Taxi travel expenses for a posted worker

An employee sent on a business trip can use a taxi service to travel to the station, airport, place of residence, as well as to the place of his permanent work during the period of the business trip.

Clause 12 art. 264 of the Tax Code of the Russian Federation allows you to include business travel expenses, including employee travel to and from work, as other expenses related to production and sales. The type of transport that can be used is not specified. In this regard, the question arises: is it possible to take into account taxi travel for an employee on a business trip as part of other expenses? Explanations on it are provided by the Ministry of Finance (see letters dated 03/02/2017 No. 03-03-07/11901, dated 06/10/2016 No. 03-03-06/1/34183, dated 06/14/2013 No. 03-03-06/1/ 22223). And the conclusion from them follows that it is possible - subject to documentary evidence and economic justification of the costs.

What documents can confirm payment for taxi fares? This could be a cash register receipt or a receipt for payment for using taxi services. In Government Decree No. 112 dated February 14, 2009, you can find the mandatory details approved for such receipts.

If at least one of the above details is missing, the document is considered unsuitable for confirming the expenses of an employee of the organization for taxi travel.

To make an economic justification for traveling by taxi while on a business trip, it is worth getting a service note from the employee explaining the choice of this particular type of transport: a work schedule that makes it difficult to travel by public transport, the distance of the place of work or temporary residence from public transport stops. Otherwise, it is better to refuse taxi rides or recognize fees for them as expenses for profit.

Is it possible to take into account the costs of car sharing for employees in tax accounting? What documents can be used to confirm such expenses? Answers to these and other questions are in ConsultantPlus. If you don't have access to the system, get a free trial online.

You can find out what expenses are reimbursed to a posted worker and whether they are subject to personal income tax in this article.

NTVP "Kedr - Consultant"

LLC "NTVP "Kedr - Consultant" » Services » Consultations on accounting and taxation » Other tax issues » Taxi costs for a business traveler traveling from home to the place of departure on a business trip

An employee, leaving on a business trip, used a taxi from home to the place of departure. Taxi expenses are not included in the business travel regulations. An agreement has been concluded with the organization providing taxi services. The fact that the employee used this information was discovered only after the counterparty’s documents were presented

Question Is it possible to recover funds from an employee as unreasonable expenses? How to properly prepare documents for retention?

Answer.

Unreasonable expenses are expenses that are not economically justified. Here are several reasons why the tax authority may try to recognize expenses as unreasonable:

• they did not generate income;

• as a result of these expenses the company incurred a loss;

• the amount of expenses does not correspond to the financial position of the organization;

• expenses are not related to the main activities of the company;

• too expensive property was purchased, for example a luxury car, designer renovations were made in the office.

However, even this does not mean that the costs can automatically be considered economically unjustified. The Tax Code of the Russian Federation does not have such a criterion as compliance of the expenses incurred with the financial situation of the taxpayer.

The justification of expenses must be assessed taking into account the taxpayer's intentions to obtain an economic effect, and not from the point of view of expediency, rationality, efficiency or the result obtained.

An organization's expenses should be related to the nature of its activities, and not to profit. They are taken into account regardless of the presence or absence of income from sales in the tax period (Letter of the Ministry of Finance of Russia dated December 28, 2017 N 03-03-06/1/87897).

The taxpayer carries out activities independently at his own risk and has the right to independently assess its effectiveness and expediency (Letter of the Ministry of Finance of Russia dated June 20, 2017 N 03-03-06/1/38489).

Guide. What expenses are recognized as expenses for income tax (ConsultantPlus, 2021) {ConsultantPlus}

Is it possible to compensate an employee for the cost of using a taxi on a business trip?

No, except in some cases.

For example, such expenses cannot be reimbursed from budgetary funds if you have a federal government institution (clause “c” of paragraph 1 of the Decree of the Government of the Russian Federation of October 2, 2002 N 729). However, it is stipulated that “other” expenses incurred with the knowledge or permission of the employer can be reimbursed, but only through savings that have arisen, in particular, when the institution implements the financial and economic activity plan (clause 3 of the Decree of the Government of the Russian Federation dated 02.10. 2002 N 729). Therefore, if the expenses for using a taxi are attributed to others and are made taking into account these conditions, we believe that you can compensate the employee for them.

