2411 Line codeIndicator

Revaluation of non-current assets

Other transactions not included in net profit

Income tax on transactions given in line 2520

Calculated using the formula: Line 2520 * Income tax rate

Earnings per ordinary share

To calculate, divide the amount of profit by the number of shares

25102500Net income adjusted for the items above 29002910Diluted earnings per share, which is an indicator of the decline in earnings per share that may occur in the futureThe report is one of the main sources of information for the financial and economic analysis of the company. For example, only after a complete analysis of the document do banks issue a loan, and investors decide on investing money.

Interrelation between the balance sheet and the financial results report

The financial statement and balance sheet link the indicators of retained and net profit. To check the correctness of filling out the FR report, use the following equation:

Retained earnings of the reporting year = Retained earnings of the previous period + Net profit of the reporting period

However, this equality may not be observed when distributing dividends, in which case another equality is appropriate:

Retained earnings of the reporting year = Retained earnings of the previous period + Net profit of the reporting period - Dividends paid

Tax authorities always check compliance with this equality. If there are discrepancies, the Federal Tax Service may request clarification, for example, the decision of the founders on the distribution of dividends.

An example of filling out a FR report

Alliance LLC purchased laptops for resale. A total of 1,000 laptops for 7,200,000 rubles, including VAT 20% - 1,200,000 rubles. The proceeds from their sale amounted to 15,000,000 rubles, including VAT 20% - 2,500,000 rubles.

Expenses for the salary of the sales department - 2,000,000 rubles, for the salary of the director - 500,000 rubles, for office rent - 150,000 rubles.

The company took out a loan to purchase laptops. Interest paid - 400,000 rubles.

Gross profit Page 2100 = Page 2110 - Page 2120

Income from participation in other organizations

Interest receivable (interest on deposits, loans issued)

| Line code | Index | Amount, thousand rubles |

| 2110 | (500 + 150 = 650) | |

| 2200 | Profit from sales Page 2200 = Page 2100 - Page 2210 - Page 2220 | 3 850 |

| 2310 | 0 | |

| 2350 | (Other expenses) | 0 |

| 2300 | Profit before tax Page 2300 = Page 2200 + Page 2310 + Page 2320 - Page 2330 + Page 2340 - Page 2350 | 3 450 |

| 2410 | Income tax, incl. | (690) |

| 2411 | Current income tax | (3 450 * 20% = 690) |

| 2412 | deferred income tax | 0 |

| 2460 | Other | 0 |

| 2400 | Net profit Page 2400 = Page 2300 - Page 2410 - Page 2460 | 2 760 |

We recommend the cloud service Kontur.Accounting. You no longer need to collect financial statements manually. The program will independently distribute turnover and balances among accounting accounts and give you a fully completed report. We give all newbies a free trial period of 14 days.

Land tax is paid by organizations, entrepreneurs and ordinary individuals who own land plots. The amount of tax depends on the rate established in the region, the cadastral value and the benefits provided. Let's figure out how land taxes can be reduced.

Vehicle owners often claim double taxation on their vehicles. In addition to the transport tax, which they pay annually to the regional budget, car owners are faced with two excise taxes. The first is included in the price of the car itself, and the second is included in the price of gasoline and diesel fuel, since all of these are excisable goods.

Source

What is an income statement

This is a form included in the financial statements along with the balance sheet and its annexes. The report form was approved by Order of the Ministry of Finance dated 07/02/10 No. 66n (hereinafter referred to as Order No. 66n).

IMPORTANT . The income statement format is not recommended. Using it is an obligation, not a right of organizations. But the company can set the level of detail itself. For example, decipher what business expenses consist of and enter an additional line “Including” for this.

By the way, previously this form was called “profit and loss statement” and “form No. 2”. The modern name was introduced more than eight years ago, but some accountants, auditors and other specialists still use the old name.

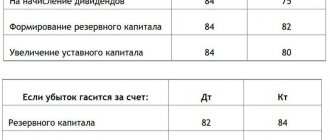

Two options for determining the current income tax

PBU 18/02 provides two options by which you can determine the amount of the current tax:

- method of deferment - according to accounting data;

- balance sheet method - according to the data reflected in the tax return.

