Is a hard drive an OS or a storage unit?

5) Vehicles, which include: vehicles designed to move people and goods - railway and rolling stock; rolling stock of water transport, road, air, urban transport; floor-mounted production vehicles, as well as other types of vehicles.

At the same time, automobile and tractor trailers, specialized and converted railway cars, the main purpose of which is to perform production or household functions, and not to transport goods and people (mobile power plants, mobile transformer installations, mobile workshops, laboratory cars, mobile diagnostic installations, carriage houses, etc.) are considered mobile enterprises

appropriate purpose, and not vehicles, and are accounted for as building and equipment.

6) Industrial and household inventory, which includes:

-production equipment - technical items that are involved in the production process, but cannot be classified as equipment or structures (containers for storing liquids, devices and containers for bulk, piece materials, not related to structures, devices and furniture, employees to facilitate production operations (tables, counters, racks, etc.);

-household equipment - office and household items that are not directly involved in the production process.

7) Working, productive and breeding livestock (except for young animals and cattle for slaughter), which include: horses, oxen, camels, donkeys, cows, sheep, stallions - producers, bulls - producers and other working, productive and breeding livestock.

Perennial plantings, which include all types of artificial perennial plantings, regardless of their age, landscaping and decorative plantings on streets, squares, parks, gardens, squares, on the territory of enterprises, in the courtyards of residential buildings; hedges, shelterbelts, plantings intended to strengthen sand and river banks, etc.; artificial plantings of botanical gardens, scientific research institutions and educational institutions for scientific research purposes.

9) Other fixed assets.

Depending on their purpose in production and economic activity, fixed assets are divided into production and non-production.

The main means of production include: machines, machine tools, apparatus, tools, as well as buildings of main and auxiliary workshops, services intended for the production process, warehouse buildings, tanks, vehicles used for moving and storing objects and products of labor. Non-production fixed assets are not directly involved in the production process, but they are used for the cultural and everyday needs of enterprise employees (fixed assets for housing and communal services, clinics, clubs, kindergartens, etc.).

Go to page: 12

345

Examples of application of Articles 310 KOSGU and 340 KOSGU in 2018-2019 – Article Holding

When an institution acquires property, the accountant is faced with the question of where to classify it: to inventories under KOSGU article 340 or fixed assets under KOSGU article 310. After all, this is not always easy to do. We provided recommendations on how to define an article and showed them with examples: flags, fire extinguishers, banners, blinds and other property.

By the way, our colleagues have published fresh material - decoding and application of KOSGU 310 and KOSGU 340 in 2022, we recommend that you read it (there is also a new table from the Ministry of Finance).

How to apply articles and subarticles of KOSGU in accounting is explained in Section V of the instructions approved by Order of the Ministry of Finance of Russia dated July 1, 2013 No. 65n. KOSGU are the same for all budget levels.

Transcript 310 KOSGU

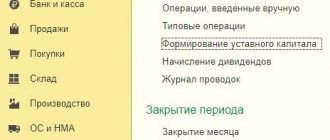

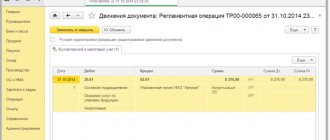

In accordance with Order No. 65, article KOSGU 310 “Increase in the cost of fixed assets” includes the expenses of institutions for the acquisition or manufacture of objects that are classified as fixed assets.

Including precious stones, nuggets of precious metals, bars and bars of gold, silver, platinum and palladium, as well as coins made of precious metals except those that are not the currency of the Russian Federation.

Transcript 340 KOSGU

Article KOSGU 340 “Increase in the cost of inventories” includes expenses for payment of contracts for objects that are classified as inventories, including:

- medicines and dressings;

- medical equipment implanted into the patient’s body;

- food;

- fuels and lubricants;

- building materials;

- soft equipment, including property functionally oriented to occupational health and safety, civil defense;

- spare parts or components for machines, equipment, office equipment, computer equipment, telecommunications systems and local computer networks, information transmission and display systems, information security, information computing systems, communications equipment, etc.;

- special equipment for research and development work;

- kitchen equipment;

- young animals of all types of animals and fattening animals, birds, rabbits, fur-bearing animals, bee families, regardless of their cost, experimental animals, livestock for slaughter;

- feed, care products, training, equipment for animals;

- seedlings of perennial plantings (planting material), including fruit and berry plantings of all types until they reach operational age or before fruiting;

- material reserves as part of the treasury property and the state material reserve;

- blank products (except for strict reporting forms);

- other similar expenses.

