What is a BSO acceptance certificate?

Let’s immediately make a reservation that paper BSOs, which will be discussed in the article, are gradually being forced out of monetary document flow. Currently (and until July 1, 2022), they have the right to be used by a limited circle of people, from among those who, before the amendments to the Law “On Cash Registers” dated May 22, 2003 No. 54-FZ introducing online cash registers, were free from using KKT.

You can find out who these individuals are here.

If you still have the right to work with BSO on paper, consider the following.

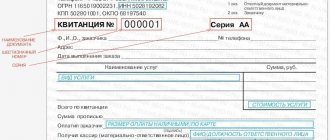

Strict reporting forms (SRF), used in calculations without the use of cash registers, can be produced in a printing house. In this case, the BSO sheets record, in particular, information about the institution that issued them, as well as the circulation of the forms (among other mandatory BSO details specified in clause 3 of the regulations approved by Decree of the Government of the Russian Federation dated May 6, 2008 No. 359).

As a rule, the printing house that produces the BSO and the user of these forms are different business entities. The transfer of printed forms from the printing house to the customer must be confirmed by a separate primary document - for example, an acceptance certificate. This document can be drawn up in any structure that is optimal for the parties to the legal relationship. In particular, it is common practice to use the form from Appendix No. 4 to Appendix No. 2 to the GMEC protocol No. 4/63-2001 dated June 29, 2001.

The forms accepted and capitalized on the basis of the acceptance certificate are subsequently used to issue BSO to employees who accept money from clients.

general information

Strict reporting forms are widely used when calculations are performed without the use of cash registers.

They can be produced in printing houses. In this case, information about the institution that issued them, as well as about the circulation of the forms, is recorded on the BSO sheets. It is quite important that, starting from July 2022, the procedure for the production of strict reporting forms, which are issued in printing houses, as well as using specialized systems not related to cash register equipment, is prohibited.

Today, the presence of only those forms that are produced using automated systems equivalent to cash register equipment is allowed. They must comply as fully as possible with the requirements established by the legislation of the Russian Federation.

Most often, the printing house with which the contract for the production of forms is concluded, as well as the users of the documentation, are completely different business entities. The transfer of forms from the printing house must be fully confirmed by a separate document, for example, an acceptance certificate.

This document can be drawn up in any structure that is optimal for the parties involved in the legal relationship. For example, today the use of the form from Appendix No. 4 to Appendix No. 2 is widespread. Forms that are accepted and capitalized on the basis of the acceptance certificate will be used in the future to issue strict reporting to employees who accept funds from their clients.

Sample of filling out an acceptance certificate for strict reporting forms: document structure

A sample act of acceptance of strict reporting forms may contain, in particular:

- information about the commission that accepts BSO from the printing house;

- information on the results of checking a batch of forms by circulation;

- information about primary documents drawn up as part of the acceptance and delivery of the circulation;

- information on the number of forms - according to the fact, according to the invoice, indicating their series;

- information about surpluses, shortages, defects;

- the cost of forms received from the printing house;

- the fact of posting BSO in the accounting book and transferring them for storage to the accounting department.

The document is signed by the members of the commission, as well as by the accountant.

Write-off procedure

By order of the enterprise, a special commission is created, which draws up an act for deregistration of strict reporting documents. The frequency of write-offs is established by the accounting policy of the institution. Before drawing up the document, the commission is obliged to verify the intended use of the forms provided by the MOL for deregistration.

The following are considered confirmation:

- stubs or copies of receipts;

- entries in the accounting book of form 0504045 with the signatures of the recipients;

- employee receipts for receiving a pass or certificate;

- journals for issuing waybills, work books and others.

Organization of BSO circulation: issuing forms to employees

The issuance of BSO to employees who accept money from clients is, as a rule, carried out by the accounting department of the enterprise. In this case, the following documents are generated:

- agreement on the financial responsibility of the employee who accepts money from customers;

- order appointing a company employee as a financially responsible person (MOL);

- requirement-invoice for the transfer of forms to the MOL.

The first 2 documents are drawn up on the basis of established internal corporate standards for the execution of relevant acts, the third can be drawn up on the basis of a unified form No. M-11. But since this form is quite complex in its structure, a simpler document is often used instead - the act of transferring BSO to employees.

Issuing BSO to clients is a procedure that also has a number of nuances.

Sanctions for issuing unspecified strict reporting forms (judicial practice)

If the client is issued a BSO of an unspecified type, then in accordance with the provisions of clause 4 of Art. 14.5 of the Code of Administrative Offenses of the Russian Federation, a fine of 30,000–40,000 rubles may be imposed. for organization or 1,500–2,000 rubles. to an official.

The legality of such sanctions is confirmed by judicial practice (resolution of the FAS Far Eastern District dated 03/07/2007, 02/28/2007 No. F03-A51/07-2/123 on arbitration proceedings No. A51-11184/06-10-330, resolution of the FAS North Caucasus District dated 04/29/2009 No. A32-18480/2008-56/286-13Аж).

How is the document filled out?

First of all, it must be said that the procedure for filling out this document is not very complicated, but requires care and responsibility. This document must be completed by a qualified specialist who has experience in maintaining such documentation. Otherwise, if the filling is done incorrectly, certain problems will arise that require immediate resolution.