In any case, the amount of current income tax reflected in accounting must be equal to the amount entered in the tax return on line 180.

The rules by which tax is calculated are contained in PBU 18/02. Changes to this document were made by the Ministry of Finance by order No. 236n dated November 20, 2018. Income tax is reflected in the financial statements, in the income statement. Its form was also changed by order of the Ministry of Finance dated April 19, 2022 No. 61n.

How to fill out an income statement

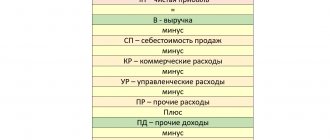

The purpose of filling out is to show how the totals were calculated:

Each final value is obtained by adding or subtracting intermediate values. For example, to find gross profit, you first need to take two intermediate indicators: revenue and cost of sales. Then subtract the second from the first.

IMPORTANT. Intermediate values that participate in calculations with a minus sign (that is, are subtracted) must be indicated in parentheses. Some indicators are always in parentheses: business expenses, interest payable, etc. But there are also those that can be either in brackets or without them. This is, for example, profit (loss) before tax.

All lines have an “Explanation” column. It contains the number of explanations that disclose information on this line. If, for example, information about revenue is summarized in a certificate with number 15, then before the line “Revenue” you need to put “15”.

ATTENTION. Previously, financial statements could be filled out in both thousands and millions of rubles. But now there is only one option - in thousands of rubles. These amendments to order No. 66n were made by order of the Ministry of Finance dated 04/19/19 No. 61n.

Balance sheet profit - line in the balance sheet

Despite the name, the BP indicator is not reflected in any of the lines of the balance sheet. The final financial result of the enterprise in the balance sheet is reflected in line 1370 “Retained earnings / uncovered loss of the enterprise.” This indicator is closely related to the net profit indicator reflected on line 2400.

For the calculation of net profit and the relationship between line 2400 “Net profit” of the general financial report and line 2300 of the balance sheet, see the material “Calculation of net profit on the balance sheet - formula”.

IMPORTANT! From 06/01/2019, updated accounting reporting forms are used as amended, approved by Order of the Ministry of Finance dated 04/19/2019 No. 61n.

BP in the financial statements is reflected in line 2300 (profit/loss before tax) of the Income Statement and includes all income and expenses from the main and other activities of the enterprise.

Income Statement: Breakdown of Lines

Each line has its own code, it is indicated in a separate column. The decoding of the codes is given in Appendix No. 4 to Order No. 66n (see Table 1).

Lines of the income statement with codes and interpretation

Indicator name

What to indicate

Turnover for the reporting period on the credit of account 90 subaccount “Revenue”. Charged without VAT and excise taxes

The amount of the following entries made during the reporting period:

Source

The essence of balance sheet profit before tax

In the economic literature, especially in the analytical direction, the term “balance sheet profit of an organization” is often found, but a study of the current forms of financial statements allows us to conclude that this indicator is absent in them.

Currently, three of the five main forms of financial reporting contain profit figures:

- the balance sheet informs interested users about the amount of retained earnings remaining from the profits of previous years and the reporting year after its distribution;

- the financial results statement provides detailed information on the formation of the organization’s financial result, but at the same time it operates with such concepts as gross profit, sales profit, profit before tax, net profit;

- the statement of changes in capital reveals the content and procedure for the formation of the retained earnings indicator reflected in the balance sheet, including net profit generated at the end of the year in the income statement.

Are you an expert in this subject area?

We offer to become the author of the Directory Working Conditions Obviously, the indicator of balance sheet profit from the point of view of regulatory documentation for accounting has a different name. As a result, a reasonable question arises, which of the listed profit indicators is its legally established analogue.

This indicator is profit before tax, reflected on line 2300 of the organization’s financial performance report.

Note 1

Balance sheet profit before tax reflects the total result obtained by the organization based on the results of its activities.

What is an income statement

Together with the balance sheet, the income statement is one of the two main forms of accounting reporting. Therefore, in practice, accountants often call it “Form No. 2,” although this name has not been used in regulations since 2013. We will also use the term “Form No. 2” for brevity. The bottom line of an income statement is the company's profit or loss for the period. Form No. 2 also contains aggregated data on the main items of income and expenses.

