Accounts

Organizations daily face situations where it is not possible to reflect property on balance sheet accounts.

What are the adopted budget commitments? Budgetary obligations in the legislation of the Russian Federation are understood as obligations

What is included in bank assets In practice, this concept includes various property. Not

What refers to household equipment and accessories What may be included in the list of tools, household

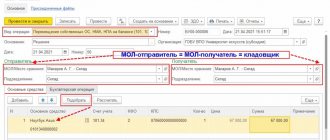

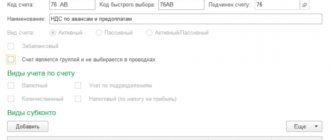

Examples of transactions on account 76 Account 76 stores information about transactions with debtors

Information disclosure rules Order of the Ministry of Finance No. 287n dated November 27, 2020 amended the provisions on

What expenses are covered by the social tax deduction? Rules for providing social tax deductions for expenses

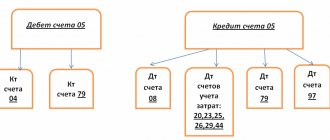

Account 05 Amortization of intangible assets is used in an organization if it has intangible assets

Commercial costs are NOT directly related to production, provision of services, performance of work and are NOT included

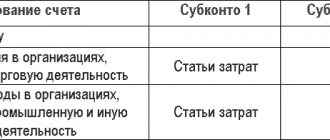

Composition of general business expenses Order of the Ministry of Finance No. 94n clearly establishes that account 26 in the accounting