What exactly does the Bank of Russia classify as cash proceeds?

In accordance with the Directive of the Bank of Russia No. 3073-U dated October 7, 2013 (clause 2), for the purpose of applying this regulatory act, cash proceeds mean funds that:

- expressed in the currency of the Russian Federation – rubles;

- received by the cash desk from individuals, entrepreneurs and organizations;

- received at the cash desk as payment for goods sold, work performed and services rendered. In this case, the goods sold must be owned by the seller, and the work and services must be performed by the contractor himself. In other words, if an intermediary accepts payment for the specified goods, works and services, then this money is not the intermediary’s revenue . In particular, this applies to such categories of intermediaries as bank payment agents (or subagents) and payment agents. The funds that came to their disposal under the agreement in the process of performing operations to receive funds from the population, organizations and entrepreneurs cannot be spent by the specified agents at all, since they are not their property;

- or received by the cash desk as insurance premiums under insurance contracts.

All these conditions must be met at the same time. And then the amount of money received at the cash desk will be recognized as cash proceeds for the purpose of controlling its expenditure.

As for spending this revenue , this process, in turn, also has its own requirements:

- Directive No. 3073-U regulates a closed list of areas that can be paid for from cash proceeds;

- and additionally, the same act established a limit on cash payments between legal entities and individual entrepreneurs.

But first things first!

Video - cash accounting (cash: limit, calculations):

What can you spend cash on?

As you know, it is not at all necessary to hand over all the money to the bank and keep it in a current account. Individual entrepreneurs and small organizations do not have to comply with the cash limit in the cash register and store them in an unlimited amount.

Of course, it is more convenient to use a current account, but if you have cash proceeds that you have not deposited with the bank, what can you spend it on? It turns out not for everything. There is an instruction from the Central Bank that regulates cash payments.

Rule No. 1. Proceeds from the sale of goods and services are allowed to be spent on:

- payments to employees for salaries and various benefits;

- payment of insurance amounts if there are insurance contracts with individuals;

- payment for goods, works and services;

- issuing money to employees on account;

- refund of money to the buyer for services not provided and returned goods, if the buyer paid you in cash;

- personal needs of the individual entrepreneur.

Please note that only an individual entrepreneur can take any amount of money for personal needs. Individual entrepreneur = individual, therefore, from the moment the money hits the cash register, it already becomes personal. The director and founder of an LLC do not have the right to do this, because the funds belong to the organization, and this is a separate legal entity.

This list of what cash proceeds can be spent on is closed, i.e. in practice, it cannot be added with new clauses. Therefore, if you decide to pay cash for renting a premises, return a loan, or vice versa, issue a loan to an employee or founder, this cannot be done from trading proceeds, but you need to go to the bank and specifically withdraw money from the account for such purposes.

In addition, there is one more important note. All these rules for spending cash apply only to revenue from the sale of your own goods or services. If you work as a paying agent under an intermediary agreement and accept payments from buyers in the interests of another company, such proceeds must be turned over to the bank in full.

Rule No. 2. You must adhere to the limit when paying in cash

Cash can be used to pay not only with individuals, but also with other organizations and entrepreneurs. But at the same time, when making cash payments with other legal entities and individual entrepreneurs, you must comply with the limit of 100 thousand rubles under one agreement.

The limit of 100 thousand rubles must be observed both for long-term contracts and if payments are periodic. The restriction applies generally to the entire agreement.

There is no need to comply with the limit on customs payments if you issue wages to employees or money on account. However, if an employee makes payments for accountable amounts on behalf of the organization, then the limit will have to be monitored.

Cash payments can be accepted from the public (ordinary citizens) without restrictions.

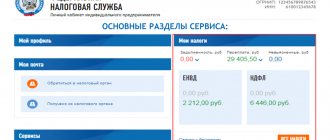

What is the penalty for violation?

For failure to comply with these rules for cash payments when checking cash discipline, the tax office may fine you under Article 15.1 of the Code of Administrative Offences. The fine for individual entrepreneurs is set at 4 - 5 thousand rubles, and for organizations it is much more significant - from 40 to 50 thousand rubles. However, such violations are subject to a statute of limitations of 2 months. This means that if the tax authorities don’t catch you during this time, they won’t be able to fine you later.