Companies are generally required to use all lines of Form No. 2 (Appendix 1 to Order of the Ministry of Finance dated July 2, 2010 No. 66n). The report indicators must be detailed taking into account their significance. For example, revenue can be deciphered by area of activity, and expenses - by individual items (clause 3 of order No. 66n). Small enterprises that have the right to conduct simplified accounting can fill out a report on financial results in an abbreviated form, using fewer lines (clause 6.1 of Order No. 66n).

Let's consider filling out a standard form of financial performance report that any organization can use: without transcripts and without reducing the number of items.

The procedure for forming balance sheet profit before tax

There are several possibilities for determining book profit before tax:

- balance sheet profit before tax is defined as the difference between the organization’s income and expenses;

- balance sheet profit before tax is defined as the sum of profit from sales and the balance of other income and expenses;

- balance sheet profit before tax is defined as the amount of income from core and other activities reduced by the amount of expenses from core and other activities.

How to reflect information on revenue and expenses for ordinary activities

On line 2110 “Revenue”, indicate your company’s revenue from its core activities without VAT and excise taxes. This could be production, trade, various services. If you have several lines of business, you can decipher line 2110, but this is not necessary.

The indicator on line 2110 is equal to the difference between the turnover on the credit of account 90 “Sales” (subaccount 90.1 “Revenue”) and the turnover on the debit of subaccounts 90.3 “VAT” and 90.4 “Excise taxes”. If you work without VAT and do not pay excise taxes, then simply use credit turnover under subaccount 90.1.

On line 2120 “Cost of sales”, indicate costs that are directly related to products sold, goods or services provided. For example, for trade this will be the cost of purchasing goods sold, and for production - the cost of written-off materials and workers' wages.

In accounting, the data for line 2120 is the sum of the entries in the debit of subaccount 90.2 “Cost of sales” in correspondence with the credit of the cost and inventory accounts:

Data on the “Cost” line and other report indicators that relate to costs should be indicated in parentheses. Also use brackets for the financial result if the calculation results in a loss.

In line 2100 “Gross profit (loss)”, indicate the difference between revenue and cost of sales:

PAGE 2100 = PAGE 2110 – PAGE. 2120

In line 2210 “Commercial expenses”, enter expenses associated with the promotion and sale of products, goods, works, and services. These could be expenses for advertising, delivery, warehouse rental, etc. To fill out line 2110, use the turnover from the debit of subaccount 90.2 in correspondence with the credit of account 44 “Sales expenses”.

In line 2220 “Administrative expenses”, indicate expenses that relate not to individual types of goods or products, but to the management of the company as a whole. This could be, for example, management and accounting salaries or office rent. In line 2220, include debit turnover for subaccount 90.2 in correspondence with the credit of account 26 “General business expenses”. If in 2022, at the end of the month, you wrote off general business expenses to the debit of account 20 “Main production”, the line “Administrative expenses” is not filled in.

The indicator for line 2200 “Profit (loss) from sales” is equal to the difference between gross profit and the amount of commercial and administrative expenses:

PAGE 2200 = PAGE 2100 – PAGE. 2210 – PAGE. 2220

How to enter information about other income and expenses into the report

Other income and expenses are not related to the main activities of the organization. Typically these expenses are a small proportion of total turnover, and some companies may not have them at all. Such income and expenses are recorded in a separate account 91, to which two sub-accounts are usually opened. Income is reflected in the credit of subaccount 91.1 “Other income”, and expenses are reflected in the debit of subaccount 91.2 “Other expenses”.

In line 2310 “Income from participation in other organizations”, enter the amount of dividends received or proceeds from the sale of shares in the authorized capital or shares.

In line 2320 “Interest receivable”, reflect your interest income: on deposits, loans issued, etc.

In line 2330 “Interest payable”, indicate your interest payments: on loans received, bonds issued, etc.

In lines 2340 “Other income” and 2350 “Other expenses”, include all other types of income and expenses not related to the main activities of the company that are not included in lines 2310, 2320, 2330.

