level. After all, using the “simplified tax” implies calculating the tax based on the total amount of income (the lower the income, the lower the tax), while with UTII the subject of the vending business is obliged to pay tax in the established amount, regardless of the level of income.

When did vending appear?

Archaeologists have found vending machines from ancient Rome

No, this is not a yellow pages headline about aliens and a global conspiracy. This is true. The fact is that in ancient Rome there already existed the simplest mechanisms that poured a small amount of consecrated water for one coin. They had little in common with the automated computer mechanisms of today, but it was then that the history of vending began.

Some more interesting facts from the past:

In 17th-century England, taverns began installing mechanical machines that could fill your pipe with smoking tobacco for one penny.

In the same England, but a century later, a saturator was invented - a device for saturating water with gas. Since then, the history of vending has made a sharp leap. Because after some time, automatic machines appeared that began to pour this carbonated water. And it was they who, of all past inventions, were most similar to what we see now.

Great Britain has generally been a storehouse of ideas in the vending industry. And in the 19th century she was also able to distinguish herself. In 1888, it was there that the first machine appeared, which gave chewing gum to customers for money.

And only then did the USA take up the baton for the development of vending. More and more new formats began to appear. Vending machines began to sell not only sparkling water and chewing gum, but also other goods.

If you think that everything came to Russia later, as usual, then you are mistaken. Already in 1898, at the turn of the 19th and 20th centuries, a machine for selling chocolate was installed in St. Petersburg. But it was not accepted as a business then.

Well, the machines known to everyone in the USSR, pouring sparkling water with syrup into faceted glasses, which became an element of an entire era - nothing more than vending machines, just the name was still unknown at that time.

New times have painted the vending industry in completely different colors. In some countries, it has gotten to the point where there are more machines than human sellers. Japan, as always, has distinguished itself in the robotization of public life. There is one machine gun for every 23 people - such a huge amount of this equipment is located on the territory of a small country. For comparison, this is one machine per 2000 people.