Acquiring calculations

Acquiring payments replace cash payments. How do you pay:

- The buyer presents a plastic card, from which funds must be debited using special devices or programs.

- The acquiring credit organization checks the client's solvency through the banking system and debits money from his card account.

- The acquiring bank credits the seller's current account with the amount received from the buyer, retaining its commission.

At this point, all settlements between the participants are completed. “Simplers” just have to enter transactions into KUDiR and show the movement of funds in accounting.

Payment under the contract

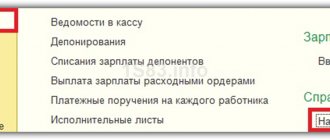

We begin to enter payment processed through acquiring. The shipment of goods or services for this payment must be done separately as a sales document. We will not dwell on this in detail in our article. To enter payment on the main page, in the left yellow field, select Bank and cash desk.

In the Cashier , select Payment card transactions .

Create a new operation using the Create .

We fill out the document. Enter the Type of operation - select the option that suits us from the drop-down list provided - Payment from the buyer . We will describe below how to enter payment by bank card in retail trade.

Next, select the Counterparty (if it is not on the list, then add it) and fill in the information about the acquiring bank and the type of payment.

Create button, we create a Payment type .

Select Payment Method – payment card. And we give the name of the operation - enter it manually.

In the Counterparty , select the acquiring bank, and in the Agreement , select the acquiring agreement. The acquiring bank and the acquiring agreement must already be included in the list of counterparties. We described how to do this in our other material - How to add a counterparty to 1C.

Select Connected equipment - the terminal through which the program runs.

We select an accounting account where we will assign payment card transactions and set the bank interest for acquiring transactions in accordance with the agreement with the bank.

Save the Payment Type the Save and Close button .

The payment type is included in the Payment Card Transactions .

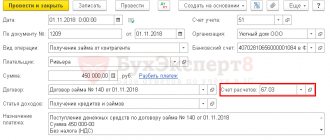

Enter the transaction amount (it will appear in the tabular section automatically) and select the agreement under which payment was made from the buyer.

The data is entered, VAT (if any) is calculated automatically. using the Post and Close button .

The operation appears in the list of payment card transactions. Let's check the created transactions using the Dt/Kt button.

The postings have been created.

Acquiring under the simplified tax system “income”

For tax accounting they keep KUDiR - a book of income and expenses.

How “income” is reflected in this register for acquiring transactions under the simplified tax system:

- amounts are included in income according to the date of crediting funds to the recipient’s current account (clause 1 of Article 346.17 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia No. 03-11-06/2/36926 dated July 28, 2014);

- Advances received from counterparties are also considered income;

- in the revenue they show how much the buyer transferred - before the acquirer deducts the commission (letter of the Ministry of Finance of Russia No. 03-11-11/54526 dated September 19, 2016).

Usually, the funds are transferred to the seller’s bank account minus the bank commission. Reflecting only the amount received in income will understate the tax base. And expenses under the object “income” are not taken into account (clause 1 of Article 346.18 of the Tax Code of the Russian Federation). The taxable revenue of a “simplified” must include the entire amount paid by the counterparty for the sale of goods, works, and services.

Acquiring in 1C - Payment through a terminal in a retail store

The organization retails goods through an automated point of sale (ATP). Accounting is carried out without using account 42 “Trade margin”.

To receive payments via plastic cards, an acquiring agreement was concluded with VTB PJSC. The bank commission is 2% of the payment amount.

On June 11, the following goods were sold for a total amount of 88,500 rubles:

- Roller blind “BLACKOUT FIBER” – 10 pcs. at a price of 4,130 rubles.

- Thread curtains “Africa”—20 pcs. at a price of RUB 2,360.

Payment for goods was made by payment card.

On June 12, the payment made by payment card was credited to the bank account.

Retail sales of goods

Fill out a detailed report on goods sold using the document Retail Sales Report, transaction type Retail in the Sales – Retail Sales – Retail Sales Reports section.

Please indicate:

- Warehouse is a retail outlet, selected from the Warehouses , type Retail store .

On the Products , fill in the products sold from the Nomenclature .

On the Non-cash payments , indicate all types of non-cash payments (payment card, electronic means, etc.):

- Payment type - setting up an acquiring agreement with the bank, selected from the Payment Types .

- Amount — the amount of non-cash payment.

Next, we will consider accounting entries in 1C when paying through the terminal.

Acquiring transactions in 1C

Crediting payment by payment card to the current account

When the bank credits customers' payments via payment cards to the current account, document the document Receipt to the current account, transaction type Receipts from sales on payment cards and bank loans in the section Bank and Cash - Bank - Bank statements - Receipt.

Please indicate:

- Payer is the bank with which the acquiring agreement is concluded.

- Amount - the amount that the bank credited to the account according to the statement. This is the amount of payment from buyers minus the amount of remuneration from the acquiring bank.

- Settlement account - 57.03 “Sales by payment cards.”

- The amount of services is the acquiring bank's remuneration for transferring payment.

- Cost account - 91.02 “Other expenses”.

- Other income and expenses - Expenses for banking services , selected from the directory Other income and expenses with the Type of article - Expenses for banking services .

Postings under the acquiring agreement in 1C

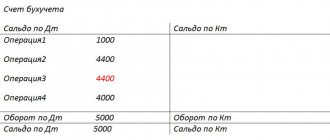

Checking settlements on account 57.03

After the payment has been received into the organization’s account, there should be no balance on account 57.03. Account Analysis report in the Reports - Standard Reports - Account Analysis section.

The absence of a final balance on account 57.03 shows that the buyer’s payment was received in full minus the bank’s remuneration amounts. There is no debt to the bank.