When filling out lines 2310 – 2350, take into account the specifics of your business. For example, if one of your main activities according to the charter is investing funds in other organizations, then you must include dividends received and other income from investments in your main income (line 2110). If you have a manufacturing or trading company and you rented out an unused part of the workshop (warehouse), the rent will be other income (line 2340). And if renting out real estate is your main business, then the same income should be entered in line 2110.

How to generate data on financial results and income tax

To calculate the indicator for line 2300 “Profit (loss) before tax,” add other income to line 2200 and subtract other expenses:

PAGE 2300 = PAGE 2200 + PAGE. 2310 + PAGE 2320 – PAGE 2330 + PAGE 2340 – PAGE 2350

Fill out line 2410 “Income tax” only if you work on the general tax system and pay income tax. The value of line 2410 is equal to the sum of lines 2411 and 2412.

Line 2411 “Current income tax” is the amount of income tax, which is calculated according to tax accounting data and reflected in the declaration.

Use line 2412 “Deferred income tax” if you apply PBU 18/02 “Accounting for corporate income tax calculations”. This line includes tax differences - deviations between accounting and tax accounting. To fill out line 2412, add up the debit turnover on accounts 09 “Deferred tax assets” and 77 “Deferred tax liabilities”, and then subtract the credit turnover on the same accounts from the resulting amount.

In line 2460 “Other”, enter other income or expenses that were not taken into account above, but affect net profit. For example, if you are using a special tax regime, then include in this line the tax under the simplified taxation system or the unified agricultural tax.

Line 2400 “Net profit (loss)” is equal to the difference between lines 2300, 2410 and 2460:

PAGE 2400 = PAGE 2300 – PAGE. 2410 – PAGE 2460

What has changed in the income statement format

In the income statement form that must be completed for 2020, the lines related to income tax have changed.

As an item that reduces (increases) profit (loss) before tax when forming net profit (loss) for the reporting period, the income tax expense (income) indicator is filled in. It is now divided into deferred income tax and current income tax.

It is indicated on line 2410, which is now called “Income tax” (without the word “current”).

But in essence, this is a new indicator “Income tax expense (income)”, which has been introduced in PBU 18/02 since 2022. This is the amount of income tax recognized in the income statement as an amount that reduces (increases) profit (loss) before tax when calculating net profit (loss).

To decrypt it, the following lines have been added:

- 2411 “Current income tax”;

- 2412 “Deferred income tax.”

Current income tax is the amount of income tax calculated according to tax accounting data, indicated in the income tax return (shown in brackets).

How to include background information in a report

Below the line “Net profit” in form No. 2 there is reference information. These are indicators that, according to accounting rules, do not affect net profit, but they are included in the total financial result.

In line 2510, reflect the result from the revaluation of non-current assets, which influenced the increase or decrease in additional capital.

In line 2520, indicate information about other transactions not included in profit or loss that affected the amount of the organization’s capital. For example, this could be a positive exchange rate difference on contributions to the authorized capital in foreign currency.

In line 2530, enter data on the income tax from the transactions indicated in line 2520. To do this, you need to multiply the value of line 2520 by the income tax rate applied by the enterprise. This is a new line that was not on Form 2 until 2022.

Line 2500 “Cumulative financial result of the period” is the net profit (loss) from line 2400, adjusted taking into account additional indicators from lines 2510, 2520, 2530.

PAGE 2500 = PAGE 2400 +– PAGE 2510 +– PAGE 2520 +– PAGE 2530

Lines 2900 “Basic earnings (loss) per share” and 2910 “Diluted earnings (loss) per share” are a separate block of reference information. They do not affect either net profit or overall financial results. Fill them out only if your company is created in the form of a joint stock company.

Line 2900 shows how much of the profit (loss) is attributable to one common share. Line 2910 shows a decrease in earnings per share that may occur in a future reporting period. The methodology for calculating these indicators is set out in detail in Order of the Ministry of Finance of the Russian Federation dated March 21, 2000 No. 29n “On approval of Methodological Recommendations for the disclosure of information on profit per share.”