If you have a state institution of a constituent entity of the Russian Federation or a municipal institution, act taking into account the procedure established for you, respectively, by the regulatory legal act of the state authority of your constituent entity of the Russian Federation or local government body (Part 3 of Article 168 of the Labor Code of the Russian Federation). For example, it may also be established for them that the employee is compensated for additional expenses with the knowledge of the employer, in particular, due to savings generated during the implementation of the institution’s financial and economic activity plan.

In any case, such expenses can be reimbursed only on the basis of supporting documents (clause 24 of the Regulations on Business Travel, Letter of the Ministry of Finance of Russia dated September 12, 2018 N 03-03-06/1/65357). For example, if an employee used a passenger taxi, he must provide you with a cash receipt or a receipt in the form of a strict reporting form, which must contain mandatory details (Letters of the Ministry of Finance of Russia dated 03/25/2020 N 03-03-07/23568, dated 03/02/2017 N 03 -03-07/11901).

Ready-made solution: How to compensate an employee of an institution for the cost of travel to the place of business trip and back (ConsultantPlus, 2021) {ConsultantPlus}

Deductions from wages to pay off an employee's debt to the employer can be made in the following cases (Part 2 of Article 137, Part 1 of Article 238, Part 1 of Article 248 of the Labor Code of the Russian Federation):

1) to reimburse unearned advances issued on account of wages;

2) to repay an unspent and not returned timely advance payment issued in connection with a business trip or transfer to another job in another locality, as well as in other cases;

3) to return amounts overpaid due to accounting errors, as well as in the event that the employee is found guilty of failure to comply with labor standards or downtime.

4) to compensate the employer for damage caused by the employee as part of bringing him to financial liability within the limits of the average monthly salary;

5) for unworked vacation days - when an employee is dismissed before the end of the year for which he received annual paid leave (except for dismissal, in particular, in connection with the liquidation of an organization or a reduction in the number or staff of employees).

Situation: In what cases does an employer have the right to make deductions from wages? (“Electronic magazine “ABC of Law”, 2021) {ConsultantPlus}

Procedure for collecting material damage

To recover damages from an employee or a group of employees, the employer must:

• conduct an inventory of property in the organization and identify lost or damaged property (clause 27 of the Accounting Regulations, approved by Order of the Ministry of Finance of Russia dated July 29, 1998 N 34n);

• order an official investigation, create an official investigation commission, establish the reasons for loss or damage to property (Part 1 of Article 247 of the Labor Code of the Russian Federation);

• request from the employee written explanations of the reasons for the damage. In case of refusal or evasion of the employee from providing the specified explanation, draw up an appropriate act (Part 2 of Article 247 of the Labor Code of the Russian Federation);

• determine the amount of damage based on actual losses at market prices on the day the damage occurred, but not lower than the value of the property according to accounting data (including wear and tear) (Part 1 of Article 246 of the Labor Code of the Russian Federation);

• if the damage was caused by several employees, it is necessary to determine the degree of guilt and the amount of responsibility of each employee.

During the inspection, as well as after its completion, the employee and (or) his representative have the right to get acquainted with all inspection materials and appeal them (Part 3 of Article 247 of the Labor Code of the Russian Federation).

Damage caused to the employer can be recovered both in court and in pre-trial proceedings.

If the damage does not exceed the employee’s average monthly earnings, recovery is made based on the employer’s order without going to court.

The order can be made no later than one month from the date of final determination by the employer of the amount of damage caused by the employee (Part 1 of Article 248 of the Labor Code of the Russian Federation).

An employee who is guilty of causing damage to the employer may voluntarily compensate for it in whole or in part. By agreement of the parties to the employment contract, compensation for damage by installments is allowed. In this case, the employee submits to the employer a written obligation to compensate for damages, indicating specific payment terms. In the event of dismissal of an employee who gave a written commitment to voluntarily compensate for damage, but refused to compensate for the specified damage, the outstanding debt is collected in court (Part 4 of Article 248 of the Labor Code of the Russian Federation).