[docs]

So, the act should contain the following information:

- Data about the commission that receives from the printing house.

- Data about the results of testing of the supplied batch.

- Information about the primary documents drawn up during the acceptance and transfer of circulations.

- Data about the number of documents in accordance with the invoice. Each form must contain its series, as well as its number.

- Information about extra forms, defective documents, shortages, and so on.

- Price for documents that were received.

- Information about capitalization in the transfer and accounting book.

Once the document has been drawn up and verified, it must be signed by all members of the commission, as well as the chief accountant or his deputy.

Where can I find a certificate of acceptance and transfer of BSO and a sample act of transfer of BSO to an employee?

On our website you can find:

- with a sample act of acceptance and transfer of BSO from the printing house to the customer;

- with a sample act of transferring strict reporting forms to an employee who is the financially responsible person.

Results

The turnover of SSO in an organization can be carried out using various acts - acceptance, transfer to an employee. How one or another sample of an act of acceptance of a BSO or a transfer of a form will be drawn up is determined mainly by the accepted norms of internal corporate document flow. If we are talking about the acceptance of printed BSO from the printing house, the form of the act approved in the GMEC protocol No. 4/63-2001 can be used.

You can learn more about the features of using BSO in the articles:

- “Strict reporting form instead of a cash receipt (nuances)”;

- “What mandatory details must be indicated in the BSO?”;

- “What applies to strict reporting forms (requirements)?”;

- “What part of the BSO should be given to the client?”

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

We write off old-style invoices that are valid for use

How to reflect in the organization's accounting the write-off of old-style invoice forms that are valid for use?

The head of the organization decided to cancel and destroy old-style invoice forms valid for use due to difficulties encountered in filling them out in accordance with current legislation.

The accounting value of old invoice forms, listed according to the organization’s accounting data in account 10 “Materials” and off-balance sheet account 006 “Document forms with a certain degree of protection,” is 5 rubles.

General provisions

TN and TTN forms refer to document forms with a certain degree of protection, information about which is subject to inclusion in the electronic data bank of document forms and documents with a certain degree of protection and printed products <*>.

The use, accounting, storage and destruction of these invoice forms are carried out in the manner established by law in relation to strict reporting forms (hereinafter referred to as SSR) <*>.

The forms of the current TN and TTN forms were approved by Resolution No. 58 and came into force on 09/02/2016.

At the same time, the previously existing forms of invoices approved by Resolution No. 53 (repealed on May 1, 2009) and Resolution No. 192 (repealed on September 1, 2016) are valid and are allowed to be used <*>.

When filling out old-style invoice forms, it is necessary to take into account that since Resolution No. 53 and Resolution No. 192 have lost force, the TN and TTN forms approved by these resolutions should be filled out in the manner prescribed by Resolution No. 58.

Since the above regulations do not oblige organizations to use the old invoice forms until they are fully used, the head of the organization has the right to decide to write off the old invoice forms due to difficulties encountered in filling them out in accordance with current legislation.

Damaged and (or) canceled SSBs, together with the register of SSBs subject to destruction, must be stored in the organization for a month after the tax authorities conduct an audit of compliance with tax legislation <*>.

After this period, a commission appointed by the head of the organization prepares damaged and (or) canceled forms for destruction and their immediate destruction <*>.

Accounting

BSO accounting is maintained in monetary and quantitative terms on account 10 “Materials” and on off-balance sheet account 006 “Document forms with a certain degree of protection” for each type of form and their storage location (MOL) <*>.

To account for BSO, the organization has the right to open a separate sub-account to account 10 “Materials” <*>.

The write-off of old-style invoice forms in the accounting records of the organization is reflected by posting the debit of subaccount 90-10 “Other expenses for current activities” and the credit of account 10 “Materials” with the simultaneous write-off of forms of specific series and numbers on the credit of off-balance sheet account 006 “Forms of documents with a certain degree protection" <*>.

Income tax

According to the author, the cost of old-style invoice forms, valid for use, written off by decision of the manager due to difficulties encountered in filling them out in accordance with current legislation, can be taken into account when taxing profits as part of non-operating expenses on the date of their write-off <*>.

VAT

Writing off old-style forms is not considered subject to VAT <*>.

According to the explanations of the tax authorities, there is no need to restore VAT on damaged BSO <*>.

Let us note that in 2022 there were no significant changes in this part of the Tax Code. According to the author, when writing off old-style invoice forms, the organization has the right to use these clarifications, since the legislation establishes a uniform procedure for writing off both damaged and canceled BSO <*>.

Accounting Entry Table

To account 10 “Materials” a subaccount 10-13 “BSO” has been opened.

| Contents of operations | Debit | Credit | Amount, rub. | Primary document |

| The cost of old-style invoice forms is written off <*> | 90-10 | 10-13 | 5 | Material write-off act, receipt and expense book for BSO accounting, register of BSO subject to destruction, accounting certificate-calculation |

| The write-off of old-style invoice forms is reflected for each type of form and their storage location (MOL) | 006 | 5 | Material write-off act, receipt and expense book for BSO accounting, register of BSO subject to destruction, accounting certificate-calculation | |

| ——————————— <*> According to the author, they are taken into account when taxing profits as part of non-operating expenses <*>. | ||||