The article is current as of 11/07/2014

What can the cash proceeds be spent on?

According to Directive No. 3073-U (clause 2), organizations and entrepreneurs cannot spend the cash proceeds received at their cash desk for any purpose.

True, there are exceptions that are approved by the same Directive:

- You can use cash proceeds to pay employees . In this case, these remunerations must be included in the wage fund. It is worth noting that the concept of “wages” is given only in the Labor Code of the Russian Federation (Article 129) and applies only to those employees with whom an employment (!) contract has been concluded. But if such an employee is a non-resident, then his salary can only be paid through a current account by transferring funds, for example, to a salary card. This is what Federal Law No. 173-FZ of December 10, 2003 says, “On Currency Regulation and Currency Control”: on the basis of subparagraph b, clause 9, part 1, article 1 of this law, the operation of alienation of Russian currency by a resident (Russian company or entrepreneur) in favor of a non-resident (foreign employee) on legal grounds (an employment contract, for example) is recognized as a currency transaction. And such operations can only be carried out through bank accounts.

When making payments to employees, it is very important to take into account that the founder, who performs the duties of a director under an employment contract, has the right to receive a salary from cash proceeds. But this does not apply to its dividends! Firstly, they do not relate to the wage fund and social benefits; secondly, their payment is not identified with civil obligations. Dividends are profits received from the results of the enterprise’s activities and calculated taking into account the founder’s share in the authorized capital. Moreover, Directive No. 3073-U nowhere provides for the possibility of paying dividends from the cash register at all - neither from proceeds, nor from money withdrawn from a bank account. True, there is no prohibition on paying dividends using borrowed funds received by the enterprise’s cash desk!

- Payments allowed from cash proceeds also include payments of a social nature , for example, financial assistance, etc. These costs apply not only to those who work under an employment contract. But the main thing is that the payments made are truly recognized by regulations as “social”;

- But what about those individuals (not entrepreneurs) with whom a civil contract has been concluded? With them, Directive No. 3073-U also allows settlements to be made from cash proceeds, allowing it to be spent on paying for purchased goods (with the exception of the purchase of securities), work and (or) services . It is worth noting that these payments can also be made in relation to organizations and entrepreneurs who act as suppliers and contractors. In this case, payment from cash proceeds from the cash desk is made to the direct representative (employee, for example) of these persons, but if he has a power of attorney to receive money;

- It is allowed to be issued from cash cash proceeds and on account to employees of the enterprise. Do not forget that this category includes any employees working under an employment or civil contract. In the latter case, it is important that the employee is not registered as an entrepreneur;

- You can give money from cash proceeds to the entrepreneur himself. But on the condition that the specified amount will go only to his personal needs , and not to pay the expenses of his business activities;

- cash proceeds can be spent from the cash register to pay for returned goods (work not performed, services not provided) . But provided that these funds were previously deposited into the cash register as payment for the supply of goods, for the performance of work, for the provision of services. In other words, if an advance was received for these purposes into a bank account, then the return of such funds if, for example, the work was not completed, must also be made through a bank account. By the way, if, for example, the goods were paid for with the buyer’s bank card, then the refund will be made to the buyer’s card in this case too!

In addition, cash proceeds can be spent from the cash register:

- in the form of payments under insurance contracts, but to those individuals who previously paid insurance premiums in cash;

- for operations carried out by bank payment agents (subagents) in accordance with Article 14 of Federal Law No. 161-FZ of June 27, 2011. “On the national payment system.”

Excluding all of the above spending areas, cash proceeds cannot be used anywhere else. This is a closed list!

What then to do with the remaining or unused cash proceeds? Take it to the bank, for example. Or, if the limit allows, store these funds in the cash desk of the enterprise (entrepreneur).

However, even in those areas that constitute exceptions, it is still impossible to freely spend cash proceeds, since additional restrictions on its use apply.