With the consent of the employer, the employee can transfer to him equivalent property to compensate for the damage caused or repair the damaged property (Part 5 of Article 248 of the Labor Code of the Russian Federation).

If the month period has expired or the employee does not agree to voluntarily compensate for the damage caused to the employer, and the amount of damage caused to be recovered from the employee exceeds his average monthly earnings, then recovery can only be carried out by the court. An employer can go to court even if the employee quit without paying compensation (Part 3 of Article 232, Part 2 of Article 248 of the Labor Code of the Russian Federation).

To recover damages, the employer may file a claim against the employee in the district court within a year from the date of discovery of the damage caused. If there is an agreement on voluntary compensation for damage, under which the employee stopped making payments, the one-year period for going to court is calculated from the moment when the employee was supposed to make the next payment, but did not do so (Part 3 of Article 392 of the Labor Code of the Russian Federation; clause 3, 12 of the Review, approved by the Presidium of the Supreme Court of the Russian Federation on December 5, 2018).

Compensation for damage is made regardless of whether the employee is brought to disciplinary, administrative or criminal liability for actions or inactions that caused damage to the employer (Part 6 of Article 248 of the Labor Code of the Russian Federation).

Situation: When is an employee financially responsible to the employer? (“Electronic magazine “ABC of Law”, 2021) {ConsultantPlus}

From the above, we conclude that if this employee was not given permission to use a taxi, then it is necessary to draw up an order to compensate the damage caused to the enterprise.

Selection of documents (see appendix)

Ready-made solution: How can a budgetary and autonomous institution keep accounting records of calculations for deductions from wage payments (account 0 304 03 000) (ConsultantPlus, 2021) {ConsultantPlus}

The explanation was given by the accountant-consultant of LLC NTVP Kedr-Consultant Natalya Borisovna Petrova in April 2021.

When preparing the answer, SPS ConsultantPlus was used.

This clarification is not official and does not entail legal consequences; it is provided in accordance with the Regulations of the CONSULTATION LINE (www.ntvpkedr.ru).

This consultation has passed quality control:

Reviewer - Bushmeleva Galina Vladimirovna, professor of the Department of Accounting and ACD, Izhevsk State Technical University named after. M.T. Kalashnikov

Taxi costs to and from work

Is it possible to take into account the cost of a taxi to take an employee to work and return him home? This issue causes a lot of controversy among accountants. And inspectors are sensitive to such expenses. On accounting for the costs of transporting employees to and from work, including using a taxi, the Ministry of Finance of the Russian Federation provided an explanation in letters dated March 16, 2017 No. 03-04-06/15198, dated November 27, 2015 No. 03-03-06/ 1/69181. Based on the letters, we draw conclusions: taxi costs for transporting an employee to work and back can be taken into account as tax-reducing expenses if one of two conditions is met:

- The use of a taxi is justified by the inconvenient geographical location of the place of work in relation to public transport stops or the production work schedule, which makes it difficult to travel by public transport. These grounds must be justified in the order of the manager, which establishes the procedure for using a taxi for official purposes.

- The delivery of an employee to and (or) from work using a taxi is provided for by the employment contract and (or) collective agreement as a remuneration system, and at the same time it is possible to determine the amount of income of each employee.

To accept expenses, they must be documented. The mandatory details on documents confirming the use of a taxi service have already been discussed.

Read more about the withholding of personal income tax from travel compensation in the article “Transport to work and back - a tax aspect.”

Is it possible to take a taxi on a business trip?

An employee who is sent on a business trip or his immediate supervisor should make a preliminary calculation of his travel expenses in order to determine how much money he needs to receive.

For this purpose, a memo is drawn up. It can provide for the use of a taxi as a means to get to the airport (station) and back, as well as to get directly to the place of business trip directly.

This is justified by the fact that the employee will have to leave at a later time, when public transport is no longer working, or the optimal time would be to use a taxi for delivery.