Acquiring under the simplified tax system “income minus expenses”

Accounting for revenue under “simplified” taxation does not depend on the selected tax object. Therefore, income from acquiring under the simplified tax system “income minus expenses” is included in KUDiR according to the same rules as for the object “income”.

However, the commission retained by the acquirer can be included in expenses. The tax base under the simplified tax system “income minus expenses” is reduced on the basis of paragraphs. 9, pp. 24 clause 1 art. 346.16 Tax Code of the Russian Federation.

Example 3

The merchant, under an agreement with the bank, has an acquiring commission of 1.5% of the amount received into the account. The buyer paid 10,000 rubles using the card. The bank transferred 9,850 rubles to the seller’s account. But the taxable income for the simplified tax system must include 10,000 rubles.

The situation with expenses is somewhat simpler. The bank's commission reduces the taxable base under all tax regimes where accounting for expenses is, in principle, provided for: OSNO, simplified tax system “Income minus expenses” and unified agricultural tax.

When accounting using the accrual method, the commission must be included in expenses in the month to which it relates under the terms of the agreement with the bank. When accounting “on payment”, the expense must be recognized on the date of actual write-off or deduction of the commission by the bank.

But in this case it is impossible to reduce the tax base for VAT. Bank commissions associated with servicing accounts and card payments are not subject to VAT (clause 3, clause 3, article 149 of the Tax Code of the Russian Federation). Therefore, the businessman cannot recover this tax through the acquiring commission.

Of all the costs associated with acquiring, VAT can only be reimbursed on the purchase or rental of a terminal. Of course, provided that the seller or lessor pays this tax himself.

Acquiring when combining modes

Entrepreneurs often apply two tax regimes simultaneously. Thus, when acquiring with the simplified taxation system/PSN, the taxpayer will have to independently organize separate accounting of revenue and expenses. The difficulty is that the bank usually transfers all receipts for the day in one amount, and the commission is calculated on the total turnover. Individual entrepreneurs have the right to develop their own tax registers for separate accounting, on the basis of which the data will be reflected in declarations and in the accounting book according to the simplified tax system.

Only that part of the revenue and costs that falls on the simplified tax system is recorded in KUDiR. Income that relates to the activities of the PSN is included in the patent income book.

Receipts from sales via payment cards

When paying by payment card, funds are credited to the organization’s account within a few days, so account 57.03 “Sales by payment cards” is used in the calculations.

Proceeds from the sale of goods are credited to the organization's current account minus the bank commission.

Receipts from sales on payment cards are documented in the document Receipt to current account transaction type Receipts from sales on payment cards and bank loans through the Bank and Cash desk - Bank statements - Receipts section. The document is generated and filled out either automatically when downloading a bank statement, or manually.

Postings according to the document

Section I of the Income and Expense Accounting Book (KUDiR) reflects the following transactions:

- payment in the amount of 155,000 rubles. classified as activities on UTII;

- payment in the amount of 30,000 rubles. registered as income under the simplified tax system;

- bank commission in the amount of 600 rubles. included in expenses.

Reporting

Section I KUDiR for the 4th quarter of 2022 will reflect:

- income according to the simplified tax system;

- commission for bank services.

If you haven't subscribed yet:

Activate demo access for free →

or

Subscribe to Rubricator →

After subscribing, you will have access to all materials on 1C: Accounting, recordings of supporting broadcasts, and you will be able to ask any questions about 1C.

Did the article help?

Get another secret bonus and full access to the BukhExpert8 help system for 14 days free of charge

Related publications

- A universal report for checking labor costs in the income and expense ledger. The income and expense ledger is an important tax register used...

- How can a non-employee accrue income (for example, rent) so that it is included in the general summary and in the statement...

- Book of accounting for income and expenses in 1C 8.3 - where is it located, how to fill it out Organizations that apply a simplified taxation system often face the fact that...

- Transferring a work book to an employee - should it be done through the cash register and what to do with VAT? The Ministry of Finance reminded employers of the need to charge VAT when issuing...

Accounting for acquiring under the simplified tax system

“Simplers” use account 57 “Transfers in transit” to reflect the movement of funds from a counterparty who paid with a plastic card. For acquiring transactions in accounting under the simplified tax system, you can do the following:

D62 / K90 subaccount “Revenue” - the amount paid by the buyer is reflected in the revenue;

D57 / K62 – shows payment debited from the card, but not yet credited to the seller’s account;

D51 / K57 - crediting funds to the seller’s bank account;

D76 / K57 - commission is withheld by the acquiring bank;

D91 subaccount “Other expenses” / K76 - bank commission is included in other expenses.

If the commission is transferred from the seller’s account after all funds from the counterparty have been credited, a posting is made: D91 subaccount “Other expenses” / K 51.

What is acquiring

Acquiring – accepting payments from plastic cards. The operation is possible either by presenting the card in person or via the Internet. In this case, an intermediary appears between the seller and the buyer - the acquiring bank, which:

- at the time of payment, debits money from the payer’s card;

- makes further credits of funds minus its commission to the seller’s account.

The moment of payment by card may differ from the moment of crediting to the supplier’s accounts, therefore accounting for such transactions is carried out using account 57 “Transfers in transit”.

Preliminary setup of accounting for acquiring transactions

First of all, we need to check whether we have all the settings for using acquiring in the 1C: Accounting 3.0 program .

Our team provides consulting, configuration and implementation services for 1C. You can contact us by phone +7 499 350 29 00 . Services and prices can be seen at the link. We will be happy to help you!

Go to the "Main" section and select "Functionality".

On the “Bank and cash desk” tab and set the flag in the “Payment cards” setting. In our case, this part of the functionality was already enabled earlier. We cannot disable it for the reason that the program already reflected reports on retail sales and bank card transactions.