The commission for the receipt and disposal of non-financial assets decides which category the property belongs to - fixed assets or inventories. Members of the commission make their decisions based on:

- to the provisions of the Instructions to the Unified Chart of Accounts No. 157n;

- on the purpose, timing and procedure for using material assets;

- on the provisions of the accounting policy - it prescribes an exact list of property that is classified as fixed assets or inventories in the accounting of the institution.

The decision of the commission may not coincide with the opinion of the inspectors. But if it is based on accounting policies, then there is no need to fear liability. After all, the procedure that is prescribed in the accounting policy must be applied by both the institution itself and the regulatory agencies when checking accounting

Lamp

Material inventories, regardless of their useful life, include equipment that needs to be installed or installed. Such equipment also includes material assets for construction and installation work.

According to paragraph 118 of Instruction No. 157n, the category of building materials includes:

- electrical materials (cables, lamps, sockets, rollers, cords, wires, fuses, insulators, etc.);

- ready-to-install building structures and parts (for heating, ventilation, sanitary and other systems).

That is, reflect the lamps as part of the inventory according to Article 340 of KOSGU.

Flags

Flags and banners are classified as fixed assets, since their useful life is more than 12 months. Acquisition costs are included in article KOSGU 310 “Increase in the cost of fixed assets.”

Gas masks

Expenses for special clothing (including gas masks) in accounting and reporting are attributed to article KOSGU 340 “Increase in the cost of inventories.”

Purchasing computer components

10 Methodological guidelines for accounting of fixed assets, approved by Order of the Ministry of Finance of Russia dated October 13, 2003 N 91n, if one object has several parts that have different useful lives, each such part is accounted for as an independent inventory item. According to clause 20 of PBU 6/01, the useful life of an item of fixed assets is determined by the organization when accepting the item for accounting. A similar provision is contained in paragraph 1 of Art. 258 of the Tax Code of the Russian Federation - the useful life of depreciable property is determined by the taxpayer independently on the date of commissioning of this object, taking into account the Classification of fixed assets included in depreciation groups, approved by Decree of the Government of the Russian Federation of 01.01.2002 N 1. This Classification includes fixed assets of electronic computer equipment to the third depreciation group with a useful life of more than three years up to five years inclusive. In accordance with the All-Russian Classifier of Fixed Assets OK 013-94, approved by Decree of the State Standard of Russia dated December 26, 1994 N 359, electronic computing equipment is reflected by code 14 3020000. In turn, devices of computer complexes and electronic machines are reflected by code 14 3020030; by code 14 3020260 - processors, operating devices; according to code 14 3020310 - control devices for computer networks, systems, complexes and digital electronic machines; by code 14 3020544 - tools and accessories for computer technology, etc. In other words, the Classifier named individual accessories of a personal computer can be considered as independent objects of fixed assets. Thus, if, when purchasing computer components (monitor, system unit, keyboard and mouse), an organization has established different periods of their useful life, then they are taken into account as separate items of fixed assets. Moreover, if the cost of any of these objects is less than 10,000 rubles, then the organization has the right to write it off as production costs (sales costs) as they are released into production or operation, both in accounting and tax accounting (clause 18 PBU 6/01, paragraph 3, paragraph 1, article 254, paragraph 1, article 256 of the Tax Code of the Russian Federation). S.S. Lysenko Publishing house "Glavnaya Kniga" 07/20/2005

Return to Financial Advice section

Popular programs for dividing a hard drive into partitions

A budgetary institution (medical college) purchased a passenger car and an additional set of wheels (studded winter tires) for it under contracts. Which article (subarticle) of the classification of operations of the general government sector should include the costs of paying for these contracts?

What budget classification code should be used to record expenses for the purchase of a removable hard drive (drive)?