Cash payment limit

First of all, the limit on cash payments between legal entities and (or) entrepreneurs established by the Central Bank of the Russian Federation in Directive No. 3073-U does not apply to all types of payments :

- Between organizations (or entrepreneurs) and individuals (without registration as an entrepreneur), cash payments in the currency of the Russian Federation and in foreign currency can be made without any restrictions on the amount (clause 5 of Directive No. 3073-U). But in this case it is necessary to take into account, for example, the requirements of Law No. 173-FZ of December 10, 2003. “On currency regulation and foreign exchange control” in relation to the implementation of foreign exchange transactions between residents and non-residents. In particular, settlements between a company and an individual in Russian currency are allowed exclusively in non-cash form if one of the payment participants is a non-resident and the other is a resident.

In addition, if an entrepreneur makes a purchase for personal purposes (!) in cash, then he is also not subject to the restriction on the amount of cash payments.

- Without taking into account the limit on cash payments, it is permitted to spend cash proceeds received at the cash desk for the purposes provided for in paragraph 2 of Directive No. 3073-U (paragraph 4, paragraph 6 of Directive No. 3073-U). True, not all of these areas of spending turned out to be unlimited, but only:

- employee salaries and social payments;

- payments that go exclusively to the personal needs of the entrepreneur, i.e. not related to his business activities;

- issuance of money on account.

But when receiving money on account, you should keep in mind that the subsequent use of these funds will have to comply with the limit on cash payments between legal entities and (or) entrepreneurs established by the Central Bank of the Russian Federation.

Specified limit for cash payments:

- applies to settlements only between organizations and (or) entrepreneurs;

- applies to settlements both in rubles and in foreign currency;

- should not exceed 100 thousand in rubles, and in foreign currency - an amount that is equivalent to 100 thousand rubles. To find out the limit for cash payments in foreign currency, it must be recalculated at its official exchange rate of the Bank of the Russian Federation, valid on the date of these calculations. The official exchange rate by the Bank of Russia is set daily and published either in the publication “Bulletin of the Bank of Russia”, or a list of rates can be found on its website cbr.ru. But only! In all other sources, the exchange rate is not recognized as official;

- applies only to settlements under civil law contracts concluded between organizations and (or) entrepreneurs. In this case, the subject of the agreement does not matter, i.e. supply of goods, or performance of work, or rental of real estate, etc.;

- applies to civil obligations that are subject to fulfillment both during the validity period of the agreement itself and beyond the period for which the specified agreement was concluded. In other words, for example, the delivery of goods under the contract must be completed on January 16, 2022, and payment for the goods must be made before the same date. But payment arrives on January 17, 2017. Thus, this money, regardless of the date of its receipt, is also subject to the requirement to comply with the limit for cash payments.

In addition to the established limit regarding cash payments between legal entities and (or) entrepreneurs, there are a number of important restrictions:

- Payments in rubles through the cash desk between companies and (or) entrepreneurs, as well as between these persons and ordinary citizens, for transactions with securities, for the rental of real estate, for the issuance or return of loans and interest on them, for gambling, are allowed only under the condition , that money to pay for these expenses was withdrawn from the bank account of the company or entrepreneur and received at their cash desk.

This list is also closed! This means that outside of this list of directions for using cash, payments cannot be made even using money withdrawn from a bank account. But at the same time, this restriction does not apply to those types of payments that are allowed to be made from cash proceeds received directly to the cash desk (wages, on account, etc.). Those. if cash proceeds are not enough to achieve the goals named in clause 2 of Directive No. 3073-U, then the enterprise or entrepreneur has the right to withdraw money from the current account to the cash desk and spend it on these very goals;

- In addition, the specified types of cash payments (real estate rental, gambling, etc.) between legal entities and (or) entrepreneurs (!) can only be carried out in compliance with the current limit on cash payments established by the Central Bank of the Russian Federation. But if an ordinary citizen participates in these calculations, then the limit does not apply to these calculations. For example, the return to the founder - an individual - of a cash loan can exceed 100 thousand rubles.

There is a category of people who are not subject to any restrictions on the use of cash!

How to issue or return a loan to the cashier

Some organizations have special rules (this is understandable: the basis of their activities is lending money).

- From cash proceeds, you can issue loans, repay borrowed loans, pay interest, penalties, fines and penalties, but not more than 50,000 rubles under one agreement. There is another limitation - the amount of such payments should not exceed 1 million rubles per day per MFO as a whole or its separate division (pawnshop and its OP);

- Credit consumer cooperatives (including agricultural ones) - can issue loans, return previously raised loans, funds under agreements for the transfer of personal savings, fees for the use of funds under agreements for the transfer of personal savings, pay interest, penalties, fines and penalties in the amount of not more than 100,000 rubles for each agreement. The limit on such payments per day is 2 million rubles (per organization or separate division).