Attention! An employee can use a taxi only if this has been agreed upon with the company administration. You can obtain management’s consent before the trip, as well as during it, by requesting permission through available means of communication.

The employer’s obligation to reimburse business trip expenses, including taxis, is provided for by the Labor Code of the Russian Federation. In addition, the local acts of the enterprise may clarify the procedure and scope of such compensation.

Taxi expenses for employees for business purposes

To expand the client base, in order to improve the quality of services and increase sales, organizations send employees to their clients (customers). A production necessity may be caused by an employee’s taxi ride to the counterparty with whom the company cooperates, which is not recognized as a business trip. Can these expenses be taken into account when taxing profits?

It is possible, if the employee used taxi rides specifically for official purposes, these trips are documented and their official purpose is justified in writing. The manager should issue an order indicating the employees who can use taxi services to perform their job duties. And employees must provide memos justifying the need for a taxi ride.

See also: “[INCOME TAX]: When is it permissible to write off taxi expenses?” .

If the employee’s job responsibilities, in principle, include regular travel, the organization must indicate the traveling nature of his work in the employment contract or local regulations. And documented taxi expenses should be taken into account for tax purposes.

If employees of an organization in the course of their work are forced to often resort to taxi services, in order to painlessly accept such expenses for tax accounting, it is advisable for the organization to enter into an agreement for the provision of taxi services with the appropriate company. Taxi payments should be made to the bank based on issued invoices or according to the terms of the agreement. In this case, to confirm expenses, the organization will have a bank statement with the amounts written off for payment of services, as well as primary documents provided by the taxi service confirming the implementation of these trips.

If you have access to ConsultantPlus, check whether you have correctly taken into account the cost of a taxi for a business trip employee. If you don't have access, get a free trial of online legal access.

Taxi expenses as entertainment expenses

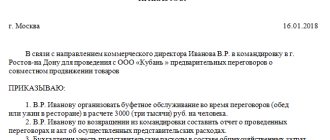

It is rare that any organization in the course of its activities can do without organizing official receptions and negotiations. The costs of transporting officials of the taxpayer organization to the venue of the entertainment event and back are expressly mentioned as entertainment expenses in paragraph 2 of Art. 264 Tax Code of the Russian Federation. To accept them for accounting, they must be documented. To do this, the organization must have:

- order from the manager to carry out this event and incur related expenses;

- estimate of entertainment expenses;

- a report on entertainment expenses, which should include: the purpose and results of the event, date and location, program of the event, list of participants and amount of expenses confirmed by primary documents.

For more information about hospitality expenses and the peculiarities of their design, read the article “Representation expenses - what are these expenses?”

If the costs of delivery using a taxi are mentioned in the report and there are supporting documents, then such costs are taken into account in other costs associated with sales and production.

IMPORTANT! Representation expenses during the reporting (tax) period are included in other expenses in an amount not exceeding 4% of the taxpayer's expenses for wages for this reporting (tax) period.

Read more about rationing entertainment expenses in this article.

The legislative framework

| Legislative act | Content |

| Article 252 of the Tax Code of the Russian Federation | "Expenses. Grouping of expenses" |

| Letter No. 03-03-06/1/68839 dated 10/20/2017 | “On accounting for income tax purposes of expenses associated with the transportation of employees by taxi services for business purposes” |

| Letter No. 20-12/060976 dated June 27, 2008 | “On accounting for profit tax purposes of expenses associated with paying for employees’ travel to and from work” |

| Article 420 of the Tax Code of the Russian Federation | “Object of taxation of insurance premiums” |

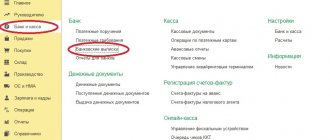

Taxi expenses in accounting

The procedure for using taxis by employees of an organization for official purposes is determined by its head. By his decision, with the issuance of an appropriate order or the development of a local regulatory act regulating the use of a taxi service on business trips, taxi fares for employees may be subject to payment.