Since fixed assets are fixed assets, you need to use accounts in section 2 of the Chart of Accounts, and account 2383 “Other fixed assets” can be used.

Changing the useful life of depreciable property for profit tax purposes is carried out only in cases established by the Tax Code. In this case, there is no provision for changing the useful life by replacing one depreciation group with another.

In his opinion, the replacement of devices and accessories (for example, a monitor, a system unit, a computer DVD rewritable drive, etc.), which perform their functions only as part of a complex and not independently, cannot be considered as a modernization of fixed assets on which the indicated replacement (Letter dated June 27, 2006 N 42-7.1-15/2.2-265).

Arbitration court decisions. Court opinions on this matter are mixed. Some arbitrators side with the organization, believing that changing the characteristics of a computer (increasing production capacity, RAM capacity, speed, replacing the monitor with a model with a larger screen diagonal, etc.) is a modernization and not a repair (Resolution of the Federal Antimonopoly Service of the Moscow Region dated September 17 .2006 N KA-A40/7292-06).

Clause 1 of Art. 257 of the Tax Code of the Russian Federation establishes that fixed assets for profit tax purposes are understood as part of the property used as means of labor for the production and sale of goods (performing work, providing services) or for managing an organization.

Thus, the initial cost of a computer consists of the sum of costs for:

- acquisition of all components;

- a minimum set of computer programs installed on it, without which the computer cannot work;

- consulting services;

- services for delivery, setup and bringing the computer to a state suitable for use.

If the purchased computer costs less than the established limit, then even if the above four conditions are met, you can take the equipment into account as part of the materials, transferring its cost directly to expenses.

At the same time, the most ordinary computer (we are not talking about a laptop), as a rule, consists of four parts: a system unit, a monitor, a keyboard and a mouse, connected by cables. True, wireless keyboards and mice have been increasingly used lately, but this does not change the essence.

If the accounting policy does not establish a procedure for accounting for the replacement of components of an OS object that have a significant cost, but writes off the cost of a broken system unit as an expense or, conversely, increases the cost of a computer by the cost of a new system unit without reducing the residual value of the failed part, then you can get a remark from the inspectors.

Thus, in order to classify property as fixed assets, the simultaneous presence of two conditions is necessary. If at least one of them is not met - and most often this refers to the cost criterion of less than 30 basic units (or the size fixed in the accounting policy) - then the computer should be taken into account as part of the items.

Currently, public sector institutions can use two approaches to accounting for a computer as a fixed asset:

- Consider a computer as a complex of structurally articulated objects, including a system unit, monitor, keyboard, mouse, etc.;

- Consider the system unit and monitor as independent fixed assets. In this case, the keyboard, mouse and other parts are integral parts of the system unit.

How to reduce the likelihood of hard drive failure

- Monitor the quality of your computer's power supply. This important device may be of poor quality, which means that not only the disks, but also other components will be affected by power surges. The same applies to laptops.

- The hard drive should absolutely not be subjected to shaking or falling, especially for external hard drives.

- Typically, hard drives rarely overheat. In my memory, in 11 years, my disks have never overheated, but this is still possible due to external factors. Make sure that the cooling system in the system unit is working properly. Also, to avoid overheating, clean your computer from dust more often.

- The high frequency of turning on and off the HDD is very harmful, and this happens from quickly turning on and off the computer. Increase the interval between turning on and off to at least half a minute.

- To speed up the system, defragment your hard drive. Typically, in modern operating systems, this procedure is enabled by default and is carried out automatically.

Useful books about hard drive recovery

- G.E. Senkevich - The art of data recovery - download Y. Smirnov - Secrets of recovering PC hard drives - download P. Tashkov - Data recovery methods - download

In general, that's all. In my opinion, an important sign of a hard drive failure is two phenomena - shaking/falling and defective drives. The disks I have were damaged only due to the fact that they fell, beat, shook, and this leads to the above technical malfunctions.

Be careful with your discs. For questions and suggestions, write in the comments.

Detecting signs of a failing hard drive can be difficult if it's in an external enclosure. For the average user, it can be quite difficult to distinguish software problems from a mechanical failure of the external hard drive, especially if the model is relatively new.