As for ordinary organizations that do not belong to credit cooperatives, pawnshops or microfinance organizations, they can also issue and receive loans from the cash register, but subject to several rules:

- You cannot issue a loan from proceeds . First, it must be deposited into the current account, then either transferred to the borrower’s account or cash withdrawn, deposited in the cash register and only then issued. Moreover, if the borrower is an individual entrepreneur or LLC, then there is a restriction - no more than 100,000 in cash under one agreement. If the borrower is an individual, then the restriction does not apply.

- You can get a cash loan . But even here it is important - who will lend you money. If this is an organization or an entrepreneur, then again you need to limit the amount - up to 100,000 in cash under one agreement. If an individual (for example, a director or founder), then the restriction does not apply.

These rules apply to all payments under contracts - not only the principal amount of the debt, but also interest, penalties or penalties.

Example: The founder issued a loan to the organization in the amount of 500,000 rubles, transferring it to the current account from his bank account. The monthly loan payment includes 50,000 rubles - the amount of the principal debt and 2,000 rubles - interest. The organization paid the first 52,000 rubles to the founder from the cash register, having previously withdrawn money from the company’s current account. The next payment from the cash desk was 48,000 rubles (52,000 + 48,000 = 100,000) towards the principal debt. The organization transferred the remaining amount - 4,000 rubles - to the founder's account and in the future it can repay the loan and interest on it only by bank transfer.

It would seem - why? We don’t use it when we issue accountable funds or salaries, so why use it for loans?

But the point is that the purpose of receiving or repaying borrowed funds plays a role.

- If the loan was received for purposes not related to the purchase of goods, work, or services, then there is no need to punch checks.

Example: the director of an LLC decided to provide a loan to renovate a house. The amount of 200,000 rubles was withdrawn from the current account and given to the employee. During the year, the employee repaid the loan in equal parts with interest to the organization's cash desk. The online cash register receipts did not go through.

Moreover, if an employee received a loan to purchase, for example, a car, then it would be considered that the purpose of the loan was to purchase goods. Tax officials insist that in this case the checks must be punched. Therefore, when concluding a loan agreement, indicate the purposes in it or just write “issued for purposes not related to payment for goods, works and services.”

- If a loan is provided to a physical buyer upon purchase (for example, deferred payment, installment plan), then the seller is required to use an online cash register.

- If the buyer is a legal entity or entrepreneur and is provided with such an installment plan, then a check will not be needed. But repaying the loan in cash or by card will require the use of a cash register .

In a letter from the Federal Tax Service dated 10/19/2018 No. ED-4-20/ [email protected] , the tax authorities explained that in the case when the buyer (customer) pays for goods (work, services) not immediately, but in parts or pays for the purchase not in the moment it is received, and later, this is also considered a loan.

Example: an organization bought a truck from an entrepreneur, the cost of the car is 600,000 rubles, paid in installments over six months. The company makes payments through an accountable person, who pays in cash. The entrepreneur accepted payments for 6 months, punching a check each time. And... he broke the law. Did you notice? An individual entrepreneur had the right to accept cash in an amount not exceeding 100 thousand rubles (remember, about the restrictions on settlements between legal entities and individual entrepreneurs).

Who is not covered by the provisions of Directive No. 3073-U?

First of all, the provisions of Directive No. 3073-U do not apply to cash payments made in rubles and (or) foreign currency between individuals. But at the same time, these persons should not be registered as entrepreneurs. Thus, the essence of these calculations does not matter. For example, you can buy an apartment or a car from an individual for cash, etc. The main thing is that the citizen does not have registration as an entrepreneur. Those. he must perform this operation as an ordinary individual!

In addition, Directive No. 3073-U does not regulate:

- banking operations that are carried out in accordance with Russian legislation, including regulations of the Bank of Russia itself;

- payments that are made in accordance with the customs and tax legislation of the Russian Federation. For example, payment of the state duty can be made in cash, and its value may well exceed the established limit of 100,000 rubles.