Such expenses, confirmed by relevant documents, are taken into account in accounting in accordance with paragraphs. 5, 7 PBU 10/99 “Expenses of the organization” (Order of the Ministry of Finance dated 05/06/1999 No. 33n), as expenses for ordinary activities.

Reflection in the accounting of these expenses made in cash occurs on the basis of the employee's advance report with supporting documents attached.

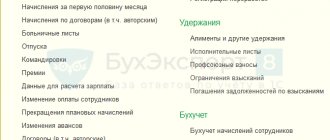

The accounting entries are as follows:

Dt 26 Kt 71 - entertainment expenses for a taxi are reflected;

Dt 20 (26, 44) Kt 71 - reflects the employee’s expenses for a taxi during a business trip.

Taxi expenses incurred by employees in connection with the performance of official duties are calculated in the same way:

Dt 71 Kt 50 - the employee’s expenses were compensated.

To reflect taxi costs in accounting, as well as in tax records, the employee must provide supporting documents, as well as a service note explaining the route.

If an organization has entered into an agreement with a taxi service, the costs associated with the movement of employees by taxi are reflected by posting:

Dt 20 (26, 44) Kt 60 - expenses associated with employees’ work trips by taxi are reflected.

How to organize accounting for a taxi fleet: features and important points

Taxi service accounting and reporting is a task that should not be entrusted to an operator or manager. A specially trained employee can best deal with accounting and reporting - this is especially true for large taxi companies registered as LLCs.

In 2022, UTII for taxi services is completely abolished. Instead, taxi company managers are given a choice: purchase a patent for a period of 3 months to 1 year or work under the simplified tax system (simplified taxation system).

When purchasing a patent, an entrepreneur may not pay taxes at all, since all the necessary amounts are already included in the cost of the patent. No taxi service was automatically transferred to the patent. If you worked under the UTII system, then for the transfer you had to submit an application to the tax service. If the application was not submitted in a timely manner, the taxi service was automatically transferred to the OSNO (general taxation system). For most services it is inconvenient, and an accountant is required to work with such a system.

Accounting for income (revenue) in a taxi

Taxi income must be recorded using a mobile cash register (online cash register). From 2022, all taxi cars are required to have such a cash register, regardless of the form of taxation. Even a single driver must have a mobile cash register in order to transfer receipts online to the tax office and send them to the passenger in a mobile application or in a special application for the self-employed “My Tax”.

If a taxi driver works as a self-employed person, all taxes for him are calculated automatically, and his responsibility is only to pay a certain amount on time (4% when working with individuals or 6% when working with legal entities). He does not pay any other taxes.

After each trip, the taxi driver is required to enter a receipt at the online cash register. Information about payments is simultaneously sent to all three parties: the client, the taxi company and the tax service.

Results

Taxi costs associated with the business activities of an organization attract special attention from accountants and inspectors. To be able to take them into account when calculating income tax, as well as to avoid the accrual of personal income tax and contributions on compensation amounts for taxi expenses for employees, the organization must develop regulations for the use of a taxi service on work trips. All employees must be familiar with these regulations to avoid having to pay for taxi fares at their own expense.

Argue with the Ministry of Finance

The position of the Ministry of Finance looks uncertain.

If you do not want to pay contributions and personal income tax on employee travel expenses and are ready to defend your position, you can use the following arguments.

Firstly

, the Supreme Court has repeatedly confirmed that not all employee benefits are considered paid as part of the performance of an employment contract. You can refer to the Determination of the Armed Forces of the Russian Federation dated October 26, 2018 No. 305-KG18-16834.

Secondly

When a company arranges for employees to travel to the office and home by taxi during the coronavirus period, this should be considered health protection. Agree, this is indeed true. There are categories of workers who are very necessary in the office, but they belong to an increased risk group of contracting the virus. It is logical that the director allows a taxi ride at the expense of the company.

Third

, such expenses are carried out in the interests of the employer, and not to satisfy any personal wishes of the employee. This means that they should not be included in an individual’s income. You can refer to paragraph 3 of the Review by the Presidium of the Supreme Court of the Russian Federation dated October 21, 2015.

Fourth

, draw up an order and provide for such payments in the company’s internal documents.