Since a hard drive can suffer serious damage after magnetic heads fail, it is necessary to know and be able to detect signs of a malfunction of an external hard drive in the initial stages.

SMART hard drive diagnostic programs

How to check the status of a hard drive using programs? Each HDD and SSD has built-in SMART (Self Monitoring Analyzing and Reporting Technology) technology - assessing the condition of the hard drive.

There are a number of characteristics that are assigned a certain value, for example, 100 or 254. These values are initial from the factory, and if you deviate from them, it is considered that the disk has a malfunction or is approaching some kind of failure.

There are special programs that measure SMART indicators. Let's take CrystalDiskInfo as an example. The tool is easy to find on the Internet, there is an installation version and a Portable version in a Zip archive.

After launch, a window will open with all the detailed disk data. There is a technical condition of Good, that is, “Good”, then there are no problems yet. At the top, service information is displayed, such as firmware, serial number, interface, and so on.

SMART Diagnostics Using CrystalDiskInfo

Below are the important attributes that are important to us. It is worth paying attention to “Read errors”, “Promotion time”, “Reassigned sectors”, “Repeated promotion attempts”, “Unstable sectors”, “Uncorrectable sector errors”. In general, all parameters matter.

There are also several other columns:

- Value (Current) – this state can constantly change and is not an indicator that determines the health status of the HDD.

- Worst (Worst) is the value coming from the current value of “Value” for the entire operating time of the disk.

- Threshold is an important value that must be less than Value. If the Threshold is less than the current state, then everything is in order, but if it’s the other way around, then there are problems with the disk. But sometimes the utility can make mistakes. That is, even if there is a higher Value indicator than Threshold, from the point of view of user analysis, the disk may have problems - squeaks, knocks, slowdowns, etc. In this case, the RAW parameter is used for the final assessment of health.

- RAW ( Data) – indicates real indicators in various number systems (by default in hexadecimal). With the ability to determine the RAW indicator, the user will easily understand the formation of the Value value. But this meaning is individual for each manufacturer and is hidden under a veil of secrecy.

How to troubleshoot hard drive problems?

The guys from the physics department of the university came with their certificates, wrote an act and she shut up! You need to call the specialists! They believe them!!!

Incorrect operation of hard drive partitions This is a very common hard drive failure. There is a high probability of information loss if the user acts incorrectly after a problem occurs.

The topic of registering computers and subsequent write-off is apparently the most painful one. A friend at work has two computers on his balance sheet. The first passes as “computer G”, the second as “celeron”. And nothing more is known about them. It needs to be written off, but no one knows that none have been found among the existing vehicles...

The service area (“service area”) is restored only in technological mode on special stands. Particularly difficult are cases of damage to the translator - sector addressing tables and disk defects. Spindle wedge is not so common, but is typical for some Seagate HDDs and Toshiba laptops. In this case, the engine is repaired, after which the data is copied from the disk.

The main reasons for hard drive failure

If you want to study the HDD structure in more detail, click on the image below. Typical hard drive malfunctions All hard drive malfunctions can be divided into software and hardware.

This situation can mean a lot, from a faulty positioning system to damaged heads. Another option is bad sectors in the boot area of the hard drive. You can correct this situation yourself. Having determined the state of the hard drive, we connect the data cable.

The main thing that Googlers insist on is that SMART is not a panacea for all ills and that focusing only on SMART data in most cases (especially individual ones) does not give anything. Most of their disks died, while according to SMART they were completely healthy and without any error messages.

To clarify the information you are interested in on your drive, call and consult with our technical specialists by phone.

How to distinguish a faulty external hard drive from software problems

Often, our customers are unsure of the reason why they cannot access their external hard drives: whether it is due to a mechanical problem or a minor software glitch. In this case, the safest thing to do to prevent data loss is to turn off the external hard drive, but there are a few simple steps that can help you verify that the drive is faulty.

Try working with the disk on another computer with the same operating system as yours. Connect your device directly to your computer (without using the USB adapter box). Use a different connection cable with a dual USB connector. If you do have software errors, these steps should restore access to your information.